Is Investing in Silver a Good Investment in 2026? (Pros, Risks & Who Should Buy)

Is Investing in Silver a Good Investment in 2026? (Pros, Risks & Who Should Buy)

If you’re an Indian retail investor asking “is investing in silver a good investment?” in 2026, you’re not alone.

Gold has always been the “safe” choice. But silver is where affordability + industrial demand + high-upside cycles collide. The catch? Silver is also moody. It can rally hard – and fall even harder.

Here’s the practical answer:

-

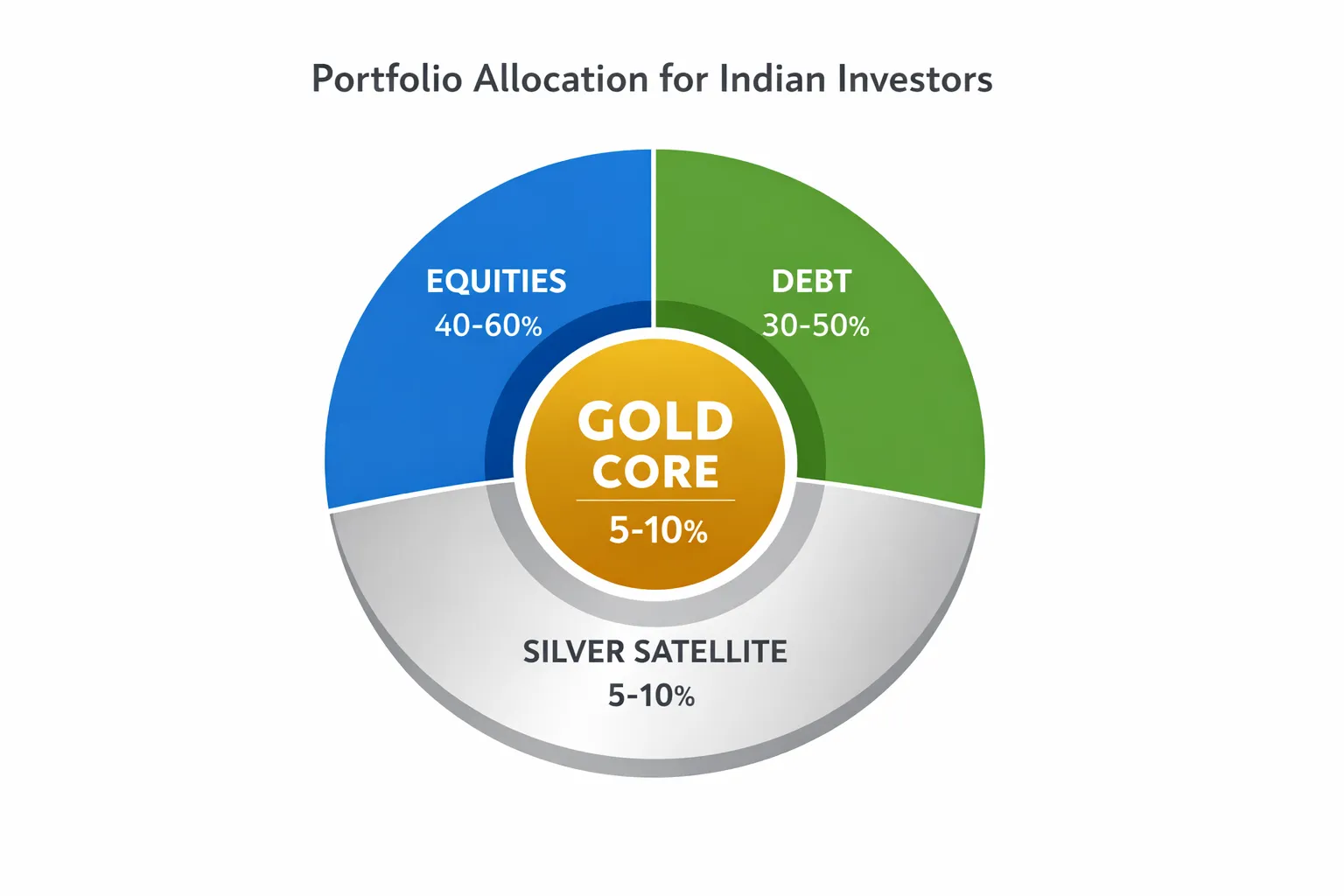

Yes, silver can be a smart investment in 2026if you treat it as a satellite allocation (typically 5–10% of your portfolio), buy in a staggered way (SIPs), and avoid expecting FD-like stability.

