Is It a Good Time to Buy Gold Now? How to Decide in India

Is It a Good Time to Buy Gold Now? Quick Answer for India

If you’re asking “is it good to buy gold now?” here’s the honest, India-specific answer: yes – if you’re long-term and disciplined. Gold works best when you buy consistently, not when you try to guess the bottom. If you need jewellery soon, accumulate 24K digital gold now and convert closer to the date to avoid peak-season premiums. If you’re waiting for a “perfect dip,” you’ll likely miss it – set rules and automate.

TL;DR – The 30‑second answer

-

If you’re buying for long-term (5–10 years): yes, start now and stagger buys to average costs.

-

If you need jewellery in <6 months: start accumulating 24K digital gold now, convert to jewellery closer to the date (avoid peak‑season price spikes and high making charges surprises).

-

If you’re waiting for a ‘perfect dip’: don’t. Use rules-based buys (SIP + buy-the-dip triggers) to avoid FOMO and regret.

Why now with OroPocket:

-

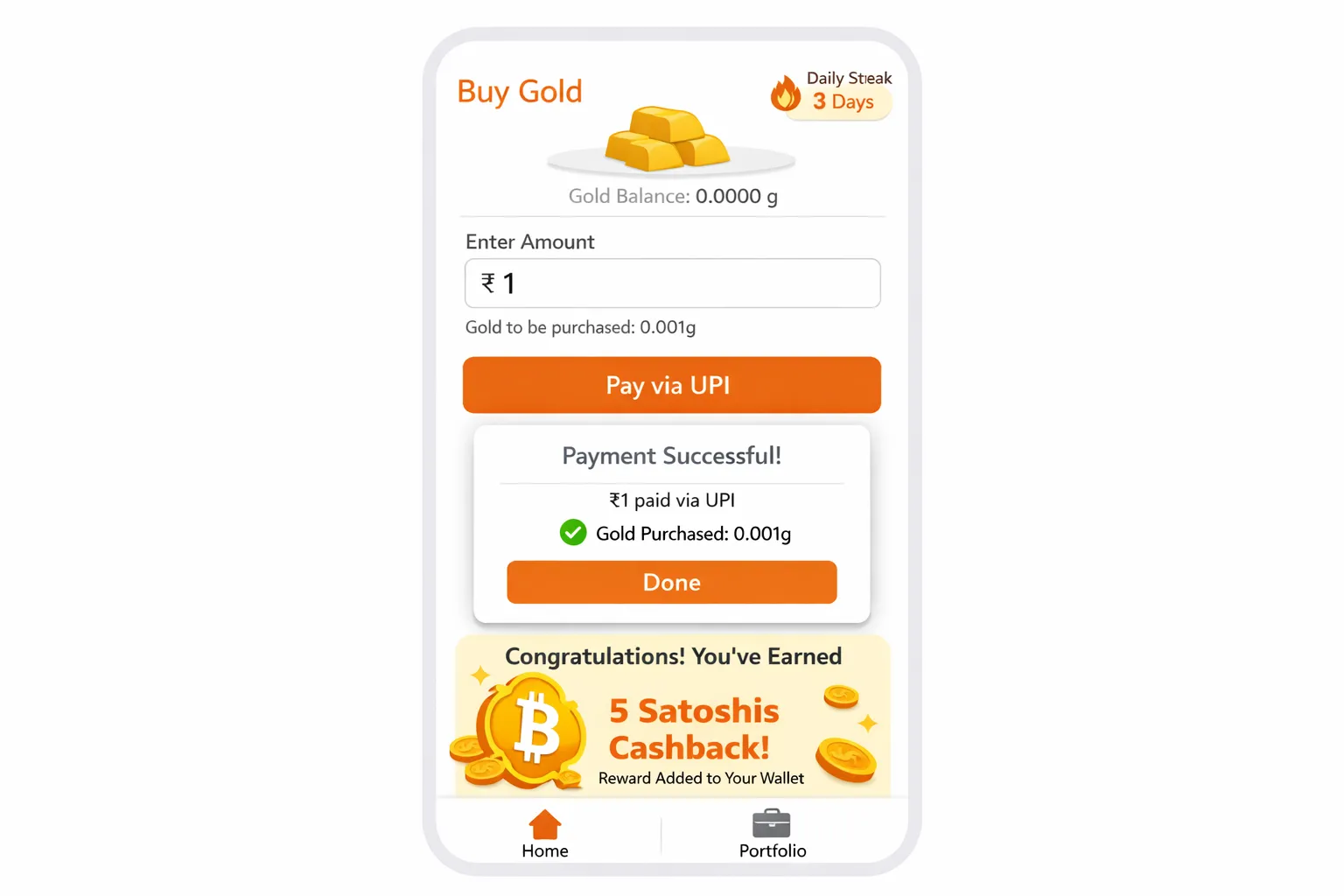

Start with ₹1 via UPI in under 30 seconds.

