Gold accounts and digital wallets: What they are and who should use them

Gold accounts and digital wallets: Why they matter in India right now

The problem: Savings accounts are losing to inflation; Indians need a modern hedge with real utility

-

Your money shouldn’t shrink while it sits. Traditional savings rates often trail inflation, quietly eroding purchasing power.

-

Physical gold is a time-tested hedge, but it’s inconvenient: high entry costs, purity checks, locker fees, and liquidity hassles.

-

Young, UPI-native Indians want a safer store of value that’s easy to buy, spend, gift, and sell – without dealing with jewellery making charges or bank lockers.

“Digital gold purchases via UPI in India jumped from ₹8 billion in Jan 2025 to ₹21 billion by Dec 2025.” – Source

Solution snapshot: Gold accounts and digital wallets let you buy, store, send, and sell 24K gold digitally via UPI

-

Open a gold account on a trusted digital gold investment platform and own allocated 24K gold backed by insured, professional vaults.

-

Start with as little as ₹1 and invest anytime at live market rates – no Demat, no paperwork.

-

Use UPI for instant purchases, then:

-

Store: Your online digital gold is fully insured and tracked in-app.

-

Send: Gift or transfer gold to friends/family instantly.

-

Sell: Liquidate 24/7 at live rates; funds hit your bank/UPI quickly.

-

-

With OroPocket, you also earn free Bitcoin on every gold/silver purchase, turning a safe hedge into a smarter rewards engine.

Scope of this guide: How balances are backed/audited, UPI flows, fees/taxes, who should use them, and how OroPocket maximizes value

-

Backing and audits: How your gold is allocated, vaulted, insured, and independently verified.

