How to buy digital gold in India: UPI step‑by‑step, KYC, fees, and tips

How to buy digital gold in India (beginner-friendly intro)

Your savings account earns ~3–4% while everyday prices climb faster. That’s inflation quietly eating your money. Physical gold helps, but it comes with making charges, locker fees, and purity worries. There’s a better way now.

“Over the last 5 years, gold in INR has outpaced India’s average CPI inflation (~5.4%) by a wide margin.” – Source

Why digital gold (24×7, ₹1 entry, no lockers)

-

The problem:

-

Savings losing to inflation; 4% returns vs 6–7% real-life price rises = negative real returns.

-

Physical gold hassles: making charges, purity checks, lockers/insurance, and liquidity.

-

-

The solution:

-

Digital gold lets you own 24K gold instantly, starting from ₹1.

-

Buy digital gold online in India 24×7 with UPI – no lockers, no paperwork, live market pricing.

-

It’s the best way to buy digital gold for beginners: transparent, liquid, and mobile-first.

-

What this guide covers (UPI step-by-step, KYC, fees, tips)

By the end, you’ll confidently:

-

Make your first buy with UPI (step-by-step).

-

Understand KYC requirements and limits.

-

Decode charges/spreads, storage, and safety checks.

-

Know taxes on buy/sell/redemption.

-

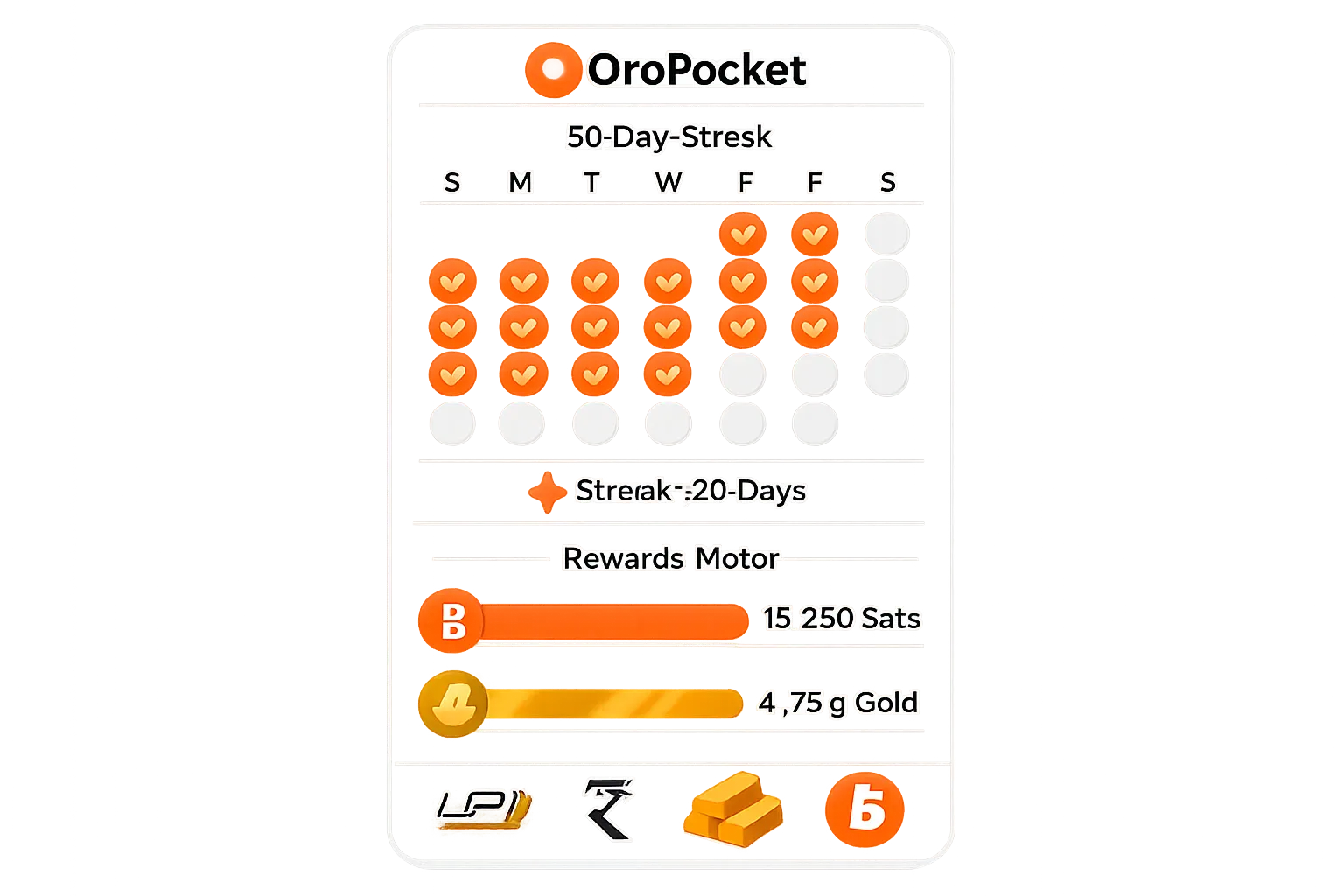

Use habit-building tricks (micro-buys, SIP-style routines, daily streaks) to grow consistently.

