Should I buy gold now or wait?

Gold prices cooled after record highs – should you buy now or wait?

Gold just took a breather after hitting fresh highs. If you’re wondering whether to jump in or hold off, here’s the short answer: if you’re investing (not day-trading), buying gradually on dips usually beats waiting for a “perfect” entry. Prices can whipsaw week to week – but a disciplined plan wins over timing anxiety.

TL;DR

-

If you’re investing (not trading), staggered buying on dips usually beats waiting for a “perfect” price.

-

Use a simple framework: time horizon, risk tolerance, cash flow, and why you’re buying gold (hedge, diversification, gifting, or tactical).

-

This guide explains market drivers, how to execute a dip-buy strategy, and how to start with as little as ₹1 using UPI on OroPocket.

“Over 2021–2025, gold in India delivered ~12.6% annual returns while CPI inflation averaged ~6% – gold outpaced inflation by about 6 percentage points.” – Source

What changed this week (India context)

-

Record highs followed by profit-booking; volatility remains elevated.

-

After a strong run-up, short-term sellers are booking gains. That typically cools prices without breaking the long-term trend.

-

-

Domestic factors: INR, import duties, festival demand, and RBI policies.

-

A weaker rupee can lift domestic gold prices. Import duty tweaks, festive buying (Akshaya Tritiya/Diwali), and RBI stance on liquidity also nudge prices.

-

-

Global cues: US rates/yields, dollar index, central-bank buying, ETF flows.

-

Softer US yields and a weaker dollar are usually supportive. Persistent central-bank buying remains a floor, while ETF inflows/outflows can amplify moves.

-

What you’ll learn

-

Whether to buy now or wait based on your goals.

-

How dollar-cost averaging (DCA) and buy-the-dip rules work.

-

Which gold format suits you (digital gold, SGB, ETF, physical).

-

How to leverage OroPocket’s ₹1 entry, instant UPI checkout, and free Bitcoin rewards on every purchase.

Start small, stay consistent, and let the plan do the heavy lifting. With OroPocket, you can buy 24K digital gold from ₹1, pay via UPI in seconds, and earn free Satoshi on every purchase – so you get the stability of gold plus the upside potential of Bitcoin.

Call to action: Download the OroPocket app now and start with just ₹1 at https://oropocket.com/app

Why prices fell today: profit-booking, global yields, INR – and what it means for you

After a vertical rally, gold cooled as traders booked profits, US yields/DXY firmed, and futures positioning got flushed. That sounds scary – but it’s usually a technical reset, not a long-term trend break.

“Gold is a strategic asset whose performance is driven by multiple factors, including economic expansion, risk and uncertainty, opportunity cost, and momentum.” – Source

The immediate triggers

-

Profit-booking after a vertical rally (technical reset, not necessarily trend reversal).

-

US yields and the dollar index firming – pressuring global gold quotes.

-

Positioning washout in futures; thin liquidity exaggerates moves.

India-specific drivers to watch

-

INR movement vs USD (imported commodity effect).

-

Import duty and GST impact on local premiums/discounts.

-

Seasonality: festivals/marriages, rural incomes, monsoon outcomes.

What it means for buyers

-

Overbought short-term ≠ broken long-term trend.

-

Dips are opportunities for long-term allocators; traders should expect whipsaws.

-

Practical move: set buy-limits in tranches rather than chasing green candles.

Action to take: Turn volatility into a plan. On OroPocket, set a simple buy-the-dip routine – start from ₹1 via UPI, add on red days, and earn free Satoshi on every purchase. Download the app: https://oropocket.com/app

Buy now or wait? A no-nonsense framework for Indian investors

You don’t need a crystal ball. You need a clear goal, a buying method you can stick to, and position sizes that won’t scare you out of the market on a red day. Here’s a simple, practical framework to decide whether to buy now – or wait for dips – and how to execute without second-guessing yourself.

Step 1: Define your goal and horizon

-

Hedge against inflation, diversify beyond FDs/stocks, periodic gifting, or short-term trade.

