Buying gold from banks vs online platforms: Which is better for investors in India?

Introduction: Banks vs Online Platforms – quick answer and comparison at a glance

What this guide covers

-

The real differences between buying gold from banks (coins/bars) and online platforms (digital gold apps)

-

Costs, purity, buyback, regulation, convenience (UPI), delivery, and who each route is best for

-

Where OroPocket fits for modern investors who want micro-investing + rewards

“Between April 2024 and August 2025, digital gold purchases via UPI surged by 377%.” – Source

TL;DR (who should choose what)

-

Banks: Best for gifting or those who want a tangible coin/bar from a known branch – but expect higher premiums and no bank buyback

-

Online platforms: Best for investing and liquidity – low entry (as low as ₹1), UPI-friendly, instant sell, door-delivery on demand

Comparison at a glance (feature snapshot)

|

Feature |

Banks (coins/bars) |

Online platforms (digital gold apps) |

|---|---|---|

|

Purity and certification |

Typically 24K 999, hallmarked |

24K 999, backed by authorized bullion partners |

|

Premiums and fees |

Higher premiums; locker rent if using home/bank storage |

Small buy/sell spread; standard 3% GST |

|

Liquidity/buyback |

Banks generally do NOT buy back coins |

Instant sell at live prices in-app |

|

Minimum investment |

Usually 5g–10g+ denominations |

Start from ₹1–₹10; fractional investing |

|

Convenience |

Branch visit, paperwork, timing constraints |

30-second UPI purchase; anytime, anywhere |

|

Delivery |

Immediate handover at branch |

Optional doorstep delivery of coins/bars |

|

Regulation/safety |

Banks are regulated entities |

Digital gold not SEBI-regulated; vaulted with insured custodians – know your provider |

Where OroPocket fits (in one line)

Mobile-first digital gold with UPI, ₹1 entry, and free Bitcoin rewards on every purchase – built for young, habit-forming investors.

How buying gold from banks works (process, costs, and policies)

What you actually buy at a bank

-

Coins/bars in standard denominations (often 5g, 10g, 20g, 50g, 100g)

-

Purity typically 24K 999 with hallmark/certification and tamper-evident packaging

The buying experience

-

Visit branch (limited online availability); complete KYC as per bank policy

-

Pay higher premiums over spot price (brand + distribution cost)

-

Limited designs; focus is on standard coins/bars rather than jewellery variety

Storage and aftercare

-

You handle storage: home safe or bank locker (annual locker rent + optional insurance)

-

Scratches, tampering, or lost invoice/certificate can reduce resale value at jewellers

Liquidity and buyback

-

Most banks do not buy back gold coins; resale usually happens at jewellers with cuts/discounts

-

No instant liquidity; requires a physical trip and negotiation on purity/price

When banks make sense

-

Buying for gifting/ceremonies where a branded coin matters

-

Large, one-time purchase where branch trust and in-person experience are preferred

Tip for searchers: If you’re comparing how to buy gold from a bank vs alternatives, factor in total cost of ownership (premium + locker rent) along with purity and resale options.

How buying from online platforms works (digital gold)

What you actually buy online

-

Fractional ownership of 24K 999 physical gold stored in insured vaults by authorized custodians

-

Your holding can be redeemed into coins/bars (optional) or sold back instantly

The buying experience

-

Mobile-first, UPI-ready, buy/sell 24×7 at live prices

-

Start with ₹1–₹10; set up SIPs/recurring buys

-

Transparent holdings and price tracking in-app

Fees and delivery

-

Standard 3% GST on purchases; platform spread applies

-

Optional doorstep delivery for redemption (delivery and minting fees apply)

Where OroPocket stands out

-

₹1 entry, instant UPI, and unique Bitcoin rewards (Satoshi) on every gold/silver purchase

-

Gamified features: daily streaks, spin-to-win, referral bonuses

-

Send/gift gold digitally to friends and family

Purity, custody, and assurance: Can you trust the gold?

