Digital Gold: Is It Safe, Legal, and Worth It in 2026?

Digital Gold: Is It Safe, Legal, and Worth It in 2026?

Digital gold sounds almost too good to be true: buy 24K gold in seconds, start with tiny amounts, track it in-app, and sell when you want – no locker, no jeweller, no awkward purity doubts.

But the real question isn’t “Is digital gold convenient?” It is.

The real question is: Can you trust it in India in 2026 – legally, operationally, and financially? This guide gives you a clear, no-fluff answer, including what SEBI has flagged, what “insured vaulting” actually means, how pricing works (and where platforms quietly earn), and who digital gold is truly for.

Stop watching inflation eat your savings. Start growing – ₹1 at a time.

The 2026 reality check (what competitors agree on – and what they miss)

Across top competitor pieces (Groww + large platforms + bullion brands), the winning themes are consistent:

-

Digital gold = real gold stored in a vault (you own a quantity, not a “token”)

-

Convenience + low ticket size are the main benefits

-

Biggest risks: regulation gap, counterparty/platform risk, pricing spread, redemption friction

-

For long-term “pure investing,” they often nudge you toward Gold ETFs/SGBs/EGRs

Content gaps most competitors gloss over (we’ll fix them here):

-

“Safe” isn’t one thing – it’s custody safety, legal clarity, redemption safety, and pricing fairness.

-

Spread is the hidden fee – many articles mention it, few show you how it changes your breakeven.

-

What happens if the app shuts down? Most explain “platform risk” but not practical steps to protect yourself.

-

Regulated alternatives are not always better – they’re better for specific goals (and worse for others).

-

Habit-building matters – micro-investing works only if you actually do it regularly.

If you want a deeper dive on risks and investor protections, read is digital gold safe in India (vaulting, regulation, and risks).

What is digital gold (and what you actually own)?

Digital gold is an online way to buy a specific weight of physical gold (usually 24K/999). That gold is stored on your behalf by a vaulting/custodian partner. Your app shows your holdings in grams and their value based on live prices.

What you own vs what you don’t

You typically own an entitlement to allocated gold held for you – not a share like an ETF and not jewellery.

You don’t get:

-

A demat holding

-

SEBI-style investor protection (in most cases)

-

The ability to walk into any jeweller and redeem instantly without process/fees

You do get:

-

Price-linked exposure to gold

-

Easy accumulation

-

Optional redemption/selling (subject to platform rules)

Is digital gold legal in India in 2026?

Digital gold is legal to buy and sell, but it often operates in a regulatory grey zone compared to SEBI-regulated products like Gold ETFs or exchange-traded instruments.

Here’s the key nuance:

-

Legal: Yes, you can transact, pay GST, and receive invoices.

-

Regulated like a security? Usually no (which changes how disputes and investor protection work).

-

Your safety depends heavily on the provider’s custody + processes, not on a single strong regulator-backed framework.

This is why due diligence matters more than usual.

SEBI warnings: what they actually mean for you

SEBI’s position is simple: if a product isn’t under its framework, you don’t get SEBI’s investor protection mechanisms.

“SEBI highlighted that [digital gold products] are not recognized as securities nor regulated as commodity derivatives… investors in digital gold are not protected by SEBI’s investor protection mechanisms.” – Source

The practical takeaway

SEBI isn’t saying “digital gold is a scam.”

SEBI is saying: “Know what you’re buying. If something breaks, your complaint path is not the same as ETFs.”

So your job is to choose platforms that are:

-

transparent on custody,

-

clear on redemption and fees,

-

operationally reliable,

-

compliant on KYC/GST/invoicing.

What “safe” means in digital gold: a 6-point safety checklist

Use this checklist before you buy even ₹10.

1) Purity: is it truly 24K/999?

Look for:

-

999 fineness

-

invoice mentioning purity + weight

-

credible bullion partner documentation

2) Vaulting: where is your gold stored?

“Stored in a vault” should not be a vague claim. You want:

-

named vault/custody partner

-

clarity on insurance coverage

-

audit/assurance practices (where disclosed)

3) Title/ownership: is it allocated to you?

The best setups clearly record your holding as allocated gold in your name (not pooled ambiguously).

