How to invest in gold and silver together: build a balanced metals portfolio

Why invest in gold and silver together (not either/or)

The diversification gap your FD + equities can’t fix

Your FD + equity combo doesn’t fully protect you when inflation spikes or headlines turn scary. Equities can sell off sharply during rate hikes, wars, or global slowdowns, and FDs barely keep up with inflation after taxes. That’s where a thoughtful gold and silver investment sleeve comes in – precious metals historically move differently from stocks, cushioning portfolio swings and preserving purchasing power.

“From 2000–2025, monthly correlations: Nifty–Gold ≈ -0.12 and Nifty–Silver ≈ +0.23 – weak to near-zero vs equities.” – Source

In plain English: metals are a volatility buffer and a time-tested inflation hedge. If you’re asking “should I invest in gold and silver?”, the smarter answer is usually “both” – not either/or.

What a balanced metals sleeve does for your portfolio

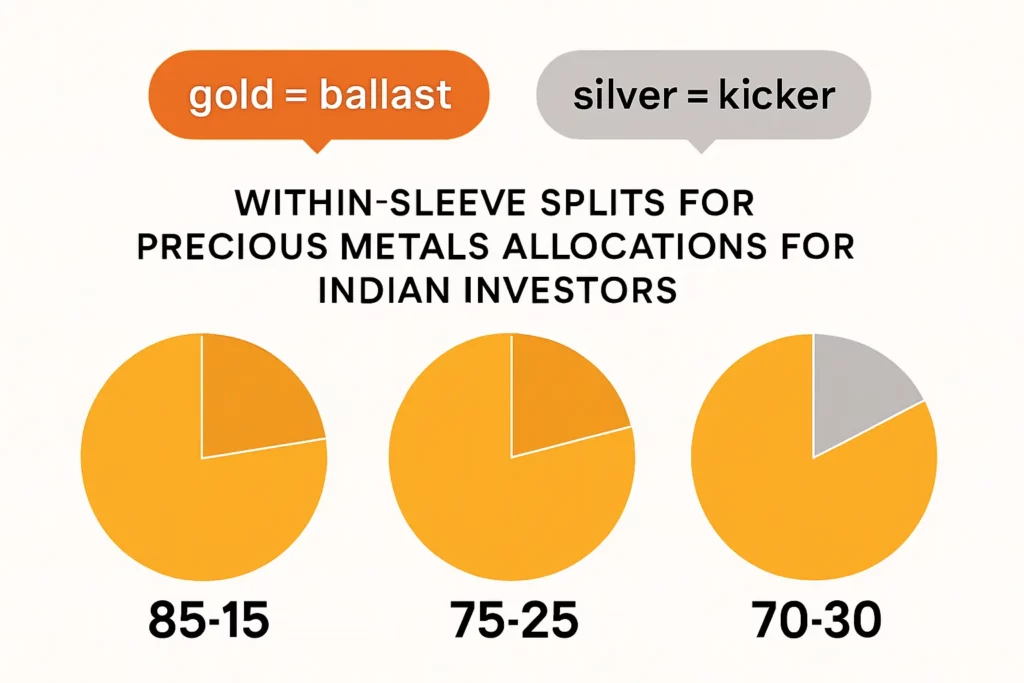

- Gold is your ballast. It tends to shine when risk assets wobble, helping you stay invested through rough patches.

- Silver is your cyclical kicker. Thanks to industrial demand (solar, EVs, electronics), it can turbocharge returns in up-cycles, but it’s more volatile than gold.

Together, they can smooth the ride – fewer gut-wrenching drawdowns, better odds of sticking with your plan, and more consistent compounding. If you’re exploring how to invest in gold and silver, think “roles and rules,” not hot takes or one-off bets.

Key takeaways in one minute

- Size your sleeve: Most Indian investors can target 10–20% in precious metals overall – gold-dominant.

- Keep silver small: Typically 10–30% of the metals sleeve (not of total portfolio). Example: if metals = 15% of your portfolio, silver might be 2–4.5% overall.

- Process beats timing: SIPs into gold & silver investments plus disciplined annual rebalancing generally outperform “all-in/all-out” timing calls.

- Practical starting point: Begin with a gold-and-silver investment split like 80:20 or 70:30 within your metals sleeve, and rebalance annually to your target weights.