Purity standards

-

Banks: Typically 24K 999 coins/bars with hallmarking and a certificate of authenticity. You get a physical invoice and sealed, tamper-evident packaging. This suits buyers who prefer to buy gold from a bank and carry documentation for future resale.

-

Online platforms: 24K 999 gold backed by reputed refiners/bullion partners; digital certificates and invoices are visible in-app. If you’re buying gold online in India, you can view purity, lot details, and download records anytime – making the purchase of gold online transparent and easy to audit.

Vaulting and audits (digital gold)

-

Custody with professional, insured vaults; periodic audits by independent trustees ensure that the total customer holdings match physical gold in storage.

-

Segregated holdings and daily reconciliation: Your grams are accounted for separately (not commingled with company assets), and balances are reconciled to bullion in vaults at regular intervals. This is key for anyone asking how to purchase gold online safely.

Traceability and redemption

-

Digital: You can track your exact grams and transactions in-app. When you choose delivery, you redeem those grams into specific coin/bar SKUs, with minting, packaging, and delivery handled by the partner. This offers a clear trail from purchase to redemption – helpful for audits or gifts.

-

Bank: You hold a physical coin/bar immediately. Keep the invoice, seal intact, and certification safe; scratches, tampering, or missing paperwork may reduce resale value at jewellers. For buyers wondering how to buy gold from a bank and preserve value, meticulous storage and documentation matter.

