Gold Charts Explained: How to Read Trends, Support/Resistance & Key Indicators

Gold Charts Explained: How to Read Trends, Support/Resistance & Key Indicators

If you’ve ever opened a gold price chart and thought, “This looks like noise… how do people make decisions from this?”, you’re not alone.

Most Indian savers (students, salaried professionals, small business owners, first-time investors) don’t need more finance jargon. They need a simple skill: read the chart, spot the trend, buy in phases, and avoid emotional decisions.

And here’s the best part: once you understand charts, you don’t need to “time the market perfectly.” You just need to stack smartly – even if it’s ₹1 at a time.

Stop watching. Start growing.

Why gold charts matter (especially in India)

Gold isn’t just a “festival purchase” anymore. It’s becoming a daily savings habit – because inflation quietly eats cash.

“The average inflation rate in India over 2021–2025 is ~5.07%.” – Source

That’s why gold charts are useful: they help you decide when to buy more, when to pause, and where risk is lower – instead of buying only when headlines scream “gold is up!”

If you’re deciding whether to buy today or wait, use this guide alongside a data-led timing framework like is it a good time to buy gold now (India).

Step 1: Understand what you’re looking at (chart types + the “4 prices”)

Line chart vs candlestick chart (what to use)

-

Line chart: simplest, usually shows only closing price. Great for quick long-term view.

-

Candlestick chart: best for decision-making. Shows the full story of price action.

The 4 prices (OHLC) inside every candle

Each candle shows:

-

Open: where price started in that time window

-

High: the highest point reached

-

Low: the lowest point reached

-

Close: where price ended

What it means in plain English:

Candles show whether buyers or sellers “won” that time period – and how hard they fought.

Step 2: Choose the right timeframe (intraday vs daily vs long-term)

Timeframes change what the chart “means.”

|

Your goal |

Best timeframe |

Why it works |

|---|---|---|

|

Buying gold as savings (weekly/monthly) |

Daily (1D) |

Clearer trend, fewer fake signals |

|

Medium-term accumulation |

4H / 1D |

Balance of detail + reliability |

|

Short-term trading (not recommended for most savers) |

15m / 1H |

More entries, more noise too |

|

Long-term “big picture” conviction |

Weekly (1W) |

Stronger support/resistance zones |

OroPocket mindset: you don’t need to predict tomorrow. You need to build wealth consistently – even with micro-buys.

If you’re new to the product side (not just charts), start with how to buy gold in India to understand formats (digital vs coins vs ETFs) before optimizing entry timing.

Step 3: Read the trend first (the fastest way to stop guessing)

Before any indicator, ask one question:

Is gold trending up, trending down, or ranging?

Uptrend

-

Higher highs + higher lows

-

“Dips” are often buying opportunities

Downtrend

-

Lower highs + lower lows

-

You buy smaller or wait for confirmation

Range

-

Price bounces between two zones

-

Great for phased buying near range support

Quick trendline method (beginner-safe)

-

In an uptrend: connect higher lows

-

In a downtrend: connect lower highs

Rule: The more times price respects a line, the more traders see it – and the more it matters.