Where OroPocket is different

-

Instant UPI checkout with ₹1 micro-buys – start small, build daily momentum.

-

Earn free Bitcoin (Satoshis) on every gold/silver purchase – two assets for the price of one.

-

Daily streak bonuses + spin-to-win rewards to keep your investing habit on track.

-

Referral perks: invite friends and both earn 100 Satoshi + a free spin.

-

24K pure gold, fully insured vaults, RBI‑compliant partners – buy, hold, sell with confidence.

Who this is for

-

First-time investors who want a simple, safe start.

-

Salaried professionals diversifying beyond FDs and mutual funds.

-

Bitcoin‑curious but risk‑averse users wanting rewards without crypto volatility.

-

Festive buyers planning Dhanteras/Diwali purchases the modern way.

-

Gifters who want to send gold instantly to loved ones.

Ready to start? Download the OroPocket app and make your first ₹1 digital gold buy in under a minute: https://oropocket.com/app

Step-by-step: How to buy digital gold online in India via UPI

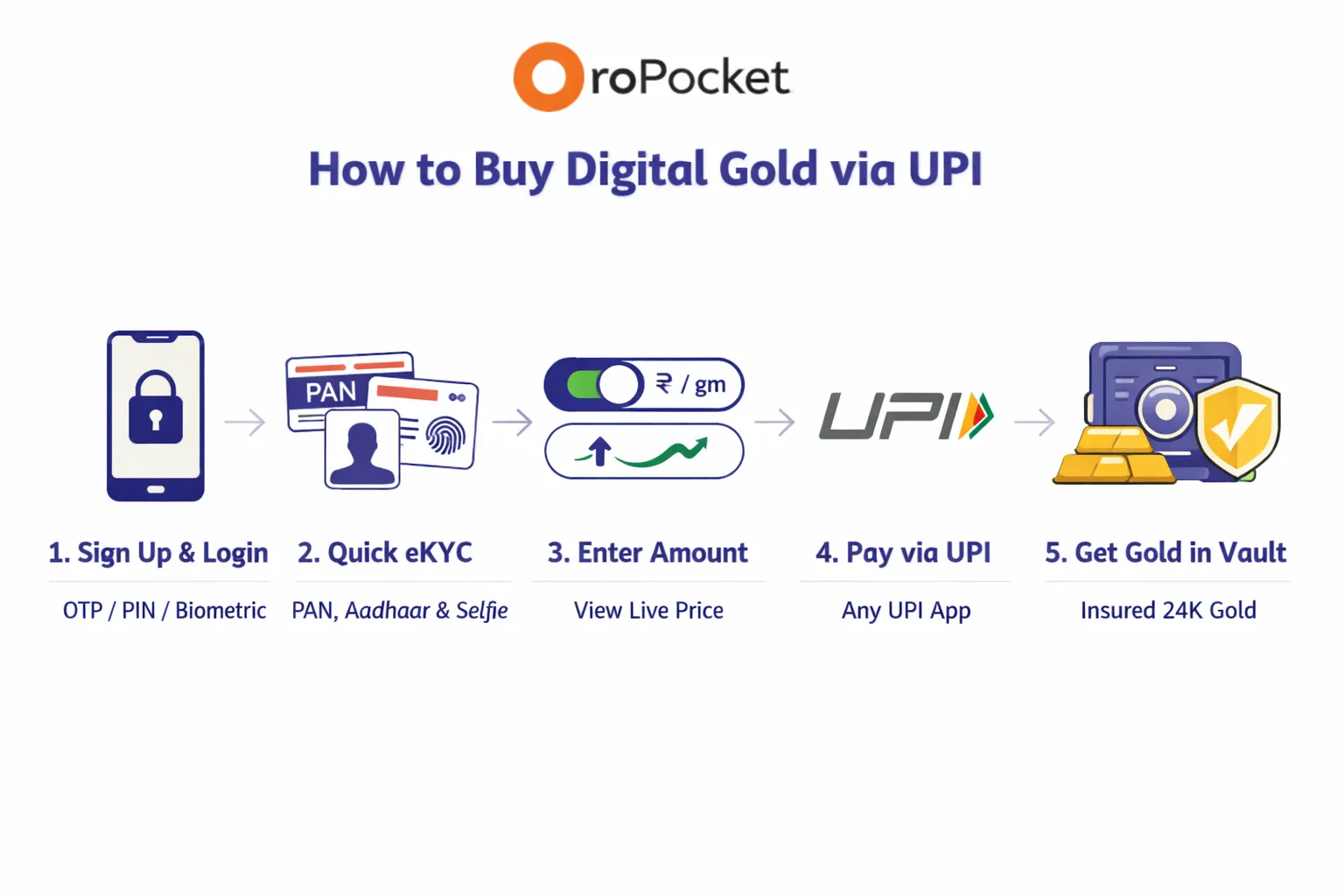

Step 1: Download and sign up on OroPocket (iOS/Android)

-

Get the OroPocket app on iOS or Android and tap Create Account.

-

Verify your mobile number with OTP.

-

Set a secure 4–6 digit PIN and enable biometric login for faster, safer access.

Step 2: Complete quick KYC (takes ~2–5 minutes)

-

Do a one-time eKYC: enter PAN, verify Aadhaar via OTP, and take a live selfie.

-

Why it matters: KYC keeps your account safe and compliant with PMLA/AML norms, and unlocks higher limits and smooth buy/sell flows.

Step 3: Choose gold amount (₹ or grams) and check live price

-

Pick Buy Gold, then choose either:

-

Amount in ₹ (fractional buying from ₹1), or

-

Weight in grams (e.g., 0.10 g, 1 g).

-

-

Live price refresh: The buy price updates with market moves. You’ll see the exact rupee cost and the net grams you’ll receive after the platform spread – transparent and upfront.

