Digigold price decoded: what drives rates and how to track value daily

Why decoding the digi gold rate matters today (and how this guide helps)

Gold isn’t just glitter – it’s math. Your digi gold rate is built from global benchmarks, currency moves, local duties, and platform spreads. Misread even one piece, and your returns leak silently. This guide breaks the digigold price into simple parts, so you can track digital gold value daily and act decisively.

“In India, the average price of 24K gold rose from

₹35,220 per 10g in 2019 to ~₹77,913 per 10g in 2024 (121% cumulative increase).” – Source

Here’s what most people miss:

-

Digital gold quotes are derived from LBMA-linked international prices in USD, converted to INR via USD/INR, adjusted for import duty + GST, then wrapped with a platform buy/sell spread.

-

That tiny spread and fee? It compounds. Over months, it can be the difference between beating inflation or not.

-

With the right tools, you can buy dips in small bites and let averages work in your favor – starting with just ₹1.

What you’ll learn in 6 minutes

-

The real drivers behind the digi gold rate: LBMA linkage, USD/INR moves, import duties, GST, and platform spreads

-

How platforms build the final “buy” and “sell” quotes you see – and why they differ

-

Daily tools to track digital gold value in real-time (alerts, live charts, moving averages)

-

Proven tactics to buy dips with micro-purchases and streak-based SIPs – plus OroPocket’s unique Bitcoin rewards edge

Why this matters if you invest even ₹1

-

Small misreads on spread, fees, or taxes can quietly eat returns, especially with frequent micro-buys

-

Timing entries with alerts and averages can boost long-term outcomes without guesswork

-

OroPocket gives extra upside with free Bitcoin rewards on every gold buy – stack gold and Satoshis together

Ready to put this into action? Start tracking the digi gold rate in real time and buy the dips from just ₹1 – while earning Bitcoin rewards. Download OroPocket now: https://oropocket.com/app