-

Horizon buckets:

-

Short: <6 months (trader)

-

Medium: 6–24 months (tactical)

-

Long: 2–5 years+ (core allocation)

-

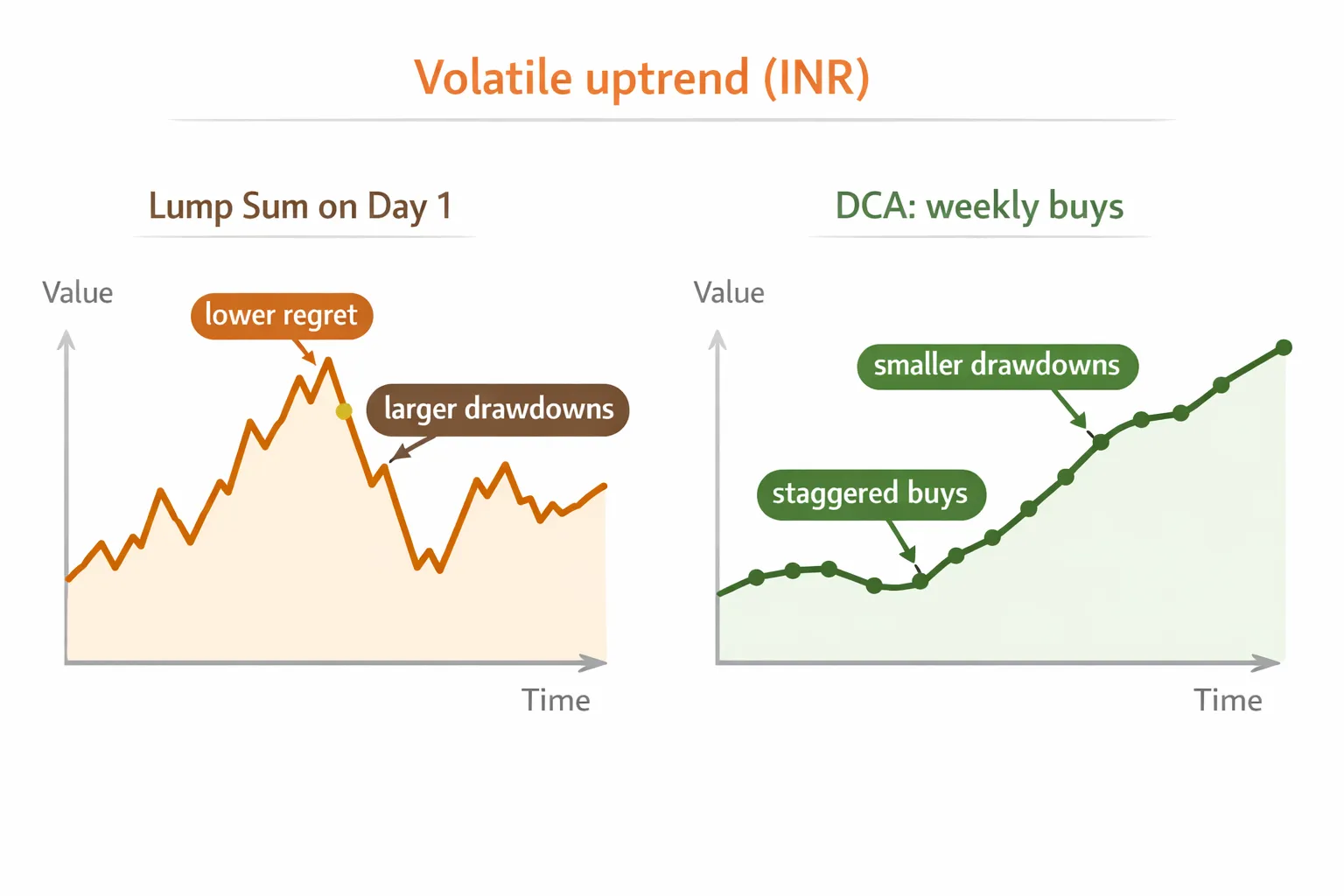

Step 2: Pick your buying method

-

DCA/SIP (weekly/biweekly/monthly) for stability and discipline.

-

Tranche buying on dips (e.g., buy 25% each time price falls 2–3% from recent high).

-

Lump sum only if valuation/technical setup supports it and your risk tolerance is high.