-

Automate SIPs and top-up on dips.

-

Earn free Bitcoin (Satoshi) cashback on every gold/silver purchase – build two assets with one move.

-

Gamified streaks and daily rewards keep you consistent.

“Should I buy gold now?” vs “Is it safe to invest in gold now?” The practical rule for India: treat gold as a long-term hedge against inflation and INR swings. Instead of timing the exact day, set a fixed SIP plus small “buy-the-dip” adds when prices drop a set percentage. This beats hesitation and FOMO.

What this guide covers

-

A simple signals framework to decide when to invest in gold in India

-

Pros/cons of buying now vs waiting

-

Smart execution: SIPs, staggered buys, and buy-the-dip rules

-

Festival timing vs best price

-

How Indian gold prices are set (USD/INR, duties, MCX)

-

How to start with ₹1 using UPI and earn free Bitcoin with OroPocket

“From 2019 to 2024, average 24K gold prices in India doubled from ₹39,108 to ₹78,245 (~100% total return).” – Source

Ready to start small and stay consistent? Download the OroPocket app now: https://oropocket.com/app

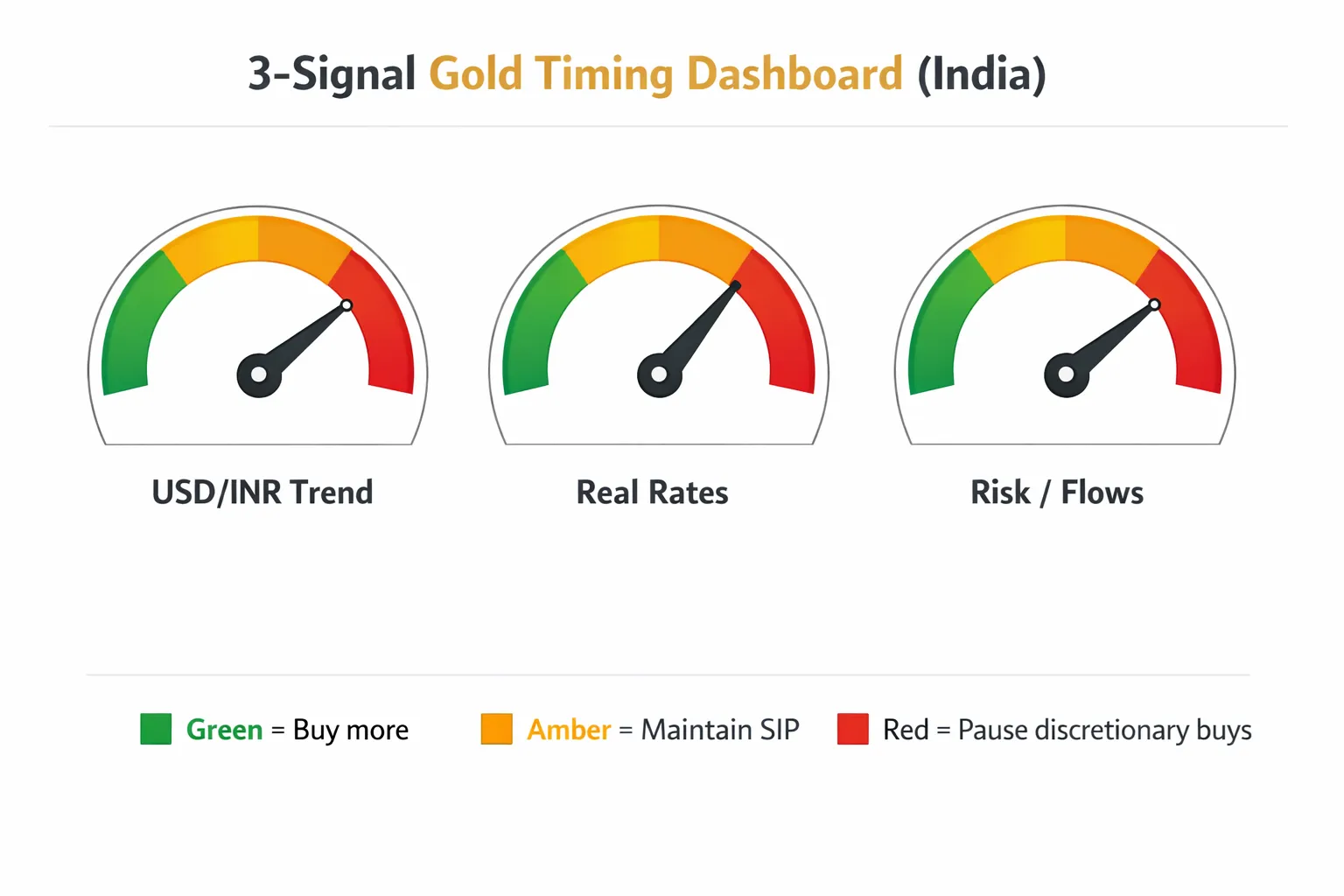

When to Invest in Gold: A 3‑Signal Framework (INR, Real Rates, Risk)