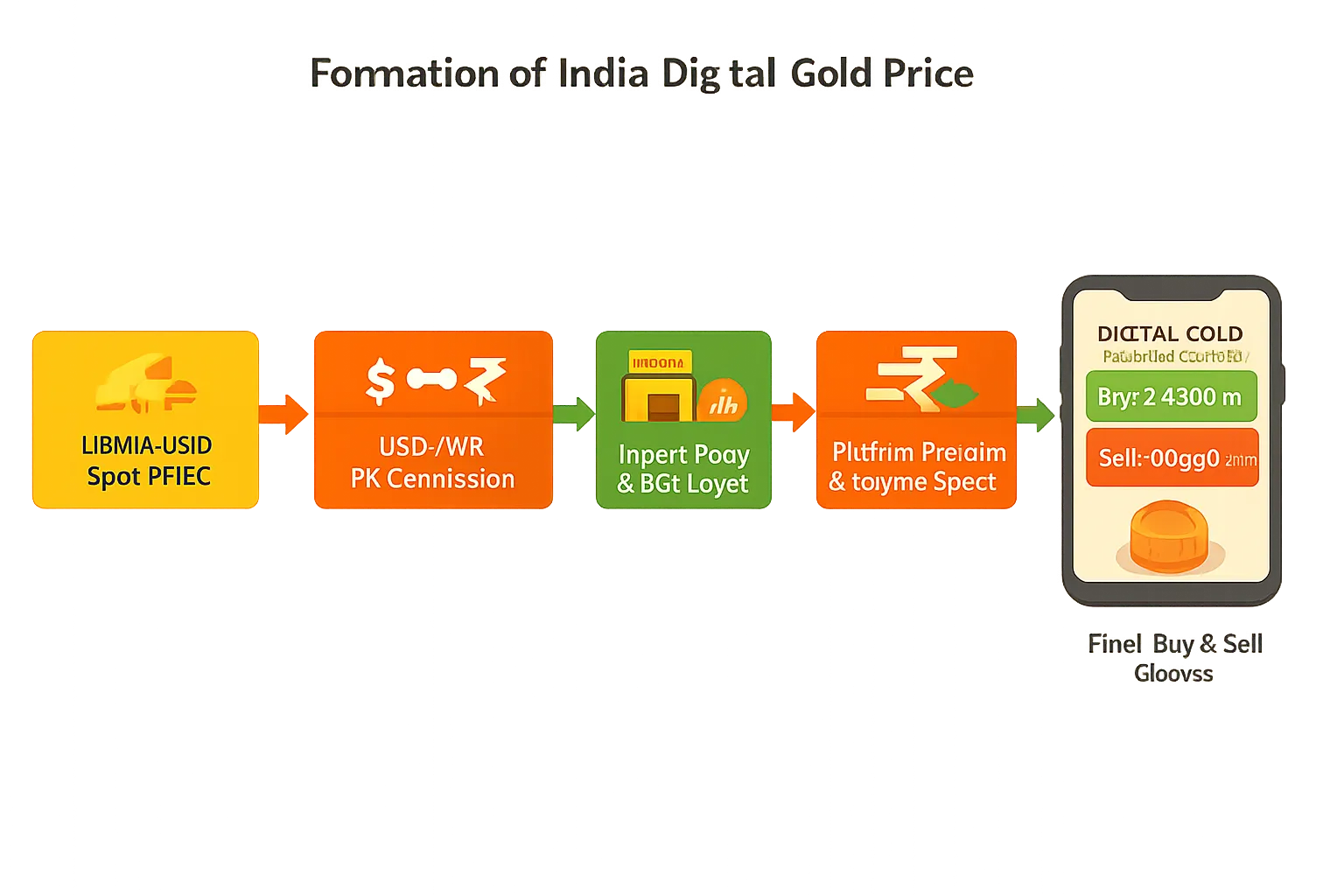

From LBMA to your app: how the digigold price is built (end-to-end)

“The LBMA Gold Price is the global benchmark for gold, set via independently administered, twice‑daily USD auctions.” – Source

1) Global reference: LBMA spot vs London AM/PM benchmark

-

OTC spot vs benchmark: Gold trades 24×5 OTC with live spot quotes, but many contracts settle to the LBMA Gold Price – an electronic auction published twice daily (London AM/PM) in USD per troy ounce. Benchmarks anchor institutional pricing and valuations.

-

COMEX influence: Futures on COMEX/T‑COMEX reflect expectations and liquidity. In volatile hours, futures moves can lead spot quotes, nudging short‑term digigold price adjustments on apps.

2) USD → INR conversion

-

Pass‑through math: Local base = (USD gold price per oz ÷ 31.1035) × USD/INR.

-

Micro‑moves matter: When USD/INR ticks higher, your INR gold rate rises – even if USD gold is flat. Minute‑by‑minute FX volatility nudges the digi gold rate you see.

3) India layer: import duty and taxes

-

Duties: India applies customs duty and applicable cesses/surcharges on imported bullion. These sit on top of the USD→INR converted value and directly lift the local reference price.

-

GST: A 3% GST applies on purchase. Platforms typically show a tax‑inclusive “buy” quote at checkout, so you see the all‑in price you’ll pay.

4) Platform layer: making, premium, and the buy–sell spread

-

What the spread covers: Liquidity provision, operations, vaulting, insurance, audit/custody, and payment rails. This appears as a small difference between “buy” and “sell”.

-

Why buy > sell: The spread compensates for providing instant two‑way quotes. Compare spreads across apps to minimize friction; tighter spreads and transparent fees help your long‑term returns. OroPocket keeps pricing simple – and adds Bitcoin rewards on every gold buy.

5) Example calculation (illustrative)

Assume these purely illustrative inputs for 24K gold:

-

LBMA spot: $2,400/oz

-

USD/INR: 84.00

-

Duties/cess (illustrative): 15% on landed value

-

GST: 3%

-

Platform premium: 0.8%

-

Buy–sell spread: ±0.5%

Step‑by‑step:

-

Convert to USD per gram: $2,400 ÷ 31.1035 = $77.15/g

-

Convert to INR: $77.15 × 84.00 = ₹6,480.6/g

-

Add duties (15%): ₹6,480.6 × 1.15 = ₹7,452.7/g

-

Add GST (3%): ₹7,452.7 × 1.03 = ₹7,676.3/g

-

Platform premium (0.8%): ₹7,676.3 × 1.008 = ₹7,737.7/g

-

Apply spread ±0.5%:

-

Buy quote ≈ ₹7,737.7 × 1.005 = ₹7,776/g

-

Sell quote ≈ ₹7,737.7 × 0.995 = ₹7,700/g

Sensitivity (rule‑of‑thumb):

