Investing in gold and silver together: Allocation strategies, rebalancing, and risk control

Invest in gold and silver together (2026–27, India)

The 10-second answer

-

Combine gold (core hedge) + silver (higher-beta satellite) inside a small sleeve of your portfolio, then rebalance on a schedule. Start tiny via UPI; automate with micro-SIPs to avoid timing mistakes.

What you’ll learn in this guide

-

Smart allocations for different risk levels (Conservative, Moderate, Aggressive)

-

When and how to rebalance (annual + ±25% drift rule)

-

Which route to buy (digital gold/silver, ETFs, SGB) and how they compare on costs, liquidity, and taxes

-

How micro-investing, SIPs, and rewards reduce volatility and boost discipline

Key takeaway for Indian investors

“Adding 7.5–15% gold to an average Indian portfolio improved risk-adjusted returns and reduced drawdowns.” – Source

Who this is for

-

First-time investors, salaried pros, and long-horizon accumulators who want a simple, rules-based way to add metals without overthinking market timing.

SEO note (topics covered)

-

Investing in gold and silver, gold & silver investments, how to invest in gold and silver, gold silver investment India, micro-investing gold and silver, rebalancing and risk control

Ready to start with ₹1 and earn free Bitcoin on every gold/silver purchase? Download the OroPocket app: https://oropocket.com/app

Why combine gold + silver now (India 2026)

Clear roles, smoother ride

-

Gold: low correlation to equities; INR shock-absorber in risk-off phases; core ballast

-

Silver: dual precious + industrial demand (EVs, solar, electronics); higher upside with higher volatility; satellite position

Timing-proof your plan

-

Use SIPs/micro-SIPs to average costs; avoid chasing rallies or panicking on dips

-

Rebalance annually or on ±25% drift inside the metals sleeve to harvest winners and refill laggards

Video chapters:

-

Roles: gold as hedge, silver as higher-beta

-

70/30 default within metals for most Indian investors

-

Rebalancing: annual review + ±25% drift rule

-

India tax notes: LTCG, SGB treatment (verify latest)

India tax/treatment snapshot (verify before investing)

“Budget 2024 aligned long-term capital gains on many gold/silver assets to a flat 12.5% after 24 months; SGB interest is taxable, while capital gains at maturity are exempt.” – Source

When each metal shines

-

Macro stress, inflation, or rupee weakness: gold tends to lead and cushion drawdowns

