How to Buy and Sell Gold Online Safely: KYC, Pricing, and Instant Liquidity

Safety‑first intro: Why buy and sell gold online now (and how to keep it safe)

“Over the past five years, gold in INR has consistently outpaced India’s average CPI inflation of approximately 5.4%.” – Source

The problem most Indians face

-

Your savings account earns ~3–4%, while your rent, groceries, and travel keep getting costlier. That gap is inflation silently shrinking your money.

-

Physical gold helps, but it’s slow and expensive to manage: making charges on jewellery, locker/insurance fees, purity worries, and “who will buy back at a fair price?” headaches.

The modern solution: buy and sell gold online

-

Own 24K gold in seconds via UPI – start from ₹1, buy anytime, anywhere. No paperwork. No bank hours.

-

Get transparent, live pricing at the moment of purchase; instant allocation to your account; 100% insured vaulting; and one‑tap liquidity so you can sell online and receive funds fast.

-

With OroPocket, you can buy gold and sell online with total clarity: live buy/sell quotes, secure custody, and swift UPI settlements.

What this guide covers

-

KYC and compliance checklist so you stay safe and within rules.

-

Pricing decoded: spreads, GST, and delivery fees – no surprises.

-

Instant liquidity: step‑by‑step sell flows, UPI settlements, and smooth exit procedures.

-

Platform verification: how to check vault partners, audits, and a red‑flag detector to avoid scams.

-

Taxes: what you pay on buy/sell/redemption, simplified.

-

Habit‑building tips and why OroPocket stands out for gold buy and gold sell:

-

₹1 entry point to start today

-

Instant UPI payments and allocation

-

Free Bitcoin rewards on every gold/silver purchase for extra upside

-

Is it safe to invest in gold online? Yes – when you choose a transparent, RBI‑compliant platform with insured vaults and clear audit trails. That’s exactly how OroPocket operates. Start with ₹1 and experience secure, modern gold investing today. Download the OroPocket app: https://oropocket.com/app

How online gold works: custody, UPI settlement, and instant allocation

From tap to vault: the end‑to‑end flow

-

Choose amount (₹ or grams) at live price.

-

Pay via UPI; funds settle instantly.

-

24K gold is allocated to your name on the platform ledger.

-

Gold is fully backed by insured vaulted bullion from authorized partners.

-

Is it safe to invest in gold online? Yes – when your gold buy is 1:1 backed by insured custody with clear audit trails and redemption rights.

Buying vs selling online

-

Buy: pay the live buy price (includes the platform’s buy‑side spread + 3% GST).

-

Sell: receive funds at the live sell price (sell‑side spread). No GST on sell proceeds; capital gains may apply.

-

Tip: Always compare the live buy vs live sell to understand the spread before you buy gold and sell online.

Why UPI makes online gold seamless

-

Real‑time payments, round‑the‑clock, across banks, low friction for micro-buys (₹1+).

“UPI enables instant money transfers across banks via a single mobile app, available 24/7 throughout the year.” – Source

Where OroPocket fits in

-

iOS/Android app with ₹1 entry – perfect for first‑time gold buy.

-

Instant UPI checkout and immediate gold allocation.

-

24K gold, insured vaults, transparent live pricing for fast gold sell when you need liquidity.

-

Unique edge: Bitcoin rewards on every purchase to boost your effective value.

Ready to try it? Download OroPocket and make your first ₹1 gold buy in under a minute: https://oropocket.com/app

KYC for buying gold online: documents, timelines, and limits

“UPI processed over 20 billion transactions in August 2025.” – Source

Why KYC matters

-

Prevents identity misuse and fraud; required under PMLA/AML norms.

-

Unlocks higher limits, smooth buy/sell/redemption, and secure payouts.

-

Gives you seamless access to buy gold and sell online with confidence.

What you’ll typically submit

-

PAN for identity and tax compliance.

-

Aadhaar eKYC (OTP-based) for fast, paperless verification.

