Digital gold price explained: live rates, spreads, and how pricing works

Why the digital gold price matters in India right now

Gold is still the simplest way to beat inflation in India – and now you can buy it in seconds on your phone. But here’s the catch: the digital gold price you see isn’t random. It’s a live number that moves with global markets, USD/INR, government taxes, and a small platform spread. Understand that, and you’ll stop overpaying and start buying smarter.

“Gold has a key role as a strategic long-term investment and as a mainstay allocation in a well-diversified portfolio.” – Source

The quick answer

- What “live digital gold price” means: It’s the real-time rate derived from the international spot benchmark, converted from USD to INR, then adjusted for Indian import duties, GST on purchase, and each platform’s spread. That’s why the price of digital gold can change minute to minute.

- Why buy vs sell prices differ: Platforms quote two rates. Buy price includes their margin; sell price is lower to cover market risk and operations – this is the “spread.” Judge a fair spread by comparing multiple apps at the same moment and noting the difference between their buy and digital gold selling price. Smaller, transparent spreads = better for you.

What you’ll learn in this guide

- How live rates are formed end-to-end (global benchmark → USD/INR → duties → GST → platform spread)

- What the “digital gold selling price” really is and how it’s calculated in practice

- GST, import duties, platform spreads, and why prices differ across apps – explained simply

- Practical ways to cut costs and slippage when buying or selling digi gold price

- Exactly how OroPocket prices gold – and how our Bitcoin rewards reduce your effective cost per gram over time

Who this is for

- First-time investors who want a clean, jargon-free explainer on digital gold price mechanics

- Jewellery buyers exploring digi gold as a smarter, more transparent alternative

- Bitcoin-curious Indians who want exposure to gold plus rewards – without crypto complexity

Note: If you’ve searched for terms like “digi gold price,” “SafeGold price,” or “price of digital gold,” this guide will help you decode all of them and choose the best-value option.

How the price of digital gold is set: live rates explained (LBMA → INR → your app)

“India levies 12.5% Basic Customs Duty (BCD) plus 2.5% Agriculture Infrastructure and Development Cess (AIDC) on gold (HS 7108), and GST on bullion/coins is 3% applied on the value inclusive of customs duty.” – Source

Step 1: Global benchmark – LBMA Gold Price (USD/oz)

- The LBMA Gold Price is the globally recognized benchmark for physical gold, quoted in USD per troy ounce via a transparent auction process. It anchors retail quotes across the world.

- OTC spot trades reference this benchmark. Futures on COMEX (global) and MCX (India) reflect expectations and hedging activity; they can lead spot during volatile periods but converge around the benchmark.

- Retail platforms in India base their live digital gold price on this stack: LBMA spot reference, adjusted for FX, duties, taxes, and platform-specific costs.

Step 2: Convert to INR per gram

- Math: USD/oz → divide by 31.1035 to get USD/gram → multiply by the live USD/INR to get INR/gram.

- Why FX matters: If USD/INR rises (weaker rupee), the local price of digital gold increases even if global gold is flat. That’s why you’ll see the price of digital gold move with currency as well as metal.

Step 3: Add Indian import duties and taxes

- Import levies typically include:

- Basic Customs Duty (BCD)

- AIDC (Agriculture Infrastructure and Development Cess)

- GST at 3% is applied on the post-duty value (i.e., value inclusive of customs duty and AIDC).

- Nuances:

- Coins/bullion for investment are treated differently from jewellery (which also factors making charges, hallmarking, etc.).

- Retail quotes you see in apps generally reflect bullion logic, not jewellery making charges.

Step 4: Add wholesale and custody costs

- Behind every gram you buy digitally is real, 24K physical gold. Costs include:

- Refining and assaying

- Logistics and secure transport

- Vaulting and insurance

- Regular third‑party audits with authorized bullion partners

- These wholesale and custody costs are modest per gram but real, and they’re part of the final price formation.

