Gifting Gold Digitally: How to Send Gold to Friends and Family in India

Why Gift Gold Digitally in India (2026 update)

A modern twist on a 5,000-year-old tradition

Indians have always gifted gold to mark love, respect, and new beginnings. In 2026, the same tradition happens on your phone – faster, safer, and private. No jeweller visits. No storage worries. Just purchase digital gold online in seconds and send it instantly.

Digital gold gifting is perfect for:

-

Birthdays and weddings

-

Dhanteras/Diwali and Akshaya Tritiya

-

Baby showers and graduations

-

Corporate rewards, bonuses, and milestone celebrations

“Digital gold purchases in India via UPI nearly tripled in 2025 – from INR 8 billion in January to INR 21 billion in December (≈13.5 tonnes bought).” – Source

With OroPocket, you go from thought-to-gift in under a minute. Buy 24K gold from ₹1, pay via UPI, and send gold to anyone – no friction, no minimums.

Digital vs physical at a glance (benefits the recipient actually feels)

-

Instant transfer, zero logistics: Send gold in seconds. The recipient sees it instantly in their account.

-

No storage stress: 24K pure gold is securely vaulted and 100% insured.

-

Live pricing transparency: You buy/sell at real-time market prices – no hidden making charges.

-

Easy redemption: Hold, sell anytime, or redeem into coins (where supported).

-

Start small, grow big: Small-ticket flexibility from ₹1 on a trusted digital gold buying app.

-

Private and secure: Digital records, OTP verification, and RBI-compliant partners.

-

Extra upside on OroPocket: Earn free Bitcoin (Sats) on every gold purchase – two assets for the price of one.

Who this guide is for

-

First-time gifters who want to send meaningful, inflation-beating gifts

-

Parents planning long-term value gifts for children

-

NRI relatives sending gold to family in India in minutes

-

Corporate HR/Finance teams gifting bonuses and festive rewards at scale

-

Anyone who wants to purchase digital gold online and send it safely, instantly

What you’ll learn (fast overview)

-

How digital gold gifting works end-to-end (in grams or rupees)

-

Fees, KYC, and safety standards (vaulting, insurance, compliance)

-

How to use UPI for instant transfers on a digital gold buy flow

-

Redemption choices: sell to INR, redeem to coins, or keep compounding

-

Festive and life-event use cases you can copy-paste

-

Tax rules to be aware of before you gift

-

A step-by-step OroPocket walkthrough for sending gold in under 60 seconds

Ready to gift gold the modern way? Download OroPocket now and send 24K gold from ₹1 via UPI: https://oropocket.com/app

How Digital Gold Gifting Works (mechanics, vaulting, transfers)

What is digital gold, simply explained

Digital gold lets you buy grams or a rupee-value of 24K gold online. Behind the scenes, the platform allocates the equivalent physical gold and stores it with authorized custodians in secure, fully insured vaults. You remain the beneficial owner, while the platform enables buy, sell, and gift actions with full digital records.

How gifting/transfer works end-to-end

-

Sender buys gold (or uses existing balance)

-

Tap “Send/Gift”

-

Enter recipient mobile/email

-

Pay via UPI if buying fresh

-

Recipient gets instant credit once KYC is verified

-

If the recipient isn’t on the same platform, they receive an invite/OTP-claim link to accept the gift and complete KYC

