Gold Market Investment (2026): What Drives Gold Prices—and How to Invest Smarter

Gold Market Investment (2026): What Drives Gold Prices – and How to Invest Smarter

Gold isn’t “mystical.” It’s math + macro + money flows. If you’re searching gold market investment, you’re likely trying to answer two questions:

-

Why is gold moving so much?

-

How do I invest without getting trapped by hype, high charges, or bad timing?

In 2026, gold is being pulled by powerful forces: interest rates, USD-INR, central bank buying, geopolitics, and India’s own wedding/festival demand cycles. The good news: you don’t need to predict every move. You need a system – allocation, low-friction investing, and disciplined buying.

And if you’re an Indian retail investor who wants to start small and stay consistent, OroPocket is built for exactly that: start from ₹1, pay via UPI in seconds, and earn free Bitcoin (Satoshi) on every gold/silver purchase – so you’re stacking two assets while most people are still “waiting for the right time.”

The 2026 Reality: Gold Isn’t Just a Commodity – It’s a Global Reserve Asset

Gold acts like:

-

insurance when markets panic,

-

a currency hedge when the dollar moves,

-

and a real-yield competitor when interest rates change.

That’s why “gold market investment” is no longer just jewellery vs coins – it’s also ETFs, SGBs, and mobile-first digital investing.

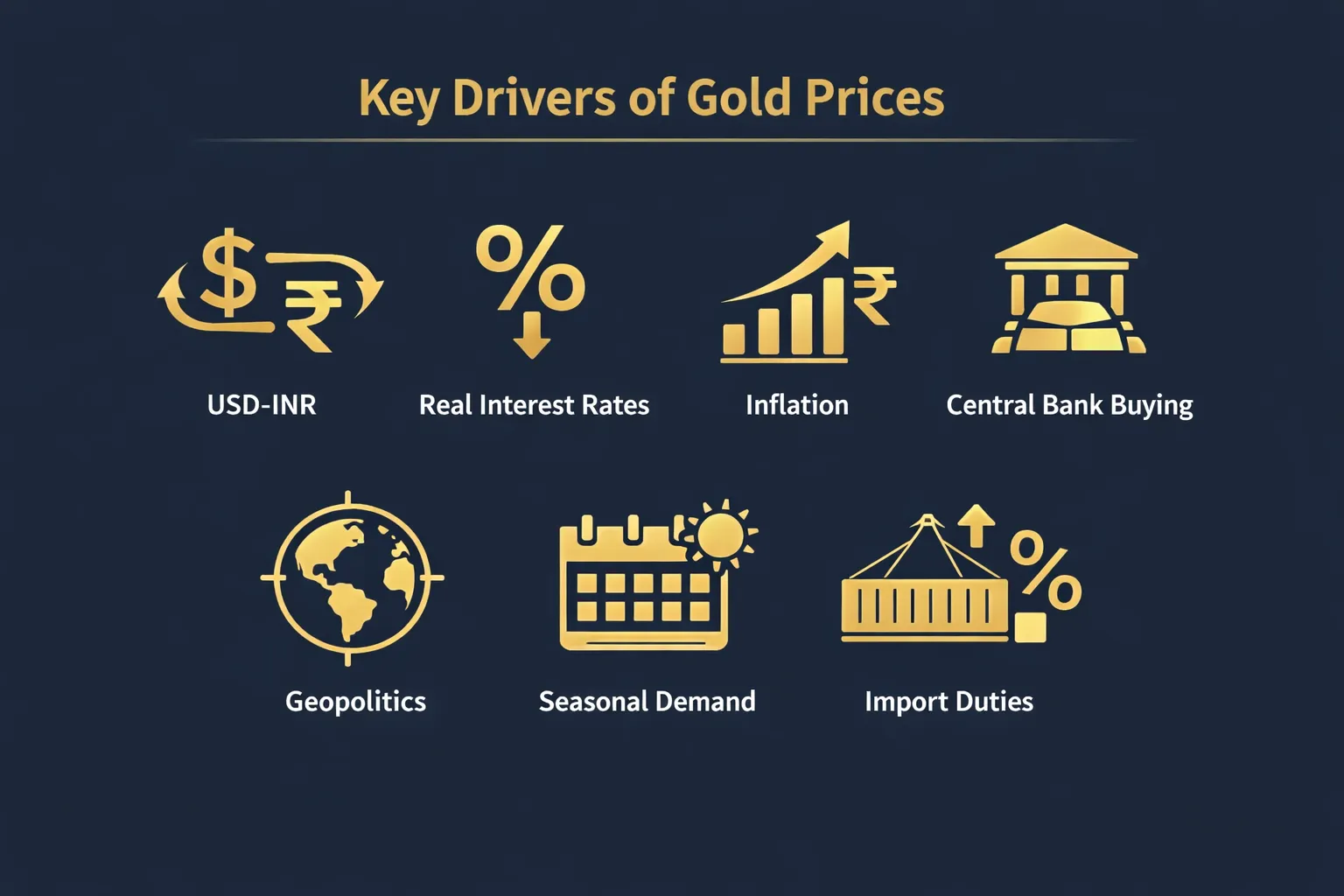

The 7 Biggest Drivers of Gold Prices (India + Global)

1) USD-INR: The “Hidden Lever” for Indian Gold Prices

In India, gold price = global gold price (USD) × USD-INR (plus duties, taxes, local premiums).

