Are gold coins a good investment in India? Pros, cons, and alternatives

Are gold coins a good investment in India? The short answer

Quick take: Yes for specific goals; not always the most cost-efficient

- Gold coins are great for gifting, small-ticket saving, and quick liquidity.

- But premiums, GST, and buyback spreads can eat into returns.

- If your goal is pure investment efficiency, alternatives like digital gold, ETFs, or SGBs may suit you better.

“Digital payments in India grew at a 61% CAGR in volume over the past five years, propelled by UPI.” – Source

This shift to UPI-native behavior is powering micro-investing and digital gold adoption – an important context when weighing coins vs digital options.

Who should consider gold coins

- Gifting during festivals/weddings

- Emergency buffer you can liquidate fast

- Small, occasional purchases (1–10 g) with emotional value

When coins fall short

- Long holding periods (SGBs may offer 2.5% interest + tax benefits on redemption)

- Systematic monthly investing (digital gold/ETFs are simpler, cost-efficient)

- Large allocations (bars/digital gold reduce per-gram cost)

Alternatives at a glance (deep-dive later)

- Coins vs bars vs digital gold vs ETFs vs SGBs vs jewellery

- What you pay (premiums, GST), what you get (purity, buyback, tax, liquidity)

Prefer efficiency over sentiment? With OroPocket, you can start buying gold from ₹1 via UPI, earn free Bitcoin on every purchase, and build a habit with daily streak rewards. Download the OroPocket app: https://oropocket.com/app

SEO tip for readers: If you’re searching “is buying gold coin a good investment” or “gold coin investment,” remember coins shine for gifting and liquidity, while digital gold and SGBs often win on costs and taxes when buying gold as investment.

Gold coins 101: types, purity, denominations, hallmarking (India-specific)

Types you’ll see in India

- Bullion coins (investment-grade, 24K/999)

- 22K/916 coins from jewellers (often for gifting)

- Government-minted/sovereign-themed coins

- Private-mint coins (MMTC-PAMP, authorized refineries)

Purity & markings

- 24K/999 vs 22K/916: investment vs wearability

- How to read purity stamps, mint marks, and weights (1 g, 2 g, 5 g, 8 g, 10 g, 20 g, 50 g)

Hallmarking & HUID (what to check before you buy)

- BIS hallmark symbols and HUID – why they matter

- Tamper-evident packaging and matching invoice details

“BIS hallmarking certifies gold purity in India and assigns each item a unique HUID for traceability and consumer verification.” – Source

Where coins come from – and why buyback policies differ

- Jewellers vs banks vs mints vs online platforms

- Why banks typically don’t buy back coins they sell

- Why explicit buyback terms matter for your exit

Prefer to avoid making charges and resale uncertainty? With OroPocket, buy 24K pure digital gold from ₹1 via UPI, and earn free Bitcoin on every purchase. Download now: https://oropocket.com/app

What drives a gold coin’s price in India: premiums, charges, spreads, and buyback