-

Live selfie (liveness check).

-

Name match across PAN/Aadhaar and your app profile.

Timelines and pro tips

-

2–5 minutes for instant eKYC in most cases.

-

Tips:

-

Use bright, even lighting for the selfie; keep your face centered and still.

-

Ensure exact name match (including initials/spaces) across documents and your profile.

-

Keep your Aadhaar-linked phone handy for OTP.

-

If Aadhaar isn’t linked to your current number, update it first to avoid delays.

-

Practical limits and flows

-

UPI transaction/day limits vary by bank/app; split large gold buy orders into multiple payments if needed.

-

Complete KYC early if you plan frequent or higher‑value buys to avoid payout or redemption friction.

-

For liquidity, your gold sell proceeds are credited to your verified account – clean KYC speeds this up.

With OroPocket

-

Streamlined eKYC inside the app; typically verified in minutes.

-

Secure, encrypted document storage; RBI‑compliant processes via authorized bullion partners.

-

Transparent limits displayed in‑app; higher limits unlocked post‑KYC.

-

Instant UPI checkout and allocation once you’re verified – making it easy, safe, and fast to buy gold and sell online.

Ready to complete KYC and start with ₹1? Download OroPocket: https://oropocket.com/app

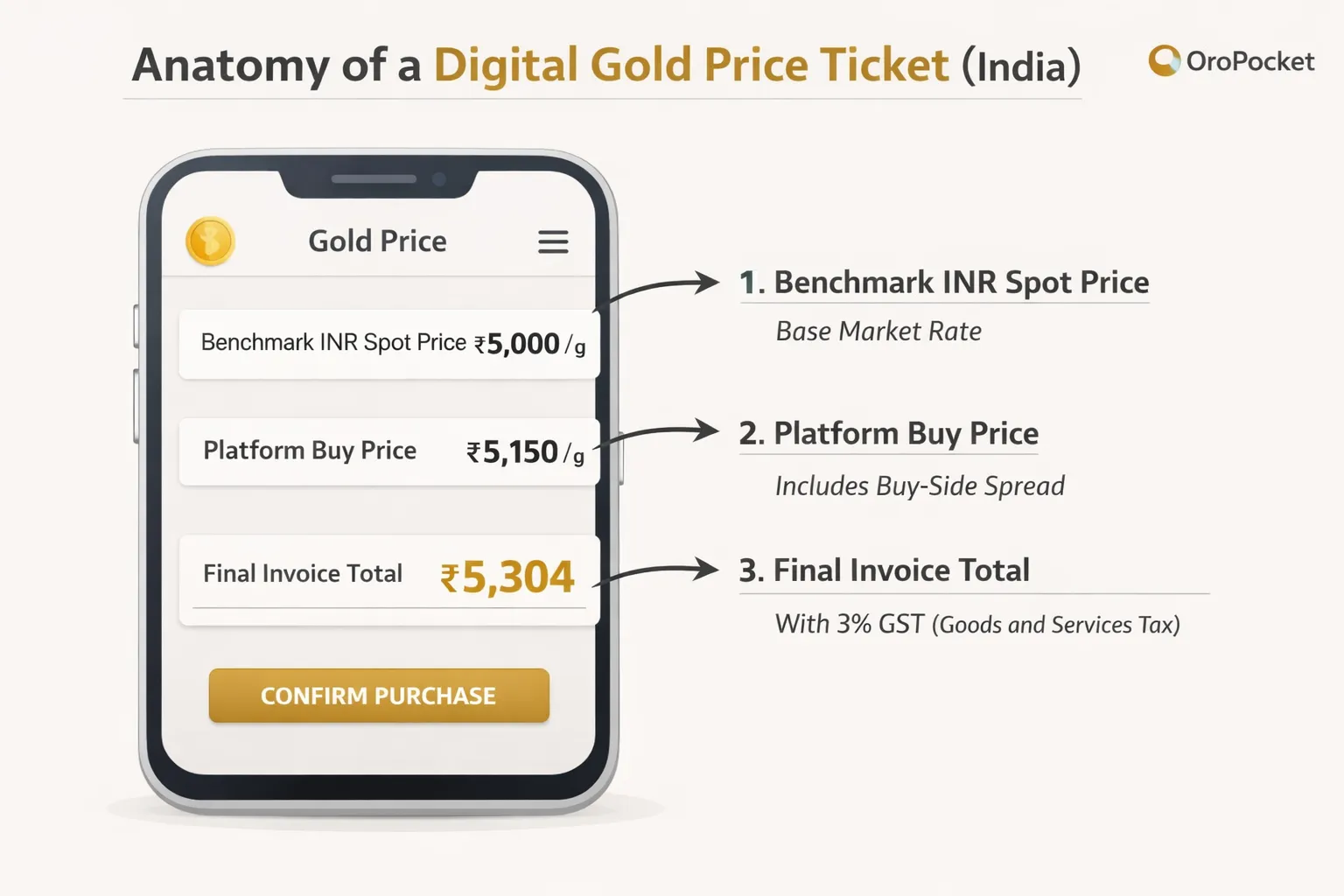

Pricing you can trust: live rates, spreads, GST, and a sample bill

The moving pieces of price

-

Benchmark spot rate in INR (derived from international spot + USD/INR + local market).

-

Platform spread: buy vs sell quotes reflect hedging, sourcing, vaulting/insurance, and operations.

-

GST at 3% on purchase value only; none on sale proceeds.

Example: what you actually pay (and how to minimize costs)

-

Sample ₹1,000 buy: you pay the live buy price for gold, then 3% GST on the taxable value; your final grams reflect the buy‑side spread.

-

Tips to reduce costs:

-

Buy during calmer markets when spreads are tighter.

-

Avoid frequent churning; sell in sensible chunks.

