Which is better, MMTC-PAMP or SafeGold in 2026?

Introduction: MMTC-PAMP vs SafeGold in 2026 – quick verdict and snapshot

Both MMTC-PAMP and SafeGold are credible ways to buy and hold 24K digital gold in India. If you want LBMA‑grade pedigree, 999.9 purity, and a refinery-backed setup, MMTC-PAMP stands out. If you prefer the widest partner network, easy jewellery redemption via major jeweller ecosystems, and micro-investing across popular payment apps, SafeGold typically wins on access and flexibility. Your best pick comes down to spreads on your chosen app, delivery SLAs in your PIN code, and whether jewellery conversion matters to you.

“India’s bar and coin demand rose 7% year-on-year to about 47 tonnes in Q1 2025.” – Source

Why this comparison matters now

-

Digital gold is mainstream for Indian savers (UPI-first, ₹1–₹100 entry on many apps)

-

What’s changed since 2024–25: tighter due-diligence by users, better delivery SLAs, clearer storage policies

What you’ll get in 5 minutes

-

Who actually holds your gold (trustee, vault, insurer)

-

Head-to-head on custody, audits, pricing/spreads, delivery, jewellery redemption, app UX

-

A practical checklist to apply before you buy

-

A modern alternative for ₹1 investors who also want Bitcoin rewards

Comparison at a glance (skim-friendly table)

|

Provider |

Purity |

Minimum buy |

Typical spread (indicative) |

Storage grace period |

Custody/Trustee & Vaults |

Audit cadence |

Delivery/Jewellery redemption |

Popular partner apps |

KYC/limits |

|---|---|---|---|---|---|---|---|---|---|

|

MMTC-PAMP |

24K 999.9 (LBMA-accredited) |

₹1–₹100 (app-dependent) |

~2.5–4.5% |

Often free up to ~5 years (channel-dependent) |

Refinery-custodied, insured vaults; global standards |

Regular external audits/assays |

Coins/bars delivery; jewellery conversion partner-dependent; gifting features common |

