1kg of Gold Price: Cost Breakdown, Taxes & Best Ways to Invest in India

1kg of Gold Price in India (2026): Cost Breakdown, Taxes & Smarter Ways to Invest

If you’re searching “1kg gold price today,” you’re really asking a bigger question:

“What is the true amount I’ll pay to own 1 kilogram of gold – and what’s the smartest way to build that exposure without getting ripped off on premiums, storage, or resale?”

This guide makes it simple. You’ll learn:

-

How to convert the live per-gram rate into 1kg cost

-

The real extras: GST, dealer premium, storage/insurance, and liquidity impact

-

A clear comparison: 1kg physical bar vs SGB vs Gold ETF vs Digital Gold

-

A checklist to avoid overpaying – and a modern way to start with ₹1 and earn free Bitcoin along the way

Why the “1kg gold price” you see online is not what you actually pay

Most websites show a reference rate (like 24K/999 per gram) – but your payable amount depends on:

-

Purity & product type (999 bar vs coin vs jewellery)

-

Dealer/jeweller premium (minting, distribution, margin)

-

GST (and GST on making charges for jewellery)

-

Storage + insurance (if you take delivery)

-

Resale spread (you may sell back below spot)

If you’re building wealth, the goal isn’t just “buy gold.”

It’s get gold exposure at the lowest friction.