Timing gold in India is simpler when you watch three things: the rupee (USD/INR), real interest rates (India + US), and global risk/flows. Use this to decide when to buy more, when to just keep your SIP running, and when to pause discretionary top-ups.

Signal 1: USD/INR trend

-

Why it matters: Gold is priced in USD. In India, you pay USD gold × USD/INR + import duties + GST. A weakening rupee lifts local gold prices even if global gold is flat.

-

Simple rule: If USD/INR is making higher highs and the trend is up (e.g., 200‑DMA sloping up), prioritize accumulating. Even if global price is quiet, INR weakness can push domestic prices higher.

What to watch:

-

Higher highs/higher lows on weekly USD/INR

-

200‑DMA trending up

-

Monthly INR depreciation >1% for multiple months

What it means for you:

-

Don’t wait for “perfect dips” in INR terms – start/boost staggered buys because INR depreciation can front‑run price spikes.

Signal 2: Real interest rates (India + US)

-

Real rate = nominal yield – inflation. When real yields are low/negative, the opportunity cost of holding gold falls. That’s typically bullish for gold.

-

Watch both India (10‑year G‑Sec vs CPI) and US (10‑year TIPS). Rising real yields can cap rallies; falling/negative real yields support them.

What to watch:

-

India 10‑year real yield near/below 1% (bullish), rising above ~1.5% (headwind)

-

US 10‑year TIPS real yield near/below 1% (supportive), rising above ~1.5% (headwind)

-

Trend direction matters as much as level

“Gold tends to perform strongly when real yields are low or negative and local currencies weaken.” – Source

Signal 3: Global risk appetite and flows

-

When risk-off hits (wars, banking stress, equity drawdowns), gold demand jumps. ETF inflows, central bank buying headlines, and volatility spikes often precede/confirm moves.

-

ETF flows = “real money” sentiment. Sustained inflows support price; persistent outflows weigh on it.

What to watch:

-

Global gold ETF net inflows/outflows (weekly/monthly)

-

Equity volatility (e.g., VIX >20 = stress; >30 = panic)

-

Big equity drawdowns (>10%) and geopolitical flare-ups

What it means for you:

-

During stress spikes, buy on pullbacks; in calm periods with ETF outflows, stick to SIP and wait for better entries.

How to use the framework

-

Treat it like a traffic light:

-

Green: 2–3 signals supportive → Buy more than your base SIP

-

Amber: Mixed → Maintain SIP and only small dips buys

-

Red: 2–3 signals headwinds → Pause discretionary buys, keep minimal SIP to stay invested

-

Gold Timing Cheat‑Sheet

|

Signal |

Thresholds to watch |

What it means for gold |

Action to take |

|---|---|---|---|

|

USD/INR |

Weekly higher highs; 200‑DMA sloping up; INR depreciation >1% m/m for 2+ months |

INR weakness can lift local gold even if USD gold is flat |

Buy more |

|

USD/INR |

Sideways; 200‑DMA flat; INR stable (+/‑0.5% m/m) |

Neutral impact; price driven more by global gold |

Maintain SIP |

|

USD/INR |

Lower lows; 200‑DMA sloping down; INR appreciation >1% m/m |

INR strength can cap/soften local prices |

Pause discretionary buys (keep SIP small) |

|

Real Rates (India + US) |

India real 10y ≤1% and/or US TIPS ≤1% (falling trend) |

Low/negative real yields support gold |

Buy more |

|

Real Rates (India + US) |

India/US real ~1–1.5% (range-bound) |

Mixed/neutral backdrop |

Maintain SIP |

|

Real Rates (India + US) |

India/US real >1.5% and rising |

Higher carry opp. in bonds can cap gold |

Pause discretionary buys (keep SIP small) |

|

Risk/Flows |

Sustained ETF inflows; VIX >20; equity drawdown >10% |

Risk-off flows support gold |

Buy more on dips |

|

Risk/Flows |

Flat ETF flows; calm volatility (VIX 12–20) |

No strong tailwind/headwind |

Maintain SIP |

|

Risk/Flows |

Persistent ETF outflows; VIX <12; risk-on rally |

Flow headwind for gold |

Pause discretionary buys (keep SIP small) |

Pro move for India:

-

Base SIP every week via UPI (₹1+ on OroPocket).