-

Expansion and clean-tech buildout: silver can benefit from PV/EV cycles

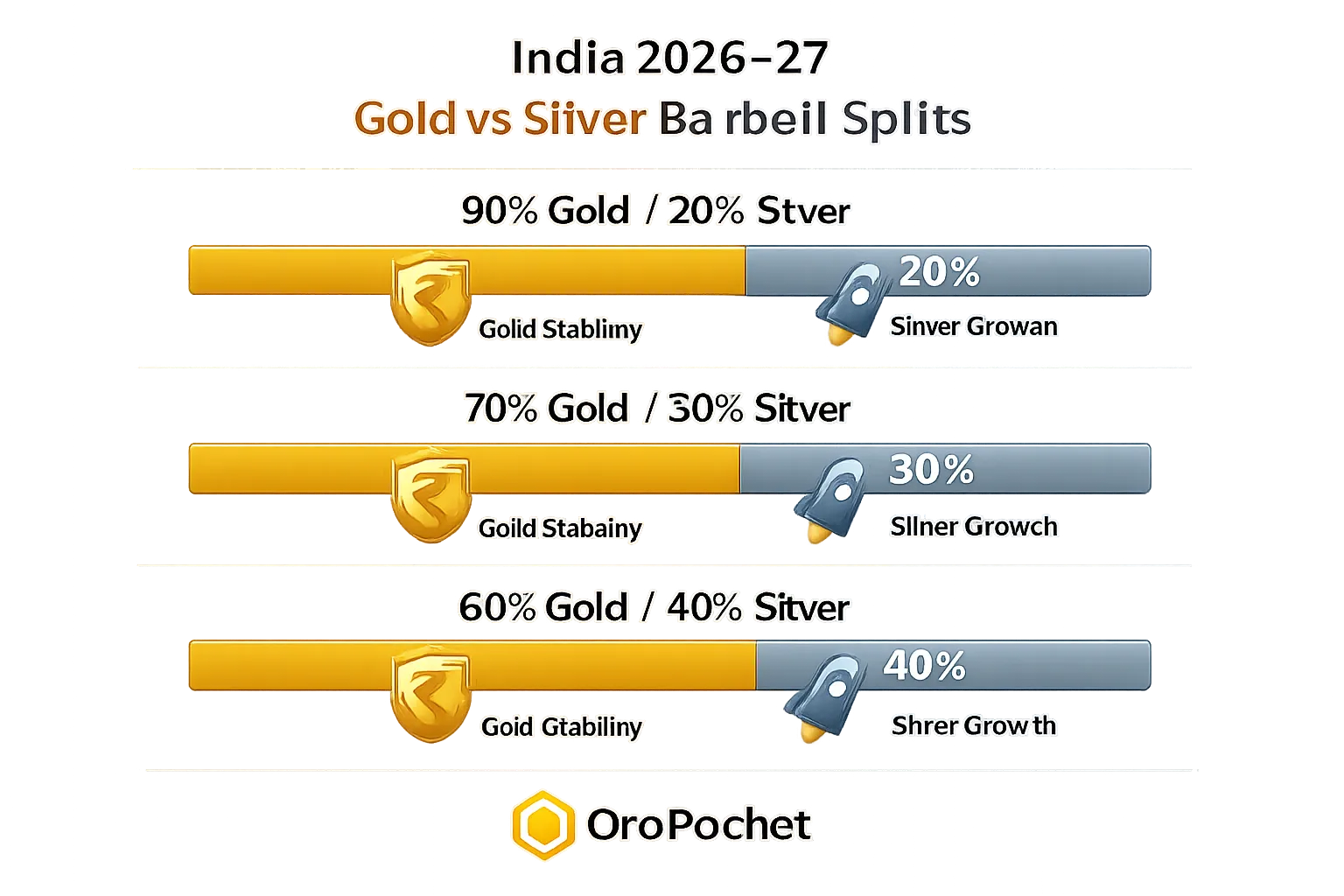

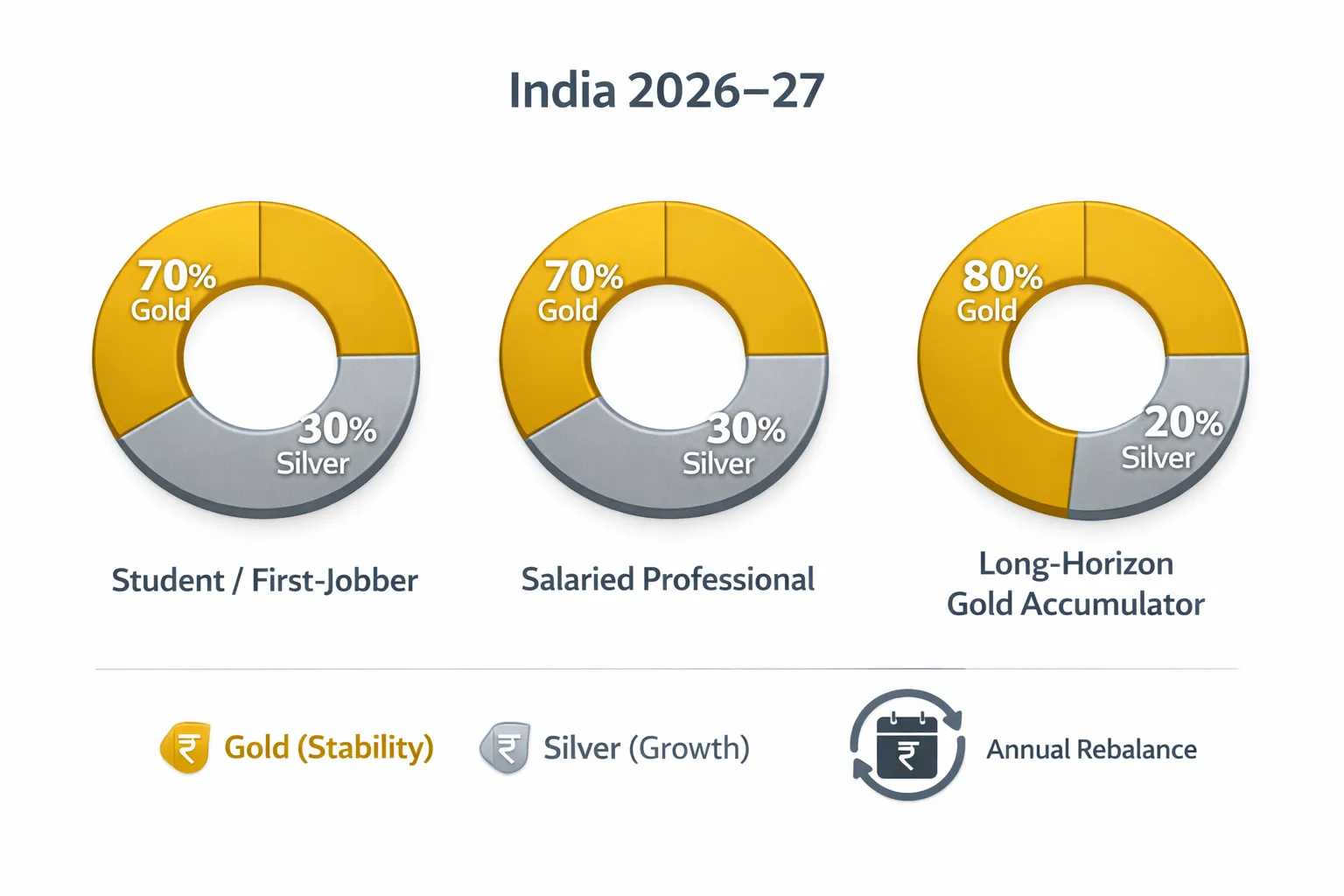

Allocation strategies: 2026–27 target splits by risk

Quick rules

-

Total metals sleeve (of total portfolio): 5–15% based on risk tolerance

-

Within metals (gold/silver): keep gold heavier; cap silver at 40%

Suggested splits (use as starting points)

-

Conservative: 80% gold / 20% silver; metals = 5–7% of total

-

Moderate: 70% gold / 30% silver; metals = 7–12% of total

-

Aggressive: 60% gold / 40% silver (cap silver at 40%); metals = 10–15% of total

Micro-SIP examples (illustrative)