Step 5: Platform spread and promos

- Two quotes, always:

- Buy price (ask): what you pay to acquire gold

- Digital gold selling price (bid): what the platform pays if you sell back

- The spread covers operations, liquidity, hedging, and extreme‑move risk. Smaller, transparent spreads = better value.

- Promotions and rewards matter: On OroPocket, Bitcoin cashback reduces your effective net cost per gram, offsetting part of the spread over time.

Step 6: Live updates and refresh rates

- Top apps refresh quotes every few seconds; some pause quoting during sharp moves to avoid stale prices.

- Watch for slippage: In fast markets, a quote can change between tap and execution. Apps may lock prices for a few seconds or re‑quote if volatility is high.

A quick worked example (illustrative only)

- Assumptions:

- LBMA spot: $2,350/oz

- USD/INR: 84.00

- BCD: 12.5%; AIDC: 2.5% (≈15% combined on value)

- GST: 3% on post‑duty value

- Wholesale/custody: ~0.3% of value

- Platform spread: ±0.6% around mid

- Step‑by‑step:

- Convert to USD/gram: 2,350 ÷ 31.1035 ≈ $75.53/g

- Convert to INR/gram (pre‑duty): 75.53 × 84.00 ≈ ₹6,345/g

- Add import duty (≈15%): 6,345 × 1.15 ≈ ₹7,297/g

- Add GST 3% (on post‑duty): 7,297 × 1.03 ≈ ₹7,516/g

- Add wholesale/custody 0.3%: 7,516 × 1.003 ≈ ₹7,539/g

- Apply platform spread:

- Mid reference ≈ ₹7,539/g

- Buy (ask) ≈ +0.6% → ₹7,584/g

- Digital gold selling price (bid) ≈ −0.6% → ₹7,494/g

- Notes:

- If USD/INR moves to 85, local prices rise even if the $2,350/oz benchmark is unchanged.

- Promos and Bitcoin rewards on OroPocket lower your effective cost versus headline ask.

- Spreads can widen slightly during high volatility or low‑liquidity hours.

This LBMA → INR → duties/GST → custody → spread pipeline is the real engine behind every live quote you see in your app. Understanding it helps you compare platforms, spot fair spreads, and time your buys to get the best possible price of digital gold – and a better digital gold selling price when you exit.

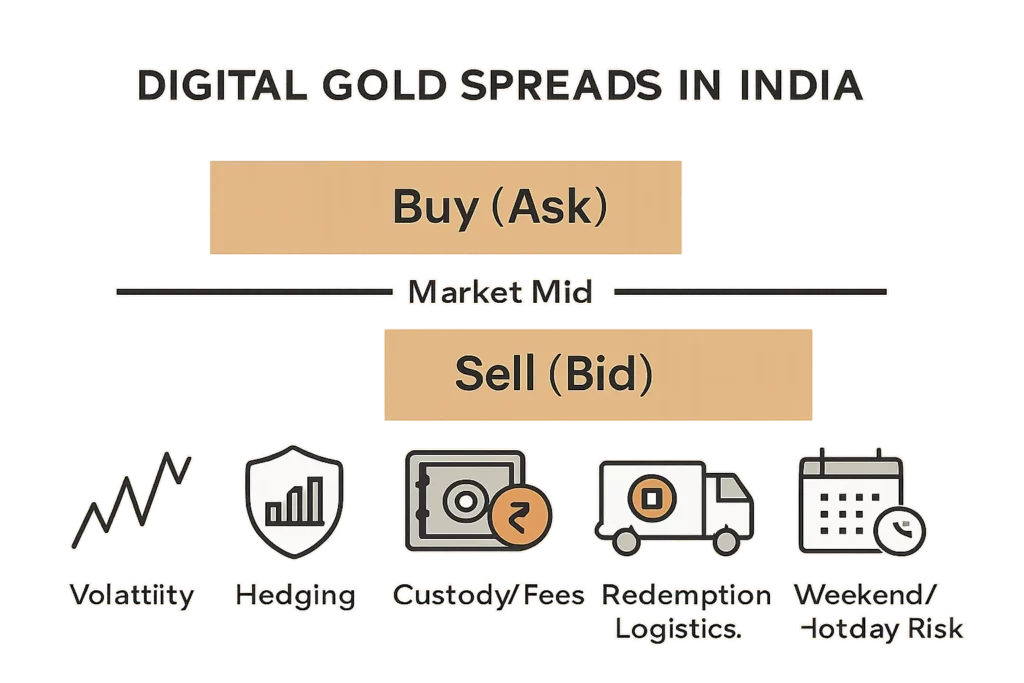

Buy vs sell: understanding spreads and the “digital gold selling price”