Payments and speed

-

UPI-first checkout with instant confirmations

-

Typical completion under a minute from purchase to gift credit

-

You’ll receive push/SMS/email confirmations for both purchase and transfer

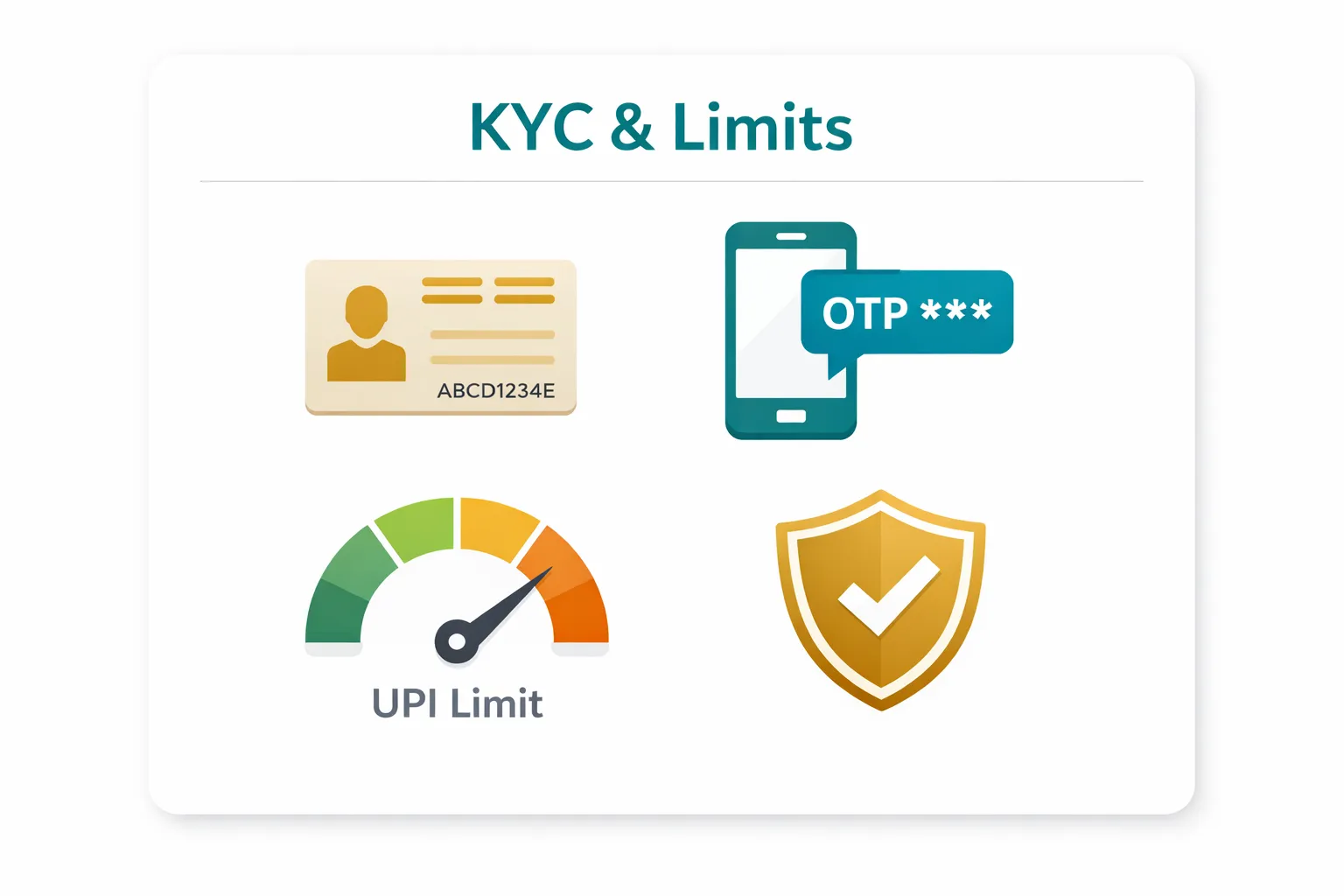

KYC basics (sender and recipient)

-

PAN and basic details are standard; some journeys add selfie/ID verification

-

Why it matters: compliance with regulations, fraud prevention, and seamless redemption/sell later

-

Tip: Encourage recipients to finish KYC upfront to avoid claim delays

Platform differences to know

-

Gifting/transfer limits per day or per month can vary

-

Claim windows for non-users (e.g., 3–14 days) before a gift auto-reverses

-

Redemption fees and pricing spreads differ by provider

-

Delivery PIN code coverage, denominations, and making/delivery charges apply for coin/bar redemption – always scan the T&Cs before gifting

“World Gold Council’s principles and leading providers like MMTC-PAMP confirm that digital gold is backed by allocated physical 24K gold stored in secure, insured vaults with regular independent audits.” – Source

