How to sell digital gold instantly: Process, charges, settlement, and taxes

Intro: Sell digital gold instantly in India (why, how, and what you’ll learn)

Selling gold shouldn’t take hours or depend on a shop’s mood. With OroPocket, you can sell digital gold or silver in seconds at a live, transparent gold buy sell price and receive money via UPI – fast, paperless, and on your terms.

Why Indians are choosing to sell digital gold/silver online now

-

Speed and convenience: Tap sell, lock the live quote, and get instant UPI payouts (T+0/T+1).

-

Real-time pricing: No guesswork or haggling – see the market-linked rate and sell at that price.

-

Micro exits: Need just ₹500 today? Sell a fraction of your holdings. No minimums.

-

Anytime access: No store visits, no restricted hours – complete sales from your phone.

The instant-sell advantage vs. offline

-

No haggling or making charges on sale – just the platform’s live buy/sell quote.

-

Paperless flow with KYC done once; future sales are frictionless.

-

Partial exits: Sell a small portion of your gold/silver as needed and keep the rest invested.

-

Instant UPI payouts: Cash in your bank fast, perfect for emergency needs or quick rebalancing.

What this guide covers (and how it helps you)

-

Process: Exactly how to sell digital gold/silver on OroPocket – from live quote to instant UPI payout.

-

Costs: Spreads, any fees, and simple tactics to reduce exit costs.

-

Settlement: T+0/T+1 timelines, UPI vs. bank rails, and payout tracking.

-

Taxes: STCG/LTCG basics so you know what to expect when you book profits.

SEO quick note This guide focuses on how to sell digital gold, gold selling online, gold buy sell price, buy and sell gold online, sale of gold, and how to sell silver online – so you get clear, actionable answers.

Watch how fast it is: live quote → confirm → instant UPI payout

Ready to try it? Download the OroPocket app and sell digital gold or silver in seconds: https://oropocket.com/app

How selling digital gold works: safety, compliance, and ownership

Vault-backed units, live quotes, instant execution

-

Your OroPocket units are 1:1 backed by 24K gold or high-purity silver stored in fully insured, independently audited vaults with authorized bullion partners.

-

You sell at a live, locked quote (transparent gold buy sell price). Once you confirm, proceeds are credited via UPI or bank transfer with T+0/T+1 settlement clarity.

Compliance and best practices

-

RBI-compliant flows with secure, UPI-native payment rails and trusted, authorized bullion partners.

-

KYC thresholds (PAN/Aadhaar) apply for higher limits and seamless withdrawals; complete KYC to unlock faster, larger payouts.

-

Independent audits and insured vaulting matter because they verify that your holdings are truly backed, segregated, and protected – critical in a market where digital gold isn’t directly overseen like SEBI-regulated securities.

“SEBI has clarified that digital gold products are outside its regulatory purview.” – Source

Proof of ownership and records

-

Every invoice/contract note captures the essentials for gold selling online: date/time (IST), metal (gold/silver), live rate, grams/units, spreads/fees, and net proceeds – so you know exactly how your sell price was calculated.

-

Download statements and capital-gains reports directly from the app for filing (helpful for STCG/LTCG), including detailed transaction history and payout confirmations.

Sell with confidence – vault-backed, audited, and paperless. Start now on OroPocket: https://oropocket.com/app

Step-by-step: how to sell digital gold (and silver) on OroPocket

Before you start

-

Check the live price and decide whether you want a partial or full exit.

-

Ensure your UPI ID or bank account is linked and verified for smooth payouts.

6-step sell flow

-

Open the OroPocket app → Go to Portfolio.

-

Choose Gold or Silver → Tap Sell.

-

Enter grams or ₹ (partial exits from ₹1 are supported).

-

Review the locked quote, spread/fees → Confirm.

-

Choose payout method: UPI or bank transfer.

-

Get instant confirmation; track payout status in-app.

Pro tips for better execution

-

Use price alerts and sell in tranches to average out price moves.

-

Prefer liquid hours for tighter spreads and faster settlements.

-

Keep KYC up to date for higher limits and seamless withdrawals.

