Digital gold charges in India explained: spreads, GST, storage, and selling fees

1) Digital gold charges in India: why fees matter more than price

The promise vs. the reality

Digital gold makes saving effortless: start small, pay via UPI, track holdings in an app. But here’s the catch – cumulative digital gold charges can quietly eat into your returns. Even a small buy–sell spread, plus GST and storage, compounds over time. If you only watch the gold price and ignore fees, your net returns can disappoint – especially at exit when digital gold selling charges show up.

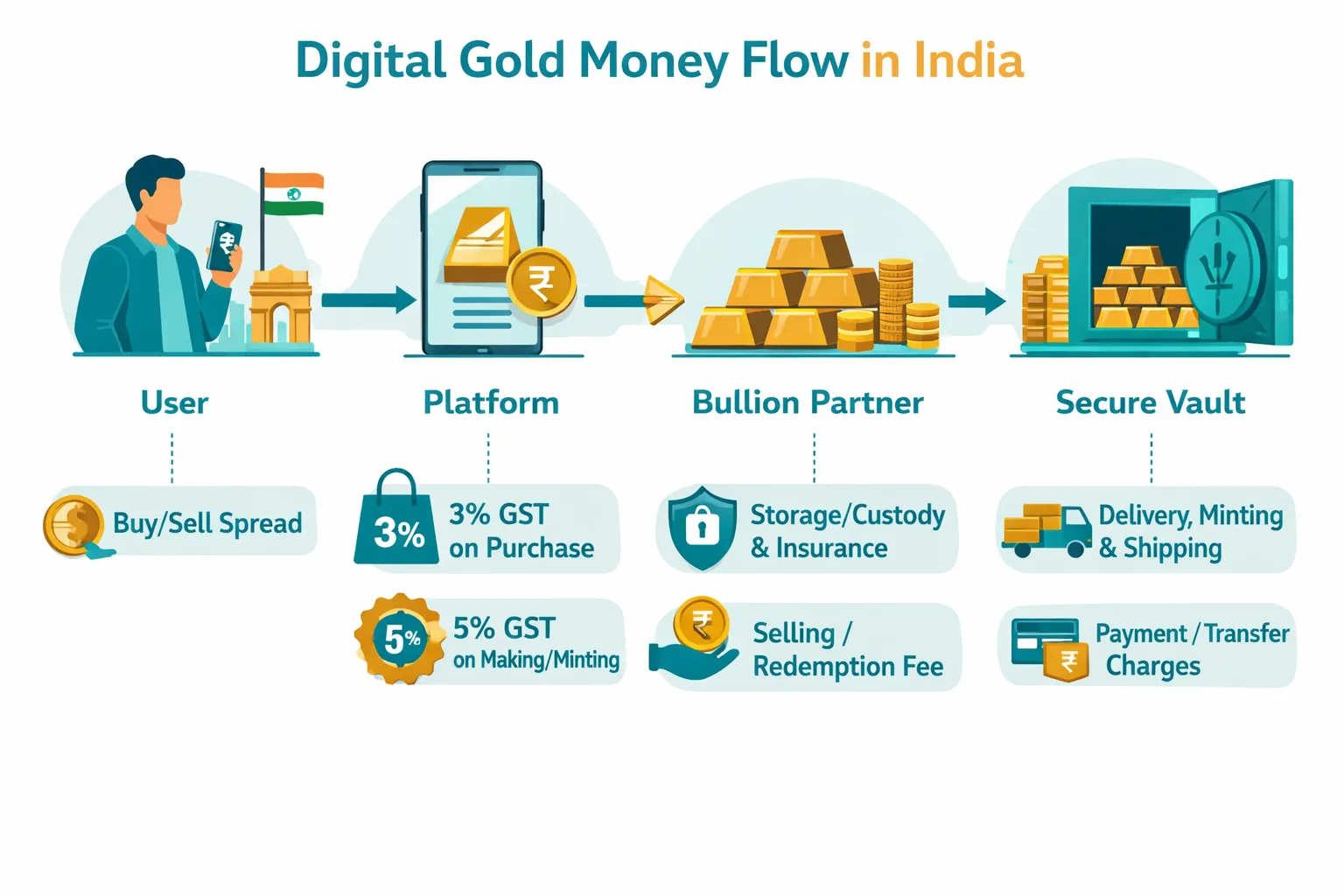

Where fees hide (quick map)

-

Buy–sell spread

-

GST on digital gold purchase and on services (storage, delivery/making)

-

Storage/custody and insurance

-

Selling/redemption fees

-

Delivery/minting and shipping

-

Payment/transfer charges (sometimes)

“On Indian digital gold platforms, the buy–sell spread typically ranges ~2–5% and can widen on volatile days.” – Source

What you’ll learn in this guide

-

Exactly what each charge means in plain English, with real-world examples.