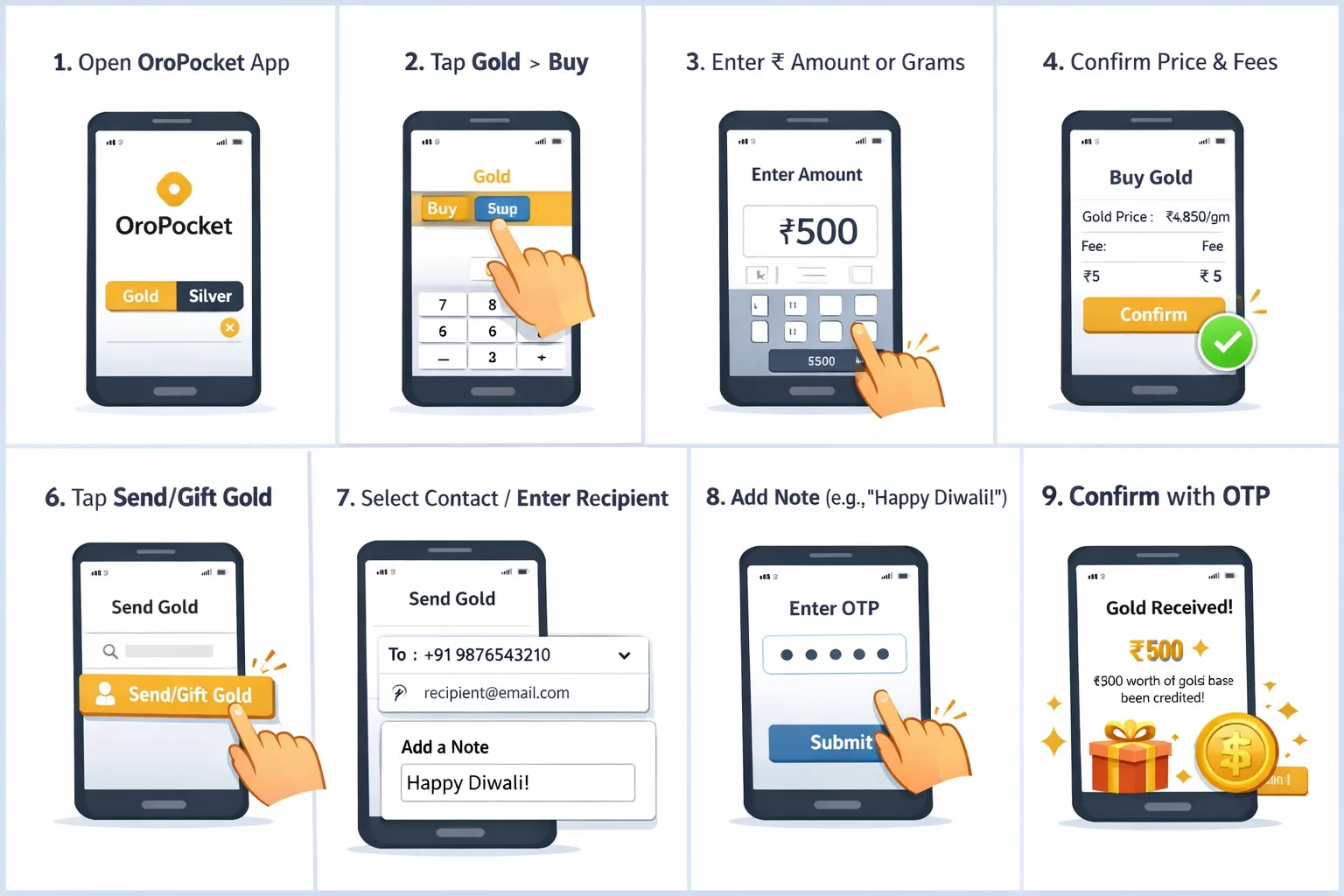

Send Gold in Minutes with OroPocket (step-by-step)

Prerequisites (takes ~2 minutes)

-

Install OroPocket (iOS/Android), complete KYC, enable UPI.

Step-by-step: purchase and gift via OroPocket

-

Open app → Gold → Buy.

-

Enter ₹ amount or grams (start from ₹1).

-

Confirm live rate and fees (transparent).

-

Pay via UPI for instant purchase.

-

Tap “Send/ Gift Gold.”