Settlement timelines, limits, and UPI/bank withdrawals

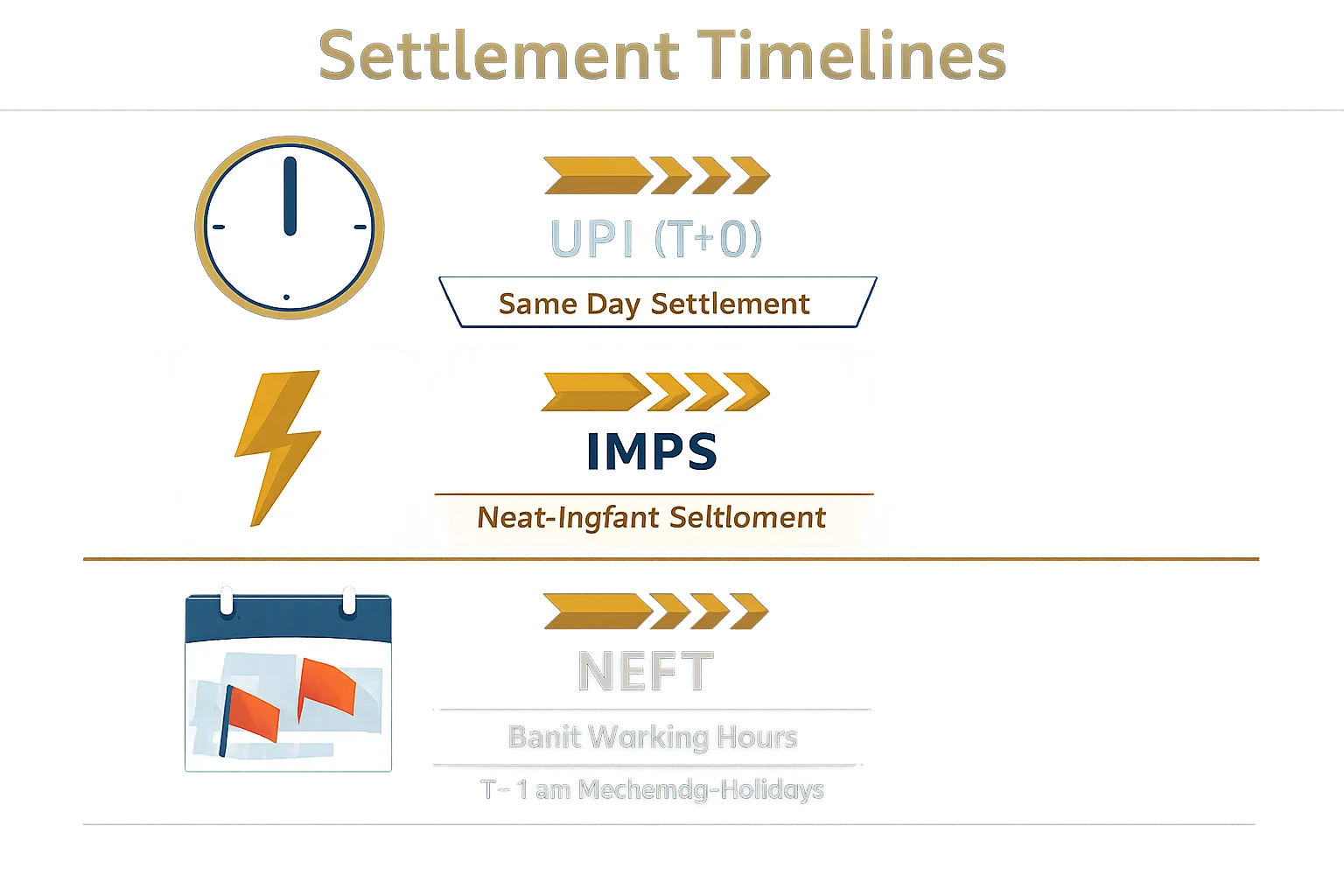

Typical timelines

-

UPI: near-instant T+0 during banking hours; may roll to T+1 during maintenance windows.

-

Bank rails (IMPS/NEFT): IMPS is near-instant; NEFT settles during working hours – weekends/holidays may push to the next business day.

