Invest in Gold (2026): Best Ways to Buy Gold in India + Pros, Cons & Returns

Invest in Gold (2026): Best Ways to Buy Gold in India + Pros, Cons & Returns

Gold is still India’s most trusted “sleep-well” asset – but 2026 investors want more than tradition. You want low minimums, UPI speed, clear fees, easy selling, and ideally… extra upside.

That’s exactly why modern gold investing is splitting into two camps:

-

Old-school: jewellery/coins/bars (high charges, storage risk)

-

New-school: Digital Gold, SGBs, Gold ETFs/Gold Funds (cleaner, trackable, easier to manage)

And if you’re smart, you’re not just buying gold – you’re building a hedge + growth combo: gold for stability, Bitcoin rewards for optional upside.

The 2026 Reality Check: Why “Just Saving Money” Is Not Enough

Most Indians don’t have an investing problem – they have a starting problem. Minimums, complexity, and fear keep people stuck.

Gold fixes that because it’s:

-

Simple: price goes up/down, you own an asset

-

Liquid: can be sold when needed

-

Psychologically easy: culturally accepted, widely trusted

And in 2026, the investment demand story is still strong:

“In 2025, India’s gold investment demand … bars and coins reaching 280.4 tonnes, a 17% increase from 2024.” – Source

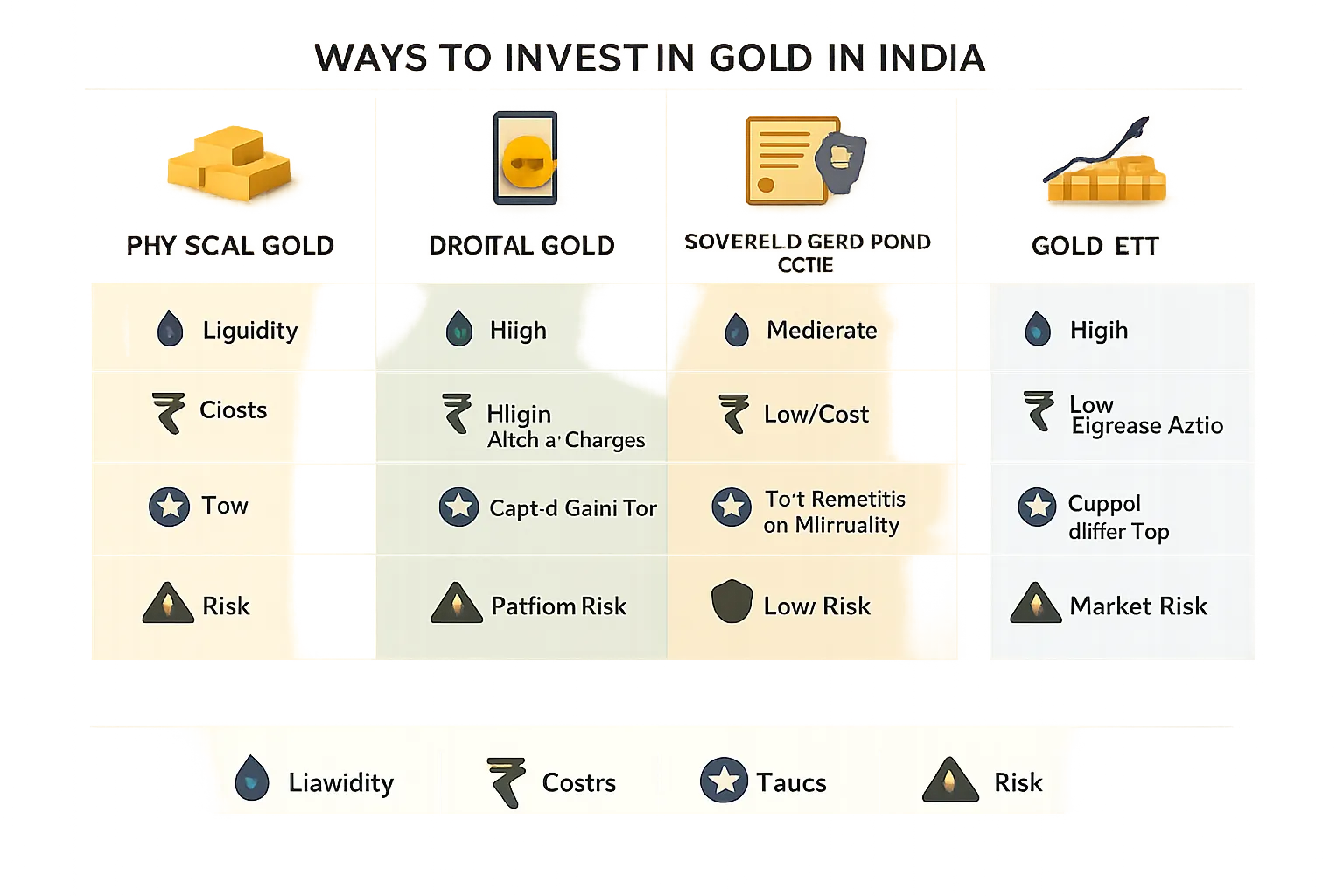

The Best Ways to Invest in Gold in India (2026)

Here are the most practical routes – ranked by what retail investors actually care about: costs, liquidity, minimum investment, and ease.

Quick Comparison Table (2026)

|

Option |

Minimum |

Best for |

Liquidity |

Key costs |

Biggest downside |

|---|---|---|---|---|---|

|

Digital Gold (OroPocket) |

₹1 |

Beginners, micro-investing, fast buy/sell |

High (app-based) |

GST + buy/sell spread |

Not as tax-optimized as SGBs at maturity |

|

Sovereign Gold Bonds (SGBs) |

~1 gram |

Long-term holders |

Medium (best if held to maturity) |

None like GST/making; interest taxed |

Lock-in + exchange prices vary |

|

Gold ETFs |

~1 unit (demat) |

Demat users, transparent pricing |

High (market hours) |

Expense ratio + brokerage |

Needs demat; tracking/bid-ask spread |

|

Gold Mutual Funds |