-

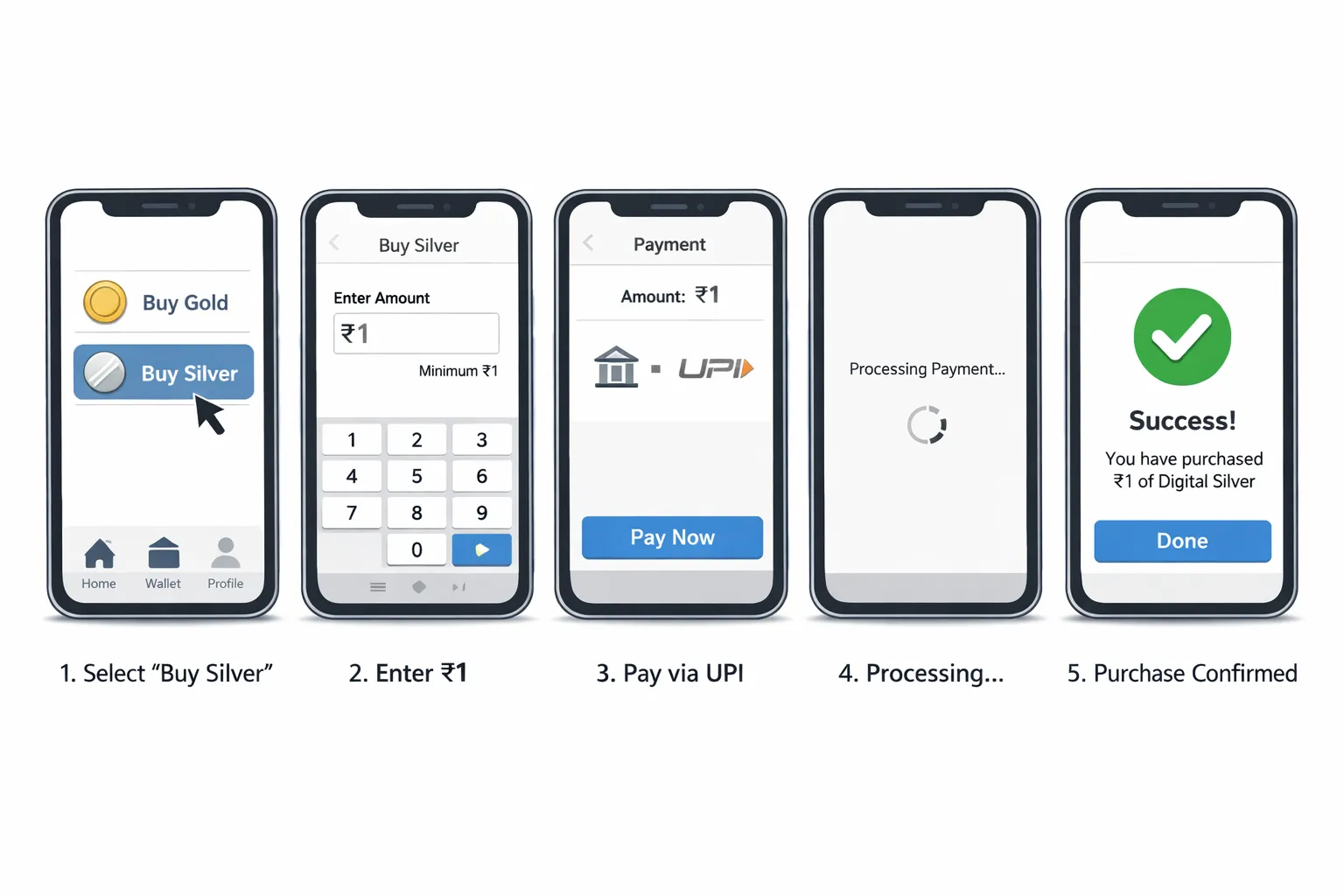

If you want the easiest, low-minimum way to start, digital silver lets you begin from ₹1, avoid storage headaches, and stay liquid – especially when you can buy in seconds via UPI.

To build conviction (and avoid hype), watch this first:

What Top Articles Get Right (and What They Miss)

Competitor content tends to agree on the basics:

-

Silver is more volatile than gold

-

Silver has industrial demand (solar, EVs, electronics)

-

Silver works best as diversification, not your entire portfolio

-

Best practice: limit allocation and avoid jewellery for investing

Content gaps we’re fixing in this guide:

-

A simple decision framework (who should buy, who should skip)

-

Actionable allocation + rebalancing rules (so silver doesn’t hijack your portfolio)

-

A clear “product-choice” guide (physical vs ETF vs digital – what fits which investor)

-

A behaviour-first strategy: micro-investing + automation + habit loops (where most people actually win)

Silver in 2026: Why Investors Are Looking Again

Silver isn’t only a “precious metal.” It’s also a working metal – used in real industries. That gives silver a dual engine:

-

Investment demand (like gold, especially during uncertainty)

-

Industrial demand (especially tied to solar + electrification)

“The silver market is projected to face a fifth consecutive annual deficit in 2025, with an estimated shortfall of 95 million ounces.” – Source

What that means for you in 2026: silver can spike in “risk-on” phases (growth optimism) and can still benefit when people want hard assets. But it won’t behave as calmly as gold.

Pros of Investing in Silver in 2026 (The Real Reasons It Works)

1) Lower entry price than gold (so you actually start)

Most people don’t lose to “bad investments.” They lose to not starting. Silver’s affordability makes it easier to build a real position without waiting months.