-

Select contact or enter recipient mobile/email.

-

Add note (Diwali wishes, birthday message).

-

Confirm OTP.

-

Recipient gets instant credit/notification.

-

Track transfer in your history.

What the recipient sees

-

If new to OroPocket: acceptance link to sign up and finish KYC.

-

If already on OroPocket: instant credit, balance update, and one-tap options to hold, sell to INR, or redeem coins later.

Pro tips to maximize rewards

-

Stack rewards with daily streaks and Spin-to-Win.

-

Time buys during promo tiers for higher Bitcoin (Satoshi) cashback.

-

Refer friends and earn 100 Satoshi each + a free spin – gifts pay you back.

What to Gift and When: Occasions, Suggested Amounts, and Messages

Popular gifting moments

-

Dhanteras/Diwali, Akshaya Tritiya

-

Weddings and anniversaries

-

Birthdays and baby showers

-

Housewarmings and festivals

-

Corporate milestones, bonuses, and awards

How much should you gift?

Think in simple bands based on intent:

-

Blessings (symbolic): ₹251–₹501 or 0.05–0.1 g

-

Milestones (meaningful): ₹1,100–₹5,000 or 0.2–1 g

-

Long-term start (portfolio boost): ₹11,000+ or 2 g+

-

Micro-gifts: start from ₹1 on a digital gold buying app like OroPocket for quick, thoughtful surprises

“Gold’s cumulative return in INR was approximately 85% over 2019–2024.” – Source

Make it personal

Short message templates you can copy:

-

Diwali/Dhanteras: “Shubh Dhanteras! May this 24K gold bring you Lakshmi’s blessings and growth. ✨”

-

Akshaya Tritiya: “On Akshaya Tritiya, here’s gold that never ‘expires.’ Keep compounding! 💛”

-

Wedding: “Two hearts, one future – here’s gold to start building it. 💍”

-

Anniversary: “To love that only gets richer – just like gold. 💛”

-

Birthday: “Golden year ahead! Invest in your dreams. 🎂”

-

Baby shower: “A golden start for the little one’s future. 👶”

-

Housewarming: “New home, new wealth goals – here’s 24K to kickstart. 🏠”

-

Corporate: “Thank you for your impact – this gold is our token of appreciation. 🚀”

Tone tips:

-

Add a personal touch (nickname, inside joke)

-

Keep it crisp (1–2 lines)

-

Emojis: 1–2 max to match the vibe

Pro move: pair gold with Bitcoin rewards

On OroPocket, your gold gift can also earn free Satoshi (Bitcoin cashback). Two assets for the price of one – plus daily streaks and Spin-to-Win to stack more rewards. It’s the smartest way to purchase digital gold online and give a modern, compounding gift.

Occasion planner

|

Occasion |

Suggested gift band (₹/grams) |

Message template (short) |

Reward tip |

|---|---|---|---|

|

Dhanteras/Diwali |

₹501–₹5,000 (0.1–1 g) |

“Shubh Dhanteras! May this gold bring prosperity.” |

Buy during streak days to boost bonuses |

|

Akshaya Tritiya |

₹1,100–₹11,000 (0.2–2 g) |

“May this 24K start a year of abundance.” |

Spin-to-Win after purchase for extra rewards |

|

Wedding |

₹5,000–₹25,000 (1–5 g) |

“A golden start to a lifelong journey.” |

Time the buy for higher BTC cashback tiers |

|

Anniversary |

₹1,100–₹5,000 (0.2–1 g) |

“Growing richer together – just like gold.” |

Maintain daily streaks for compounding bonuses |

|

Birthday |

₹251–₹2,500 (0.05–0.5 g) |

“A golden year ahead!” |

Refer-and-earn 100 Satoshi for both of you |

|

Baby shower |

₹1,100–₹5,000 (0.2–1 g) |

“For the little one’s future.” |

Gift small now; set monthly top-ups |

|

Housewarming |

₹1,100–₹11,000 (0.2–2 g) |

“A golden blessing for your new home.” |

Combine multiple micro-gifts over a week |

|

Graduation |

₹501–₹5,000 (0.1–1 g) |

“Invest in your next chapter.” |

Split buys across days to maximize streak |

|

First salary |

₹251–₹1,100 (0.05–0.2 g) |

“Welcome to wealth-building!” |

Use Spin-to-Win daily after micro-buys |

|

Corporate milestone |

₹1,100–₹11,000+ (0.2–2 g+) |

“Thanks for moving the needle.” |

Bulk-gift on promo days for better tiers |

Level up your gifting with a meaningful asset that compounds – and gets rewarded. Download OroPocket and send 24K gold from ₹1 via UPI in minutes: https://oropocket.com/app