-

USD/INR ±1% → INR gold ≈ ±1% (here, ≈ ±₹78/g on the buy quote)

-

Spot ±$10/oz → ≈ ±₹32–33/g on the buy quote after duties, GST, premium, and spread

What builds your digi gold rate?

|

Component |

What it is |

Typical impact |

Where you see it |

|---|---|---|---|

|

LBMA spot (USD/oz) |

Global benchmark/spot that anchors pricing |

Largest driver |

Referenced indirectly in all app quotes |

|

USD→INR conversion |

FX pass‑through from USD to rupee |

1:1 directionality |

Built into live price; minute‑by‑minute |

|

Import duties/cess |

India customs on landed bullion |

Lifts local base |

Included in Indian market reference |

|

GST (3%) |

Tax on purchase |

Small uplift |

Reflected in your final buy price |

|

Platform premium |

Ops, custody, payment rails |

Modest markup |

Line‑item or embedded in quote |

|

Buy–sell spread |

Liquidity/ops compensation |

Small gap between quotes |

Visible difference in buy vs sell |

|

Total (illustrative) |

All layers combined |

Buy ≈ ₹7,776/g; Sell ≈ ₹7,700/g |

Final quotes you see in‑app |

Track the digi gold rate in real time, buy dips from just ₹1, and earn free Bitcoin on every purchase with OroPocket. Download now: https://oropocket.com/app