If you’re still wondering how to invest in gold and silver without overthinking, keep it simple: gold for stability, silver for cyclical upside, SIP for habit, and rebalancing for discipline.

Gold vs silver: behavior, drivers, and when each shines

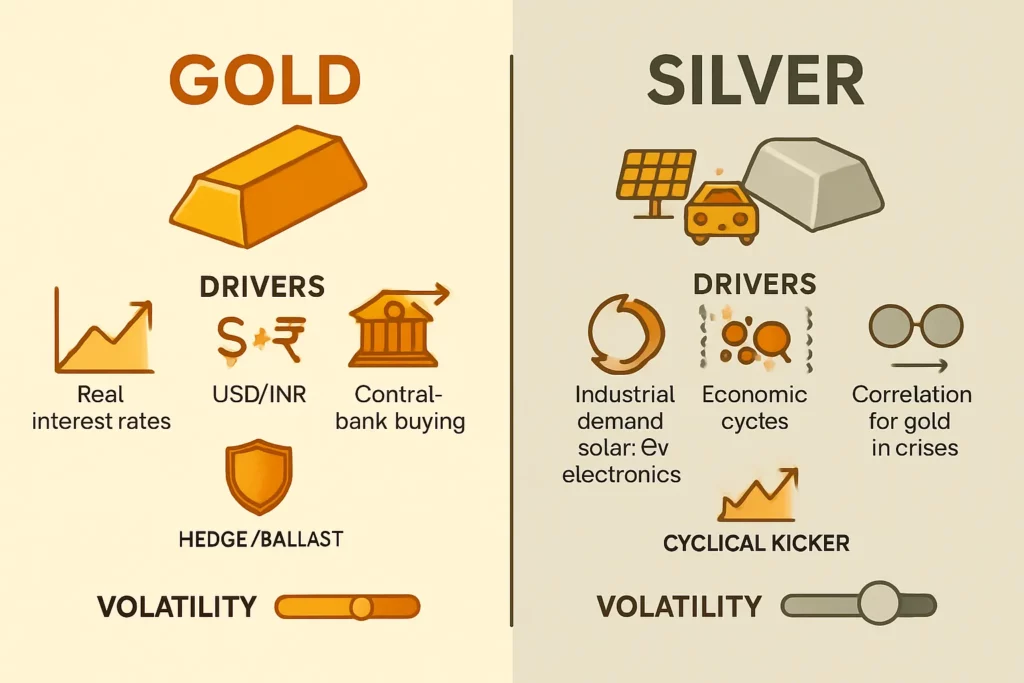

What moves gold?

- Real interest rates: When real rates fall or turn negative, the opportunity cost of holding gold drops – typically bullish for gold.

- USD/INR: A weaker INR often lifts domestic gold prices even if global prices are flat; a strong USD can also support gold during global risk-off.

- Central-bank buying: Persistent official sector purchases add a powerful structural bid.

- Risk-off flows: In turbulence (wars, recessions, market shocks), gold benefits from safe-haven demand.

“Central banks purchased over 1,000 tonnes of gold in 2022 and again in 2023, with elevated buying continuing into 2024.” – Source

What moves silver?

- Industrial demand: Silver is a critical input in solar, EVs, and electronics – booming capex and adoption cycles can push prices higher.

- Economic cycles: Broad global expansion and manufacturing upturns tend to favor silver’s performance.

- Crisis correlation with gold: In deep risk-off, silver often “follows” gold, but with more volatility.

Volatility and drawdowns

- Gold generally exhibits lower volatility and smaller maximum drawdowns than silver – making it a steadier ballast in a gold silver investment plan.

- Silver can overshoot both ways: it often rallies harder in upcycles and falls sharper in corrections. Expect bigger swings, wider drawdowns, and faster reversals.

When to prefer one over the other

- Risk-off or inflation scare: Prefer gold. It typically leads on safe-haven flows, policy uncertainty, and currency stress.

- Broad global expansion/industrial upcycles: Tilt to silver. Rapid growth in solar/EV/electronics can help silver outpace gold.

- Practical approach for gold & silver investments India: Use gold as the core “hedge/ballast,” and add a measured silver sleeve as a cyclical kicker – then rebalance. This keeps your gold and silver investment aligned with your risk and the macro backdrop while avoiding timing traps.

