How to Invest in Gold and Silver Together: A Practical Allocation Guide for India

Why invest in gold and silver together in India (2026–27): quick answer and expectations

Inflation vs savings: why idle cash loses value in India

Your savings account pays 2.5–3.5% while prices rise faster. That gap is your “real loss.” Keep too much cash idle and your purchasing power quietly shrinks every month. Metals won’t replace your equity–debt core, but adding a small, rules-based sleeve of gold and silver can hedge shocks while your long-term investments do the compounding.

“Dec 2024 CPI ~5.22% vs savings 2.5–3.5% → negative real returns for savers.” – Source

Gold hedge + silver growth: use roles, not guesses

-

Gold = shock absorber. In risk-off phases, gold often zigs when equities zag. It’s also a practical INR hedge during global stress. Think “gold hedge” at the core of your metals sleeve.

-

Silver = higher-beta torque. With industrial demand from EVs, solar, and electronics, silver can outrun gold in expansions – but it swings more.

-

Search intent answered:

-

“Should I invest in gold and silver?” Yes – together. A gold-heavy allocation with a smaller silver sleeve balances stability and upside.

-

“Which is the better investment, gold or silver?” Neither in isolation. Use both: gold for defense, silver for growth. Combine “gold silver” exposure with clear rules instead of guesses.

-

How this guide works (what you’ll learn)