“The bid-ask spread is the difference between the highest price a buyer is willing to pay for an asset and the lowest price a seller is willing to accept.” – Source

Bid vs ask, explained in one minute

- Ask (buy price): What you pay to acquire gold.

- Bid (digital gold selling price): What you receive if you sell back to the platform.

- The bid is always lower than the ask because the spread covers operations, custody, hedging risk, and liquidity. It’s similar to currency exchange counters or brokerage quotes – two prices, with a gap in between.

What drives spreads in India

- Volatility and hedging costs: During sharp moves in LBMA/COMEX/MCX or USD/INR, spreads can widen to protect against slippage.

- Custody and operational overheads: Vaulting, insurance, audits, and reconciliation add real costs per gram.

- Redemption logistics: Physical delivery options and buyback commitments introduce handling and logistics risk.

- Weekend/holiday risk: When global markets are closed, price discovery is thinner, so platforms may quote wider spreads.

Typical spread ranges you’ll see

- Consumer platforms often show a total buy–sell gap of about 2–5% in normal conditions. Spreads may widen in fast markets or during illiquid hours.

- Context: Currency booths often quote wider gaps than online FX apps; stock brokers in liquid equities quote very tight spreads. Digital gold sits somewhere in the middle due to custody and logistics.

How to tell if a spread is fair

- Compare both sides at the same timestamp: Check buy and digital gold selling price simultaneously across two or three apps.

- Watch the mid: Estimate the “market mid” (halfway between buy and sell) and see how far each side is from it.

- Look for hidden fees: Some platforms add convenience or redemption fees that behave like extra spread. Read the fine print.

- Track consistency: A platform that stays transparent and stable across the day (including volatile periods) is usually more reliable.

Ways to reduce spread impact

- SIP/DCA: Buy small amounts regularly instead of one big lump sum. This averages out price and spread.

- Avoid immediate round-trips: Don’t buy and sell within minutes unless necessary – wait for a reasonable move to overcome the spread.

- Time your trades: Avoid peak volatility if you can; spreads often normalize when markets are calmer.

- Use rewards to offset costs: On OroPocket, Bitcoin cashback, streak bonuses, and spin-to-win rewards reduce your effective net cost per gram over time – helping to beat headline spreads.

Illustrative digital gold price build vs selling price (not real quotes)

| Step | Component | Example value (₹) | Notes |

|---|---|---|---|

| 1 | LBMA benchmark (USD/oz) | – | Assumed $2,300/oz (for illustration) |

| 2 | Convert to USD/gram | – | $2,300 ÷ 31.1035 ≈ $73.98/g |

| 3 | Convert to INR/gram (pre-duty) | 6,251 | $73.98 × 84.50 USD/INR ≈ ₹6,251/g |

| 4 | Add import duties (BCD + AIDC ≈ 15%) | 7,189 | ₹6,251 × 1.15 |

| 5 | Add GST 3% (on post-duty value) | 7,404 | ₹7,189 × 1.03 |

| 6 | Add custody/premium (~0.3%) | 7,427 | Vaulting, insurance, audits (₹7,404 × 1.003) |

| 7 | Platform Buy Price (ask) | 7,516 | +1.2% vs mid to cover ops/liquidity |

| 8 | Platform Sell Price (bid) | 7,337 | −1.2% vs mid to cover hedging risk |

| 9 | Resulting spread | 2.4% total | (₹7,516 − ₹7,337) ÷ ₹7,427 ≈ 2.4% |

Disclaimer: All numbers are illustrative to explain mechanics, not real quotes. Actual duties, GST, custody costs, and spreads can change and may vary by platform and market conditions. Always check live digital gold price and the current digital gold selling price before placing an order.

