Coins vs Bars vs Jewellery vs Digital: Which Gold Is Best for Investment in India?

Introduction: Coins vs Bars vs Jewellery vs Digital – which gold fits your goal?

Gold is a trusted wealth protector in India. But which gold is best for investment? The format you choose directly affects costs, purity, resale value, and convenience.

Why this guide

-

We compare four formats head-to-head: Jewellery, Coins, Bars, and Digital Gold.

-

Quick answer: For pure investing, bars/coins/digital typically beat jewellery on costs and resale. For wearing, gifting, and tradition, jewellery wins.

-

Where OroPocket fits: We’re a mobile-first way to invest in 24K digital gold from just ₹1, with free Bitcoin rewards on every purchase. Perfect for small, frequent, goal-based investing with instant UPI liquidity.

Comparison at a glance (TL;DR)

|

Format |

Purity |

Typical costs/premium bands |

Liquidity |

Storage |

Best for |

|---|---|---|---|---|---|

|

Jewellery |

Usually 22K (91.6%); some 24K designs exist |

Making charges 8–25%+; wastage/melting deductions on resale |

Moderate; resale often at discount vs live rate |

Locker/home; theft risk and cost |

Wearing, gifting, tradition |

|

Coins |

Typically 24K (999/999.9) with mint certification |

Premium ~1–5% over spot; minimal making charges |

High at reputed buyers/platforms |

Compact; easier than jewellery |

Smaller ticket investing, gifting, emergency liquidity |

|

Bars |

Typically 24K (999/999.9) with serial/assay |

Premium ~0.5–2% over spot (lower for higher weights) |

High with bullion dealers; KYC/purity checks apply |

Requires safe locker; low bulk cost |

Pure investment, long-term hedge, larger amounts |

|

Digital Gold |

24K (999/999.9) backed by vaulted bullion |

Buy–sell spread ~1–3%; platform/storage terms apply; 3% GST at buy |

Very high; instant buy/sell via app at live price |

No personal storage; insured vaults |

Micro-investing, SIP-style stacking, instant liquidity and tracking |

What you’ll learn

-

Exact cost stacks: making charges, spreads, GST, and storage

-

Purity and verification: BIS hallmarking, 24K vs 22K realities

-

Liquidity and resale deductions; how counterparty risk differs

-

Taxes that apply – and which type of gold investment is best for different goals

How to evaluate any gold format (framework)

Use this simple, apples-to-apples framework to decide which type of gold investment is best for you – whether you’re eyeing jewellery, coins, bars, or digital gold.

1) Total cost of ownership

-

Upfront premiums

-

Jewellery: 8–25%+ making charges, plus wastage; 5% GST on making charges; 3% GST on gold value.

-

Coins: ~1–5% premium over spot; minimal minting premium; 3% GST on gold value.

-

Bars: ~0.5–2% premium (lower for higher weights); 3% GST on gold value.

-

Digital Gold: Buy–sell spread typically ~1–3%; 3% GST on purchase; delivery/minting charges if you take physical delivery.

-

-

Recurring costs

-

Physical (home/locker): Bank locker fees ~₹2,000–₹15,000/year; optional home insurance riders.

-

Digital: Vaulting is usually free for an initial period; thereafter ~0.5–1% p.a. custody fees may apply depending on the platform; no theft risk to you.

-

Pro tip: For pure investing, lower premiums (bars), competitive spreads (digital), and minimal recurring costs are key to maximizing long-term returns.

2) Purity and verification

-

24K (999/999.9) vs 22K (916)

-

24K (coins/bars/digital) usually fetches prices closer to spot and avoids melting loss at resale.

-

22K jewellery is great for wear but can face deductions on resale due to alloy content and workmanship.

-

-

Proofs that matter

-

Jewellery: BIS hallmark with HUID, invoice, and karat/purity stamp.

-

Coins/Bars: Assay card, serial number, refinery/mint certification (ideally LBMA-accredited).

-

Digital Gold: Vaulting confirmation, trustee/custodian arrangements, third-party audits, regular reconciliation.

-

Pro tip: Always keep invoices/certificates. Verification lowers resale friction and narrows haircuts.

3) Liquidity and resale

-

Where you can sell and the typical haircut

-

Jewellery: Local jeweller buyback; often 5–15% deduction for making/melting/testing; negotiation is common.