-

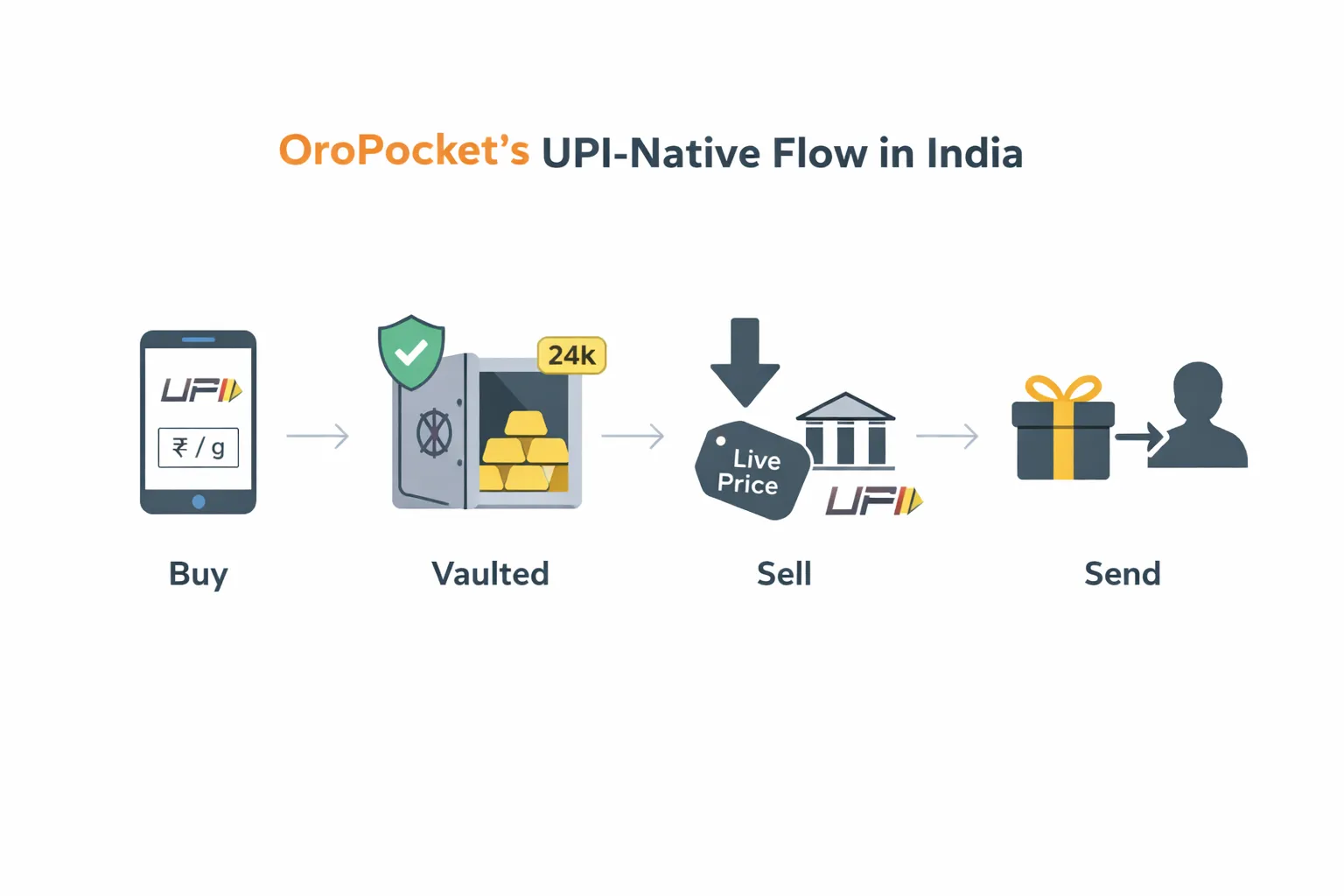

UPI flows: Step-by-step on buying, sending, and selling gold via UPI – plus SIP-style micro-investing.

-

Fees and taxes: GST, spreads, storage, redemption, and capital gains treatment.

