Union Budget 2026 Key Takeaways and its impact on the market

Union Budget 2026: Key Takeaways (and What It’s Doing to Markets Right Now)

Union Budget 2026-27 is a “growth + discipline” budget: big push on infrastructure and manufacturing, tighter compliance and enforcement (especially in GST/customs), and no headline change in personal income tax slabs or capital gains rates – but multiple important tweaks that will quietly change investor behaviour.

Markets often react less to headlines and more to surprises. This year, the immediate reaction across risk assets has been cautious – stocks softened and safe-haven bias (gold) stayed relevant, especially with global uncertainty still high.

What Union Budget 2026 Actually Announced (Quick Scan)

1) Macro: Fiscal discipline + capex-led growth

The government stayed on a consolidation path while keeping capital expenditure strong.

“In line with the new fiscal prudence path of debt consolidation, the fiscal deficit in BE 2026-27 is estimated to be 4.3 percent of GDP.” – Source

“Public capex enhanced … to ₹12.2 lakh crore in FY 2026-27.” – Source

Why it matters for markets: Capex supports cyclicals (infra, cement, industrials, logistics), while fiscal discipline supports bond market confidence and keeps long-term rates more anchored.

2) Direct taxes: No slab shock, but important “rule-changes”

Key investor-facing items (as per Budget 2026 highlights):

-

Revised return timeline extended to 31 March (from 31 December), with late fees:

-

Up to ₹5 lakh income: ₹1,000

-

Above ₹5 lakh income: ₹5,000

-

-

Buyback taxation: Buyback proceeds move away from “dividend-like treatment” and are proposed to be taxed under capital gains (with additional tax for promoters).

-

STT increased on select derivatives:

-

Futures: 0.05% (from 0.02%)

-

Options premium: 0.15% (from 0.10%)

-

Options exercise: 0.15%

-

-

TCS rate rationalisation (notable consumer angle):

-

Overseas tour package: 2% (simplified)

-

Education/medical remittances above ₹10 lakh under LRS: 2%

-

-

Easier TDS process for property purchase from NRI: buyer may not need TAN; PAN-based challan route proposed.

-

Foreign asset disclosure scheme proposed for small taxpayers (one-time window; dates to be notified).

3) Indirect tax: Tightening & simplification (GST and Customs)

This budget didn’t “change GST rates loudly”, but strengthened the rails:

-

GST

-

Post-sale discount rules clarified (less invoice-linkage friction if ITC is reversed).

-

Credit/Debit note linkage tightened.

-

Refund improvements (including better export refund flow).

-

Place of supply rule for intermediary services being removed (shifts to general rule – recipient location), potentially reducing disputes for exporters.

-

-

Customs

-

Supportive measures for manufacturing inputs + digitisation and enforcement tightening.

-

Tariff rate on dutiable goods imported for personal use proposed to reduce (20% → 10%).

-

Multiple sector-specific exemptions & rationalisations (critical minerals, energy storage, aircraft parts, etc.).