“In August 2025, UPI processed 20.0 billion transactions worth ₹24.85 lakh crore.” – Source

Limits and KYC

-

Daily/monthly sell and withdraw limits apply; complete KYC to unlock higher tiers.

-

UPI per-transaction caps vary by app/bank; your bank’s limits also apply to IMPS/NEFT transfers.

Payout tracking and issue resolution

-

In-app statuses: Processing / Credited / Reversed.

-

On payout failure: the system auto-retries or switches to alternate rails (e.g., IMPS/NEFT).

-

For escalations, support may request screenshot of bank statement entry, UPI reference ID, PAN/KYC confirmation, and registered mobile number/email.

Best practices

-

Ensure your bank/UPI account name matches your PAN/KYC to avoid reversals.

-

If you changed bank/UPI recently, test with a small withdrawal first.

-

Enable push notifications and email receipts to track settlements in real time.

Exit costs explained: spreads, fees, and how to reduce them

What you pay when you sell

-

The spread: the difference between the buy and sell quote – your primary exit cost.

-

Platform fee (if any) and tax context: GST typically applies at buy; on sale, capital gains tax (STCG/LTCG) may apply based on your holding period.

-

Rare cases: certain rails may levy a small network fee; if applicable, it’s disclosed upfront.

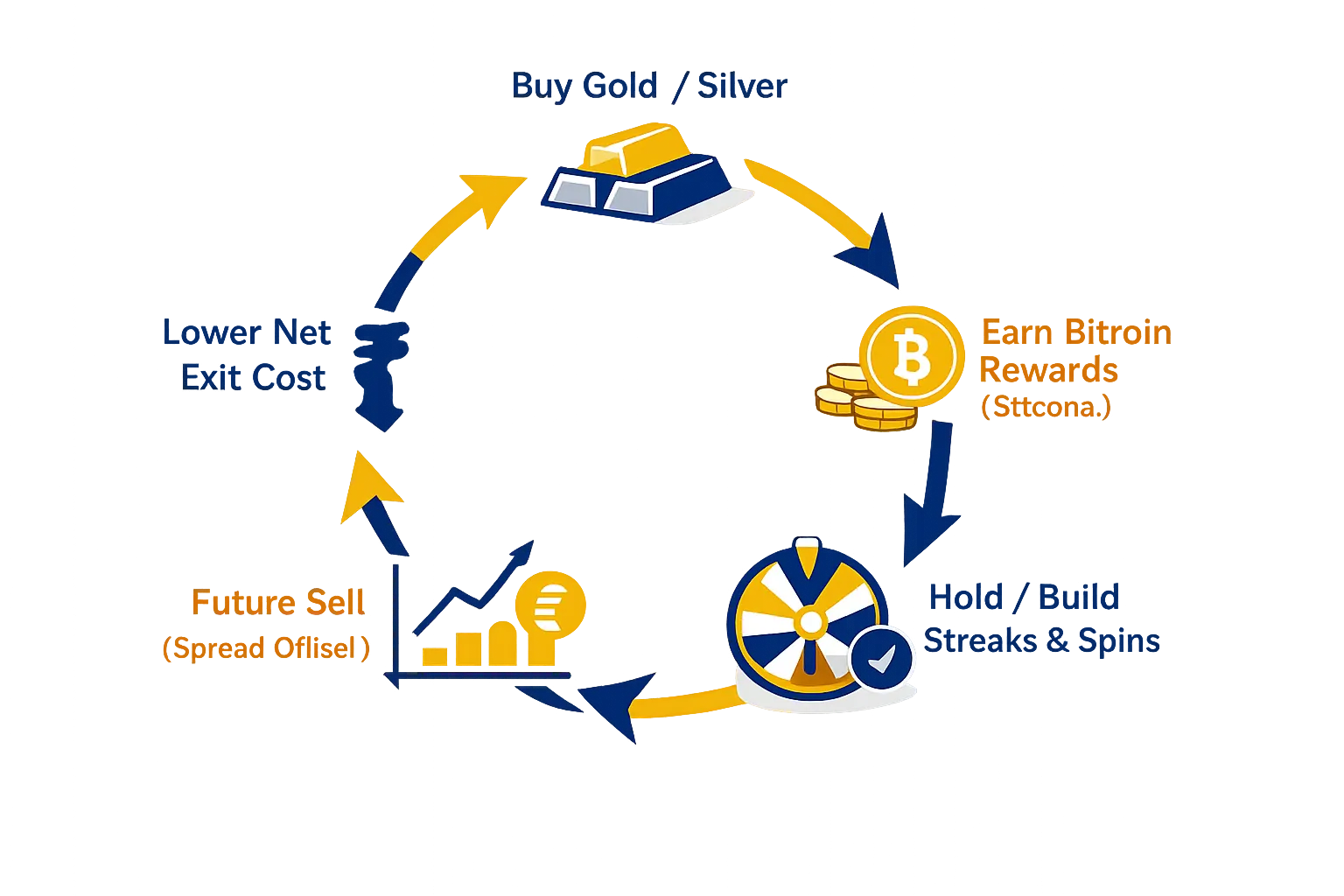

Lower your effective costs

-

Sell during normal liquidity hours for tighter spreads and smoother execution.

-

Use partial exits in volatile markets to average out price moves.

-

Stack OroPocket rewards – Bitcoin cashback, daily streak bonuses, spin-to-win, and referrals – to offset spreads over time.

When redemption makes sense

-

Physical redemption is great for gifting, weddings, or when you specifically want coins/bars in hand.

-

If your goal is pure liquidity, an instant UPI sell is usually faster and avoids making/delivery charges.

Worked examples: spread vs rewards offset

|

Transaction size |

Spread (₹) |

Rewards offset (₹) |

Net effective cost (₹) |

Effective spread % |

|---|---|---|---|---|

|

₹500 |

7.50 |

2.00 |

5.50 |

1.10% |

|

₹1,000 |

12.00 |

3.50 |

8.50 |

0.85% |

|