Taxes, fees, and the final bill: GST, storage, redemption and delivery

“GST on gold bullion and coins (HSN 7108) is 3% in total – 1.5% CGST + 1.5% SGST – as per Notification No. 1/2017–Central Tax (Rate), Schedule III.” – Source

Taxes you’ll actually pay

- 3% GST on bullion/coins at purchase: Applied on the invoice value (which already reflects duties for imported bullion). For jewellery, GST applies on both the gold value and making charges, so the effective tax bill is higher than on bullion.

- Sellback: No GST on selling your digital gold back to the platform. The bid–ask spread still applies and represents your transaction cost.

Platform-level fees to watch

- Storage charges after X years: Many platforms offer free vaulting for a limited period, then levy a nominal annual fee per gram.

- Delivery and coin minting fees: If you redeem into coins/bars, expect minting/purity certification charges plus packing.

- Minimum redemption thresholds: Physical delivery often has minimum gram thresholds (e.g., 0.5g, 1g, 5g).

- Pick–pack–ship charges: Includes secure shipping, insurance in transit, and tamper-proof packaging.

- Inactivity and small-order fees: Some providers charge for dormant accounts or very small redemptions – check the fine print.

Hidden costs you can avoid

- Unnecessary physical redemption: If you only want investment exposure, staying digital avoids minting/shipping costs.

- Frequent micro-sells: If there’s a flat per-transaction fee, small frequent exits can eat returns – batch your sells.

- Shipping surcharges: Remote area delivery and re-delivery attempts can add up – confirm address and delivery window.

Product-wise cost stack at a glance

| Product | Upfront taxes/charges | Ongoing costs | Exit costs | Liquidity | Best for |

|---|---|---|---|---|---|

| Digital Gold | 3% GST on purchase; embedded platform spread | Possible storage fee after free period; vaulting/insurance included initially | Bid–ask spread on sell; delivery/minting + shipping if you redeem coins/bars | Instant buy/sell on app; T+0 settlement norms vary by platform | Beginners, SIP/DCA investors, goal-based savers who may redeem small amounts |

| Jewellery | 3% GST on gold value + making charges; making/wastage charges | Locker rent (if bank locker); maintenance/repair | Buyback deductions; making charge not fully recoverable; purity checks | Lower liquidity; resale depends on jeweller and purity | Gifting, ceremonies, wearing gold; not optimized for investment returns |

| Gold ETF | Securities transaction charges, small brokerage; no GST on purchase of ETF units | Expense ratio (annual) | Brokerage/exit load (if any); market impact on sell | Market hours liquidity; NAV tracking error possible | Regulated, Demat investors seeking market access and low storage hassle |

| SGB (Sovereign Gold Bond) | Issue price set by RBI; no GST; potential online discount per gram | No storage cost; earns 2.5% annual interest (taxable) | No capital gains tax if held to maturity; early exit via exchange may have spread | Locked in; early exit after 5th year via interest payout dates | Long-term investors seeking sovereign guarantee + interest + potential tax benefit |

Note: Figures are indicative. Taxes, fees, and policies can change. Always check live terms on your chosen platform or with your broker/jeweller before transacting.

Why rates differ across apps: SafeGold price vs MMTC-PAMP vs Augmont vs OroPocket

Two apps, same moment, different price of digital gold – what gives? Short answer: each platform runs a slightly different pricing pipeline on top of the same global benchmark. The live digi gold price you see reflects their sourcing costs, hedging model, refresh policy, and redemption fees. Here’s how to decode it.

Different bullion partners, slightly different pipelines

- Sourcing premiums: SafeGold, MMTC-PAMP, and Augmont source bars and coins through their own channels. Wholesale premiums, bar sizes, and purity assurance costs can nudge the final quote up or down by a few basis points.

