Cost of Gold Per Gram: What Decides It in India (2026)

Cost of Gold Per Gram: What Decides It in India (2026)

If you’ve ever checked the cost of gold per gram in the morning and seen it change again by afternoon – you’re not alone. In India, “today’s gold rate” looks simple on the surface, but it’s actually a layered price made up of global markets, currency moves, taxes, purity, and local premiums.

This guide breaks it down in plain English so you can:

-

Understand what the per-gram price really includes

-

Compare rates across jewellers/apps without confusion

-

Avoid hidden markups and overpriced “deals”

-

Buy smarter – whether you’re buying jewellery, coins, or digital gold

What “gold price per gram” in India actually means

When you see a gold rate like “₹X per gram,” it usually refers to the base bullion price for a specific purity (often 24K), before jewellery-specific extras.

There are 3 different “prices” people confuse

|

Term |

What it usually means |

Who it applies to |

|---|---|---|

|

Spot price (global) |

International benchmark price (USD/ounce) |

Traders, bullion market |

|

Domestic bullion rate |

Spot + USD/INR + import costs/taxes |

Coins, bars, digital gold pricing |

|

Final jewellery price |

Bullion rate + making charges + GST on making + wastage/margins |

Jewellery buyers |

If you’re buying jewellery, don’t stop at “per gram.” You must calculate the all-in cost.

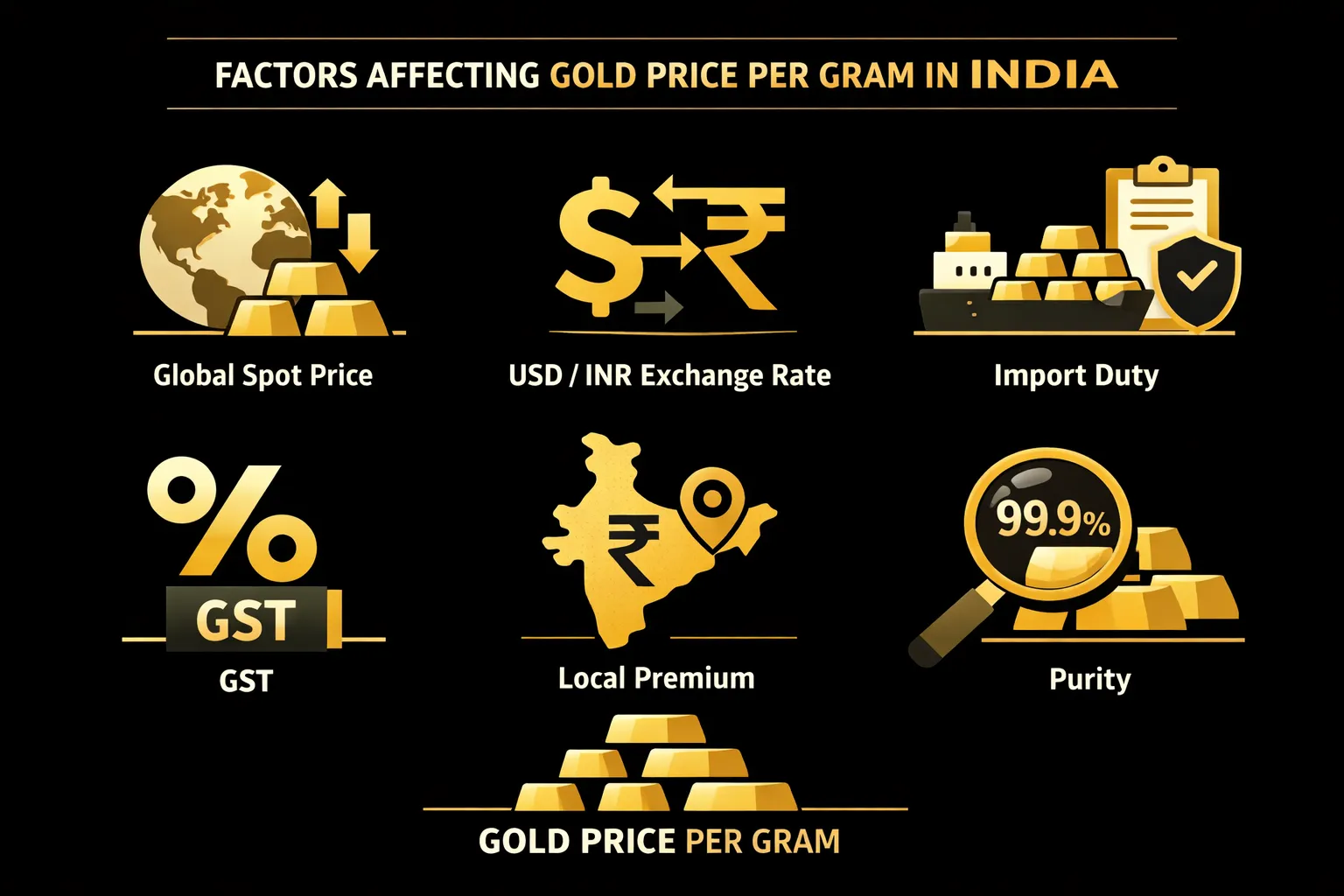

The 6 biggest factors that decide the cost of gold per gram (India, 2026)

1) Global gold spot price (USD)

Gold is priced globally (COMEX/LBMA) in USD per troy ounce.