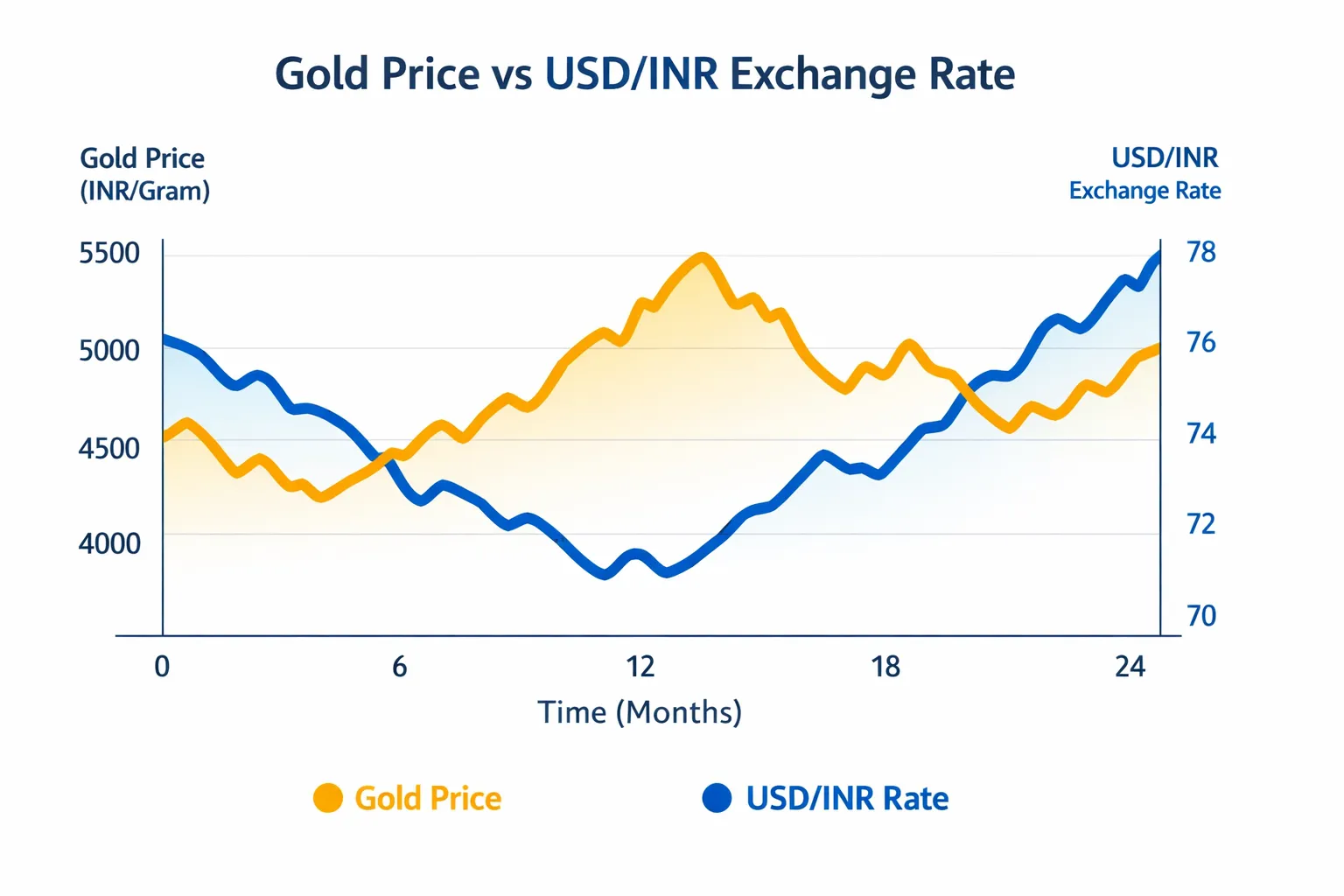

The INR/USD effect: why rupee moves change your digital gold value

A big chunk of your digi gold rate is simply USD gold translated into INR. So even when global gold is flat, a weaker rupee can push India’s digital gold value higher – and a stronger rupee can cool it.

Why FX matters even if global gold is flat

-

A weaker rupee lifts local INR quotes even if USD gold doesn’t move.

-

A stronger rupee can dampen the digi gold rate, partially offsetting a rise in USD gold.

“INR moved from ~₹66/USD in 2015–16 to ~₹83/USD in 2023–24, reflecting a long-run depreciation that magnifies local gold swings.” – Source

Quick scenarios

-

Gold flat, INR weak → Indian digi gold rate up

-

Gold up, INR strong → partial offset

Practical takeaway

-

Track USD/INR alongside gold; set dual alerts (price + FX).

-

Consider staggered entries when INR volatility spikes – micro-buys help average costs.

-

On OroPocket, automate disciplined entries with streak-based SIPs and earn free Bitcoin on every gold buy while you average into dips.

Taxes, fees, and spreads: what really affects your net digi gold rate

Your final digital gold value is shaped by more than the headline digi gold rate. GST, platform spreads, storage, and exit taxes all add up – and they decide how much you actually take home.

Purchase taxes

-

3% GST at buy on digital gold value.

-

How it’s shown:

-

Some apps display a base rate and add GST at checkout.

-

Others show an all‑inclusive “buy” quote (GST embedded). For cost of acquisition, your full paid amount (including GST) typically becomes your tax cost base.

-

Capital gains

-

STCG (<3 years): Added to income; taxed as per your slab.

-

LTCG (≥3 years): 20% with indexation (similar to physical gold).

-

Note: Verify latest Finance Act updates before filing.

Platform economics

-

Buy–sell spread: Usually tight (e.g., ~0.2%–1.0% each side), but can widen during volatile hours or low‑liquidity windows.

-

Storage/insurance: Often 0–0.5% p.a. (some platforms offer free periods); custody, audits, and insurance are covered here.

-

Optional charges: Physical redemption/doorstep delivery (minting, shipping, handling).

-

Pro tip: Tighter spreads + transparent storage terms = higher net returns. OroPocket keeps pricing simple – and adds Bitcoin rewards on every gold buy.

Worked example (illustrative)

Assumptions:

-

You buy ₹10,000 of digi gold today (GST included in the buy quote).

-

Platform spread: ±0.5% (buy at +0.5%, sell at −0.5% vs mid).

-

Storage/insurance: 0.25% p.a.

-

Price moves +10% over 14 months, then you sell (STCG).

Step‑by‑step:

-

You receive grams worth ₹10,000 at the buy quote (which embeds +0.5% vs mid).

-

After 14 months, mid is +10%. Sell quote applies −0.5% vs mid. Effective uplift ≈ +8.8% after two‑way spread.

-

Proceeds ≈ ₹10,880

-

-

Storage for 14 months ≈ 0.25% × 14/12 ≈ 0.29% of ₹10,000 = ~₹29

-

Pre‑tax gain ≈ ₹10,880 − ₹10,000 − ₹29 = ₹851

-

STCG tax at slab (illustrative):

-

5% slab: ~₹43 tax → Net ≈ ₹10,837 (≈ +8.37%)

-

30% slab: ~₹255 tax → Net ≈ ₹10,596 (≈ +5.96%)

-

Note: If you hold ≥3 years, LTCG at 20% with indexation applies (verify latest rules and indexation factors at filing time).