-

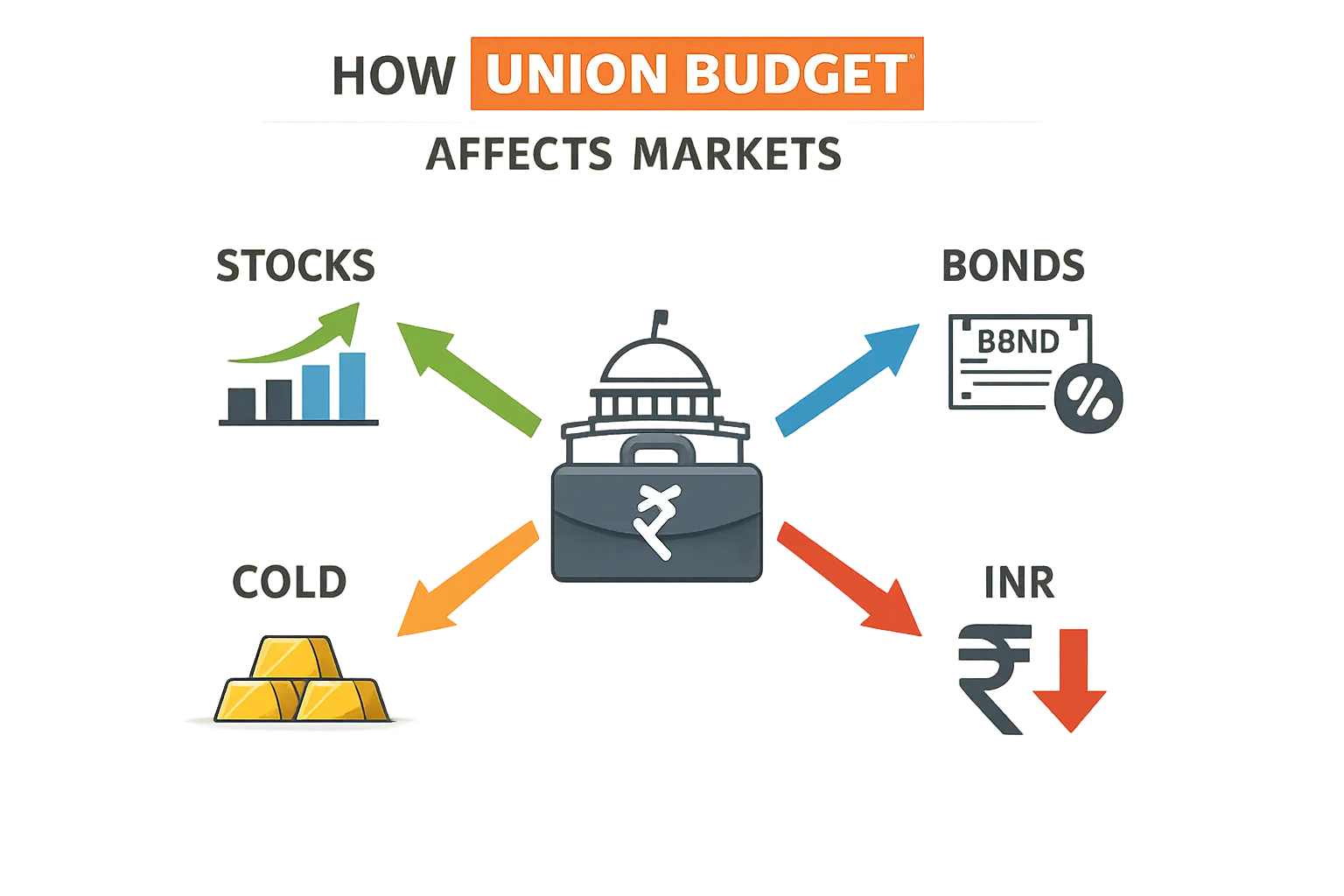

How Markets React to Budgets (So You Don’t Overtrade the Noise)

Budgets usually move markets in 3 layers:

-

Instant reaction (0–48 hours): sentiment, positioning, surprises

-

Short-term trend (2–8 weeks): sector rotation, earnings narrative

-

Real impact (6–18 months): execution of capex, demand cycle, inflation, rates

The trap retail investors fall into: buying/ selling based on Day-1 headlines.

Impact of Budget 2026 on Key Markets (What Changes, What Doesn’t)

1) Stock Market: “Execution Budget” means selective winners, not a broad rally

What supports equities

-

Higher public capex → tailwind for infra-linked themes

-

Manufacturing, logistics, supply-chain localisation focus

-

Policy direction continuity (less uncertainty)

What can pressure equities (near term)

-

Higher STT increases cost of derivatives trading (sentiment negative for high-F&O activity)

-

Compliance tightening (GST/customs) can hit low-quality operators

-

If bond yields rise globally, equity risk premium compresses (macro externality)

Actionable takeaway: Avoid trying to “budget-trade” the index. Focus on:

-

Quality businesses in capex cycle beneficiaries

-

Strong balance sheets (execution cycles reward survivors)

2) F&O / Active Trading: Costs go up (and that changes behaviour)

With STT hikes in futures and options, frequent traders feel it immediately.

