Is It Safe to Buy Digital Gold on Google Pay and Other Payment Apps?

Quick answer: Is it safe to buy digital gold on Google Pay and other payment apps?

Short answer: yes – if you know what to check. Payment apps like Google Pay don’t sell you gold themselves; they route your order to authorized bullion partners (MMTC-PAMP, SafeGold, Augmont), who hold your 24K gold in insured vaults and maintain auditable ownership records. It’s risky only when the custodian isn’t clear, storage tenure is limited without disclosure, redemption is vague, or fees/spreads are opaque.

TL;DR (answer in 30 seconds)

-

Yes – if the app partners with authorized bullion providers (e.g., MMTC-PAMP, SafeGold, Augmont), uses insured vaults, and provides auditable ownership records.

-

Risk appears when you can’t verify the custodian, storage tenure, or redemption terms, or when fees/spreads are opaque.

“2019–2024: Gold in India delivered roughly 60–70% total return (~10–11% p.a.), while average savings paid ~2.5–3% and CPI inflation averaged ~5–6%.” – Source

Why payment-app gold is popular (context + search intent)

-

UPI convenience: buy/sell in seconds with ₹1–₹100 entry points – perfect for first-time investors.

-

Instant liquidity: sell at live prices; no jeweller negotiations or making charges.

-

Aligns with what people search: “google pay gold investment,” “how to buy digital gold in google pay,” and “is it safe to buy gold online.”

-

Feels modern and secure vs. storing jewellery at home; ideal for building a small, steady position over time.

What this guide covers (what competitors miss)

-

Who actually holds your gold (the bullion partner/custodian) and how your ownership is recorded.

-

Regulation reality: digital gold is not a SEBI-regulated product; safety comes from partner credibility, vaulting, and audits.

-

Fee traps and spreads you should check before buying.

-

Storage limits and what happens after the free storage period ends.

-

Step-by-step “how to buy digital gold in Google Pay.”

-

Safe redemption and transfer options (physical delivery vs. selling).

-

A smarter alternative with rewards: OroPocket – an online gold app (digital gold purchase app) that adds free Bitcoin on every gold/silver purchase, gamified streaks, and instant UPI.

Ready to start smarter? Download the OroPocket app now: https://oropocket.com/app

How payment apps sell gold: partners, custody, audits, and regulation (the fine print)