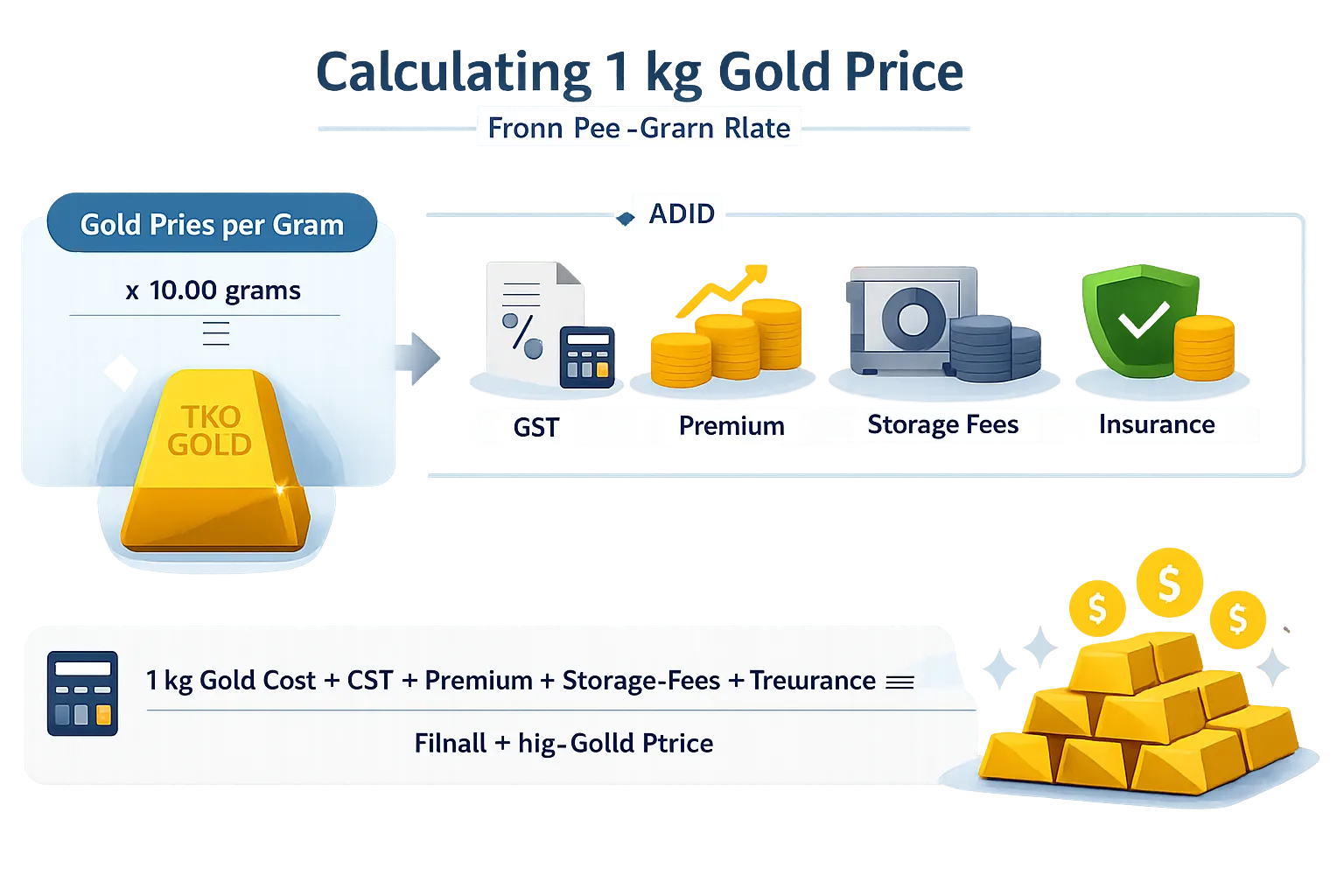

Step 1: How to calculate 1kg gold price from today’s per-gram rate

The simple formula

1kg gold price (before taxes/premium) = (Gold rate per gram) × 1000

Example:

-

If gold is ₹6,700 per gram, then:

-

1kg = 6,700 × 1000 = ₹67,00,000

Quick conversion table

|

Unit |

Grams |

Multiply by per-gram rate |

|---|---|---|

|

10 grams |

10 |

×10 |

|

100 grams |

100 |

×100 |

|

1 kilogram |

1000 |

×1000 |

Step 2: Purity matters – 24K vs 999 vs 995 vs 22K (and why it changes pricing)

Most “investment-grade” gold bars are:

-

999 = 99.9% pure (commonly marketed as 24K)

-

995 = 99.5% pure (also used in bullion markets)

Jewellery is typically:

-

22K = 91.6% pure (more durable for wearing)

If your goal is investment, prefer 999/995 bullion or paper/digital instruments linked to 24K prices.

Step 3: The true payable cost for a 1kg gold bar (full breakdown)

Here’s what typically adds to the “spot” value when buying a 1kg physical bar:

1) GST (big one)

In India, GST on gold is 3% (coins/bars/jewellery on value of gold).

“A GST rate of 3% is applied to the value of physical gold, including coins and bars.” – Source

What that means for 1kg:

If base value = ₹67,00,000, GST alone = ₹2,01,000

2) Dealer premium / minting premium

Even for bars, sellers may add a premium for:

-

Minting, packaging, certification

-

Inventory cost and hedging

-

Their margin

Premium varies by:

-

Brand (e.g., MMTC-PAMP, Valcambi, Perth Mint, etc.)

-

Availability and demand

-

Payment method and location

3) Storage + insurance (ongoing cost)

Owning a 1kg bar at home is risky. Most serious buyers use:

-

Bank locker (annual rent)

-

Private vaulting (higher-end)

-

Insurance (if you can get it reasonably)

This doesn’t show up on day 1 – but it hits returns every year.

4) Resale discount / spread

When you sell, buyers may:

-

Pay below spot

-

Deduct melting/testing charges

-

Offer lower rates if documentation is missing

Net: Physical gold is often “expensive to enter” and “costly to exit.”

What about import duty – does it affect the 1kg price?

Yes, but indirectly.

India imports a large portion of its gold. Import duty, global USD gold price, and INR/USD rates influence domestic prices.

If you want to understand what drives price moves (so you don’t buy purely on hype), read:

what drives gold prices and how to invest smarter in 2026.