-

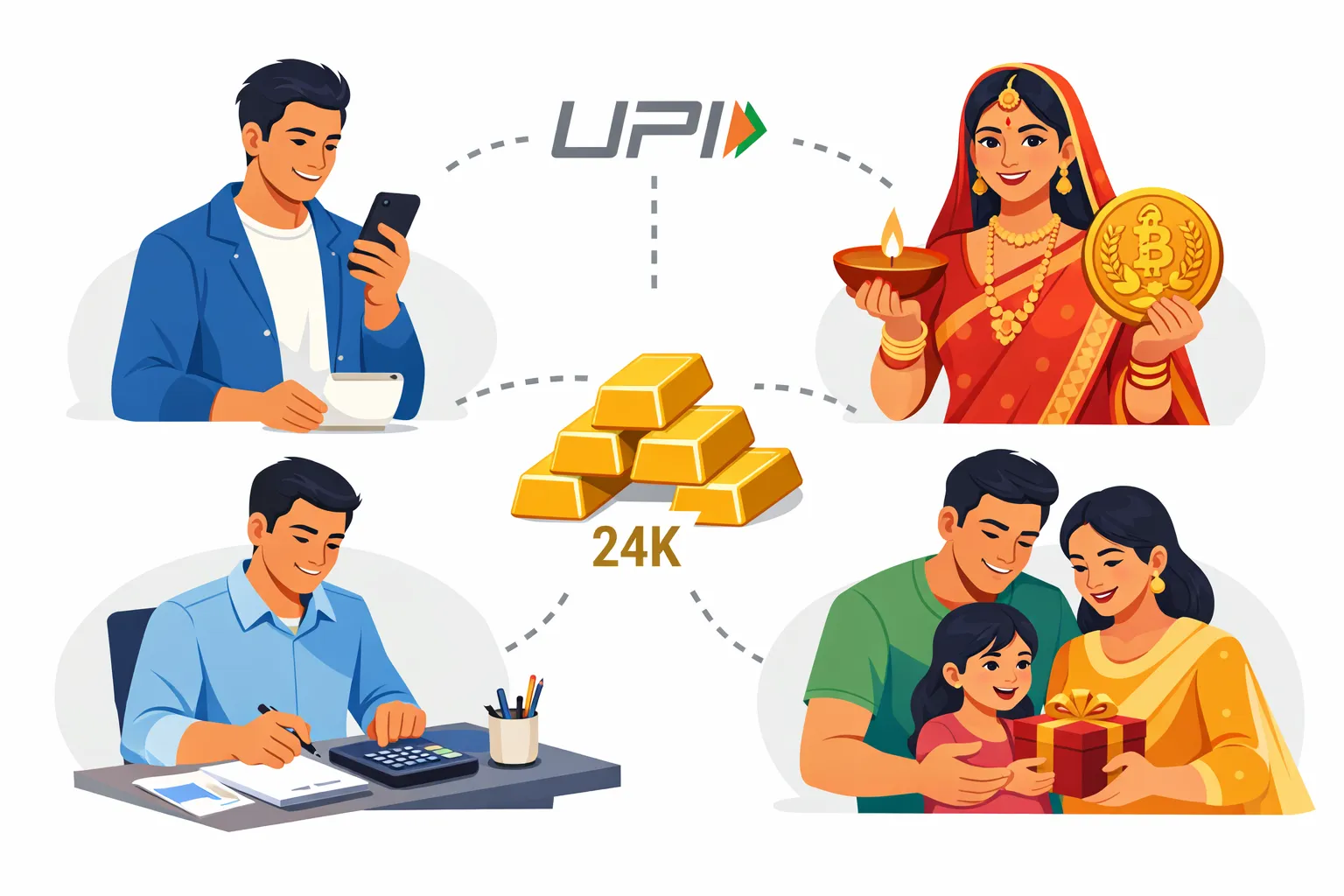

Who should use them: First-time investors, salaried professionals, Bitcoin-curious users, festival buyers, and gifters.

-

Why OroPocket: ₹1 entry, 24K purity, RBI-compliant partners, instant UPI, gamified rewards (daily streaks, spins), and Bitcoin cashback on every buy.

SEO focus terms: gold accounts, digital gold platform in India, online digital gold, digital gold investment platform

Ready to turn your savings into real, 24K-backed value with daily rewards? Download OroPocket now: https://oropocket.com/app

What exactly is a gold account or wallet? (and how it differs from crypto)

Clear definitions

-

Gold account: A custodial account that records your ownership of 24K physical gold stored 1:1 in insured, professional vaults. You own allocated bullion (not a derivative), and your balance is shown in grams/milligrams or ₹ value at live market prices.

-

Digital wallet: The mobile app interface from a digital gold investment platform that lets you buy, sell, send, receive, and track online digital gold in real time – often with UPI for instant payments, mini-statements, and easy gifting.

Not cryptocurrency

-

Digital gold ≠ crypto. Your holdings are fully backed by physical bullion stored in vaults and priced off global spot benchmarks (e.g., LBMA-linked rates).

-

There’s no token minting or mining. No blockchain volatility. You’re buying audited, 24K gold via a regulated financial flow, not a crypto asset.

-

Note: Gold-backed crypto tokens exist, but a gold account on a digital gold platform in India represents allocated, vault-backed metal – not a blockchain token.

How reputable platforms work

-

Authorized bullion partners: Platforms source 24K gold from accredited refiners and work with authorized ecosystem partners in India.

-

Insured vaults and independent trustee: Your metal is stored in professional, 100% insured vaults; a trustee oversees reconciliation between platform liabilities and physical holdings.

-

Periodic audits: Third-party auditors verify that customer gold is fully backed and properly segregated.

-

Transparent pricing spreads: You see a live buy/sell quote. The difference (spread) covers operational costs; GST (3%) applies on purchase as per Indian rules.

“Managed gold products should be backed by physical gold held with an independent, professional custodian and verified through regular, independent audits.” – Source

OroPocket at a glance

-

RBI-compliant operations with authorized bullion partners; 24K pure gold stored in insured vaults.

-

Micro-investing from ₹1 and instant UPI payments – buy online digital gold in under 30 seconds.

-

Unique rewards: Earn free Bitcoin (Satoshis) on every gold/silver purchase, plus daily streak bonuses, spin-to-win rewards, and referral benefits.

-

Send gold instantly to friends and family, track your holdings live, and redeem or sell 24/7 with transparent pricing.

Ready to try a modern gold account with real utility and daily rewards? Download OroPocket: https://oropocket.com/app

From UPI to vaulted metal: How online digital gold actually works

Step-by-step purchase flow (UPI-native)

-

Choose ₹ or grams: Enter how much you want to buy – either a rupee amount or weight in mg/g.

-

Pay via UPI/NetBanking: Approve the UPI collect request or pay through net banking/card.

-

Platform sources 24K gold: The digital gold platform locks an LBMA-linked price and places an order with its authorized bullion partner.

-

Custodian vaults it: An independent, professional custodian allocates and stores your 24K gold 1:1 in insured vaults.

