Digital gold price today explained: Pricing, spreads, and buy/sell quotes

Digital gold price today: the quick explainer you actually need

“India had an estimated 5–6 million active digital gold accounts by 2022, driven by young investors.” – Source

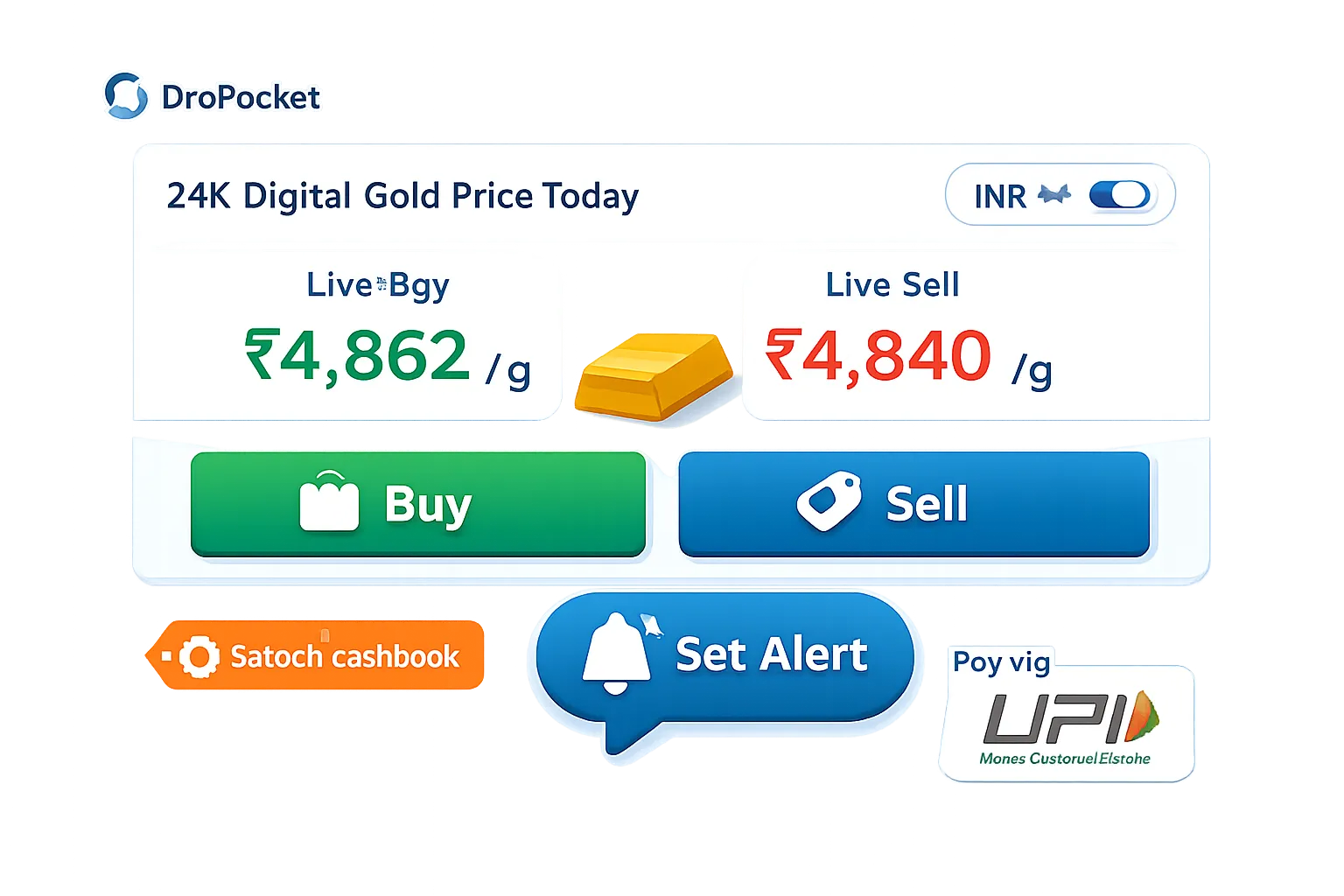

What “today’s digital gold price” means on Indian apps

-

It’s the live 24K price quoted in INR per gram, refreshed every few seconds – what you actually pay if you buy now.

