Gold Coins vs Gold Bars in India: Pros, Cons, and Best Use Cases

Introduction: Gold Coins vs Gold Bars in India – Which fits your goal?

Gold is a must-have in Indian portfolios – whether you’re stacking for long-term wealth, buying during festivals, or building a small SIP-like habit. But when it comes to format, the big question is simple: coins or bars? And there’s a modern third option too – digital gold on OroPocket. Here’s the no-nonsense breakdown to help you choose the best gold investment for your goal.

Quick takeaway

-

Coins = flexible, gift-friendly, small denominations, slightly higher premiums

-

Bars = lowest cost per gram, best for larger, long-term allocations

-

Bonus alternative: Digital gold on OroPocket = start from ₹1, zero storage hassles, Bitcoin rewards on every buy (ideal for SIP-like accumulation and gifting)

Comparison at a glance (read this if you’re in a hurry)

-

Purity: Coins (often 22K/24K with BIS hallmarking), Bars (24K – 995/999.9), Digital gold (OroPocket: 24K vaulted)

-

Typical premiums: Coins > Bars; Digital gold: no making charges, platform buy/sell spread applies

-

Buyback/liquidity: Coins/Bars via jewellers or bullion dealers; Digital gold (OroPocket) = instant in-app liquidity

-

Storage: Physical coins/bars need safekeeping; Digital gold = zero storage, fully insured vaults

-

Denominations: Coins (0.5g–50g common), Bars (1g–1kg), Digital gold (start from ₹1)

-

Best use cases: Coins (gifting, small flexible lots), Bars (bulk, long-term, best per-gram pricing), Digital gold (start small, automate, instant gifting, earn Bitcoin rewards)

Feature-by-feature comparison: Gold Coins vs Gold Bars vs Digital Gold (OroPocket)

|

Type |

Purity |

Typical premium |

Denominations |

Liquidity/buyback |

Storage |

Ideal for |

|---|---|---|---|---|---|---|

|

Gold Coins |

22K or 24K (BIS hallmarked) |

Higher due to minting/design |

0.5g to 50g (common) |

Good; depends on jeweller/bank policies |

Needs locker/home safe |

Gifting, festivals, small-ticket gold coin investment |

|

Gold Bars |

24K (995/999.9) |

Lower (best per-gram pricing) |

1g to 1kg |

Strong; widely accepted by bullion dealers |

Needs locker/vault |

Investing in gold bar for long-term, larger allocations |

|

Digital Gold (OroPocket) |

24K vaulted |

No making charges; transparent spread |

Start from ₹1 (no gram minimum) |

Instant buy/sell in-app; UPI-enabled |

Zero storage burden; 100% insured |

Best way to buy gold in India for SIP-like accumulation, instant gifting, and rewards |

When to choose coins vs bars (30-second guidance)

-

If you need small, giftable, frequently sellable bits: pick coins

-

If you’re compounding wealth in bigger tickets and want best price per gram: pick bars

-

If you want to start tiny, invest often, and gift instantly: consider digital gold via OroPocket

“India was the world’s second-largest consumer of gold in 2024, with demand of about 803 tonnes.” – Source

Price mechanics in India: Spot price, premiums, making charges, and GST

Understanding how gold is priced in India helps you avoid overpaying and compare apples-to-apples across coins, bars, and even digital gold.