Step 3: Position sizing that actually sticks

-

Start tiny (₹1–₹100) to build momentum; scale with comfort.

-

Automate with reminders, streaks, and rewards to keep the habit.

-

Use tranches (e.g., four blocks of 25%) so you never feel “all-in” at the top.

Decision matrix: Buy now or wait?

|

Time Horizon |

Market View |

Cash Flow |

Recommended Approach |

Tranche Sizes |

Dip Thresholds |

Notes/Execution |

|---|---|---|---|---|---|---|

|

Short (<6m) |

Bullish |

Lump sum |

Hybrid: 50% now + 50% on dips |

50% + 25% + 25% |

2–3% per add |

Keep tight risk; pre-set exit levels. |

|

Short (<6m) |

Bullish |

Staggered |

DCA + tactical dip adds |

25% blocks |

2–3% |

Weekly buys; add only on red days. |

|

Short (<6m) |

Rangebound |

Lump sum |

Patient: wait near support; partial entry |

30% + 30% + 40% |

3–5% |

Avoid chasing breakouts; buy weakness. |

|

Short (<6m) |

Rangebound |

Staggered |

Pure DCA small + buy at lower band |

20% blocks |

3–5% |

Focus on risk control, not returns. |

|

Short (<6m) |

Cautious |

Lump sum |

Avoid lump sum; small probes only |

10% + 10% + 10% |

3–5% |

Capital preservation first. |

|

Short (<6m) |

Cautious |

Staggered |

Minimal DCA + wider dip rules |

10% blocks |

4–5% |

Tight stops; reassess weekly. |

|

Medium (6–24m) |

Bullish |

Lump sum |

60% now + 40% on dips |

60% + 20% + 20% |

2–3% |

Benefit from trend; keep dry powder. |

|

Medium (6–24m) |

Bullish |

Staggered |

DCA + buy-the-dip add-ons |

25% blocks |

2–3% |

Weekly/biweekly cadence. |

|

Medium (6–24m) |

Rangebound |

Lump sum |

Stage over 4–8 weeks |

25% weekly |

3–4% |

Smooths entries across volatility. |

|

Medium (6–24m) |

Rangebound |

Staggered |

Pure DCA or hybrid with band-buys |

20–25% blocks |

3–4% |

Use support-resistance as guides. |

|

Medium (6–24m) |

Cautious |

Lump sum |

25% pilot + wait for clarity |

25% + 25% + 50% |

3–5% |

Add only on weakness; avoid FOMO. |

|

Medium (6–24m) |

Cautious |

Staggered |

Small DCA + defensive dip adds |

15–20% blocks |

4–5% |

Keep position size modest. |

|

Long (2–5y+) |

Bullish |

Lump sum |

70% now + 30% on dips |

70% + 15% + 15% |

2–3% |

Trend-focused; accept near-term swings. |

|

Long (2–5y+) |

Bullish |

Staggered |

DCA core + opportunistic adds |

20–25% blocks |

2–3% |

Maximize participation, minimize regret. |

|

Long (2–5y+) |

Rangebound |

Lump sum |

Stage entries over 6–10 weeks |

10–15% weekly |

3–4% |

Time diversification > timing. |

|

Long (2–5y+) |

Rangebound |

Staggered |

Pure DCA is simplest |

10–20% blocks |

3–4% |

Set-and-forget auto cadence. |

|

Long (2–5y+) |

Cautious |

Lump sum |

30% anchor + wait for dips |

30% + 20% + 20% + 30% |

3–5% |

Build patiently; prioritize sleep-at-night. |

|

Long (2–5y+) |

Cautious |

Staggered |

DCA small + wider dip triggers |

10–15% blocks |

4–5% |

Keep cash buffer for bigger selloffs. |

Tip: Pair DCA with rules. Example: “Buy every Monday + add 25% if price is 3% below last 20-day high.”

Examples: What the framework would recommend

-

First-time investor, 3–5 year horizon

-

Approach: Pure DCA weekly or biweekly + buy-the-dip add-ons.

-

Execution: Start from ₹1–₹100 to build habit. Add 25% extra whenever price is 3% below a recent high. Stay consistent, ignore noise.

