Is it safe to buy silver online in India in 2025?

The quick answer

- Yes – if you verify purity, buy from compliant platforms, pay securely via UPI, and insist on insured delivery or vaulted storage when you purchase silver online.

- This guide shows you exactly how to do that – how to buy silver online safely in India – step by step.

“Industrial applications accounted for approximately 59% of total silver demand in 2024.” – Source

What you’ll learn in this guide

- How to buy silver online safely (checklist + red flags)

- Digital silver vs physical silver vs Silver ETFs – what’s best in 2025

- How to verify purity, pricing, and taxes (GST 3%)

- Payment and delivery safety (UPI, tamper-evident packaging, insurance)

- Storage options (home safe, bank locker, vaulted)

- How OroPocket lets you start from ₹1 and earn free Bitcoin on every silver purchase

Who this is for

- First-time investors asking “where can I buy silver online?”

- Savers who want inflation protection without complicated setups

- Busy professionals who prefer UPI, mobile-first investing, and instant liquidity

Digital silver vs physical silver vs Silver ETFs (2025): which is safest for online buyers?

The big picture

- Physical silver = tangible ownership but storage/security hassles and purity checks

- Digital silver = instant buy/sell, vaulted and insured, great for micro-investing, depends on platform standards

- Silver ETFs = SEBI-regulated, exchange-traded transparency, no vault logistics for you

When each option shines

- Physical: gifting, ceremonial use, collectors who want to hold bars/coins

- Digital silver: convenience, small-ticket SIPs, instant liquidity via app, gifting digitally

- Silver ETFs/FoFs: long-term, regulation-first investors with demat (or without via FoFs)

| Feature | Digital Silver | Physical Silver | Silver ETF/FoF |

|---|---|---|---|

| Regulation | Not SEBI-regulated; relies on platform standards, audited vault partners, and transparent terms. Do KYC and check custodian details. | No central regulator for bullion purchases; rely on reputed dealers and BIS-hallmarked items (for jewellery). | SEBI oversight (Silver ETFs permitted Dec 2021); FoFs regulated as mutual funds. |

| Purity standard | Typically 999/999.9 with refiner certificates; look for LBMA-aligned sourcing and independent audits. | Investment-grade bars/coins usually 999/999.9; verify mint/refiner stamp, serial number, and BIS/assay documentation. | Must hold 99.9% purity LBMA Good Delivery 30 kg bars; periodic physical verification/audits. |

| Storage | Custodian-vaulted and 100% insured on your behalf. | Home safe or bank locker (risk/fees). | Fund handles vaulting and custody; you hold units – no storage burden. |

| Liquidity | Instant buy/sell in-app at live rates; UPI settlement. | Sell to dealers/jewellers; price depends on local spreads and verification. | Exchange liquidity (market hours) for ETFs; FoFs via AMC platforms with T+ settlement. |

| Minimum investment | Micro amounts (start from ₹1 on OroPocket) enable silver investment online without barriers. | Starts from the smallest coin price; bars require larger capital. | ETFs: cost of 1 unit (+ brokerage); FoFs often allow SIPs from ₹100–₹500. |

| Price discovery | Platform-linked live price; check spreads/markups vs spot/MCX. | Dealer quotes vary by city/brand/premium. | NAV tracks spot; exchange price offers transparent discovery. |

| Typical charges (premium/storage/expense ratio) | Platform spread, 3% GST, possible storage/withdrawal fee. | Premium over spot, 3% GST; jewellery includes making/wastage charges. | ETF expense ratio (~0.4–1%), brokerage, bid–ask spread; FoF adds its own small expense. |

| Buy/Sell process | App-based, UPI instant payments, e-KYC; option for insured, tamper-evident delivery. | Walk-in/online dealer; pay, collect with invoice/certification; manage storage yourself. | Buy via demat/broker (ETF) or AMC/MF app (FoF); simple redemption/sale like mutual funds/shares. |

| Best for | Convenience, small-ticket SIPs, instant liquidity, digital gifting. | Gifting, rituals, collectors who value tangibility. | Regulation-first, long-term portfolios; SIPs via FoFs if no demat. |

“SEBI’s Dec 2021 circular enabled Silver ETFs, requiring 99.9% LBMA Good Delivery silver and periodic independent physical verification.” – Source

Bottom line

- Safety = verify regulation + vaulting + audits + transparent pricing. Combine products based on goals: Digital silver for ease (UPI, instant buy/sell), ETFs for regulation and exchange transparency, physical for tangibility and gifting. If you’re wondering how to buy silver online or where to purchase silver online with minimal friction, start small with digital silver, automate SIPs, and park long-term allocations in SEBI-regulated Silver ETFs/FoFs.