Owning gold in India: cost and tax snapshot

|

Option |

Upfront taxes/charges |

Ongoing costs |

Liquidity |

Tax on exit |

Extras |

|---|---|---|---|---|---|

|

Digital gold |

3% GST on purchase; small platform premium |

Storage/insurance ~0–0.5% p.a.; optional redemption fees |

Instant T+0 at app quotes |

STCG: slab; LTCG: 20% with indexation (verify latest rules) |

Micro‑buys from ₹1, UPI, send/gift gold; OroPocket adds Bitcoin rewards |

|

Jewellery |

3% GST + making/wastage (often 5–25%+) |

Locker rent; appraisal costs |

Depends on jeweller; possible buyback cuts |

Capital gains rules apply; resale often below spot due to making/wastage |

Wearable, gifting; hallmark quality matters |

|

SGB (Sovereign Gold Bond) |

No GST on purchase; issued at RBI price |

None |

Tradable on exchanges; best held to maturity |

Redemption at 8‑yr maturity: capital gains exempt; interest (2.5% p.a.) taxable; early sale: CG taxes apply (check rules) |

Semiannual interest; sovereign guarantee; option for early redemption windows |

|

Gold ETF |

Brokerage + taxes on brokerage (no GST on gold value) |

Expense ratio ~0.4–1.0% p.a. |

Market hours; depends on ETF liquidity |

Subject to latest rules for specified MF units; verify Finance Act updates |

Demat/broker required; SIP via brokers; NAV transparency |

Want to keep more of your gains? Choose tighter spreads, transparent storage, and smart exits. On OroPocket, you can start from ₹1, automate streak‑based SIPs, and earn free Bitcoin on every gold buy – boosting your net return. Download now: https://oropocket.com/app

Beyond the screen: demand, central banks, rates, and festival seasonality

India’s digi gold rate isn’t just a chart on your phone. Real-world demand, central bank buying, interest rates, and festival calendars all tug the digital gold value you see.

Indian demand rhythms

-

Akshaya Tritiya, Dhanteras, and wedding cycles drive predictable purchase waves; jewellers and platforms often face tighter supply and higher traffic.

-

Premiums can widen around peak demand as wholesale quotes adjust and platform spreads reflect liquidity and logistics pressure.

-

Practical play: pre-position with micro-buys before festival windows, then average in with streak-based SIPs if prices spike.

Global macro drivers

-

Real yields and policy signals: Falling real (inflation-adjusted) yields and dovish cues from the Fed/RBI tend to support gold; rising real yields can cap rallies.

-

Recession risk and growth scares push safe-haven demand up; strong risk-on phases can cool it temporarily.

-

Geopolitics (conflicts, sanctions, trade frictions) can trigger flight-to-safety bids that lift the digi gold rate even without local news.

Central bank flows

-

Net purchases by central banks reduce available float and reinforce long-run price support, especially when buying is broad-based across EM/DM institutions.

-

Watch quarterly WGC updates; strong reserve diversification cycles often coincide with firmer price floors.

“Central banks bought over 1,000 tonnes of gold in each of 2022, 2023 and 2024 – sustained, near-record net purchases.” – Source

Use these drivers to time entries: track festival seasonality, monitor real yields and policy meetings, and keep an eye on WGC central bank data. On OroPocket, automate staggered buys from ₹1 and build positions through streak-based SIPs – while earning Bitcoin rewards on every purchase. Download the app: https://oropocket.com/app