- Custody setups: Vaulting partners, insurance terms, audit cadence, and logistics all add small but real per‑gram costs that flow into the live digital gold price.

- Reconciliation windows: Some platforms update inventory and risk positions more frequently than others; tighter reconciliation can support tighter spreads but may re‑quote more often during volatility.

Result: A SafeGold price might differ slightly from an MMTC-PAMP or Augmont quote at the same time – even though all are anchored to the same LBMA benchmark.

Update frequency and hedging approach

- Quote refresh intervals: One app may refresh every few seconds, another every 30–60 seconds. Faster refresh = closer tracking to the global market but more visible flicker in the price of digital gold.

- Weekend/holiday policies: When global markets are shut, some platforms widen spreads or pause frequent updates; others keep quoting with extra cushion for gap risk.

- Inventory hedging: Platforms hedge via OTC spot, COMEX/MCX futures, or a mix. The cost of carrying those hedges, and how quickly they’re rolled, shows up in the buy/sell spread you see.

- Slippage controls: Aggressive price locks can reduce slippage for you but increase risk for the platform – often compensated via a slightly wider spread.

Redemption and delivery policies

- Coin/bar premiums: If you plan to redeem, the total cost includes minting premiums, packaging and certification – not just the displayed digi gold price.

- Minimum redemption sizes: Higher minimums can keep per‑unit logistics cheaper, while micro‑redemptions may carry higher per‑gram costs.

- Delivery fees and timelines: Pick‑pack‑ship, insurance-in-transit, and remote‑area surcharges vary. These don’t change the on‑screen digital gold selling price, but they do change your realized all‑in cost if you take delivery.

Transparency checklist for any platform

- Show both sides: Display buy and digital gold selling price side‑by‑side with timestamps, not just one headline rate.

- Clear taxes/fees: 3% GST on bullion at purchase should be explicit; list delivery, minting, storage-after-X-years, and any per‑transaction fees.

- Name partners: Identify vaulting/custodian partners, insurance coverage, and audit frequency.

- Publish the spread: Make the spread and any weekend/holiday policy public. If spreads widen in high volatility, say so upfront.

- Hedging and refresh: State how often quotes refresh and how price locks or re‑quotes work during sharp moves.

- Redemption policy: Spell out coin/bar premiums, minimum redemption sizes, turnaround times, and return/failed-delivery rules.

- Rewards and promos: Show how cashback, points, or Bitcoin rewards reduce your effective cost per gram.

Why OroPocket often feels cheaper on a net basis

- Even when headline quotes are similar to SafeGold price, MMTC-PAMP, or Augmont at a given moment, OroPocket’s Bitcoin rewards, daily streaks, and spins can lower your effective acquisition cost over time – helping offset spreads without adding complexity.

- Micro‑invest from ₹1 via UPI, stay digital to avoid delivery costs, and use SIP/DCA to smooth out short‑term price differences between apps.

Bottom line: Small differences in pipelines, hedges, and policies explain why two reputable apps can show different price of digital gold or digital gold selling price at the same second. Use the checklist above to compare apples to apples – and pick the platform that’s most transparent, lowest net cost, and best aligned with how you plan to buy, hold, and redeem.