-

Add “buy-the-dip” triggers: extra 1–2 units when INR weakens >1% in a month, or when VIX >20 and gold pulls back 1–2%.

-

Reassess signals monthly; don’t overtrade mid-month noise.

Start small, stay consistent, and let the signals guide your top-ups. Download OroPocket to set up SIPs, buy from ₹1 via UPI, and earn free Bitcoin on every gold purchase: https://oropocket.com/app

Should You Buy Gold Now or Wait? Pros, Cons, and Scenarios

There’s no perfect crystal ball. But there is a practical way to decide whether to buy gold now or wait – based on your horizon, goal (jewellery vs investment), and the 3-signal backdrop. Here’s the trade-off in plain English.

If you buy now

-

Pros: average into trend, avoid festival spikes, start compounding habit and rewards

-

Cons: short‑term pullbacks possible; manage via staggered entries

How to execute:

-

Set a weekly SIP (even ₹1 via UPI on OroPocket)

-

Add “buy-the-dip” rules (e.g., +10% of SIP when price drops 1–2% in a week)

-

Convert digital 24K to jewellery closer to your event date to avoid making‑charge shocks

If you wait

-

Pros: potential better entry if a correction comes

-

Cons: you might miss upside; hard to time; emotional decisions

How to execute:

-

Define clear triggers (e.g., buy if price drops 3–5% or INR strengthens 1–2%)

-

Keep a base SIP so you don’t miss the move if dips never come

Practical scenarios

-

Bull case: weak INR, softening real rates, geopolitical risks → accumulate faster

-

Base case: choppy prices → maintain SIP + buy small dips

-

Bear case: rising real rates, strong INR → maintain SIP only

Decision matrix

-

Time horizon:

-

<6 months: accumulate digital 24K now; convert to jewellery near the date to dodge festive spikes and surprise making charges.

-

6–24 months: maintain a steady SIP; use predefined dip triggers.

-

3–10 years: prioritize consistency over timing; stagger monthly/weekly buys.

-

-

Jewellery need vs investment allocation:

-

Jewellery need: buy digital gold early; lock purity; convert later with designs/offers.

-

Investment: stick to 24K digital gold; avoid making charges; keep liquidity.

-

-

Cash flow and risk tolerance:

-

Tight cash flow/low risk: small weekly SIPs; pause discretionary top-ups in bear cases.

-

Comfortable cash flow/moderate risk: base SIP + buy‑the‑dip rules.

-

High risk appetite: add on volatility spikes, but cap position size.

-

“Digital gold purchases in India jumped roughly 50% year-on-year – from 8 tonnes in 2024 to an estimated 12 tonnes in Jan–Nov 2025 – driven by young investors and micro-investing access.” – Source

Build the habit, not the hype. Start with ₹1, automate SIPs via UPI, and earn free Bitcoin on every gold purchase with OroPocket. Download now: https://oropocket.com/app