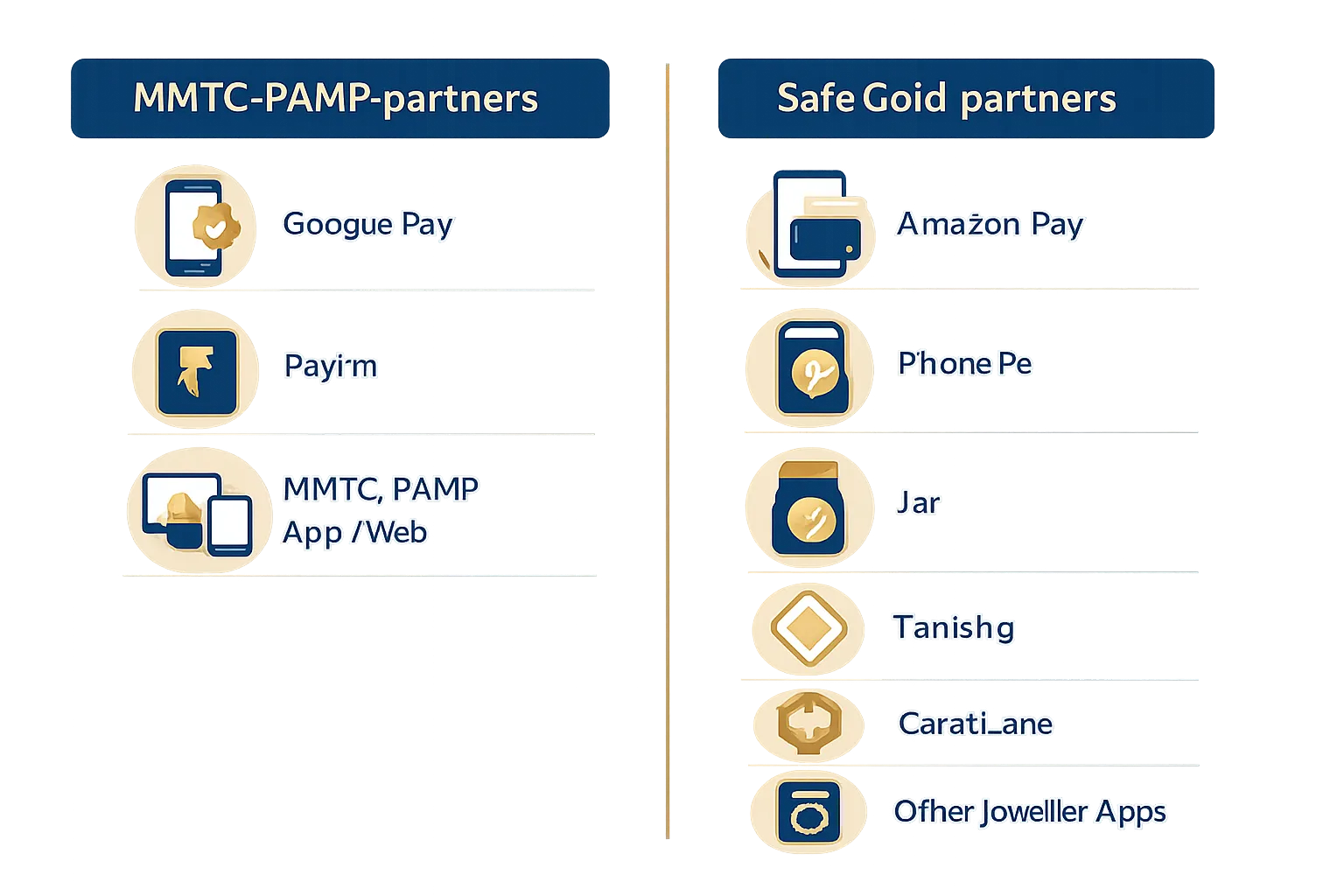

Paytm, Google Pay, own channels |

PAN beyond common thresholds; app-level daily caps may apply |

|

SafeGold |

24K 999/999.9 |

₹10–₹50 (app-dependent) |

~2.5–5.0% |

Often free initially; nominal fee thereafter (varies by app) |

Independent trustee (e.g., IDBI Trusteeship); Brink’s/Sequel-style vault partners; insured |

Periodic third‑party audits; trustee oversight |

Coins/bars delivery; jewellery exchange via select jeweller partners |

Amazon Pay, PhonePe, Jar, jeweller apps |

PAN beyond common thresholds; app-level daily caps may apply |

Note: spreads/fees vary by partner app; always confirm in-app.

If you’re also exploring alternatives

OroPocket offers ₹1 entry, instant UPI buys, and free Bitcoin rewards (Satoshis) on every gold/silver purchase – built for micro-investors who want gold’s stability plus BTC upside.