Checklist: How to buy silver online safely (step-by-step)

1) Vet the platform/dealer

- RBI/SEBI alignment where applicable; named vaulting partners; insurance details

- Independent audits and proof of physical backing (for digital silver)

- Transparent pricing (spot, premium, fees, GST)

2) Verify purity upfront

- Look for 999/99.9 fineness mark, brand/refiner logo, serial number

- For physical: BIS hallmark components; for digital: LBMA Good Delivery bars in vaults

3) Confirm live pricing and premiums

- Cross-check spot rate vs seller price and premiums by weight/brand

- Avoid “too low to be true” deals

4) Pay the safe way

- Prefer UPI or trusted gateways; avoid cash or direct wallet-to-wallet when possible

5) Delivery or vaulting

- Insist on tamper-evident, insured shipping with tracking – or choose vaulted storage

6) Keep records

- Save invoice, certificates, order IDs, tracking details; record batch/serial numbers

7) Red flags – walk away if you see

- No GST invoice, missing hallmark/assay details, pressure selling, opaque fees

| Red flag | What to do instead |

|---|---|

| Massive discount vs spot price | Verify live spot and typical premium; compare across 2–3 reputable sellers |

| No hallmark/assay details | Ask for BIS hallmark (physical) or LBMA Good Delivery proof and audit reports (digital) |

| No GST invoice offered | Demand a proper GST invoice with itemized purity/weight and taxes |

| No independent audit or unnamed vault partner | Look for platforms with independent audits and clearly named, insured vault partners |

| Cash-only or direct wallet-to-wallet | Pay via UPI or trusted payment gateways; avoid untraceable payments |

How to verify purity and pricing before you purchase silver online

“Hallmarked silver must carry the BIS Standard Mark, fineness (e.g., 999), the Assaying & Hallmarking Centre’s ID, and the jeweller’s identification mark.” – Source

Purity: what to check

- 999/99.9 fineness, brand/refiner logo, serial number (for bars)

- BIS hallmarking components (for artefacts/jewellery): BIS logo, fineness mark, Assaying & Hallmarking Centre mark, jeweller ID

Pricing: avoid overpaying

- Understand spot vs premium vs GST (3%)

- Expect higher premiums for smaller bars/coins vs larger bars

- Compare across 2–3 reputed sellers/apps before purchase

Mini example: cost breakdown

- Example line items to expect: Base price (linked to spot), making/premium, GST 3%, shipping/insurance if delivered