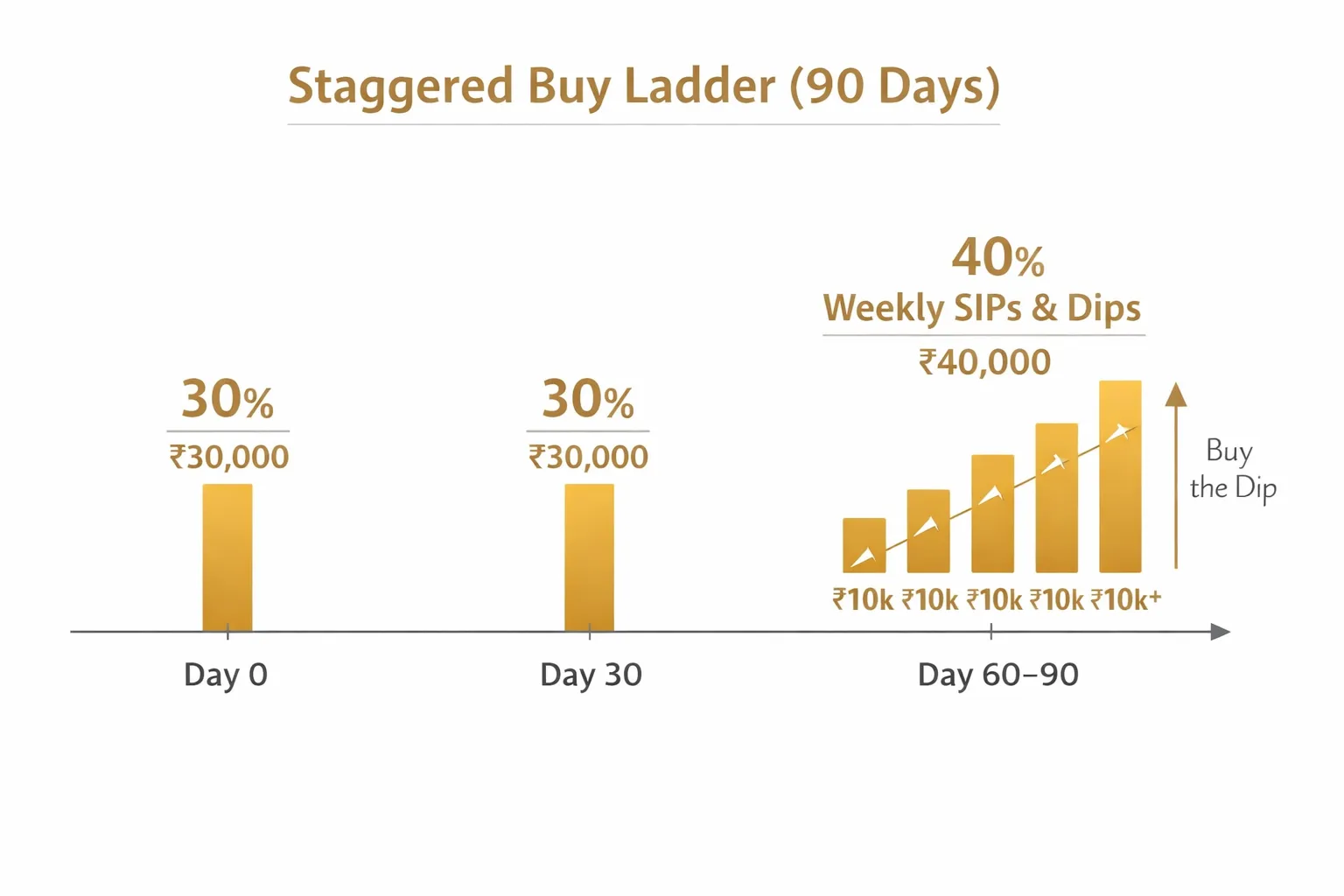

How to Execute Smartly: Staggered Buys, SIPs, and Buy‑the‑Dip Rules

You don’t need perfect timing – just a system. Here’s a simple playbook to average costs, lock in discipline, and avoid festival‑season shocks.

Staggered buys that actually work

-

30/30/40 ladder over 90 days:

-

Day 0: invest 30% of your planned amount

-

Day 30: invest another 30%

-

Days 60–90: invest the remaining 40% in 3–6 smaller tranches (weekly or biweekly)

-

-

Weekly/biweekly SIP for habit + price averaging:

-

Set a fixed weekly SIP (even ₹1–₹500 via UPI on OroPocket)

-

Combine with the ladder above so you build position steadily without overthinking

-

Buy‑the‑dip triggers (rules, not guesses)

-

Add extra 10–20% on every 2–3% price dip from your last buy

-

Example: if your last buy was at ₹X, set alerts to add +10% allocation when price is 2% lower, +20% if 3% lower

-

-

Set price alerts; automate as much as possible

-

Keep your base SIP running and let rules handle top‑ups

-

Review signals monthly; don’t micromanage daily noise

-

Jewellery planning hack

-

Accumulate 24K digital gold first → convert to jewellery closer to the event

-

Avoid surprise making charges by locking gold value early

-

Shop designs and negotiate making charges when you’re ready

-

Time conversion away from peak festivals to dodge surge pricing

-

UPI‑friendly execution

-

Small, frequent buys via UPI in under 30 seconds (ideal for ₹1–₹500 daily top‑ups)

-

OroPocket lets you:

-

Start with ₹1 (no minimums)

-

Automate SIPs + add buy‑the‑dip rules

-

Earn free Bitcoin (Satoshi) cashback on every purchase

-

Build a streak with daily rewards to keep the habit going

-

-

Get started in minutes. Download OroPocket: https://oropocket.com/app

Auspicious Days vs Best Prices: Festivals, Pushya Nakshatra, and Data

India’s gold culture is powerful – and beautiful. The trick is balancing auspicious timing with smart pricing so you don’t overpay during rush periods.