-

Behind the scenes, quotes reflect:

-

Global spot (international XAU/USD benchmarks)

-

USD/INR conversion

-

Import duties and taxes embedded in the landed cost

-

A small platform spread (the service’s operating margin)

-

-

Translation: “today digital gold price” on your app is a real-time, all-in reference for 24K bullion – not a generic newspaper rate.

Why buy and sell prices differ (the spread)

-

Buy price > Sell price. That gap is normal across markets (like currency exchange).

-

The spread covers:

-

Operational costs (vaulting, insurance, audits, logistics, technology)

-

Liquidity and inventory risk (prices move every second)

-

Volatility buffers (to avoid loss when markets swing intraday)

-

-

Focus on your effective cost: compare gold buy and sell price today on the same app at the same time, not across screenshots or different platforms.

24K vs 22K context

-

Digital gold is typically 24K (~999 purity), which tracks global bullion benchmarks.

-

Jewellery quotes are mostly 22K/18K and include making charges, wastage, brand premiums, hallmarking, and GST – so they are not directly comparable to 24K digital bullion.

-

If you’re checking the digital gold selling price, compare it only against 24K bullion references, not a jewellery invoice.

City-wise vs digital rates

-

City rate boards (Mumbai, Delhi, Chennai, etc.) reflect local bullion reference prices that can include neighborhood premiums and dealer preferences.

-

Digital quotes are pan‑India conversions from global benchmarks in INR with platform-specific spreads.

-

Expect small differences between city boards and your app’s “digital gold price today” due to local premiums, timing, and FX ticks.

Key takeaway

-

Don’t chase a single “today rate.” Compare:

-

The app’s live buy and sell quotes (the spread you’ll actually face)

-

Total costs after fees, delivery/redemption options, and any rewards you earn

-

-

On OroPocket, you buy 24K digital gold in seconds via UPI – and earn free Bitcoin (Satoshis) on every purchase, plus streak and spin rewards. Those rewards lower your effective cost over time.

Ready to check a live quote and stack rewards? Download the OroPocket app: https://oropocket.com/app

How platforms derive the digital gold price in India (formula, components, and ranges)

“The LBMA Gold Price is the internationally recognized benchmark for gold pricing.” – Source