-

Stay digital if you don’t need coins/bars to avoid making + delivery fees.

-

Physical redemption costs (optional)

-

Making charges for coins/bars vary by weight/design (higher for small coins).

-

Secure shipping + insurance fees depend on location and order size.

OroPocket’s approach

-

Live quotes with visible spread and real‑time buy/sell rates.

-

Standard custody and insurance included; clear terms in‑app.

-

No hidden gateway fees for UPI – what you see is what you pay.

Every charge you might encounter when you buy/sell/redeem gold online

|

Charge |

Applies on (buy/sell/redeem) |

Typical range/notes |

How to minimize |

How OroPocket shows it |

|---|---|---|---|---|

|

Buy spread |

Buy |

~1–3% above benchmark; varies with volatility/liquidity |

Buy in calmer windows; compare live buy vs sell |

Live buy price displayed with effective grams |

|

Sell spread |

Sell |

~1–3% below benchmark; market-dependent |

Consolidate sells; avoid hyper‑volatile periods |

Live sell quote shown before confirmation |

|

3% GST on buy |

Buy |

Statutory 3% on purchase value |

NA (tax) |

Itemized on invoice at checkout |

|

Making charges (if redeeming) |

Redeem |

Higher for small coins; varies by weight/design |

Redeem only when needed; prefer larger denominations |

Estimated before you confirm redemption |

|

Delivery/shipping (if redeeming) |

Redeem |

Secure shipping + insurance; location-based |

Club orders; choose standard shipping |

Clear estimate shown pre‑checkout |

|

Storage/insurance (custody terms) |

Hold |

Often included for a defined period; check terms |

Stay within included period; stay digital |

Custody terms visible in‑app |

|

UPI payment fee (typically NIL) |

Buy/Sell payouts |

Usually NIL for consumers |

Use UPI for micro-buys and payouts |

No surcharge from OroPocket’s side |

Want transparent, no‑surprise pricing with instant UPI checkout? Download OroPocket and start with ₹1: https://oropocket.com/app