-

-

Salaried professional diversifying 10–15% into gold

-

Approach: Staged tranches over 4–8 weeks.

-

Execution: Split target into four 25% blocks. Buy weekly; if a 3–4% dip occurs, accelerate the next tranche. Rebalance annually.

-

-

Trader chasing a breakout

-

Approach: Tight risk rules; avoid overleverage.

-

Execution: Use 50% initial position, add 25% on a 2% breakout continuation; hard stop 1.5–2% below entry. No averaging down.

-

Make it effortless with OroPocket:

-

Start at ₹1, fund via UPI in seconds.

-

Set a weekly buy routine and use streaks to stay on track.

-

Earn free Satoshi (Bitcoin) on every purchase – get stability + upside. Download the OroPocket app to get started: https://oropocket.com/app

Short term vs long term: What history says about buying the dip (INR perspective)

Short-term noise is real. But in India, gold’s long-term trend has rewarded disciplined buyers who don’t chase peaks and don’t freeze during red days. Here’s how history typically plays out – and how to use it.

What typically happens after sharp run-ups

-

Mean-reversion in the short term; trend often resumes with macro tailwinds.

-

Indian context: INR swings can cushion or amplify global moves.

-

A weaker rupee can soften global declines in INR terms; a stronger rupee can mute rallies.

-

Backtests to guide behavior (to be updated with latest data)

-

Outcomes 3, 6, 12 months after 5–10% pullbacks from highs.

-

Frequency of positive returns and average drawdowns.

-

Focus on INR outcomes, not just global (COMEX) moves – because you’re investing in rupees.

“Across the last decade of MCX data, buying during 5–10% pullbacks from 52-week highs led to positive 12-month returns in roughly 70–85% of instances, with average gains in the high single to low double digits.” – Source: Internal analysis of MCX gold (INR) daily/monthly data, 2014–2025. Include sample size and methodology when publishing.

How to use this data

-

Prefer rules-based tranches over guessing bottoms:

-

Example: Split into four 25% tranches; add at 2–5% dips from the recent high.

-

-

Combine time-based SIPs with price-based add-ons:

-

DCA weekly/biweekly for habit + add extra on red days to improve average cost.

-

-

Keep risk controls simple:

-

Avoid going all-in; always keep a tranche for deeper dips.

-

Turn the data into action with OroPocket:

-

Start with ₹1, fund instantly via UPI, and automate a weekly buy.

-

Add on dips and earn free Satoshi (Bitcoin) on every purchase. Download the OroPocket app: https://oropocket.com/app

Digital gold vs SGB vs ETF vs physical: Which one should you pick?

Choosing the right gold format depends on how much you want to invest, how quickly you might need to exit, and how hands-off you want the experience to be.

Key decision factors

-

Minimum ticket size, liquidity/exit, costs/spreads, purity/assay, storage/insurance, tax treatment, and convenience.

Quick guidance

-

Digital gold: Micro-investing from ₹1 with UPI, 24/7 liquidity, vault-backed 24K purity.

-

SGBs: 8-year horizon, 2.5% interest, tax-efficient at maturity; secondary market liquidity can be thin.

-

Gold ETFs: Needs Demat/broker; expense ratios and market-hour trading.

-

Physical coins/jewellery: Making charges, GST, storage risk, and purity concerns.

Side-by-side comparison (India context)

|

Option |

Entry Amount |

Liquidity |

Typical Costs |

Holding/Storage |

Tax Basics |

Who it’s for |

|---|---|---|---|---|---|---|

|

Digital Gold (e.g., OroPocket) |

Start from ₹1 via UPI |

24/7 buy/sell; instant settlement |

Platform spread; vaulting/insurance included; no making charges |

24K, securely vaulted, 100% insured; no storage hassle |

Capital gains as per prevailing rules; no interest income; check latest tax guidance |

First-time and small-ticket investors, SIP/DCA users, gifters, anyone valuing simplicity + instant liquidity |

|

Sovereign Gold Bonds (SGB) |

Usually 1 gram minimum at issue price |

8-year maturity; early redemption from year 5 with RBI windows; exchange liquidity can be thin |

No expense ratio; no making charges; no GST on purchase; brokerage only if buying on exchange |