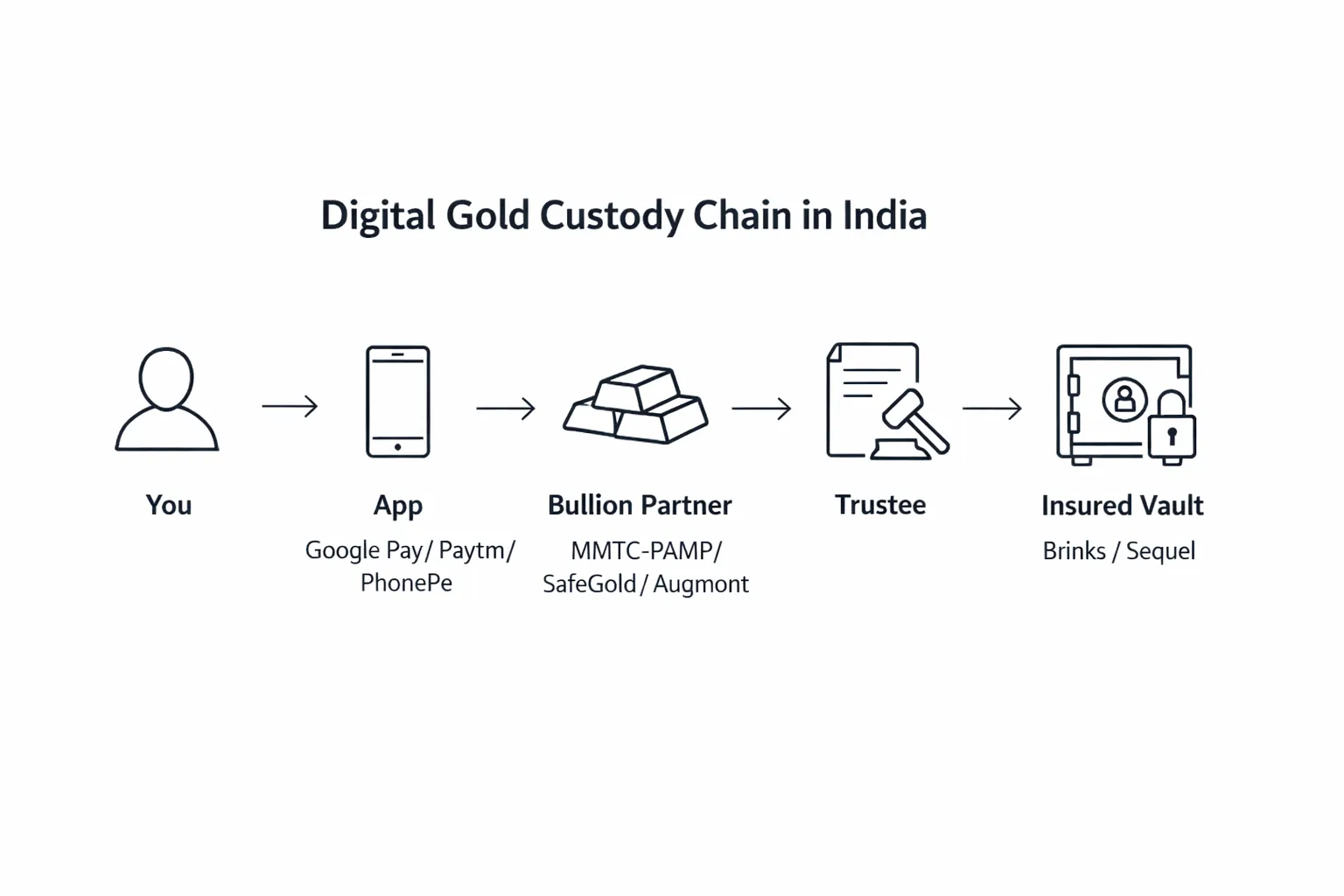

The custody chain (who owns what)

-

App (Google Pay/Paytm/PhonePe) is a front-end marketplace.

-

Your actual counterparty is the bullion provider (MMTC-PAMP, SafeGold, Augmont).

-

Gold is vaulted with an insured professional (e.g., Brinks, Sequel). Title is held via trustee for end users.

Purity, audits, and insurance

-

24K 999/995 purity aligned to Good Delivery standards with batch-level certification.

-

Periodic third-party audits reconcile total client holdings with vaulted metal.

-

100% insurance covers vaulted bullion against theft, fire, and physical damage.

Regulation reality (SEBI, exchanges, and guidelines)

“NSE (Aug 10, 2021) directed members to stop offering unregulated products like digital gold on trading platforms, citing SEBI’s view under SCRR Rule 8(3)(f).” – Source

-

Digital gold is not a SEBI-regulated security; hence stockbrokers were told not to offer it via trading accounts.

-

Consumer safety relies on the bullion partner’s governance: vaulting, trusteeship, audits, and transparent T&Cs.

-

Apps typically follow industry best practices (e.g., NITI Aayog guideline adoption) and work with authorized bullion brands, but due diligence varies by app – verify before you buy.

What to verify before buying

-

Named custodian and trustee: Check the exact vaulting partner (Brinks/Sequel) and trustee entity.

-

Audit frequency: Look for independent audits and reconciliation cadence (monthly/quarterly) and public summaries.

-

Vault insurance: Confirm comprehensive insurance on your gold while in custody.

-

Redemption policy: Physical delivery availability, minting/delivery fees, minimum grams, and location coverage.

