How to Buy and Sell Digital Gold in India: Step-by-Step With UPI

Why buy and sell digital gold in India (beginner-friendly intro)

Inflation vs savings (the real problem)

-

Savings accounts at ~3–4% while everyday inflation runs ~5–7% means your money loses purchasing power. That’s a negative real return.

-

Indians turn to gold because, in INR terms, it historically holds value better during inflationary periods and market stress.

“Over the last five years, gold in INR has outpaced India’s average CPI inflation.” – Source

What is digital gold (24K, fractional, instantly liquid)

-

Digital gold is 24K pure gold you buy and sell online at live market-linked prices – starting from as little as ₹1. It’s fractional, so you own grams, not jewellery.

-

Every online digital gold purchase is fully backed by equivalent physical gold stored in insured, professional vaults. You can buy anytime and sell anytime – no market hours – and get near-instant liquidity.

-

If you’re searching “how to buy and sell digital gold” or “how to invest digital gold in India,” digital gold is the simplest on-ramp: fast, transparent, and mobile-first.

Why digital beats physical for investors

-

No lockers, no making charges on buying – your costs are limited to the transparent buy/sell spread + 3% GST at purchase.

-

Instant UPI checkout simplifies the digital gold buy and sell experience; you see live prices and confirm in seconds.

-

Get proper invoices and downloadable statements for every order. If you want coins/bars later, redeem easily (making + delivery charges apply). For pure investing, staying digital keeps costs lower.

Where OroPocket is different (USP snapshot)

-

₹1 entry + instant UPI checkout for frictionless, bite-sized investing.

-

24K pure gold held in fully insured vaults with RBI‑compliant partners.

-

Earn Bitcoin rewards (Satoshis) on every gold/silver buy – two assets for the price of one.

-

Habit-building tools: gamified daily streaks, spin-to-win bonuses, price alerts.

-

Social and festive-friendly: send/gift gold instantly to friends and family.

Ready to start your first online digital gold purchase? Download OroPocket and make your first ₹1 buy in under a minute: https://oropocket.com/app