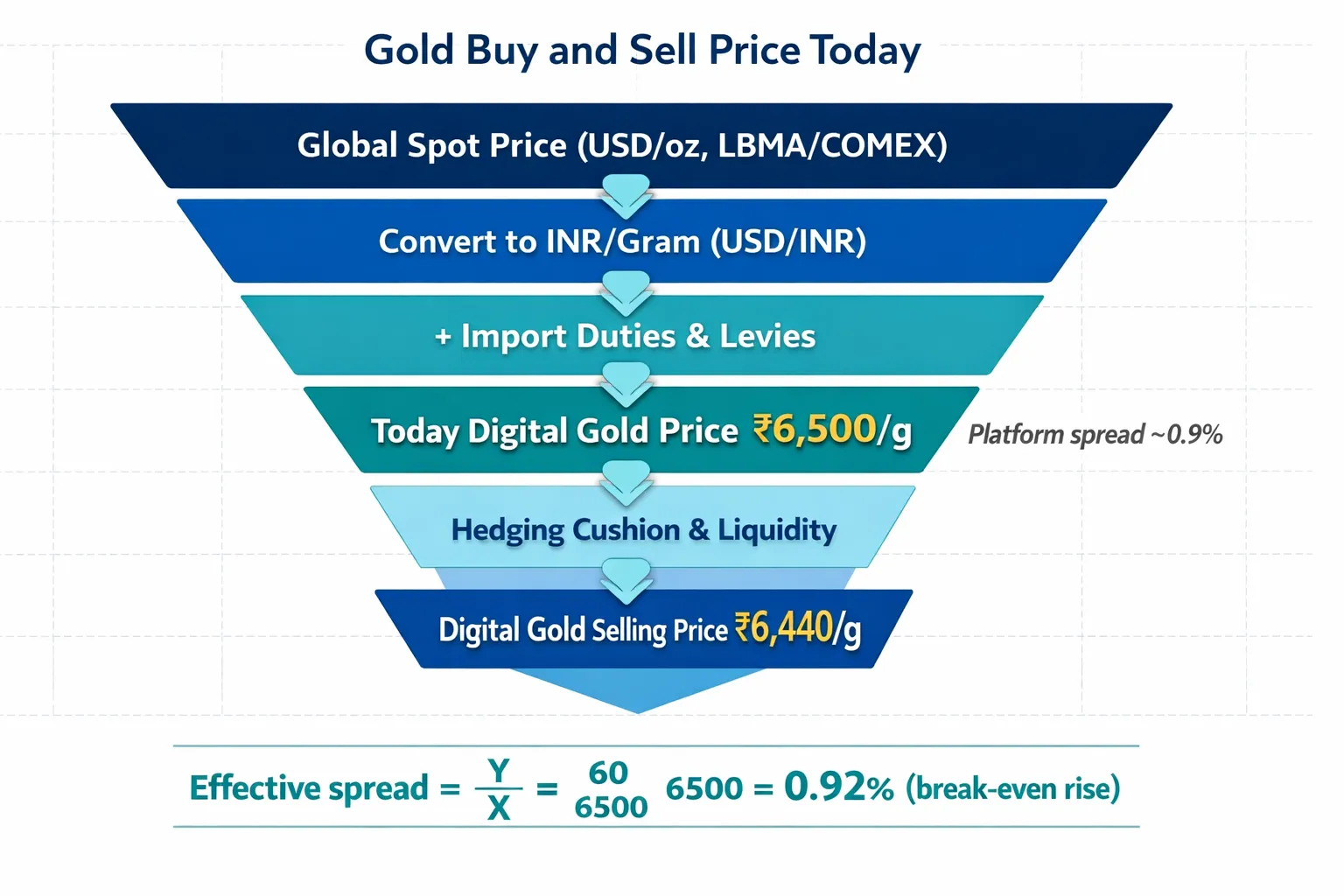

The pricing stack

-

Global benchmark: LBMA/COMEX spot in USD per troy ounce.

-

USD → INR conversion at real-time interbank rates (FX ticks drive INR quotes).

-

Import duties/levies: basic customs duty, AIDC (if applicable), social welfare surcharge; GST is applied downstream on physical delivery/jewellery invoices.

-

Platform spread: covers operations, liquidity, hedging, and volatility buffers.

Simple formula to understand

-

Indicative INR/gram = [Global USD/oz ÷ 31.1035] × [USD/INR] × [1 + landed-cost factor] ± [platform spread].

-

Where “landed-cost factor” captures import duty/levies; the “± platform spread” yields the live buy vs sell quotes you see as the digital gold price today.

What changes minute to minute

-

USD gold ticks (LBMA/COMEX).

-

USD/INR moves (FX).

-

Hedging costs and basis vs MCX.

Components of “today’s digital gold price” and typical ranges

|

Component |

What it is |

Typical impact range |

Notes |

|---|---|---|---|

|

Global benchmark |

International spot price (USD/oz) from LBMA/COMEX |

Intraday ±0.2% to ±1.5% (can be higher on volatile days) |

Primary driver; converts to INR/gram via 31.1035 and USD/INR. |

|

USD/INR |

Real-time FX rate applied to USD gold |

Intraday ±0.1% to ±1.0% |

Direct multiplier; even small FX moves shift the INR quote you see as the today digital gold price. |

|

Import duties/levies |

Basic customs duty + AIDC + SWS (policy‑dependent) |

Roughly +12% to +18% uplift to landed cost |

Actual mix changes with policy; platforms embed this into INR quotes. |

|

GST (application point) |

3% GST on physical delivery/jewellery invoice |

Applied at checkout/redemption (not to global spot) |

Digital bullion pricing shows the base; GST appears when you redeem/convert to jewellery/coins as per platform policy. |

|

Platform spread |

App’s buy vs sell margin |

~0.20% to 2.50% (product- and volume-dependent) |

Covers vaulting, insurance, audits, liquidity, and hedging; defines the gold buy and sell price today on the app. |

How OroPocket keeps quotes tight

-

Authorized bullion partners with 24K purity and fully insured vaults.