-

Storage tenure: Free storage period and what happens after (charges, auto-sell, or mandatory delivery).

-

Grievance redressal: Email/helpdesk, escalation matrix, and TAT for resolving disputes.

Prefer an app built for gold from day one? OroPocket offers 24K insured gold with instant UPI, micro-investing from ₹1, and free Bitcoin rewards on every purchase. Try it now: https://oropocket.com/app

Safety checklist before you buy on Google Pay/Paytm/PhonePe

10-point pre-purchase checklist

-

Identify the bullion partner on the buy screen (MMTC-PAMP/SafeGold/Augmont).

-

Confirm 24K purity and Good Delivery standards.

-

Look for a named trustee and insured vault.

-

Read storage tenure (e.g., free storage for X years) and what happens after expiry.

-

Check spread/fees (buy-sell difference), GST (3%), and redemption charges.

-

Verify daily/monthly limits and KYC thresholds (PAN/Aadhaar).

-

Confirm redemption options (coin/bar delivery, platform-to-platform transfers, sell-back to wallet/bank).

-

Review audit frequency and independent audit firm.

-

Ensure invoice with unique vault/folio ID is issued.

-

Avoid buying during extreme spread hours (overnights/holidays) unless necessary.

Red flags (don’t proceed if you see these)

-

No visible custodian or trustee.

-

No clear redemption fees or storage policy.

-

Aggressive, guaranteed-return claims.

-

Inability to download a statement or ownership certificate.

Extra safety tips

-

Enable UPI device lock, SIM lock, and app lock.

-

Use your own mobile network; avoid public Wi‑Fi for payments.

-

Keep your UPI PIN private; never share OTPs.

-

For “google pay gold investment” or “how to buy digital gold in google pay” queries, always read the bullion partner’s T&Cs before tapping Buy.

“In August 2025, UPI processed 81.03 billion transactions worth ₹35.24 lakh crore, reflecting strong nationwide adoption.” – Source

Prefer an online gold app built for investing? Try OroPocket – the digital gold purchase app where you can start from ₹1, buy 24K insured gold via UPI, and earn free Bitcoin on every purchase. Download now: https://oropocket.com/app

Fees, limits, and the fine print apps rarely explain

The real cost of convenience

-

Spread: The difference between buy and sell price (often 1–3%+ depending on provider, time of day, and volatility). This is your invisible cost every time you enter and exit.

-

Quick check: Spread % = (Buy price − Sell price) / Buy price × 100

-

Example: If Buy = ₹6,200/g and Sell = ₹6,020/g, spread = 2.9%.

-

-

GST: 3% GST on the gold value applies on purchases across all platforms (industry-wide). Selling back typically doesn’t add GST, but you may owe taxes on gains as per applicable laws.

-

Redemption charges: For physical coins/bars, expect minting/making charges and delivery fees. Charges vary by weight (1g vs 10g vs 50g) and purity (995 vs 999). Check minimum grams for redemption.

-

Storage tenure: Many providers offer free storage for a fixed period (e.g., 5 years). After that:

-

You may be charged storage fees, or

-

You may be asked to take delivery (paying minting + shipping), or

-

Your holdings could be sold after notice (terms vary – read carefully).

-

-

Transfer fees: Platform-to-platform transfers (e.g., between different “online gold app” providers) may be blocked or chargeable. Internal gifting may be free or capped – read the T&Cs.

Limits and KYC

-

Minimum buy: As low as ₹1 on some apps (great for “how to buy digital gold in Google Pay” beginners).

-

Caps: Daily/monthly purchase and sale limits vary by bullion partner and app.

-

KYC: PAN/Aadhaar and full KYC are typically required beyond certain thresholds; providers also run AML/PEP checks.

-

Gifting limits: If you gift gold frequently, keep records for compliance and personal accounting.

When spreads widen

-

Weekends/holidays: Wider spreads when domestic markets are closed; providers price in extra risk.