Step 4: Pay with UPI and get instant allocation

-

Select UPI, approve the collect request in any UPI app (GPay, PhonePe, Paytm, BHIM, bank apps).

-

Instant confirmation: Payment completes in seconds and your 24K gold is allocated immediately.

-

Your gold balance updates in real time – no waiting, no NEFT-style delays.

Step 5: Track, sell, send, or redeem later

-

Track: View your portfolio, holdings, avg. buy price, and current value. Set price alerts to time micro-buys.

-

Sell: Get instant liquidity at live sell rates, credited back to your linked account.

-

Send/Gift: Transfer gold to contacts – perfect for birthdays, Dhanteras, or just saying thanks.

-

Redeem: Optionally redeem as coins/bars later (making + delivery charges apply).

Pro tip

-

Make a ₹101 micro-buy to learn the flow end-to-end. Then set a recurring reminder (daily/weekly) to build the habit – consistent micro-buys beat trying to time the market.

Why UPI is the best way

-

Speed: Real-time, always-on payments – no business hours, no T+1.

-

24/7/365: Works even on Sundays and bank holidays.

-

Interoperable: Approve from any UPI app; no specific bank dependency.

-

Seamless: Ideal for micro-investing – top up and buy in under 30 seconds.

“UPI enables immediate money transfer round the clock – 24x7x365 – across banks via a single mobile app.” – Source

Ready to buy digital gold online in India now? Download OroPocket and make your first ₹1 UPI purchase in under a minute: https://oropocket.com/app

KYC for digital gold: what you need and how long it takes

Why KYC matters

-

Stops fraud and identity misuse.

-

Keeps your account compliant with PMLA/AML and authorized bullion partner norms.

-

Ensures secure payouts to your verified bank account.

-

Unlocks higher limits, smooth buy/sell, and redemption on OroPocket.