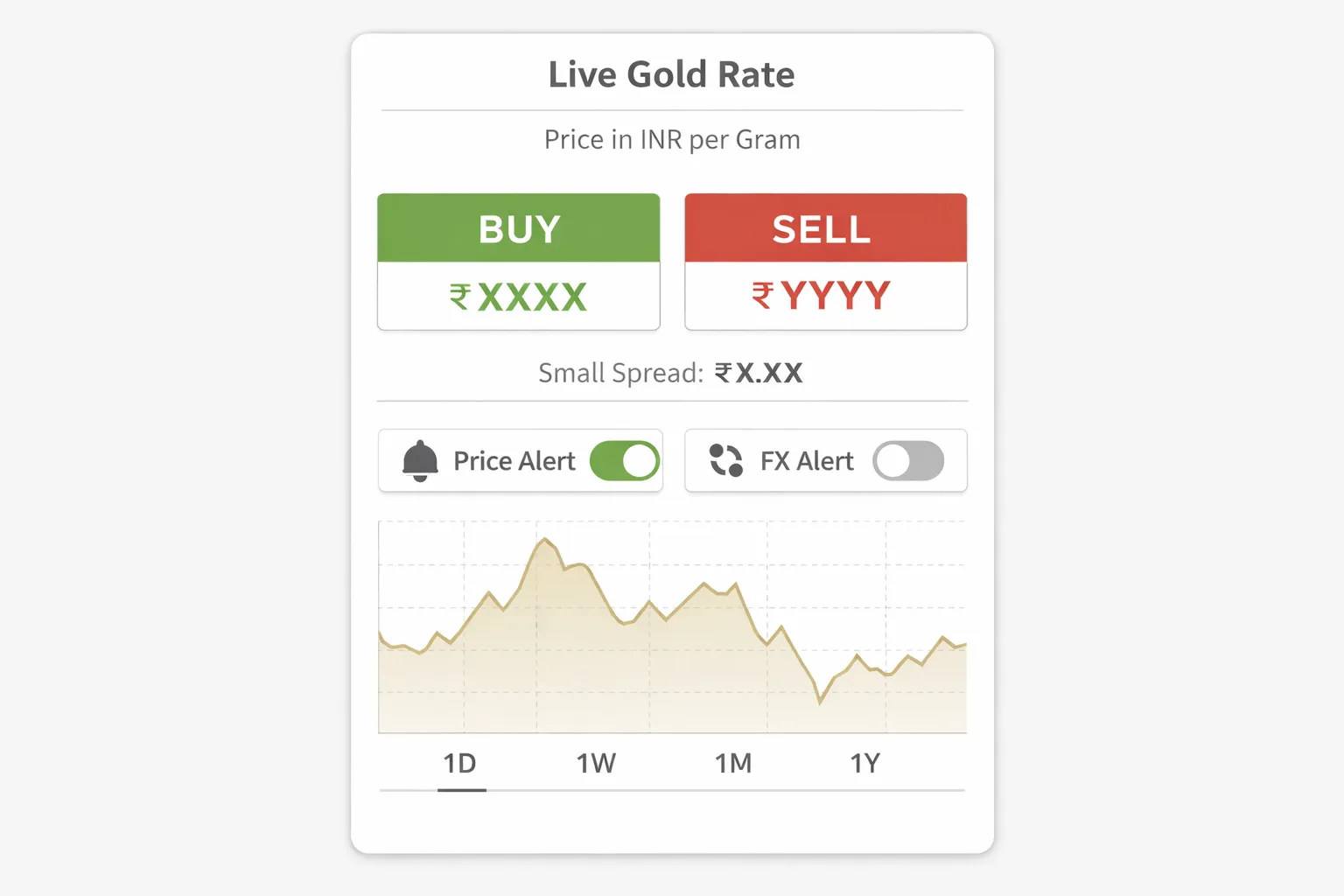

Track the digi gold rate daily: the ultimate toolkit

Data you should watch

-

Spot gold (LBMA/COMEX), USD/INR, and India duty/import circulars

-

Your platform’s real-time buy/sell quotes and spreads – tightness tells you friction

Tools that make it effortless

-

OroPocket app: live digi gold rate, 24K pure gold, instant UPI, alerts, and ₹1 micro-buys

-

Set alerts at key levels: 52‑week highs/lows, 20/50/200‑DMA, and psychological round numbers

-

Keep a weekly price log: jot down gold, USD/INR, spread, and your action (buy/hold). It cuts noise and trains discipline

Pro move

-

Combine price + FX alerts: trigger only when both gold and USD/INR hit your zones

-

Journal entries: record why you bought, spread paid, and result after 2–4 weeks. Refine timing steadily

-

Automate with OroPocket streak-based SIPs: buy small, often, and earn free Bitcoin on every purchase – stack gold and Satoshis together

Start tracking now and buy dips from just ₹1. Download OroPocket: https://oropocket.com/app

Smart buying playbooks: micro-buys, buy-the-dip, and streak-based SIPs

1) Micro-buys (₹1–₹200)

-

Nibble on red days to average costs without stress.