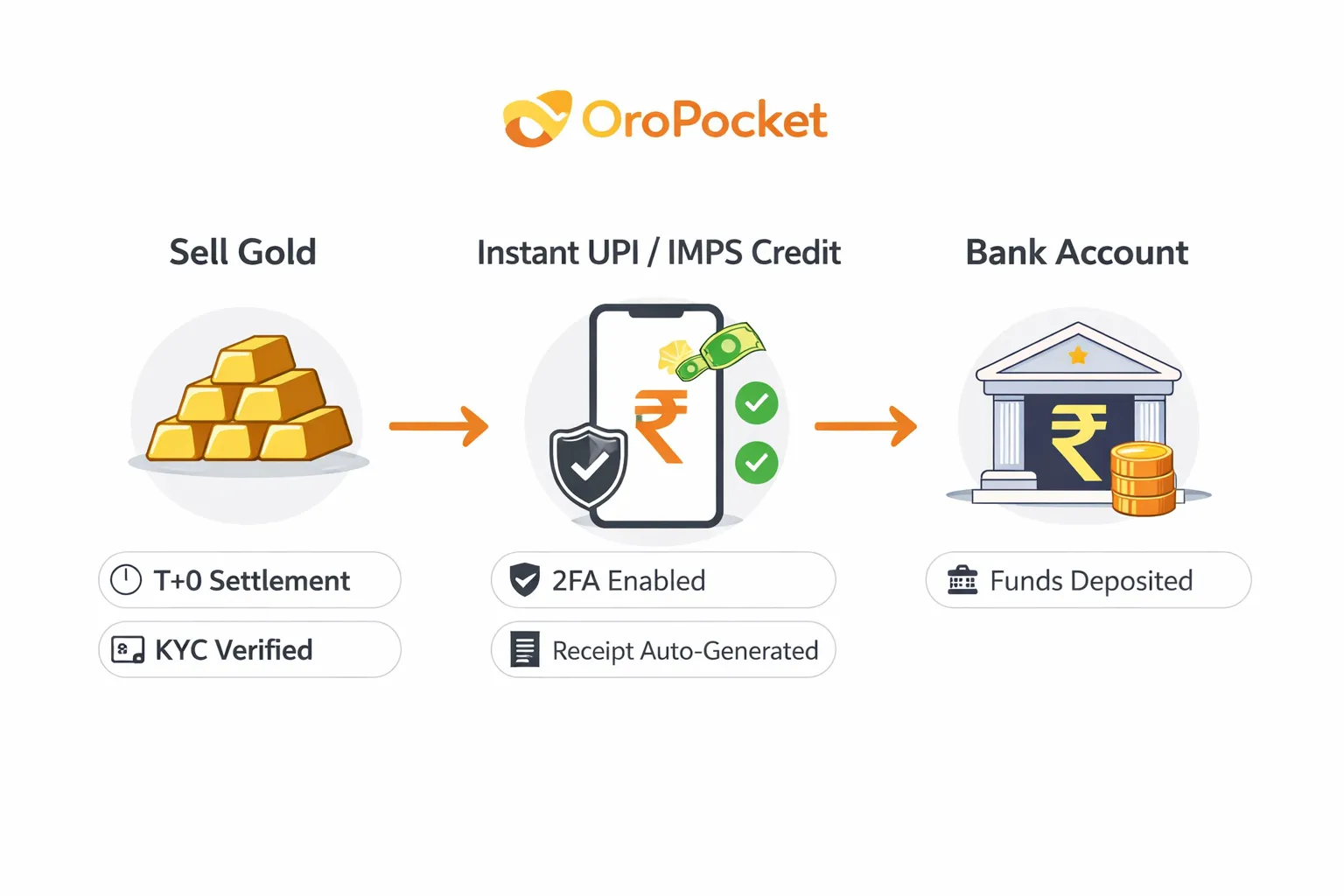

Instant liquidity: how to sell gold online and get paid fast

The sell flow (T+0)

-

Tap Sell at the live quote; confirm grams or ₹.