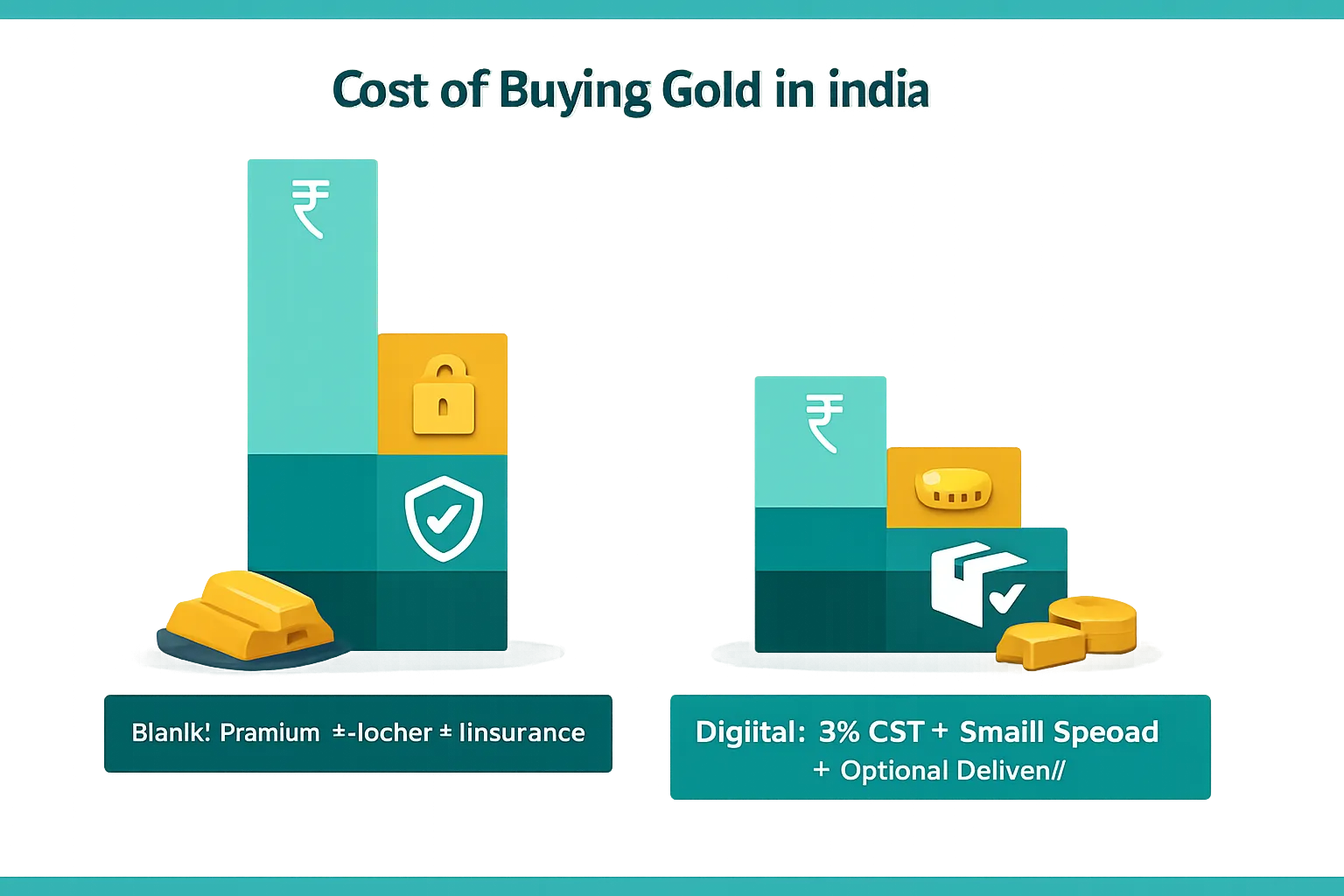

Total cost of ownership: premiums, GST, storage, spreads

The costs you’ll actually pay

-

Banks: Higher upfront premiums over spot + optional locker rent + insurance

-

Digital: Standard 3% GST + platform spread; storage is covered by the provider; pay delivery/minting fees only if you redeem coins/bars

“Gold purchases in India attract 3% GST on the gold value; jewellery making charges carry an additional 5% GST.” – Source

Typical add-ons to watch

-

Bank locker rent if you store physically

-

Making/packaging/design premium on gift coins

-

Digital redemption/delivery charges (only when you want physical)

Example scenarios (how costs add up)

-

Small saver (₹500/week): Digital wins on flexibility and zero locker costs

-

Festive gift (10g coin): Bank coin offers tangibility, but premium may be higher than digital redemption of a coin

|

Cost component |

Banks (coins/bars) |

Digital platforms |

|---|---|---|

|

Upfront premium over spot |

High (brand/distribution) |

Low-to-moderate (buy/sell spread) |

|

GST on gold value |

3% |

3% |

|

Making/packaging |

Often applied (esp. gift coins) |

Only on physical redemption |

|

Storage |

Locker rent + insurance (optional) |

Included in platform; no locker rent |

|

Liquidity cost |

Travel + time + potential jeweller cuts |

Instant sell at live prices |

|

Minimum ticket size |

Usually 5g–10g+ |

Start from ₹1–₹10 |

Liquidity and exit: how fast can you get cash or gold back?

Selling timeline and friction

-

Banks: Generally no buyback on coins/bars. If you want to exit, you’ll typically sell to a jeweller who may insist on purity checks, deduct melting/testing charges, and negotiate a discount to spot price. There’s no instant liquidity; you must visit during branch/jeweller hours and carry the invoice/certification.

-

Digital: Tap to sell at live prices, 24×7. Proceeds are initiated to your linked bank account quickly, without negotiating or visiting a store. For anyone asking how to purchase gold online and exit efficiently, this is the fastest route to cash.

Redemption options

-

Digital: Besides instant sell, you can redeem your grams into specific coins/bars from a catalog (designs/weights). Delivery, minting, and packaging fees apply only when you choose physical redemption – ideal for planned gifting.

-

Physical: You already hold the coin/bar. To convert back to cash, you must find a buyer (usually jewellers), accept purity checks and potential cuts, and complete the sale in person.

Real use-cases

-

Emergency cash: Digital’s instant sell is typically faster and more predictable than visiting multiple jewellers to compare offers.