-

Coins/Bars: Bullion dealers or reputed stores; tighter spreads (~1–3% for coins; lower for larger bars).

-

Digital Gold: Instant platform sell-back at live price; spread disclosed upfront; proceeds can settle to your bank/UPI quickly.

-

-

Pricing dynamics

-

Real-time pricing (digital/bullion quotes) reduces haggling and uncertainty.

-

Negotiated pricing (many jewellers) can mean slower exits and wider variance.

-

Pro tip: If fast, transparent exits matter, choose formats with live pricing and standardized buyback policies.

4) Storage and security

-

Physical storage

-

Home: Convenient but higher theft risk and potential underinsurance.

-

Bank locker: Safer than home, but has recurring fees and limited access hours; insurance may require a separate policy.

-

-

Digital custody

-

Insured, professional vaults with custodian/trustee oversight; no personal storage hassle; documentation and audits reduce operational risk.

-

Pro tip: For larger holdings, weigh the ongoing locker cost and risk vs. the convenience and insurance of vaulted digital gold.

5) Counterparty/regulatory risk

-

Physical risks

-

Theft, loss, and assay disputes on resale (especially for non-hallmarked jewellery).

-

-

Digital risks

-

Platform and custody risk; mitigate by choosing providers with insured vaults, authorized bullion partners, clear T&Cs, and independent audits.

-

-

Practical mitigants

-

Stick to BIS-hallmarked jewellery with HUID.

-

Prefer LBMA-linked mints/refineries for coins/bars.

-

For digital, choose RBI-compliant, fully insured, transparently audited platforms.

-

Pro tip: Documentation is your shield – certificates, invoices, and clear platform disclosures protect your resale value.

6) Taxes

-

GST on purchase

-

Physical and Digital Gold: 3% GST on the gold value; jewellery also attracts 5% GST on making charges.

-

-

Capital gains

-

Physical/Digital Gold: If held <3 years, gains taxed as per your income slab (STCG). If held ≥3 years, taxed at 20% with indexation (LTCG).

-

-

For context vs SGB/ETF

-

SGB: 2.5% interest is taxable; capital gains on redemption at maturity are exempt (secondary market sales may attract capital gains tax).

-

ETFs/EGRs: Exchange-traded, market-linked instruments; expense ratios and evolving tax rules apply – check the latest regime before investing.

-

Bottom line: If you’re optimizing for returns, focus on all-in costs (premiums + GST + storage), purity and proof, and your exit path. This framework helps answer which gold is best for investment for your goal – wearability and tradition (jewellery) vs low-cost, high-purity investing (coins/bars/digital).

The cost math: spreads, making charges, GST and storage

|

Format |

Typical purity |

Making/minting premium |

Buy–sell spread |

GST on purchase |

Storage costs (typical) |

|---|---|---|---|---|---|

|

Jewellery |

Mostly 22K (916); some 24K designs |

8–25% making charges (+ possible wastage) |

Resale haircut often 5–15% vs live rate |

3% on gold value + 5% on making charges |

Bank locker ~₹2,000–₹15,000/year; home storage risk |

|

Coins |

24K (999/999.9) with certification |

~1–5% minting premium |

~1–3% |

3% |

Compact; optional locker cost similar to above |

|

Bars |

24K (999/999.9) with assay/serial |

~0.5–2% (lower at higher weights) |

~0.5–2% |

3% |

Locker recommended for larger values; ~₹2,000–₹15,000/year |

|

Digital Gold |

24K (999/999.9) vaulted |

None unless taking delivery (minting/delivery fees apply on conversion) |

~2–5% platform spread |

3% at buy |

Free vaulting period on many platforms; post-free ~0.5–1% p.a. custody |

“Jewellery making charges in India typically range from 8% to 25% of the gold’s value – and these charges aren’t recovered on resale, reducing returns.” – Source