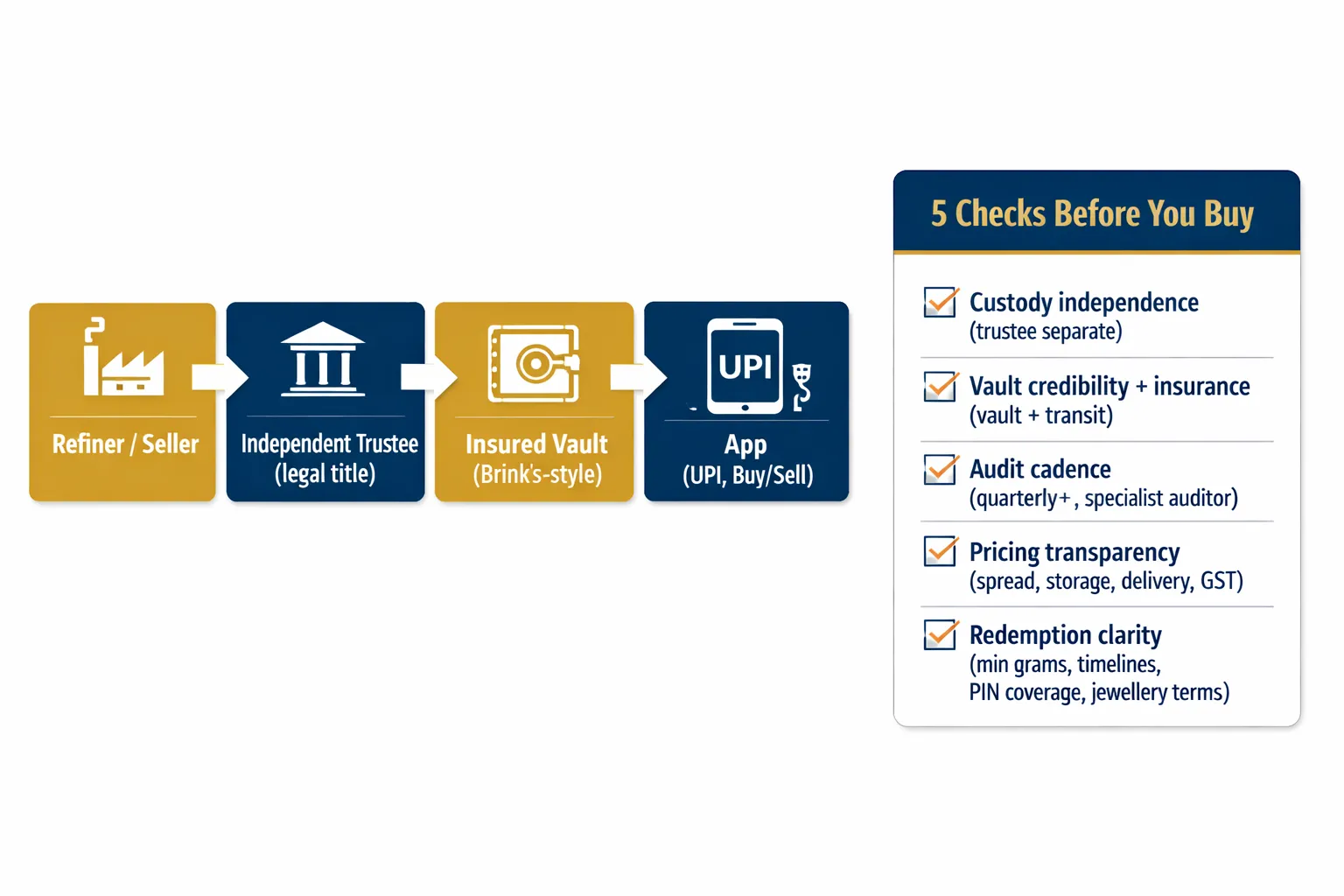

How digital gold works (and the 5 checks that actually matter)

The ecosystem in plain English

-

Seller/refiner issues your 24K units

-

Independent trustee holds legal title for investors (segregated from operator)

-

Vault partner stores the metal; insurer covers physical risks

-

The app is just the distribution layer (pricing UI, payments, support)

What proves you own the gold

-

Tax invoice with grams, purity, GST, your KYC

-

Trustee confirmation/statement

-

Bar lists/serialised linkage (where available)

The 5 checks before you buy

-

Custody independence: trustee named and separate from operator

-

Vault partner credibility and insurance scope (vault + transit)

-

Audit cadence and who audits (prefer quarterly+; bullion-specialist firm)

-

Pricing transparency: live source, total buy–sell spread, storage/delivery fees, GST

-

Redemption clarity: min grams, timelines, PIN-code coverage, jewellery exchange terms

Feature-by-feature: MMTC-PAMP vs SafeGold (what’s the real difference?)

Purity, pedigree, and credibility

-

MMTC-PAMP: LBMA-accredited 24K 999.9 with a joint venture pedigree (Government of India’s MMTC + Switzerland’s PAMP). Strong brand trust, refinery-backed purity, and global standards.

-

SafeGold: 24K 999/999.9 delivered via a very wide distribution network. Known for jeweller partnerships and accessibility across major consumer apps.

Custody structure and audits

-

Trustee independence, named vault partners, insurance coverage:

-

MMTC-PAMP: Institutional-grade custody with insured vaulting; refinery-led infrastructure and established global best practices.

-

SafeGold: Independent trustee structure (commonly IDBI Trusteeship), recognised vault partners (e.g., Brink’s/Sequel-type), full vault insurance.

-

-

Frequency and transparency of third-party audits/assays:

-

MMTC-PAMP: Regular external audits/assays aligned with international standards; assay-sealed packaging for delivered products.

-

SafeGold: Periodic third-party audits and trustee oversight; look for published audit notes and bar lists on partner/app disclosures.

-

Minimum buy, spreads, storage

-

Typical minimums across partner apps:

-

MMTC-PAMP: Often ₹1–₹100 depending on the channel.

-

SafeGold: Often ₹10–₹50 depending on the app.

-

-

Indicative buy–sell spread bands; 3% GST is non-recoverable:

-

MMTC-PAMP: ~2.5–4.5% typical spread band, plus 3% GST on buys.

