What caused silver price to crash last week?

What caused silver price to crash last week? (Jan 2026 recap for Indian investors)

The last week of Jan 2026 was a wake-up call for anyone who thought silver only “goes up.” Prices didn’t just dip – they collapsed across global markets and India, shocking first-time investors, traders, and even seasoned bullion buyers.

If you’re a retail investor in India, here’s what you actually need to know (without the jargon): this wasn’t one single “bad day.” It was a chain reaction – overbought prices + forced liquidation + rising margins + a dollar/yield shock + premium collapse.

And if you’re looking at digital silver price today and wondering “Should I panic?” – this breakdown is your map.

The crash in one line: silver got “too crowded,” then got “forced out”

Silver’s rally into Jan 2026 became a crowded trade – too many leveraged long positions, too much FOMO, too little margin safety.

When the trigger hit, silver didn’t fall gently. It gapped down, hit stop-losses, caused margin calls, and forced liquidations – a classic “euphoria to exhaustion” unwind.

“Silver prices experienced significant volatility, culminating in a sharp decline of approximately 31% on January 30… the largest one-day drop since 1980.” – AInvest

What exactly triggered the silver crash last week? (The 6 real drivers)

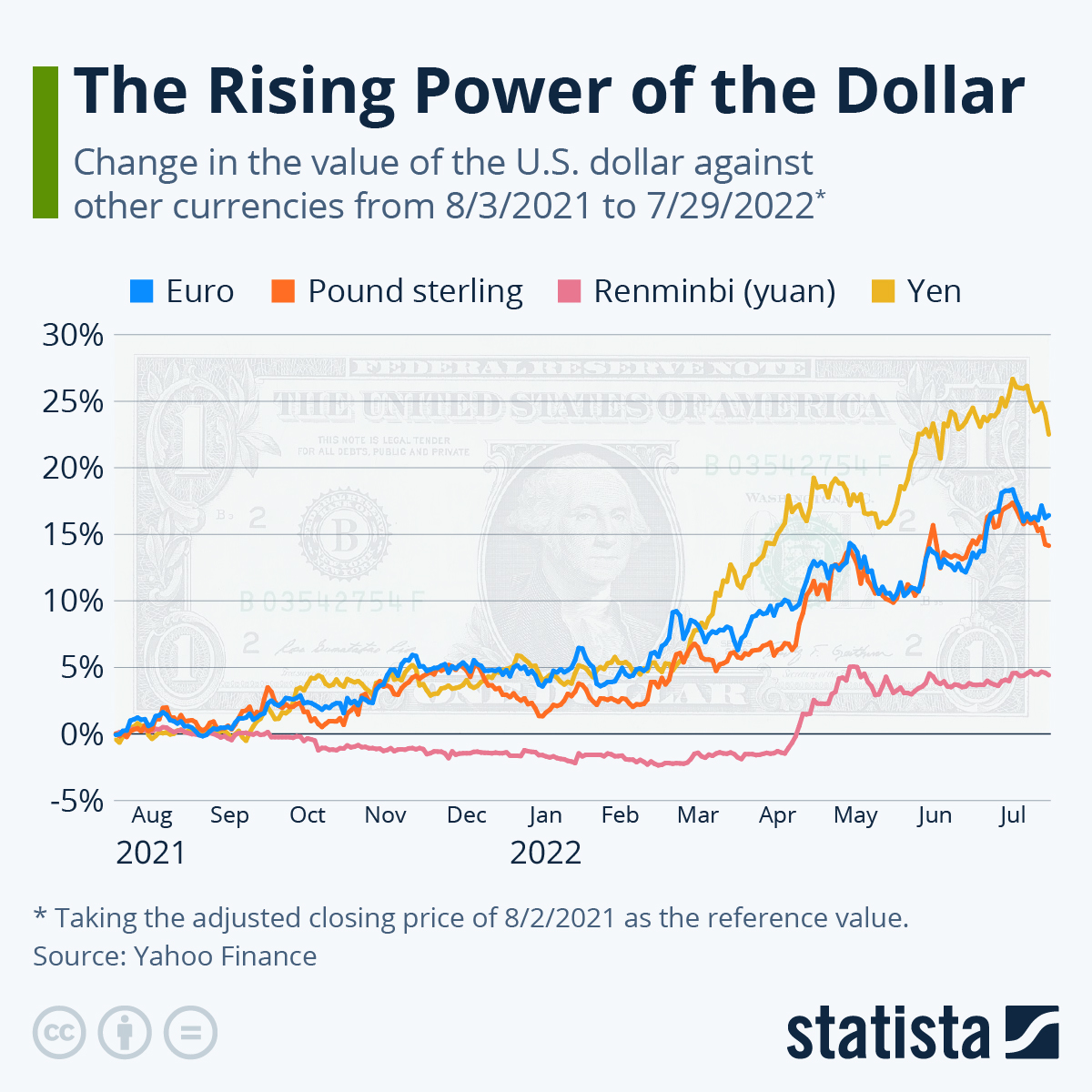

1) The “Warsh shock”: markets repriced rates, the dollar jumped, metals got hit

The biggest narrative trigger across competitor coverage is consistent: Donald Trump’s pick of Kevin Warsh as the next Fed chair candidate (seen as hawkish) changed expectations around rate cuts.