4) Platform risk: what if the app goes down?

Ask:

-

Can you sell without friction?

-

Can you redeem to physical delivery?

-

Are there support escalation channels that actually work?

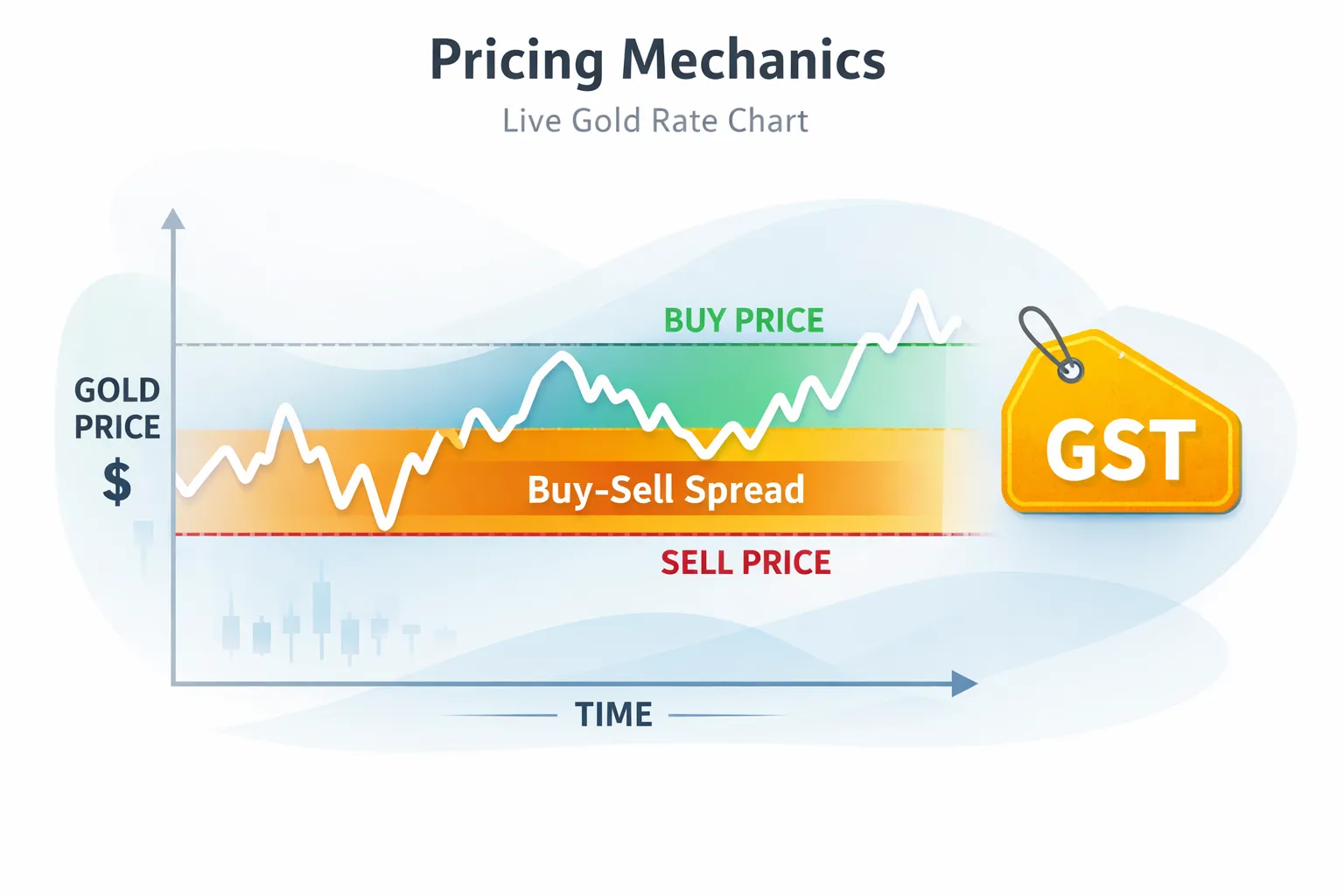

5) Pricing: buy–sell spread (your hidden cost)

Your first loss is often the spread (buy price higher than sell price). If spread is wide, you need bigger price movement just to break even.