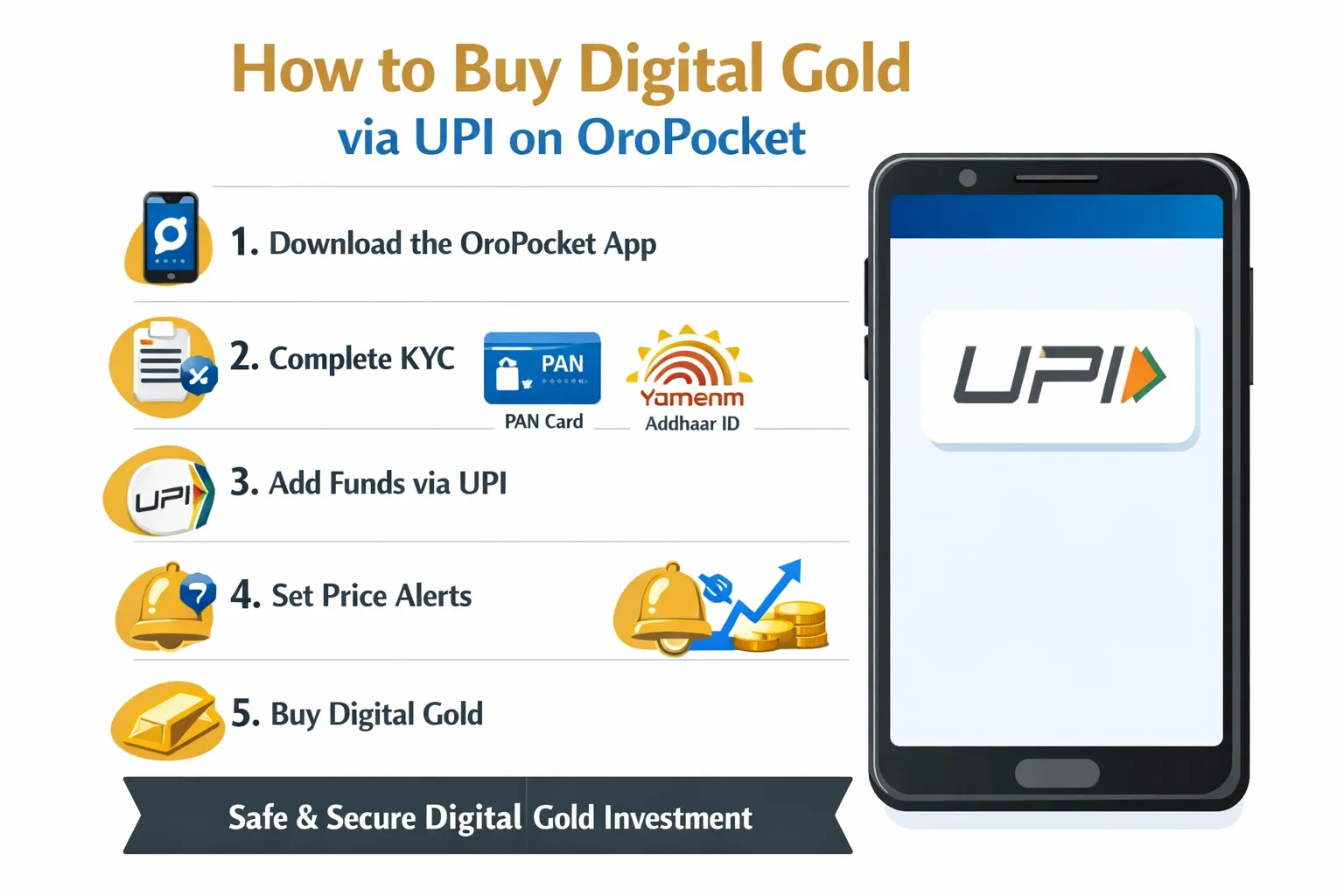

Step-by-step: Buy digital gold online in India via UPI (OroPocket walkthrough)

Step 1 – Download OroPocket (iOS/Android) and sign up

-

Install the OroPocket app from the App Store or Google Play.

-

Verify your mobile number via OTP.

-

Set a secure PIN and enable biometrics for faster, safer logins.

-

If you searched “digital gold how to buy” or “how to buy digital gold in India,” this is the fastest way to start an online digital gold purchase.