SIP-friendly |

SIP investors without demat |

Medium (T+ settlement) |

Expense ratio (often higher than ETF) |

Indirect (FoF) + costs stack |

|

Physical Gold (coins/jewellery) |

Varies |

Gifting, cultural use |

Medium |

Making charges + GST + storage |

Costly + resale deductions + safety risk |

Option 1: Digital Gold (Fastest & Lowest Barrier in 2026)

Digital gold is simple: you buy fractional 24K gold, stored securely in insured vaults, and you can sell anytime.

Why OroPocket is built for 2026 India (not 2016 India)

OroPocket is for people who want to start small, build a habit, and still feel rewarded.

Core advantages:

-

₹1 entry point – no more “I’ll start next month”

-

Instant UPI payments – buy in under 30 seconds

-

24K gold + insured vault storage – no locker stress

-

Free Bitcoin on every purchase – earn Satoshi cashback every time you buy gold/silver

-

Gamified investing – streaks + spin-to-win makes discipline feel effortless

-

Referral rewards – both users earn 100 Satoshi + a free spin

If you’re starting with a small amount, read: how to invest in gold with little money in India.

Who should choose Digital Gold?

Pick this if you want:

-

To start tiny (₹1–₹100/day)

-

To build a gold habit via UPI

-

To keep liquidity (sell when needed)

-

To get something extra (Bitcoin rewards) while stacking a stable asset

Stop watching. Start growing.

Option 2: Sovereign Gold Bonds (SGBs) – Best for Patient, Tax-Smart Investors

SGBs are government securities linked to gold prices, issued via RBI. You get:

-

Gold price movement exposure

-

Plus fixed interest

“The Sovereign Gold Bond (SGB) scheme … offers an annual interest rate of 2.50% on the initial investment amount.” – Source

SGB Pros

-

No storage risk

-

No making charges

-

Government-backed

-

Often best when held to maturity (tax treatment may be favorable depending on rules)

SGB Cons (what most blogs gloss over)

-

Lock-in reality: while tradable, actual liquidity can be patchy

-

Premium/discount problem: exchange price can differ from “gold rate”

-

Interest is taxable at your slab

Use SGBs as your long-horizon “set and forget” gold bucket.