Higher expected rates → higher real yields + stronger USD → bad for non-yielding assets like gold/silver, especially when they’re already stretched.

2) CME margin hike: the “forced selling” accelerator

One of the most practical reasons silver crashed harder than expected: higher margin requirements.

When exchanges raise margins, leveraged traders must deposit more collateral fast – or cut positions. That selling pressure itself pushes prices down further.

“CME… increased margins for silver futures… from 11% to 15% (non-heightened risk profile).” – IndexBox

Why this matters to Indian investors: even if you never trade COMEX, global futures impact international spot, which impacts MCX, which flows into retail/digital prices in India.

3) Profit booking after a vertical rally (the “gravity” part)

Silver didn’t crash in a vacuum – it crashed after an explosive, near-parabolic rally.

When an asset moves up too fast, the market becomes fragile:

-

long positions become overleveraged

-

buyers start waiting for dips

-

sellers become aggressive on the first sign of weakness

That’s why the first drop often becomes the biggest.

4) Stop-loss cascades: selling caused more selling

Competitors mention liquidation, but most don’t explain how it mechanically spreads.

Here’s the chain reaction:

-

Price drops sharply

-

Stops trigger (automatic sell orders)

-

That pushes price down further

-

More stops trigger

-

Margin calls appear

-

Forced selling kicks in

This is why you saw sudden “air pockets.”

5) China premium collapse (especially painful for silver)

Silver pricing isn’t just “global spot + INR.” Regional physical premiums matter.

A key driver last week was the collapse of premium in China, especially for silver – meaning physical demand pricing stopped supporting futures at elevated levels. That premium drop removed a “floor” under prices.

6) India-specific pressure: duty expectations + local demand fatigue

In India, bullion prices were also sensitive to:

-

Union Budget 2026 expectations around import duties (even rumors shift sentiment)

-

demand fatigue in jewellery/retail after extreme price spikes

Why silver fell harder than gold (and why it always does)

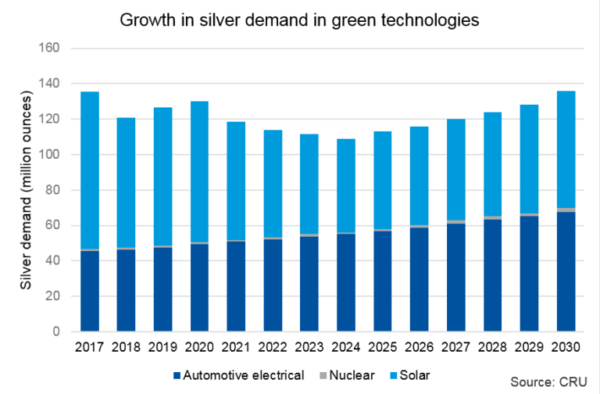

Silver is “two assets in one”:

-

monetary metal (like gold; reacts to rates, USD, fear)

-

industrial metal (reacts to manufacturing cycles, China demand, solar/EV expectations)

That dual nature makes it more volatile than gold – upside is faster, downside is sharper.

What this means for “digital silver price” in India

If you’re tracking a digital silver price (or MCX-linked price) in India, expect:

-

higher short-term volatility after a margin shock

-

wider spreads temporarily during fast markets

-

more whipsaws (sharp up-down moves) as liquidity normalizes

This is exactly why you need an investing method that reduces emotional decisions.

If you’re still deciding the right vehicle, read OroPocket’s comparison on digital silver vs silver ETF in 2026.

The content gap most articles missed: crashes are where strategy matters, not prediction

Most competitor articles stop at “reasons.” Retail investors need the next step: what to do now.

Here’s the practical framework:

If you’re a long-term investor (most Indians should be)

-

Don’t try to “catch the exact bottom.”

-

Use a micro-SIP style approach to average volatility.

-

Focus on allocation and discipline, not day-to-day price.

This guide will help you do it the right way: how to invest in silver in India.

If you’re a short-term trader

-

Respect volatility regimes after margin hikes.

-

Keep position size smaller than usual.

-

Avoid leverage traps.

Why OroPocket exists for moments like this

Silver crashes punish two types of people:

-

those who went all-in at the top

-

those who freeze and never invest again

OroPocket is built for the third type: the habit builder.

With OroPocket you can:

-

Start from ₹1 (no “minimum panic”)

-

Buy via instant UPI (under 30 seconds)

-

Earn free Bitcoin (Satoshi) cashback on every buy

-

Stay consistent through streaks + spin-to-win rewards

-

Invest with peace of mind via secure, insured vaulting + compliant partners

You’re not just buying metal. You’re building a system.

To understand charges/spreads the right way (so volatility doesn’t confuse you), read: digital silver in India: how to buy, store, and sell safely.

Final verdict: silver didn’t “die” – leverage did

Last week’s silver crash was driven by a violent unwind:

-

hawkish Fed expectations

-

USD/yields jump

-

CME margin hikes

-

cascading stops + forced liquidation

-

premium compression (China)

-

local India sentiment around duties + demand

Silver remains structurally relevant – but your approach has to match its volatility.

Stop watching. Start growing.

Download OroPocket, start with ₹1, and get free Bitcoin rewards while you build a real asset habit – day by day.