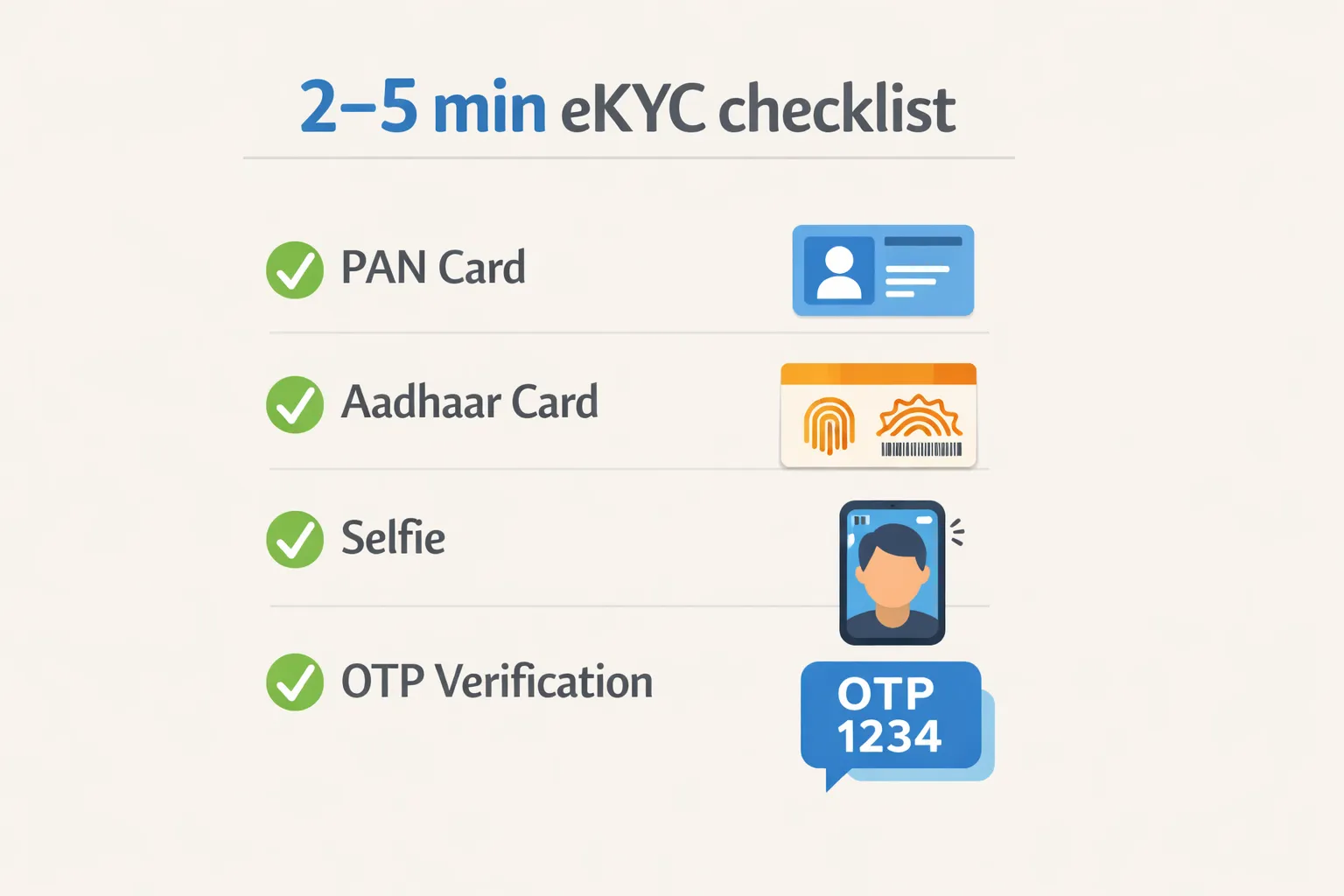

Step 2 – Complete quick eKYC (2–5 minutes)

-

Enter PAN, verify Aadhaar via OTP, and take a quick live selfie.

-

eKYC unlocks higher limits, faster payouts, and smooth buy/sell.

-

Once verified, you’re ready to buy electronic gold instantly via UPI.

Step 3 – Choose amount (₹ or grams) and review live quote

-

Select Gold > Buy.

-

Pick how you want to invest:

-

Amount in ₹ (fractional from ₹1), or

-

Weight in grams (e.g., 0.10 g, 1 g).

-

-

See a transparent, live buy quote that shows:

-

Current market‑linked price,

-

Net grams you’ll receive after the spread,

-

3% GST at purchase (shown on invoice).

-

-

This makes the UPI gold buy step-by-step process simple and predictable.

Step 4 – Pay with UPI and get instant allocation

-

Choose UPI and approve the collect request in any app: GPay, PhonePe, Paytm, BHIM, or your bank app.

-

Payment settles in seconds; your 24K gold is allocated immediately.

-

Your OroPocket portfolio updates in real time – no waiting, no NEFT delays.

Step 5 – Track, set alerts, and plan future micro-buys

-

See your holdings, average buy price, and current value in the Portfolio view.

-

Set price alerts to buy dips and build a weekly/daily micro‑buy routine.

-

Keep it consistent to smooth out volatility over time.

Pro tip

-

Make a ₹101 micro‑buy to learn the flow end-to-end. Then set a recurring reminder (daily/weekly) so your digital gold buy and sell habit compounds without effort.

Why UPI is the best way to buy digital gold

-

Always-on and real-time: works 24×7, even on Sundays/holidays.

-

Interoperable across all major UPI apps and banks.

-

Perfect for micro‑investing and SIP‑like routines – buy in 30 seconds, any day.

“In August 2025, UPI recorded 10.77 billion transactions in India.” – Source

Ready to make your first online digital gold purchase? Download OroPocket and buy gold digital from just ₹1 with instant UPI: https://oropocket.com/app

KYC for digital gold: documents, limits, and timelines

Why KYC matters

-

Prevents fraud and identity misuse, keeping your account safe.

-

Ensures AML/PMLA compliance so you can buy and sell digital gold confidently.

-

Enables secure payouts only to your verified bank account.

What you need (and common pitfalls)

-

PAN, Aadhaar eKYC (OTP), and a quick live selfie.