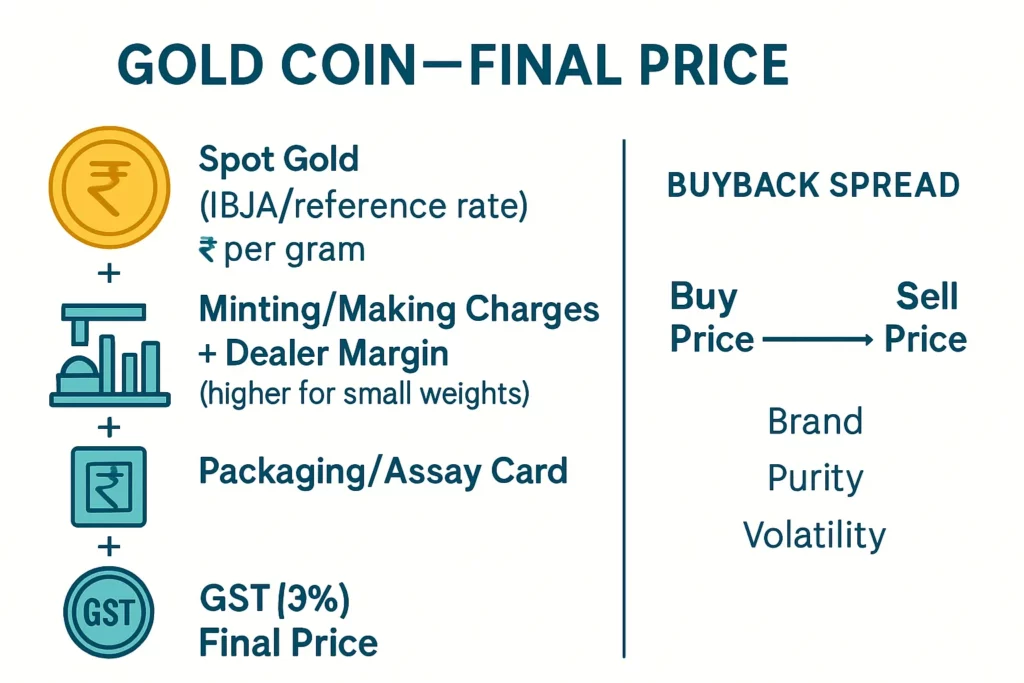

The price stack (beyond spot gold)

- Spot gold (IBJA/reference rate)

- Minting/making charges and dealer margin (higher for small weights)

- Packaging/assay card costs

- GST (levied on purchase)

Size matters

- Why 1–2 g coins carry higher per-gram premiums than 10–20 g

- Sweet spots for investors (5–10 g+)

The hidden cost: the spread

- Buy price vs sell price gap (how much you actually lose if you sell back same day)

- What influences spreads: brand, purity, packaging, market volatility

Buyback in practice

- Typical deductions, KYC needs, and invoice checks

- Why bank-sold coins are hard to sell back

- Practical tip: always get buyback terms in writing

Prefer fewer premiums and tighter spreads? With OroPocket, you buy 24K digital gold from ₹1 via UPI, earn free Bitcoin on every purchase, and enjoy instant liquidity inside the app. Try it now: https://oropocket.com/app

Coins vs bars vs digital gold vs ETFs vs SGBs vs jewellery: costs, liquidity, tax

What matters for investors

- Total cost of ownership (premiums, GST, brokerage/expense ratios)

- Liquidity and exit spreads

- Purity, storage, and risk

- Taxation and lock-ins

“Gold purchases in India attract 3% GST.” – Source

Quick comparison

- When each option shines – and when it doesn’t

- How much to allocate if you hold multiple gold formats

| Instrument | Minimum investment | Typical premium/fees | GST/brokerage | Storage need | Buyback/exit | Liquidity speed | Tax treatment | Ideal use-case |

|---|---|---|---|---|---|---|---|---|

| Coins | 0.5–1 g | Higher for small coins (making/minting, dealer margin) | 3% GST on metal value; packaging may apply | Home locker/bank locker | Depends on jeweller; banks often don’t buy back | Same day at jeweller (subject to spread/KYC) | Capital gains as per current rules | Gifting, small-ticket saving, quick emergency liquidity |

| Bars | 5–20 g+ | Lower per-gram vs coins; better for larger sizes | 3% GST on metal value | Home/bank locker | Fewer buyers than coins; check policies | Moderate; depends on brand and buyer | Capital gains as per current rules | Larger allocations where per-gram efficiency matters |

| Digital Gold (e.g., OroPocket) | ₹1 | Platform spread; no making charges | GST applicable on purchase | Vaulted, insured by provider | Sell back in-app at platform price | Instant (in-app) | Capital gains as per current rules | Micro-investing, UPI-native convenience, habit-building |

| Gold ETFs | 1 unit (broker-minimum) | Expense ratio (~0.4–1.0% p.a.); brokerage | No GST on ETF units; brokerage/SEBI charges apply | Demat/brokerage account | Exchange-traded; market price + bid-ask spread | T+2 settlement (exchange liquidity) | Capital gains as per current rules for mutual fund units | SIP-friendly, low operational friction, portfolio allocation |