-

Your account updates instantly: Your balance appears in-app in mg/grams and ₹ value, with a digital certificate/transaction record.

Pro tip with OroPocket: Pay via UPI in under 30 seconds, start with ₹1, and earn free Bitcoin on every purchase.

Selling/withdrawing

-

Sell at live price: Tap Sell to liquidate all or part of your holdings at the live buy quote (spread applies).

-

Payout: Proceeds are credited back to your linked bank account or UPI handle.

-

Typical timelines: Instant to a few hours for smaller amounts; T+1 in some cases for larger settlements or bank cut‑offs.

-

Fees to expect: GST applies only on purchase; selling may include a platform spread and small withdrawal/IMPS/NEFT charges depending on provider.

Redemption & gifting

-

Convert to coins/bars: Where available, redeem your balance into 24K coins/bars. Expect making/delivery charges and standard KYC/address verification for shipment.

-

Delivery considerations: Serviceable pin codes, insured shipping, and minimum redemption quantities may apply.

-

Gifting gold: Send gold to contacts by mobile number/UPI ID/app handle. The recipient gets real-time credit; great for festivals, birthdays, or group saving goals.

Backing and audits

-

Segregated holdings: Customer gold is recorded separately from the platform’s own assets; you own allocated bullion.

-

Insurance: Vaulted gold is covered by comprehensive insurance against theft or damage.

-

Trustee oversight: An independent trustee monitors reconciliation between customer liabilities and physical holdings.

-

Audit frequency: Regular third‑party audits verify 1:1 backing and segregation; platforms publish certificates or summaries for transparency.

-

Reconciliation practices: Daily operational reconciliations with periodic independent verification ensure your online digital gold stays fully matched to vaulted metal.

Want a seamless UPI-to-gold experience with rewards? Download OroPocket and start in seconds: https://oropocket.com/app

Digital gold vs physical storage: Where digital wins (and when it doesn’t)

When digital wins

-

Micro-investing from ₹1: Build a habit without waiting for a lump sum.

-

24/7 liquidity: Buy/sell any time at live rates on a digital gold platform in India.

-

Zero locker headaches: No bank locker visits, waitlists, or keys to manage.

-

Easy gifting: Send gold instantly to contacts – perfect for birthdays, weddings, and festivals.

-

Transparent pricing: See live buy/sell spreads and fees upfront on an online digital gold account.

When physical still makes sense

-

Heavy jewelry needs: Bridal sets, custom designs, and pieces you’ll wear often.

-

Sentimental heirlooms: Family ornaments passed down generations.

-

Limited-tech environments: When app access or UPI isn’t practical or preferred.

Real-world scenarios

-

Salaried saver building a gold SIP: Set a weekly/monthly amount in a gold account; automate buys from ₹1 and track progress in grams.

-

Festival gifting: Send digital gold instantly on Dhanteras/Diwali; no courier delays or stockouts.

-

Emergency liquidity: Sell online digital gold in seconds; funds move to bank/UPI quickly.

-

NRIs gifting to family in India: Top-up a loved one’s gold balance remotely without shipping hassles.

Table 1: Cost comparison over 5 years for ₹50,000 worth of gold – Bank locker vs Digital gold account

|

Cost component |

Physical (bank locker) |

Digital gold account |

|---|---|---|

|

GST on purchase |

3% on gold value = ₹1,500; if jewellery, 5% GST on making charges also applies |

3% on purchase = ₹1,500 |

|

Locker rent (annual) |

₹2,000–₹4,000/yr (≈₹10,000–₹20,000 over 5 yrs) |

Not needed |

|

Insurance |

Optional personal cover ~0.2%–0.5% p.a. (₹100–₹250/yr; ≈₹500–₹1,250 over 5 yrs) |

Vault insurance included by provider for stored metal |

|

Making/wastage charges (if jewelry) |

Jewellery: 8%–20% making + up to ~0%–10% wastage (₹4,000–₹15,000+ one-time); Coins/bars: 1%–3% premium |

Only if you redeem into coins/bars; jewellery making doesn’t apply unless you convert |

|

Platform spread |

Not applicable; jeweller premium/buyback spread applies (coins/bars: 1%–3%; jewellery: 8%–20%) |