-

₹500/week: metals 7% of portfolio; split 70/30 inside metals

-

₹5,000/month: metals 10%; split 70/30; rebalance annually

Target allocations by risk

|

Risk Profile |

Metals % of Portfolio |

Gold % |

Silver % |

Example Monthly Metals SIP (₹) |

Example Gold/Silver split (₹) |

|---|---|---|---|---|---|

|

Conservative |

5–7% |

80% |

20% |

1,000 |

₹800 / ₹200 |

|

Moderate |

7–12% |

70% |

30% |

5,000 |

₹3,500 / ₹1,500 |

|

Aggressive |

10–15% |

60% |

40% |

10,000 |

₹6,000 / ₹4,000 |

Implementation tips

-

Start gold-heavy; add silver gradually

-

Pre-commit your rebalance date; write down rules

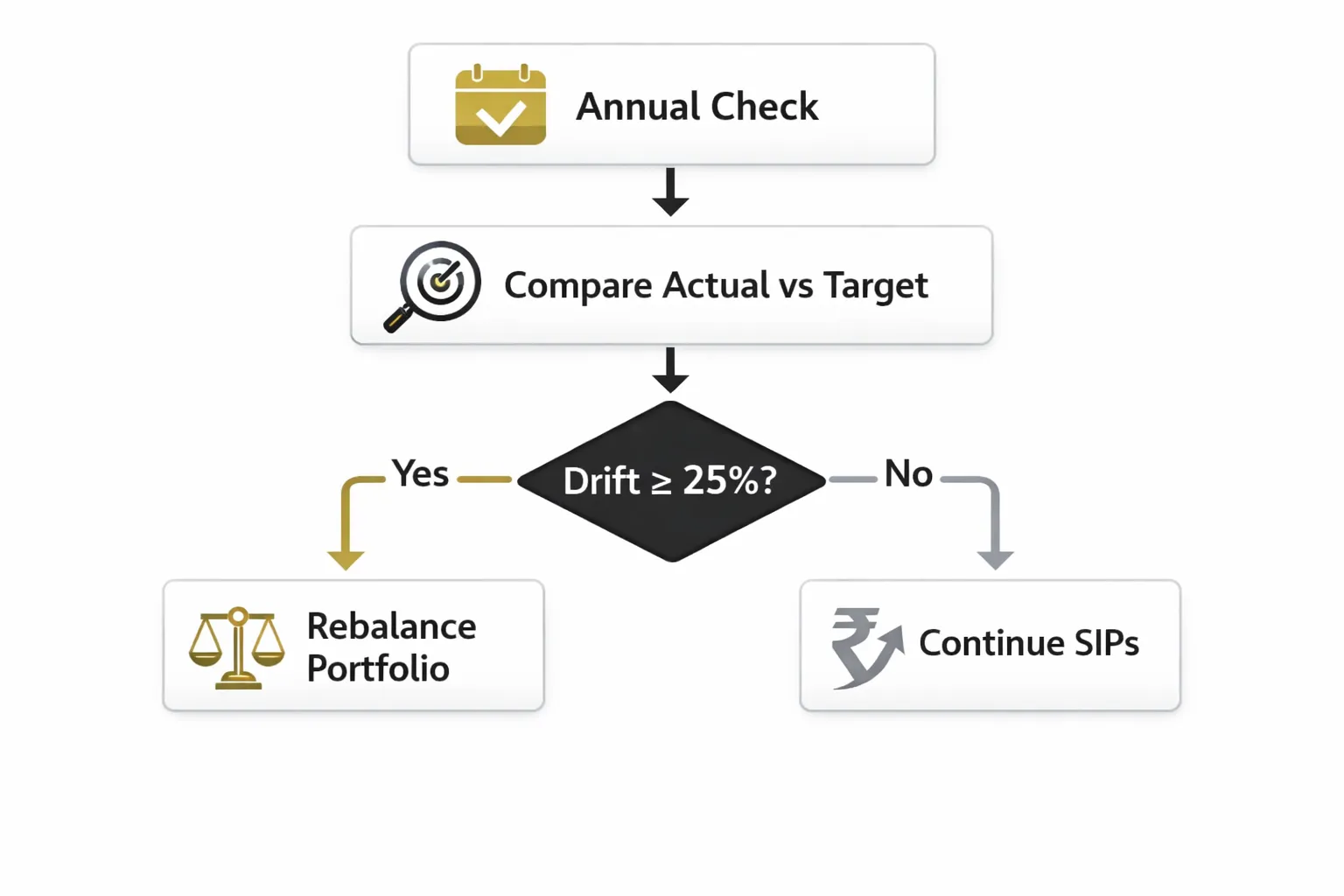

Rebalancing and risk control

Two-rule framework

-

Time-based: annual rebalance (solid default for most)

-

Threshold-based: also rebalance if gold–silver split drifts ±25% from target within the metals sleeve

How to execute (by instrument)

-

Digital (OroPocket): one corrective buy/sell to restore target; keep SIPs running

-

ETFs: use limit orders during market hours to reset weights economically

-

SGB: treat as core gold; adjust sleeve via digital/ETFs rather than trimming SGB

Calendar anchors that help

-

Use Diwali/Dhanteras top-ups as mini-rebalances toward the underweight metal

Keep it lean

-

Fewer, rules-based actions beat frequent tinkering; minimize costs and decision fatigue

How to invest in gold and silver: routes compared (India)

Options at a glance

-

OroPocket (digital 24K gold & silver): ₹1 entry, UPI-native, Bitcoin rewards, insured vaulting, in-app gifting

-

Gold ETF + Silver ETF (SEBI-regulated): broker/demat, expense ratio + bid–ask, market-hour liquidity

-

Sovereign Gold Bonds (RBI SGB): gold-only, interest + gold price linkage, long tenor with early-exit windows

Picking the right tool for your need

-

Need ₹1 micro-buys + 24/7 + rewards: OroPocket

-

Need intraday exchange execution: ETFs

-

Need sovereign comfort and interest for long-term gold: SGB

Instrument comparison

|

Option |

Metals |

Entry & How to Buy |

Liquidity |

Costs/Fees |

Rewards/Interest |

Regulation & Safety |

Best For |

|---|---|---|---|---|---|---|---|

|

OroPocket (digital) |

Gold + Silver (24K) |

Start from ₹1 via UPI in the app; no demat required |

Instant in-app buy/sell; 24/7 |

Buy–sell spread; no expense ratio |

Bitcoin cashback on every purchase; daily streak bonuses; spin-to-win; referral Satoshi |