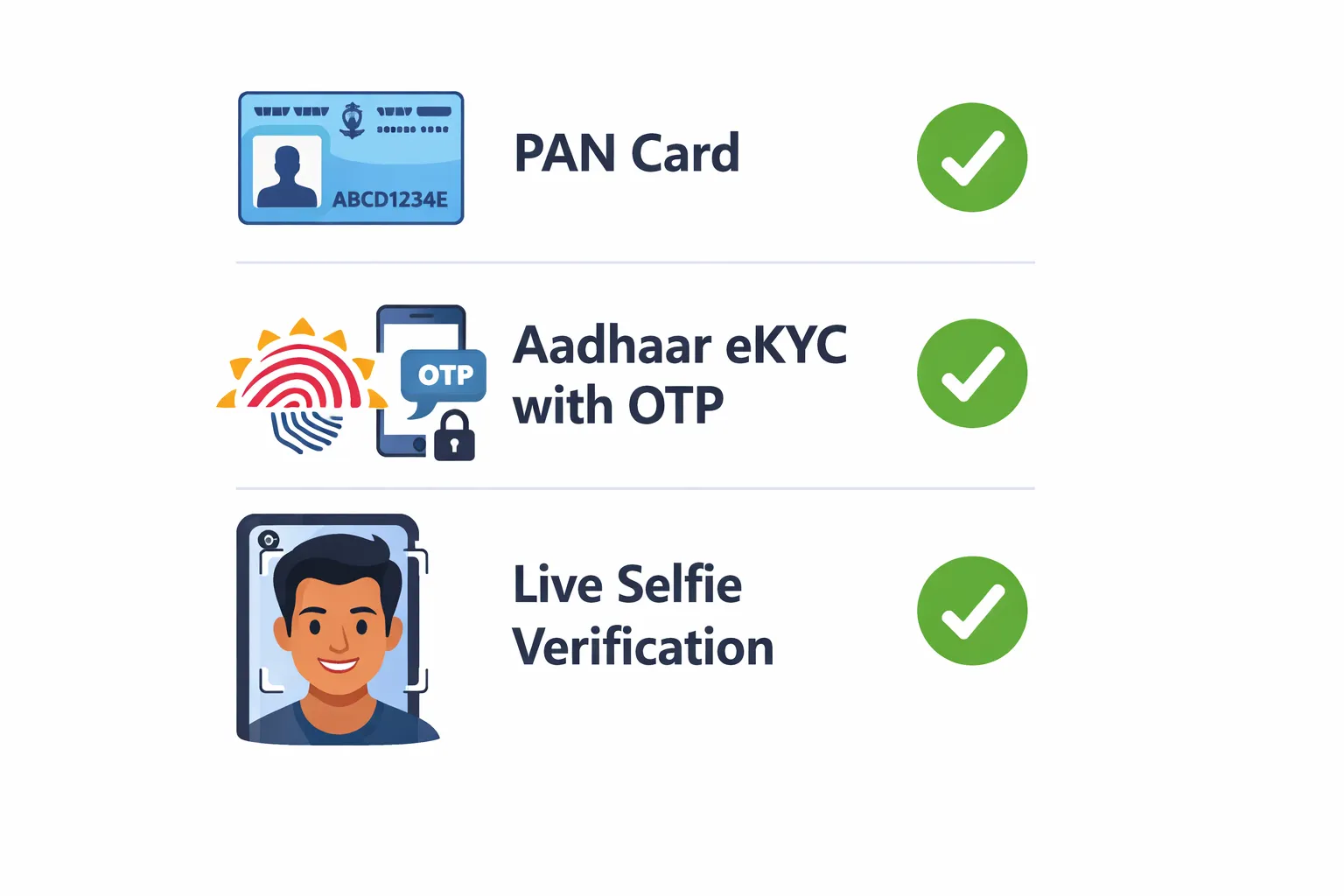

What you need

-

PAN: For identity and tax compliance.

-

Aadhaar eKYC (OTP): Fast, paperless verification via your Aadhaar-linked mobile.

-

Live selfie: Liveness check to confirm it’s really you.

-

Name match: Your name on PAN and Aadhaar should match your OroPocket profile.

Typical timelines and tips

-

Time to complete: 2–5 minutes for instant eKYC in most cases.

-

Tips for approval:

-

Use bright, even lighting for the selfie; keep the camera steady.

-

Ensure your PAN and Aadhaar names match exactly (including initials/spaces).

-

Keep your Aadhaar-linked phone handy for OTP.

-

If Aadhaar is not linked to your current number, update it first to avoid delays.

-

UPI limits and practical buying ranges

-

Typical UPI caps:

-

Per transaction: commonly up to ₹1,00,000 (varies by bank/app; some allow higher, e.g., ₹2,00,000 for select categories).

-

Daily cumulative: bank/app-specific; check your UPI app’s limits.

-

-

Practical ranges for habit-building:

-

Micro-buys: ₹1–₹500 to build a daily/weekly streak without timing the market.

-

Regular top-ups: ₹500–₹5,000 suited for monthly goals.

-

Larger buys: Split into multiple UPI payments if you hit per-tx/day caps.

-

“UPI processed 10.77 billion transactions in August 2025.” – Source

Troubleshooting

-

KYC failed or pending:

-

Re-capture the selfie in good light; remove hats/masks; keep your face centered.

-

Re-check that your name in the app matches PAN/Aadhaar exactly.

-

Ensure PAN is active and Aadhaar is linked to your current mobile for OTP.

-

Retry eKYC after a few minutes if the network was unstable.

-

Still stuck? Contact OroPocket support from in-app Help with your registered number.