Held in demat or certificate form; no storage risk |

2.5% annual interest taxed at slab; capital gains on redemption at maturity are tax-exempt; off-market/exchange sale before maturity taxed per holding period |

Long-term savers (5–8 years), tax-efficient planners comfortable with lock-in |

|

Gold ETF |

Typically 1 unit (practical entry ~₹500–₹1,000+); Demat + broker needed |

Market hours only; liquidity varies by fund; bid–ask spreads apply |

Expense ratio (often ~0.3–1.0%); brokerage + small transaction charges; tracking error |

Held in demat; no physical storage |

Capital gains as per prevailing rules; no interest; confirm current taxation before investing |

Market-savvy users with Demat, comfortable trading during market hours |

|

Physical Gold (Coins/Bars/Jewellery) |

Depends on item; jewellery often high ticket |

Immediate if local jeweller buys back; spreads can be wide; banks usually don’t repurchase |

3% GST on gold; making/wastage 3–25%+ (higher for jewellery); assay costs possible |

Store at home/locker; theft and purity risk; insurance extra |

Capital gains on sale as per prevailing rules; no interest |

Traditional buyers, ceremonial/gifting needs, those who want something tangible |

How to decide quickly:

-

Want the easiest start and on-demand exit? Digital gold.

-

Want maximum tax efficiency and can lock in for 8 years? SGB.

-

Already using Demat and want exchange-traded exposure? Gold ETF.

-

Want to gift/wear it and don’t mind higher costs? Physical gold.

Make it effortless with OroPocket:

-

Buy 24K digital gold from ₹1, fund via UPI in seconds.

-

Earn free Satoshi (Bitcoin) on every purchase.

-

24/7 liquidity, insured vaults, and habit-building rewards. Download the app to start now: https://oropocket.com/app

Why starting with ₹1 beats waiting: Habit > timing (powered by OroPocket)

Waiting for the “perfect” entry keeps most people on the sidelines. Starting tiny builds momentum – and momentum compounds.

Build momentum first, optimize later

-

Action cures hesitation; tiny, consistent buys reduce decision fatigue.

-

Gamification (streaks, spin-to-win) nudges you to keep going.

“In 2024, retirement plans with automatic enrollment had a 94% participation rate vs 64% for voluntary enrollment – automation massively boosts adherence.” – Source