-

Automate tiny, regular entries (daily/alternate days) so volatility works for you, not against you.

2) DCA with guardrails

-

Run a regular SIP, then add small top-ups only when price dips below a 7–14 day moving average.

-

This “DCA+” approach keeps you invested, but concentrates adds during weakness.

3) Streak SIPs (OroPocket edge)

-

Build a daily/weekly habit and keep streaks alive.

-

Unlock bonus rewards every 5 consecutive days – your consistency compounds.

4) Turn rewards into returns

-

OroPocket Bitcoin cashback on every buy + spin‑to‑win + referrals (100 Satoshi bonus) reduce your net cost basis over time.

-

Reinvest rewards into more gold to accelerate compounding.

5) Risk rules

-

Cap daily adds (e.g., ≤0.5–1% of monthly budget).

-

Avoid chasing green candles after sharp spikes.

-

Review monthly: adjust SIP size, streak cadence, and dip thresholds.

Start with ₹1, automate your streaks, and stack gold plus Satoshis with every micro‑buy on OroPocket. Download the app: https://oropocket.com/app

Why digi gold rates differ across apps (and how to compare)

Not all “live” quotes are built the same. Two apps can show different digi gold rates at the same second because their sources, hedging, fee policies, and refresh cadences vary. Here’s how to decode it like a pro.

Factors behind price differences

-

Different bullion partners and inventory costs

-

Apps source from different LBMA-linked partners, each with their own procurement, hedging, and logistics. If one carries higher inventory or hedges differently, its price can sit a touch higher.

-

-

Hedging methodology and refresh cadence

-

How frequently they sync to LBMA/COMEX and USD/INR matters. Faster FX pass‑through can make quotes look higher or lower minute-to-minute.

-

-

Spread policies and timing

-

Buy is always above, sell is below the mid. Spreads can widen during low-liquidity hours, volatile moves, or around holidays.

-

-

Fee disclosures

-

Some apps show a base price plus GST and fees at checkout. Others show an all‑inclusive buy quote. Transparency makes comparison easier.

-

Pro tip to compare in 30 seconds:

-

Take both Buy and Sell quotes from the same app and time.

-

Compute mid = (Buy + Sell)/2 and effective spread = (Buy − Sell)/mid.

-

Lower spread + clear fee disclosure wins.

Purity and assurance

-

24K purity standards

-

Check 24K 99.9% vs 99.99% claims, and whether bars are from LBMA Good Delivery refiners.

-

-

Vaulting and insurance

-

Look for segregated, fully insured, professional vaults (e.g., BRINKS, Sequel) and explicit insurance coverage.

-

-

Audit frequency and reconciliation

-

Monthly/quarterly independent audits, reconciliation of user balances vs physical holdings, and published reports add trust.

-

-

Redemption quality

-

If you plan physical redemption, verify available coin/bar denominations, hallmarking, and mint/assayer credentials.

-

Feature stack that adds value

-

Speed and convenience

-

UPI-native checkout, instant settlements, and smooth KYC flow.

-

-

Smart investing tools

-

Price/FX alerts, micro-buys from ₹1, SIP automation, and streak tracking.

-

-

Rewards and ecosystem effects

-

Cashback/rewards can reduce your net cost basis over time. OroPocket is unique: free Bitcoin (Satoshis) on every gold buy.

-

-

Flexibility and social features

-

Gifting/sending gold, referral bonuses, and simple redemption options.

-

Checklist before you choose

-

Pricing transparency

-

Clear buy/sell spread, fee breakdown, and whether the displayed price is GST-inclusive.

-

-

Partner pedigree

-

LBMA-linked bullion partners, reputable vaults, and independent audits.

-

-

Compliance alignment

-

RBI-compliant workflows and adherence to NITI Aayog digital gold guidelines; SEBI-registered partners where applicable.

-

-

Liquidity and user support

-

Reliable two‑way quotes, tight spreads, responsive in‑app support.

-

-

Total value, not just price

-

Consider rewards, SIP tools, and habit features that improve long‑term outcomes. With OroPocket, you get ₹1 entry, tight pricing, and Bitcoin rewards that can meaningfully lower your effective cost over time.