-

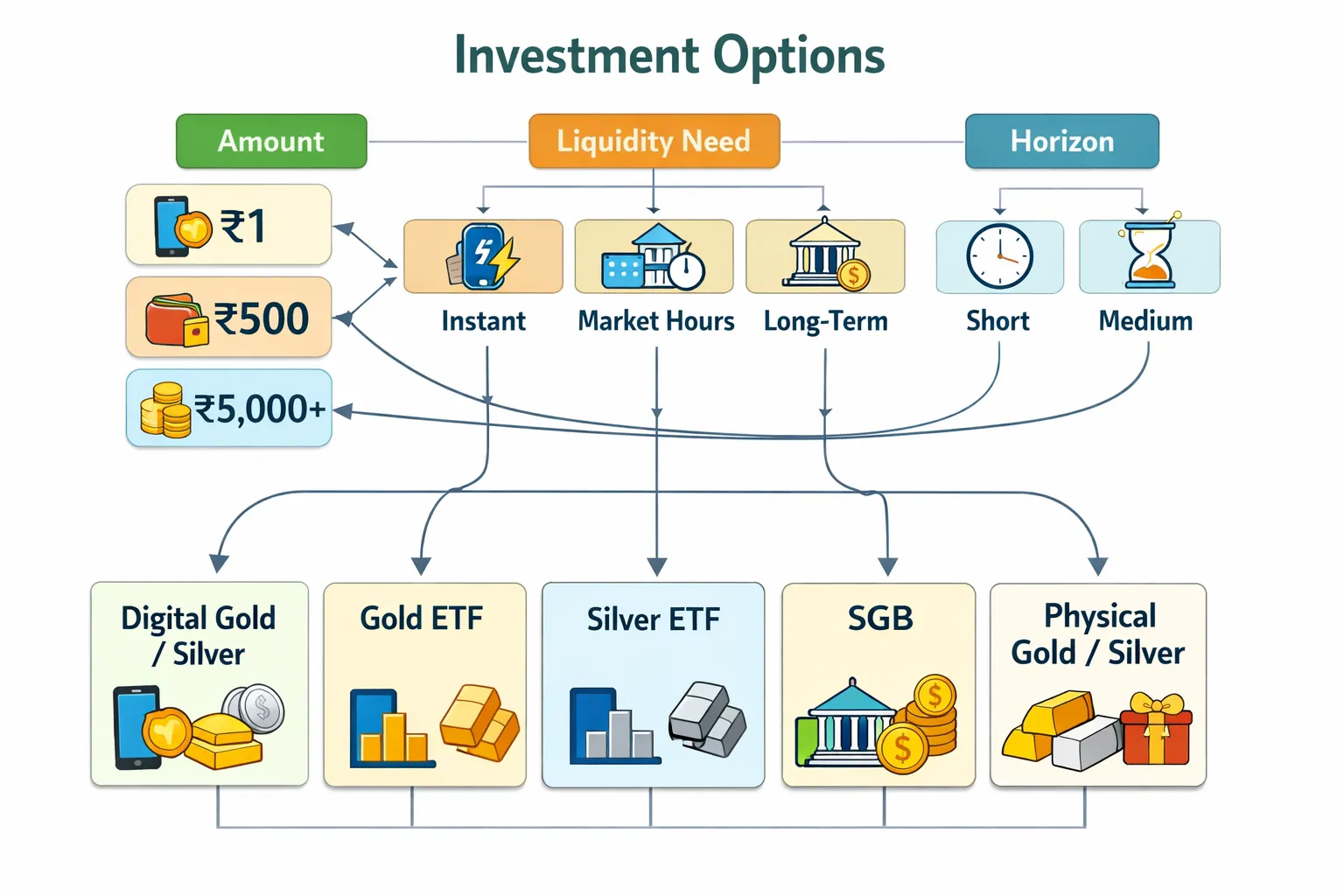

Simple allocation rules from ₹1 to ₹5,000+ per week, SIP plans that stick, and when to rebalance (annual or ±25% drift).

-

How to tilt using the Gold–Silver Ratio (GSR) smartly – add to the laggard without overtrading.

-

The best route for you – digital gold/silver, ETFs, SGBs, or physical – plus how to minimize costs and taxes.

-

Fast start on OroPocket:

-

₹1 entry via UPI, 24K insured vaulting, instant liquidity

-

Bitcoin rewards on every gold/silver purchase, daily streaks, and spin-to-win to lower effective net costs over time

-

Start now with ₹1 and build your gold–silver sleeve the modern way. Download the OroPocket app: https://oropocket.com/app

Gold vs silver: roles, correlation, and volatility (India lens)

Gold as a hedge (low correlation, INR cushion)

-

Gold tends to zig when equities zag. In market stress, it has historically reduced portfolio drawdowns and acted as a shock absorber.

-

INR cushion: during global risk-off, the rupee often weakens – gold priced in INR can offset some currency pain.

-

Practical use cases:

-

Market stress and drawdowns (protect purchasing power)

-

Currency wobble (INR weakness)

-

Inflation spikes (gold as a store of value)

-

-

Bottom line: treat gold as the core “gold hedge” within your metals sleeve, not as a trading bet.

Silver’s dual demand and higher upside/higher volatility

-

Silver has dual engines:

-

Precious metal appeal (store of value)

-

Industrial demand from solar PV, EVs, electronics, and 5G

-

-

Why silver can outrun gold: when manufacturing and clean-tech cycles expand, silver’s industrial demand can amplify upside – but swings are bigger both ways.

-

For beginners: keep silver as a smaller satellite sleeve (the “torque”), paired with a gold-heavy core.

Correlation and volatility in practice (2026–27 mindset)

-

A gold-heavy, silver-light “barbell” is beginner-friendly:

-

Gold = defensive ballast with low equity correlation and INR cushion

-

Silver = higher-beta satellite for growth cycles

-

-

Which is the better investment, gold or silver? It depends on the role. Combine both and rebalance – gold for resilience, silver for upside.

-

Keep rules simple: set your split (e.g., 70% gold / 30% silver within metals) and rebalance annually or when the split drifts ±25% from target.

“Indian portfolios historically improved risk-adjusted returns with a 7.5–15% gold allocation.” – Source

What to expect month-to-month

-

In stress: gold typically leads, helping cushion drawdowns; silver can lag or be choppy.

-

In expansions: silver often catches tailwinds from PV/EV/electronics demand; gold may trail but still steadies the portfolio.

-

Expect swings: silver’s volatility is higher. Use SIP-based averaging (weekly or monthly) to smooth entries, and let scheduled rebalancing move you toward the laggard.

Want a smoother ride with real-world rules? Start a gold‑heavy, silver‑light SIP from ₹1 via UPI – and earn free Bitcoin on every purchase. Download OroPocket: https://oropocket.com/app

Your allocation and SIP plan (₹1 to ₹5,000+): exact splits and rebalancing

Suggested within-metals splits by risk level (2026–27)

-

Conservative: 80% gold / 20% silver; metals sleeve = 5–7% of total portfolio.