-

Real-time hedging against global and MCX signals to manage volatility and keep spreads lean.

-

Transparent live buy/sell quotes in INR with instant UPI checkout – plus Bitcoin rewards that reduce your effective cost over time.

Compare the live digital gold selling price and buy price on OroPocket now, and see your total effective cost after rewards. Download the app: https://oropocket.com/app

Buy vs sell quotes and spreads: understand the gap and your break-even

What is a spread?

-

The spread is the difference between the app’s buy quote and sell quote at the same moment.

-

Platforms need a spread to cover operations (vaulting, insurance, audits), technology, liquidity provision, and hedging risk against fast-moving markets.

Typical spread ranges

-

Digital bullion apps: tightest spreads due to electronic execution and real-time hedging.

-

Banks: moderate spreads; higher overheads and risk buffers.

-

Jewellers: widest spreads because invoices bundle making charges, wastage, brand premiums, and GST, which are not part of 24K bullion pricing.

Worked example at today’s price

-

Suppose buy = ₹6,500/g and sell = ₹6,440/g.

-

Your effective spread Y is ₹60. Spread ratio = Y/X = 60/6,500 = 0.92%.

-

Break-even: If the gold price rises by ~0.92% from your entry, you’re at parity (before any additional fees or rewards).

How OroPocket reduces effective spread

-

Bitcoin cashback on every buy (Satoshi) reduces your net cost per gram.

-

Daily streak bonuses and Spin-to-Win stack with your purchases to offset spreads.

-

Referral rewards add extra Satoshis, improving your break-even even if market prices are flat for a while.

When spreads widen

-

Around high-volatility events (US CPI, Fed decisions), during illiquid hours, or when USD/INR moves sharply.

-

Tip: In volatile windows, place smaller tranches and let streak rewards and Bitcoin cashback narrow your effective cost of ownership.

Download OroPocket and see your live buy/sell quotes with rewards applied: https://oropocket.com/app