The smarter question: Should you even buy a 1kg gold bar?

A 1kg bar makes sense mainly if you:

-

Need large physical holdings

-

Have secure storage and strong safety protocols

-

Can negotiate tight premiums and have a reliable resale channel

For most retail investors, there are more efficient ways to get 1kg exposure.

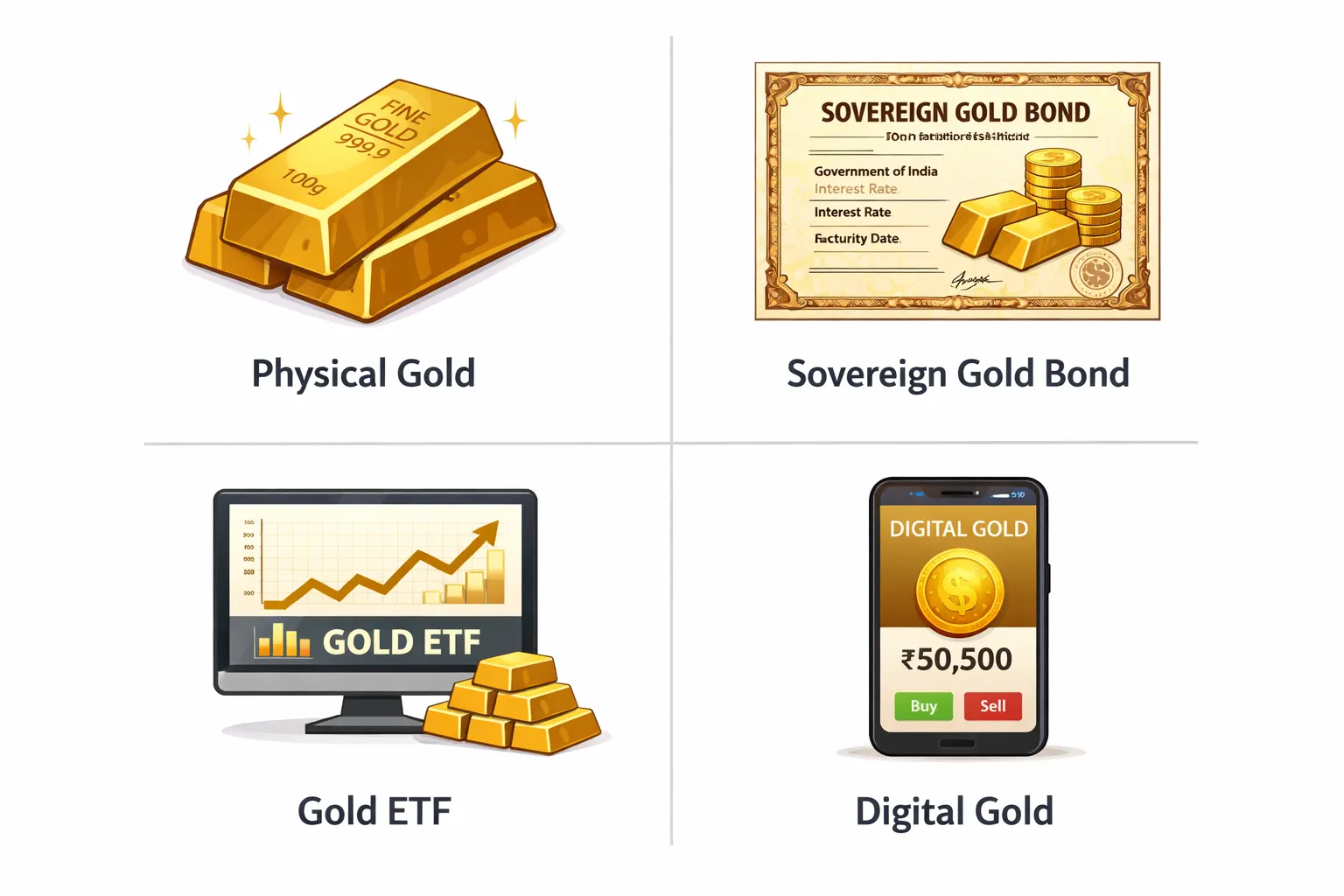

1kg Physical Gold Bar vs SGB vs Gold ETF vs Digital Gold (comparison)