What tradition says

-

Akshaya Tritiya, Dhanteras/Diwali, Navratri, Gudi Padwa, Pushya Nakshatra

-

Families often prefer buying jewellery or coins on these days for prosperity and blessings

What prices actually do around festivals

-

Demand spikes often lift local premiums; inventory constraints

-

Jewellers may tighten discounts and raise making charges as footfall surges

-

Logistics and supply strain can widen the gap between global price and local retail tags

Smart blend: culture + math

-

Keep SIP running year‑round; add a symbolic top‑up on auspicious days

-

Pre‑buy weeks in advance for weddings to avoid peak charges

-

Accumulate 24K digital gold early, convert to jewellery closer to the event (choose design after you’ve locked the grams)

Mini‑plan examples

-

Akshaya Tritiya: begin 6 weeks prior with weekly buys; do a ceremonial top‑up on the day

-

Dhanteras: ladder buys through Navratri → hold a festive top‑up on Dhanteras

“During Diwali and Akshaya Tritiya – considered highly auspicious – India often sells around 40–60 tonnes of gold across just these two festivals.” – Source

Follow tradition without overpaying: set a small SIP (₹1+ via UPI), add a festive top-up, and keep the big allocations outside peak rush. Start on OroPocket and earn free Bitcoin on every gold buy: https://oropocket.com/app

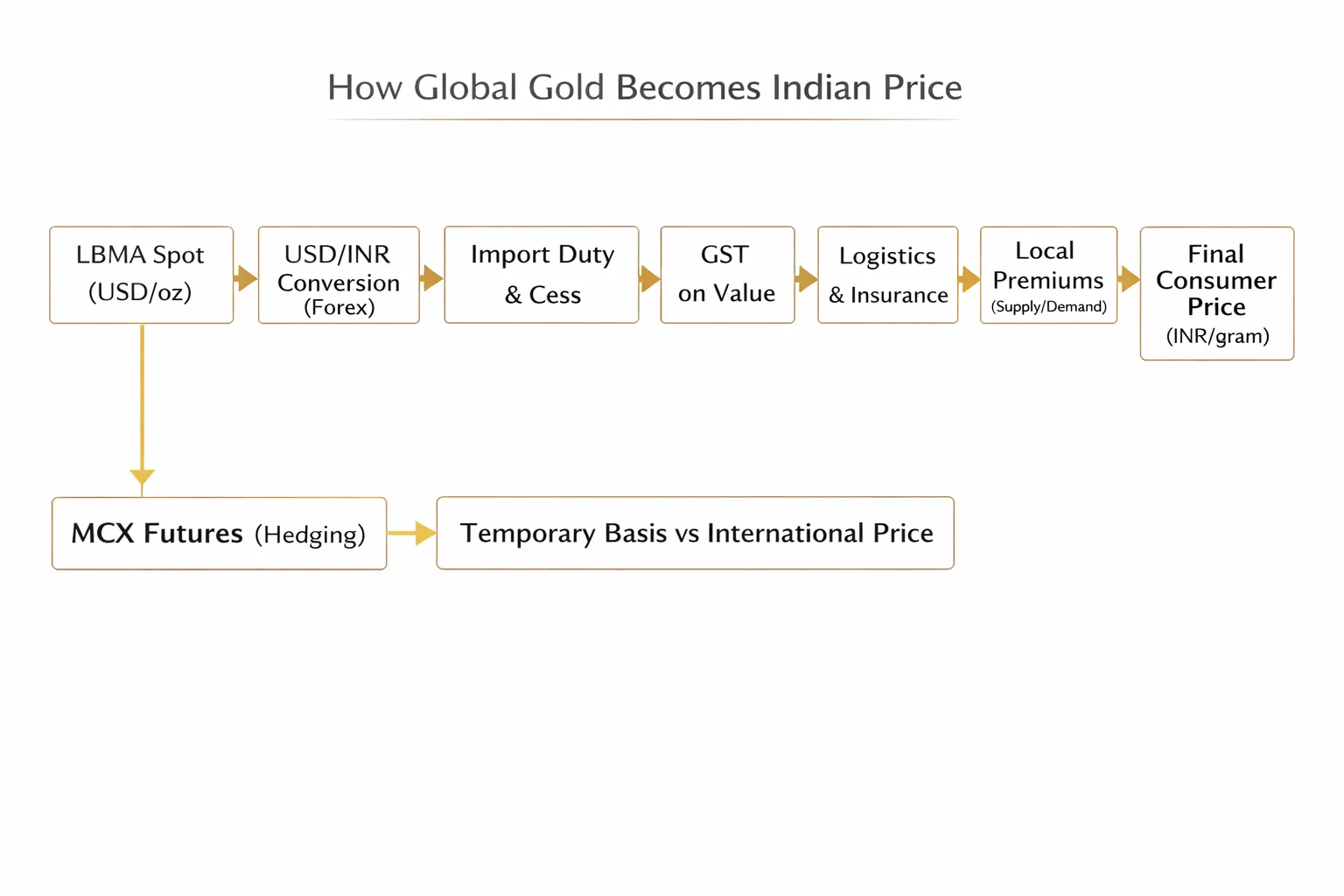

What Moves Indian Gold Prices Today: From USD/INR to Import Duty

Gold you buy in India starts its journey on global markets. Here’s how the number on your screen turns into the rupee price you pay – and what to check before you hit “buy.”