So even if global gold is flat, a weaker rupee can push Indian gold higher. This is why Indian investors should track currency moves – not just “gold news.”

If you’re buying online, also know the compliance basics – read rules for buying gold in India to avoid messy KYC, purity, or documentation issues later.

2) Real Interest Rates (Real Yields): Gold’s Most Powerful Macro Rival

Gold doesn’t pay interest. So when real yields (interest rate minus inflation) rise, gold becomes less attractive.

When real yields fall (or go negative), gold tends to shine.

Practical signal:

-

Falling rate expectations → gold supportive

-

Rising real yields → gold faces pressure

3) Inflation Expectations: Gold as a “Purchasing Power Hedge”

Gold often benefits when investors fear that cash returns won’t beat inflation. In simple terms: when people stop trusting “savings interest,” they look for protection.

“Gold has returned 180%+ over the last 5 years vs. savings accounts losing real value to inflation.” – Source

4) Central Bank Buying: The Demand That Doesn’t Panic-Sell

One of the biggest structural changes since 2022 has been central banks accumulating gold as reserves.

“Central banks bought 1,081.9 tonnes (2022), 1,037.4 tonnes (2023), and 1,044.6 tonnes (2024).” – Source

This matters because central bank demand can create a strong floor under prices even when retail sentiment cools.

5) Geopolitical Risk: Gold as a “Crisis Asset”

Wars, sanctions, trade tensions, and political uncertainty push investors toward safe-haven assets. Gold is the default “global safety trade” when trust in systems gets shaky.

6) India’s Seasonal Demand: Weddings + Festivals Move Real Physical Flows

India is not just an investor market – it’s a cultural demand market. That means:

-

Wedding seasons

-

Akshaya Tritiya

-

Dhanteras/Diwali

often tighten physical demand and local premiums.

Smart move: instead of trying to “time the exact day,” build a buying plan so you’re not forced to buy lump-sum at peak season.

7) Import Duties + Taxes: The India-Specific Price Add-On

Indian gold prices include:

-

import-related costs,

-

GST components (depending on form),

-

and local spreads/premiums.

This is where many investors lose money quietly – especially in physical gold (making charges, buyback spreads, purity disputes).

2026 Outlook: Could Gold Still Surprise on the Upside?

Several major research desks remain bullish. J.P. Morgan has projected gold higher into late 2026.

“J.P. Morgan sees gold averaging $5,055/oz by the fourth quarter of 2026.” – Source

Translation: volatility will happen – but the long-term demand story isn’t dead.