Purity and verification: getting what you paid for

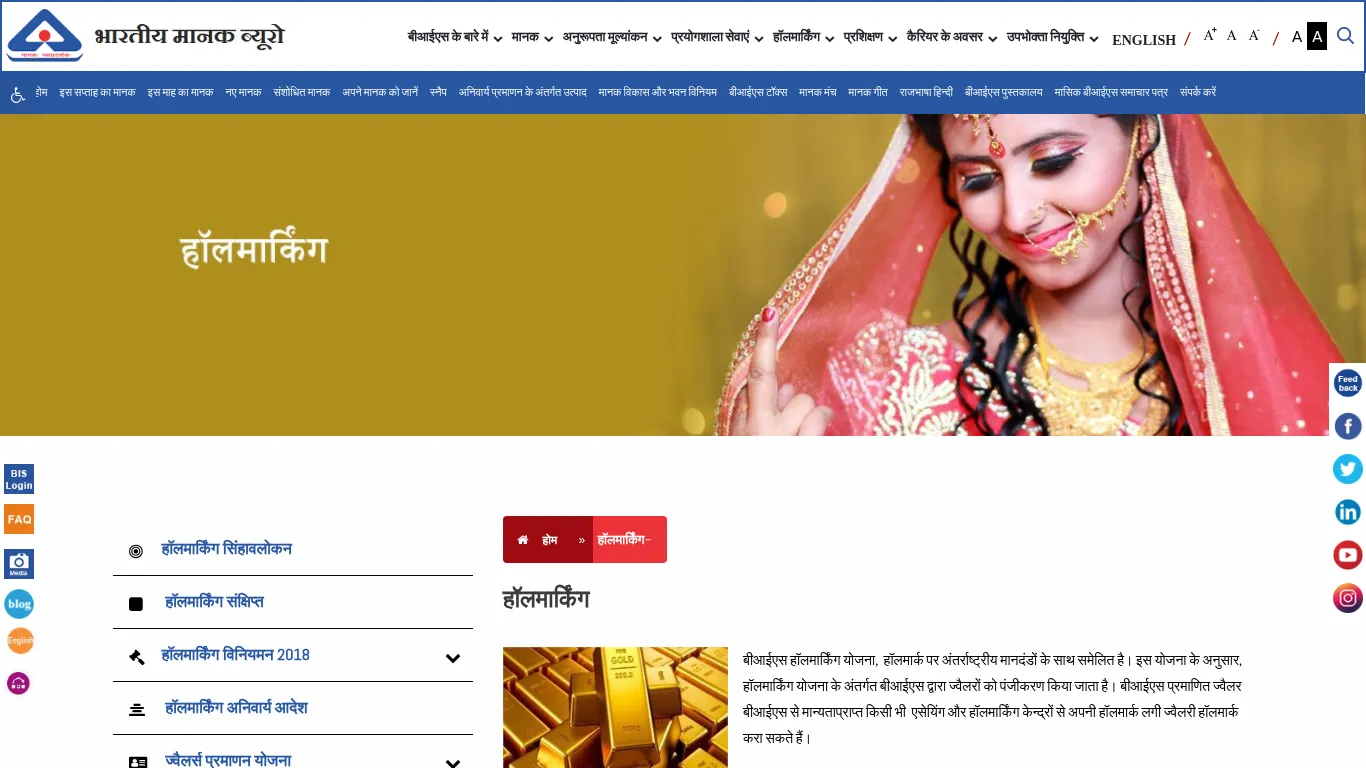

Hallmarking and HUID (jewellery)

-

BIS hallmarking with HUID is your official purity assurance. Check for: BIS logo, purity mark (e.g., 22K916/24K999), Assaying & Hallmarking Centre mark, jeweller ID, and the unique HUID on the piece and invoice.

-

22K vs 24K jewellery: 22K (916) is stronger and better for daily wear; 24K is purer but softer and less suited for intricate, wearable designs – better treated as an investment metal.

Coins/Bars

-

Aim for 24K 999/999.9 fineness from LBMA-accredited refiners/mints.

-

Prefer serialized packaging with tamper-proof assay cards and clear refinery certification for easy verification and smoother resale.

Digital Gold

-

Should be backed 1:1 by 24K physical gold held in insured, professional vaults.

-

Look for transparent custody structures (independent trustee/custodian), periodic third-party audits, and an option to redeem to physical (coins/bars) with disclosed minting/delivery fees.

Practical checks before buying

-

Insist on a proper invoice with purity, weight, and taxes clearly mentioned.

-

Understand buyback clauses and any deductions (melting/testing for jewellery; spreads for coins/bars/digital).