To understand this in detail, see digital gold charges in India (spreads, GST, storage, selling fees).

6) Redemption: can you get physical gold when needed?

Check:

-

minimum grams for redemption

-

minting/delivery charges

-

timelines and cancellation rules

Digital gold pricing in 2026: how you really pay

Digital gold typically includes:

-

Live gold rate reference (base)

-

Platform spread (implicit)

-

GST (usually 3%) at purchase

-

Optional: delivery/minting/storage fees (platform-dependent)

A simple rule to remember

If you’re buying small amounts frequently, the “cost” is not only fees – it’s whether the platform keeps spreads fair and transparent.

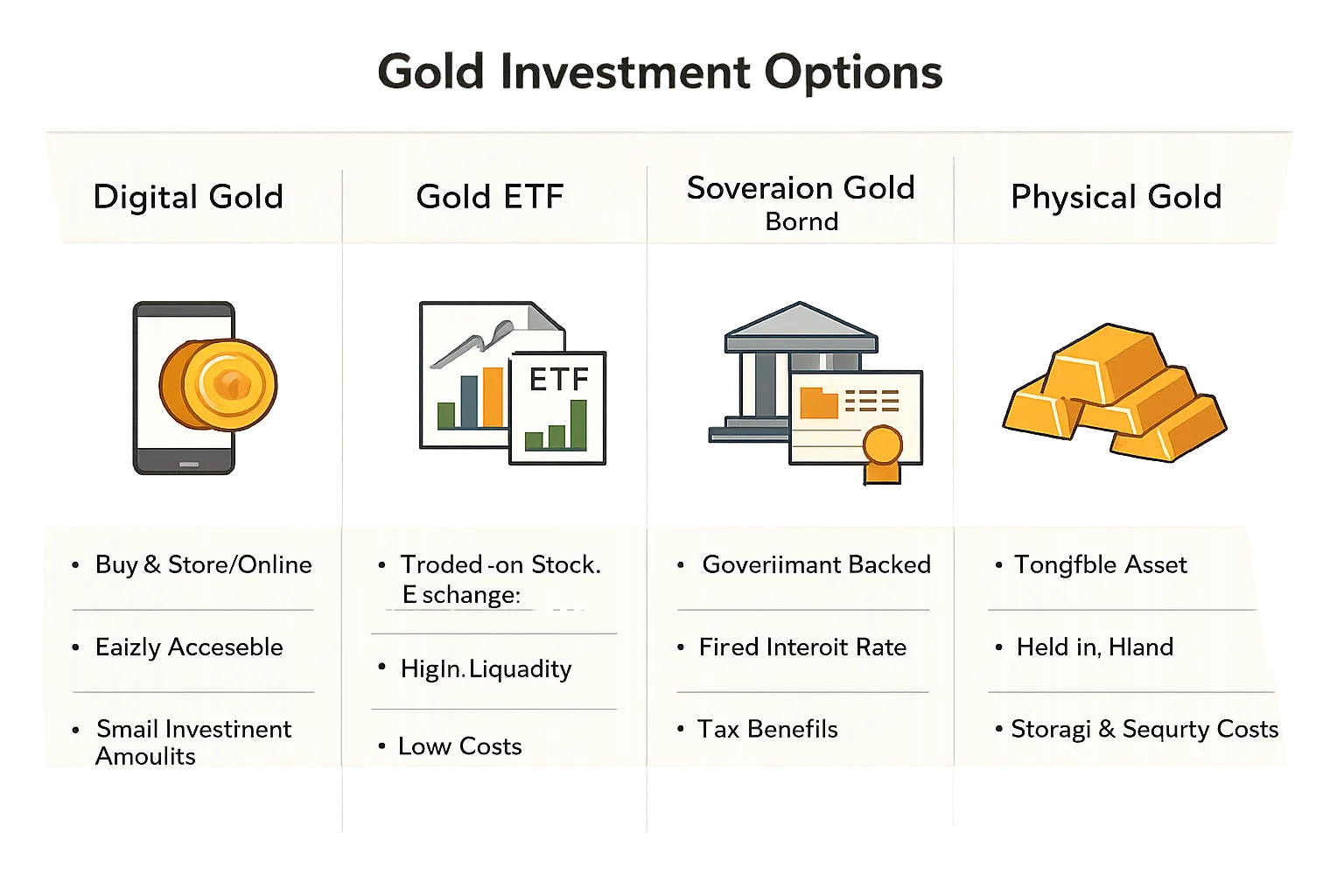

Digital gold vs Physical gold vs Gold ETF vs SGB (2026 comparison)