-

High volatility: Sharp global moves (Fed decisions, CPI prints, geopolitical events) can widen spreads.

-

Low-liquidity hours: Overnight quotes or thin liquidity windows often cost more – prefer active market hours.

Pro tip for “google pay gold investment” buyers: Before tapping Buy, note the live buy and sell price, calculate the spread %, scan the redemption fee table for your preferred coin size, and check storage tenure. If anything’s unclear, don’t proceed.

Want full transparency plus rewards? Try OroPocket – the digital gold purchase app with micro-buys from ₹1, 24K insured gold, instant UPI, and free Bitcoin on every purchase. Download now: https://oropocket.com/app

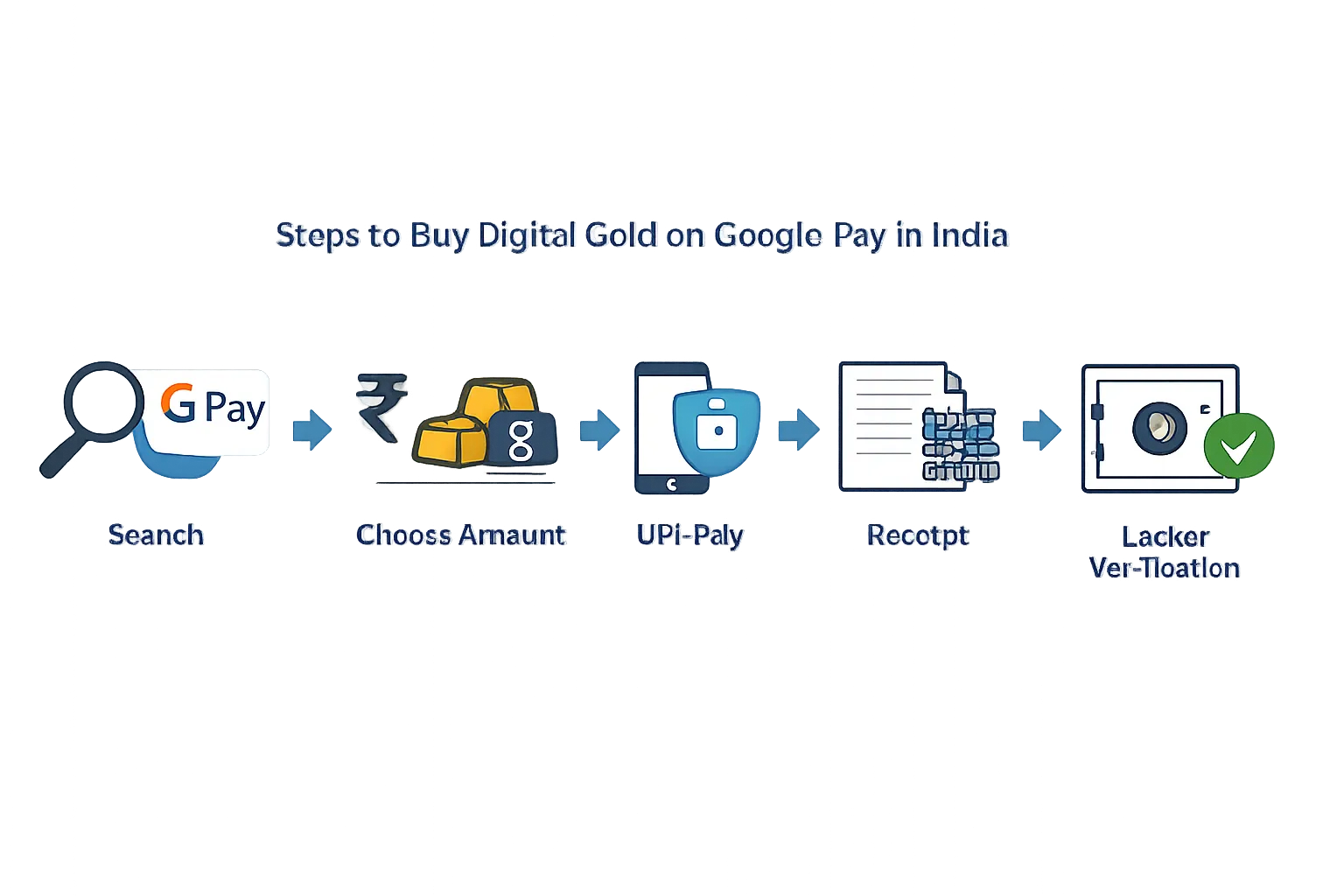

How to buy digital gold in Google Pay safely (step-by-step)

Pre-checks (1 minute)

-

Search “Gold” in GPay; open the gold tile; confirm the bullion partner logo (e.g., MMTC-PAMP) and purity (24K 999).

-

Tap “T&Cs” to review storage tenure, redemption, fees, and custodian/trustee.

Buy flow

-

Choose Rupee or grams (start with ₹1+).

-

Review live price and spread; note taxes and any platform fee.

-

Pay via UPI; ensure correct VPA and device lock is enabled.

-

Get invoice and vault/folio ID; save it to cloud/email.

After purchase (verify safety)

-

Open “My Gold” locker; match grams/₹ and provider; download statement; check unique ID and date/time.

Redeem or sell

-

Sell: execute at live prices; confirm net proceeds and credit destination.

-

Physical redemption: review making + delivery charges; select weight/purity; track shipment; receive tamper‑proof pack.

-

Transfer/gift (if supported): confirm recipient’s provider compatibility.

Record-keeping

-

Keep PAN-linked records for tax; export annual statement during ITR season.