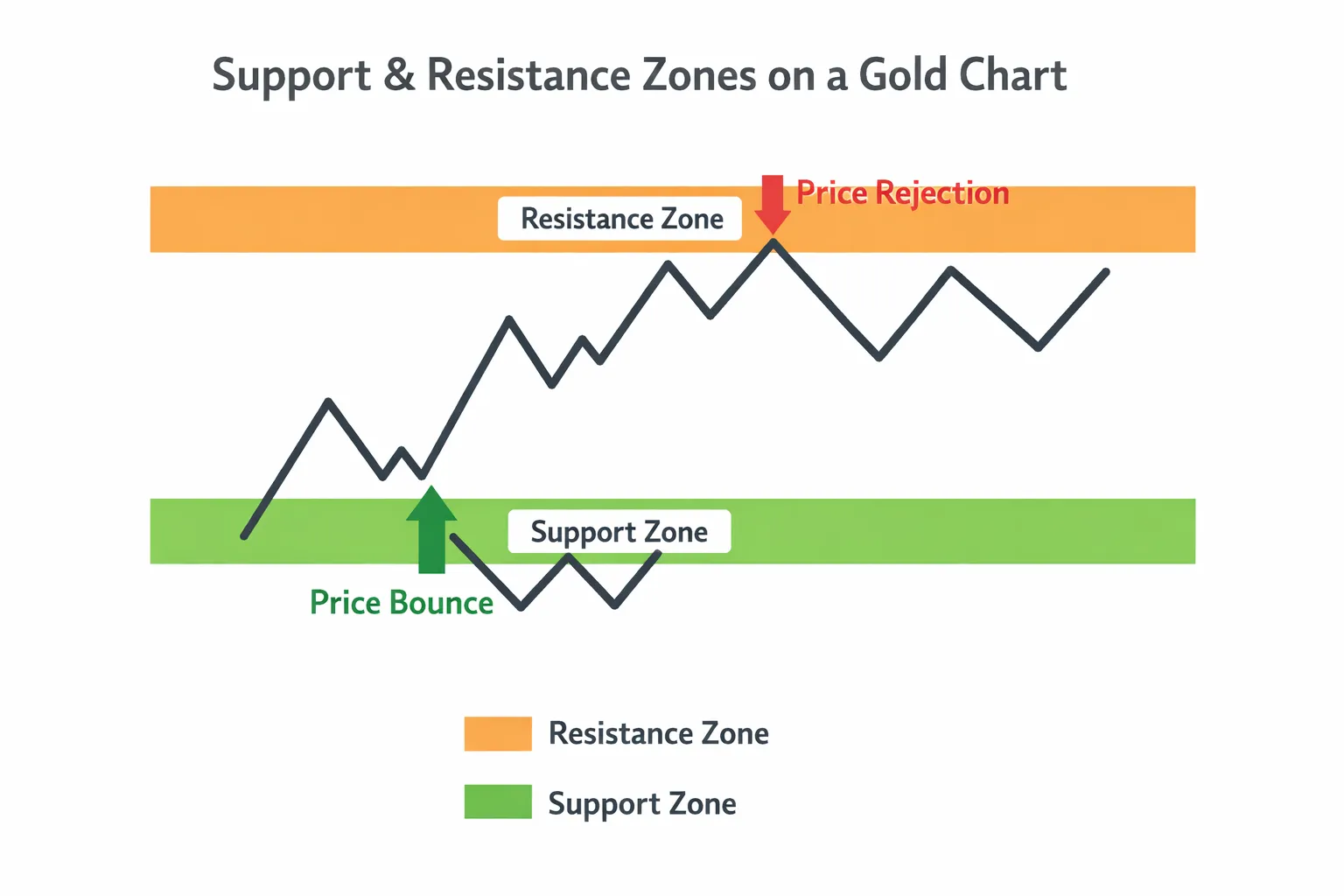

Step 4: Support & resistance (the levels where decisions happen)

Support/resistance is where most retail investors either:

-

panic sell near the bottom, or

-

FOMO buy near the top.

Support = “floor”

A zone where buyers repeatedly step in.

Resistance = “ceiling”

A zone where sellers repeatedly step in.

Important: treat them as zones, not single price points.

The 3 outcomes when price hits a level

-

Bounce (support holds / resistance holds)

-

Breakout (level breaks with strength)

-

Fakeout (breaks briefly, then snaps back)

Beginner filter:

Don’t react to the wick. Wait for a close above/below the zone – especially on daily charts.

Step 5: Key indicators that actually help (without drowning you)

Indicators don’t “predict.” They summarize.

1) Moving Averages (MA): trend + dynamic support

The most used MAs:

-

50-day MA: medium trend

-

200-day MA: long-term trend

How to use simply

-

Price above 50 & 200: trend bias is bullish

-

Price below: trend bias is bearish

-

50 crossing above 200 (“golden cross”): bullish shift

-

50 crossing below 200 (“death cross”): bearish shift

Micro-investor tip:

Use MAs to avoid buying aggressively in obvious downtrends. Instead, buy smaller and wait for trend improvement.

2) RSI (Relative Strength Index): momentum, not magic

RSI helps you spot when moves are stretched.