-

Ready to compare live? Download OroPocket, check our real-time buy/sell quotes, start from ₹1, and earn Bitcoin on every gold purchase: https://oropocket.com/app

Risks, safeguards, and your compliance checklist

Even the best digi gold rate means little if your safeguards are weak. Here’s how to protect your capital, keep your paperwork clean, and stay liquid – without surprises.

Safeguards to insist on

-

RBI-compliant partners and authorized bullion networks; 24K (99.9%/99.99%) from LBMA Good Delivery–accredited refiners

-

100% insured, professional vaults (e.g., BRINKS/Sequel); segregated, fully allocated holdings in your name

-

Regular third‑party audits with downloadable certificates; position reconciliation of user balances vs. physical inventory

-

Clear fee and spread disclosures on the buy/sell screen; no hidden storage or redemption charges

-

Strong operational controls: dual authorization for movements, immutable audit trails, and robust disaster recovery

Practical risk controls

-

App security: enable device lock + app PIN/biometric; never share OTPs; verify domain/app publisher; beware phishing links

-

KYC and limits: keep PAN/KYC current; set custom per‑day/per‑transaction limits; whitelist your bank/UPI handles

-

Diversification: avoid overconcentration – treat digital gold as a core allocation within a broader mix (SGBs/ETFs/cash)

-

Execution hygiene: avoid market orders during extreme spikes; prefer staggered micro‑buys to reduce slippage on volatile days

Redemption and liquidity

-

Trading windows and spreads: spreads can widen during off‑hours, holidays, or high‑volatility events

-

Settlement expectations: most in‑app gold sales are T+0 credit in wallet; bank withdrawals may land T+0/T+1 depending on rails

-

Physical conversion: check minimum grams, making/minting, shipping/insurance charges, GST treatment, address/KYC checks, and ETA

-

Cut‑offs and SLAs: confirm same‑day cut‑off times for redemption requests and courier timelines; track order status in‑app

Documentation to keep

-

Tax invoices for every buy (with GST), showing grams and cost of acquisition

-

Contract notes and in‑app statements (export CSV/PDF) for realized gains/losses by FY

-

Bank/UPI proofs for funding/withdrawals; reconcile with your statement monthly

-

Redemption documents: dispatch notes, delivery receipts, and invoices for coins/bars

-

Audit references: links or copies of independent vault audit summaries for your records

Compliance checklist (quick pass):

-

Partner pedigree and RBI‑compliant flows verified

-

Vaulting: insured, segregated, audited – documents available

-

Pricing: buy/sell spread and fees visible before you confirm

-

KYC: PAN matched, address verified, statements exportable for filing

-

Liquidity: cut‑offs and settlement times understood; redemption fees clear

Make your digital gold value work harder – with tight spreads, clean documentation, and smart risk controls. On OroPocket, start from ₹1, set alerts, automate streak‑based SIPs, and earn free Bitcoin on every gold buy. Download now: https://oropocket.com/app

Final word: start tracking and stacking with OroPocket

Gold isn’t just an emergency asset anymore – it’s a daily habit you can build in minutes. If you’ve made it this far, you know exactly what drives the digi gold rate and how to spot value. Now, put it to work with the only app that rewards you in Bitcoin while you stack gold.

Why OroPocket for everyday gold stacking

-

Start with just ₹1 and buy/sell in 30 seconds via UPI – no paperwork, no friction

-

Earn free Bitcoin (Satoshis) on every gold/silver purchase – reduce your net cost basis over time

-

Daily streaks, spin-to-win, and referral rewards keep you consistent and motivated

-

24K pure gold, fully insured vaults, RBI-compliant partners – track your digital gold value in real time with transparent buy/sell quotes

Your next step (60 seconds)

-

Download the OroPocket app, set your first price alert on the digi gold rate, and schedule a streak-based SIP

-

Link UPI, make your first ₹1 micro-buy, and watch your gold – and Satoshis – stack automatically

Download now: https://oropocket.com/app

![How to Buy Digital Silver Online in India: Fees, Safety, Redemption [2026] 6 How20to20Buy20Digital20Silver20Online20in20India 20Fees20Safety20Redemption205B20265D cover](https://blog.oropocket.com/wp-content/uploads/2025/12/How20to20Buy20Digital20Silver20Online20in20India-20Fees20Safety20Redemption205B20265D-cover-300x200.webp)