RBI-compliant processes; authorized bullion partners; 100% insured vaults |

Micro-investing, habit-building SIPs, quick top-ups, gifting |

|

Gold ETF |

Gold |

Through broker/demat; place orders on exchange |

Market hours; depends on ETF liquidity |

Expense ratio + bid–ask spread; minor tracking error |

None |

SEBI-regulated ETF structure |

Regulated, liquid gold exposure; tactical trims via exchange |

|

Silver ETF |

Silver |

Through broker/demat; place orders on exchange |

Market hours; depends on ETF liquidity |

Expense ratio + bid–ask spread; minor tracking error |

None |

SEBI-regulated ETF structure |

Regulated silver sleeve to complement gold-heavy allocation |

|

RBI SGB |

Gold |

Subscribe during issuance via bank/broker or buy listed series on exchange |

8-year tenor; early exit windows from year 5; exchange liquidity varies |

No storage cost; no expense ratio |

Fixed interest plus gold price linkage (per scheme); tax benefits at maturity |

Sovereign-backed (RBI) |

Long-term gold holders seeking sovereign comfort and interest |

Start small, stay consistent, and let rewards work for you. Download OroPocket and begin with ₹1: https://oropocket.com/app

Costs, taxes, and liquidity (India 2026)

Cost control

-

Batch tiny buys into 1–2 weekly purchases to reduce spread impact

-

Use OroPocket rewards (Bitcoin cashback, streak bonuses, spin-to-win, referrals) to lower effective net cost over time

-

Prefer larger, liquid ETFs; use limit orders to manage bid–ask; monitor tracking error

-

Keep rebalancing rules-based (annual or ±25% drift) to avoid overtrading and extra costs

-

Track total cost of ownership: spreads + brokerage/fees + slippage; optimize order size and timing

Tax high-level (illustrative – verify latest rules)

-

Many gold/silver assets: short-term gains taxed per slab; long-term often at a flat rate after 24 months (confirm current law and instrument-specific rules before investing)

-

SGB: interest taxable; gains at maturity exempt under the scheme; early exits follow capital gains rules by holding period

-

Keep records: invoices, contract notes, demat statements, and app exports to maintain accurate cost basis and simplify filing

-

If in doubt, consult a tax professional to ensure compliance across digital gold, ETFs, and SGB

Liquidity checklist

-

Need instant: Digital (OroPocket) in-app sells

-

Need market-hour execution: ETFs

-

Comfortable with long hold + interest: SGB

Start minimizing drag today – use OroPocket to batch buys, automate micro-SIPs, and earn Bitcoin rewards on every purchase. Download the app: https://oropocket.com/app