How much to allocate: model portfolios by risk profile

Choose your metals sleeve size (within your overall portfolio)

- Conservative: 10–20% sleeve (gold-heavy).

- Balanced: 12–18% sleeve (gold-dominant; small silver).

- Aggressive: 10–15% sleeve (allow slightly higher silver within the sleeve).

Within the metals sleeve (gold:silver split)

- Conservative: 85:15

- Balanced: 75:25

- Aggressive: 70:30 (cap silver at 30–35% of the sleeve for risk control)

Sample SIP plans (₹1 to ₹10,000/month)

Use SIPs to automate how to invest in gold and silver together. Keep gold the core; use a small silver kicker and rebalance annually.

- ₹1/day habit builder: Gold ₹0.80, Silver ₹0.20

- ₹100/week: Gold ₹75, Silver ₹25

- ₹1,500/month (Balanced 75:25): Gold ₹1,125, Silver ₹375

- ₹5,000/month (Conservative 85:15): Gold ₹4,250, Silver ₹750

- ₹10,000/month (Aggressive 70:30): Gold ₹7,000, Silver ₹3,000

Suggested Metals Allocation by Risk Profile + SIP Examples

| Profile | Metals Sleeve (% of total portfolio) | Within Metals (Gold:Silver) | Example SIP/mo (₹1,500) | Example SIP/mo (₹5,000) | Example SIP/mo (₹10,000) | Rebalancing rule |

|---|---|---|---|---|---|---|

| Conservative | 10–20% | 85:15 | 1,275 : 225 | 4,250 : 750 | 8,500 : 1,500 | Calendar (annual) + 5/25 band |

| Balanced | 12–18% | 75:25 | 1,125 : 375 | 3,750 : 1,250 | 7,500 : 2,500 | Calendar (annual) + 5/25 band |

| Aggressive | 10–15% | 70:30 | 1,050 : 450 | 3,500 : 1,500 | 7,000 : 3,000 | Calendar (annual) + 5/25 band |

Notes:

- 5/25 band = rebalance if an asset drifts by 5 percentage points (or 25% of its target weight), whichever is smaller.

- Keep silver capped at 30–35% of the metals sleeve for risk control.

- This is a starting framework for gold and silver investment allocation – tune to your goals and risk capacity.

Rebalancing rules that actually work (simple, automated, low-cost)

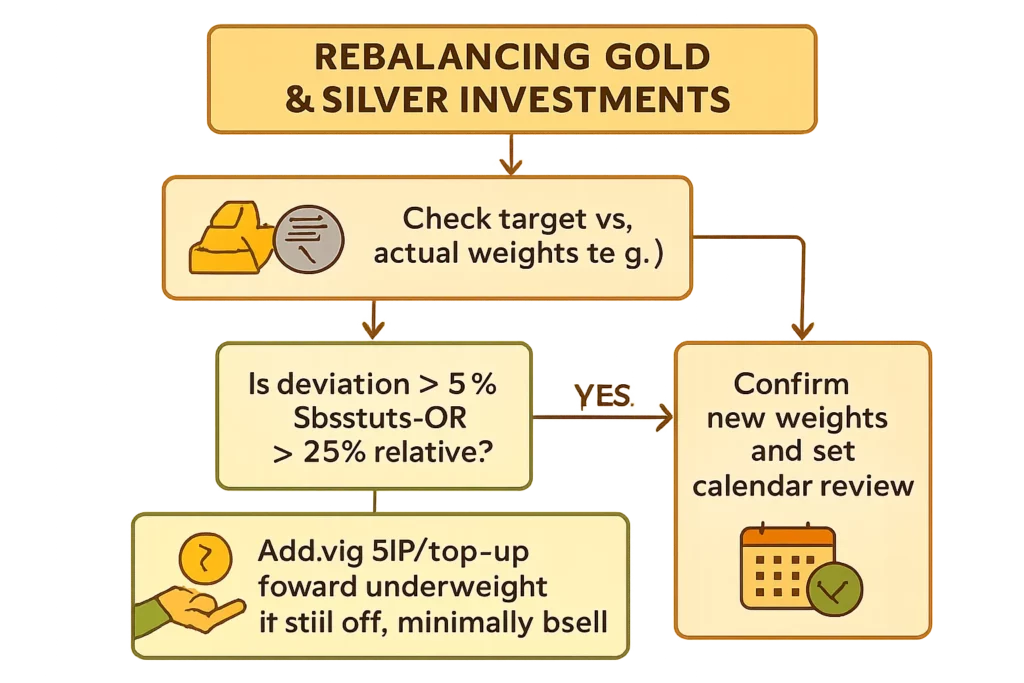

Calendar vs threshold

- Calendar: Rebalance on a fixed schedule – annual or semiannual. Simple, predictable, and low-effort.