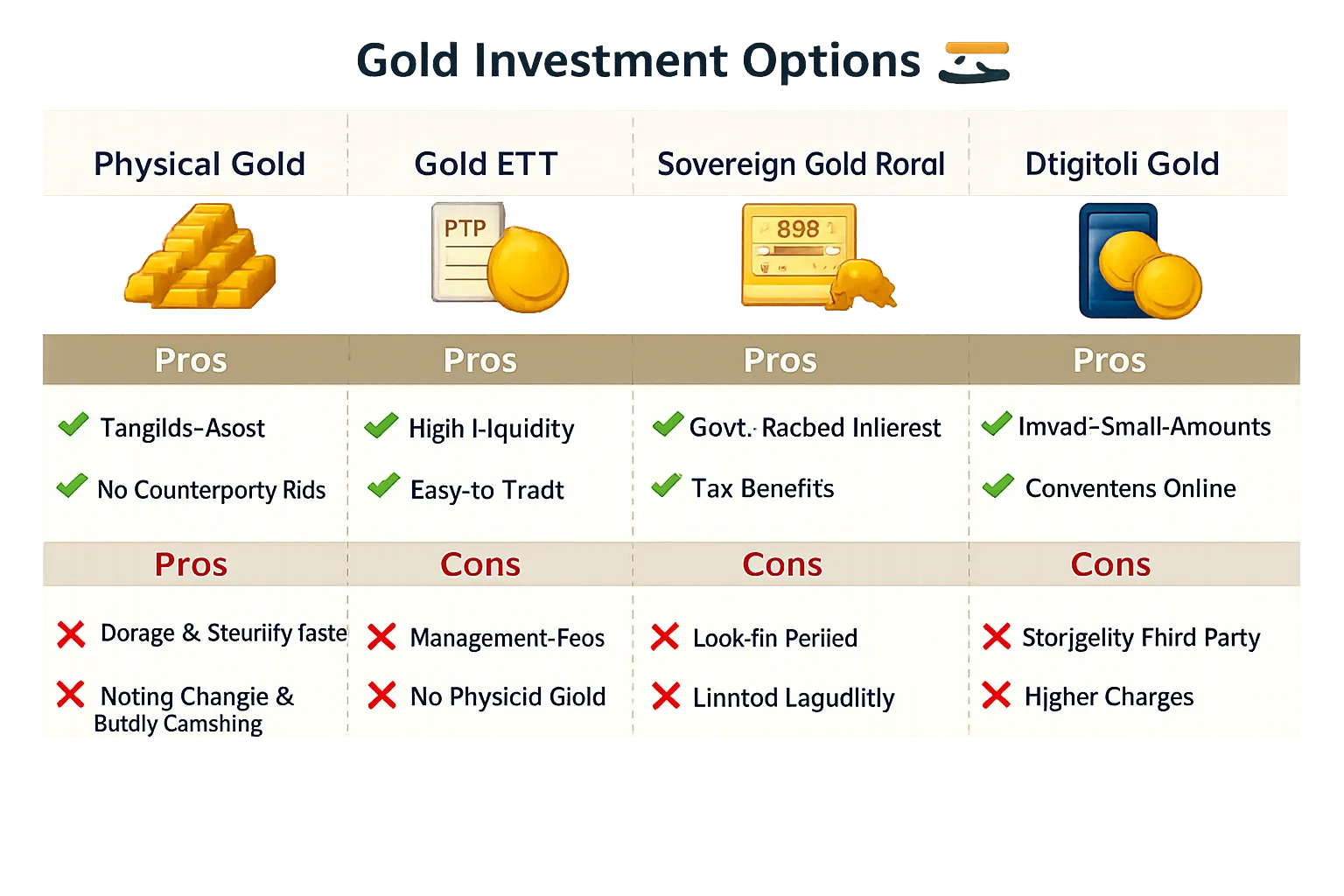

How to Invest in Gold in India (2026): Best Routes Compared

Quick Comparison Table (Retail-Friendly)

|

Option |

Best for |

Pros |

Watch-outs |

|---|---|---|---|

|

Physical gold (jewellery/coins) |

Gifting, cultural use |

Tangible, widely accepted |

Making charges, storage risk, buyback spread |

|

Gold ETFs |

Market-linked investing |

Transparent pricing, liquidity |

Requires demat/broker, expense ratio |

|

Sovereign Gold Bonds (SGBs) |

Long-term holders |

Govt-backed, interest (when available) |

Lock-in/market liquidity, issuance cycles |

|

Digital gold (via app) |

Micro, frequent investing |

Start tiny, easy buy/sell, no storage hassle |

Choose only trusted, insured, compliant platform |

If you’re evaluating formats specifically for 2026, you’ll also like this deeper breakdown: Gold SIP vs Gold ETF vs SGB: which is best for 2026?