-

-

Privacy & data protection:

-

Your documents are encrypted and used strictly for verification and compliance.

-

Access is restricted; OroPocket follows RBI-compliant processes with authorized bullion partners.

-

Ready to complete KYC and buy digital gold online in India the smart way? Download OroPocket and start with a ₹1 micro-buy today: https://oropocket.com/app

Digital gold fees explained: spreads, GST, delivery charges

The buy-sell spread

-

What it is: The difference between the platform’s buy price and sell price at any moment.

-

Typical market range: Net 2–6% in total (commonly ~1–3% on each side), varying by volatility, liquidity, and provider.

-

Why spreads exist: Covers wholesale sourcing, hedging, vaulting/insurance, logistics, and operational costs so you can buy/sell 24×7 in small amounts.

Taxes

-

GST: 3% GST applies on the purchase value of digital gold.

-

On selling: No GST when you sell back; however, capital gains tax may apply based on your holding period (we cover this in the Tax section).

-

Invoices: Good platforms share a proper invoice showing base value + GST.

Storage and insurance

-

Usually included: Industry norm is that secure vaulting and insurance are bundled for a defined period (often multiple years).

-

After the free period: Some providers may levy a small custody charge; check the fine print before buying.

Physical redemption costs

-

Making charges: Apply only if you convert digital gold to coins/bars; varies by weight/design and minting (often higher for small denominations).

-

Delivery/shipping: Includes secure shipping, insurance, and handling – varies by location and order size.

-

When digital-only saves: If you’re investing for value (not gifting or display), staying digital avoids making/delivery costs altogether.

How to keep costs low

-

Buy during calmer market windows when spreads are typically tighter.

-

Avoid frequent micro-sells; accumulate digitally and sell in sensible chunks.

-

Compare the effective price (including GST and spread) before tapping confirm.

-

Only redeem physically when you truly need coins/bars (gifting, ceremonial use).

-

Use UPI for instant settlement and avoid failed-payment retries that can add friction.

OroPocket cost clarity

-

Transparent pricing: See live buy/sell prices and the effective spread upfront – no guessing.

-

No hidden fees: What you see is what you pay at checkout.

-

UPI-friendly: Instant UPI payments with no payment gateway surcharge from OroPocket’s side.

-

Storage and insurance: Included for standard custody; full details available in-app before you buy.

Every charge you might encounter when you buy digital gold online

|

Charge |

What it is |

When it applies |

Typical range/notes |

How OroPocket handles it |

|---|---|---|---|---|

|

Buy spread |

Difference between live benchmark and your buy price |

Every purchase |

~1–3% above benchmark; varies with market conditions |

Displayed transparently with live price before you confirm |

|

Sell spread |

Difference between live benchmark and your sell price |

Every sale |

~1–3% below benchmark; varies with liquidity/volatility |

Shown in real time; instant quote before you sell |

|

GST on purchase (3%) |

Statutory tax on buying gold |

On every buy |

3% on taxable value |

Auto‑calculated and shown on invoice at checkout |

|

Making charges (only if redeeming) |

Minting cost for coins/bars |

Only on physical redemption |

Varies by weight/design; often higher for small coins |

Applied only if you opt to redeem; shown before you confirm |

|

Delivery/shipping (if redeeming) |

Secure shipping + insurance |

Only on physical redemption |

Location/insurer dependent |

Clear estimate provided pre‑checkout; pay only if you redeem |

|

Storage/insurance (usually included) |

Vaulting and insurance of gold |

While holding digitally |

Often free for multiple years; check terms |

Included during standard custody period; details in‑app |

|

UPI payment fee (generally NIL) |

Payment processing fee to customer |

At payment |

Typically NIL for consumers |

OroPocket does not add any UPI surcharge |

Want transparent pricing with instant UPI checkout? Download OroPocket and make your first ₹1 buy today: https://oropocket.com/app