-

Ensure purity verification options: BIS HUID lookup for jewellery, assay/serial verification for coins/bars, and vaulting/audit confirmations for digital.

“BIS hallmarking with HUID is India’s official framework to assure and verify the purity of gold jewellery; the HUID can be checked by consumers for authenticity.” – Source

Liquidity and resale: how fast and at what haircut?

Jewellery

-

Resale realities: Most buyers pay only for melt value after purity testing. Design and making charges aren’t paid back, so haircuts feel steep. Policies vary widely by jeweller and city; negotiation is common and can delay exits.

Coins

-

Generally well-accepted by reputable jewellers and bullion dealers, especially with original bill and sealed assay card. Spreads are tighter than jewellery, and verification is faster.

Bars

-

Strongest liquidity at authorised bullion dealers. Larger bars usually get the best per-gram pricing but may have a smaller buyer pool; however, spreads tend to be tight with proper assay and serial numbers.

Digital Gold

-

Instant sell-back on the platform at live market-linked prices. Settlement can be T+0 to instant into wallet/bank depending on provider. If you prefer, you can also request delivery (fees apply).

What moves your resale

-

Documentation (invoice, HUID/assay), purity confidence, live pricing access, market timing, and disclosed spreads/fees.

“Typical buy–sell spreads in India: jewellery 5–15% at resale, coins 1–3%, bars 0.5–2%, digital platforms 2–5% (provider-dependent).” – Source

Safety, storage and counterparty risk

Physical (home/locker)

-

Theft/fire risk: Home storage is convenient but vulnerable; many home insurance policies require explicit disclosure and limits for jewellery. Fireproof safes help but aren’t foolproof.

-

Bank lockers: Lower theft risk but involve annual rent, KYC, and limited access hours. Note: locker contents are typically not automatically insured; you may need a separate all-risk policy.

-

Family access planning: Keep a secure record of locker details, nominees, and keys. Establish clear access instructions for dependents to avoid issues in emergencies.

Coins/Bars

-

Keep sealed packaging intact: Tamper-proof assay cards and serialised packaging make verification easier and protect resale value.

-

Store bills/assay cards: Retain invoices, refinery certificates, and photos. These documents reduce disputes during buyback.

-

Insure for declared value: Update your policy when you add/remove items. Use an inventory log with weights, karats, and photos stored in a secure, encrypted location.

Digital Gold

-

Platform vs custody: Your operational exposure is to the platform, but the metal is typically held in insured, professional vaults with a custodian/trustee structure. Prefer providers that segregate client assets from company assets.

-

Audits and reconciliations: Look for regular third-party audits, daily reconciliation of holdings, and transparent statements that reflect exact grams owned.

-

T&Cs checklist: Confirm who the custodian is, storage insurance coverage, free-storage duration, custody fee post free period, redemption options/fees, and dispute resolution mechanisms.

Practical safeguards

-

For physical:

-

Maintain an itemised inventory (photos, karat, weight, purchase date/value).

-

Use discreet storage and avoid predictable patterns (e.g., festival-time withdrawals).

-

Take adequate insurance cover (all-risk/jewellery floater) and keep proof of purchase.

-

-

For digital:

-

Enable 2FA, use strong PIN/biometrics, and keep your device OS updated.

-

Complete and verify KYC; keep bank/UPI details current for smooth withdrawals.

-

Prefer reputed custodians, insured vaults, independent audits, and clearly disclosed redemption and storage fee timelines.

-

Taxes and regulation: what Indian investors must know

GST

-

3% GST applies on the purchase of gold across retail formats (jewellery, coins, bars, digital).

-

Jewellery also attracts 5% GST on making charges.

Capital gains

-

STCG: If sold within 3 years, gains are taxed as per your income slab.

-

LTCG: For holdings over 3 years, recent rules provide a 12.5% rate without indexation, with an option for resident individuals/HUFs to choose 20% with indexation if it leads to lower tax outgo. Calculate both and choose the lower liability.

“From 23 July 2024, LTCG on gold is taxed at 12.5% without indexation; resident individuals/HUFs can instead apply 20% with indexation if it results in a lower tax liability.” – Source

Regulation snapshot

-

Jewellery: Governed by BIS hallmarking (with HUID) and general consumer protection laws.