-

Gifting on a deadline: Use digital redemption with doorstep delivery to order a coin/bar, or walk into a bank branch to buy a branded coin if you need it the same day.

If you’re comparing buying gold from a bank versus buying gold online in India, think about your exit path upfront. For frequent savers or anyone who wants quick liquidity, digital gold’s tap-to-sell flow and UPI settlements make the purchase of gold online the simplest way to move between gold and cash without friction.

Safety and regulation: what risks you’re taking (and how to reduce them)

Regulatory landscape

-

Banks are regulated entities; their coin sales are straightforward commodity sales.

-

Digital gold isn’t a SEBI-regulated security; custody is held with private, insured vaults via authorized bullion partners. The onus is on you to choose a credible provider and understand custody/audit arrangements.

“It is hereby clarified that the activities of offering digital gold by the Stock Brokers/Exchanges are in contravention of Rule 8(3)(f) of SCRR, 1957.” – Source

Key risks and mitigants

-

Counterparty risk (digital): Choose platforms that work with reputed refiners/bullion partners, use independent trustees, and publish regular audit reports and reconciliation statements.

-

Cyber risk (digital): Use strong passwords, device locks, and 2FA; update apps/OS regularly; avoid public Wi‑Fi for transactions.

-

Theft/storage risk (physical): Prefer bank lockers or insured storage; keep invoices, certificates, and tamper‑evident packaging intact for resale.

What SEBI has said (why it matters)

-

In 2021, SEBI highlighted that stockbrokers should not offer unregulated digital gold through their platforms. This doesn’t ban digital gold outright; it signals that investors must verify who holds the gold, how it’s audited, and what protections exist if a platform shuts down.

“Between April 2024 and August 2025, digital gold purchases via UPI surged by 377%.” – Source

OroPocket angle

-

RBI-compliant operations with authorized bullion partners and fully insured vaults. Built for micro-investors who want safety + instant liquidity + rewards: start from ₹1, buy/sell via UPI in seconds, and earn Bitcoin (Satoshi) on every purchase.

Convenience and experience: payments, KYC, and automation

Payments and onboarding

-

Banks: Branch visit, in-person paperwork, and limited timing. You’ll typically pay via card/NEFT at the counter. Good for ceremonial buys, but not great for speed.

-

Digital: Instant UPI, netbanking, and cards with 24×7 access. Buy or sell in under 30 seconds at live prices – ideal if you’re buying gold online in India for the first time or topping up frequently.

KYC and transparency

-

Banks: Standard banking KYC at the branch when you buy gold from a bank; invoices and physical certificates are handed over with the coin/bar.

-

Digital: App-based KYC with quick verification. Your holdings, invoices, and price charts are visible anytime – useful if you’re comparing how to purchase gold online and want clean records for every gram owned.

Automation and habits

-

Set up SIPs/recurring buys for as little as ₹1–₹100 to build a habit without feeling the pinch.

-

OroPocket adds rewards and gamification – daily streaks, spin-to-win, and referral bonuses – so staying consistent with micro‑investing becomes easy and motivating.

Gifting and P2P

-

Banks: Physical coin gifting for festivals and ceremonies; requires a visit and safe storage afterward.

-

Digital: Send gold instantly to contacts – perfect for birthdays, Dhanteras, and wedding gifts without logistics or delivery worries.

Which route fits your goal? (profiles and decision paths)

If your goal is gifting/ceremonies

-

Prefer: Bank coin or digital redemption to a coin/bar; presentation matters

If your goal is investing/wealth-building

-

Prefer: Digital gold for low-cost accumulation, tiny starting amounts, and instant liquidity

If your goal is short-term parking/emergency fund buffer

-

Prefer: Digital for tap-to-sell liquidity

If your goal is large-ticket purchase planned later (e.g., jewellery)

-

Prefer: Accumulate digitally; redeem as coin/bar or sell when ready

Decision guide

-

Do you need to wear it? Choose bank coin/jewellery

-

Need flexibility/UPI/₹1 starts? Choose digital (consider OroPocket for rewards)

How to evaluate any provider (quick checklist)

Purity and partners

-

24K 999 purity with BIS hallmarking on coins/bars (if you buy gold from a bank) and verifiable certificates for digital gold.