-

SafeGold: ~2.5–5.0% typical spread band, plus 3% GST on buys.

-

-

Storage grace periods and post-grace fees:

-

MMTC-PAMP: Frequently free storage for up to ~5 years on many channels; nominal fee thereafter.

-

SafeGold: Often free initially; nominal annual storage fees after the grace period (varies by partner app).

-

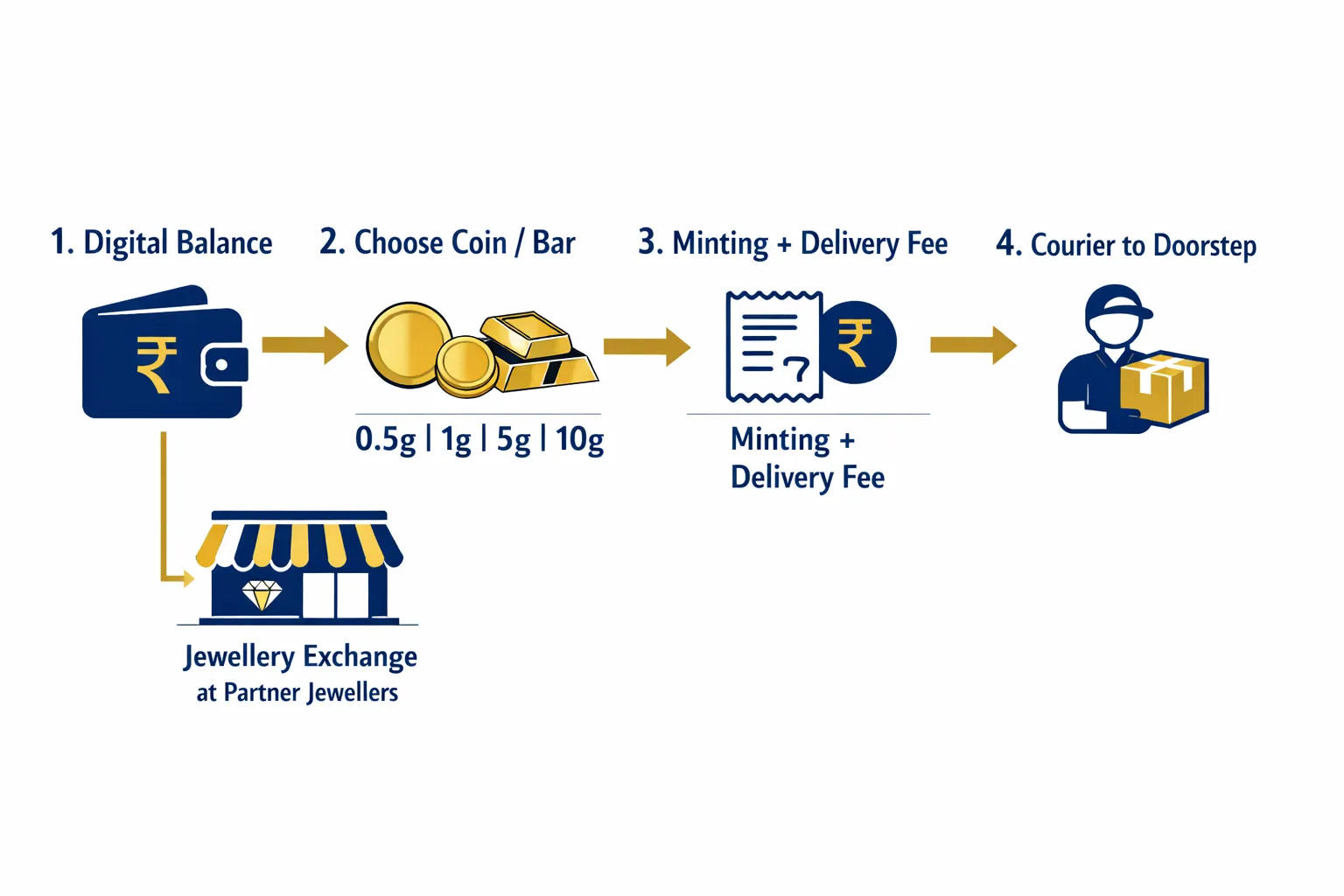

Redemption and jewellery exchange

-

Coins/bars thresholds and delivery SLAs:

-

Both: Delivery to coins/bars once minimum gram thresholds are met; typical fulfilment in a few business days with minting and courier charges shown at checkout.