-

How GST on goods vs services applies to a digital gold purchase.

-

Practical ways to cut spreads, reduce storage costs, and minimize digital gold selling charges.

-

Smart timing tips and tactics to keep more of your returns.

Quick glossary

-

Spread: The gap between the platform’s buy price and sell price for digital gold.

-

Markup: Any extra margin added over the reference/spot price you see quoted.

-

Storage fee: Ongoing vaulting/custody and insurance cost charged by the platform/partner.

-

Redemption fee: A fee charged when you sell or withdraw your gold holdings.

-

Making/minting charge: The fee to convert vaulted gold into coins/bars for delivery.

-

GST on goods vs services: 3% GST on gold value (goods); 5% or applicable GST on service components like making, delivery, storage.

Ready to keep more of your gains and still enjoy micro-investing? Download the OroPocket app and start smart, low-fee gold savings today: https://oropocket.com/app

2) Every digital gold charge decoded: spreads, GST, storage and selling fees

Buy–sell spread

-

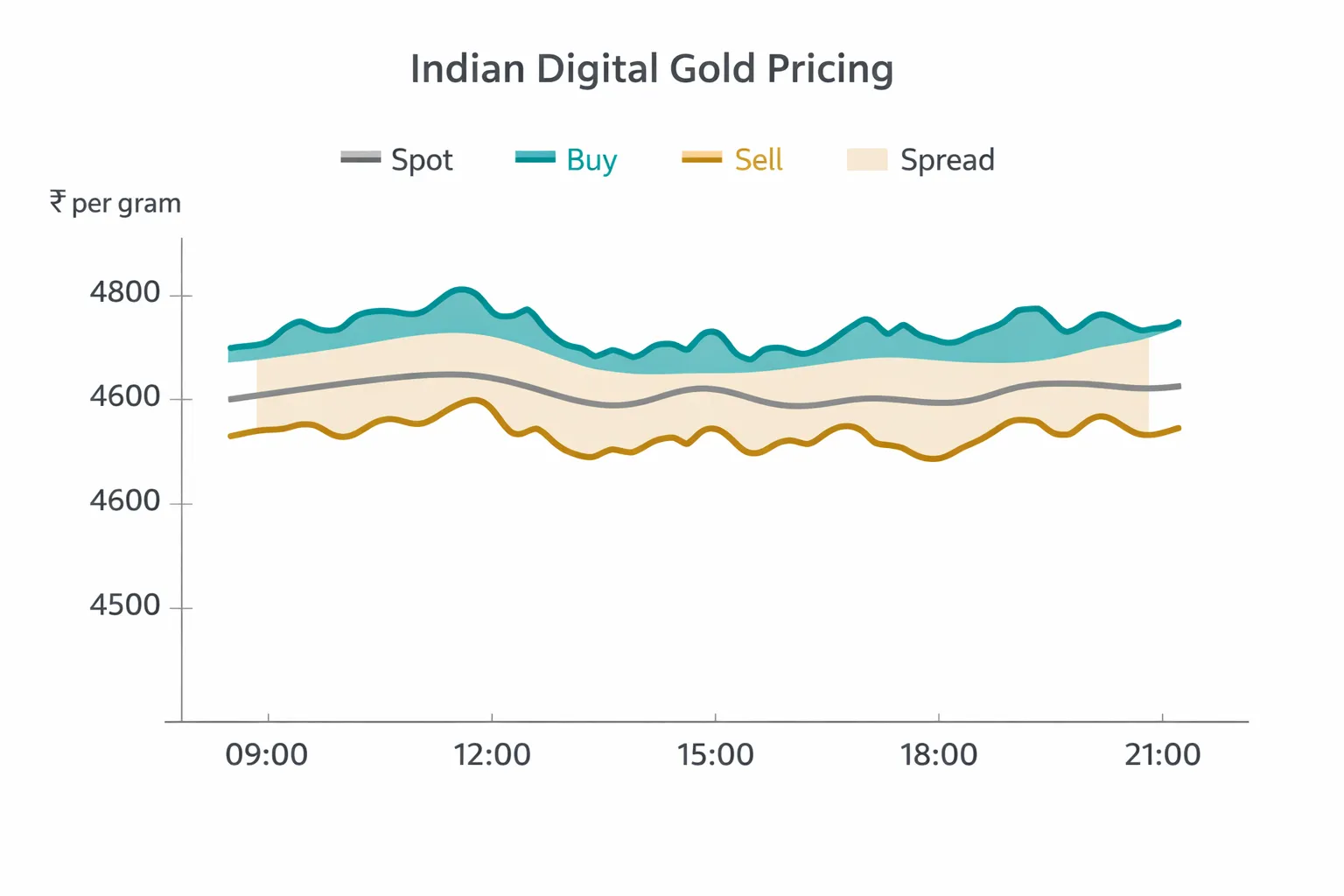

What it is: The spread is the difference between the platform’s buy price (what you pay) and sell price (what you get). It’s the most important component of digital gold charges and directly affects your entry and exit.

-

How it’s calculated: Spread % ≈ (Buy price – Sell price) ÷ Sell price × 100.

-

Example: If the platform shows buy at ₹6,200/g and sell at ₹6,000/g, spread ≈ (₹200 ÷ ₹6,000) = 3.33%.

-

-

Why it exists: It covers platform operations, bullion procurement, vaulting, insurance, payment processing, and risk from price volatility. Spreads can widen during volatile markets or off-peak hours.

GST on digital gold purchase and services

-

3% on gold value at purchase (goods): Charged when you buy digital gold; it’s applied on the gold value you acquire.

-

5% on making/minting and other service components: If you convert to coins/bars (minting/making), or use chargeable services, GST on services applies separately (commonly 5% for job-work/making).

-

GST on storage/processing where applicable: If storage, handling, or processing is charged as a service, it may draw GST at the applicable service rate.