-

Funds are credited instantly to your linked account via UPI/IMPS (subject to partner rails/bank).

-

You receive a transaction receipt, and your portfolio updates immediately – no waiting.

Timing your exits

-

Use alerts to sell into strength; avoid panic selling during extreme volatility when spreads can widen.

-

Prefer fewer, larger sells over many micro-sells to reduce slippage, spreads, and friction.

Common questions

-

Are there sell limits? Yes – limits vary by app/bank; split a large order into smaller chunks if you hit caps.

-

Any tax on selling? No GST on sale proceeds; capital gains may apply based on holding period.

-

Can I redeem physically instead? Yes – convert to coins/bars anytime; making and secure shipping fees apply.

With OroPocket

-

Fast UPI settlement, crystal‑clear sell quotes, and instant portfolio updates – so you can move from gold to cash in minutes. Download the app: https://oropocket.com/app

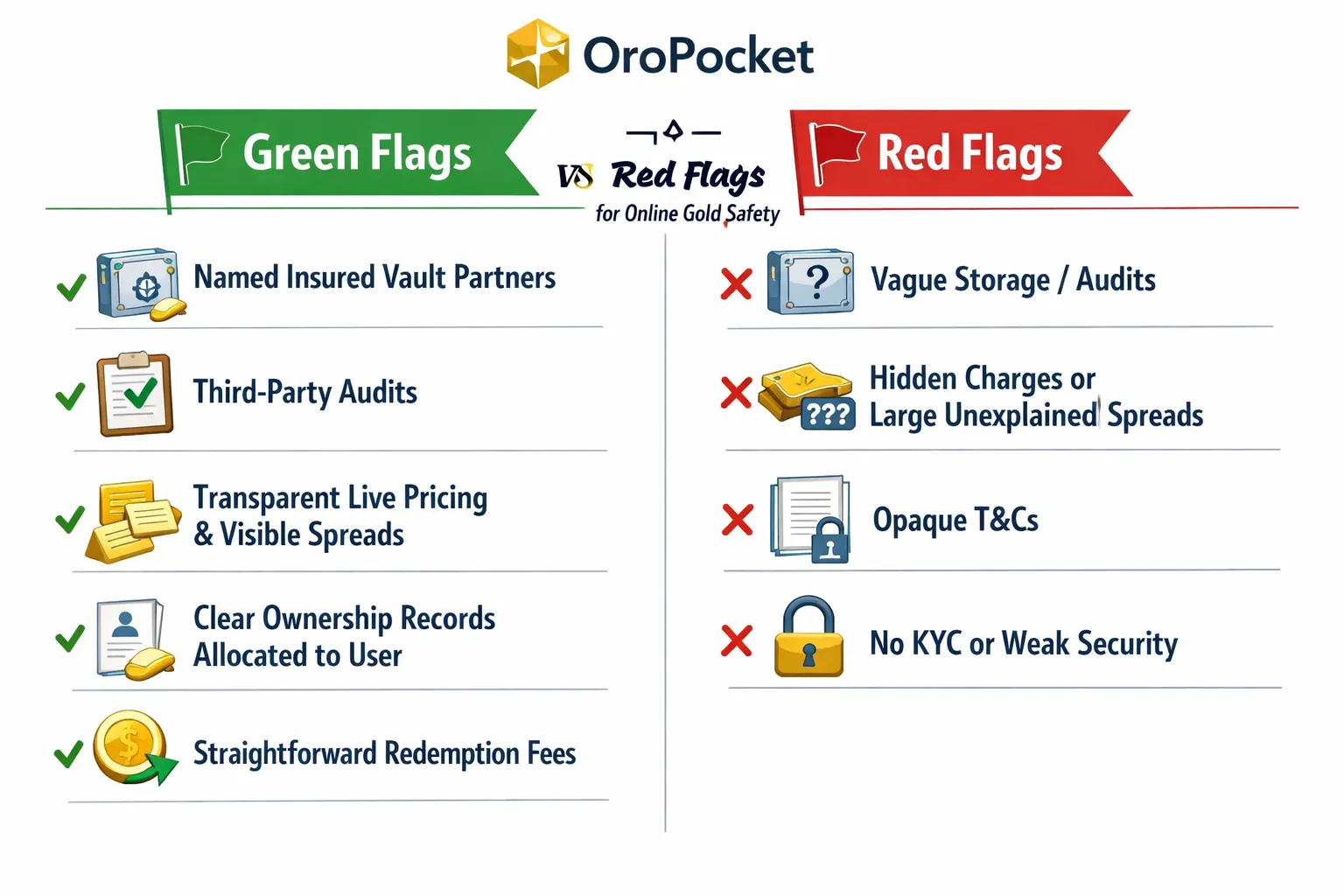

Is it safe to invest in gold online? Vaults, audits, and red flags

“The LBMA Good Delivery standard ensures accredited bars meet strict criteria for weight, purity, and appearance – underpinning trust in the global precious metals market.” – Source

What ‘safe’ really means

-

24K, 99.9x purity with serialised bars and clear custody separation from the platform’s own assets.

-

Fully insured professional vaults with periodic reconciliation and independent third‑party audits.

Green flags to look for (verify before you buy)

-

Named, insured vaulting partners and a documented audit cadence.

-

Clear ownership records (allocated to your name) with downloadable invoices/statements.

-

Transparent, live pricing with buy/sell quotes and visible spreads.

-

Straightforward redemption terms for coins/bars with all fees disclosed upfront.

Red flags to avoid

-

Vague claims about storage or audits; no credible third‑party verification.

-

Hidden charges, large unexplained spreads, or opaque T&Cs.

-

No KYC or lax security practices (weak 2FA, unclear data protection).

OroPocket’s guardrails

-