|

Feature |

Digital Gold |

Physical Gold (coins/jewellery) |

Gold ETF |

SGB |

|---|---|---|---|---|

|

Start small |

Very easy (micro amounts) |

Usually ≥ 1g; jewellery higher |

Needs demat/broker |

Issue windows; units vary |

|

Storage |

Provider vault |

Your responsibility (locker/theft risk) |

No storage |

No storage |

|

Regulation |

Often not SEBI-regulated |

Consumer/BIS/GST, not a security |

SEBI-regulated |

RBI-backed |

|

Liquidity |

Usually high (in-app sell) |

Depends on buyer/jeweller |

High during market hours |

Tradable but can be illiquid; maturity lock |

|

Costs |

Spread + GST (+ optional fees) |

Making charges (jewellery), wastage, GST, resale deductions |

Expense ratio + brokerage |

Price vs issue, tax rules; opportunity cost |

|

Best for |

Convenient accumulation + goals |

Gifting/usage/heritage |

Market-linked investing |

Long-term holding + interest component |

The honest verdict

-

If your priority is regulated investing rails, ETFs/SGBs can be cleaner.

-

If your priority is habit + accessibility + small-ticket buying, digital gold wins – if you choose the right platform.

Who should invest in digital gold in 2026 (and who shouldn’t)

Digital gold is great for you if:

-

you’re a first-time investor who wants to start tiny and build discipline

-

you want a simple inflation hedge without lockers or jewellers

-

you want to save toward short-term goals (gifts, festivals, emergency buffer)

-

you value speed: UPI → buy → track → sell in minutes

“Gold has delivered a CAGR of approximately 12–14% per annum (2019–2024) in India.” – Source

Avoid digital gold (or keep it small) if:

-

you want maximum regulatory protection like securities markets

-

you plan to hold for generations as physical heirloom (jewellery/coins fit better)

-

you don’t want any counterparty/platform dependency

Why OroPocket makes digital gold feel worth it (not just “available”)

Most apps stop at: “Buy gold digitally.”

OroPocket is built for something bigger: consistent wealth-building habits – with rewards that make you want to show up daily.

What you get with OroPocket (the unfair advantage)

-

Start from ₹1: no “minimum amount” excuses – ever.

-

Instant UPI buys (under 30 seconds): invest the moment you decide.

-

100% secure & compliant: RBI-compliant approach, insured vaults, authorized bullion partners.

-

Free Bitcoin on every purchase: earn Satoshi cashback when you buy gold/silver – two assets for the price of one.

-

Gamified investing: daily streaks + spin-to-win + tiered rewards that turn “saving” into a habit.

-

Referral rewards: you and your friend earn 100 Satoshi + a free spin.

The emotional win (this is what changes behavior)

-

Control: “I’m not waiting for a ‘perfect time’ – I’m acting.”

-

Progress: “My grams grow every week.”

-

Smart: “I’m hedging inflation instead of hoping FDs keep up.”

-

Modern: “Gold investing that fits my phone-first life.”

-

Rewarded: “I get Bitcoin back just for being consistent.”

If you also want to use gold for gifting (without the chaos of last-minute jewellery shopping), see how to gift or send gold online in India.

The final verdict: safe, legal, and worth it – if you choose it the smart way

Digital gold in 2026 can be safe and worth it – but only when you treat it like a real financial product, not a “wallet feature.”

Do these 3 things and you’re ahead of 90% of buyers:

-

Choose credible custody + transparent pricing

-

Understand spreads + GST + redemption rules

-

Use digital gold for what it’s best at: consistent accumulation

OroPocket is built exactly for that: ₹1 entry, instant UPI, insured vaulting, and free Bitcoin rewards that make investing addictive – in a good way.

Stop watching. Start growing. Download OroPocket and buy your first ₹1 of gold today.