Option 3: Gold ETFs – Market-Linked Gold in Your Demat

Gold ETFs track domestic gold prices and trade like shares.

Pros

-

Transparent, regulated (SEBI)

-

Intraday buy/sell during market hours

-

Easy to rebalance in a portfolio

Cons

-

You need a demat + broker

-

Total cost includes: expense ratio + brokerage + bid/ask spread

-

Small tracking error is normal

Gold ETFs suit investors who already invest in equity and want gold exposure in the same workflow.

Option 4: Gold Mutual Funds (Gold Funds/FoFs) – SIP-Friendly Without Demat

Gold mutual funds typically invest in Gold ETFs (fund-of-funds).

Pros

-

Start SIPs easily (no demat needed)

-

Convenient for long-term accumulation

Cons

-

You pay fund expenses (and sometimes the ETF layer too)

-

Settlement takes time (not instant liquidity)

If you want SIP simplicity, this route works – just watch costs.

Option 5: Physical Gold (Coins, Bars, Jewellery) – The Most Expensive “Investment Gold”

Physical gold is emotionally satisfying – but financially inefficient for most investors.

Pros

-

Useful for gifting, cultural needs

-

No platform risk (you hold it)

Cons (the real return killers)

-

Making charges (especially jewellery)

-

Storage costs / theft risk

-

Purity verification and resale deductions

-

Lower flexibility vs digital routes

If you buy physical, treat it as consumption + culture, not your primary investment engine.

The “Better Than Competitors” Section: How to Choose Based on Your Goal

Most articles compare products. Few actually help you decide.

Use this simple goal map

|

Your goal |

Best option |

Why |

|---|---|---|

|

Start investing today with ₹1–₹500 |

Digital Gold (OroPocket) |

Lowest barrier + UPI + habit-building + Bitcoin rewards |

|

Build long-term gold allocation (5–8+ years) |

SGBs |

Govt-backed + interest + best for patient investors |

|

You already use demat and rebalance actively |

Gold ETF |

Intraday, transparent, portfolio-friendly |

|

You want gold SIP without demat |

Gold Mutual Fund |

Automated SIP convenience |

|

Gifting / weddings / traditions |

Physical gold |

Cultural utility (not best returns) |

Want a deeper breakdown? Use digital gold vs gold ETFs vs sovereign gold bonds.