-

Exact name match across documents and your app profile (including initials/spaces).

-

Tips to pass first-time:

-

Use good, even lighting for the selfie; keep the camera steady and your face centered.

-

Keep your Aadhaar-linked mobile handy for OTP delivery.

-

Ensure PAN is active; verify Aadhaar-mobile linkage beforehand.

-

Typical approval timelines and troubleshooting

-

Most eKYC approvals finish instantly in 2–5 minutes.

-

If pending or failed:

-

Retake the selfie in better lighting; remove hats/masks/glasses.

-

Recheck spelling/format of your name to match PAN/Aadhaar exactly.

-

Wait a few minutes and retry if network/OTP was unstable.

-

If it still doesn’t go through, reach in‑app support with your registered number.

-

UPI limits to plan your buys

-

Per‑transaction and daily caps vary by bank/app. If a payment hits a limit, split into multiple UPI transactions.

-

Habit-friendly buying ranges:

-

Daily micro-buys: ₹1–₹500 to build consistency.

-

Weekly/monthly top-ups: ₹500–₹5,000 for goals without timing the market.

-

-

Searching “how can I buy digital gold with UPI” or “digital gold account verification India”? Complete KYC once, then keep stacking with quick UPI buys – simple.

Fees decoded: spreads, GST, storage, and physical redemption charges

The buy–sell spread and why it exists

-

Typical market range: total effective spread often ~2–6% (commonly ~1–3% on each side), depending on volatility and liquidity.

-

What drives wider/tighter spreads:

-

Market volatility (faster moves = wider spreads)

-

Time of day/liquidity (off-peak hours can be wider)

-

Provider hedging and vaulting costs

-

Denomination and order size (very small tickets can carry slightly wider spreads)

-

-

How to compare across digital gold platforms:

-

Always check the live buy and live sell price side-by-side.

-

Calculate spread% = (Buy − Sell) ÷ Mid-price.

-

Track it over a few days to understand typical vs spike conditions.

-

-

If you’re researching “spread on digital gold platforms” or “digital gold fees India,” focus on transparent, real-time quotes – not just marketing claims.

Taxes (GST now, capital gains later)

-

GST: 3% on the transaction value at the time of purchase of digital gold.

-

No GST on sale-back to the platform.

-

Capital gains: Tax depends on holding period (covered later in the Tax section); keep invoices for accurate cost basis.

“GST on gold purchases is 3% on the transaction value.” – Source

Storage and insurance

-

Most reputable providers bundle secure vaulting and insurance for a defined period.

-

After the included period, nominal custody fees may apply – read the fine print.

-

Insurance typically covers risks like theft/fire as per policy terms; confirm coverage scope and duration in the T&Cs.

Physical redemption costs

-

Making charges: Apply only if you convert to coins/bars; per‑gram making costs are usually higher for smaller denominations (e.g., 0.5–2 g coins) and lower for larger bars.

-

Delivery/shipping: Secure, insured shipping and handling vary by location and order size.

-

When to stay digital: If your goal is pure investment or gradual accumulation, staying digital avoids making and delivery charges entirely.

How to keep costs low

-

Buy during calmer market windows to benefit from tighter spreads.

-

Avoid frequent micro‑sells; accumulate and sell in sensible chunks to reduce frictional costs.

-

Compare the effective price (live price + spread + 3% GST) before confirming.

-

Use UPI for fast, reliable checkout and to prevent payment retries.

-

If you don’t need coins/bars for gifting or ceremonial use, avoid physical redemption to skip making/shipping fees.