- Threshold: Use a 5/25 rule within your metals sleeve. Rebalance when either:

- Absolute deviation > 5 percentage points from target, or

- Relative deviation > 25% of target weight. This keeps your gold & silver investments aligned without overtrading.

Practical playbook for Indian investors

- Route fresh money smartly: Direct new SIP/top-up flows to the underweight metal first. This minimizes selling and taxes.

- Keep costs low: If selling is required, do it once a year in one batch to reduce transaction costs and simplify tax reporting.

- Automate discipline: Put calendar reminders, and use percentage alerts to avoid emotional decisions when markets are loud.

On OroPocket

- Set targets (e.g., 75:25 gold:silver), review quarterly, and apply the 5/25 threshold.

- Execution flow:

- Check current weights vs targets in-app

- Redirect SIPs/UPI top-ups to the underweight metal

- If still off, sell a small portion of the overweight metal to snap back to targets

- Confirm new weights and reset alerts

Worked example

- Start at 75:25 (gold:silver).

- After a silver rally, sleeve flips to 65:35.

- Threshold check:

- Gold 75% target → actual 65% = 10 percentage points underweight (>5 pp)

- Silver 25% target → actual 35% = 10 percentage points overweight (>5 pp)

- Action:

- Redirect SIPs/top-ups to gold for a few weeks.

- If weights still breach thresholds, sell just enough silver to restore 75:25.

- Result: You’ve locked in gains from silver and restored balance – without timing the market.

If you’re asking “should I invest in gold and silver and how do I maintain my plan?”, this approach gives you simple, automated rules to keep your gold & silver investments on track.

When to tilt: rules-of-thumb to shift gold vs silver weights

Gold–silver ratio (GSR)

- Simple heuristic for a gold and silver investment strategy:

- GSR > 80: Allow a +5% tilt to silver within your metals sleeve (e.g., move 75:25 to 70:30).

- GSR < 60: Allow a +5% tilt back to gold (e.g., move 70:30 to 75:25).

- Keep guardrails: never exceed your predefined sleeve bounds (e.g., silver capped at 30–35% of the sleeve).

Macro signposts to watch

- Real rates: Falling real rates often favor gold (lower opportunity cost of holding a non-yielding asset).

- INR weakness: A weaker INR tends to lift INR gold prices even if global gold is flat.

- Industrial tailwinds: Strong global PMIs, record solar installations, and robust EV sales are silver-friendly.

“Industrial uses now account for roughly 59% of total silver demand (2024), led by photovoltaics, electronics, and EVs.” – Source

Guardrails

- Keep tilts small: Limit shifts to ±5% within the metals sleeve to avoid overbetting.

- Timebox the tilt: Review quarterly; if signals fade, revert to your base split (e.g., 75:25).

- Respect drift rules: If your 5/25 threshold is hit first, rebalance before applying any new tilt.

Use these rules as a practical way to invest in gold and silver together – small, data-led tilts layered on top of a disciplined base allocation.

Where to invest: SGBs, ETFs, and digital gold/silver on OroPocket

Instrument-by-instrument (India)

- Sovereign Gold Bonds (SGBs): Government-backed, interest-bearing paper gold. Great for long-term gold silver investment India strategies as a core gold holding.

- Gold ETFs: Market-linked, high liquidity, transparent pricing; good for flexible allocations and SIPs.

- Silver ETFs: Easiest regulated way to own silver; useful for tactical tilts or building a measured silver sleeve.