Is digital gold safe? Purity, vaults, and compliance checklist

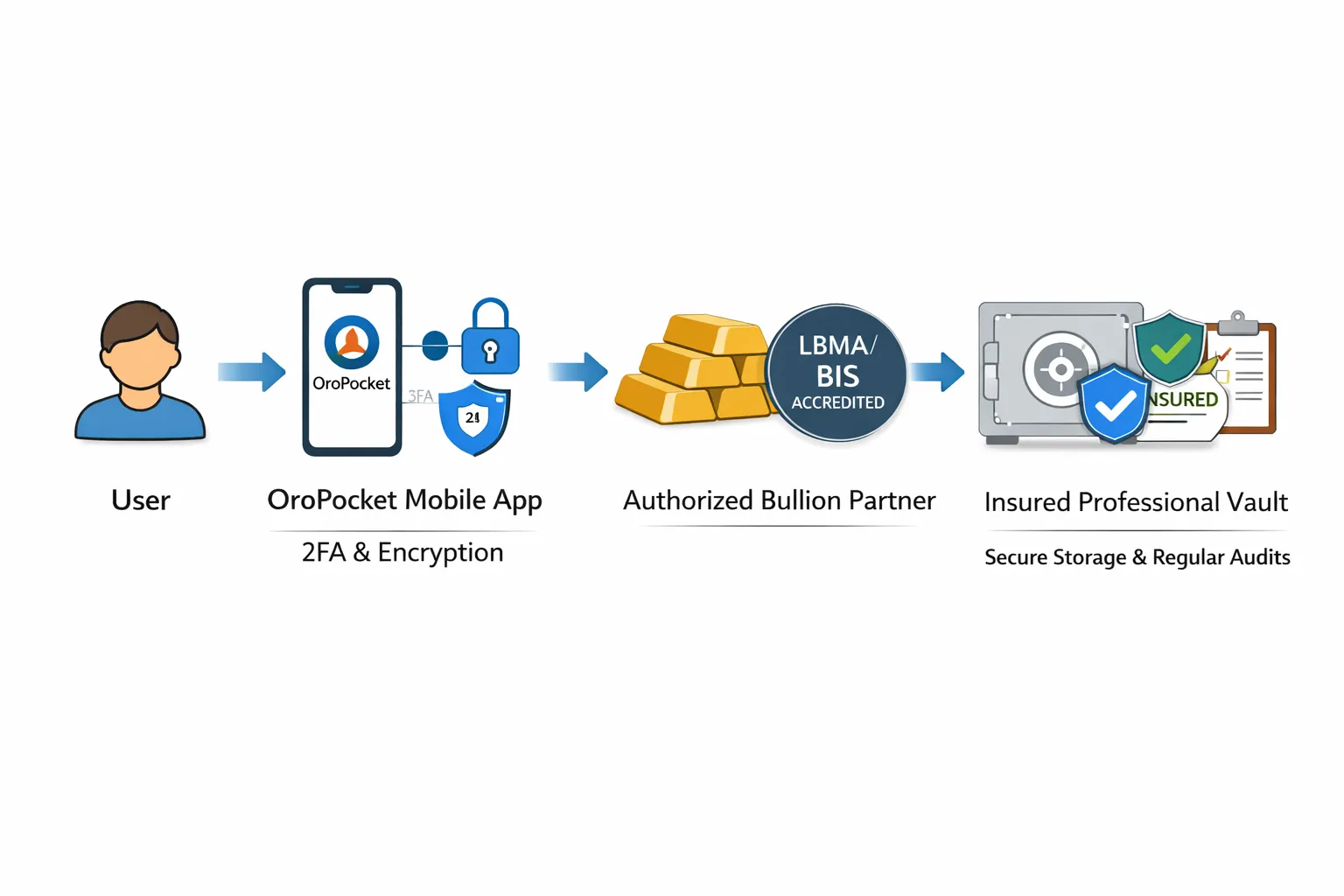

24K, 99.9x purity and how it’s assured

-

Sourced via authorized bullion partners working to international standards.

-

Serialised bullion with certificates; purity tested and tracked end‑to‑end.

-

Independent audits reconcile vaulted bars with platform allocations on a periodic schedule.

Vaulting & insurance

-

Stored in fully insured professional vaults with multi‑layer security.

-

Coverage includes theft, fire, and natural disasters as per policy terms.

-

Regular reconciliation between partner vault records and OroPocket’s ledger to ensure 1:1 backing.

Proof of ownership

-

Gold is allocated on a ledger to your name; you see your balance instantly after every buy.

-

Download statements/invoices any time for compliance and record‑keeping.

-

You retain redemption rights: sell back instantly or redeem coins/bars (making + delivery apply).

OroPocket security features

-

RBI‑compliant processes with authorized bullion partners and 100% insured vaults.

-

Two‑factor login, device binding, and encrypted data at rest/in transit.

-

Real‑time audit trails and alerts for account actions.

-

Transparent pricing and live portfolio view for full control.

What to verify on any platform

-

Purity: 24K, 99.9x standards; documented assay/certification.

-

Vaulting: Credible, insured vault partners with reconciliation cadence.

-

Audits: Frequency and independence of third‑party audits.

-

Pricing: Clear spreads, GST breakdown, and buy/sell quotes in real time.

-

Redemption: Transparent T&Cs for physical delivery and fees.