Payments, delivery, and buyer protection: UPI, insured shipping, and KYC

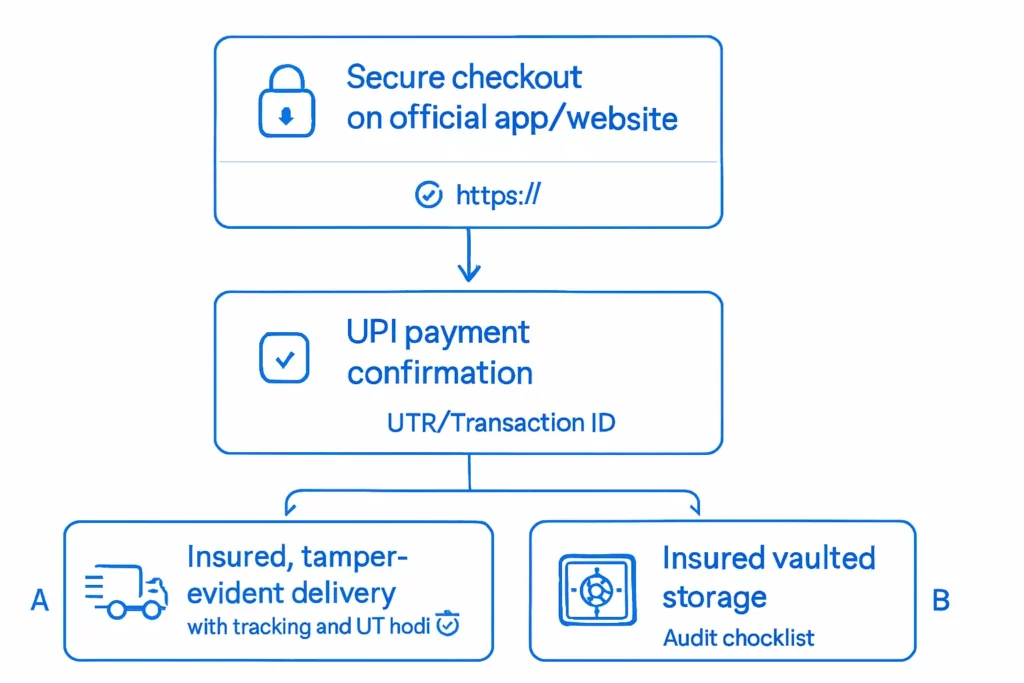

Paying securely

- Use UPI or trusted gateways; confirm transaction receipt and GST invoice immediately

- Avoid links sent on social media – pay only inside the official app/website

Delivery you can trust

- Insist on tamper-evident, insured shipping with tracking and OTP delivery

- Unbox on camera; verify seals/serials match invoice; report discrepancies same day

Vaulted storage alternative

- If you don’t need doorstep delivery, choose vaulted storage with insurance and independent audits

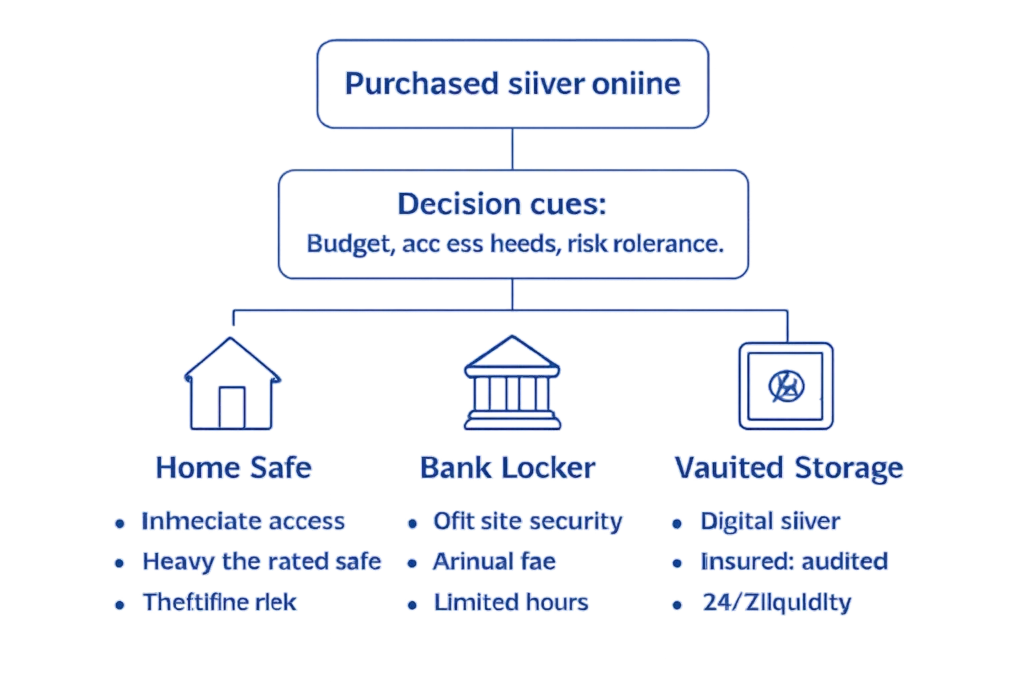

Storage options after you purchase silver online: home safe vs bank locker vs vaulted storage

Home safe

- Pros: immediate access; Cons: theft/fire risk; choose heavy, fire-rated safes

Bank locker

- Pros: off-site security; Cons: annual fee, limited access hours

Vaulted storage (digital silver)