“GST on gold value is 3%; job-work/manufacturing (making/minting) services attract 5% GST.” – Source

Storage/custody and insurance

-

Explicit annual fee vs embedded-in-spread: Some platforms charge a transparent annual storage/custody fee (e.g., % of holdings or a fixed rupee fee). Others embed vaulting and insurance costs into a wider spread. The visible fee looks “zero,” but you pay it via pricing.

-

What to check: Audit frequency, vault partner credibility, and whether insurance is comprehensive (theft, fire, movement). Ask if fees rise with balance or remain flat.

Digital gold selling charges and redemption fees

-

Flat vs percentage: Digital gold selling charges can be a flat fee per redemption or a % of the order. Some platforms also enforce minimum redemption amounts.

-

Platform-specific minimums: Look for minimum grams/₹ thresholds to sell or withdraw. Small exits may be penalized via minimum fees or worse spreads.

-

Tip: If you plan frequent redemptions, prefer platforms with low, transparent exit fees and competitive spreads.

Physical delivery and making/minting

-

When delivery makes sense: Gifting or ceremonial needs. Delivery transforms investment gold into a consumption item – expect minting, shipping, and GST on the service components.

-

When it erodes returns: Small-denomination coins or bars often carry higher minting and logistics costs. For pure investing, staying vaulted and selling digitally usually preserves more value.

Payment and transfer charges

-

UPI vs cards: UPI is typically low-cost or free. Cards/net banking may attract gateway fees – check the fine print.

-

P2P gold transfers: Some apps let you send gold to friends/family. Transfers are often free or nominally charged; verify whether there’s a cap or daily limit.

Who sets fees and why transparency matters

-

Platform vs bullion partner: Pricing is a combination of the platform’s commercial model and its bullion partner’s costs. Spreads, storage, and delivery are jointly influenced.

-

How to compare fairly: Check the live spread at the same time across apps, read fee schedules (storage, selling, delivery), and simulate a small buy-and-sell to see your net. Transparency beats “zero fee” claims that hide costs in pricing.