Fees, Limits, and KYC: Everything to Know Before You Send

Minimums and maximums

-

Start from ₹1 on OroPocket – perfect for micro-gifts and stacking streak rewards.

-

UPI limits: Most banks allow up to ₹1 lakh/day via UPI; some set per-transaction caps (₹25k–₹1 lakh). Your bank/app may vary.

-

Platform gifting caps: Daily/monthly send limits can apply based on KYC tier and risk checks. Check the app’s Limits section before large gifts.

Pricing and spreads (transparency first)

-

Buy/sell spread: A small difference between buy and sell prices covers operational costs and liquidity. You’ll always see the live rate before paying.

-

Platform fee: OroPocket keeps pricing transparent; any applicable fee is shown upfront during checkout.

-

Price source: Rates reflect live wholesale market prices for 24K gold from authorized bullion partners, updating in real time.

Redemption fees (only if/when you want coins/bars)

-

Making charges: Apply to minted coins/bars (not to digital balances).

-

Delivery and insurance: Charged for home delivery; varies by weight/PIN code.

-

How to check: See a full fee breakdown in-app before you confirm a redemption. If you only hold or sell to INR, these charges don’t apply.

KYC checklist for smooth gifting

-

PAN verification

-

Mobile OTP

-

Address basics; selfie/ID if prompted

-

Recipient must complete KYC to accept and later redeem/sell

-

Why it matters: Protects both parties, prevents fraud, ensures compliance, and avoids payout delays

Speed and failures

-

Speed: Purchases and gifts typically complete instantly; confirmations via push/SMS/email.

-

If UPI fails: Verify balance and internet, retry the same mandate, or use another UPI app/account.

-

Refunds: If money is debited but the order fails, banks usually auto-reverse within minutes to a few hours (rarely up to T+1). Reattempt after confirmation.

-

Pro tip: For large gifts, split into smaller UPI transactions if your bank enforces tight per-transaction limits.

Download OroPocket and send 24K gold from ₹1 via UPI in minutes: https://oropocket.com/app

Security, Purity, and Compliance (so you feel 100% safe)

24K, 999 purity – what it means

-

24K (999) is pure gold – no alloys. It’s the global benchmark for investment-grade gold, aligning with BIS and LBMA standards.

-

Why it matters: Maximum resale value, no ambiguity on purity, and the most suitable form for digital gifting and later redemption into coins/bars.

Vaulting and insurance

-

Your gold is allocated and stored with professional custodians in secure, access-controlled vaults.

-

Insurance covers loss, theft, or damage; independent audits reconcile platform records with physical stock.

-

Net result: Your holdings are safeguarded end-to-end, with dual layers of custody and verification.

RBI-compliant flows

-

UPI-native payments with full audit trails.

-

Authorized bullion partners and 100% insured vaults.

-

OroPocket’s transparency ethos: clear pricing, visible fees, and downloadable statements.

Proof you can trust

-

Transaction history: Every buy/sell/gift is time-stamped and recorded.

-

Holding statements: View and download statements to verify balances.

-

In-app verification: Check live gold grams/₹ value, past rewards (Satoshi cashback), and redemption history – everything in one place.

Ready to gift 24K gold with confidence? Download OroPocket and send gold in minutes: https://oropocket.com/app

Redeem, Sell, or Hold: What Your Recipient Can Do Next

Sell to INR (instant liquidity)

-

Sell partially or fully at live market prices – no need to liquidate everything at once.

-

Proceeds are credited to the linked bank/UPI account. Most payouts are instant; in rare bank downtimes, it may show up T+1.

-

Helpful for emergencies, portfolio rebalancing, or short-term goals.