-

-

Jewellery conversion flows (where supported) and making-charge expectations:

-

MMTC-PAMP: Jewellery exchange is partner-dependent; commonly strong coin/bar delivery and gifting.

-

SafeGold: Stronger jewellery conversion via partner jewellers (where offered). Expect standard jewellery making charges on final pieces.

-

App distribution and UX

-

Where each is commonly available:

-

MMTC-PAMP: Prominent on Google Pay and Paytm, plus its own channels.

-

SafeGold: Widely integrated with Amazon Pay, PhonePe, Jar, and jeweller ecosystems (e.g., Tanishq/CaratLane via partners).

-

-

UPI-first flows, SIPs, gifting, alerts, and support experience:

-

Both: UPI-first buying/selling, live rates, instant liquidity; SIPs/gifting/alerts availability varies by app integration.

-

Support: Typically routed through the app you use; escalations coordinate with provider, trustee, vault, and logistics partners.

-

Trust, custody and audits: who actually holds your gold

SafeGold – what to verify

-

Independent trustee (e.g., IDBI Trusteeship) holding investor title

-

Vault partners like Brink’s/Sequel; insurance for theft/physical loss in vaults

-

Periodic independent audits and bar-list disclosures on-site/app

-

Where to find these pages on SafeGold’s site

MMTC-PAMP – what to verify

-

LBMA accreditation, 999.9 standard, international assay credibility

-

Institutional-grade vaulting with insurance; independent assurance

-

External assay/audit statements; packaging with serials for delivered coins/bars

-

Where to find these pages on MMTC-PAMP’s site

Quick self-audit steps

-

Match invoices, trustee confirmations, and (where available) bar lists

-

Prefer providers that publish auditor names and audit cadence

Pricing, spreads, storage and delivery fees – the real cost math

The 4 cost components you must account for

-

3% GST on purchase (sunk cost)

-

Buy–sell spread (covers hedging, custody, logistics, ops)

-

Storage fees post any grace period

-

Minting + delivery charges for coins/bars

Worked example (₹10,000 buy → sell in 3 months)

-

GST of ₹300 upfront

-

Spread impact (e.g., 3.5% band): price needs to rise ~3.5% just to break even (excluding storage/delivery)

-

Storage pro‑rate if beyond grace; delivery costs only if you take physical

Typical policies (indicative; check in-app)

-

MMTC-PAMP: free storage windows on many channels; transparent delivery/assay packaging

-

SafeGold: grace periods vary by partner app; jewellery exchange options via jeweller partners

Pricing/fees matrix (indicative; confirm in-app)

|

Provider |

GST (3%) |

Typical spread band |

Storage grace |

Storage fee after grace |

Delivery/minting notes |

Minimum redemption grams |

|---|---|---|---|---|---|---|

|

MMTC-PAMP |

Applied on buy value |

~2.5–4.5% |

Often up to ~5 years (channel-dependent) |

Nominal annual fee thereafter |

Assay-sealed coins/bars; minting + courier shown at checkout |

App/channel-specific; often 0.5–1g+ |

|

SafeGold |

Applied on buy value |

~2.5–5.0% |

Often free initially (varies by partner app) |

Nominal annual fee (app-dependent) |

Minting + delivery displayed pre-checkout; jewellery exchange on select partners |

App-specific; often 0.5–1g+ |

Tactics to minimise costs

-

Avoid frequent in‑out trades; use SIPs or larger, less frequent adds

-

Prefer digital sellback unless you genuinely want coins/bars

-

Compare minting/delivery fees by weight and city before redeeming

Redemption, delivery and jewellery exchange – what to expect day-to-day

Coins/bars redemption

-

Minimum gram thresholds (e.g., 0.5g/1g/5g/10g depending on SKUs)

-

Standard SLAs: processing + courier timelines; PIN-code serviceability

-

Tamper-proof, assay-sealed packaging and serialisation

Jewellery conversion

-

SafeGold’s jeweller ecosystem (e.g., Tanishq/CaratLane) and how netting off works

-

MMTC-PAMP: gifting common; jewellery conversion depends on partner tie-ups

-

Making charges on jewellery are separate; watch for offers

Practical tips

-

Check thresholds and fees before you start accumulating

-

Plan redemptions around festivals to leverage promo windows

App experience and partner networks (UPI flows, limits, support)