Charge-by-charge breakdown and optimization

|

Charge type |

When it applies |

Typical range/logic |

How to minimize |

|---|---|---|---|

|

Buy–sell spread |

At both entry and exit |

~2–5% typically; can widen on volatile days or low-liquidity hours |

Compare live spreads across apps; transact during regular hours; avoid panic buying/selling |

|

GST on purchase (goods) |

At buy |

3% on gold value acquired |

Consolidate purchases (avoid tiny fragmented orders if fees apply elsewhere); plan long-term holding |

|

GST on services (making/minting) |

On converting to coins/bars |

5% on service component (minting/making) |

Take physical delivery only for gifting/consumption; stay vaulted if investing |

|

Storage/custody & insurance |

Ongoing (monthly/annual) or embedded |

Explicit %/year or embedded in spread |

Prefer transparent low-cost storage; check if thresholds waive fees; audit reports for value |

|

Digital gold selling/redemption fee |

At exit (sell/withdraw) |

Flat fee or %; platform minimums may apply |

Batch redemptions; pick platforms with low exit fees and tight spreads |

|

Delivery/shipping |

On physical delivery |

Fixed + distance-based; higher for small denominations |

Avoid small coins; group orders; consider digital gifting over physical |

|

Payment gateway charges |

At purchase |

UPI often free/low; cards/net banking may have fees |

Use UPI; avoid high-fee payment modes |

|

P2P transfer fee (if any) |

On sending gold to others |

Usually free or nominal |

Use in-app P2P features; check daily/monthly limits |

Pro tip: For pure investing, keep it simple – buy vaulted gold with transparent spreads and minimal storage costs, and sell digitally. For gifting, plan ahead to avoid rush premiums and small-coin making charges.

Ready to optimize your digital gold purchase and minimize digital gold selling charges? Start with transparent pricing and instant UPI on OroPocket. Download the app: https://oropocket.com/app

3) Buy–sell spread explained: the real driver of digital gold purchase and selling price

Why there are two prices (buy vs sell)

-

Digital gold platforms quote two prices because they must cover procurement, vaulting, insurance, payment processing, and market-risk. The gap – the spread – also reflects liquidity and the cost of making an instant two-way market for you.

Simple math example (illustrative)

-

Suppose the app shows:

-

Buy price: ₹5,100/gram

-

Sell price: ₹4,980/gram

-

-

Spread % ≈ (₹5,100 – ₹4,980) ÷ ₹4,980 ≈ 2.41%.

-

Your break-even requires the sell price to rise above your effective entry:

-

If you buy 1g at ₹5,100, you’d need to sell above ₹5,100 (net of any other fees) to profit.

-

If the sell price later moves to ₹5,120, your notional gain ≈ ₹20 after covering the initial spread; other charges (if any) will reduce this further.

-

What’s a “fair” spread?

-

Calm markets: Tighter spreads are common when volatility is low and liquidity is healthy.

-

Volatile periods: Spreads usually widen to protect platforms from rapid swings.

-

Time-of-day effects: Off-peak hours or illiquid windows can see wider spreads. Check live quotes before transacting.

How to check spreads fast

-

Open the app, note the current Buy and Sell.

-

Compute spread quickly: (Buy – Sell) ÷ Sell × 100.

-

Compare across two or three apps at the same time of day to get a fair read.

Timing tips to minimize spread impact

-

Avoid peak volatility windows (major macro announcements, sharp intraday moves).

-

Batch small buys into fewer, slightly larger orders when spreads are tight.

-

Use SIPs/recurring buys to average out both price and spread over time.

-

Plan exits ahead – don’t redeem into a sudden spike in spreads unless necessary.

Ready to buy digital gold with tight spreads and instant UPI? Start on OroPocket now: https://oropocket.com/app