Want a purpose-built “online gold app” with instant UPI, micro-buys from ₹1, and free Bitcoin rewards on every purchase? Try OroPocket: https://oropocket.com/app

App comparison: Google Pay vs Paytm/PhonePe vs OroPocket

What to compare (beyond the logo)

-

Bullion partner and trustee, minimum buy, spread/fees transparency, storage tenure, redemption costs/options, transfer flexibility, rewards, compliance, and support.

Why this matters

-

Two apps can show the same live price but differ meaningfully in spread, redemption fees, storage tenure, and user protections. If you care about low entry amounts, instant UPI, and rewards, you’ll compare more than just “google pay gold investment” quotes – you’ll compare the fine print.

Summary view (illustrative; verify before purchase)

|

Feature |

Google Pay |

Payment apps (Paytm/PhonePe) |

OroPocket |

|---|---|---|---|

|

Bullion partner |

Usually SafeGold/Augmont or MMTC-PAMP (verify on the buy screen) |

MMTC-PAMP or SafeGold (varies by app) |

Authorized bullion partners; 24K 999 gold; 100% insured vaults |

|

Minimum buy |

₹1–₹100+ (provider-dependent) |

₹1–₹10+ (provider-dependent) |

₹1 (no minimum) |

|

Typical spread/fees (ranges) |

Spread commonly 1–3%+; 3% GST on purchases; physical redemption fees apply |

Spread commonly 1–3%+; 3% GST on purchases; physical redemption fees apply |

Transparent live buy/sell spread; 3% GST on purchases; clear redemption fee table |

|

Storage tenure policy |

Provider-defined (often free up to 5 years); post-expiry storage fees or redemption/auto-sell may apply |

Similar: free period, then fees or mandatory redemption/sell |

Transparent tenure and insured custody; reminders before any tenure changes |

|

Redemption options/charges |

Sell at live price to bank/wallet; physical coins/bars with minting + delivery fees; minimum grams may apply |