-

Moderate: 70% gold / 30% silver; metals sleeve = 7–12%.

-

Aggressive: 60% gold / 40% silver (cap silver at 40%); metals sleeve = 10–15%.

SIP amounts that stick (weekly rhythm)

-

Start anywhere from ₹1 micro-buys to ₹5,000+ per week via UPI.

-

Use a two-day cadence (Mon/Thu) to build habit and average prices.

-

Scale your weekly SIP by 10–20% after every successful 4‑week streak.

Rebalancing rules that take 5 minutes

-

Annual time-based rebalance is a solid default.

-

Threshold-based: also rebalance if the gold–silver split drifts ±25% from your target within the metals sleeve.

-

Use festival top-ups (Diwali/Dhanteras) as mini‑rebalances – direct new money to the underweight metal.

Allocation planner (copy-ready)

|

Risk Level |

Gold % |

Silver % |

Total Metals % of Portfolio |

Suggested Weekly SIP (₹) |

Rebalance Rule |

|---|---|---|---|---|---|

|

Conservative |

80% |

20% |

5–7% |

100–500 |

Annual / ±25% drift |

|

Moderate |

70% |

30% |

7–12% |

250–1,000 |

Annual / ±25% drift |

|

Aggressive |

60% |

40% |

10–15% |

500–5,000+ |

Annual / ±25% drift |

Example executions

-

If silver runs hot and breaches target by 25% or more, buy gold (the laggard) to pull weights back to plan; reverse the action if gold outruns.

-

Keep the total metals sleeve aligned with your overall portfolio target (e.g., don’t let 7–12% creep to 20% without a deliberate plan change).

“PV silver demand surged from ~118.1 Moz (2022) to ~193.5 Moz (2023), with a further ~20% rise forecast for 2024 – cementing solar as a key silver driver into 2026.” – Source

Ready to automate your plan? Start a gold‑heavy, silver‑light SIP from ₹1 via UPI – and earn free Bitcoin on every purchase. Download OroPocket: https://oropocket.com/app

Tilt with the Gold–Silver Ratio (GSR): when to lean gold, when to lean silver

GSR basics in one minute

-

The Gold–Silver Ratio (GSR) = gold price ÷ silver price. It’s a quick way to gauge relative value between the two metals.

-

High GSR means gold is expensive relative to silver; low GSR means silver is expensive relative to gold. Use it to nudge new contributions without overtrading.

Simple tilt bands (keep it rules-based)

-

High GSR (e.g., 80–90+): tilt new buys a bit more toward silver – while staying within your silver cap.

-

Mid GSR (e.g., 65–80): hold your target weights and keep averaging via SIP.

-

Low GSR (e.g., <60): lean new buys back toward gold.

Guardrails and discipline

-

Never exceed your silver cap (e.g., 40% within the metals sleeve).

-

Apply tilts only on new contributions; keep rebalancing annual/±25% drift.

-

Evaluate monthly, act at set windows (e.g., first Monday of the month) to avoid tinkering.

Start with ₹1 via UPI on OroPocket (and earn free Bitcoin)

30-second setup

-

Download the OroPocket app on iOS/Android.

-

Complete quick KYC in-app.

-

Enable UPI payments for instant buys.

Buy your first gram-equivalent from ₹1

-

Tap Gold or Silver, enter any amount from ₹1, and pay via UPI.

-

Get instant vaulted custody of 24K gold/silver – 100% insured – visible in your portfolio with live tracking.

Rewards that lower effective cost

-

Bitcoin (Satoshi) cashback on every gold/silver purchase.

-

Daily streak bonuses and spin-to-win for extra gold/Bitcoin rewards.

-

Referral rewards: both you and your friend earn Satoshi when they join.

Build a habit you’ll keep

-

Set weekly micro-SIPs (₹1 to ₹5,000+) and turn on reminders.

-

Stick to two buy days (Mon/Thu) to average prices.

-

Let rewards offset spreads over time as your streaks add up.

Ready to invest the modern way? Start from ₹1 via UPI and earn free Bitcoin on every purchase. Download the OroPocket app: https://oropocket.com/app

Costs, taxes, and liquidity: minimize drag and stay liquid (India 2026)

Cost control, practically

-

Batch micro-buys into 1–2 weekly purchases to reduce spread impact.