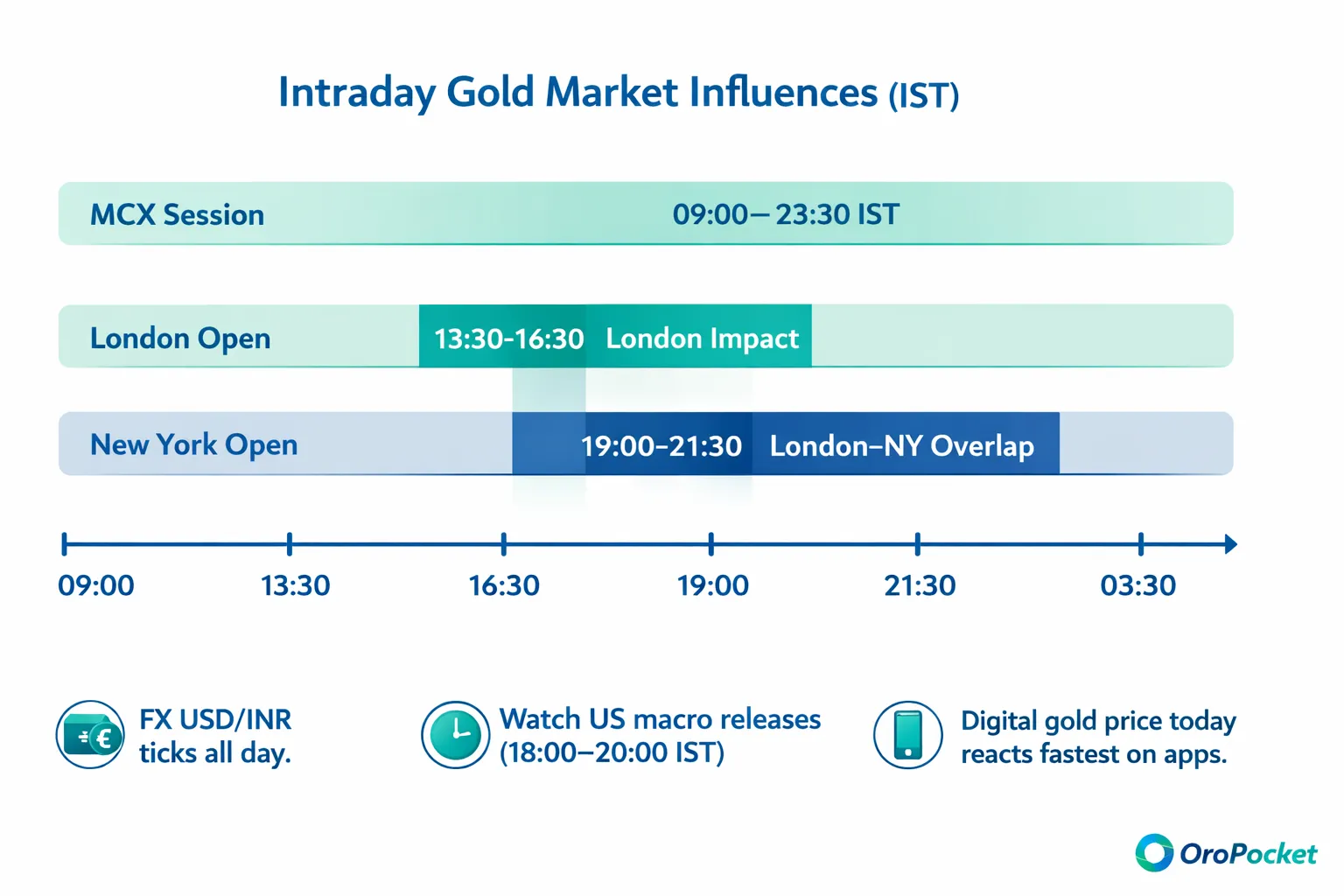

Intraday moves: what pushes today’s digital gold price up or down

“Imports made up 86% of India’s gold supply between 2016–2020, underscoring sensitivity to USD/INR.” – Source

Major drivers

-

USD gold reacts to macro data: inflation prints (US CPI/PCE), jobs (NFP), growth (GDP), and Fed commentary.

-

USD/INR fluctuations directly shift INR/gram quotes – import dependence amplifies FX impact.

-

MCX futures and local liquidity can widen/tighten basis versus global spot.

Volatility windows to watch (IST)

-

London open to early session: roughly 13:30–16:30 IST.

-

London–New York overlap: roughly 19:00–21:30 IST.

-

MCX open/close and expiry days can add noise: 09:00–23:30 IST.

Practical playbook

-

Set price alerts on OroPocket; avoid chasing sudden spikes.

-

Buy in tranches across the day or week to average in during volatility.

-

Use rewards to offset timing risk: Satoshi cashback, streak bonuses, and daily spins lower your effective entry.

Why city boards may lag

-

Aggregators and apps refresh close to real time.

-

Some storefront rate boards update less frequently, so their “today’s gold price” can trail rapid changes in global spot or USD/INR ticks.

Comparing products and platforms: spreads, fees, and liquidity you actually face

Product types

-

Digital gold (24K, professionally vaulted and insured): Best for micro-investing, instant buy/sell, and transparent 24K quotes.

-

Coins/bars: Physical delivery; premiums vary by brand, size, and purity. Liquidity depends on local dealers’ buy-back policies.

-

Jewellery: Primarily 22K/18K with making charges, wastage, and brand mark-ups. Not directly comparable to 24K digital bullion pricing.

Platform/provider types

-

Specialist bullion apps: Pan-India 24K live quotes with tight spreads and instant INR liquidity.

-

Banks: Branded coins/bars and deposit-like products; typically higher margin structures.

-

Large jewellers/marketplaces: Strong retail presence; spreads widen due to making and brand premiums.

What truly matters

-

Effective buy/sell spread you face right now (gold buy and sell price today).

-

Fees: redemption, delivery, and any platform/handling charges.

-

Liquidity: how fast you can convert to INR or receive delivery, and at what discount.

-

Rewards/benefits: cashback or loyalty credits that lower your effective cost.