Redeem coins/bars (turn it into a keepsake)

-

Convert digital gold into 24K coins/bars (common weights: 0.5 g, 1 g, 2 g, 5 g, 10 g, and above – varies by partner).

-

Check delivery PIN code coverage, making charges, and insured delivery fees in-app before confirming.

-

Best for weddings, anniversaries, and heirloom-worthy moments where a physical keepsake matters.

Keep gifting forward

-

Re-gift a portion to parents, siblings, or friends – keep the tradition going digitally.

-

Split transfers into small, thoughtful amounts for birthdays, results, and “micro-milestones.”

-

Build a family habit: set monthly or festive top-ups everyone can contribute to.

Timing tips

-

Dollar-cost average (DCA) into gold; avoid chasing peaks or panic-selling on dips.

-

Set occasion-based reminders (Diwali, Akshaya Tritiya, birthdays) to automate good behavior.

-

Use price alerts and portfolio goals to decide when to sell or redeem.

Redemption options matrix

|

Option |

Pros |

Cons/Fees |

Typical timeline |

Best for |

|---|---|---|---|---|

|

Sell to INR |

Instant liquidity; partial or full sell; no making charges |

Buy/sell spread; possible platform fee; capital gains tax may apply |

Instant to a few minutes (rarely T+1 if bank delays) |

Emergencies, short-term goals, rebalancing |

|

Redeem coins/bars |

Tangible 24K keepsake; hallmark/purity assurance; great for ceremonies |

Making + delivery + insurance fees; PIN coverage varies; minimum weights |

2–7 business days (location and weight dependent) |

Weddings, anniversaries, heirlooms, corporate trophies |

|

Re-gift/transfer |

Instant, no logistics; perfect for micro-gifts; builds saving habits |

Recipient KYC required; daily/monthly transfer limits may apply |

Seconds to minutes after acceptance/KYC |

Family traditions, festive chains, corporate rewards |

Want to keep or convert with total control? Do it in-app with OroPocket – sell to INR, redeem coins/bars, or re-gift in minutes. Download now: https://oropocket.com/app

Tax Implications of Gifting Digital Gold in India (plain-English)

Gift tax basics (Section 56)

-

Gifts from specified relatives are fully exempt. This includes spouse, parents, grandparents, children, grandchildren, siblings, and in-laws covered under the Act’s definition of “relative.”

-

Gifts from non-relatives: If the total value you receive in a financial year exceeds ₹50,000, the entire amount above the threshold may be taxable as “Income from Other Sources” in the recipient’s hands.

-

Occasions-based exemptions: Gifts received on marriage are exempt. Festival or birthday gifts from non-relatives count towards the ₹50,000 threshold.

“Gifts from specified relatives are exempt; gifts from non-relatives above ₹50,000 in a year may be taxable to the recipient under Section 56(2)(x). Long-term capital gains on gold are taxed at 20% with indexation under Sections 48 and 112.” – Source

When the recipient sells

-

Capital gains apply on sale, not on gift receipt.

-

Short-Term Capital Gains (STCG): If sold within 36 months, gains are added to the recipient’s income and taxed as per their slab.

-

Long-Term Capital Gains (LTCG): If held for more than 36 months, taxed at 20% with indexation (plus surcharge/cess as applicable). Cost of acquisition typically equals the donor’s purchase price, and the holding period usually includes the donor’s period.

Gifting to minors and documentation

-

Gifts to minors are allowed; income may be clubbed with the parent/guardian as per clubbing provisions.

-

Keep records: simple gift note, transaction ID, PAN (donor/recipient), date, and fair market value at the time of gift (screenshot/statement). This helps during future sale computations.

Disclaimer

This is general information, not tax advice. Tax treatment can vary based on your facts. Consult a qualified tax professional or CA before making decisions.