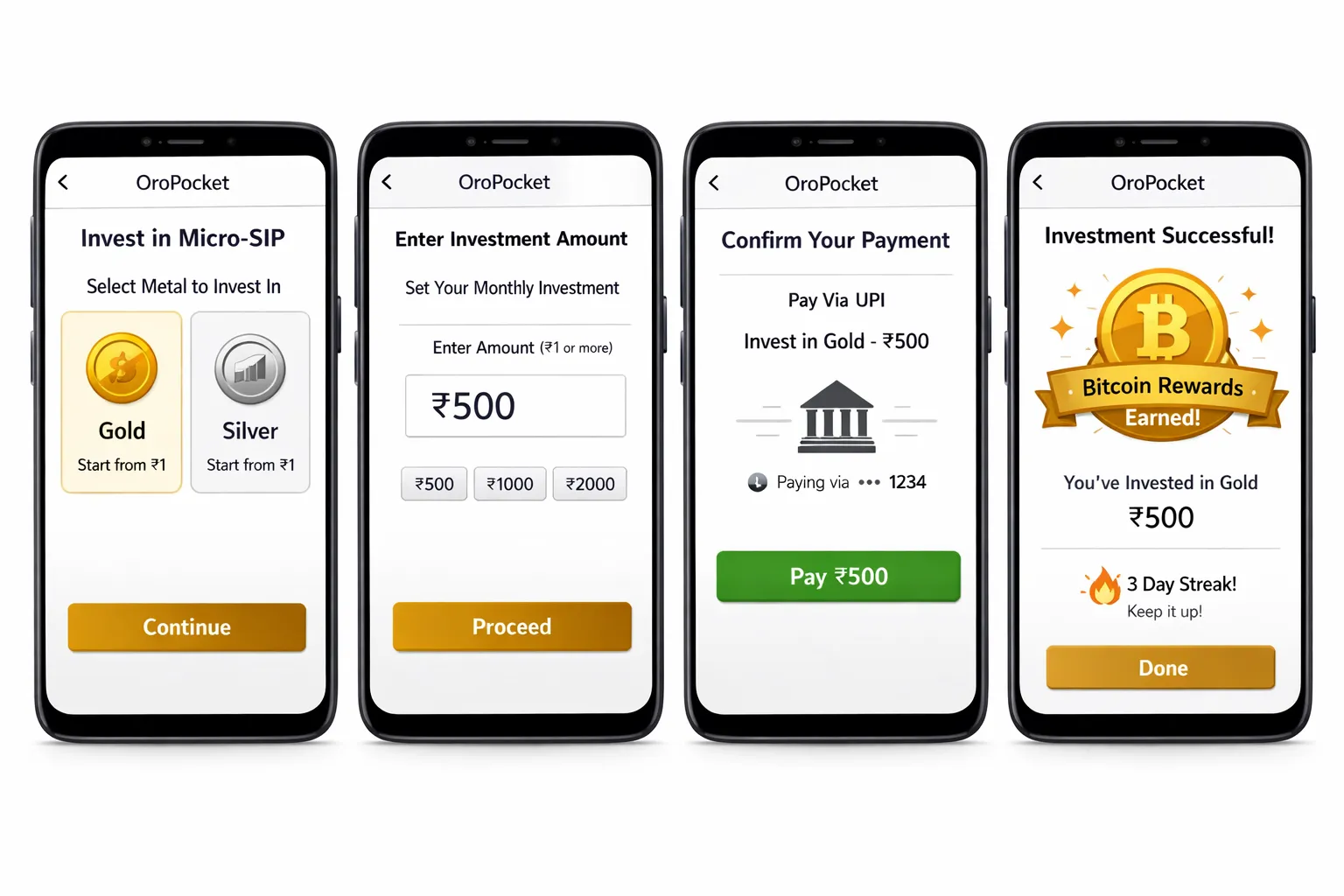

How to start (step-by-step)

OroPocket (digital gold + silver, ₹1 via UPI)

-

Download app (iOS/Android) and complete quick KYC

-

Tap Gold or Silver, enter ₹1+, pay via UPI; holdings are vaulted and insured

-

Turn on weekly micro-SIPs; activate streaks/spins; refer friends for Satoshi bonuses

Gold ETF / Silver ETF (SEBI-regulated)

-

Open demat + trading account; search tickers; place buy orders during market hours

-

Optional: set up SIP via broker; review expense ratio, liquidity, and tracking error

Sovereign Gold Bonds (RBI SGB)

-

Subscribe during issuance windows via bank/broker or buy listed series

-

Plan to hold to maturity/early exit window to realize full benefits

Start now with ₹1 and earn free Bitcoin on every gold/silver purchase: https://oropocket.com/app

Example portfolios for Indians (2026–27)

Student/first-jobber (₹500/week)

-

Metals sleeve: 7% of total; within metals 70% gold / 30% silver

-

Tools: OroPocket micro-SIPs; annual rebalance or on ±25% drift

Salaried professional (₹5,000/month)

-

Metals sleeve: 10%; within metals 70/30

-

Tools: OroPocket for both metals; optional Silver ETF for exchange execution; annual rebalance

Long-horizon gold accumulator

-

Metals sleeve: 8–10%; within metals 80/20

-

Tools: Core via SGB; top-ups via OroPocket; adjust silver via Silver ETF

Risk controls and common mistakes

Guardrails that keep you safe

-

Keep total metals at 5–15% of portfolio based on risk; cap silver at 40% within metals

-

Maintain a 3–6 month emergency fund so you never sell metals for short-term needs

-

Write down your target split (e.g., 70/30) and your rebalance date

Do / Don’t

-

Do automate weekly SIPs; don’t chase headlines

-

Do one annual review; don’t overtrade minor moves

-

Do prefer large, liquid ETFs on exchange; don’t ignore bid–ask and tracking error

Behavioral edge

-

Fix two buy days (e.g., Mon/Thu) to cut decision fatigue

-

Use streaks, rewards, and visible progress to stay consistent

Ready to put rules over noise? Start investing in gold and silver from ₹1 and earn Bitcoin rewards on every purchase. Download OroPocket: https://oropocket.com/app

Final verdict: Gold is the shock absorber; silver is the torque – use both, then rebalance

-

For most Indians in 2026–27, the smarter path isn’t “gold or silver,” it’s a gold‑heavy sleeve with a smaller silver satellite.

-

Start small, stay systematic, and let rewards offset costs over time.

-

OroPocket makes it effortless: ₹1 entry, UPI in seconds, 24K insured vaulting, and free Bitcoin on every purchase – plus streaks, spins, and referrals to keep your habit strong.

Call to action: Download the OroPocket app now and start your gold + silver SIP in under a minute – https://oropocket.com/app