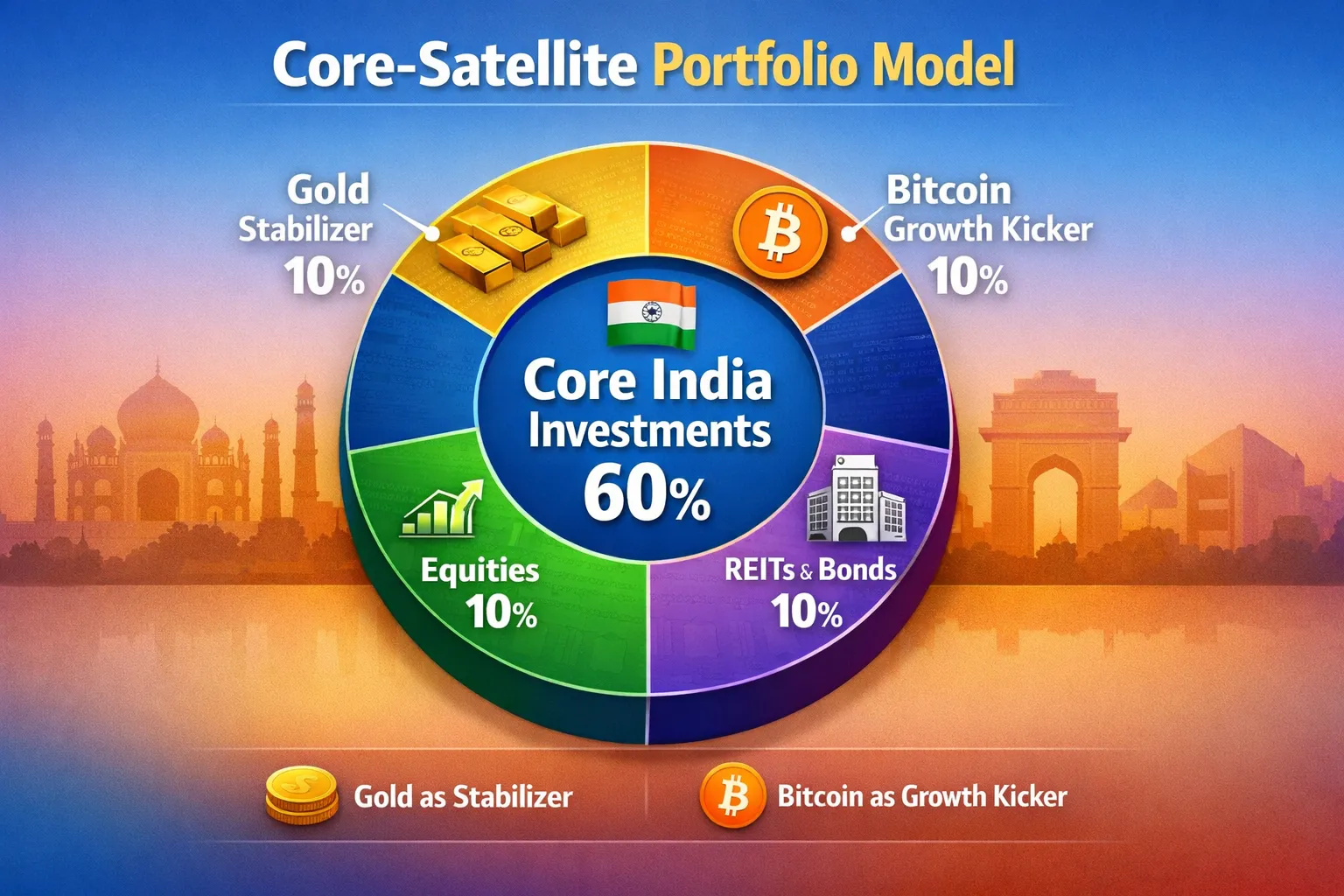

A Simple Allocation Framework (Gold That Works in Real Life)

Gold is not meant to “make you rich fast.” It’s meant to protect wealth and smooth volatility.

A practical retail framework:

-

Core (stability): Gold (Digital Gold/SGB/ETF)

-

Optional kicker (growth): Bitcoin rewards (via OroPocket) – without “trading crypto”

This is the 2026 edge: you get gold’s 5,000-year stability plus a Bitcoin upside track – two assets for the price of one action.

2026 Checklist: Avoid These Gold Investing Mistakes

Before you buy any gold, check:

-

Total cost (not just “gold rate”): spreads, making charges, expense ratios

-

Liquidity: can you sell instantly, or only during market hours, or after years?

-

Purity & custody: 24K, insured vaulting, authorized partners

-

Taxes: holding period rules vary by instrument

-

Intent: investment gold ≠ wedding jewellery

If your focus is selling convenience and real charges, read: how to sell digital gold instantly (process, charges, taxes).

Final Verdict: What’s the Best Way to Invest in Gold in 2026?

If you want the most beginner-friendly, UPI-fast, low-minimum, habit-forming gold investing path in India:

Start with Digital Gold on OroPocket.

You can begin from ₹1, stack consistently, sell when needed, and earn free Bitcoin on every purchase.

If you’re also building long-term, add SGBs when tranches/attractive prices show up. But don’t wait for the “perfect time.”

Your next move

Stop watching. Start growing.

-

Invest from ₹1

-

Pay via UPI

-

Earn Bitcoin rewards

-

Build a daily habit with streaks + spins

-

Stay protected with insured vault storage and compliant partners

Gold made simple. Wealth made fun.