What it could lead to

-

Lower retail participation at the margin

-

Slight liquidity impact in certain contracts

-

More focus on longer-horizon strategies vs hyperactive churning

Actionable takeaway: If you’re trading weekly options, your edge must be real. If it’s not – costs will eat you.

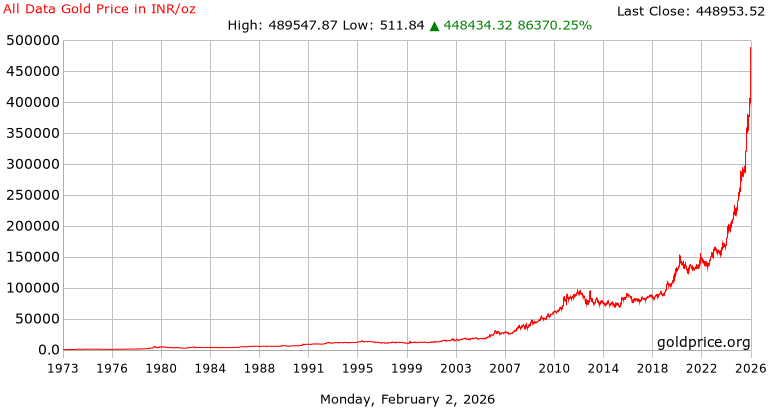

3) Gold: Still the default “fear hedge” when uncertainty is high

Budget itself doesn’t directly set gold prices, but it influences:

-

Inflation expectations

-

INR direction

-

Real yields (via fiscal stance and borrowing)

If the market reads the budget as fiscally disciplined, it can support INR stability (which can cool domestic gold price spikes). But global gold can still rise if global risk rises.

If you’re planning to buy gold as a hedge or long-term savings tool, build process – not opinions. Start with this guide on how to buy gold in India.

4) Bonds & Interest Rates: Fiscal discipline supports confidence, but watch borrowing needs

Fiscal deficit target moderation is positive for long-term credibility, but borrowing remains large in absolute terms (as it must – India is still building).

Actionable takeaway: If you’re only in savings accounts, you’re exposed to inflation. Balance across:

-

short-duration debt options (for stability)

-

gold (for hedge)

-

equities (for growth)

5) INR and Imported Inflation: Secondary effects that hit your daily life

A stable INR helps:

-

reduce imported inflation (oil, electronics, fertilisers)

-

control cost pressures for businesses

Budget’s direction (capex + consolidation) typically supports stability, but global USD strength can still dominate.

What This Means for Retail Investors (The “Do This, Not That” Playbook)

|

If you are… |

Common mistake after Budget |

Smarter move |

|---|---|---|

|

A first-time investor |

Waiting for “perfect time” |

Start a small, automatic habit (₹1–₹50/day) |

|

A salaried saver |

Staying fully in bank savings |

Add gold + equity allocation systematically |

|

A trader |

Overtrading on headlines |

Reduce churn; track costs; set strict risk limits |

|

A long-term investor |

Ignoring tax rules |

Plan for buyback taxation changes & revised return window |

If you want a clear view of taxes on precious metals (GST + capital gains logic), read taxes on gold and silver investments in India (FY 2026-27).

Where OroPocket Fits In (When Markets Are Shaky, Habits Win)

Budget weeks create noise. Smart wealth is built by systems.

With OroPocket, you can:

-

Start from ₹1 (no minimum barriers)

-

Buy real 24K gold and silver, stored in fully insured vaults

-

Pay instantly via UPI

-

Get free Bitcoin (Satoshi) cashback on every purchase – two assets for the price of one

-

Use streaks + spin-to-win + tiered rewards to stay consistent when motivation drops

-

Earn more via referrals: 100 Satoshi + free spin for both people

If you’re comparing instruments, don’t guess – use a framework. Start here: digital gold vs FD: which is better?

Final Verdict: Budget 2026 Rewards Builders, Not Guessers

Union Budget 2026 is not a “quick relief” budget for markets – it’s a structure + compliance + capex budget. Short-term volatility is normal. The opportunity is in how you respond:

Stop watching. Start growing.

Build a habit that survives every budget, every correction, every headline.

Start with ₹1 on OroPocket today – and earn Bitcoin rewards while you build your gold stack.