What actually drives your final bill

-

International spot price (converted to INR) + import duties

-

Dealer premium: varies by brand, format, packaging

-

Making/minting costs: higher for coins than for bars

-

GST: 3% on gold value; for jewellery, 5% on making charges as well

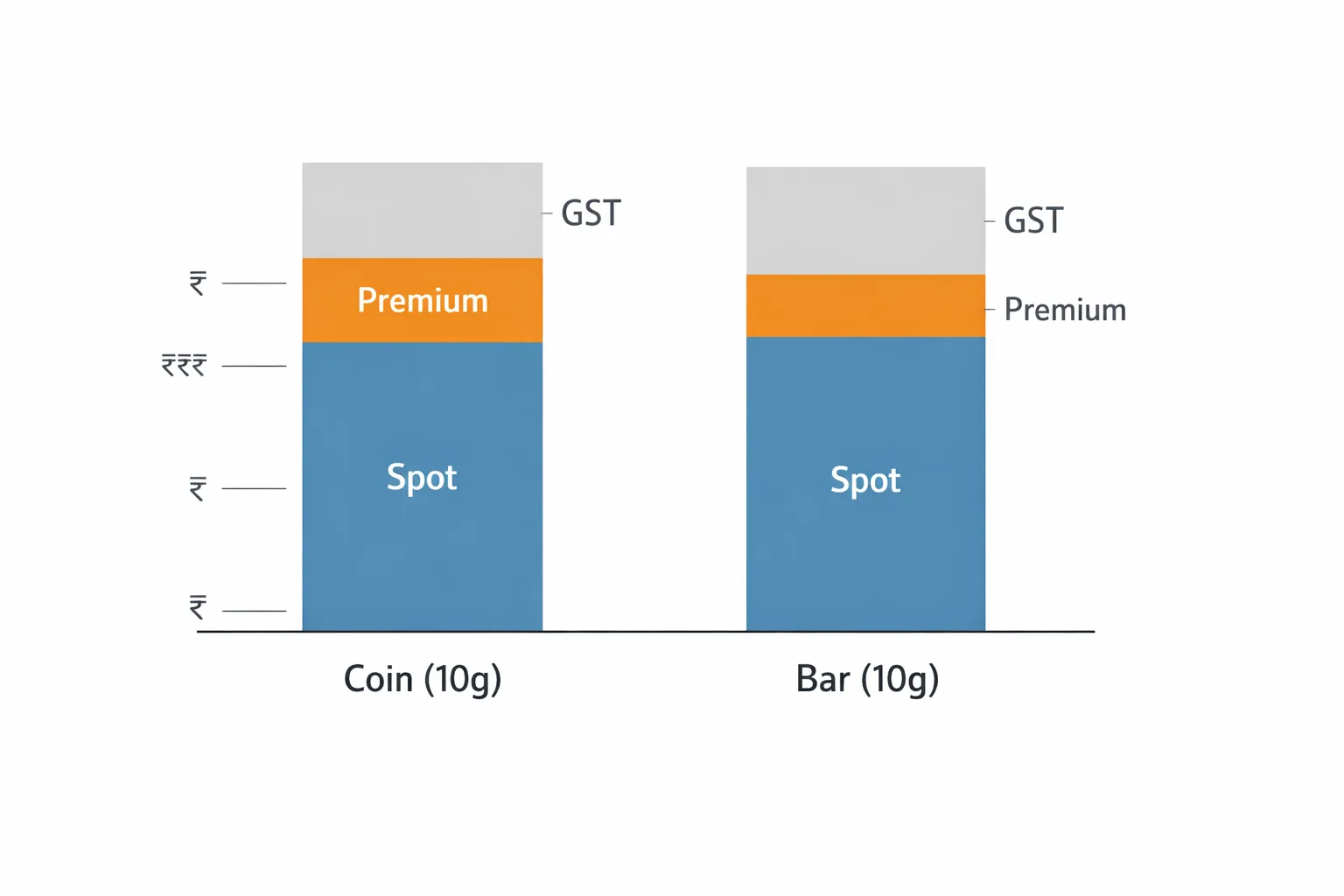

Typical premium ranges (illustrative – vary by brand and weight)

-

Coins: generally higher premium per gram due to design, packaging, distribution

-

Bars: lower premium per gram; bigger bars = lower per-gram premium

Worked example (illustrative math)

Assume spot price (inclusive of duties) = ₹6,200/g.

-

10 g coin:

-

Premium/minting: ~4% (₹248/g) → ₹2,480

-

Base gold value: ₹62,000

-

Subtotal: ₹64,480

-

GST @3% on gold value: ₹1,860

-

Final outlay (approx.): ₹66,340

-

-

10 g bar:

-

Premium/minting: ~2% (₹124/g) → ₹1,240

-

Base gold value: ₹62,000

-

Subtotal: ₹63,240

-

GST @3% on gold value: ₹1,860

-

Final outlay (approx.): ₹65,100

-

Difference: Coin costs ~₹1,240 more for the same 10 g due to higher premium/minting.