“The LBMA Good Delivery List ensures bars meet strict standards for weight, purity and appearance – upholding integrity and trust in the global precious metals market.” – Source

Invest with confidence. Get started on OroPocket and buy 24K gold with instant UPI: https://oropocket.com/app

Best way to buy digital gold: build a simple investing habit

Start tiny, stay consistent

-

Begin with micro-buys (₹1–₹100). Learn the flow, stay engaged, and avoid decision fatigue.

-

Set weekly or monthly reminders (or SIP-like routines) to automate consistency.

-

Track your grams and average buy price; small, regular buys smooth out volatility.

Daily streaks and gamified progress

-

Keep your investing streak alive – OroPocket gives a bonus every 5 consecutive days.

-

Watch your progress bar fill; the visual feedback keeps motivation compounding.

-

Missed a day? Restart quickly – momentum matters more than perfection.

Earn free Bitcoin on every gold/silver purchase

-

Tiered Satoshi rewards on every buy = two assets for the price of one.

-

Over time, Bitcoin cashback helps offset part of the spread and boosts your effective yield.

-

Redeemable and trackable alongside your gold balance in-app.

Spin to Win and referrals

-

Spin daily for a chance to win bonus gold/Bitcoin rewards – free upside for sticking to the habit.

-

Invite friends: both earn 100 Satoshi + a free spin when they join via your link.

Send/gift gold

-

Festivals, birthdays, milestones – send small, meaningful gold gifts instantly via phone number or handle.

-

Perfect for Dhanteras/Diwali shagun without jeweller visits or making charges.

Practical routine

-

A simple 30-day plan:

-

Day 1–30: Buy ₹101 daily (or set a weekly budget split across days).

-

Maintain your streak for bonus boosts every 5 days.

-

Do your daily spin; claim any wins.

-

Share your referral link once a week – help friends start and earn extra Satoshis.

-

Review your grams and rewards each Sunday; adjust next week’s target.

-

Build the habit now – download OroPocket and make your first ₹1 buy with UPI in under a minute: https://oropocket.com/app

Comparing platforms: best way to buy digital gold online in India

What to look for

-

Transparent, live pricing with clear spreads and GST

-

₹1 entry for micro-buys and habit-building

-

UPI speed and reliability (24×7/365)

-

Clear custody with insured vaults and redemption rights

-

Rewards that boost effective returns

-

Habit tools (streaks, reminders) to keep you consistent

-

Easy gifting and physical redemption when you need it

Why OroPocket stands out

-

The only platform that gives free Bitcoin (Satoshis) on every gold/silver buy

-

Gamified daily streaks and spin-to-win that make saving addictive in a good way

-

Seamless UPI checkout, ₹1 minimum, instant allocation

-

Send/gift gold to contacts – perfect for festivals and birthdays

-

Transparent pricing and RBI‑compliant processes with insured vaults

Alternatives at a glance

-

Wallet apps (Paytm, Google Pay/SafeGold): Convenient UPI and live price, but typically no Bitcoin rewards or habit gamification.

-

Broker apps: Portfolio convenience; limited rewards/gamification; sometimes fewer gifting tools.

-

Bullion platforms (Augmont, others): Strong redemption catalogs; fewer habit tools; no Bitcoin rewards.

OroPocket vs others (feature snapshot)

|

Platform |

₹1 Entry |

UPI Payments |

Bitcoin Rewards |

Daily Streaks |

Spin-to-Win |

Referral Bonuses |

Send/Gift Gold |

Physical Redemption |

Pricing Transparency |

|---|---|---|---|---|---|---|---|---|---|

|

OroPocket |

Yes |

Yes (instant) |

Yes (on every buy) |

Yes (bonus every 5 days) |

Yes |

Yes (100 Satoshi + free spin) |

Yes |

Yes (coins/bars; making+delivery apply) |

Live buy/sell with spread shown |

|

Paytm Gold |

Yes |

Yes |

No |

No |

No |

Limited/Promos |

No (gifting discontinued) |

Yes |

Live price + invoice |

|

Jar |

Yes |

Yes |

No |

Basic habit tools |

No |

Yes (varies) |

Limited/Varies |

Yes (via partner) |

Live price + charges shown |

|

Augmont |

Yes |

Yes |

No |

No |

No |

Limited/Varies |

Yes |

Yes |

Live price + catalogue |

|

Google Pay (SafeGold) |

Yes |

Yes |

No |

No |

No |

Limited/Varies |

Limited/Varies |

Yes (via partner) |

Live price + invoice |

Note: Features change over time; check each app for the latest details.