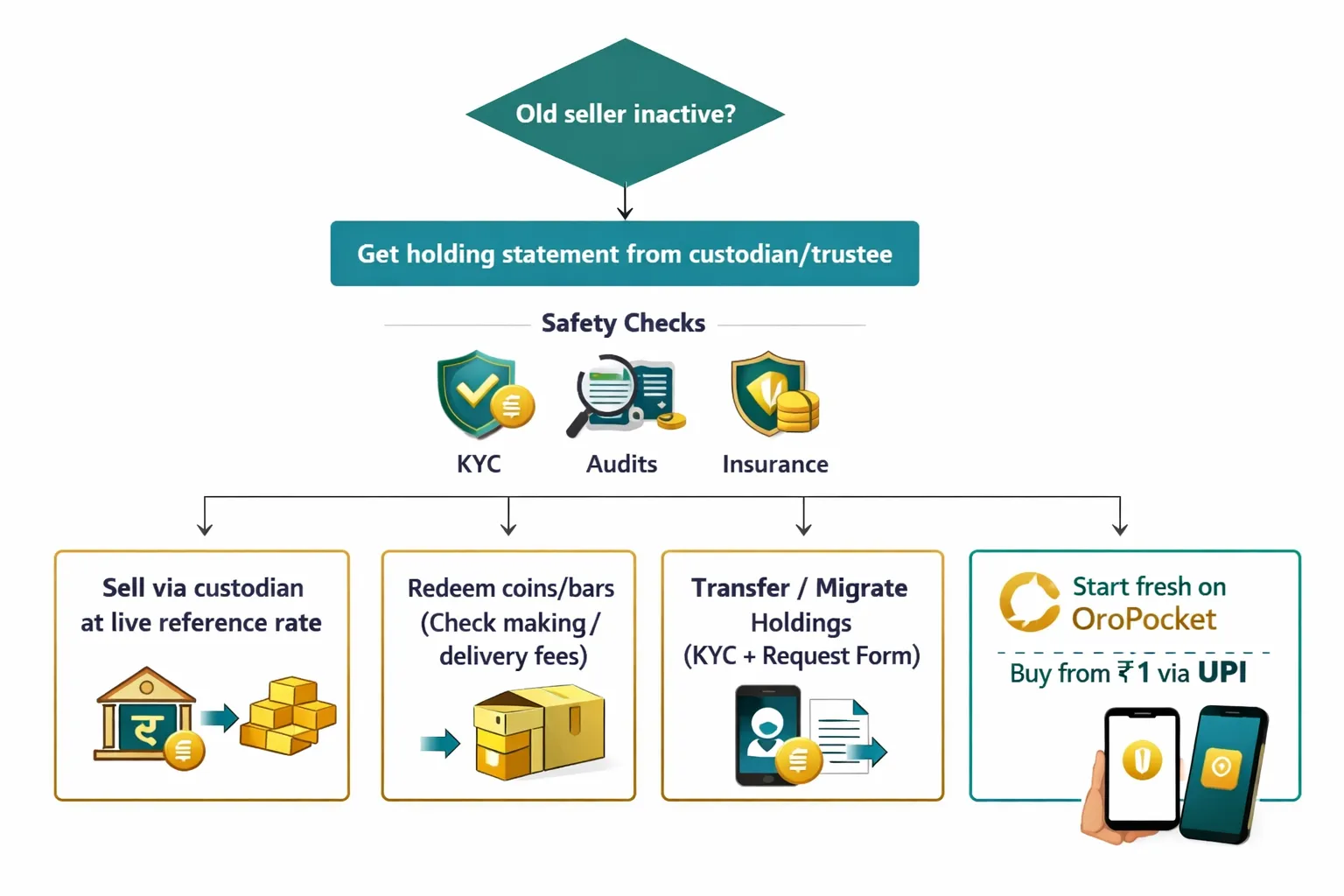

Troubleshooting & FAQs (including if your old seller stopped service)

If your previous digital-gold seller stopped servicing your account

-

Safeguard access now:

-

Find your bullion partner/custodian (e.g., appears on invoices, email receipts, FAQs – common partners include MMTC-PAMP, Augmont, SafeGold).

-

Raise a ticket with the custodian or trustee to request your holding statement/certificate.

-

Share registered mobile/email, PAN, and past order IDs to help them locate your balance.

-

-

Why trustee oversight matters:

-

An independent trustee/custodian monitors that total gold in vaults ≥ total customer liabilities.

-

Regular audits and full insurance protect your holdings even if a front-end seller exits.