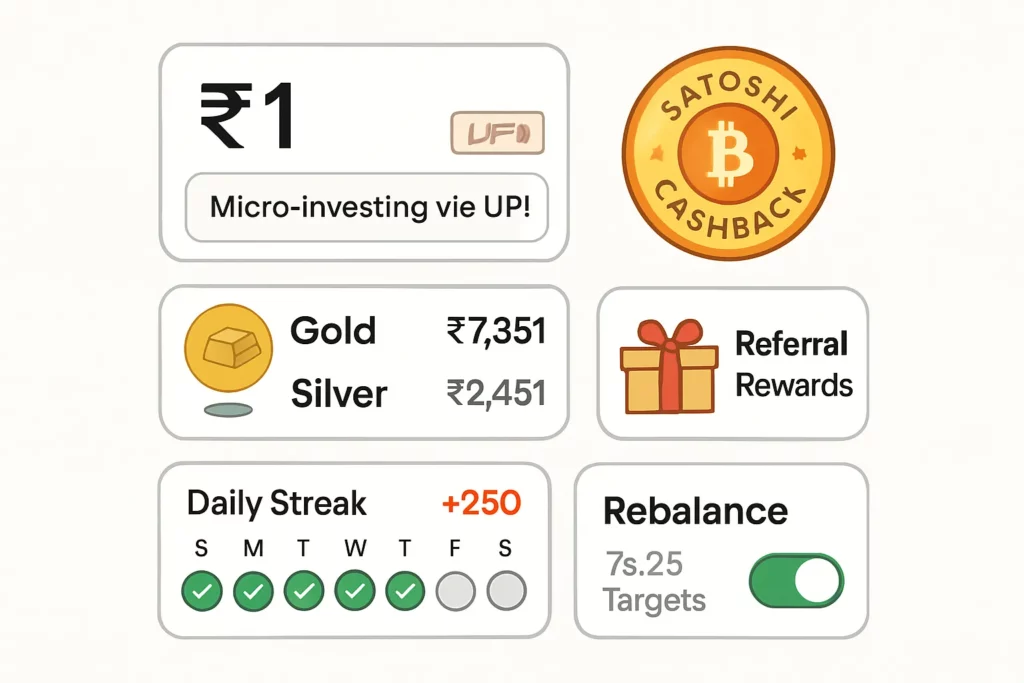

- Digital gold/silver (OroPocket): Mobile-first, UPI-enabled, start from ₹1, instant buy/sell, insured vaulting. Earn free Bitcoin rewards on every purchase – a unique edge vs ETF/physical routes.

- Physical coins/jewellery: Tangible, gifting-friendly, but higher making/spread costs and storage hassles; jewellery is consumption-first, not investment-first.

“SGBs pay a fixed 2.50% annual interest (taxable), while capital gains on redemption at maturity (for individuals) are exempt from tax.” – Source

Cost, liquidity, storage, rewards, and tax (high-level)

- SGBs: No storage costs, but secondary-market liquidity can vary; best held to maturity to enjoy tax exemption on redemption. Coupon is taxable.

- ETFs (Gold/Silver): Brokerage + TER apply; high liquidity, ideal for periodic rebalancing and tactical moves.

- OroPocket digital metals: No demat needed, micro-investing from ₹1 via UPI, 24K insured vaulting, instant liquidity, plus Bitcoin cashback, daily streaks, and gamified rewards. Convenient for building habits and topping up during rebalances.

- Physical: Making charges/spreads and storage risk; better for cultural use and gifting than compounding.

Fit to goals

- Long-term hedge: Anchor with SGBs and/or OroPocket digital gold as the core.

- Tactical silver: Use a Silver ETF or OroPocket silver for small cyclical tilts; rebalance to target weights annually.

- Habit + convenience: SIP in ETFs or automate daily/weekly buys on OroPocket; easy UPI flows help you stay consistent.

- Digital gold vs ETF: Prefer ETFs for market-hours trading and rule-based SIPs; choose OroPocket for ₹1 micro-buys, instant UPI, insured storage, and Bitcoin rewards.