Global reference vs local price

-

LBMA spot is the global benchmark in USD/oz. Indian prices begin there.

-

The USD gold price is converted to INR using USD/INR. A weaker rupee means higher local gold even if USD gold is flat.

Taxes and levies

-

Import duty and any applicable cess add to the landed cost.

-

GST is levied on the value (post duty).

-

Logistics/insurance premiums and jeweller/bullion margins are added on top.

Market plumbing

-

MCX futures reflect domestic pricing and hedging needs; prices can diverge from international quotes due to currency moves, duties, local demand/supply, and funding costs.

-

Short-term basis differences happen, especially around festivals or when INR is volatile.

Policy and macro

-

RBI actions (FX interventions, liquidity), domestic inflation prints, and fiscal moves can sway USD/INR and local premiums.

-

US yields, Fed policy, and geopolitics impact global gold direction and risk appetite.

Quick checklist before you buy today

-

USD/INR trend: higher highs = local gold tailwind

-

Real rates: falling/negative = supportive for gold

-

Near‑term event risk: CPI, Fed/RBI meetings, geopolitical flare‑ups

-

Festival premium risk: pre‑buy or stick to digital 24K, convert later

Make your moves the smart way: set a SIP, add buy‑the‑dip rules, and execute via UPI in seconds. Start on OroPocket and earn free Bitcoin on every gold purchase: https://oropocket.com/app

How Much Gold Should You Own? Allocation Rules for Indians

Finding your “right” gold allocation is about balancing inflation protection, INR risk, and your real-life goals (wedding, house down payment, kids’ education). Here’s a simple, India-first playbook.

Simple allocation rules of thumb

-

New investors: 10–15% of total portfolio in gold (start at 10%, scale toward 15% as your portfolio grows)

-

Conservative savers or heavy INR exposure: 15–20% (especially if most income and assets are rupee-linked like salary, FDs, and rent)

Rebalancing tip:

-

Review quarterly. If gold rises above your target by ~2–3%, trim; if it falls 2–3% below, add. This keeps risk stable without overtrading.

Adjust for your reality

-

High‑interest debt first; keep emergency fund

-

Pay off credit cards/personal loans (>12–14% APR) before increasing gold allocation

-

Maintain 3–6 months’ expenses in liquid savings; gold is a hedge, not your emergency fund

-

-

Separate goals clearly

-

Wealth gold (24K, investment-grade) vs adornment (22K jewellery)

-

Don’t mix the two – making charges and design loss make jewellery a poor “investment” proxy

-

-

Income volatility

-

If your cash flow is irregular, use small weekly SIPs (₹1–₹500) and top up on dips

-

Product mix by goal

-

Long‑term wealth (5–10 years):

-

24K digital gold for pure exposure and easy SIPs

-

Sovereign Gold Bonds (SGBs) for long-term holders who can lock in (note: fixed tenor, interest component; consider tax rules)

-

-

Liquidity and flexibility (can redeem anytime):

-

Digital gold and Gold ETFs

-

-

Gifting and occasions:

-

Digital gold transfers (instant, precise grams)

-

Convert to jewellery closer to the event to avoid early making‑charge lock-ins

-

Execution with OroPocket:

-

Start with ₹1 via UPI; set weekly SIPs and buy‑the‑dip rules

-

Earn free Bitcoin (Satoshi) on every gold/silver purchase

-

Track holdings in grams and ₹ – see progress daily

-

Send gold instantly to family for gifting

Common pitfalls to avoid

-

Overpaying making charges assuming “investment”

-

Jewellery = emotions + adornment; wealth compounding needs 24K with no making charge drag

-

-

Big lump sums at peaks

-

Use staggered entries and SIPs to average costs

-

-

Ignoring FX effect

-

USD/INR depreciation can lift local gold even when global prices are flat – watch the rupee trend

-

-

Not rebalancing

-

Overexposure increases drawdown risk; underexposure reduces inflation hedge

-

Quick worksheet (2 minutes):

-

Decide target: 10%, 15%, or 20%

-

Portfolio size: e.g., ₹5,00,000 → 10% target = ₹50,000 in gold

-

Convert to grams: divide by INR/gram (24K)

-

Plan: weekly SIP amount + monthly top-up if price dips 2–3%

Own the right amount, the right way. Automate SIPs from ₹1, buy via UPI in seconds, and earn free Bitcoin on every purchase with OroPocket: https://oropocket.com/app

Why Buy on OroPocket: ₹1 Entry, UPI Speed, and Free Bitcoin Rewards

OroPocket is built for the way India invests today – UPI-native, micro amounts, and gamified rewards that keep you consistent. If you’re wondering “should I buy gold now?” this is the simplest way to start and stick with it.