Where you can typically buy

-

MMTC-PAMP: Google Pay, Paytm, own web/app

-

SafeGold: Amazon Pay, PhonePe, Jar, jeweller apps (Tanishq/CaratLane), others

UX highlights and quirks

-

UPI-first buys, instant sellback quotes, SIPs/gifting on many partner apps

-

Policies vary by app: minimum buy, storage grace, delivery thresholds

-

Daily value/gram limits and PAN/KYC requirements

Support and escalations

-

Start with the partner app’s helpdesk; custody/delivery escalations route to provider + logistics/vault teams

-

What good support looks like: clear SLAs, proactive updates on delivery

Which is better for you? Scenarios and buyer personas

If you prioritise brand pedigree and 999.9 purity with big-wallet integrations

-

Lean MMTC-PAMP, especially if you already use Google Pay or Paytm daily.

-

You’ll value LBMA-accredited 999.9 purity, refinery pedigree, and strong delivery packaging.

If you want widest jewellery exchange options and broad partner access

-

Lean SafeGold, especially if you shop via Tanishq/CaratLane or use Amazon Pay/PhonePe.

-

You’ll benefit from flexible jewellery conversion and a wide network of partner apps.

If you’re a micro-saver building habit with SIPs and small top-ups

-

Either can work – choose the app you already open every day.

-

Compare the live buy–sell spread, storage grace period, and delivery thresholds on that app before you start.

Gifting and festivals

-

Both offer simple digital gifting; compare delivery timelines in your PIN code.

-

Watch for festive promo windows that reduce minting/delivery costs or offer bonus grams.

Not sure yet? Use the checklist in Section 9 to decide in under 5 minutes

-

It covers custody independence, audit cadence, pricing transparency, and redemption specifics so you can make a confident pick fast.

Risks, regulation and a 2-minute due-diligence checklist

The reality today

-

Digital gold isn’t directly regulated by SEBI/RBI like securities; follow provider disclosures carefully

-

Why the trustee–vault–audit triad matters more than the app skin

Red flags

-

No named trustee/auditor, vague audit pages, hidden spreads/fees until checkout, unclear redemption terms

Quick due-diligence checklist

-

Trustee named and independent? Latest audit published?

-

Vault partner + insurance scope (vault + transit) disclosed?

-

Spread, GST, storage and delivery/minting fees visible up front?

-

Min redemption grams, timelines and PIN-code serviceability clear?

-

KYC limits and support SLAs stated in writing?

Tax basics (India)

-

3% GST on buys; STCG taxed as per slab (<3 years); LTCG 20% with indexation (≥3 years)

-

Jewellery making charges are separate from gold value

“NSE directed brokers on Aug 10, 2021 to cease offering unregulated products like digital gold by Sep 10, 2021, citing Rule 8(3)(f) of the Securities Contracts (Regulation) Rules, 1957.” – Source

Final verdict – and a modern alternative for ₹1 investors

Bottom line

-

Choose MMTC-PAMP if you want 999.9 pedigree with strong brand assurance and you already use Google Pay/Paytm

-

Choose SafeGold if you value broad partner access and jewellery exchange via leading jewellers (Tanishq/CaratLane) and daily-driver wallets like Amazon Pay/PhonePe

-

Both suit long-term holders who want credible custody + clear audits; your cost outcome hinges on the spread, storage policy after grace, and delivery fees

A modern alternative if you’re app-first (₹1 entry + rewards)

-

OroPocket: buy 24K gold/silver in seconds via UPI, starting ₹1

-

Earn free Bitcoin (Satoshis) on every purchase; daily streaks, spin-to-win, referrals

-

Send/gift gold instantly; RBI-compliant setup with fully insured vaults

Call to action

-

Want gold’s stability plus Bitcoin rewards? Download OroPocket: https://oropocket.com/app

![How to Invest in Gold & Silver Together in India [2026 Portfolio Guide] 8 How20to20Invest20in20Gold2020Silver20Together20in20India205B202620Portfolio20Guide5D cover](https://blog.oropocket.com/wp-content/uploads/2025/12/How20to20Invest20in20Gold2020Silver20Together20in20India205B202620Portfolio20Guide5D-cover-300x200.webp)