Buy/sell spread typically ~1%–3% (visible in-app) |

|

Storage fee after free period |

N/A beyond locker costs |

Often free for an initial period (varies by provider, commonly 3–5 yrs); thereafter ~0.2%–0.5% p.a. of holdings (≈₹100–₹250/yr on ₹50,000) |

|

Redemption/delivery charges (if any) |

Nil if you already hold physical; future making charges apply only if you remake jewellery |

If converting to coins/bars: delivery/fulfilment ₹300–₹1,000+ plus any minting/making charges as per product |

Assumptions and notes:

-

Illustrative ranges for metro/small-locker tariffs and mainstream digital gold providers as of 2026; actual costs vary by bank/platform/city.

-

Comparison excludes market price movement; focuses on ownership/holding costs.

-

Digital gold storage can be free for a fixed period depending on provider; check your plan. Spreads are indicative of typical digital gold investment platform quotes.

-

Jewellery making/wastage charges apply only if you buy jewellery; bullion coins/bars have lower premiums.

Want the ease of digital with real 24K backing – and daily rewards on top? Try OroPocket. Buy from ₹1 via UPI, send gold in seconds, and earn free Bitcoin on every purchase. Get the app: https://oropocket.com/app

Due diligence checklist: How to pick a trustworthy digital gold platform

Non‑negotiables

-

1:1 physical backing: Your balance must be fully matched with 24K bullion held in professional, insured vaults.

-

Independent trustee: A trustee should oversee reconciliation between platform liabilities and vaulted holdings.

-

Third‑party audits: Regular external audits with published certificates; verify frequency and auditor credentials.

-

Insured vaults: Clear insurance coverage against theft/damage; ask for insurer names or policy summaries.

-

Transparent pricing spread: Live buy/sell quotes with visible spreads; no hidden convenience fees.

Compliance and partners

-

RBI‑compliant operations: Clear mention of regulatory adherence and applicable Indian guidelines.

-

Authorized bullion partners: Sourcing from accredited refiners with documented chain of custody.

-

KYC and data security: PAN‑based KYC, 2FA, encryption at rest/in transit, and explicit privacy policy.

-

Grievance redressal: Dedicated support, escalation matrix, and TATs for complaints/refunds.

Fees & limits

-

Storage fee policy: Is storage free for a period? What’s the annual rate after that? Any threshold waivers?

-

Redemption/delivery charges: Minting, making, packaging, and courier charges for coins/bars; minimum redemption quantities.

-

Min/max limits: Daily, monthly, or lifetime purchase/storage caps; per‑transaction limits.

-

Inactivity terms: Dormancy rules, reminders, and any fees for inactive accounts.

Red flags

-

Vague custody disclosures: No specifics on vault provider, trustee, or custodian.

-

No audit evidence: Missing or outdated audit reports; reluctance to share independent certificates.

-

Unrealistic offers: Deep discounts or “guaranteed returns” on gold purchases – gold doesn’t pay interest.

-

Opaque pricing: Hidden charges, wide unannounced spreads, or inconsistent quotes vs market rates.

Shortlist done? Choose a platform that’s secure, transparent, and rewarding. With OroPocket, buy gold from ₹1 via UPI, get 24/7 liquidity, and earn free Bitcoin on every purchase. Start now: https://oropocket.com/app

UPI-native buying, selling, and sending with OroPocket

Buy gold in under 30 seconds

-

Enter ₹/mg: Choose how much to invest – ₹ amount or mg/grams.

-

UPI: Pay via your preferred UPI app – no forms, no friction.

-

Instant confirmation: 24K gold is allocated and insured in vaults; your balance updates immediately.

-

Bonus: Earn free Bitcoin (Satoshi) rewards on every gold/silver purchase.

Sell anytime

-

Live pricing: Sell at real-time buy quotes on the app; spreads are transparent.

-

Proceeds to bank/UPI: Withdraw to your linked account or UPI handle.

-

Typical settlement: Instant to a few hours for most amounts; larger withdrawals may settle by T+1 due to banking cut-offs.

Send/gift gold

-

To phone contacts: Send gold instantly to friends and family using their mobile number or app handle.

-

Perfect for: Birthdays, Dhanteras, weddings, achievements – no shipping, no stockouts.

Tips to speed things up

-

Complete KYC: Verify PAN and ID once for smooth, higher limits.