-

Coins/Bars: Follow standard trade norms; buy from authorised dealers with assay/serial documentation.

-

Digital Gold: Not under SEBI/RBI. Review custody setup, insurance, audits, and redemption/storage terms. If direct regulation is a priority, consider SEBI-regulated Gold ETFs or RBI/government-issued SGBs.

Alternatives for context

-

SGBs: 8-year tenor, 2.5% interest (taxable), and no capital gains tax on redemption at maturity for individuals.

-

Gold ETFs: Exchange-traded exposure with an expense ratio; units bought on the market do not attract GST at purchase.

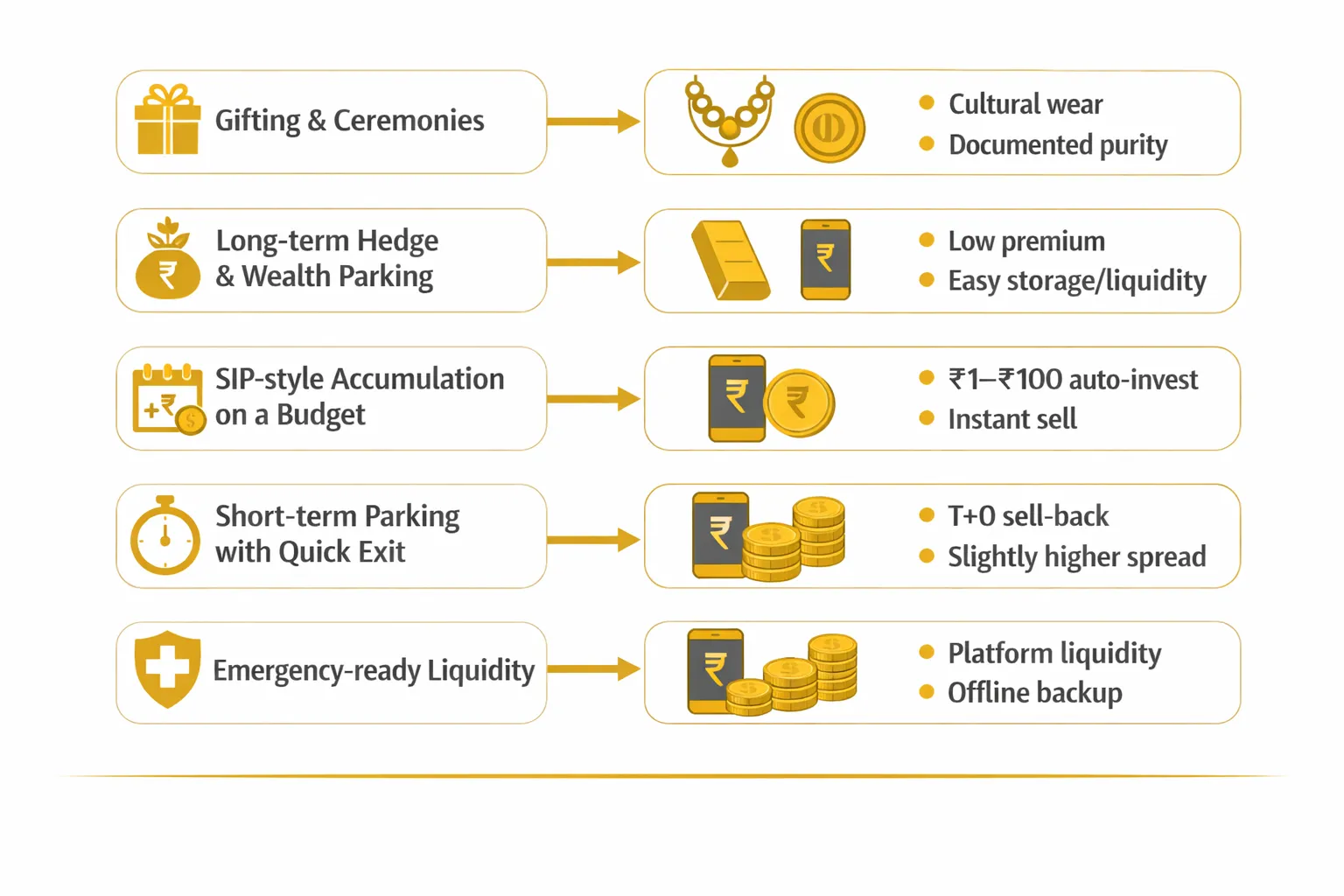

Use-case mapping: best format for your goal

Gifting and ceremonies

-

Jewellery or coins; choose 22K/18K for daily wear and durability, or a 24K coin for gifting value and purity. Keep invoices, hallmark/HUID details, and insure valuable items.