- Pros: insured, 24/7 liquidity, no logistics; Cons: platform-dependent – pick audited, reputed partners

When to redeem vs stay vaulted

- Redeem for gifting/usage; stay vaulted for pure investment exposure and instant liquidity

Costs and taxes on silver investment online in India (GST, premiums, ETF expense ratios)

“GST on silver bullion and coins is 3% in India under CBIC’s GST rate schedule.” – Source

Common costs you’ll see

- Premium over spot (varies by weight/brand)

- GST at purchase (bullion/coins): 3%

- Shipping and insurance (for delivery); storage fees (some digital platforms)

- ETF/FoF: brokerage + expense ratio

Tax basics (not advice)

- Physical/digital silver: capital gains tax when you sell; consult a tax professional for your slab/applicability

- Silver ETFs/FoFs: taxed like debt mutual funds under current rules (no indexation; slab-rate for individuals)

Practical tip

- Track your buy price, taxes, and fees in a simple sheet/app for accurate net returns

When to buy: timing, SIPs, and managing volatility in silver

Volatility is normal

- Silver’s dual role (precious + industrial) means sharper swings vs gold

- Expect cycles driven by electronics/solar demand, USD strength, and interest rates

- Plan for volatility instead of trying to predict every move

Smarter entry strategies

- Use small, regular buys (SIPs) to average cost over time

- Avoid chasing spikes; add more on weakness when your thesis is intact

- Split entries: stagger purchases across weeks instead of one lump sum

- For silver investment online, compare platform spreads before each buy

Set rules you can stick to

- Define target allocation (e.g., 5–15% of portfolio across silver/gold)

- Rebalance annually or when allocation drifts by ±2–3%

- Pre-decide exit/trim levels (e.g., book partial gains after 20–30% rallies)

- Keep an emergency buffer; don’t fund purchases with short-term money

Tip: If you prefer simplicity, automate SIPs via your investing app and review quarterly. This keeps behavior consistent and removes the urge to time every peak and dip when you purchase silver online.

Why buy digital silver on OroPocket: safe, simple, and rewarded

What makes OroPocket different

- Start from ₹1 – micro-investing with no minimums

- Earn free Bitcoin (Satoshis) on every silver purchase – two assets for the price of one

- Daily streaks and spin-to-win keep you consistent (bonus rewards on 5-day streaks)

- Instant UPI payments; buy silver in under 30 seconds

- RBI-compliant, 100% insured vaults with authorized bullion partners

- Transparent live pricing and easy sell-back for instant liquidity

- Referral rewards: invite friends and both of you win

How to buy silver on OroPocket (in under 2 minutes)

- Download the OroPocket app (iOS/Android) and complete quick KYC

- Tap Silver, enter ₹ or grams, and pay via UPI

- Choose to keep in insured vault or redeem later for physical delivery

- Track live price, set alerts, and build a SIP-like habit with streaks and rewards

Who this is perfect for

- First-time investors who want a safe, low-ticket start

- Bitcoin-curious users who prefer rewards over direct crypto risk

- Savers who value convenience, liquidity, and rewards over storage hassles

- Busy professionals asking “where can I buy silver online?” who want simple UPI payments and instant confirmation

Social proof and shareability

- Send silver to friends/family from the app; earn referral rewards (100 Satoshi + free spin when they join)

- Build a silver investment online habit with streaks, spins, and real-time progress – see your portfolio grow, one rupee at a time

Tip: If you’re new to silver investment online, start with ₹1, automate small weekly buys, and let Satoshi rewards supercharge your journey while your silver sits safely in insured vaults.

Conclusion: Ready to buy silver online safely? Start with OroPocket

- You now know how to verify purity, compare prices, pay safely via UPI, choose delivery vs vaulting, and understand taxes/fees – everything you need for safe silver investment online.

- Put it into action with OroPocket: start from ₹1, buy in 30 seconds, and earn free Bitcoin on every purchase. No storage headaches, no guesswork – just safe, modern, mobile-first silver investing.

- Download the app, make your first micro-purchase today, and build your silver stack the 21st-century way. If you were wondering “where can I buy silver online?” – this is how to buy silver online the smart way.