-

Keep UPI mandate ready: Approve collect requests quickly.

-

Verify bank details: Ensure the right account/UPI is linked to avoid payout delays.

Start your first buy with ₹1 and feel the difference of a truly UPI-native gold experience. Get OroPocket: https://oropocket.com/app

Rewards that build habits: Free Bitcoin on every purchase, streaks, and spins

Bitcoin (Satoshi) cashback

-

Get tiered Satoshi rewards on every gold/silver purchase. It’s exposure to Bitcoin without buying it directly or dealing with wallets/exchanges.

-

Two assets for the price of one: 24K gold as your core hedge + Bitcoin rewards layered on top.

Daily streaks and Spin to Win

-

Build the investing habit with daily streaks. Earn bonus rewards every 5 consecutive days.

-

Spin to Win daily for extra gold/Bitcoin rewards – small boosts that add up over time.

Referral program

-

Invite friends and family. Both of you earn 100 Satoshi + a free spin when they join and start investing.

-

Social proof meets network effects: your circle invests smarter, and everyone benefits.

How rewards can boost long-term value (without guaranteeing returns)

-

An example month shows how micro-buys stack. Add daily Satoshi cashback, periodic streak bonuses, and occasional spin rewards – great for first-time investors building consistency.

Assumptions for the example below:

-

Daily buy: ₹100; illustrative gold price: ₹7,000/gram (so ~14.29 mg per day).

-

Tiered Satoshi cashback: Days 1–10 = 30 Sat/day; Days 11–20 = 40 Sat/day; Days 21–30 = 50 Sat/day.

-

Streak bonus: +100 Sat on days 5, 10, 15, 20, 25, 30.

-

Cumulative value shown as cumulative gold (mg) + cumulative Satoshi; spin rewards excluded for simplicity.

Disclaimer: Rewards, tiers, and gold/Bitcoin prices are illustrative and subject to change. Rewards are not guaranteed. Bitcoin is volatile.