How to compare apples-to-apples

-

Use per‑gram effective cost in INR: compare today digital gold price (buy) vs digital gold selling price (sell) on the same platform.

-

Check both buy and sell quotes at the same timestamp; log the spread percentage.

-

Include all fees and delivery/redemption charges.

-

Subtract rewards/cashback to compute your net breakeven (effective spread after benefits).

Typical ranges by provider type

|

Provider Type |

Typical Buy/Sell Spread Range |

Delivery/Redemption Fees |

Liquidity Notes |

Who it suits |

|---|---|---|---|---|

|

Specialist bullion apps |

~0.30%–1.50% (tightest; varies intraday) |

Delivery/redemption fees apply if you take coins/bars; digital-to-INR is instant |

High: instant buy/sell in-app, real-time INR quotes, UPI settlement |

Daily savers, micro-investors, cost-sensitive buyers who want live 24K pricing |

|

Banks |

~1.00%–3.00% |

Branded coin/bar delivery fees; limited/no digital redemption to INR |

Medium: buy-back may be channel-specific; fewer real-time quotes |

Brand-first buyers, gift purchases, long-term holders comfortable with premiums |

|

Jewellers/marketplaces |

~2.00%–6.00%+ (includes making/brand premiums) |

Delivery, making, and customization charges; GST on invoices |

Medium to low for immediate INR: resale depends on store policy; better for exchange within same brand |

Jewellery buyers prioritizing design/brand; festival/wedding purchases |

Prefer a modern, low-friction path? On OroPocket you get live 24K quotes, instant UPI payments, and free Bitcoin (Satoshi) rewards that reduce your effective cost. Compare your spread and see your net breakeven in-app.

Download OroPocket now: https://oropocket.com/app

Taxes, duties, and the ‘fine print’: GST, TCS, and redemption costs

“GST on gold is 3% on the gold value, while jewellery making charges attract 5% GST.” – Source

GST and where it applies

-

For 24K bullion pricing you see in-app (today digital gold price), GST isn’t part of the global spot – it’s a tax applied at the point of supply.

-

Practically, GST shows up when you take physical delivery (coins/bars) or buy jewellery: 3% on the gold value, 5% on making/service components, plus GST on shipping/handling where applicable.

-

If you stay fully digital (buy/sell within the app), you avoid jewellery making charges and delivery GST; check platform policy for any taxes/fees displayed at checkout.

Import duties and levies

-

Basic Customs Duty (BCD), AIDC, and Social Welfare Surcharge (SWS) are embedded in the landed cost of bullion imported into India.

-

Apps show clean live buy/sell quotes in INR (gold buy and sell price today) that already reflect these policy-driven costs – so you compare apples-to-apples across platforms without doing the customs math yourself.

TCS thresholds and documentation

-

High-value purchases may trigger Tax Collected at Source (TCS) under prevailing Income-tax rules. Thresholds and rates can vary by policy updates.

-

Expect KYC: PAN (and often Aadhaar) for larger transactions or redemptions. Keep invoices handy for tax filing and capital gains reporting.

Redemption and delivery

-

Redeeming digital gold into coins/bars can involve minting/pick-pack fees, insured shipping, and applicable GST at delivery – these are outside the bullion quote.

-

Staying fully digital maximizes liquidity and often minimizes add-on costs versus physical delivery.

Net-net

-

Taxes (GST/TCS) and redemption/delivery fees shape your exit price. Plan for them on day one so your break-even vs the digital gold selling price is clear – and consider rewards that offset costs.

Get transparent 24K quotes, instant UPI checkout, and Bitcoin rewards that reduce your effective cost on OroPocket. Download now: https://oropocket.com/app