4) GST on digital gold purchase and redemption: what’s taxed and what isn’t

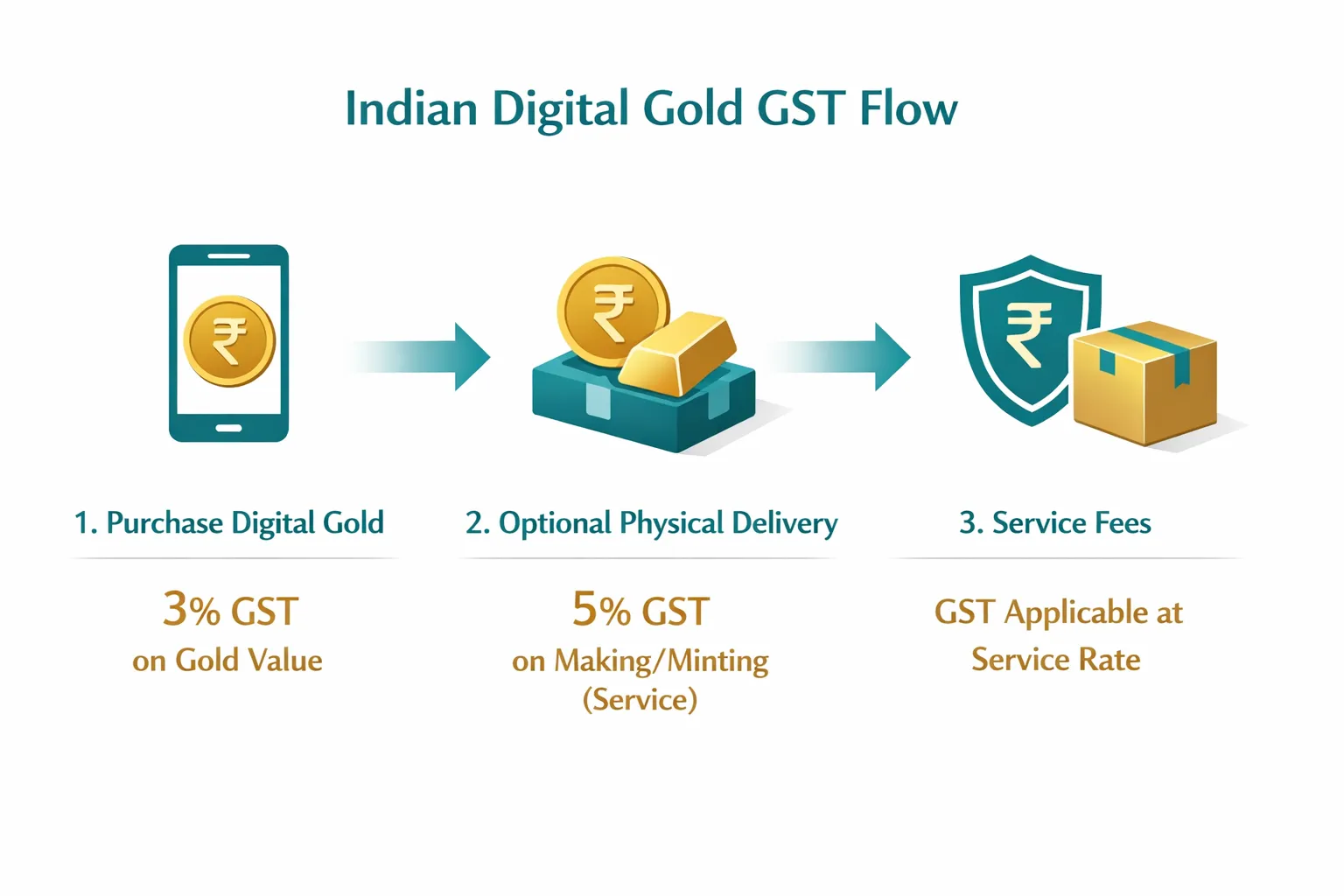

The GST stack for digital gold

-

3% on gold value at purchase.

-

5% on making/minting for physical delivery (if opted).

-

GST on applicable service fees (storage, shipping/insurance).

“GST on the value of gold is 3%; making/minting (job-work) charges attract 5%; applicable service fees such as storage or shipping are also subject to GST.” – Source

How this differs from ETFs/SGBs

-

Gold ETFs and Gold mutual funds are securities under a regulated framework; you don’t pay 3% GST on units purchased. Costs appear as expense ratios and brokerage/STT-like charges where applicable.

-

SGBs (Sovereign Gold Bonds) are government securities; no 3% GST at purchase. They pay interest per scheme rules and have their own tax treatments on redemption/interest as notified by RBI/Income Tax provisions.

Micro-example

-

You buy ₹1,000 of digital gold today.

-

3% GST = ₹30.

-

Amount going into gold value ≈ ₹970 (before considering spread/platform pricing).

-

If you later opt for delivery, making/minting service may attract 5% GST on the service fee, plus GST on shipping/insurance if charged.

-

Practical tips

-

Keep physical delivery for gifting or consumption needs; otherwise, stay vaulted and redeem digitally to avoid making/delivery GST.

-

Consolidate redemptions to minimize per-order service charges.

-

Track invoices for accurate tax records.

Compliance note

-

GST rates and interpretations can change. Always verify with the latest CBIC/GST Council circulars before making decisions.

5) Storage, custody, and digital gold selling charges: what to expect and how to cut them

Storage/custody models

Digital gold is backed by physical gold in insured vaults. But how you pay for storage and custody varies by platform:

-

Explicit annual fee: A clear, line-item charge (fixed ₹ or % of holdings). Transparent and easy to compare.