| SGBs | 1 g | No premium; issue price often with online discount | No GST; no brokerage for primary | Demat/certificates; no storage risk | 8-year maturity; early exit via exchange after 5 years | Low-to-moderate liquidity on exchange; full redemption at maturity | 2.5% interest taxable; capital gains on redemption by individuals is tax-exempt | Long-term investors optimizing taxes and passive interest |

| Jewellery | Variable (often 1 g+) | High making + wastage charges; design premiums | 3% GST on gold + GST on making charges (as applicable) | Home/bank locker; wearability risk | Resale deductions common; style/stone deductions | Same day (local jeweller), price haircut likely | Capital gains as per current rules | Wear-and-invest; cultural/festive use with emotional value |

How to allocate if you hold multiple formats:

- For pure investment efficiency: prioritize SGBs (long-term, tax edge) + ETFs (SIP/liquidity), then digital gold for micro-investing and instant liquidity.

- Keep coins/jewellery for gifting and sentiment; limit to a smaller share due to premiums and resale spreads.

- Bars can complement coins for larger physical allocations to reduce per-gram costs.

Want low costs, instant liquidity, and rewards? Start buying 24K digital gold from ₹1 on OroPocket via UPI – and earn free Bitcoin on every purchase. Download the app: https://oropocket.com/app

Pros and cons of gold coin investment (India)

Pros

- Tangible, easy to gift, universally recognized

- High purity when 24K/999; simple to understand

- Quick liquidation at jewellers; can be used as collateral with many lenders

Cons

- Premiums + spreads reduce effective returns vs alternatives

- Storage and security cost/effort

- Buyback uncertainties (brand/bank policies)

- Counterfeit risk without proper hallmark/HUID and packaging

“Gold’s low-to-negative correlation with equities and major currencies helps diversify portfolios and reduce overall volatility.” – Source

Diversification angle

- Coins can sit alongside more efficient formats (SGBs/ETFs/digital gold) to balance sentiment and liquidity needs.

- Keep overall gold allocation around 5–15% of total assets based on risk appetite and time horizon.

- Use coins for gifting and emergency liquidity; use SGBs/ETFs/digital gold for long-term, cost-efficient exposure.

Prefer low effort and tight spreads? Start with OroPocket: buy 24K digital gold from ₹1 via UPI and earn free Bitcoin on every purchase. Get the app: https://oropocket.com/app