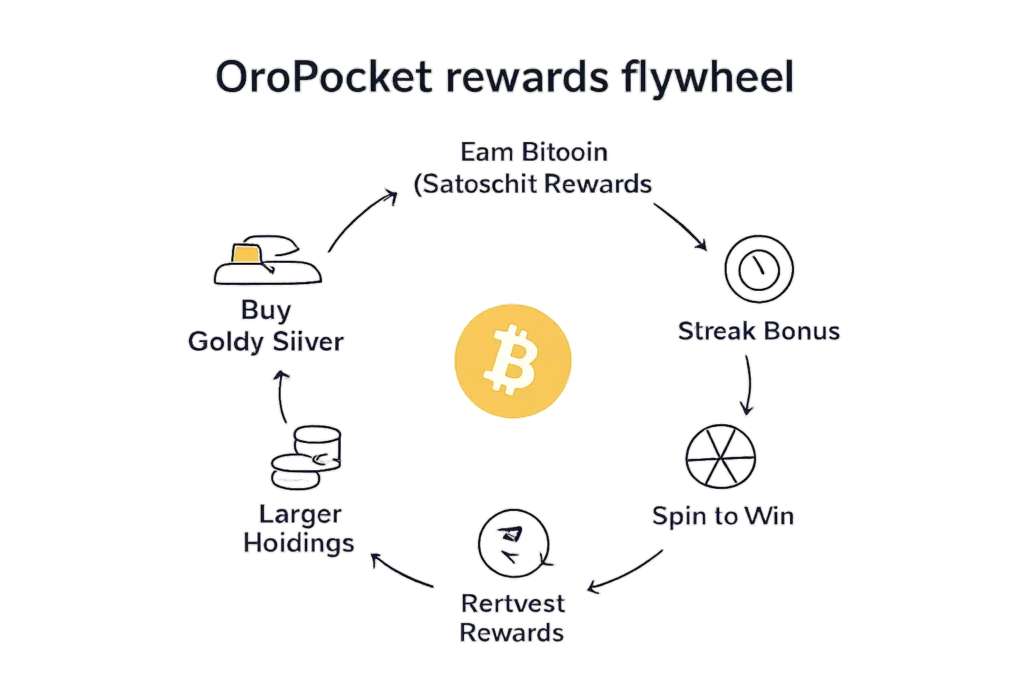

How OroPocket prices gold – and how to pay less than the sticker price

Transparent rate formation

- Live benchmark → INR conversion → minimal, clearly disclosed spread

- RBI‑compliant partners, 24K pure gold, and fully audited, 100% insured vaults

- You see both sides: live buy and digital gold selling price, so you always know the spread you’re paying

Earn free Bitcoin on every purchase

- Every gold/silver buy earns tiered Satoshi cashback, automatically credited

- Your rewards offset part of the spread, effectively lowering your per‑gram cost

- Example: Buy ₹1,000 of gold and earn Bitcoin worth, say, ₹15 (illustrative). If the visible spread was 1.2%, your effective spread drops toward 0.7% after rewards

Gamified ways to save more

- Daily streaks: Bonus every 5 consecutive days you invest

- Spin to Win: Free daily spins to win extra gold or Bitcoin rewards

- Referral rewards: Invite friends and earn 100 Satoshi + a free spin; your friend gets rewards too

- All these stack with your base cashback, compounding your savings over time

Start from ₹1 via UPI

- No minimums – begin with ₹1 and build consistency

- Micro‑investing smooths timing risk and helps you accumulate gold + Bitcoin steadily

- Buy in under 30 seconds with any UPI app

Security, compliance, and trust

- RBI‑compliant operations with authorized bullion partners

- Regular third‑party audits; vaults are fully insured end‑to‑end

- Send/gift gold instantly to friends and family – securely and transparently

Bottom line: OroPocket keeps pricing transparent and lets you beat the sticker price with Bitcoin rewards and gamified bonuses. Keep stacking, keep earning, and keep your effective cost per gram trending lower.