What to watch

-

Ask for transparent premium breakdown vs spot

-

Compare total final price across 2–3 reputed dealers before buying

Purity, hallmarking, and certificates: 24K (999/995), BIS, and serialised packaging

Getting purity and paperwork right protects your resale value and your peace of mind. Here’s what matters most for Indian buyers.

Purity basics

-

24K (999/995) standard for investment-grade bars and coins

-

22K coins exist; better for jewellery conversion, not pure investment

BIS hallmarking & HUID

-

Why BIS hallmarking matters for resale confidence

-

Independent purity verification boosts buyback value and trust.

-

-

HUID-encoded hallmark – what it is and how to verify

-

Each hallmarked piece carries a unique alphanumeric HUID you can verify on the BIS Care app.

-

“From April 1, 2023, BIS made HUID-based hallmarking mandatory – sale of gold jewellery/artefacts without HUID is prohibited.” – Source

Packaging and serial numbers

-

Tamper-evident packaging (assay cards), unique serial numbers

-

Why documented purity + serialisation eases resale and loan processing

-

Serialised assay cards and invoices speed up verification, reduce discounting at buyback, and simplify gold loan eligibility.

-

What great documentation looks like

-

Invoice + BIS mark + HUID + assay card = smoother liquidity

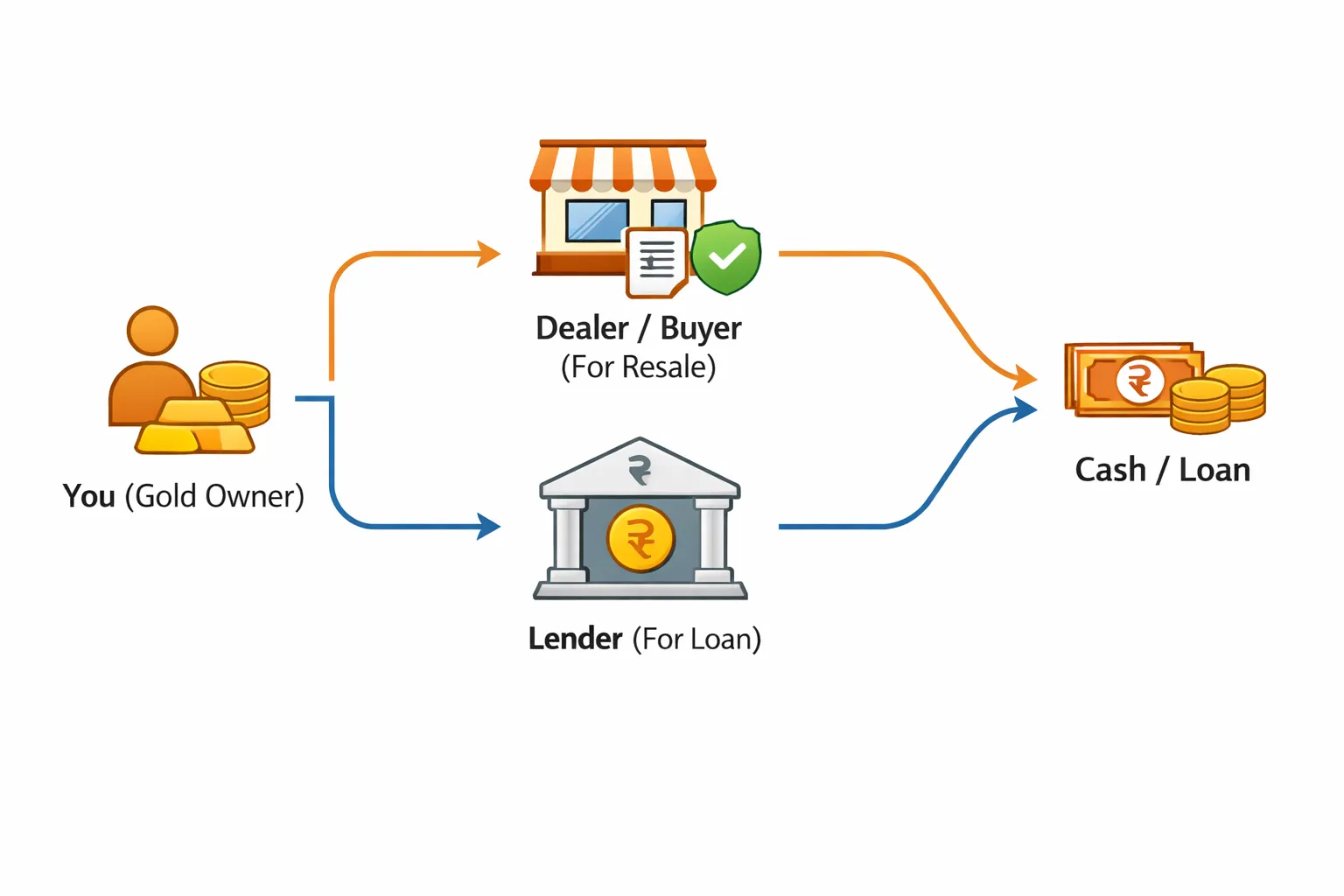

Liquidity, resale spreads, and loans against gold

Liquidity decides how quickly you can turn your gold into cash or a loan without losing value to spreads and penalties. Here’s what to expect in India.

Resale realities in India

-

Coins: widely recognised; some banks won’t buy back; jeweller/bullion buyback policies vary

-

Bars: standardised; easier with bullion dealers; bigger bars may need full unit sale

Spreads you’ll face

-

Buy/sell spread depends on purity, brand, and market conditions

-

Practical tip: get 2–3 quotes before selling; carry invoice/assay packaging

Loans against gold

-

Lenders prefer standardised, high-purity bars/coins with documentation

-

Typical LTV norms and why bars may be favoured for verification

-

Bars with assay cards and serial numbers simplify purity checks, often fetching quicker processing.

-

“RBI has introduced a tiered LTV structure for gold loans: up to ₹2.5 lakh at 85% LTV, ₹2.5–5 lakh at 80%, and above ₹5 lakh at 75%.” – Source