Similar options; charges vary by weight/purity and location |

Sell instantly via UPI; physical redemption available; fees shown upfront in-app |

|

Transfer/gift features |

Gifting/transfer depends on partner; cross-platform transfers limited |

In-app gifting on some flows; cross-platform transfers generally limited |

Send gold to contacts in-app; easy gifting; referral rewards |

|

Rewards |

Occasional promos; no Bitcoin rewards |

App-specific offers; no Bitcoin rewards |

Free Bitcoin (Satoshi) on every gold/silver purchase; daily streaks; spin-to-win; referral bonuses |

|

Compliance notes |

Digital gold is not SEBI-regulated; apps work with authorized bullion partners; UPI via NPCI/RBI |

Same: not SEBI-regulated; partners provide custody/insurance; UPI via NPCI/RBI |

RBI-compliant UPI; authorized bullion partners; insured vaults; digital gold not a SEBI-regulated security |

Note: This table is illustrative. Policies, partners, fees, and features can change. Always verify in-app before purchase. If you’re asking “is it safe to buy gold online,” safety depends on custody clarity, audits, insurance, and transparent fees – whichever online gold app or digital gold purchase app you choose.

Want low entry, instant UPI, and real rewards? Try OroPocket – buy 24K insured gold from ₹1 and earn free Bitcoin on every purchase. Download the app: https://oropocket.com/app