₹10,000 |

120.00 |

30.00 |

90.00 |

0.90% |

|

₹25,000 |

300.00 |

110.00 |

190.00 |

0.76% |

|

₹50,000 |

550.00 |

200.00 |

350.00 |

0.70% |

Note: Numbers are illustrative. Actual spreads, fees, and reward values vary by market conditions, time of day, and your OroPocket rewards tier.

Taxes when you sell digital gold or silver in India (updated rules)

The basics (as per current regime)

-

Digital gold/silver are capital assets.

-

Holding period ≤ 24 months: Short-Term Capital Gains (STCG), taxed as per your income slab.

-

Holding period > 24 months: Long-Term Capital Gains (LTCG), typically taxed at 12.5% without indexation (plus applicable surcharge/cess).

Cost and consideration

-

Cost of acquisition = buy price + applicable charges at purchase.

-

Sale consideration = net proceeds post selling costs/spread.

Documentation

-

Keep invoices, contract notes, and payout proofs (UPI/bank).

-

Download year-end capital-gains (CG) statements from OroPocket for easy filing.

Examples (illustrative only; consult a tax professional)

-

STCG example (10 months): Buy ₹20,000 → Sell ₹22,400 → Gain ₹2,400 → taxed at your slab.

-

LTCG example (30 months): Buy ₹50,000 → Sell ₹65,000 → Gain ₹15,000 → taxed at 12.5% (+ surcharge/cess).

Tax scenarios (illustrative)

|

Holding period |

Type |

Applicable rate |

Example (buy/sell) |

Approx. tax due |

|---|---|---|---|---|

|

10 months |

STCG |

As per slab (e.g., 20%) |

Buy ₹20,000 → Sell ₹22,400 (Gain ₹2,400) |

₹2,400 × 20% = ₹480 |

|

18 months |

STCG |

As per slab (e.g., 30%) |

Buy ₹1,00,000 → Sell ₹1,12,000 (Gain ₹12,000) |

₹12,000 × 30% = ₹3,600 |

|

26 months (silver) |

LTCG |

12.5% (no indexation) |

Buy ₹30,000 → Sell ₹36,000 (Gain ₹6,000) |

₹6,000 × 12.5% = ₹750 |

|

30 months |

LTCG |

12.5% (no indexation) |

Buy ₹50,000 → Sell ₹65,000 (Gain ₹15,000) |

₹15,000 × 12.5% = ₹1,875 |

|

48 months |

LTCG |

12.5% (no indexation) |

Buy ₹1,50,000 → Sell ₹1,90,000 (Gain ₹40,000) |

₹40,000 × 12.5% = ₹5,000 |

Footnote: Examples are for education only. Surcharge/cess may apply. Rules are subject to change; consult a qualified tax advisor for personalized guidance.