So if global gold rises due to:

-

geopolitical risk

-

inflation fears

-

central bank buying

-

recession expectations

…the Indian price moves too (even before currency/taxes).

2) USD/INR exchange rate (rupee vs dollar)

India imports most of its gold. So the gold cost in India is basically:

Global gold price × USD/INR

Even if global gold is flat, a weaker rupee makes gold more expensive in India.

Shortcut to remember:

-

USD up vs INR → gold cost per gram usually up

-

INR strengthens → gold can cool off even if global is steady

3) Import duty on gold

Import duties create a built-in gap between global and Indian prices.

As of 2026, the import duty structure commonly cited is:

-

6% total on gold bullion (e.g., Basic Customs Duty + cess components)

“The import duty on gold bullion remains at 6%…” – Moneycontrol

This is one reason Indian gold can look “more expensive” than global charts.

4) GST (and why jewellery costs more than bullion)

GST affects gold in two major ways:

-

3% GST on gold value (coins/bars/jewellery)

-

5% GST on making charges (jewellery-specific)

“A uniform GST rate of 3% is applied to the value of gold…” – Axis Max Life

Meaning: two jewellery pieces with the same grams can still have different final costs depending on making charges.

5) Local premiums, supply-demand, and city-wise pricing

Your city and your seller can change the per-gram rate because of:

-

local demand (wedding season spikes)

-

transport/insurance costs

-

jeweller margins

-

inventory positioning (some sellers discount to move stock)

That’s why you’ll often see small differences between Mumbai/Delhi/Chennai etc., even on the same day.

6) Purity (24K vs 22K vs 18K) changes per-gram pricing

This is the most common “overpay” trap: comparing 24K rates with 22K buying.

|

Purity |

What it means |

Typical use |

|---|---|---|

|

24K |

~99.9% pure gold |

coins, bars, digital gold |

|

22K |

~91.6% gold + alloys |

most jewellery |

|

18K |

75% gold |

diamond jewellery, daily wear |

Quick conversion logic:

If 24K is ₹100 per unit, 22K is roughly ₹91.6 per unit (before other charges).

To go deeper on smart buying and practical steps, use this guide on how to buy gold in India without getting caught in pricing confusion.

The “hidden costs” that change your effective gold price per gram

Making charges (flat or percentage)

Jewellery is not priced like a commodity. You pay for craftsmanship.

-

High-design pieces → higher making %

-

Machine-made chains → lower making

-

Some jewellers quote low making but add higher wastage/margins

Wastage

Sometimes added openly, sometimes hidden inside making charges. Either way, it increases your effective cost per gram.

Buy-sell spread

The spread is the difference between what you pay and what you get when you sell back – important for:

-

coins bought from banks

-

some digital gold platforms

-

jewellery resale (often lowest recovery)

If you want a clear-eyed view of where costs can hide in online formats, read digital gold charges explained (spreads, GST, storage, selling fees).

Why gold keeps getting bought even when prices feel “high”

Because for many Indians, gold isn’t just tradition – it’s a survival strategy against inflation.

“Between 2020 and 2025, gold prices in India increased by approximately 160%…” – INDmoney

Translation: gold has historically punished “I’ll buy later” procrastination during inflationary cycles.

How OroPocket makes gold investing simpler (and more rewarding) in 2026

Most people don’t need another price chart. They need a system.

OroPocket is built for the real India:

-

students starting small

-

salaried professionals building discipline

-

small business owners parking profits safely

-

first-time investors who want clarity + speed

What you get with OroPocket (built for action, not hesitation)

-

Start from ₹1: no “minimum investment” excuses

-

Instant UPI payments: buy in under 30 seconds

-

Real 24K gold: securely vaulted + insured

-

Free Bitcoin on every purchase: yes, you earn Satoshi cashback while stacking gold

-

Gold + Bitcoin combo: stability + growth potential without “crypto trading headaches”

-

Gamified investing: streaks, spin-to-win, tiered rewards that build habits

-

Referral rewards: you and your friend get 100 Satoshi + a free spin

If you’re comparing options for 2026, this breakdown of the best app for investing in gold in India (fees, rewards, safety compared) will help you choose with confidence.

Conclusion: stop guessing the gold rate – start using it strategically

The cost of gold per gram in India isn’t random. It’s a formula: global price + USD/INR + duties + GST + local premium + purity.

Once you understand that, you stop overpaying, stop getting misled by “low per-gram” banners, and start buying with control.

Stop watching. Start growing.

Start with ₹1 on OroPocket, buy real 24K gold instantly via UPI, and earn free Bitcoin cashback on every purchase – so your savings doesn’t just sit there. It levels up.