Gold Value History: Biggest Rallies, Crashes & What They Mean for Investors Today

Gold Value History: Biggest Rallies, Crashes & What They Mean for Investors Today

Gold doesn’t move in a straight line. It surges when fear + inflation rise, and it crashes when real interest rates spike and the US dollar strengthens. If you’re an Indian retail investor trying to decide whether gold is “too high” or “still worth buying,” the fastest way to get confident is to study gold value history across major cycles – and then build a simple, repeatable investing plan.

This guide breaks down the biggest gold rallies and drawdowns from the 1970s to today, explains the forces behind them, and turns history into practical rules you can actually use (without becoming a macro nerd). If you want the simplest way to start, see how to invest in gold with little money in India (start from ₹1) – then come back to understand why it works.

What “gold value” really means (and why it shocks people)

Gold’s “value” is not just jewellery demand. It’s a global price shaped by:

-

Inflation expectations (what people think inflation will be)

-

Real interest rates (interest rates minus inflation)

-

USD strength (gold is priced in dollars globally)

-

Geopolitics & risk-off mood

-

Central bank buying

-

Liquidity & profit-booking after big rallies

Gold can be calm for years – then move violently in months. That’s not a bug. That’s the asset.

The simplest mental model: Gold loves falling real rates

If you remember only one thing from gold value history, remember this:

-

When real rates fall → gold tends to rise

-

When real rates rise → gold tends to fall

Because gold doesn’t pay interest. If bonds start offering strong inflation-adjusted returns, gold looks less attractive.