With OroPocket, you can start from ₹1 – so you stop watching and start growing.

2) Industrial demand can create stronger upside cycles

Gold is mainly monetary + sentiment driven. Silver is sentiment + industry. When manufacturing, solar adoption, and capex cycles pick up, silver often gets extra momentum.

3) Portfolio diversification (silver is a different beast)

Silver doesn’t move exactly like equities, debt, or gold. That makes it valuable in a portfolio – when sized correctly.

4) Silver can “catch up” fast in rallies

Historically, silver can move more aggressively than gold in bullish phases. That’s a benefit only if you:

-

keep allocation disciplined, and

-

rebalance profits instead of getting greedy

Risks of Silver Investing (What Can Go Wrong)

1) Volatility (the big one)

Silver can drop sharply in short periods – especially when global growth fears rise, USD strengthens, or commodities cool off.

“Between 1990 and Oct 31, 2024: Gold delivered ~10.6% CAGR with ~14.7% volatility; Silver ~7.6% CAGR with ~26.6% volatility.” – Source

Translation: silver may feel exciting, but it demands patience and risk control.

2) Physical silver is bulky (storage + security is real)

Silver is heavy. If you buy meaningful amounts physically, storage becomes a recurring headache (locker cost, theft risk, resale friction).

3) Spreads, premiums, and “hidden leaks”

Physical coins/bars can have:

-

dealer premiums

-

buy-sell spread

-

purity concerns if sourcing is weak

If your plan is to flip quickly, these costs can crush your returns.

4) Tax complexity (don’t wing it)

Taxes vary by product structure and holding period. Silver can still be worth it – but don’t invest blind.

If you want a deeper tax breakdown, read: taxes on gold and silver investments in India (FY 2026–27).

Silver vs Gold in 2026: What’s Better for Indian Investors?