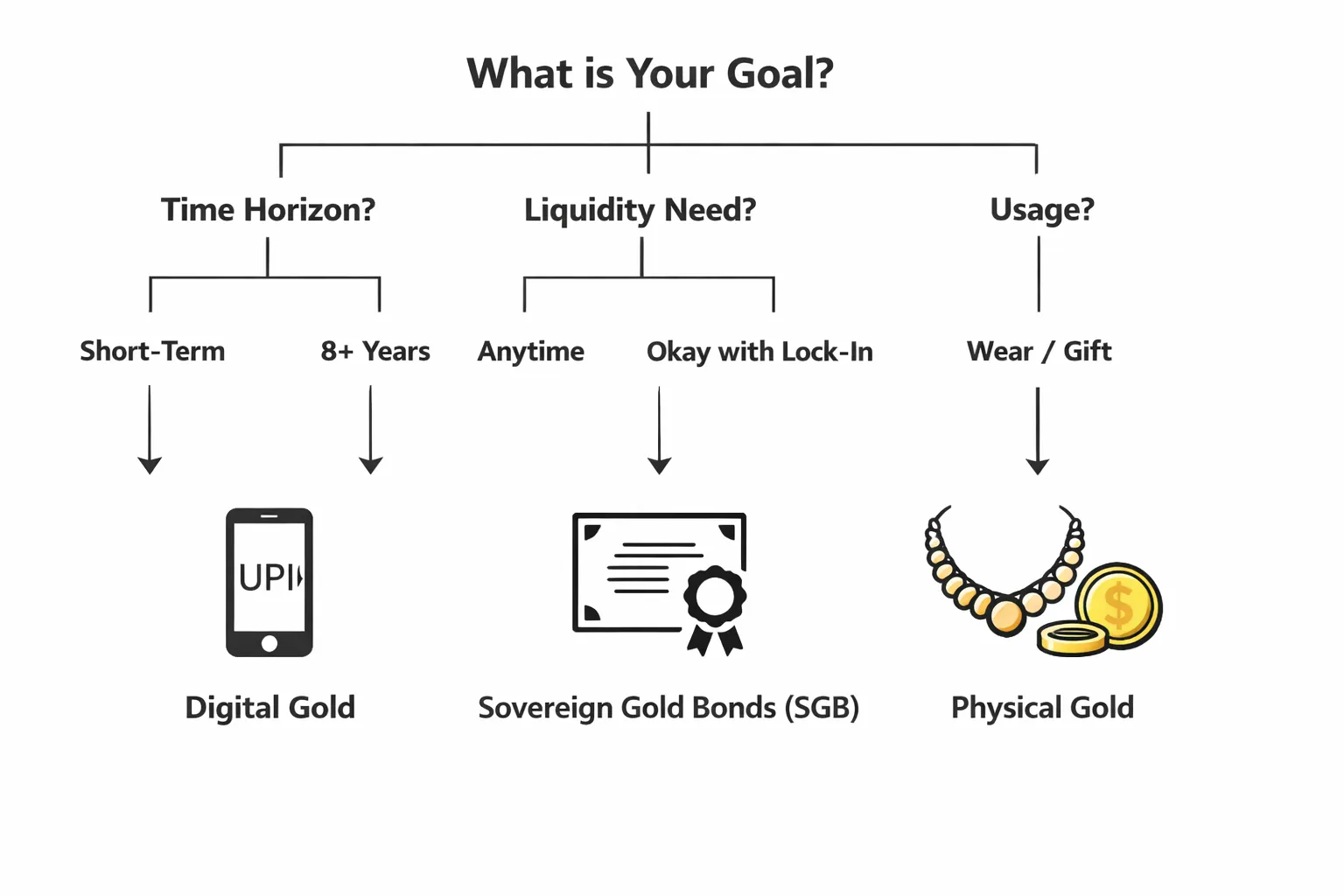

Digital Gold vs Sovereign Gold Bonds (SGB) vs Physical Gold: which is right for you?

The quick guide

-

Short-term flexibility (months to a couple of years): Digital Gold wins on liquidity and fractional buying.

-

Long-term wealth (8+ years) with tax edge: SGBs add 2.5% interest and capital gains tax exemption at maturity.

-

Cultural/ceremonial use and heirloom: Physical gold (coins/jewellery) despite making charges.

Important nuances

-

Regulation: SGBs are RBI/GoI-backed; digital gold follows industry standards via authorized partners; physical gold purity risks without testing.

-

Costs: SGBs have no making/storage costs; digital gold has spread + GST; physical jewellery has making charges.

Decision helper

-

If you need anytime liquidity and micro-investing: Digital gold.

-

If you’re okay with lock-in and want tax + interest: SGB.

-

If you want to wear it: Physical gold.

Feature comparison (verify specifics before purchase)

|

Feature |

Digital Gold |

Sovereign Gold Bonds (SGB) |

Physical Gold (Coins/Jewellery) |

|---|---|---|---|

|

Regulation |

Industry guidelines; custody via authorized bullion partners; not SEBI-regulated |

RBI/GoI-backed bond issued by RBI |

Market/trade regulated; quality varies by jeweller |

|

Liquidity |

Instant buy/sell via app; fractional grams |

Tradable on exchanges but liquidity varies; full redemption at maturity (8 years, early exit from year 5 with conditions) |

Immediate if you sell to jeweller but price negotiation and purity checks apply |

|

Costs |

Spread 1–3%+; 3% GST on purchase; redemption fees for coins/bars; storage tenure limits |

No making/storage costs; issue price discount for online; no GST on purchase |

Making charges + wastage; storage/locker cost; potential buyback deductions |

|

Tax |

Capital gains tax rules apply on sale; GST paid on purchase |

2.5% annual interest; capital gains tax exempt at maturity (GoI policy); interest taxable |

Capital gains as per holding period; GST on jewellery making; no interest |

|

Purity/Quality |

Typically 24K 999/995; third‑party audits; insured vaults |

Tracks gold price; purity not applicable (bond) |

Purity varies; insist on hallmarking (BIS) |

|

Minimum investment |

As low as ₹1 |

1 gram per unit (issue-specific) |

Varies; coins from ~0.5g; jewellery much higher |

|

Redemption/use-case |

Sell to wallet/bank; redeem coins/bars; gifting |

Hold to maturity for tax benefit; tradable units |

Wear, gift, or pledge; ideal for ceremonies |

Want a simple way to start with Digital Gold? OroPocket lets you buy 24K insured gold from ₹1 via UPI and earn free Bitcoin on every purchase. Download now: https://oropocket.com/app

Risks to watch (and how to avoid them)

Platform/custody risks

-

Provider insolvency risk if the bullion partner or trustee fails.