Ways to Buy Gold & Silver in India – At a Glance

| Instrument | Minimum investment | Liquidity | Typical costs/charges | Storage/insurance | Special perks | Tax notes (high-level) |

|---|---|---|---|---|---|---|

| SGB | ~1 gram equivalent at issue | Primary in tranches; secondary varies; best held to maturity | No making; issue/exit price spreads | No storage cost | 2.5% annual interest | Coupon taxable; capital gains on redemption at maturity exempt for individuals (consult a tax pro) |

| Gold ETF | 1 unit (typically ~0.01–1 gram) | High (exchange hours) | Brokerage + TER | No storage by investor | SIPs, easy rebalancing | Debt-like tax treatment; check current rules (consult a tax pro) |

| Silver ETF | 1 unit | High (exchange hours) | Brokerage + TER | No storage by investor | Regulated exposure to silver | Debt-like tax treatment; check current rules (consult a tax pro) |

| Digital Gold/Silver (OroPocket) | Start from ₹1 | Instant in-app buy/sell | Small platform spread | 24K insured vaulting | Bitcoin rewards, streaks, spin-to-win, referrals | Treated as capital asset; gains taxable per holding period (consult a tax pro) |

| Physical (coins/jewellery) | Varies by product | Jeweller buyback varies | Making/spread + purity charges | Home/locker costs and risk | Tangible, gifting | Capital gains per holding period; documentation varies (consult a tax pro) |

Step-by-step: Build your balanced metals portfolio on OroPocket

1) Decide your sleeve and split

- Pick your metals sleeve as a % of your total portfolio. Example: 15% in metals with a 75:25 gold:silver split.

- Keep silver capped at 30–35% of the sleeve for risk control.

2) Set SIPs with UPI (start at ₹1)

- Daily/weekly SIPs build habit and smooth entry – how to invest in gold and silver with ₹1:

- ₹50/day: ~₹35 to gold, ~₹15 to silver (75:25)

- ₹100/day: ~₹75 to gold, ~₹25 to silver

- Small, frequent buys compound fast when paired with rebalancing and rewards.

3) Automate discipline, get rewarded

- Bitcoin cashback (Satoshis) on every buy.

- Daily streaks with bonus rewards every 5 consecutive days.

- Spin-to-win and referral bonuses (you + friend earn Satoshis and a free spin).

4) Rebalance like a pro

- Quarterly check; apply the 5/25 rule inside your metals sleeve.

- Use top-ups/SIPs to correct drifts first; only sell if still off-target.

- Keep the base split (e.g., 75:25) unless a small, rule-based tilt is triggered.

5) Use case: gifting and micro-goals

- Create Diwali/Dhanteras goals and automate daily buys.

- Treat digital gold as an emergency hedge.

- Gift gold to family and friends directly from the app.

Trust and security

- 24K pure gold; fully insured vaults with authorized bullion partners.

- RBI-compliant, instant UPI payments, no demat required.

- Transparent pricing, no making charges or locker headaches.

Make OroPocket your daily system for OroPocket gold and silver investment – simple SIPs, automated discipline, and rewards that keep you consistent.

Case studies: 3 quick scenarios (SIPs, targets, and outcomes)

A) First-time investor (₹2,000/month total investing)

- Setup: Metals sleeve 12% of portfolio (₹240/month)

- Split: Gold ₹180, Silver ₹60 (75:25)

- SIP cadence: ₹6/day (₹4.5 gold, ₹1.5 silver) to build habit

- Rebalancing: Annual calendar check; use top-ups first

- Outcome you’re aiming for: A simple SIP in gold and silver that adds an inflation hedge and reduces portfolio swings – without changing your core equity plan

B) Salaried professional (₹10,000/month)

- Setup: Metals sleeve 15% of portfolio (₹1,500/month)

- Split: Gold ₹1,125, Silver ₹375 (75:25)

- SIP cadence: Weekly SIPs; add SGBs when available for the core gold allocation

- Rebalancing: Annual calendar + 5/25 band; redirect SIPs to underweight metal post big moves

- Outcome you’re aiming for: A gold-heavy ballast with a small silver kicker; smoother drawdowns + tax-efficient core via SGBs; tactical flexibility via digital gold/silver or ETFs

C) Bitcoin‑curious but cautious (₹5,000/month)

- Setup: Metals sleeve 15% of portfolio (₹750/month) via OroPocket to earn Satoshi rewards

- Split: Gold ₹560, Silver ₹190 (≈75:25)

- SIP cadence: Daily ₹25 (₹18.75 gold, ₹6.25 silver); maintain streaks to boost rewards

- Rebalancing: Quarterly top-ups; if drift persists, small one-time sell to snap back

- Outcome you’re aiming for: Exposure to gold and silver with steady habit formation, plus Bitcoin rewards – keeping risk moderate while compounding consistently

What to watch

- Deviation from targets: If gold/silver drift >5 percentage points or >25% relative to target, rebalance.