The simple truth

-

Gold = anchor (stability, crisis hedge behaviour)

-

Silver = satellite (higher volatility, higher upside potential)

|

Factor |

Gold |

Silver |

What it means |

|---|---|---|---|

|

Volatility |

Lower |

Higher |

Silver needs longer holding power |

|

Primary driver |

Monetary + safe-haven |

Monetary + industrial |

Silver can outperform in growth cycles |

|

Portfolio role |

Core stabilizer |

Satellite diversifier |

Don’t replace gold with silver |

|

Best buying style |

SIP + goal-based |

SIP + staggered buying |

Avoid lump-sum FOMO in silver |

Want to balance both like a pro? Use a “core + satellite” metals plan (gold core, silver add-on). For allocation ideas, see investing in gold and silver together: allocation + rebalancing.

Who Should Buy Silver in 2026 (and Who Should Avoid It)

You should consider silver if you are:

-

A long-term investor (3+ years) who can tolerate drawdowns

-

Diversifying beyond FDs and equity funds

-

Bullish on the solar/EV/electrification trend

-

Willing to buy via SIPs and rebalance, not gamble

You should avoid or keep it tiny if you:

-

Need the money within 12–24 months

-

Panic-sell during falls

-

Want “fixed return” behaviour

-

Are already overexposed to volatile assets

How Much Silver to Allocate (A Rule That Actually Works)

Use this simple band:

-

Conservative: 3–5% silver

-

Balanced: 5–10% silver

-

Aggressive (still disciplined): 10–15% silver (only if you rebalance)

Rebalancing rule (so silver doesn’t take over)

Pick a target (say 8% silver). Rebalance when:

-

silver becomes 10%+ (trim and lock gains), or

-

silver falls to 6% (add via SIP/dip-buy if your plan allows)

This is how you stay “smart” instead of emotional.

Best Ways to Invest in Silver in India (2026)

1) Physical silver (coins/bars)

Good if you want tangible ownership. But storage + spreads can be painful.

2) Silver ETFs

Great for demat users; transparent, exchange-traded. Watch expense ratios and tracking.

3) Digital silver (best for most beginners)

Best for mass-market investors who want:

-

low minimums

-

quick buys

-

no storage hassle

-

simple tracking

If you’re deciding between ETF vs digital, see digital silver vs silver ETF in 2026.

Why OroPocket Makes Silver Investing Stupid-Simple (and More Rewarding)

OroPocket is built for the way India saves today: UPI-first, mobile-first, habit-first.

What you get with OroPocket

-

Start from ₹1 (no minimums, no waiting)

-

Instant UPI payments (buy in under 30 seconds)

-

Free Bitcoin (Satoshi) on every purchase (silver + Bitcoin exposure without crypto trading stress)

-

Gamified investing: daily streaks, spin-to-win, tiered rewards

-

100% secure & compliant: RBI-compliant model, insured vaulting, authorized bullion partners

-

Referral rewards: you and your friend earn 100 Satoshi + a free spin

This isn’t just investing. It’s behaviour design:

-

Control: “I’m taking charge.”

-

Progress: “My wealth grows daily.”

-

Smart: “I’m beating inflation while others don’t even start.”

-

Rewarded: “I get Bitcoin cashback for doing the right thing.”

How to Start Investing in Silver (In Under 30 Seconds)

Your action plan

-

Set your silver allocation target (start with 5%)

-

Start a weekly/monthly SIP (small is fine – ₹1 works)

-

Don’t chase spikes – build consistently

-

Rebalance every quarter/half-year

Stop watching. Start growing.

Final Verdict: Is Investing in Silver a Good Investment in 2026?

Yes – if you invest like an adult.

Silver in 2026 makes sense as a satellite diversifier driven by affordability and industrial demand, but it punishes impatience. The winning strategy is boring (and effective): SIP + small allocation + rebalancing.

Your next step

Download OroPocket, start with ₹1 in digital silver via UPI, and earn free Bitcoin on every purchase.

Build wealth the 21st-century way – simple, secure, and rewarding.