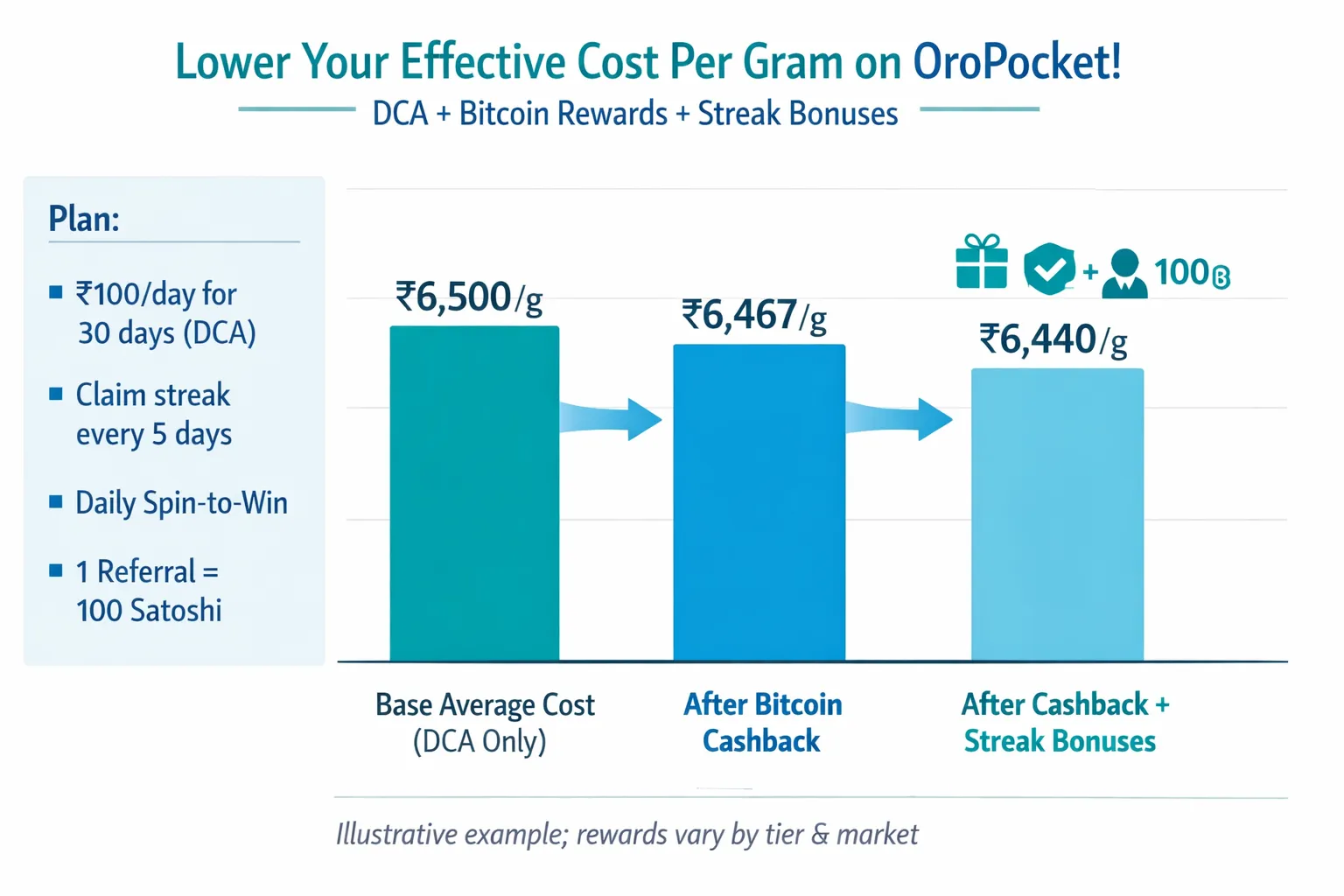

Actionable tactics to minimize impact cost on OroPocket

Start micro and build habits

-

Begin with ₹1 micro-buys. Set a daily or weekly DCA so volatility works for you instead of against you.

-

Small, consistent purchases compound – and your streak bonuses kick in every 5 days.

Time your adds

-

Prefer calmer windows outside major US data releases or Fed events.

-

If markets are jumpy, split entries into smaller tranches across the day.

Stack rewards

-

Bitcoin cashback (Satoshi) on every purchase.

-

Daily streak bonuses every 5 consecutive days.

-

Spin-to-Win for extra gold/Bitcoin rewards.

-

Refer a friend: you earn 100 Satoshi + a free spin (and they do too).

Use UPI for speed

-

Instant, seamless UPI payments reduce slippage between your decision and execution, keeping your entry price closer to the quote.