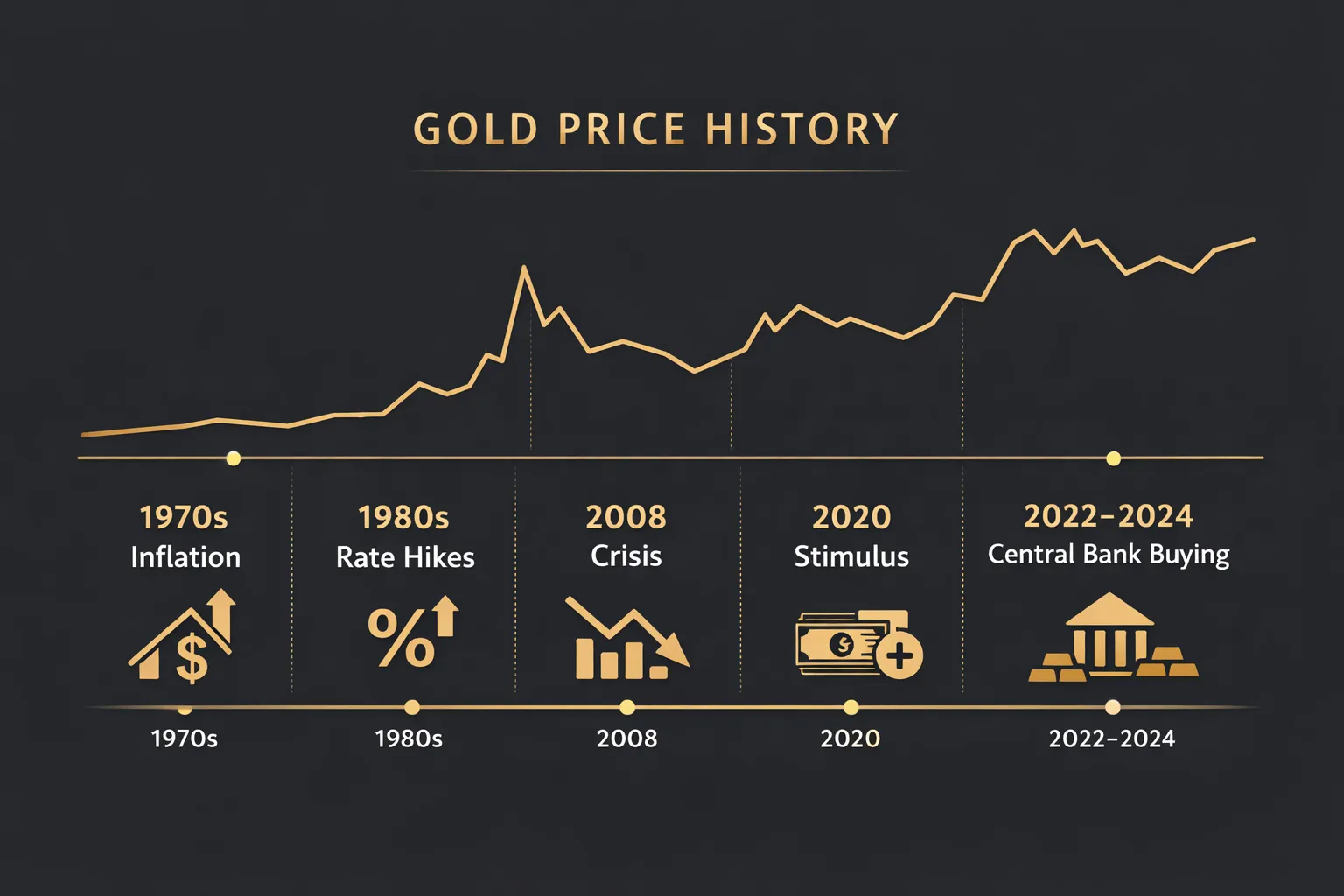

Gold value history: timeline of the biggest cycles (1970s → now)

1) 1970s inflation shock: gold breaks out (biggest “new era” rally)

Backdrop: Oil shocks, high inflation, currency instability, end of Bretton Woods

Why gold rallied: Inflation fear + loss of trust in paper money + negative real rates

This era is why gold became the modern “inflation hedge” narrative.

2) Early 1980s rate hikes: gold crashes hard

Backdrop: Volcker hikes in the US, inflation fight, real yields spike

Why gold fell: Suddenly, cash and bonds paid attractive real returns

Lesson: Gold can drop sharply even if inflation is still in headlines – if central banks get serious and real rates rise.

3) 2008 Global Financial Crisis: gold as fear insurance

Backdrop: Banking system panic, stimulus, QE begins

Why gold rallied: Systemic risk + money printing + falling real rates

This is where gold proved its “portfolio hedge” value for modern investors.

4) 2011–2015: a long cooling phase (death-by-a-thousand-cuts)

Backdrop: Recovery narrative, tapering fears, stronger USD

Why gold underperformed: Real rates stabilized, risk appetite returned

Lesson: Gold can be boring – and that’s exactly why you don’t want to chase it only when it’s trending on social media.

5) 2020 stimulus era: gold spikes again

Backdrop: Pandemic shock, ultra-low rates, massive liquidity

Why gold rallied: Negative real rates + currency debasement fears + uncertainty

6) 2022–2024: inflation + geopolitics + central bank demand

Even when rates rose, gold found support from geopolitics and central bank accumulation.

“In 2022, central banks collectively purchased 1,136 tonnes of gold, marking the highest annual level of buying on record since 1950.” – World Gold Council

Biggest rallies vs crashes: what triggered them (pattern recognition)

|

Phase |

What was happening |

Gold’s typical reaction |

What to watch |

|---|---|---|---|

|

Inflation surprise + slow rate response |

Inflation rising faster than policy |

Gold rallies |

CPI trend + central bank tone |

|

Rate hikes + rising real yields |

Policy tightens hard |

Gold corrects/crashes |

Real yields, bond curve |

|

Crisis / panic |

Stocks/credit stress |

Gold rallies (often) |

VIX, liquidity, credit spreads |

|

Strong USD |

Dollar up, EM currencies weak |

Gold pressured |

DXY trend, INR depreciation |

|

Central bank buying wave |

Reserve diversification |

Supports prices |

WGC demand reports |

The two forces Indian investors must add: INR and import dynamics

Global gold is priced in USD. Indian gold price depends on:

-

USD gold price

-

USD/INR exchange rate

-

Import duties / local premiums

-

Domestic demand (wedding/festive)

So sometimes global gold is flat, but gold in INR rises because rupee weakened.