RBI‑compliant processes with authorized bullion partners, 100% insured vaults, and real‑time audit trails.

-

Transparent live pricing and downloadable statements so you can verify your holdings anytime.

-

Clear redemption terms and fees disclosed upfront – no surprises.

Taxes and records: GST, capital gains, and clean audit trails

What you pay and when

-

GST: 3% on purchases only (charged on the taxable value at checkout).

-

Capital gains:

-

Short-term (STCG): If you sell within <3 years, gains are taxed at your slab rate.

-

Long-term (LTCG): If you sell after ≥3 years, gains are taxed at 20% with indexation (cost base adjusted by the Cost Inflation Index).

-

Record-keeping that saves you headaches

-

Keep every invoice showing base gold value + 3% GST; save digital statements for all gold buy and gold sell transactions.

-

Track holding periods by lot (FIFO/LIFO as applicable to your method); note buy and sell dates clearly.

-

Maintain a simple ledger:

-

Date/time of trade

-

Amount (₹) and grams

-

Effective unit price (₹/g)

-

Applicable fees/taxes at buy

-

Transaction ID/UTR for audit trails

-

Practical tips

-

For long-term goals, aim for ≥3-year holds to avail indexation on LTCG.

-

Avoid frequent, short-term churning purely to “catch moves” – spreads and taxes can eat into returns.

-

Reconcile your app statement with bank credits/debits monthly for a clean audit trail.

-

At tax time, compile lot-wise gains, attach invoices, and export statements for your CA/filing tool.

With OroPocket

-

Downloadable invoices (with base + GST breakdown) and full statements in-app – ideal for audits and filing.

-

Clear cost basis view per lot to help estimate potential tax impact before you sell.

-

UPI settlement references and transaction IDs recorded for every buy/sell, creating a tamper-evident trail.

-

Make your first compliant, well-documented ₹1 gold buy in minutes: https://oropocket.com/app

Why OroPocket for digital gold: ₹1 entry, UPI, and free Bitcoin rewards

Core advantages you don’t get elsewhere

-

₹1 entry point with instant UPI checkout – start your gold buy habit in seconds.