-

Let rewards (Satoshi cashback, streak bonuses, spin-to-win) offset net spread over time.

-

Avoid impulsive, high-frequency trades; stick to your SIP and scheduled rebalancing.

Taxes (illustrative; verify latest rules)

-

Many gold/silver assets: STCG taxed at slab; LTCG often at a flat rate after a defined holding period, with indexation removed – verify current law before acting.

-

SGB specifics: interest is taxable; capital gains at maturity are exempt under the scheme. Early exits are subject to capital gains rules based on holding period.

“From 2024, long-term gains on many gold/silver holdings are taxed at a flat ~12.5% after 24 months (indexation removed); SGB interest is taxable while gains at maturity are exempt.” – Source

Liquidity and exits

-

Need instant access: use digital in-app sells for quick liquidity.

-

Need market-hour execution: choose ETFs via your broker/demat.

-

Comfortable with long hold + interest: consider SGBs, aligning to issuance and early-exit windows.

Records & hygiene

-

Save invoices and contract notes; export app transaction history at FY-end.

-

Track lots for FIFO-aware rebalancing and accurate cost-basis reporting.

-

Keep a simple log of rebalance dates, allocation targets, and tilt rules.

Ready to keep costs low and access high? Start with ₹1 via UPI and earn free Bitcoin on every purchase. Download OroPocket: https://oropocket.com/app

Which route when? Digital gold/silver vs ETFs vs SGB vs physical (choose the right tool)

What fits your goal, horizon, and liquidity

-

Digital (OroPocket): ₹1 entry, UPI-native, Bitcoin rewards, insured vaults; perfect for micro-SIPs and habit building with instant liquidity.

-

ETFs: demat + broker; market-hour liquidity; costs = expense ratio + bid–ask spread; suited to exchange execution.

-

SGB: gold-only, sovereign-backed, long tenor plus interest; best as a long-hold core.

-

Physical: cultural/usage value (gifting/jewellery); less efficient for pure investing due to making charges and storage.

Practical blends

-

Gold core via Digital/ETF/SGB; silver via Digital or a Silver ETF.

-

Keep silver as the smaller satellite; rebalance annually or on ±25% drift.

Execution shortcuts

-

Use limit orders for ETFs to manage bid–ask.

-

Schedule SIPs (weekly/monthly) to automate discipline.

-

Align SGB purchases with issuance windows; use digital or ETF for interim top-ups.

Comparison at a glance

|

Option |

Metals |

Minimums/Entry |

Liquidity |

Costs/Fees |

Rewards/Interest |

Regulation/Safety |

Best For |

|---|---|---|---|---|---|---|---|

|

Digital (OroPocket) |

Gold + Silver |

From ₹1 via UPI |

24/7 in-app buy/sell; instant partial exits |

Buy–sell spread |

Bitcoin (Satoshi) cashback; streaks; spin-to-win; referrals |

RBI-compliant partners; 100% insured vaults |

Micro-SIPs, habit building, instant liquidity |

|

Gold ETF |

Gold |

1 unit (via broker/demat) |

Market hours; exchange-driven |

Expense ratio + bid–ask; tracking error |

None |

SEBI-regulated ETF |

Regulated exchange exposure; tactical trims |

|

Silver ETF |

Silver |

1 unit (via broker/demat) |

Market hours; exchange-driven |

Expense ratio + bid–ask; tracking error |

None |

SEBI-regulated ETF |

Regulated silver sleeve to complement gold |

|

SGB |

Gold |

Small gram denominations during tranches |

Long tenor; early exit windows; exchange liquidity varies |

No storage cost; issue/redemption norms |

Semi-annual interest; maturity gains exempt |

Sovereign-backed |

Long-term gold core; low liquidity need |

|

Physical |

Gold/Silver (coins, bars, jewellery) |

Store/retailer purchase amounts |

Immediate to sellable but with friction |

Making charges; storage/security costs |

None |

Purity verification; self-storage risk |

Cultural use, gifting, ceremonial needs |

Ready to apply the best-fit route for your goals? Start from ₹1 via UPI and earn free Bitcoin on every gold/silver purchase. Download OroPocket: https://oropocket.com/app

Automation and gamification: habits that compound (OroPocket advantage)

Automate your micro-SIPs

-

Set weekly auto-buys of ₹50–₹500 (or start at ₹1) to smooth volatility.