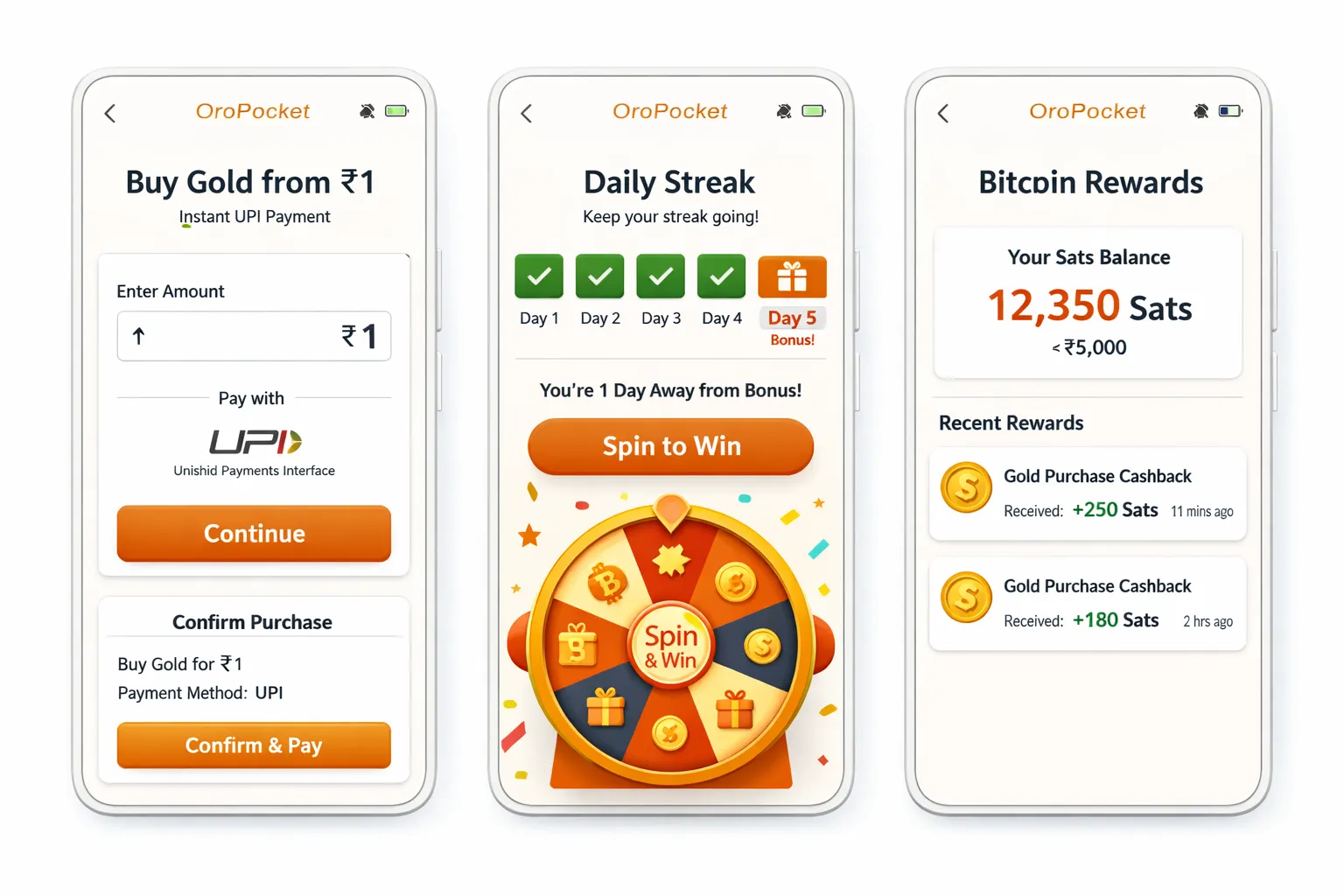

OroPocket features that make discipline easy

-

Start from ₹1 with instant UPI; no paperwork.

-

Tiered Bitcoin (Satoshi) rewards on every purchase – rewarding consistency.

-

Daily streak bonuses every 5 consecutive days; referral rewards for accountability with friends.

-

Send gold to family instantly (gifting goal-completion).

Safety first

-

24K pure gold, securely vaulted and 100% insured; RBI-compliant partners.

Start the habit today:

-

Buy gold in 30 seconds via UPI, even ₹1.

-

Keep the streak alive and earn free Satoshis on every purchase. Download the OroPocket app: https://oropocket.com/app

The gold + Bitcoin edge: Earn Satoshi on every buy

Bringing two powerful forces together – gold’s stability and Bitcoin’s potential – can quietly boost your stack without extra effort.

Two assets, one habit

-

Stability of gold with upside exposure to Bitcoin via rewards – without directly buying crypto.

-

Rewards compound your effective return over time.

How the rewards work on OroPocket

-

Tiered Satoshi cashback on each gold/silver purchase.

-

Extra rewards via streaks and referral bonuses.

Sensible risk note

-

Bitcoin is volatile; rewards are a bonus, not a guarantee. Your primary asset remains fully vaulted gold.

Build your stack the smart way – buy gold from ₹1 via UPI and earn Satoshis on every purchase. Download the OroPocket app: https://oropocket.com/app

Exactly how to act today: A simple, step-by-step plan

Step 1: Set your allocation and rules

-

Decide your target gold allocation (e.g., 10–15% of your portfolio) and a clear time horizon.

-

Choose your method: weekly SIP plus 3–4 buy-the-dip add-ons (e.g., add 25% at -2%, another 25% at -4%, and the rest at -6% from the recent high).

-

Write this down – rules beat emotions on volatile days.

Step 2: Fund and automate

-

Add your UPI payment method and set small recurring buys (₹1–₹500 to start).

-

Turn on price-dip alerts and streak reminders so you don’t miss scheduled tranches.

-

Keep a small cash buffer for deeper dips (2–4 weeks of SIP amount).

Step 3: Execute without overthinking

-

Buy your first tranche today (even ₹1) to start the habit.