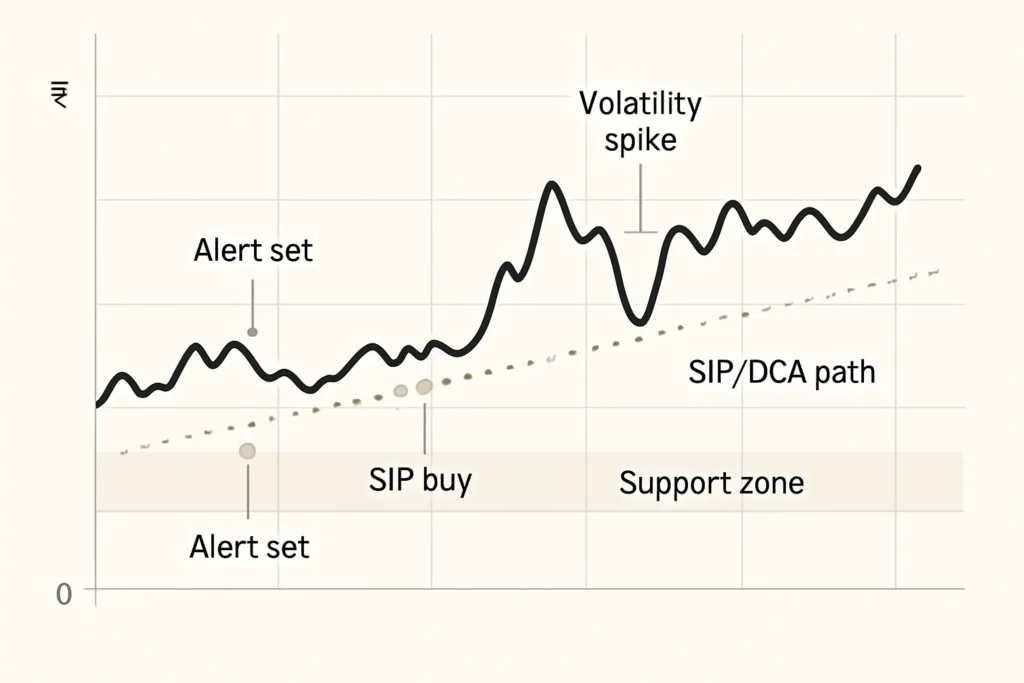

Reading live charts: time your buys with SIPs, alerts and volatility control

SIP/DCA beats guesswork

- Set fixed daily/weekly buys so you capture more grams during dips and fewer during spikes – this averages your entry price and helps offset spreads over time.

- SIP/DCA protects you from “all-in at the peak” regret and smooths timing risk, especially when USD/INR or LBMA moves quickly.

- Start small (₹1 onwards on OroPocket via UPI) and scale as your confidence grows.

Set alerts, not emotional triggers

- Create price alerts for meaningful dip levels instead of chasing every tick. Let alerts prompt you; don’t let FOMO drive you.

- Use watchlists and reminders to review positions weekly. If spreads widen on a volatile day, wait for calmer conditions before topping up.

Avoid slippage in fast markets

- Prefer limit-like executions if the platform offers price locks for a few seconds; avoid illiquid hours and holidays when quotes can be sparse.

- Expect wider spreads during extreme moves or weekend gaps. If you’re SIPing, let your schedule work for you and skip chasing intraday noise.

When to redeem vs hold

- Redeem to coins/bars when you specifically need physical gold (gifting, milestones). Factor in minting, delivery, and minimum redemption sizes.

- Stay digital if your goal is pure investment exposure and liquidity. It avoids redemption costs and keeps compounding simple.

- Goal-based rule of thumb: If your target is more than 6–12 months away, keep accumulating digitally with SIP/DCA; plan physical conversion closer to the event date to minimize shipping and storage overlap.

FAQs: digital gold price, MCX vs spot, SafeGold price, delivery and more

- Is the digital gold price the same as MCX futures? How are they different?

- No. MCX quotes futures (INR contracts with expiry), while the price of digital gold tracks the international spot/LBMA benchmark converted to INR. Futures include carry/financing and can trade at a premium/discount to spot. They converge near expiry but can diverge intraday.

- Why is my platform’s sell quote lower than the buy quote (even when the market is flat)?

- That’s the bid–ask spread. The buy price (ask) includes platform margin; the digital gold selling price (bid) is lower to cover custody, operations, and hedging risk. Even in a flat market, the two-way quote remains.

- Why do SafeGold price and MMTC-PAMP price differ slightly at the same time of day?

- Small differences come from sourcing premiums, vaulting/insurance structures, quote refresh speeds, and hedging approaches. Each provider overlays these costs on the same global benchmark, so tiny quote gaps are normal.

- Do I pay GST when I sell digital gold back to the platform?

- Typically no GST on sellback to the platform; you just receive the bid price. GST (3%) applies at purchase of bullion/coins. Your profit/loss may be subject to tax as per Income Tax rules – consult a tax advisor.