-

Embedded-in-spread: No visible “storage fee,” but the platform widens the buy–sell spread to recover vaulting and insurance costs.

-

What to look for:

-

Named vault partner(s) and bullion counterparty.

-

Clear custody model: pooled vs. specifically allocated.

-

Access to regular third-party audit reports and reconciliation frequency.

-

Why it matters: If storage is hidden in a wider spread, your true cost scales with every digital gold purchase and redemption. With explicit fees, you can calculate and optimize.

Insurance and audit costs

Insured vaults and independent audits protect you from operational and custody risks:

-

Insurance covers events like theft, fire, or transit (policy scope varies; check exclusions).

-

Independent audits verify that total customer gold equals gold in the vault – by weight, purity, and serials where applicable.

-

Signs of a trustworthy provider:

-

Independent auditor named (not internal).

-

Audit frequency disclosed (monthly/quarterly).

-

Public audit summaries or downloadable certificates.

-

Clear escalation/grievance redressal and a defined chain of custody.

-

Tip: If audits are infrequent or not shared, factor that risk into your platform comparison – tight pricing means little without strong custody proof.

Digital gold selling charges (a.k.a. digital gold selling charges)

Expect one or more of the following at exit:

-

Flat vs percentage: A fixed ₹ per redemption vs. a % of order size.

-

Minimum grams/₹: Some platforms impose minimums to sell or withdraw.

-

Spread impact: Even with “zero selling fee,” the spread determines your net.

-

Timing your exit:

-

Avoid high-volatility windows when spreads widen.

-

If a platform has “slabbed” fees, redeem in optimal sizes to avoid crossing higher-fee tiers.

-

Pro move: Simulate a small sell before you scale. Note the live sell price, observable fee, and final ₹ credited. Repeat at a similar time across two platforms for a fair comparison.

Practical ways to reduce these costs

-

Consolidate redemptions: Fewer, larger exits can reduce flat fees and minimize repeated spread hits.

-

Avoid rush-hours: High volatility or thin-liquidity windows often widen spreads; choose calmer periods.

-

Monitor fee updates: Platforms sometimes tweak storage, redemption, or delivery charges. Review pricing pages monthly.

-

Leverage rewards/offsets: Use platform rewards to offset digital gold charges. With OroPocket, you earn free Bitcoin (Satoshi) on every digital gold purchase – reducing your effective cost over time.

-

Prefer digital redemption for investing: Keep delivery for gifting/consumption; making and shipping add service costs and GST.

-

SIP your buys, batch your sells: SIPs average out both price and spread; batching sells reduces repeated exit costs.

-

Use low-cost payment rails: Prefer UPI over cards/net banking where gateway charges apply.

Bottom line: Transparent storage, provable custody, and competitive spreads determine your real return – not just the headline gold price. Choose a platform that shows you the math upfront.

Ready to cut costs without cutting corners? Buy, store, and redeem with transparent pricing – and earn free Bitcoin on every purchase – with OroPocket. Download the app: https://oropocket.com/app

6) Hidden and indirect costs: slippage, payment fees, delivery thresholds, and platform lock-in

Slippage vs. spread

-

Spread is visible (buy vs sell gap). Slippage is invisible – it’s the tiny price move between what you see and where your order actually fills during fast markets.

-

When it bites: Sudden intraday jumps (global cues, data releases). If the quote refreshes every few seconds, late execution can land you a slightly worse price.

-

How to limit it:

-

Transact during calmer hours.

-

Avoid chasing sharp spikes.

-

Re-check the final “lock-in” price before confirming.

-

Payment rails

-

UPI: Generally the lowest-friction and lowest-cost route for a digital gold purchase (fast, widely supported).

-

Cards/net banking: Some gateways may levy convenience fees – small on big orders but painful on micro-buys. Always verify the payment screen total before paying.

-

Tip: If you stack gold frequently, prefer UPI to avoid cumulative payment charges.

Delivery thresholds and geography

-

Minimum grams: Platforms often require 0.5g, 1g, or more for delivery. Small coins/bars carry higher making/minting cost per gram.

-

Pin-code limits: Delivery may be restricted by location; out-of-coverage or re-delivery attempts can add fees.

-

When to deliver: Great for gifting/consumption. For investing, staying vaulted and redeeming digitally usually preserves more value.

Platform lock-in and liquidity

-

Most providers require you to sell back on the same platform. You can’t freely transfer to an exchange or demat like a Gold ETF – your exit is the platform’s sell price plus any digital gold selling charges.