- Use top-ups before selling: Redirect SIPs toward the underweight metal first to minimize taxes and costs.

- Cap silver: Keep silver within 10–30% of the metals sleeve if volatility stresses you.

- Stay systematic: These gold & silver investments examples work best with fixed SIPs, periodic checks, and disciplined rebalancing – not market timing.

Risks, FAQs, and mistakes to avoid

Key risks

- Silver volatility: Silver can swing harder than gold – big upcycles and sharp reversals. Keep it a smaller slice of your metals sleeve.

- Tracking error (ETFs): Gold/Silver ETFs may deviate from spot prices due to expenses, liquidity, and replication methods – expect small gaps.

- Liquidity windows (SGB): SGBs are best held to maturity. Interim liquidity depends on exchange trading; prices may deviate from intrinsic value.

- Taxation changes: Tax rules on debt-like funds/ETFs and digital assets can change. Always check the latest guidance.

- Currency moves: USD/INR can lift or drag domestic prices independent of global moves.

- Platform risk (digital metals): Choose regulated partners with insured vaults and transparent audits.

Common mistakes

- Oversizing silver: Chasing recent outperformance and pushing silver beyond 30–35% of the metals sleeve raises drawdown risk.

- Skipping rebalances: Not trimming the winner and topping up the laggard defeats the point of diversification.

- Timing everything: All‑in/all‑out calls on headlines often backfire. Small SIPs plus rules-based rebalancing work better.

- Ignoring costs/spreads: Brokerage, TER, platform spreads, and taxes add up – minimize churn, batch sells, and prefer SIP/top‑ups.

- Mixing goals: Jewellery is a consumption good (making charges, purity issues). Keep investing separate from gifting/cultural buys.

Quick FAQs

- How much to start with?

- Start small. A typical range is 10–20% metals sleeve within your total portfolio (gold‑dominant). You can begin with ₹1 on OroPocket and scale via SIPs.

- Is digital gold safe?

- On OroPocket, you buy 24K pure, 100% insured vaulted metal via authorized partners, with instant UPI payments. Still, treat it as an investment: diversify and follow your allocation rules.

- How often to rebalance?

- Simple rule: Annual calendar check plus a 5/25 threshold inside your metals sleeve (rebalance if absolute drift >5 percentage points or relative drift >25% of target).

- What if prices crash?

- Stick to plan. Direct new SIPs/top‑ups into the underweight metal first, then do a minimal one‑time sell if still off-target. Avoid panic selling and keep silver capped if volatility stresses you.

- Should I invest in gold and silver if I already hold equities?

- Yes – if you want a volatility buffer and inflation hedge. A gold‑heavy sleeve with a small silver kicker can smooth drawdowns and improve the odds of staying invested.

Compliance note

- This is educational content, not investment/tax advice. Your situation is unique – consult a qualified advisor and a tax professional before investing.

For anyone wondering “should I invest in gold and silver” and the broader risks of gold and silver investment: keep it gold‑dominant, start small with SIPs, use clear rebalance rules, and minimize costs.

Conclusion: Start small, stay consistent – build your metals sleeve on OroPocket

- Recap: Use gold for stability and inflation hedging; let silver add selective, industrial‑cycle upside. Keep silver small for most investors – typically 10–30% of your metals sleeve – to manage volatility while preserving growth potential.

- Action steps:

- Pick your sleeve size within your total portfolio (commonly 10–20%).

- Set a gold‑dominant split (e.g., 75:25).

- Start a SIP via UPI (even ₹1/day works). Automate daily/weekly buys.

- Lock targets, review quarterly, rebalance using the 5/25 rule.

- Why OroPocket:

- ₹1 entry point so anyone can begin immediately.

- 24K pure gold, fully insured vaults, RBI‑compliant partners.

- Instant UPI payments and seamless buy/sell.

- Free Bitcoin (Satoshis) on every purchase, daily streaks, spin‑to‑win, and referral rewards – habit‑forming nudges that help you stay consistent.

- Download OroPocket on iOS or Android and set your first ₹1 SIP today. Build your gold‑first, silver‑smart metals sleeve the modern way – simply, safely, and with rewards that keep you on track.