Practical guidance

-

Keep packaging intact; avoid scratches/dents; store invoices for highest bids

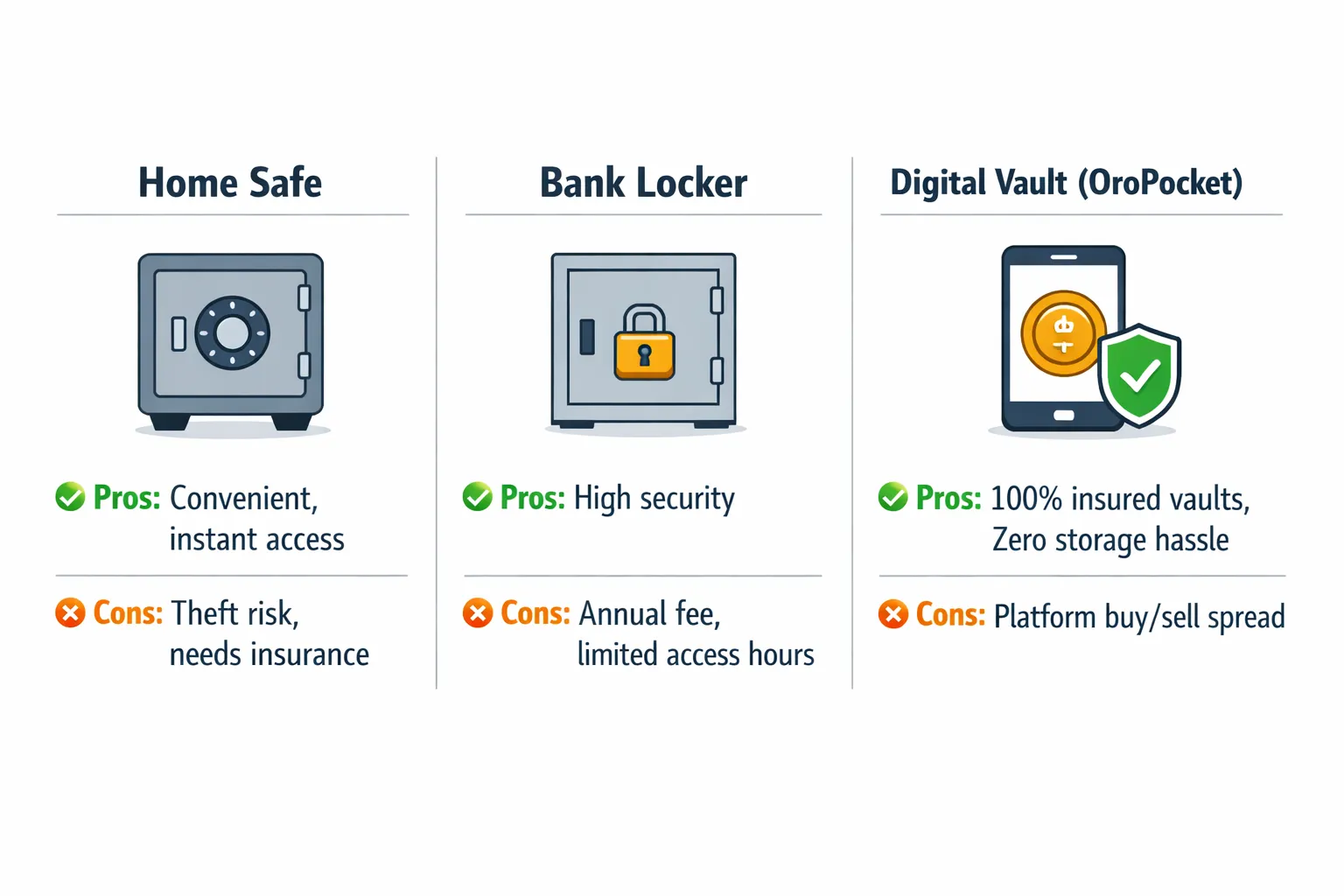

Storage, safety, and insurance costs

Choosing how to store your gold affects both peace of mind and ongoing costs. Here’s the quick guide.

Physical storage options

-

Home safes vs bank lockers: convenience vs recurring costs

-

Home safes: easy access but higher theft risk; consider a robust safe and home insurance rider.

-

Bank lockers: strong security but annual fees and limited access hours.

-

-

Bars: space-efficient; Coins: easier to split for partial selling

Insurance and risk

-

Theft/damage risk; the value of documentation for claims

-

Keep invoices, hallmark/HUID details, and photos; they speed up claims and reduce disputes.

-

Digital gold alternative (OroPocket)

-

No storage/insurance hassle; 100% insured vaulting via authorised partners

-

Ideal for small, frequent purchases and gifting

-

Start from ₹1, buy via UPI in seconds, and even gift gold instantly – plus earn Bitcoin rewards on every purchase.

-

Use cases: Who should pick coins vs bars (and when digital gold wins)

Choosing the right format isn’t about hype; it’s about fit. Here’s how to match your goal with the right gold.

If you’re gifting or starting small

-

Coins (1–5 g): ceremonial, easy to gift, easy to liquidate in parts; great for first-time gold coin investment