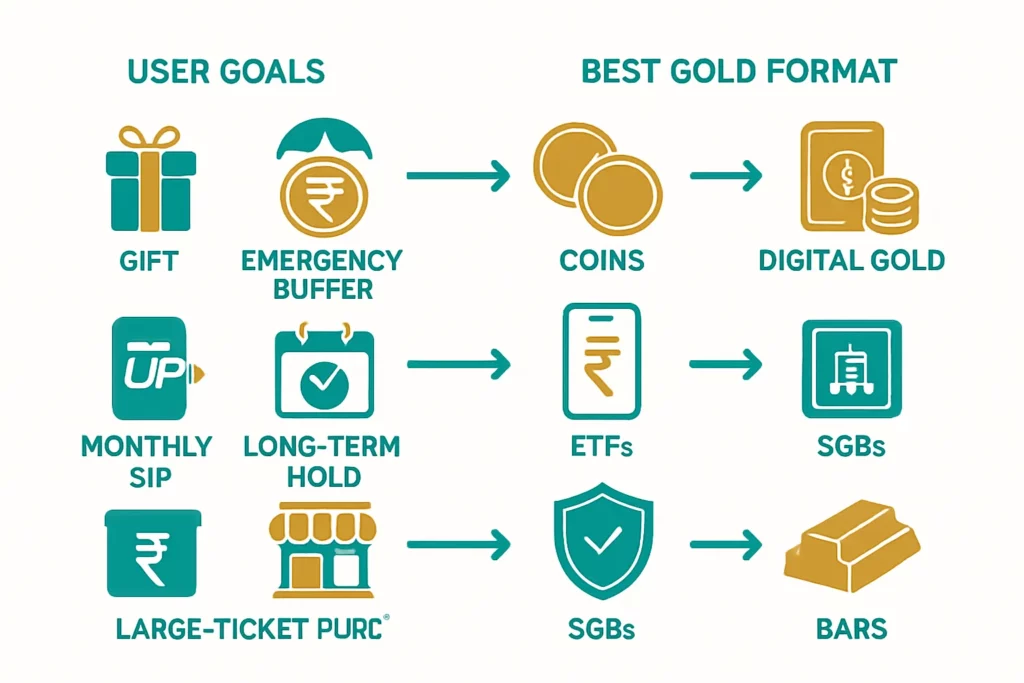

When gold coins make sense – and when another format is smarter

Best-fit scenarios for coins

- Cultural gifting (Diwali, Dhanteras, weddings)

- Small, occasional purchases (1–10 g) you want to physically hold

- Emergency buffer you can liquidate at a local jeweller

Better alternatives by goal

- Long-term compounding with tax efficiency: SGBs (2.5% interest + capital gains tax exemption at maturity)

- SIP-style investing with instant liquidity: digital gold or ETFs

- Large-ticket exposure with lower premiums: bars/digital gold

Practical takeaways

- Decide by time horizon, ticket size, and need for physical ownership

Prefer a modern, cost-efficient route? With OroPocket, start a gold SIP from ₹1 via UPI, earn free Bitcoin on every purchase, and access instant liquidity. Download the app: https://oropocket.com/app

How to buy gold coins the smart way: a 10‑point checklist

The checklist

- Prefer 24K/999 bullion coins for investing; 22K/916 is fine for gifting.

- Look for BIS hallmark + HUID on the coin and invoice.

- Pick tamper-evident assay packaging; avoid repacked/open coins.

- Ask the seller’s written buyback policy (deduction %, ID proof, time limits).

- Choose 5–10 g+ weights to reduce per-gram premium.

- Compare final bill-to-IBJA rate; negotiate premiums.

- Avoid numismatic/collectible coins for pure investing.

- Keep invoice, HUID, and payment proof (UPI/card) safe.

- Plan storage: home safe or bank locker; consider insurance.

- Don’t buy from banks if you may need buyback; prefer jewellers/mints/platforms with clear exit.

Ready to complement your gold coin investment with a low-cost, liquid option? Start a gold SIP from ₹1 on OroPocket via UPI and earn free Bitcoin on every purchase. Download the app: https://oropocket.com/app

Taxes, KYC, and liquidity: what to expect when you buy or sell gold in India

Taxes and costs

- GST on purchase (coins, bars, jewellery)

- Coins/bars: 3% GST on metal value.

- Jewellery: 3% GST on gold value + GST on making charges as applicable.

- Digital gold: Platforms generally levy 3% GST as underlying bullion is purchased.

- ETFs/SGBs: No GST on buying units/bonds.

- Capital gains tax: STCG vs LTCG (with indexation) on physical/digital gold and ETFs

- Physical gold (coins/bars/jewellery) and digital gold:

- Held ≤ 36 months: STCG taxed at slab rate.

- Held > 36 months: LTCG at 20% with indexation.

- Gold ETFs:

- Post–1 Apr 2023 units are generally taxed at slab rates (no indexation). Legacy holdings may differ.

- Physical gold (coins/bars/jewellery) and digital gold:

- SGB tax nuance:

- 2.5% annual interest is taxable at slab rate.

- Capital gains on redemption at maturity (8 years) are exempt for individuals. Early sale on exchange is taxable as capital gains.

KYC & limits

- PAN typically required for cash transactions ≥ ₹2 lakh; digital platforms/brokers/SGB require standard KYC (PAN, Aadhaar/CKYC).

- Always insist on a proper invoice. For physical coins/jewellery, verify BIS hallmark + HUID on the item and invoice.

Liquidity realities

- Coins/bars/jewellery: Same-day at jewellers, subject to spreads, purity checks, and ID/invoice. Banks usually don’t buy back coins they sell.