Every charge you might encounter when you buy digital gold online

|

Charge |

What it is |

When it applies |

Typical range/notes |

How OroPocket handles it |

|---|---|---|---|---|

|

Buy spread |

Difference between benchmark price and your buy quote |

Every purchase |

Commonly ~1–3% above benchmark; wider in high volatility |

Shown live before you confirm; fully transparent |

|

Sell spread |

Difference between benchmark price and your sell quote |

Every sale |

Commonly ~1–3% below benchmark; depends on liquidity |

Instant sell quotes shown in real time |

|

GST on purchase (3%) |

Statutory tax on buying gold |

On every buy |

3% on transaction value |

Auto‑calculated and itemized on invoice |

|

Making charges (only if redeeming) |

Minting cost for coins/bars |

Only on physical redemption |

Higher per‑gram for small coins; lower for larger bars |

Displayed upfront at redemption checkout |

|

Delivery/shipping (if redeeming) |

Secure shipping + insurance + handling |

Only on physical redemption |

Varies by location and order size |

Clear estimate shown before payment |

|

Storage/insurance |

Vaulting and insurance of your gold |

While holding digitally |

Usually bundled for a defined period; nominal fees may apply later |

Included during the standard custody period; details in‑app |

|

UPI payment fee (typically NIL) |

Consumer payment processing fee |

At payment |

Typically NIL for consumers |

No added UPI surcharge |

Comparing digital gold fees in India? Focus on platforms with transparent spreads, proper GST invoicing, bundled storage/insurance, and clear redemption costs. OroPocket shows you everything upfront, so your online digital gold purchase is straightforward and predictable.

Ready to buy smart and keep costs low? Download OroPocket and start from ₹1: https://oropocket.com/app

Is digital gold safe? Purity, vaults, audits, and compliance checklist

24K purity and bar standards

-

Sourced via authorized bullion partners following international best practices.

-

Serialized bars with assay/certificates ensure traceability and authenticity.

-

Independent checks and reconciliations verify that each gram of 24k digital gold purity you own is fully backed.

“The LBMA Good Delivery Standard requires gold bars to meet strict specifications for weight, purity and appearance.” – Source

Vaulting and insurance

-

Fully insured, professional vaults with multi-layer security.

-

Regular reconciliation between vault holdings and customer allocations (1:1 backing).

-

Insurance coverage includes risks like theft/fire/natural disasters as per policy terms – ideal for anyone asking “is digital gold safe in India?”

Proof of ownership

-

1:1 allocation on a secure ledger to your verified account.

-

Downloadable invoices and statements for every buy/sell – clear audit trail.

-

Redemption rights preserved: sell back instantly or redeem coins/bars (making + delivery charges apply).

OroPocket security practices

-

RBI‑compliant processes with authorized bullion partners.

-

Encryption in transit and at rest, device binding, and 2FA for account access.

-

Real-time alerts for account actions; strict access controls and monitoring.

-

Transparent pricing, live quotes, and clear GST/spread disclosure.

Platform due‑diligence checklist for readers

-

Purity documentation (24K, assay/certificates; LBMA Good Delivery adherence).

-

Credible, insured vault partners with published reconciliation/audit cadence.

-

Independent third‑party audits and clear ownership records.

-

Transparent spreads and GST on every transaction.

-

Clear, fair redemption T&Cs (making/delivery fees, timelines, denominations).

Looking for insured vault digital gold with full transparency? Download OroPocket and buy 24K gold from ₹1 with instant UPI: https://oropocket.com/app

How to sell, withdraw, gift, or redeem coins/bars

Selling your digital gold (instant liquidity)

-

How to sell at live rates:

-

Open Portfolio > Select Gold > Tap Sell.

-

Enter either grams or ₹ value you want to liquidate.

-

Review the live sell quote and fees (spread shown upfront).

-

Confirm to execute at the displayed rate.

-

-

Settlement to your linked bank:

-

Payouts are processed instantly to your verified bank account via UPI/IMPS rails.

-

Typical credit is within minutes; in rare cases, it may take a few hours depending on your bank’s systems.

-

-

Pro tips:

-

Keep KYC completed and bank details verified to avoid payout delays.

-

Download the sell invoice/statement for your records and taxes.

-

Gifting/sending gold

-

Send grams to contacts in seconds – perfect for festivals, birthdays, or thank-yous.

-

How it works:

-

Go to Send/ Gift > Choose recipient (phone/contact) > Enter grams or ₹ > Add a note > Confirm.

-

The recipient gets an instant notification and sees the gold in their account.

-

If they’re new, they receive a secure link to claim after quick signup and KYC.

-

-

You’ll get an on-screen and in-app confirmation once it’s delivered.

Physical redemption

-

When it makes sense:

-

Ideal for gifting/ceremonies or when you want coins/bars in-hand.