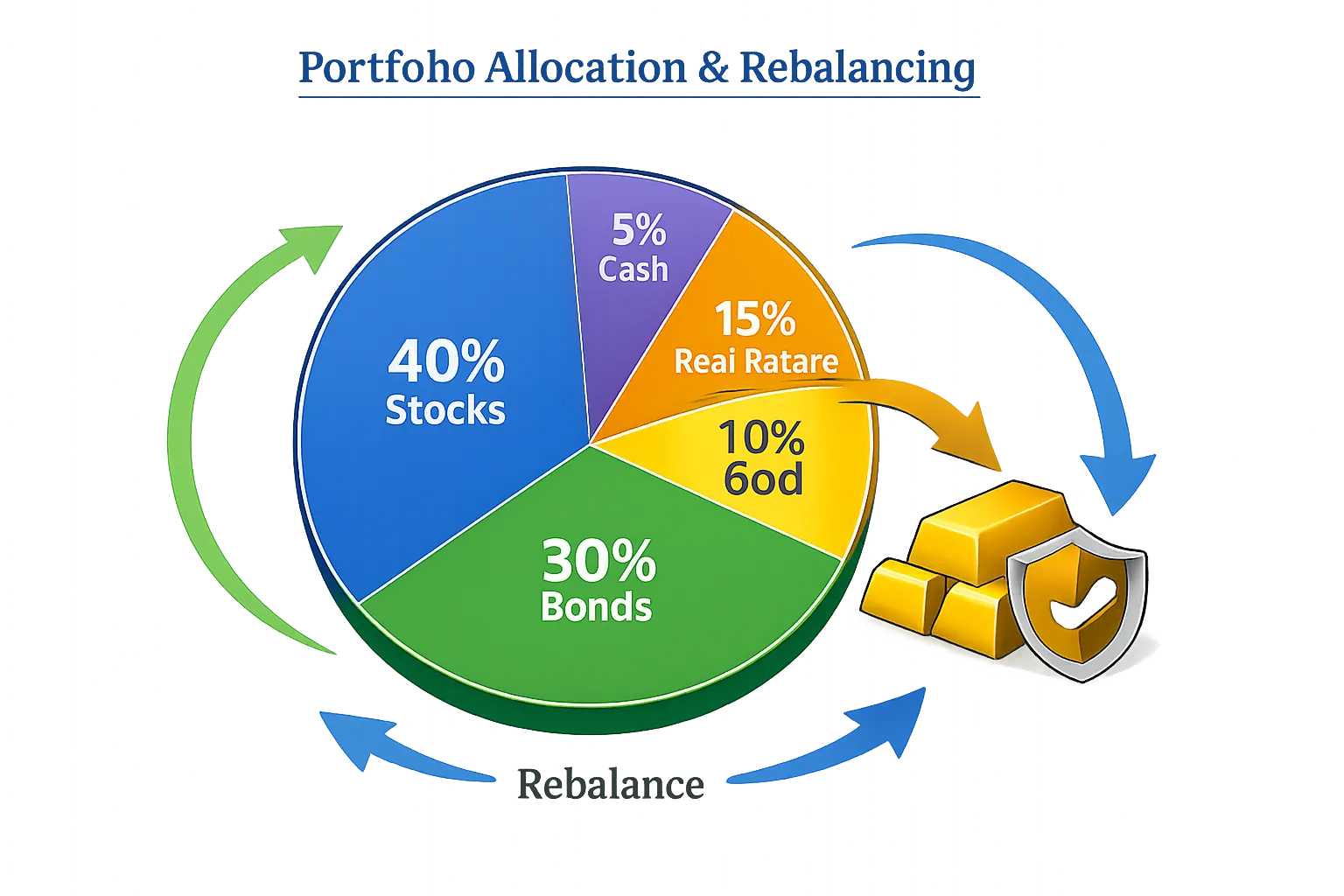

The Smart Strategy Most Investors Miss: Allocation Beats Prediction

Trying to “buy the bottom” is usually how retail investors get stuck – waiting, doubting, then buying late.

A smarter gold market investment plan looks like this:

-

Set a target allocation (commonly 5–15% depending on risk profile)

-

Buy consistently (weekly/monthly)

-

Rebalance annually (sell a little when gold becomes too large a share)

Common Timing Mistakes (And the Fix)

Mistake 1: Buying only when everyone is talking about gold

Fix: automate micro-buys. Boring wins.

Mistake 2: Going “all-in” on one day

Fix: stagger buys. Gold is volatile – your entry shouldn’t be.

Mistake 3: Ignoring charges/spreads

Fix: choose transparent products and trusted platforms; know your buy/sell spread.

For a tactical approach to timing without guessing, use this guide: is it a good time to buy gold now (India)?

Why OroPocket Fits the Modern Indian Gold Investor (2026)

Most platforms help you buy gold. OroPocket helps you build a habit – and rewards you for it.

What you get (without needing “big money”)

-

Start from ₹1: no minimums, no excuses.

-

Instant UPI buying (under 30 seconds): invest at the moment you decide.

-

Free Bitcoin on every purchase: earn Satoshi cashback while stacking gold/silver.

-

Gold + Bitcoin combination: stability + growth potential, without needing to trade crypto.

-

Gamified investing: streaks, spin-to-win, tiered rewards – habit-building by design.

-

100% secure & compliant: RBI-compliant, insured vaults, authorized bullion partners.

-

Referral rewards: both sides earn 100 Satoshi + free spin – built for community growth.

This is what “smart” looks like in 2026: you’re not just buying gold – you’re building a system that compounds.

Final Verdict: Stop Watching Gold. Start Owning It.

Gold market investment in 2026 will reward investors who understand one thing: you don’t need perfect timing – you need consistent exposure, low friction, and discipline.

OroPocket gives you the easiest on-ramp in India:

-

invest from ₹1,

-

pay instantly via UPI,

-

and earn free Bitcoin on every buy – so your savings journey feels rewarding, visible, and modern.

Stop watching. Start growing. Download OroPocket and begin your ₹1 gold habit today.