Long-term hedge and wealth parking

-

Bars (larger weights) or digital gold to minimize premiums and friction. Prefer LBMA-accredited mints and well-known custodians with insured vaults.

SIP-style accumulation on a budget

-

Digital gold with ₹1–₹100 minimums and auto-invest features. Track progress, earn rewards, and retain instant liquidity for emergencies.

Short-term parking with quick exit

-

Digital gold for live pricing and T+0 sell-back. If you prefer physical, coins are a close second – expect slightly higher spreads than bars.

Emergency-ready liquidity

-

Digital for near-instant sell; keep a small float in 24K coins as a physical backup for offline needs.

Format-by-format playbook (how to buy right and sell smart)

Jewellery (when you must buy it)

-

Best for: Wear/gifting; not optimal for returns.

-

Buy right: Insist on BIS HUID hallmark on the piece and invoice, a written making charge percentage, and a clear buyback policy.

-

Sell smart: Carry the original bill; get 2–3 resale quotes; expect deductions for melting/wastage and purity testing.

Gold Coins

-

Best for: Gifting + flexible investment.

-

Buy right: Choose 24K 999/999.9 coins with sealed assay card from a reputed, accredited mint; confirm buyback terms and applicable spreads.

-

Sell smart: Keep seals intact, preserve invoice, and compare live spreads at 2–3 dealers for better exit pricing.

Gold Bars

-

Best for: Pure investment in larger tickets; tight spreads and lowest per-gram premiums at higher weights.

-

Buy right: Opt for serial-numbered bars with assay cards from accredited refiners; inspect tamper-proof packaging; verify dealer reputation.

-

Sell smart: Approach established bullion dealers; plan liquidity for very large bars (fewer retail buyers); carry all documentation.

Digital Gold (with OroPocket context)

-

Best for: Micro-investing and instant liquidity; easy tracking and goal-based stacking.

-

Buy right: Prefer platforms with insured vaults, independent audits, and transparent buy–sell spreads and storage timelines.

-

Extra with OroPocket: Start from ₹1 via UPI, earn free Bitcoin on each gold/silver purchase, maintain daily streaks for bonuses, and gift/send gold easily in-app.

-

Sell smart: Know your free-storage period and post-free custody fee; use live price windows for fast, transparent exits or redeem to physical if needed.

Final verdict: Which gold is best for investment in India?

If returns and efficiency are the priority

-

Pick Bars (larger denominations) for the lowest per-gram spreads if you want physical exposure.

-

Pick Digital Gold for seamless, low-ticket accumulation with instant liquidity and transparent pricing.

If gifting/tradition matters more than ROI

-

Jewellery or Coins. Prefer 24K coins for value retention and 22K/18K jewellery for wear and sentiment.

Our take for most young investors

-

Build your core in Digital Gold for SIP-style stacking, daily tracking, and instant sell. Add a few 24K Coins for festive gifting, and consider a single investment-grade Bar when your corpus grows to lower long-term costs.

-

OroPocket makes starting effortless: ₹1 entry, UPI in 30 seconds, insured 24K gold, and free Bitcoin rewards on every purchase – so you get gold’s stability plus a modern rewards layer.

Next steps

-

Define your goal (gift, hedge, SIP, emergency), pick the format above, and set a monthly plan.

-

Ready to start in 30 seconds? Download the OroPocket app at https://oropocket.com/app

“Minimum ticket sizes today: many coins/bars start at 1 gram; Digital Gold minimums often range from ₹1–₹100, platform-dependent.” – Source

![10 best places to buy digital silver online in India [2026] 10 1020best20places20to20buy20digital20silver20online20in20India205B20265D cover](https://blog.oropocket.com/wp-content/uploads/2025/12/1020best20places20to20buy20digital20silver20online20in20India205B20265D-cover-300x200.webp)