-

-

What to expect:

-

Minimum denomination thresholds apply (shown in-app).

-

Making charges vary by weight/design (smaller coins usually have higher per‑gram making costs).

-

Delivery/shipping includes secure, insured logistics and is shown upfront before you pay.

-

-

Steps:

-

Go to Redeem > Pick coin/bar > Review making + delivery charges > Confirm address > Pay applicable fees > Track shipment.

-

Price alerts and exit planning

-

Set price alerts for your target sell or buy‑the‑dip levels to avoid FOMO and panic selling.

-

Plan exits in chunks:

-

Instead of one large sell, consider staggered sells at predefined targets to reduce timing risk and spread impact.

-

-

Keep records:

-

Save invoices/statements for each sell; they help with capital gains calculations later.

-

Searching “how to sell digital gold” or “digital gold sell online India”? OroPocket gives you instant sell quotes, fast bank withdrawals, and a smooth path to redeem digital gold to coins – transparent from start to finish.

Ready to sell or gift in seconds? Download OroPocket and manage your gold with one tap: https://oropocket.com/app

Build a habit: micro-buys, streaks, Bitcoin rewards, and referrals

Start tiny, stay consistent

-

Begin with ₹1–₹100 micro‑buys – fast, low‑stress, and perfect for SIP in gold India‑style routines.

-

Set weekly/monthly reminders so your habit runs on autopilot.

-

Consistent averaging smooths day‑to‑day volatility and keeps you invested.

Gamification that keeps you going

-

Daily streak bonuses unlock every 5 consecutive days to reward consistency.

-

Progress bars keep motivation high; price alerts nudge you to buy dips.

-

This is the best way to buy digital gold online if you struggle with timing – make it a game, not a chore.

Free Bitcoin on every gold/silver buy

-

Earn tiered Satoshi cashback on every purchase – track it alongside your grams in‑app.

-

Over time, Bitcoin rewards can offset part of the spread and lift your effective return.

-

Two assets for the price of one: gold stability + Bitcoin upside.

Spin-to-Win and referral perks

-

Spin daily for a chance to win bonus gold/Bitcoin rewards – free upside for showing up.

-

Invite friends: both of you get 100 Satoshi + a free spin when they join – grow your stack together.

A simple 30-day plan

-

Daily ₹101 routine to build momentum.

-

Maintain streaks (bonus every 5 days), do the daily spin, and share your referral link weekly.

-

Review your grams and rewards each Sunday; adjust the next week’s target.

-

Searching “micro-investing gold UPI”? OroPocket makes it effortless to stack gold in minutes, not months.

Ready to lock in your habit and earn rewards on every buy? Download OroPocket and start today from ₹1: https://oropocket.com/app

Compare platforms: find the best app to buy digital gold online in India

What to look for (buyer’s checklist)

-

Transparent spreads and GST breakdown (no hidden fees)

-

₹1 entry so you can start small and build a habit

-

UPI speed and reliability (24×7, instant allocation)

-

Clear vaulting, insurance, and third‑party audits

-

Rewards that boost effective returns (cashback, bonuses)

-

Gifting/sending options for festivals and milestones

-

Simple physical redemption with upfront making/shipping charges

Why OroPocket stands out

-

Only app that gives Bitcoin rewards (Satoshis) on every gold/silver buy

-

Gamified streaks and Spin‑to‑Win to keep you consistent

-

Seamless UPI checkout and instant allocation from just ₹1

-

Send/gift gold in seconds; perfect for Dhanteras, birthdays, or shagun

-

Transparent pricing with live buy/sell quotes and clear spreads

Snapshot vs popular alternatives

-

Wallet apps (Paytm, Google Pay/SafeGold): Solid UPI and live pricing but typically lack Bitcoin rewards and deep habit gamification.

-

Broker apps: Convenient portfolio view; rewards/gifting often limited.

-

Bullion platforms (Augmont, others): Strong redemption catalogs; fewer habit tools; no Bitcoin rewards.