-

OroPocket: gift digital gold instantly; start from ₹1; earn Bitcoin rewards

If you’re allocating ₹50,000+ for long-term holding

-

Bars (10 g, 20 g, 50 g, 100 g): lowest per-gram cost, standardised purity (24K 999/995); ideal for investing in gold bar for multi-year holding

If you want SIP-like accumulation without storage pain

-

Digital gold via OroPocket: automate buys, sell/redeem anytime; the best way to buy gold in India for small, frequent purchases

If you plan to take a gold loan later

-

Prefer 24K hallmarked bars/coins with assay cards and invoices for smoother verification and stronger LTV

Coins vs Bars: Pros/Cons matrix

|

Type |

Pros |

Cons |

Ideal buyer |

|---|---|---|---|

|

Coins |

Giftable, small denominations, easy partial liquidation, widely recognised |

Higher premiums per gram, packaging/design add cost |

Gifting, beginners, small and frequent buyers |

|

Bars |

Lowest per-gram cost, standardised purity (24K 999/995), efficient for large allocations |

Requires full-unit sale, needs secure storage/insurance |

Long-term investors allocating ₹50,000+ seeking the best gold investment and tighter spreads |

Taxes and charges in India: What affects your net returns

Getting your tax math right can easily add 1–3% to your net outcomes over time. Here’s the quick breakdown for coins, bars, and digital gold so you can decide which gold investment is best for you.