Start with ₹1 – truly micro

-

Build the habit daily; no minimums

-

Set SIPs as low as ₹1 and top up on dips without stressing timing

Two assets for the price of one

-

Earn free Satoshi (Bitcoin) on every gold/silver purchase; tiered rewards as you level up

-

Boost momentum with daily streaks, spin‑to‑win, and referral bonuses (100 Satoshi when friends join)

Seamless and secure

-

24K pure gold, 100% insured, RBI‑compliant partners

-

Instant UPI payments – buy gold in under 30 seconds

-

Send gold to friends/family in a tap – perfect for birthdays, weddings, and festivals

Why this beats old‑school buying

-

No haggling, no storage anxiety, no large lump sums needed

-

Avoid making‑charge shocks by accumulating 24K digital gold first and converting to jewellery when you’re ready

Ways to Buy Gold – What Fits Your Goal?

|

Option |

Minimum Investment |

Liquidity |

Rewards/Extras |

Costs/Charges |

Best For |

|---|---|---|---|---|---|

|

OroPocket Digital Gold |

₹1 (₹1 entry highlights micro‑investing) |

Instant, 24×7 buy/sell |

Bitcoin cashback (Satoshi) on every purchase, daily streaks, spin‑to‑win, referral bonuses |

Transparent spread + GST; no making charges |

Habit-building via UPI, SIPs, buy‑the‑dip rules, gifting and small frequent buys |

|

Sovereign Gold Bonds (SGBs) |

Typically 1 gram (subscription lots) |

Semi‑liquid (8‑year maturity; early exits via exchange after lock‑in) |

2.5% annual interest + price appreciation (tax considerations apply) |

Issue price, potential brokerage/spread on secondary market |

Long‑term savers who can lock in and want interest on gold exposure |

|

Gold ETFs |

Price of 1 unit (+ brokerage) |

Market hours liquidity via demat |

Convenient portfolio integration |

Brokerage + fund expense ratio |

Liquid, demat-based gold exposure for market-savvy investors |

|

Jewellery (22K) |

Varies by piece |

Low (resale discounts apply) |

Aesthetic/emotional value; cultural significance |

Making charges, wastage, design loss, GST |

Gifting/occasions; wearables – not ideal for pure investment returns |

Note: OroPocket stands out with true ₹1 entry and Bitcoin rewards – making it the most accessible way to start and stay invested.

Start building your gold habit today. Download OroPocket: https://oropocket.com/app

Step‑by‑Step: Start a Gold SIP on OroPocket in 5 Minutes

1) Download the app

-

Go to https://oropocket.com/app (iOS/Android)

2) Quick onboarding

-

Verify mobile; complete simple KYC

-

Secure your account with a PIN/biometrics

3) Fund via UPI

-

Add as little as ₹1; set a weekly or biweekly SIP amount

-

You can edit or pause SIP anytime – full control

4) Automate your habit

-

Turn on reminders; use daily streaks to stay consistent

-

Enable “buy‑the‑dip” rules for extra top‑ups on pullbacks

5) Maximise rewards

-

Buy steadily to climb reward tiers; spin daily; refer friends (earn 100 Satoshi + free spin)

-

Earn Bitcoin (Satoshi) cashback on every gold/silver purchase

6) Track and gift

-

See live portfolio (grams and ₹); monitor average buy price

-

Send gold instantly to family for birthdays, weddings, and festivals

Ready to start? Download OroPocket and set your first SIP in minutes: https://oropocket.com/app

Conclusion: Don’t Time Perfection – Start Small Today on OroPocket

-

Waiting for the ‘perfect’ dip often means missing years of compounding. The smarter move is starting small now, staying consistent, and using a rules‑based plan. If you’re asking “is it good to buy gold now?” – yes, when you automate SIPs and add small buy‑the‑dip triggers, you beat FOMO and regret.

-

OroPocket makes this easy: ₹1 entry, UPI speed, 24K insured gold, and free Bitcoin rewards on every purchase. It’s gold for the 21st‑century Indian – habit‑forming, transparent, and built to help you average costs instead of chasing them.

-

Take control today. Download the OroPocket app and start your gold SIP in minutes: https://oropocket.com/app