Feature snapshot: OroPocket vs others

|

Platform |

₹1 Entry |

UPI Payments |

Bitcoin Rewards |

Daily Streaks |

Spin-to-Win |

Referral Bonuses |

Send/Gift Gold |

Physical Redemption |

Pricing Transparency |

|---|---|---|---|---|---|---|---|---|---|

|

OroPocket |

Yes |

Yes (instant) |

Yes (on every buy) |

Yes (bonus every 5 days) |

Yes |

Yes (100 Satoshi + free spin) |

Yes |

Yes (coins/bars; making + delivery apply) |

Live buy/sell with spread shown |

|

Paytm Gold |

Yes |

Yes |

No |

No |

No |

Varies/Promos |

Varies |

Yes |

Live price + invoice |

|

Jar |

Yes |

Yes |

No |

Basic habit tools |

No |

Yes (varies) |

Limited/Varies |

Yes (via partner) |

Live price + charges shown |

|

Augmont |

Yes |

Yes |

No |

No |

No |

Varies |

Yes |

Yes |

Live price + catalogue |

|

Google Pay (SafeGold) |

Yes |

Yes |

No |

No |

No |

Varies/Promos |

Limited/Varies |

Yes (via partner) |

Live price + invoice |

Note: Features change over time; verify the latest details in each app.

Decision shortcut

-

If you want the best app to buy digital gold with habit‑building, rewards, and simplicity, choose OroPocket. You’ll stack 24K gold, earn Bitcoin on every purchase, keep streaks alive, and gift gold in seconds – backed by insured vaults and transparent pricing.

Ready to buy digital gold online in India today? Download OroPocket and start from ₹1 with instant UPI: https://oropocket.com/app

Taxes on digital gold in India: STCG, LTCG with indexation, and records

Capital gains 101

-

STCG: If you sell within <3 years, gains are taxed at your income tax slab rate.

-

LTCG: If you sell after ≥3 years, gains are taxed at 20% with indexation (your purchase cost is adjusted using the Cost Inflation Index).

-

Cost basis: Include the purchase price + 3% GST on digital gold purchase + eligible platform/processing fees shown on your invoice.

GST recap and invoices

-

GST at 3% applies only when you buy digital gold.

-

No GST is charged when you sell back to the platform.

-

Keep every invoice – these prove your cost basis and GST paid, crucial for calculating taxes on digital gold in India.

High-value compliance and payout hygiene

-

Keep PAN/KYC completed to avoid payout delays and meet compliance norms.

-

Use UPI/bank-linked payments only; ensure your bank details and name match your KYC.

-

Update your profile promptly if you change your phone number, address, or bank account.

Record-keeping template

Maintain a simple log for each transaction (buy/sell/redeem). You can export statements from OroPocket and paste into your tracker:

-

Date of transaction

-

Amount in ₹ and grams

-

Effective price per gram and total cost (incl. 3% GST)

-

Reference ID/invoice number

-

Notes (e.g., “festival buy,” “partial sell,” “coin redemption”)

Pro tip

-

Prefer holding ≥3 years to benefit from indexation on LTCG.

-

Avoid frequent churning just to “catch moves” – spreads, GST on rebuys, and taxes can erode returns. A steady plan usually wins.

Searching “capital gains on digital gold” or “taxes on digital gold India”? OroPocket makes it easy: every buy/sell generates clear invoices and downloadable statements so your tax filing is straightforward.

Start building your gold stack with clean records from day one. Download OroPocket: https://oropocket.com/app

Conclusion and next steps: Start with ₹1 on OroPocket

Why act now

-

Inflation quietly eats idle cash – every month you wait is value lost.

-

UPI makes buying 24K digital gold instant – no paperwork, no bank hours.

-

Small daily actions compound – ₹101 a day builds a serious stack over time.

OroPocket advantage (quick recap)

-

Start from ₹1 with instant UPI checkout.

-

Earn free Bitcoin (Satoshis) on every gold/silver buy.

-

Keep your streak alive with daily bonuses + Spin‑to‑Win.

-

Hold 24K pure gold in fully insured vaults with RBI‑compliant partners.

-

Transparent live pricing with clear spreads and proper invoices.

-

Send/gift gold in seconds – perfect for festivals and milestones.

Clear call to action

-

Download OroPocket and make your first ₹101 buy today: https://oropocket.com/app

Friendly nudge

-

Start tiny, learn the flow, and let consistency plus rewards do the heavy lifting. Your first ₹1 is all it takes.