- What’s the minimum I can buy – is ₹1 real? How does UPI make this seamless?

- On OroPocket, yes – start from ₹1. Micro-buys via UPI complete in seconds, letting you SIP/DCA instead of timing the market.

- How pure is digital gold? Who audits/vaults it?

- OroPocket offers 24K (99.9%) pure gold with authorized bullion partners. Gold is stored in fully insured, third‑party audited vaults. We disclose partners, insurance, and audit practices for transparency.

- Can I redeem for coins/bars later? What charges apply?

- Yes. You can convert to coins/bars subject to minimum redemption sizes. Expect minting/purity certification charges, packaging, and insured shipping. Applicable taxes and fees are itemized at checkout before you confirm.

- Why does the digi gold price change every few seconds?

- It reflects live international spot benchmarks, USD/INR moves, and platform refresh intervals. During volatile periods, quotes may update faster and spreads can widen briefly.

- How do I compare platforms fairly?

- Check both buy and digital gold selling price side‑by‑side with timestamps, confirm total fees (GST, storage-after-X-years, delivery/minting), read redemption minimums, and watch how spreads behave during volatile hours.

- When should I redeem vs stay digital?

- Redeem if you specifically need physical coins/bars (gifts, occasions). Stay digital for pure investing and liquidity – no minting/shipping costs, easier SIP/DCA. Plan redemptions close to the event to minimize logistics overlap.

- Does OroPocket help reduce my effective cost?

- Yes. You earn Bitcoin (Satoshi) rewards on every purchase, plus streak and spin bonuses. These rewards offset part of the spread over time, lowering your effective cost per gram while you keep stacking systematically.

Quick checklist before you buy or sell today

- Check the time-stamp on the live rate (avoid stale quotes)

- Make sure the quote just refreshed – LBMA and USD/INR move constantly. If your app’s refresh is slow (or paused), wait for the next tick.

- Compare buy vs digital gold selling price (spread) across two platforms

- Look at both sides (ask vs bid) at the same moment. Calculate the spread percentage: (Buy − Sell) ÷ Mid. Smaller, transparent spreads = better.

- Factor duties/GST and any platform-specific fees

- Remember: 3% GST applies at purchase for bullion/coins. Add delivery/minting, storage-after-X-years, or small-order fees if you plan to redeem physically.

- Consider SIP/DCA if you’re hesitating on timing

- Fixed daily/weekly buys smooth out volatility and help offset spread over time – especially when the digi gold price is choppy.

- On OroPocket: activate streaks, claim Spin to Win, and refer a friend before checkout to lower effective cost

- Stack Bitcoin rewards, streak bonuses, and referral Satoshi to reduce your net per‑gram cost versus the headline price.

- Plan your exit – sellback vs physical redemption – so there are no surprises later

- If you’ll redeem coins/bars, check minimums, minting/pack/ship fees, delivery timelines, and address coverage. If you’ll sell back, watch the live bid and typical spread.

Your next step: Get the best digital gold price with OroPocket

- Buy 24K digital gold from ₹1 via UPI – done in under 30 seconds

- Earn free Bitcoin (Satoshi) on every purchase – two assets for the price of one

- Build habits with daily streaks, Spin to Win, and referral rewards (100 Satoshi + free spin)

- RBI‑compliant, 100% insured vaults, authorized bullion partners; send/gift gold in‑app

- Download on iOS and Android; start with ₹100 today and feel the difference

Ready to lock in a transparent live digital gold price and lower your effective cost with rewards? Open OroPocket, compare buy vs digital gold selling price in real time, and start stacking gold + Bitcoin the smart way.

![How to Invest in Gold & Silver Together in India [2026 Portfolio Guide] 8 How20to20Invest20in20Gold2020Silver20Together20in20India205B202620Portfolio20Guide5D cover](https://blog.oropocket.com/wp-content/uploads/2025/12/How20to20Invest20in20Gold2020Silver20Together20in20India205B202620Portfolio20Guide5D-cover-300x200.webp)