-

Check exit rules:

-

Minimum sell quantities/values

-

Settlement timelines

-

Any withdrawal/redemption fees

-

“SEBI cautioned that many ‘digital gold’ offerings via online platforms fall outside SEBI’s regulatory perimeter; investors should evaluate disclosures and risks carefully.” – Source

Recordkeeping to catch hidden fees

-

Save every invoice and monthly statement; note the grams credited and rupees debited (including GST and any fees).

-

Maintain a simple tracker: date, amount, grams, quoted buy/sell, realized sell value, any platform charges.

-

Reconcile monthly to spot creeping costs (widening spreads, new fees, delivery surcharges).

Cut hidden costs without cutting convenience. Buy with UPI, track spreads, avoid rush-hour slippage, and keep delivery for gifting – then let compounding do the rest. Start with OroPocket and earn free Bitcoin on every gold purchase: https://oropocket.com/app

7) Real-world math: ₹10,000 lump sum vs ₹1,000/month SIP – total charges over 12 months

Assumptions (illustrative)

-

Gold reference price steady all year for simplicity.

-

Buy–sell spread: 3% (Buy = ₹6,180/g, Sell = ₹6,000/g; mid = ₹6,090/g).

-

GST: 3% on digital gold purchase value; no delivery; no storage fee charged explicitly.

-

Redemption fee: 0.25% of sell value.

-

Goal: Isolate the impact of digital gold charges, digital gold selling charges, and GST on a digital gold purchase under two patterns.

Scenario A: One-time ₹10,000 purchase, sell after 12 months

-

Line items include GST at buy, spread impact at entry and exit (embedded in prices), and a redemption fee at sell.

Scenario B: ₹1,000 SIP x 12

-

You average the market and spreads; you still pay GST on each purchase and the exit redemption fee once.

Two-scenario calculator (illustrative)

|

Line item |

Scenario A: ₹10,000 lump sum |

Scenario B: ₹1,000 x 12 (₹12,000 total) |

Logic |

|---|---|---|---|

|

Total amount paid in (principal) |

₹10,000.00 |

₹12,000.00 |

Inputs |

|

GST at purchase (3%) |

₹300.00 |

₹360.00 |

3% of each buy |

|

Net rupees into gold (after GST) |

₹9,700.00 |

₹11,640.00 |

Principal minus GST |

|

Buy price per gram |

₹6,180 |

₹6,180 |

Spread-impacted buy |

|

Net grams acquired |

1.57071 g |

1.88485 g |

Net rupees ÷ buy price |

|

Spread effect at entry (indicative) |

₹141.36 |

₹169.64 |

Grams × (Buy – Mid) = g × ₹90 |

|

Spread effect at exit (indicative) |

₹141.36 |

₹169.64 |

Grams × (Mid – Sell) = g × ₹90 |

|

Gross proceeds at sell (₹6,000/g) |

₹9,424.25 |

₹11,309.10 |

Grams × sell price |

|

Redemption fee (0.25%) |

₹23.56 |

₹28.27 |

% of gross proceeds |

|

Net proceeds credited |

₹9,400.69 |

₹11,280.83 |

Gross – redemption fee |

Note: Illustrative assumptions; not investment advice; actual platform fees vary.

Sensitivity check

-

If the spread narrows by 1 percentage point (from 3% to 2%):

-

The total spread band shrinks by ₹60/g (₹180 → ₹120), improving outcomes by roughly grams × ₹60.

-

Scenario A improvement ≈ 1.57071g × ₹60 ≈ ₹94.

-

Scenario B improvement ≈ 1.88485g × ₹60 ≈ ₹113.

-

-

If the spread widens by 1 percentage point (from 3% to 4%), expect a roughly equal and opposite impact.

Takeaways

-

SIPs can smooth both price and spread – useful when you don’t want to “time” the market. But cumulative GST on many micro-buys adds up; consider batching if payment fees apply.

-

Lump sum minimizes repeated GST invoices but is more exposed to the spread you face on that single day.

-

For pure investing, avoid delivery (making/shipping GST) and pick platforms with tight live spreads and transparent digital gold charges. Watch digital gold selling charges at exit and batch redemptions when possible.

Want to keep costs low while you build a habit? Start a ₹1 SIP, earn free Bitcoin on every digital gold purchase, and redeem seamlessly with OroPocket. Download the app: https://oropocket.com/app

8) Cost-minimization playbook: 9 tactics to pay less in digital gold charges

Tactics you can use today

-

Compare buy vs sell quotes before every order; avoid peak volatility windows.