-

Storage tenure expiry leading to fees, forced redemption, or auto-sell after notice.

-

Restrictions on inter‑platform transfers; gifting may be limited to same-partner ecosystems.

Pricing and liquidity risks

-

Wide spreads during volatile or holiday hours; prices can be less favorable when markets are shut.

-

Thin liquidity for niche denominations during physical redemption (certain weights may be out of stock or pricey).

Cyber and payment risks

-

Phishing and fake “Google Pay gold” pages; screen-sharing/KYC scams; SIM swap and social engineering.

-

Never share UPI PIN/OTP; don’t approve unknown collect requests.

“Enter UPI PIN ONLY to deduct money from your account. UPI PIN is NOT required for receiving money.” – Source

How to minimize risk today

-

Buy during active market hours; check live buy/sell and calculate the spread.

-

Verify custodian/trustee, storage tenure, and redemption fees in T&Cs.

-

Use device lock, SIM lock, and app lock; keep UPI PIN private.

-

Whitelist official support channels; never install unknown screen-sharing apps.

-

Keep invoices, vault/folio IDs, and statements in secure cloud + offline backups.

Grievance redressal plan

-

Save provider support numbers and email IDs.

-

Raise a ticket in writing; request an acknowledgment/ticket ID.

-

Preserve evidence: invoices, statements, folio IDs, screenshots, timestamps.

Prefer a safer, transparent path to start? OroPocket lets you buy 24K insured gold from ₹1 via UPI, with clear fees and free Bitcoin on every purchase. Download now: https://oropocket.com/app

Why OroPocket is a safer, smarter way to stack gold in 2026

Safety and compliance first

-

RBI-compliant framework with authorized bullion partners

-

24K pure gold (999/995) stored in fully insured, professional vaults

-

Clear audit trails, downloadable statements, and transparent T&Cs

-

Real ownership records and swift grievance redressal

The OroPocket edge vs payment-app gold

-

Start from ₹1 with instant UPI payments – buy in under 30 seconds

-

Transparent pricing and spreads; no surprise storage expiry

-

Earn free Bitcoin (Satoshi) on every gold/silver purchase

-

Tiered rewards, daily streaks, and Spin to Win for extra bonuses

-

-

Send/gift gold instantly to friends and family

-

Built as an online gold app from day one – no confusing menus, just a clean, investing-first experience

Build the habit, not just a holding

-

Gamified investing that actually sticks:

-

Daily streak bonuses every 5 days

-

Referral rewards: both get 100 Satoshi + a free spin

-

Progress you can see – micro-buys that add up over time

-

Who it’s perfect for

-

First-time investors who want to start small and safe (₹1 entry)

-

Salaried professionals diversifying beyond FDs and chasing better real returns

-

Bitcoin‑curious users who want upside without directly buying crypto

-

Anyone comparing “google pay gold investment” or “how to buy digital gold in google pay” and deciding a purpose-built digital gold purchase app is better

Proof you’ll feel

-

Control: clear records, instant liquidity, and simple redemption

-

Progress: watch grams stack up every week, not just at festival time

-

Modern: UPI-native flow, mobile-first design, and rewards that make investing feel good

-

Smarter: the stability of gold plus free Bitcoin rewards – in one app

Ready to stack smarter? Download OroPocket and buy 24K insured gold from ₹1 with instant UPI – and get free Bitcoin on every purchase. https://oropocket.com/app

Conclusion: Start safe, start small – then level up with OroPocket

Final take

-

Buying digital gold on Google Pay and other payment apps is safe when you verify the custodian, storage, audits, and fees – and when you understand redemption rules upfront. Do that, and you’re making a smart, modern move.

Next steps

-

If you want the same safety plus smarter rewards, download OroPocket. Start with ₹1, buy in 30 seconds via UPI, and earn free Bitcoin on every purchase. It’s the online gold app that turns good habits into real progress.

Call to action

-

Download the OroPocket app: https://oropocket.com/app