-

UPI-native, 30 seconds to set up – no timing stress, just steady gold–silver accumulation.

Turn consistency into rewards

-

Bitcoin (Satoshi) cashback on every purchase.

-

Daily streak bonuses for 5-day runs – miss fewer days, earn more.

-

Spin-to-win once a day for surprise gold/Bitcoin rewards.

-

Referral flywheel: invite friends – both of you get 100 Satoshi + a free spin.

Social and gifting layer

-

Send gold instantly for birthdays, weddings, and festivals – no making charges, no logistics.

-

Add personal notes and watch recipients track growth in-app.

Guardrails baked in

-

Calendar reminders for your annual rebalance; nudge to review allocation.

-

Portfolio view that highlights gold/silver drift – rebalance on schedule or ±25% threshold.

-

Clear guidance to cap silver (e.g., ≤40%) so beginners don’t overexpose to volatility.

Start automating your gold–silver plan and let rewards lower your effective cost. Download OroPocket and begin with ₹1 via UPI: https://oropocket.com/app

Copy-ready India portfolios (2026–27) for different life stages

Student/first-jobber (₹500/week)

-

Metals sleeve: ~7% of portfolio; within metals 70% gold / 30% silver.

-

Example flow: ₹350 gold (Mon) + ₹150 silver (Thu) via UPI.

-

Tooling: OroPocket micro-SIPs; annual + ±25% drift rebalance; use streaks/spins to offset spread.

Salaried professional (₹5,000/month)

-

Metals sleeve: ~10%; within metals 70% gold / 30% silver.

-

Example flow: ₹3,500 gold + ₹1,500 silver monthly (or split weekly).

-

Tooling: OroPocket for daily/weekly SIPs; optional Silver ETF for exchange execution; maintain silver cap ≤40%.

Long-horizon gold accumulator

-

Metals sleeve: 8–10%; within metals 80% gold / 20% silver.

-

Example flow: Core via SGB (plan around issuance); monthly top-ups via OroPocket (e.g., ₹2,000 gold, ₹500 silver).

-

Tooling: SGB for long-hold gold; adjust silver via Silver ETF; rebalance annually or on ±25% drift.

Festival-focused gifter

-

Six festival buys per year (birthdays/Diwali/Dhanteras/weddings).

-

Use each top-up as a mini‑rebalance – direct more to the underweight metal.

-

Tooling: OroPocket “Send Gold” for instant, no‑making‑charge gifting; add notes.

Action checklist

-

Fix buy days (Mon/Thu) and set a weekly/monthly SIP.

-

Write down target splits (e.g., 70/30) and total metals sleeve (e.g., 7–12%).

-

Cap silver at 40% within the metals sleeve.

-

Set an annual rebalance date; also act on ±25% drift.

-

Use rewards (Satoshi cashback, streaks, spins) to lower effective net cost.

Start in 30 seconds with ₹1 via UPI – and earn free Bitcoin on every gold/silver purchase. Download OroPocket: https://oropocket.com/app

Conclusion: Start your gold + silver plan now with OroPocket

Bottom line

-

Gold is your hedge; silver is your torque. Combine both, keep silver smaller, and rebalance on a schedule. If you’re asking “should I invest in gold and silver?” or “which is the better investment, gold or silver,” the practical answer is both – gold for stability, silver for upside, used with a disciplined plan.

Why OroPocket

-

₹1 entry, UPI speed, 24K purity, insured vaults, RBI‑compliant partners.

-

Unique edge: free Bitcoin (Satoshi) on every gold/silver purchase – plus streaks and spin‑to‑win that reward consistency and help offset costs.

Next step (30 seconds)

-

Download the OroPocket app, set a weekly micro‑SIP, and pick your 2026–27 split (e.g., 70% gold / 30% silver).

-

Rebalance annually or on ±25% drift; use festival top‑ups as mini‑rebalances toward the underweight metal.

-

Not investment advice. Invest as per your risk profile.

Download now: https://oropocket.com/app