Sell with clarity and keep clean records – download OroPocket to export invoices and CG statements anytime: https://oropocket.com/app

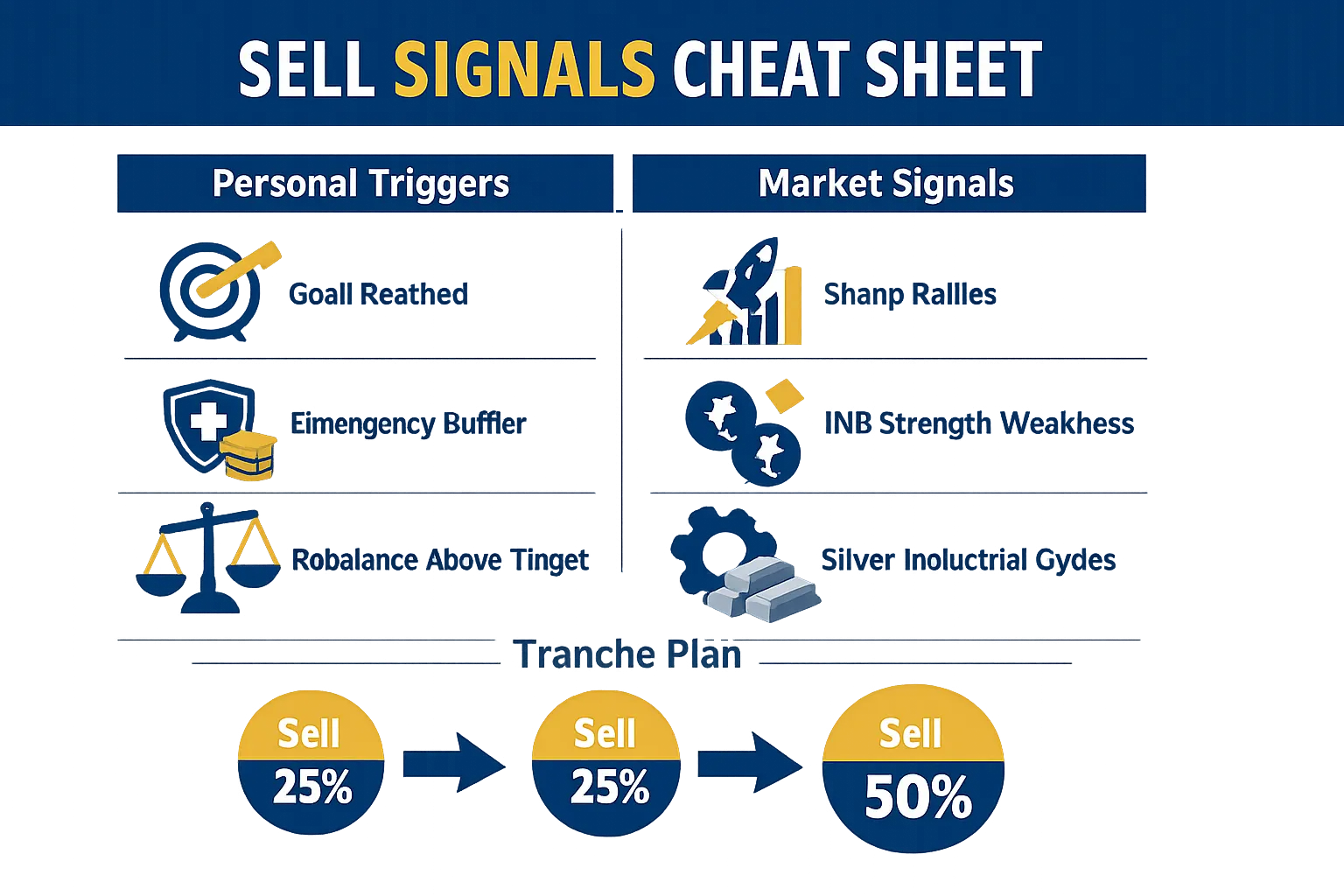

When should you sell? Practical signals and timing tactics

Personal triggers

-

Hitting a goal (wedding fund, emergency buffer).