Decision shortcut

-

If you value habit-building + extra rewards + simplicity, choose OroPocket. You’ll stack 24K gold while earning Bitcoin rewards, keep your streaks alive, and gift gold in seconds – all with instant UPI.

Start now with ₹1 and build your daily streak. Download OroPocket: https://oropocket.com/app

Taxes on digital gold in India: what to know before you sell

Capital gains

-

Short-term (STCG): If you sell within <3 years, gains are taxed at your income tax slab rate.

-

Long-term (LTCG): If you sell after ≥3 years, gains are taxed at 20% with indexation benefits (cost inflation index adjusts your purchase price, reducing taxable gains).

-

Cost basis: Your cost includes the purchase price plus 3% GST and any applicable fees charged at buy.

GST

-

3% GST applies on the purchase value when you buy digital gold.

-

No GST is levied on sale proceeds when you sell back to the platform.

High-value transactions & compliance

-

PAN is typically required for large-value purchases; ensure your KYC is completed for smooth redemptions and payouts.

-

Stick to UPI/bank-linked payments and keep your profile details updated to avoid payout delays.

-

If you plan frequent or high-value buys, complete KYC early to unlock higher limits and faster settlements.

Records and invoices

-

Always download invoices for each buy (showing base gold price + 3% GST) and maintain a running transaction statement for sells.

-

Keep a simple log: date, amount (₹), grams, net price, and fees. This makes it easy to calculate holding periods and cost basis at tax time.

-

In OroPocket, you can access your transactions, statements, and invoices in-app – export and save them periodically.

Pro tip

-

Consider holding for ≥3 years to benefit from indexation on LTCG.

-

Avoid frequent short-term churning solely to “catch moves” – spreads and taxes can erode returns. Build a steady accumulation plan instead.

Plan your buys smartly and keep clean records. Ready to buy digital gold online in India via UPI? Start with ₹1 on OroPocket: https://oropocket.com/app

Common pitfalls (and easy fixes) when you buy digital gold online

Don’t ignore the spread

-

What goes wrong: You buy at the “buy” price and later see the “sell” price is lower – this gap is the spread.

-

Easy fix: Always check the live buy vs sell price before confirming. If the spread looks wider than usual, wait for calmer market conditions.

Verify the platform

-

What goes wrong: Shiny apps but weak custody or unclear ownership.

-

Easy fix: Look for:

-

Custody disclosures (who holds the gold, insured vaults)

-

Audit frequency (independent, periodic)

-

Vaulting partners (reputable, accredited)

-

Transparent pricing and easy-to-reach support

-

-

On OroPocket, you get 24K insured vaulting, audit trails, and clear spread display.

Understand delivery costs

-

What goes wrong: You plan to “take delivery later” without realizing extra costs.

-

Easy fix: Physical redemption involves making + delivery/shipping fees (higher for small coins). If you want pure investment, keep it digital and save on those charges.

Beware FOMO buying

-

What goes wrong: Chasing price spikes leads to poor average buy prices.

-

Easy fix:

-

Use micro-buys (₹1–₹500) and set reminders to average in.

-

Build a steady plan instead of reacting to headlines.

-

Leverage price alerts to buy on dips, not peaks.

-

Security hygiene

-

What goes wrong: Weak device/app security puts your account at risk.

-

Easy fix:

-

Use a strong PIN and enable biometric login.

-

Avoid public Wi‑Fi for transactions; use cellular or a trusted network.

-

Keep PAN/Aadhaar private; never share OTPs.

-

Turn on app notifications to catch any unusual activity instantly.

-

Skip the pitfalls and make smarter buys with transparent pricing, instant UPI, and rewards on every purchase. Download OroPocket: https://oropocket.com/app

Conclusion: Start with ₹1 today on OroPocket

Why this is the best time

-

Inflation doesn’t wait. Your savings lose value every month.

-

UPI makes buying 24K digital gold instant – no bank hours, no paperwork.

-

Small daily actions compound. A ₹101 micro-buy habit beats one “perfect” timed trade.

OroPocket advantage, summarized

-

₹1 entry point to start now

-

Instant UPI checkout (24×7)

-

Free Bitcoin on every gold/silver purchase

-

Daily streak bonuses + spin-to-win rewards

-

24K pure gold in fully insured vaults

-

Send/gift gold instantly to contacts

-

Transparent pricing with live buy/sell rates

Clear call to action

-

Download the OroPocket app and make your first ₹101 gold buy today: https://oropocket.com/app

Friendly nudge

-

Start small, learn the flow, and let consistency (plus Bitcoin rewards) do the heavy lifting. Build your gold stack in minutes, not months.

CTA: Download OroPocket (iOS/Android) → https://oropocket.com/app