On purchase

-

GST: 3% on the gold value (coins/bars). This is applied on the metal value, not on any premium separately.

-

Jewellery also attracts 5% GST on making charges. That’s in addition to the 3% GST on the gold value – one reason jewellery is not the best way to purchase gold purely for investment.

On sale

-

Capital gains:

-

Short-term capital gains (STCG): If held ≤ 36 months, gains are taxed as per your income slab.

-

Long-term capital gains (LTCG): If held > 36 months, gains are typically taxed at 20% with indexation (subject to prevailing law).

-

-

Keep invoices and ensure banked transactions for a clean audit trail. This helps you establish cost basis and holding period to correctly compute STCG/LTCG.

For digital gold

-

Same capital gains rules as physical gold (STCG vs LTCG with indexation after 3 years).

-

No GST on storage (since you don’t store physically). On OroPocket, your 24K vaulted holdings are 100% insured with authorised partners, letting you avoid locker charges and insurance riders.

Practical tip

-

Focus on total cost of ownership: premium/spread + GST on purchase + storage/insurance (if physical). Comparing all-in costs across 2–3 reputed dealers – and against digital gold on OroPocket – helps you find the best way to buy gold in India for your exact goal.

How to buy right: Checklist and red flags

Make every rupee count by buying smart – compare total costs, verify purity, and plan your exit. Here’s your quick, no-nonsense guide.

Pre-purchase checklist

-

Compare final price (spot + premium + GST) across 2–3 reputed dealers/apps

-

Insist on BIS hallmark + HUID, assay card, and invoice with serial number

-

Confirm buyback policy (spread, deductions, ID required)

-

Cross-check purity (24K 999/995 for investment) and brand reputation

-

If you plan to sell soon, ask for indicative buyback spread today

Choosing the right unit size

-

Match denomination to your exit plan:

-

Partial selling later? Prefer multiple coins (1–5 g) over a single large unit

-

Long-term, ₹50,000+ allocation? Consider bars (10–100 g) for best per-gram pricing

-

-

Don’t over-commit to very large bars if you’ll need liquidity in smaller chunks

Red flags to avoid

-

No hallmark/HUID or mismatch between invoice and item

-

Damaged/tampered packaging or missing assay card/serial number

-

Unusually high discounts vs market (often recouped via poor buyback rates)

-

Vague or verbal-only buyback promises; insist on written policy

Digital alternative (OroPocket)

-

Download the app, buy from ₹1 via UPI, and earn Bitcoin rewards on every purchase

-

Send gold to friends/family instantly; no storage/insurance hassle

-

Ideal if you want SIP-like accumulation without locker fees

Ready to buy gold the smart way? Download OroPocket and start from ₹1: https://oropocket.com/app

Final verdict: Coins vs Bars (and where OroPocket fits)

If you value flexibility and gifting

-

Choose coins (1–10 g) for ceremonial buys and small, frequent exits. They’re widely recognised, easy to gift during weddings/Diwali, and simple to liquidate in parts – perfect for first-time buyers and gift-led purchases.

If you want best value per gram for long-term wealth

-

Choose bars (10–100 g or larger) for lower premiums and standardised purity (24K 999/995). If you’re allocating ₹50,000+ and plan to hold for years, bars typically deliver the tightest spreads and the best per-gram pricing.

If you’re building the habit, starting tiny, or gifting online

-

Choose digital gold on OroPocket: ₹1 entry, UPI in 30 seconds, Bitcoin rewards on every buy, and 100% insured vaulting with authorised partners. Ideal for SIP-like accumulation, instant gifting, and avoiding locker/insurance costs.

Next step

-

Decide your goal, pick your format, and start. Don’t wait for the “perfect” price – accumulate steadily and let compounding do the work.

-

Call to action: Download the OroPocket app (https://oropocket.com/app) and start with ₹1 today.