Compounding Interest: How It Works (With Simple Examples)

Compounding Interest: How It Works (With Simple Examples)

If you’re saving money in India – whether it’s ₹100 a week, a monthly SIP, or a small stash you keep “for later” – your biggest enemy isn’t a bad stock pick.

It’s time wasted.

Because compounding is brutally simple:

-

Start early → money snowballs

-

Start late → you work harder for the same result

-

Withdraw often → the snowball melts

And here’s the good news: you don’t need big capital to use compounding. With OroPocket, you can start with ₹1, pay instantly via UPI, and get free Bitcoin (Satoshi) cashback on every gold/silver buy – so you’re compounding habits and stacking two assets at once.

“Compound interest is the process of earning interest on both the initial principal and the accumulated interest from previous periods.” – Source

What Is Compounding Interest (Plain English)

Compounding interest means you earn returns on:

-

your original money (principal), and

-

the returns you already earned earlier.

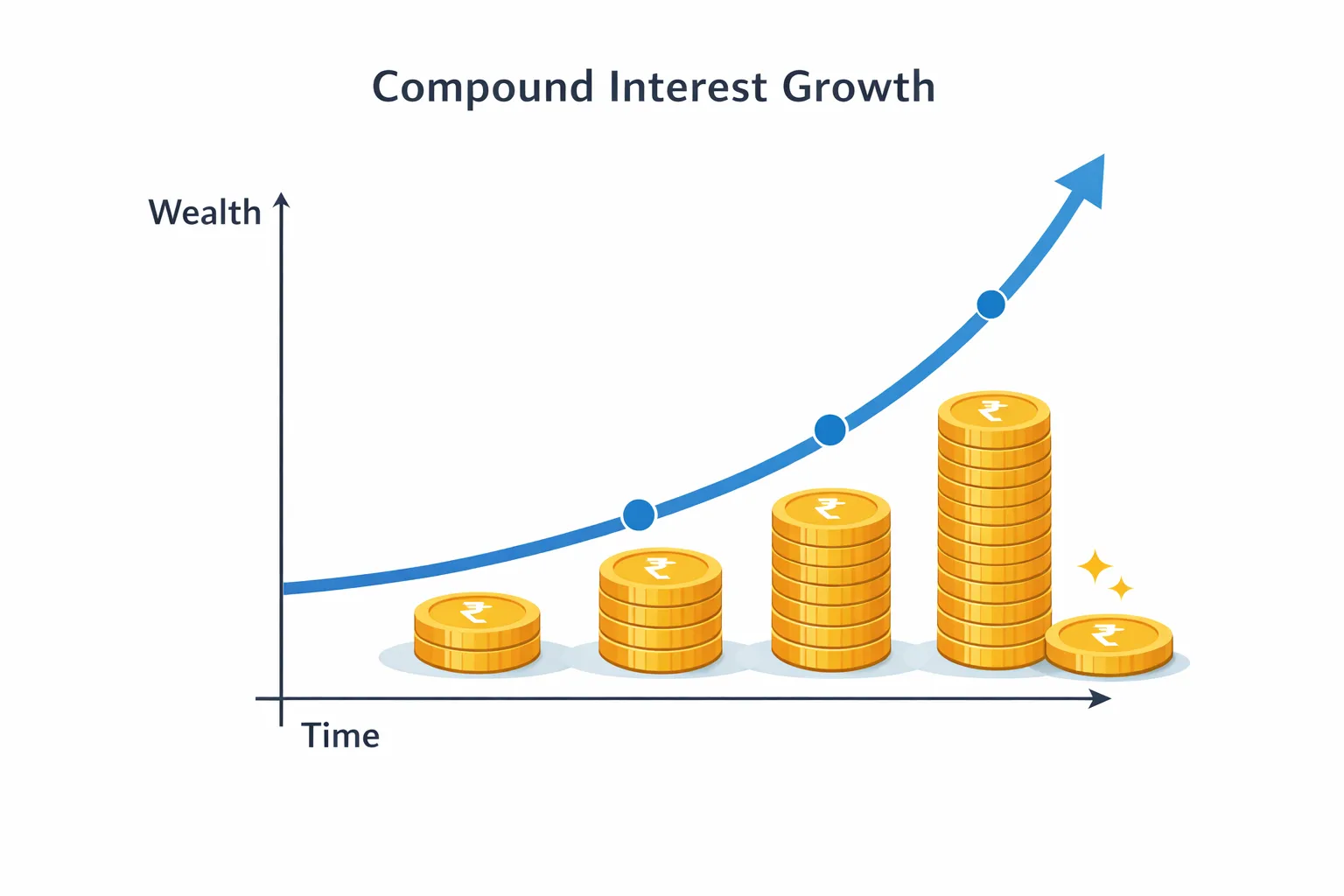

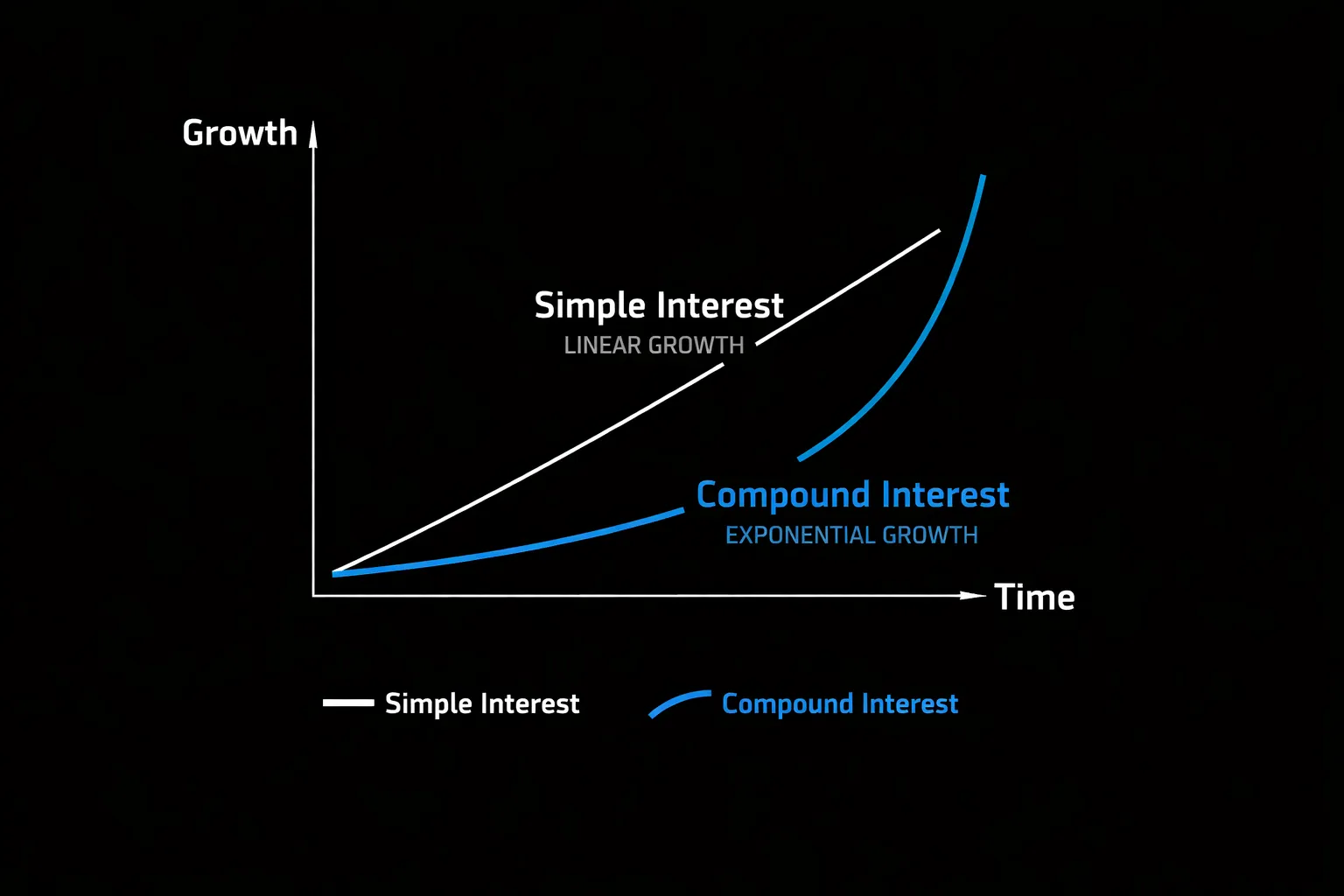

So every period, your “base” gets bigger. That’s why compounding creates exponential growth – the curve bends upward over time.