-

RSI > 70: overbought (often overheated)

-

RSI < 30: oversold (often washed out)

How beginners should use RSI

-

In an uptrend: RSI hitting 40–50 and turning up can be a “dip-buy zone”

-

In a downtrend: RSI hitting 60–70 and turning down can be a “sell-pressure zone”

Avoid this mistake:

RSI can stay overbought for long periods in strong rallies. Always check the trend first.

3) Volume (if available): conviction behind the move

-

Breakout + high volume = more believable

-

Breakout + low volume = more likely to fail

Digital gold apps may not show “exchange volume” like stocks – but when you’re using TradingView or broker charts, volume is a helpful confirmation layer.

Step 6: The chart patterns worth knowing (only the practical ones)

You don’t need 50 patterns. Learn 5 and act calmly.

1) Higher high / higher low sequence

This is the simplest “pattern” and the most powerful.

2) Double top / double bottom

-

Double top near resistance: potential reversal down

-

Double bottom near support: potential reversal up

3) Breakout + retest

Price breaks resistance, then returns to “test” it as support.

This is one of the cleanest entry styles for disciplined investors.

4) Doji near key levels

Doji = indecision.

Near support/resistance it can signal a turning point – if confirmed by the next candle.

5) Long wick rejection

A long upper wick at resistance shows sellers rejected higher prices.

A long lower wick at support shows buyers rejected lower prices.

How to use gold chart signals for real decisions (not theory)

Most people don’t fail because they lack charts – they fail because they overreact.

Here’s a simple playbook you can actually stick to:

1) Buy in phases (the anti-FOMO system)

Instead of “all-in today,” split buys:

-

20–30% near support zone

-

20–30% if it breaks out and retests

-

20–30% on the next dip in the trend

This turns chart reading into a process, not a gamble.

2) Set alerts (so you don’t stare at charts)

Set alerts at:

-

major support zone

-

major resistance zone

-

50/200 MA area (if you use MAs)

Alerts prevent emotional buying.

3) Track your real cost (digital gold pricing matters)

For digital gold, don’t only watch “market price.” You should also understand spreads, taxes, and platform charges – because they impact your net returns.

Use digital gold charges in India explained to avoid the #1 silent mistake: thinking “price went up” means “I’m profitable.”

Why OroPocket makes chart-based gold investing easier (and more rewarding)

Chart skills give you timing. OroPocket gives you execution + habit + rewards.

What you get with OroPocket (built for Indian retail investors)

|

Feature |

Why it matters for you |

|---|---|

|

Start from ₹1 |

No “I’ll invest when I have more money.” You start now. |

|

Free Bitcoin on every gold/silver buy |

You earn Satoshi cashback while building gold savings – two assets, one action. |

|

Gold + Bitcoin combination |

Gold = stability. Bitcoin rewards = upside exposure without trading stress. |

|

Gamified investing (streaks, spin-to-win, tiers) |

You build consistency – the real driver of long-term wealth. |

|

Instant UPI payments |

Buy gold in under 30 seconds – no bank transfer friction. |

|

Secure & compliant |

RBI-compliant, authorized bullion partners, insured vault storage. |

|

Referral rewards |

You + your friend earn 100 Satoshi + free spin – wealth grows faster together. |

And yes – this is how you beat inflation like a pro: consistent buying + smart zones + rewards that compound.

“As of Feb 2026, India’s 24K gold per 10g rose from ₹37,018 (5 years prior) to ₹156,709.” – Source

Conclusion: Read the chart. Control the outcome.

If you take only one lesson from this guide, let it be this:

Trend first. Zones second. Indicators last.

Then buy in phases, set alerts, and stay consistent.

OroPocket helps you do that with:

-

₹1 entry

-

UPI-fast buying

-

fully insured, compliant digital gold

-

and free Bitcoin rewards on every purchase

Stop watching. Start growing. Download OroPocket, start with ₹1, and turn gold chart knowledge into a real wealth habit – starting today.

![10 best places to buy digital silver online in India [2026] 4 1020best20places20to20buy20digital20silver20online20in20India205B20265D cover](https://blog.oropocket.com/wp-content/uploads/2025/12/1020best20places20to20buy20digital20silver20online20in20India205B20265D-cover-300x200.webp)