-

Recognized refiners/bullion partners with global accreditation (e.g., LBMA) and a clear chain-of-custody.

-

For buying gold online in India, ensure certificates and invoices are downloadable in-app; avoid platforms that can’t show source refinery and lot details.

Custody and audits

-

Insured vaults with professional custodians; confirm the vault operator’s name and insurance coverage.

-

Independent trustees and regular third‑party audits; look for published audit reports and reconciliation summaries.

-

Segregated holdings (customer assets aren’t commingled with company funds) and daily/weekly reconciliation.

Fees and fine print

-

Banks: Premiums over the live price, packaging/design charges for gift coins, plus optional locker rent and insurance.

-

Digital: Platform spread vs live price, 3% GST, and delivery/minting fees only if you redeem to a coin/bar. No locker rent.

-

Scan for hidden charges (account/closure/inactivity), minimum redemption thresholds, and any extra fees during high‑volatility periods.

Liquidity and limits

-

Buyback terms: Do banks buy back coins? If not, what’s the jeweller’s typical deduction? For digital, is sell available 24×7 at live prices?

-

Settlement timelines to your bank account (T+0/T+1), minimum/maximum order sizes, and daily limits.

-

Redemption catalog clarity: weights, designs, fees, delivery timelines, return policy for damaged packages.

App experience and support

-

Payments: UPI support for instant buys/sells, plus cards/netbanking. Smooth onboarding and quick KYC.

-

Investing tools: SIPs/recurring buys (₹1–₹100+), price alerts, goal trackers, and downloadable statements.

-

Rewards and education: Streaks, cashback, or tutorials that help you build habits. Responsive customer support with clear SLAs and grievance redressal.

Security

-

Strong authentication: 2FA, device locks, biometrics, and session timeouts.

-

Data protection: End‑to‑end encryption, secure cloud infrastructure, and transparent privacy policies.

-

Compliance: RBI‑compliant operations and SEBI‑regulated partners where applicable; clear escalation paths and dispute resolution mechanisms.

-

User hygiene: Encourage PIN/biometric login, avoid public Wi‑Fi, and keep invoices/certificates safely stored (digital or physical).

If you’re comparing how to buy gold from a bank versus how to purchase gold online, use this checklist to weigh purity, custody, total cost, and exit options before you commit.

Final verdict: What should Indian investors choose? (+ next step)

Our take

-

Investors focused on returns, convenience, and flexibility will typically get more value with online platforms: lower entry amounts, instant liquidity, UPI ease, and optional delivery. If you’re comparing how to buy gold from a bank versus buying gold online in India, digital is the smarter choice for regular investing and quick exits.

-

Banks remain great for ceremonial gifting or when the emotional value of a branch-issued coin matters – expect higher premiums and no easy buyback. If presentation is key, a bank coin or digital redemption to a coin/bar works well.

Where OroPocket fits best

-

For first-time and habit-driven investors who want to start with ₹1, buy in 30 seconds via UPI, and earn free Bitcoin on every purchase – OroPocket offers a modern, rewarding way to build gold steadily. It’s perfect if you want to automate small SIPs, track holdings transparently, and keep instant sell liquidity at your fingertips.

Action step

-

Ready to try digital gold the smart way? Download OroPocket on iOS/Android: https://oropocket.com/app

![10 best places to buy digital silver online in India [2026] 7 1020best20places20to20buy20digital20silver20online20in20India205B20265D cover](https://blog.oropocket.com/wp-content/uploads/2025/12/1020best20places20to20buy20digital20silver20online20in20India205B20265D-cover-300x200.webp)