-

Check the live buy–sell spread in-app. If it looks wide, wait for calmer hours. Even a 0.5–1% tighter spread meaningfully boosts long-term returns.

-

-

Use SIP/micro-buys to average spreads and reduce timing regret.

-

A small, recurring digital gold purchase smooths both price and spread. If volatility is high, SIPs reduce the chance you buy at an unfavourable moment.

-

-

Prefer UPI; avoid card gateways if they add fees.

-

UPI is typically lowest-cost and fastest for a digital gold purchase. If your payment page shows a convenience fee on cards/net banking, switch to UPI.

-

-

Batch small redemptions; keep delivery for true gifting to avoid making/shipping fees.

-

For investing, redeem digitally to skip making/minting and shipping. If you must exit, fewer, larger redemptions reduce repeated digital gold selling charges.

-

-

Track total cost of ownership (simple spreadsheet: date, grams, price, GST, fees).

-

Record each order’s buy/sell price, GST, and any charges. You’ll spot creeping costs like widening spreads or new fees and can adjust platforms or timing.

-

-

Set alerts for policy updates; re-check fee pages quarterly.

-

Platforms update storage, redemption, or delivery fees. A quick quarterly scan helps you stay ahead of changes and avoid surprises.

-

-

Consider switching part of long-term allocation to regulated options if fees stay high.

-

If spreads remain consistently wide, shift a portion of your core gold exposure to ETFs/SGBs, while keeping digital gold for convenience and gifting.

-

-

Use platform rewards/loyalty to offset spread and fees where available.

-

On OroPocket, you earn free Bitcoin (Satoshi) on every gold/silver purchase. Streaks and rewards can lower your effective net cost over time.

-

-

Keep clean records for taxes and dispute resolution.

-

Save invoices and statements. If a fee looks off, you have documentation to query support – and for accurate tax reporting later.

-

Ready to put these into action with tight spreads, instant UPI, and Bitcoin rewards on every buy? Download OroPocket now: https://oropocket.com/app

9) Why OroPocket helps you beat digital gold charges (and earn Bitcoin)

Transparent fees and trusted custody

-

RBI-compliant partners, 24K insured vaulted gold, and clearly quoted buy/sell prices so you can see – and minimize – your true spread and exit costs.

Micro-investing from ₹1 via UPI

-

Start instantly with no minimums. Use small, frequent buys to average spreads and avoid timing regret. UPI makes transactions fast and low-friction.

Bitcoin rewards on every purchase

-

Earn Satoshi cashback on every gold/silver buy. Over time, these rewards help offset part of the spread and fees, lowering your effective cost of ownership.

Habit builders that compound

-

Build a daily saving habit with streak bonuses, Spin-to-Win, and a referral program where you and your friends earn 100 Satoshi + a free spin.

Smart exits and gifting

-

Send/gift gold in a tap. Keep delivery only for purposeful gifting to avoid making/shipping charges; otherwise redeem digitally for better net outcomes.

Example (illustrative)

-

A ₹1,000/month plan for 12 months:

-

You earn Satoshi cashback on each purchase, plus periodic streak bonuses.

-

Even if spreads stay flat, rewards meaningfully offset your net cost – especially when you stay vaulted, redeem digitally, and batch exits.

-

Ready to save smarter, pay less in digital gold charges, and earn free Bitcoin? Download OroPocket now: https://oropocket.com/app

10) Conclusion: Pay less in fees, keep more gold – start with OroPocket

The bottom line

-

Know every line item: buy–sell spread, 3% GST on digital gold purchase, storage/custody, and digital gold selling charges at exit.

-

Plan your buys and sells: avoid peak volatility, batch redemptions, and keep delivery for true gifting to skip making/shipping costs.

-

Use rewards to offset costs: Satoshi cashback, streaks, and bonuses can meaningfully reduce your effective net fees over time.

-

Track your TCO: maintain a simple spreadsheet (date, grams, price, GST, fees) so you catch creeping spreads or policy changes early.

Your next step

-

Start with ₹1 micro-buys or a small SIP to average price and spread.

-

Prefer UPI for low-friction payments; compare live buy vs sell quotes before every order.

-

Stay vaulted for investing; redeem digitally; review fee pages quarterly and keep clean records.

Call to action

-

Download the OroPocket app and start optimizing your digital gold costs today: https://oropocket.com/app