- Digital gold: Instant in-app sale at the platform quote; funds typically settle instantly to wallet/bank per provider.

- Gold ETFs: Market hours liquidity; settlement usually T+2; subject to bid-ask spreads and market depth.

- SGBs: Best held to maturity for tax-free redemption; early exits via RBI windows after year 5 or via exchange (liquidity varies).

| Instrument | GST/applicable charges | Income/tax treatment | Lock-in | Exit time | Documentation needed |

|---|---|---|---|---|---|

| Coins | 3% GST on metal value; minting/premium extra | STCG slab (≤36m); LTCG 20% with indexation (>36m) | None | Same day at jeweller (subject to spread) | Invoice, PAN for large cash, BIS hallmark + HUID |

| Bars | 3% GST on metal value; lower premium vs coins (by weight) | STCG slab; LTCG 20% with indexation | None | Same day/quick, depending on buyer | Invoice, PAN for large cash, purity certificate |

| Digital Gold | Typically 3% GST (platform-dependent) | Treated like physical gold: STCG slab; LTCG 20% with indexation | None | Instant in-app | KYC on platform (PAN, Aadhaar), transaction records |

| Gold ETFs | No GST on units; brokerage + exchange fees | Post–Apr’23: taxed at slab rates (no indexation) for most units; legacy holdings may differ | None | T+2 (exchange) | Demat + broker KYC (PAN, Aadhaar) |

| SGBs | No GST; no brokerage in primary issue | 2.5% interest taxable; capital gains at maturity exempt; early sale taxable | 8 years (early exit after year 5 via RBI or anytime on exchange) | Maturity redemption; exchange sale timing varies | KYC (PAN, Aadhaar); Demat optional (certificate otherwise) |

| Jewellery | 3% GST on gold + GST on making charges (as applicable) | STCG slab; LTCG 20% with indexation | None | Same day at jeweller; deductions likely | Invoice, PAN for large cash, hallmark/HUID details |

Prefer clean KYC, instant liquidity, and low friction? Buy 24K digital gold from ₹1 on OroPocket via UPI, earn free Bitcoin on every purchase, and cash out anytime. Download the app: https://oropocket.com/app

Prefer simple, low‑effort gold investing? Try OroPocket (digital 24K gold + free Bitcoin rewards)

Why OroPocket is different

- Buy/sell 24K pure gold from ₹1 via UPI in under 30 seconds

- Earn free Bitcoin (Satoshi) on every purchase; tiered rewards + daily streak bonuses

- Gamified features: Spin-to-Win, streaks, referrals (100 Satoshi + free spin for friends who join)

- Send gold instantly to friends/family; perfect for gifting

Cost, security, and compliance

- RBI-compliant framework; partnered with authorized bullion providers

- Gold is 100% insured and securely vaulted; you own allocable, real metal

- No storage hassles, no making charges; transparent pricing

Coins vs OroPocket – who should pick what?

- Want physical gifting/emergency cash-out at a local jeweller? Coins.

- Want frictionless SIP-style investing with rewards and instant liquidity? OroPocket.

- Want to start tiny and build a habit? ₹1 entry with daily streaks on OroPocket.

How to start in 3 steps

- Download OroPocket app (iOS/Android)

- Complete quick KYC; add UPI

- Buy your first ₹1 of gold and earn Bitcoin rewards

Get started now: https://oropocket.com/app

Conclusion: Are gold coins a good investment in India? Your next step

The bottom line

- Coins are excellent for gifting, small-ticket tangible savings, and quick local liquidity.

- For pure investing efficiency, many Indians get lower costs, better convenience, and habit-building features with digital gold, ETFs, or SGBs.

- If you’re asking “is buying gold coin a good investment,” the answer is: yes for emotion and emergency use; consider digital formats for cost-effective, long-term “buying gold as investment.”

Take action

- Prefer simple, SIP-friendly gold coin investment alternatives with instant liquidity and rewards? Start with OroPocket.

- If you value simplicity, micro-investing from ₹1, and Bitcoin rewards on every purchase, download OroPocket now and start building your gold stack today.

- Get the app: https://oropocket.com/app