-

Rebalancing if gold/silver exceeds your target allocation.

Market/context signals (not advice)

-

Sharp rallies: scale out in tranches (e.g., 25/25/50).

-

INR impact: rupee strength/weakness can shift local metal prices.

-

Silver-specific: industrial demand cycles (solar, electronics) increase volatility – plan staged exits.

Execution tactics

-

Use price alerts, avoid low-liquidity windows, and always confirm spreads before selling.

-

Keep a core position and trim the excess during spikes.

-

Pair sales with accrued rewards to offset spreads and lower your net exit cost.

How to sell silver online: volatility-aware tips

Why silver behaves differently

-

Higher day-to-day swings; spreads may widen during off-peak or maintenance windows, so your silver sell price can move quickly.

-

Industrial demand cycles (EVs, solar, electronics) add momentum and can amplify moves versus gold – expect sharper rallies and faster reversals.

Silver selling tactics

-

Prefer partial exits; avoid all-or-nothing on spikes. Scale out in tranches (e.g., 25/25/50) to reduce timing risk when you sell silver online.

-

Set alerts around major global data (CPI, jobs, PMI, central bank meetings) to plan sells during liquid hours and confirm spreads before executing.

-

Be flexible with payout rails if UPI acknowledgements are delayed – switch to IMPS/NEFT as a backup for smooth settlement.

Sell silver online with live quotes and instant UPI payouts on OroPocket. Get started now: https://oropocket.com/app

Pro tips, safety, and FAQs for sellers

Security and compliance

-

Use RBI-compliant, audited platforms with insured vaults and authorized bullion partners.

-

Enable 2FA/biometric login, keep your app updated, and verify payout details (UPI ID, account number, IFSC).

-

Ensure your bank/UPI name matches your PAN/KYC to avoid payout reversals.

Avoid common mistakes

-

Don’t chase intraday spikes; plan tranches (e.g., 25/25/50) to average out risk.

-

Review the live spread and any fees before confirming a sale.

-

Keep KYC and bank/UPI info current to unlock higher limits and faster settlements.

Quick FAQs

-

How to sell gold instantly? → Tap Sell in OroPocket; UPI typically settles T+0 during banking hours.

-

Can I sell a small amount? → Yes, partial exits from ₹1 are supported.

-

Any lock-in? → No mandatory lock-in for selling digital gold/silver.

-

Payout charges? → UPI is typically free; check in-app disclosures for any rail/network fees.

-

Can I gift instead? → Yes, use Send Gold in-app to transfer to friends or family.

-

What if payout fails? → The system auto-retries or switches rails (IMPS/NEFT). Track status in the app: Processing / Credited / Reversed.

Sell fast, safe, and on your terms. Download OroPocket to get live quotes and instant UPI cash-outs: https://oropocket.com/app

Conclusion: Sell smarter with OroPocket (fast, transparent, and rewarded)

Selling your digital gold or silver should be quick, clear, and cost‑efficient. With OroPocket, you get live quotes, partial exits from ₹1, instant UPI payouts, and clean records for tax filing – all in a few taps.

-

Live, transparent quotes with a locked sell price

-

Partial exits from ₹1 for flexible, goal-based selling

-

Instant UPI payouts (T+0/T+1) and reliable bank rails

-

Downloadable invoices and capital-gains statements for taxes

What makes OroPocket unique

-

Bitcoin rewards on every buy help offset future selling spreads – your past purchases can reduce tomorrow’s exit cost.

-

Gamified rewards (streaks, spin-to-win, referrals) stack over time to further improve your effective spread.

Trust and safety, built in

-

Insured, vault-backed gold and silver with authorized partners

-

RBI-compliant payment flows

-

Exportable statements and contract notes for complete transparency

Ready to sell digital gold and silver online in minutes? Get live quotes and instant UPI payouts – no paperwork, no store visits.

Download OroPocket on iOS/Android – https://oropocket.com/app