Example playbook

-

Two-week plan:

-

DCA: ₹100/day for 14 days (small tranches).

-

Maintain daily streaks to unlock bonuses on day 5 and day 10.

-

Use Spin-to-Win daily; bank the wins.

-

Refer one friend in week 2 for 100 Satoshi + free spin.

-

Net effect: your effective cost per gram trends down as rewards offset the spread.

-

Safety and purity

-

24K pure gold, 100% insured vaults, and RBI-compliant bullion partners.

-

Transparent live buy/sell quotes and instant liquidity when you need it.

Start stacking gold and Satoshis the smart way. Download OroPocket: https://oropocket.com/app

FAQs: today’s digital gold price, spreads, and buy/sell quotes

How often do quotes refresh on OroPocket?

-

Near real-time during market hours. In high-volatility windows (e.g., US data releases), spreads may adjust to reflect liquidity and hedging costs.

Why is digital gold different from jewellery quotes?

-

Digital gold is 24K (~999) bullion with no making charges and instant liquidity. Jewellery is mostly 22K/18K, includes making/wastage/brand premiums, and GST on the invoice – so it’s not directly comparable.

What affects the sell quote I see right now?

-

Global spot (LBMA/COMEX), USD/INR, platform spread, and real-time hedging. These inputs drive the digital gold selling price you see.

Is there a minimum to start?

-

Yes – ₹1 on OroPocket via UPI. No paperwork, instant buy.

Can I redeem physical gold?

-

Yes. You can redeem coins/bars where eligible. Delivery and minting/handling fees apply – check the app before confirming redemption.

Is my gold insured?

-

Yes. Your 24K gold is held with authorized bullion partners in fully insured, audited vaults.

Do I earn Bitcoin on every buy?

-

Yes. You earn Satoshi cashback on every gold/silver purchase. Rewards are tiered and stack with streaks and Spin-to-Win.

How do taxes work on exit?

-

Capital gains depend on your holding period and personal tax situation. OroPocket provides complete transaction history; consult a tax advisor for filings.

Why do buy and sell prices differ?

-

The spread covers operations (vaulting, insurance, audits), liquidity, and hedging against market volatility. Focus on the gold buy and sell price today on the same app at the same time to judge your effective spread.

Why do some city boards show a different rate than my app?

-

City boards are local references and may update less frequently. Apps convert global benchmarks to INR in near real time, so small differences are normal.

Ready to see live quotes and earn Bitcoin rewards on every buy? Download OroPocket: https://oropocket.com/app

How to check and act on today’s price inside the OroPocket app

30-second flow

-

Open OroPocket → Tap Gold → View live buy/sell quotes (24K in INR/gram) → Enter amount (₹ or grams) → Pay via UPI → Done. Instant ownership, instant liquidity.

Pro tips

-

Toggle INR/gram vs grams/INR to avoid mental math during fast moves.

-

Set price alerts at your target levels so you don’t chase spikes.

-

Switch on SIP/DCA mode to build a habit and smooth volatility automatically.

Transparency checklist

-

Purity: 24K; check vaulting and custodian details in-app.

-

Spread: View both live buy and sell to know your effective spread.

-

Rewards: Check the Rewards tab – see Satoshi cashback earned, streak milestones, and Spin-to-Win credits.

Ready to act on the live digital gold price today? Download OroPocket: https://oropocket.com/app

Conclusion: Put idle cash to work with gold + Bitcoin rewards

Gold is your inflation shield; Bitcoin rewards are the turbo boost that lowers your effective cost. With OroPocket, you get the best of both – 24K digital gold priced off global benchmarks in INR and Satoshi cashback that stacks through streaks and spins. Check the digital gold price today, compare the gold buy and sell price today in‑app, and let rewards close the gap.

-

Gold helps you fight inflation; Bitcoin rewards sweeten your effective entry price.

-

Start with ₹1, buy in 30 seconds via UPI, and build a daily streak that actually pays.

-

Transparent buy/sell quotes, 24K purity, insured vaults, and instant liquidity.

Call to action: Download the OroPocket app and check today’s digital gold price now: https://oropocket.com/app