Table 2: Example rewards math – ₹100/day for 30 days

|

Day |

Gold bought (mg) |

Satoshi cashback (by tier) |

Streak bonus (if any) |

Cumulative value |

|---|---|---|---|---|

|

1 |

14.29 |

30 |

– |

14.29 mg + 30 Sat |

|

2 |

14.29 |

30 |

– |

28.58 mg + 60 Sat |

|

3 |

14.29 |

30 |

– |

42.87 mg + 90 Sat |

|

4 |

14.29 |

30 |

– |

57.16 mg + 120 Sat |

|

5 |

14.29 |

30 |

100 |

71.45 mg + 250 Sat |

|

6 |

14.29 |

30 |

– |

85.74 mg + 280 Sat |

|

7 |

14.29 |

30 |

– |

100.03 mg + 310 Sat |

|

8 |

14.29 |

30 |

– |

114.32 mg + 340 Sat |

|

9 |

14.29 |

30 |

– |

128.61 mg + 370 Sat |

|

10 |

14.29 |

30 |

100 |

142.90 mg + 500 Sat |

|

11 |

14.29 |

40 |

– |

157.19 mg + 540 Sat |

|

12 |

14.29 |

40 |

– |

171.48 mg + 580 Sat |

|

13 |

14.29 |

40 |

– |

185.77 mg + 620 Sat |

|

14 |

14.29 |

40 |

– |

200.06 mg + 660 Sat |

|

15 |

14.29 |

40 |

100 |

214.35 mg + 800 Sat |

|

16 |

14.29 |

40 |

– |

228.64 mg + 840 Sat |

|

17 |

14.29 |

40 |

– |

242.93 mg + 880 Sat |

|

18 |

14.29 |

40 |

– |

257.22 mg + 920 Sat |

|

19 |

14.29 |

40 |

– |

271.51 mg + 960 Sat |

|

20 |

14.29 |

40 |

100 |

285.80 mg + 1,100 Sat |

|

21 |

14.29 |

50 |

– |

300.09 mg + 1,150 Sat |

|

22 |

14.29 |

50 |

– |

314.38 mg + 1,200 Sat |

|

23 |

14.29 |

50 |

– |

328.67 mg + 1,250 Sat |

|

24 |

14.29 |

50 |

– |

342.96 mg + 1,300 Sat |

|

25 |

14.29 |

50 |

100 |

357.25 mg + 1,450 Sat |

|

26 |

14.29 |

50 |

– |

371.54 mg + 1,500 Sat |

|

27 |

14.29 |

50 |

– |

385.83 mg + 1,550 Sat |

|

28 |

14.29 |

50 |

– |

400.12 mg + 1,600 Sat |

|

29 |

14.29 |

50 |

– |

414.41 mg + 1,650 Sat |

|

30 |

14.29 |

50 |

100 |

428.70 mg + 1,800 Sat |

Small daily buys. Streak bonuses. Bitcoin rewards. That’s how habits turn into portfolios. Start your streak today – download OroPocket: https://oropocket.com/app

Who should use a gold account or digital wallet?

First-time investors (22–35, Tier 1/2 cities)

-

Signs it fits: Want to beat inflation, prefer UPI over cash, like tiny daily investments that build up.

-

How to use: Start with ₹1–₹100/day, track streaks to build consistency, turn on auto-reminders or SIP-like schedules.

Salaried professionals diversifying beyond FDs/MFs

-

How to use: Set a monthly SIP into gold as a hedge; keep an emergency buffer that you can sell instantly to bank/UPI.

Bitcoin-curious but cautious

-

How to use: Earn Satoshi rewards on every gold buy. Learn about crypto gradually – without buying Bitcoin directly.

Traditional gold buyers (festivals, weddings)

-

How to use: Accumulate digitally through the year at transparent prices; redeem into coins/bars for gifting or use with partner jewellers.

Parents/gifters

-

How to use: Gift gold instantly on birthdays and milestones; use it to teach children the habit of saving and tracking value.

You’re one step from a smarter, simpler gold habit. Download OroPocket and start with ₹1 via UPI: https://oropocket.com/app

Know the fine print: Risks, fees, and taxes

Fees to check

-

Purchase GST (3% on gold): Applied on buy value; this is standard for both bullion and online digital gold.

-

Pricing spreads: The difference between buy/sell quotes on a digital gold investment platform in India; compare across providers for fairness.

-

Storage fee after free window: Many gold accounts offer free custody for a period; post that, a small annual fee may apply.

-

Redemption/delivery charges: If you convert to coins/bars, expect minting/making, packaging, and courier fees; minimum redemption quantities may apply.

Platform and regulatory context

-

RBI-compliant, audit-transparent platforms: Prefer providers that clearly disclose compliance posture, publish audit summaries, and name their independent trustee/custodian.

-

Verified vaulting and insurance: Look for 1:1 physical backing, insured professional vaults, and segregation of customer holdings from platform assets.

-

Clear T&Cs and limits: Review per-transaction and cumulative limits, inactivity rules, cut-off times for settlements, and grievance redressal timelines.

Taxes 101 (high-level)

-

Capital gains treatment: Tax outcomes depend on holding period, asset form, and prevailing law at the time of sale/redemption.

-

Records matter: Keep transaction histories, invoices, and redemption proofs for accurate tax filing.

-

Professional advice: Consult a qualified tax advisor for guidance on your specific situation; tax rules can and do change.

Smart practices

-

Complete and update KYC: Ensures smooth limits, faster payouts, and compliance.

-

Diversify: Don’t put everything into one platform or asset; spread across categories and time.

-

Review audit reports: Check platform disclosures on physical backing, trustee oversight, and audit frequency.

-

Avoid impulsive churn: Frequent buy/sell to “time” the market can erode returns through spreads and fees; consider a steady SIP-like approach.

Ready for a transparent, UPI-native way to own 24K gold with real backing – and daily rewards? Download OroPocket: https://oropocket.com/app

Conclusion: Open your gold account with OroPocket today

-

Bottom line: Gold accounts and digital wallets give you real, 24K gold with instant liquidity via UPI and zero locker hassles – own online digital gold without the stress.

-

With OroPocket, you also earn free Bitcoin on every purchase, plus streaks, spins, and referral rewards – so you build investing habits and long-term value effortlessly.

-

Trust you can verify: 100% insured vaults, RBI-compliant operations, and authorized bullion partners – exactly what you want from a digital gold platform in India.

Ready to start with just ₹1 and make every purchase work harder? Download the OroPocket app now: https://oropocket.com/app