Quick comparison table (real-world decision factors)

|

Option |

Best for |

Key costs |

Liquidity |

Storage |

What to watch |

|---|---|---|---|---|---|

|

1kg physical bar |

Ultra-long-term physical ownership |

GST + dealer premium + storage + resale spread |

Medium |

You manage it |

Authenticity, premium, safe storage |

|

Sovereign Gold Bonds (SGBs) |

Long-term investors who want interest |

No “visible” management fee; interest taxed |

Low-medium (better at maturity; secondary market varies) |

None |

Availability of new issues; lock-in & liquidity |

|

Gold ETFs |

Investors with demat who want tight tracking |

Expense ratio + brokerage |

High |

None |

Demat needed; tracking error |

|

Digital Gold (app-based) |

Small + regular investing without demat |

GST + platform spread |

High |

Vaulted by partner |

Choose credible provider; spreads |

Key detail: SGB interest

“Sovereign Gold Bonds provide a fixed annual interest rate of 2.5%, payable semi-annually.” – Source

The “hidden” cost most people miss: digital gold spread

Digital gold is convenient – but spreads matter.

“The buy-sell spread in digital gold investments typically ranges from 2% to 3%.” – Source

If you’re actively trading in and out, spread hurts.

If you’re accumulating steadily, it’s often still far more efficient than paying physical premiums + storage.

For a deep breakdown, see:

digital gold charges explained (spreads, GST, storage, selling).

The OroPocket way: build your “1kg gold goal” starting from ₹1 (and get Bitcoin rewards)

Most people never buy 1kg gold because it feels impossible. That’s the trap.

The smarter approach: Treat 1kg as a target, not a one-time purchase.

With OroPocket, you can:

-

Start with ₹1 (no minimum – remove the biggest barrier)

-

Buy via UPI in under 30 seconds

-

Own 24K gold backed by insured vault storage

-

Earn free Bitcoin (Satoshi) cashback on every purchase

-

Stay consistent with daily streaks, spin-to-win, and tiered rewards

-

Invite friends and both earn 100 Satoshi + free spin

Gold gives stability. Bitcoin rewards add upside.

That’s the OroPocket edge: two assets for the price of one, without the stress of trading crypto directly.

If you’re starting out, follow this step-by-step guide:

how to buy digital gold in India via UPI (KYC, fees, tips).

Checklist: how to avoid overpaying when buying 1kg gold in India

If you’re buying a physical 1kg bar

-

Confirm purity (999/995) + assay certification

-

Compare premiums across multiple sellers (premium can swing a lot)

-

Ask for buyback terms in writing

-

Plan storage (locker/vault) before purchase

-

Keep invoice + certificate safely for resale

If you’re building 1kg exposure digitally (recommended for most)

-

Compare spreads and fees

-

Prefer platforms with insured vaulting + credible bullion partners

-

Ensure easy sell + transparent settlement timelines

-

Use a habit strategy: daily/weekly buys beat “perfect timing”

Conclusion: What’s the best way to “buy 1kg gold” in 2026?

If you want the headline:

1kg gold price = per-gram rate × 1000.

But if you want the truth:

your real cost depends on GST, premiums, and exit friction.

For most Indians, buying a 1kg bar is less “investment” and more “logistics + hidden costs.” The smarter move is to accumulate gold exposure gradually – with liquidity, safety, and minimal friction.

Stop watching gold prices. Start growing your gold stack – starting at ₹1 – with OroPocket.

And while you’re building your gold, collect free Bitcoin cashback on every buy.