-

Can I keep holding my digital gold?

-

Typically yes, as long as the gold is allocated with the custodian and fully insured.

-

Verify:

-

Holding statement (grams/₹ value, date, custodian details)

-

Any lock-ins or minimum redemption thresholds

-

Contact route for future sell/redeem

-

How do I sell now?

-

If the original app is unavailable:

-

Custodian-led liquidation: Request a sell instruction via the custodian/trustee support channel. Execution is usually at live market-linked pricing.

-

Alternate route: Some partners provide a web portal or email-based redemption path.

-

Timelines: Proceeds typically settle T+0/T+1 to your verified bank/UPI after KYC confirmation.

-

Can I transfer holdings to another platform/partner?

-

Depends on custodian policies. Some support migrations; others don’t.

-

If supported, you may need:

-

PAN, address proof, and bank proof

-

Latest holding statement

-

Consent/indemnity form

-

KYC re-verification on the destination platform

-

-

Caveats: Processing time, possible fees, and minimum transfer quantities.

What gold rate applies if I don’t sell via the old seller’s live price?

-

Redemptions/sales typically use live reference rates (LBMA/MCX-linked) plus the platform’s spread at execution time.

-

You don’t get legacy or historical app rates; the price locks when the custodian processes your instruction.

Where can I see my current holdings?

-

Ask the custodian/trustee for your holding statement and verification method (email portal, official letter).

-

Some custodians offer a balance-check portal or ticket-based confirmation.

-

On OroPocket, you’ll see balances and full history for gold purchased via OroPocket (and any holdings migrated through approved custodian processes).

Partial sales, gifting onward, and restrictions

-

Partial sells are typically allowed at the custodian level, subject to minimum gram/₹ thresholds.

-

Re-gifting/transfer may require both parties to complete KYC again and may have daily/monthly caps.

-

Expect re-verification if your registered mobile, bank, or address changed.

Who ensures safety inside partner vaults (e.g., MMTC-PAMP)?

-

Professional custodians store gold in high-security, insured vaults.

-

Independent trustees and external auditors verify stocks vs liabilities.

-

Insurance covers loss/theft; audit trails align platform records with physical holdings.

Redeeming to coins/bars when a seller is inactive

-

Prepare documents: PAN, address proof, holding statement, contact details, delivery PIN code.

-

Confirm:

-

Available denominations (e.g., 0.5 g, 1 g, 2 g, 5 g, 10 g)

-

Making, delivery, and insurance charges

-

Expected delivery timeline and coverage to your PIN code

-

Fast-track path: move to OroPocket

-

Start fresh on OroPocket – the digital gold buying app to purchase digital gold online from ₹1 via UPI.

-

Complete KYC in minutes, buy at live prices, gift instantly, and earn Bitcoin (Satoshi) rewards on every purchase.

-

If your custodian supports migration, follow their documentation flow to transfer holdings; otherwise, begin a new stack on OroPocket without delay.

Send 24K gold in minutes and track everything in one place. Download OroPocket: https://oropocket.com/app

Conclusion: Gift smarter, grow faster – start with OroPocket

Why OroPocket for digital gold gifting

-

Start from ₹1 with instant UPI checkout – no minimums, no friction.

-

24K pure gold, securely vaulted and 100% insured.

-

Unique edge: earn free Bitcoin (Satoshi) rewards on every gold/silver purchase.

-

Gamified streaks, daily Spin-to-Win, and referral bonuses (100 Satoshi each) turn gifting into a habit that actually builds wealth.

Your next 60 seconds

Download the app, complete KYC, buy 24K gold at the live rate, tap “Send,” and make someone’s day – in under a minute. Tradition meets tech, and you earn Bitcoin on top. It’s the smartest way to purchase digital gold online via a modern, UPI-native digital gold buying app.

Call to action

Ready to purchase digital gold online and gift it in minutes? Download OroPocket now: https://oropocket.com/app

![9 best places to buy digital silver online in India [2025] 8 9 best places to buy digital silver online in India 2025 cover](https://blog.oropocket.com/wp-content/uploads/2025/12/9-best-places-to-buy-digital-silver-online-in-India-2025-cover-300x200.webp)