-

Earn free Bitcoin (Satoshis) on every gold/silver buy – two assets for the price of one.

-

Gamified investing: daily streaks (bonus every 5 days) and spin‑to‑win for extra rewards.

-

Send/gift gold instantly to friends and family – perfect for Dhanteras, birthdays, and shagun.

-

24K pure gold in fully insured vaults; RBI‑compliant processes with authorized partners. Is it safe to invest in gold online? Yes, when custody, audits, and pricing are transparent – the OroPocket way.

Habit-building that compounds

-

Micro-buys (₹1–₹500), weekly reminders, and price alerts keep momentum without timing stress.

-

Visual streak tracker and rewards meter that nudge you toward consistency.

Transparent pricing, simple exits

-

Live buy/sell quotes with spread shown before you confirm – no surprises.

-

Instant sell liquidity to your bank via UPI/IMPS so you can gold sell at live rates and get paid fast.

OroPocket vs typical digital gold platforms (feature snapshot)

|

Feature |

OroPocket |

Typical platform |

|---|---|---|

|

₹1 entry |

✓ Start from ₹1 |

Often ₹10–₹100 minimum |

|

Instant UPI |

✓ 24×7 UPI checkout/payouts |

Yes, but speed varies by app/bank |

|

Bitcoin rewards on every buy |

✓ Satoshis on every purchase |

✗ Not offered |

|

Daily streak bonuses |

✓ Bonus every 5 days |

✗ Rarely available |

|

Spin-to-win |

✓ Daily reward spins |

✗ Not offered |

|

Referral bonus (100 Satoshi + free spin) |

✓ Both referrer and referee |

Limited/varies; cashbacks only |

|

Send/gift gold |

✓ Instant to contacts |

Varies; often limited |

|

Transparent live spread display |

✓ Buy/sell quotes shown upfront |

Live price shown; spread clarity varies |

|

Insured vaults & RBI‑compliant partners |

✓ Disclosed custody, insured vaults |

Varies; disclosures may be generic |

|

Physical redemption option |

✓ Coins/bars (fees apply) |

Yes (fees apply) |

Start stacking 24K gold the modern way. Download OroPocket and make your first ₹1 buy in under a minute: https://oropocket.com/app

UPI step‑by‑step: buy and sell on OroPocket in under a minute

Buy flow (₹1 entry)

-

Download OroPocket (iOS/Android) and create your account.

-

Complete quick eKYC (PAN, Aadhaar OTP, live selfie).

-

Tap Buy Gold; choose ₹ or grams; check the live quote (grams you’ll receive shown upfront).

-

Pay via UPI; approve in your preferred app (GPay/PhonePe/Paytm/BHIM/bank app).

-

Gold allocated instantly; portfolio updates in real time; invoice auto‑generated.

Sell flow (instant liquidity)

-

Tap Sell; choose grams/₹; review the live sell quote.

-

Confirm; funds are credited to your linked account via UPI/IMPS.

-

Statement updates; download receipt anytime.

Pro tips

-

Start with a ₹101 micro‑buy to learn the flow.

-

Set weekly reminders or use streaks to build consistency.

-

Use alerts to buy dips; avoid peak‑volatility spreads.

Ready to try it right now? Download OroPocket: https://oropocket.com/app

Conclusion: Start today with ₹1 – download OroPocket

Why wait?

-

Inflation won’t pause; small, consistent actions beat perfect timing.

-

Buy and sell gold online safely with KYC, transparent live pricing, and instant UPI liquidity. If you’re wondering “is it safe to invest in gold online?”, the answer is yes – when you choose a platform with insured vaults, audits, and clear spreads.

Your next step

-

Download OroPocket and make your first ₹1 gold buy today. Earn free Bitcoin on every purchase, keep your daily streaks alive, and build your gold stack the modern way – ₹1 entry, instant UPI, 24K purity, and one‑tap gold sell when you need cash.

Download now: https://oropocket.com/app