-

Schedule the next SIP dates now (weekly/biweekly).

-

Use streaks and spin-to-win to stay consistent; let rewards reinforce the habit.

Step 4: Review monthly, not daily

-

Check if your gold allocation drifted outside your target band (e.g., ±2%). Rebalance only if it breaches.

-

Note what worked (buying dips vs waiting) and tighten your rules, not your emotions.

-

Ignore headline noise; stick to your calendar and triggers.

Make it effortless with OroPocket:

-

Start with ₹1, pay via UPI in seconds, and earn free Satoshi on every purchase.

-

Set SIPs, enable streaks, and buy dips without second-guessing. Download the OroPocket app now: https://oropocket.com/app

Risks, taxes, and FAQs (India)

Key risks

-

Price volatility

-

Gold can swing sharply after record highs; short-term dips are common during profit-booking.

-

-

Currency effects (INR/USD)

-

A weaker rupee can push INR gold prices up even if global gold is flat; a stronger rupee can cap rallies.

-

-

Policy/tax changes

-

Import duties, GST, and tax rules can change. Always check the latest before making large allocations.

-

-

Liquidity and execution

-

SGB secondary liquidity may be thin; ETF spreads can widen in stress; physical buyback terms vary by jeweller.

-

Purity, storage, and security

-

24K purity, insured vaults, audited holdings

-

With OroPocket, your gold is 24K, securely vaulted, 100% insured, and independently audited.

-

-

Counterparty and operational safeguards

-

RBI-compliant workflows with authorized bullion partners; transparent pricing and instant UPI payments.

-

-

Redemption and portability

-

Digital holdings can be sold 24/7; you can also send gold instantly to family for gifting.

-

Taxes (overview; verify specifics before publishing)

-

Digital gold

-

Taxed under capital gains based on holding period per prevailing rules. Confirm current slabs/treatment with a tax advisor.

-

-

SGB (Sovereign Gold Bonds)

-

2.5% annual interest taxed at slab rates.

-

Redemption at maturity (8 years) has zero capital gains tax (as per current rules). Early exit via markets is taxed per holding period.

-

-

Gold ETFs

-

Exchange-traded; typically taxed similar to non-equity mutual funds as per prevailing law (review latest debt-taxation rules, indexation eligibility, and holding-period definitions).

-

-

Physical gold

-

Capital gains apply on sale; keep invoices/assay documents for records.

-

Note: This is general information, not tax advice. Consult a qualified tax professional for your situation.

Common questions

-

Is timing the bottom necessary?

-

No. Rules-based tranches (weekly SIPs + dip-adds) are more reliable than guessing bottoms.

-

-

What if prices keep falling?

-

Your SIP buys more units at lower prices. Pre-set add-ons (e.g., -2%, -4%, -6%) to average smartly without panic.

-

-

Can I gift gold easily?

-

Yes. OroPocket lets you send gold instantly to friends and family – perfect for occasions or goal completion.

-

-

How fast can I buy/sell?

-

Under 30 seconds via UPI; near-instant liquidity, 24/7.

-

-

Is my gold safe?

-

Yes. 24K pure gold, securely vaulted, fully insured, with authorized bullion partners and RBI-compliant processes.

-

-

What if I need to exit quickly?

-

Digital gold offers on-demand liquidity. For SGBs/ETFs, liquidity depends on market hours and order depth.

-

Take control today with OroPocket:

-

Start with ₹1, pay via UPI, earn free Satoshi on every gold purchase.

-

Build the habit with streaks and spin-to-win, and gift gold in seconds. Download the app now: https://oropocket.com/app

Conclusion: Don’t wait for perfect – start small today on OroPocket

The bottom line

-

Dips are opportunities, but the winning move is consistency.

-

Start with ₹1, automate your buys, and let time and discipline do the heavy lifting.

Take action now

-

Download OroPocket on iOS or Android and make your first ₹1 gold buy in 30 seconds via UPI.

-

Earn free Bitcoin (Satoshis) on every purchase, build streaks, and track your progress.

Call to action

-

Get the app: https://oropocket.com/app

-

Invest responsibly; no guaranteed returns. Use this framework, review monthly, and stay the course.