This is also why gold works as a currency hedge for Indian portfolios.

The “biggest content gap” most blogs miss: gold drawdowns are normal in bull markets

Many competitor posts talk about rallies – but avoid the uncomfortable truth: 10–20% drawdowns are common even in strong bull phases. That’s not a sign gold is “broken.” It’s how profit-taking and liquidity cycles work.

“Since the United States ended the gold standard in 1971… the average annual price of gold rose from ~$40.62/oz (1971) to ~$1,800.09/oz (2022) – an increase of about 4,330%.” – National Mining Association

Translation for you: Stop trying to buy the exact bottom. Build a system.

How long can gold cycles last?

Gold cycles can last years, not weeks.

-

Macro shifts (inflation regime changes, central bank pivots) take time

-

Gold often moves in multi-year waves with violent corrections inside them

That’s why gold is best used for:

-

diversification

-

downside protection

-

inflation + currency hedge

-

not as a daily trading instrument.

Myths vs Facts (save this before you buy)

|

Myth |

Fact |

|---|---|

|

“Gold is only for weddings.” |

Investment gold is a financial asset; jewellery is consumption (making charges hurt returns). |

|

“If gold fell this week, it’s a bad investment.” |

Corrections are normal. Gold can fall 10–20% and still be in a long-term uptrend. |

|

“Gold always beats stocks.” |

Gold is a hedge and diversifier; equities usually win over very long periods. |

|

“Best strategy is to time the bottom.” |

Most people fail at timing. Disciplined allocation wins. |

|

“Digital gold is fake.” |

Digital gold can be real, vaulted, insured – if you choose a compliant platform. |

If you want the risk checklist many investors skip, read is digital gold safe in India (vaulting, regulation, risks).

A simple checklist: indicators to watch before you add more gold

Use this quick dashboard. You don’t need to predict perfectly – just avoid obvious mistakes.

1) Real rates direction

-

Falling or expected to fall = supportive for gold

-

Rising sharply = headwind

2) USD trend (DXY) + INR trend

-

Strong USD can cap gold globally

-

Weak INR can still lift gold in India

3) Inflation expectations (not just CPI)

-

Markets move on expectations before headlines

4) Risk sentiment / geopolitics

-

Gold often responds to uncertainty faster than most assets

5) Central bank buying

-

A steady “bid” under gold can reduce downside

How to use gold correctly in your portfolio (not like a gambler)

The practical rule

Gold works best as 5%–15% of a diversified portfolio (based on your risk appetite).

The execution rule

Buy gold in small, repeated buys (SIP-like behavior), especially after sharp rallies.

This is exactly where OroPocket is built differently: you can start with ₹1, use instant UPI, and turn “I’ll invest someday” into an everyday habit.

Why OroPocket is the easiest way to turn gold’s history into your advantage

Most people lose money in gold for one reason: they buy emotionally (at peaks) and sell anxiously (after dips). OroPocket flips that with a system designed for consistency:

-

₹1 Entry Point: start instantly, no “minimum amount” excuse

-

Instant UPI payments: buy gold in under 30 seconds

-

Free Bitcoin on every purchase: you stack gold and get Satoshi cashback – two assets for the price of one

-

Gold + Bitcoin combination: stability + upside potential, without needing to “trade crypto”

-

Gamified investing: streaks, spins, tiered rewards → habits that compound

-

100% secure & compliant: RBI-compliant flows, authorized bullion partners, insured vaulting

-

Referral rewards: both friends earn 100 Satoshi + free spin

Want a deeper decision guide on choosing the right instrument in 2026? Compare options in gold SIP vs gold ETF vs SGB (which is best for 2026).

Final verdict: Gold value history rewards discipline, not drama

Gold’s biggest rallies came when inflation fears surged, real rates fell, and uncertainty spiked. Its biggest crashes came when central banks tightened hard and real yields rose. That pattern hasn’t changed – only the headlines have.

If you want gold in your life, don’t “wait for the perfect price.”

Stop watching. Start growing.

Start your gold habit on OroPocket with ₹1 via UPI – and earn free Bitcoin on every buy.