Simple vs Compound Interest (1-minute clarity)

-

Simple interest: interest is calculated only on the original principal

-

Compound interest: interest is calculated on principal + previous interest

The Compound Interest Formula (So You Can Calculate Anything)

Amount formula

[ A = P times left(1 + frac{r}{n}right)^{n times t} ]

Where:

-

A = final amount

-

P = starting principal

-

r = annual interest rate (decimal; 10% = 0.10)

-

n = compounding frequency per year (1 yearly, 12 monthly, 365 daily)

-

t = time in years

Compound interest earned

[ CI = A – P ]

Simple Example: ₹10,000 at 10% for 3 Years (Compounded Annually)

Let’s keep it simple: P = ₹10,000, r = 10%, n = 1, t = 3

[ A = 10,000 times (1.10)^3 = 10,000 times 1.331 = ₹13,310 ]

So:

-

Final amount: ₹13,310

-

Compound interest earned: ₹3,310

Now compare to simple interest:

|

Method |

Interest after 3 years |

Amount after 3 years |

|---|---|---|

|

Simple interest |

₹3,000 |

₹13,000 |

|

Compound interest |

₹3,310 |

₹13,310 |

The difference looks small in 3 years. Over 10–20 years, this gap becomes massive.

Why Compounding Frequency Matters (Daily vs Monthly vs Yearly)

The more frequently returns are added back, the faster the money grows (even if slightly).

Assume:

-

Principal = ₹1,00,000

-

Rate = 10% p.a.

-

Time = 10 years

|

Compounding |

Approx. Amount After 10 Years |

|---|---|

|

Yearly (n=1) |

₹2,59,374 |

|

Monthly (n=12) |

₹2,70,707 |

|

Daily (n=365) |

₹2,71,828 |

Key takeaway: Frequency helps – but time + consistency matter more than obsessing over daily vs monthly.

Compounding in Real Life (India): Savings, FD, SIP-Style Investing

1) Savings account compounding (the boring baseline)

Savings accounts may compound, but returns often struggle to beat inflation meaningfully. That’s why many people look for assets that historically protect purchasing power.

2) FD compounding (predictable, but capped)

FDs can compound, but your return is still limited to the FD rate, and taxes can reduce actual gains. If you’re deciding between the two, see: FD vs digital gold: which is better for Indians?

3) SIP-style investing (compounding meets consistency)

A SIP works because you keep adding money, and your older contributions keep compounding longer.

Even if you can only invest small amounts, doing it consistently is what unlocks the curve.

Compounding + Gold: Why Many Indians Use It as an Inflation Hedge

Gold has historically acted as a store of value – especially when prices rise and currency purchasing power drops.

“Between 2019 and 2024, gold prices in India increased by approximately 160%.” – Source

If you want to understand what actually moves the price, read: what drives gold prices and how to invest smarter

Where OroPocket Makes Compounding Easy (Even If You’re Starting From Zero)

Most people don’t fail at investing because they lack knowledge.

They fail because:

-

they wait for “the right time”

-

they think they need ₹10,000+ to start

-

they don’t feel rewarded, so they quit

OroPocket is designed to solve that.

OroPocket = habit-first compounding

What you get:

-

₹1 entry point: start instantly; no “minimum investment” anxiety

-

Instant UPI payments: buy gold/silver in under 30 seconds

-

Free Bitcoin on every purchase: you get Satoshi cashback, so you accumulate two assets

-

Gold + Bitcoin combination: stability + growth potential, without needing to “trade crypto”

-

Gamified investing: streaks, spin-to-win, tiered rewards that make you stay consistent

-

100% secure & compliant: RBI-compliant, insured vaulting, authorized bullion partners

-

Referral rewards: you and your friend earn 100 Satoshi + free spin

If you’re new, start with this beginner guide: how to invest in digital gold online in India (step-by-step)

A Quick Checklist to Maximize Compounding (Do This, Not “More Research”)

1) Start early (even with ₹1)

Time is the multiplier you can’t buy later.

2) Stay consistent (automate your behavior)

A small daily/weekly buy beats random big deposits.

3) Reinvest returns (don’t break the cycle)

Compounding works only when you keep the base growing.

4) Avoid unnecessary withdrawals

Every withdrawal resets momentum.

5) Pick assets you can hold through volatility

Gold helps many Indians stay invested because it feels stable and familiar.

Conclusion: Compounding Isn’t a Hack. It’s a Habit.

Compounding interest is what happens when money gets time, consistency, and reinvestment.

OroPocket makes those three things ridiculously easy – with ₹1 investing, instant UPI, and free Bitcoin rewards so you feel progress immediately.

Stop watching. Start growing.

Download OroPocket, start your ₹1 gold/silver streak today, and stack Satoshi automatically – every single time you invest.