Digital Gold Price in India: Premiums, Spreads, and How to Save Money

Digital Gold Price in India – What You’re Really Paying For

Open any app and the price of digital gold rarely matches the “spot price” you see on TV tickers or news sites. That’s not a glitch. It’s because the app shows your all-in buy price for real 24K gold in India, while the news flashes an international “spot” rate that doesn’t include India-specific costs and taxes.

“Indian households are estimated to hold up to 25,000 tonnes of gold.” – Source

Why the price on apps looks higher than the news spot price

-

News “spot price” is an international benchmark (usually USD/oz) before any taxes or retail costs.

-

Your app shows the final landed price in INR for 24K gold you actually own – after currency conversion, vaulting, insurance, hedging, and taxes.

-

Result: the price of digital gold on apps is higher than the pure spot, and the sell price is a bit lower due to the spread.

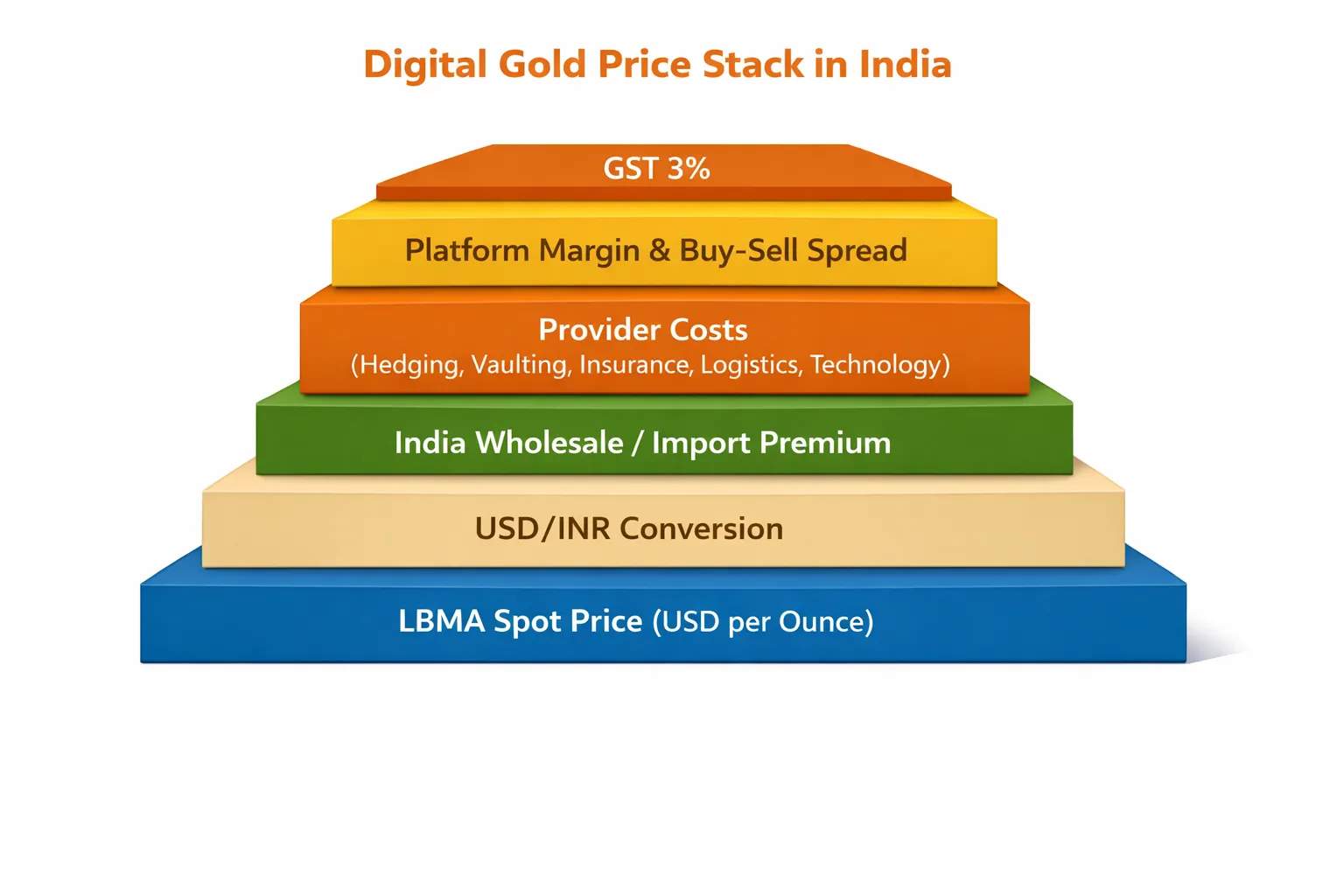

What builds the final price you see

-

Global gold spot (USD)

-

FX rate (USD/INR) + conversion to per gram

-

Provider premium (vaulting, insurance, hedging, logistics)

-

Buy–sell spread (market risk + operating costs)

-

GST (3% on purchase in India)

-

Platform fees (if any)

What you’ll learn in this guide

-

How to decode premiums, spreads, and GST so you know exactly what you’re paying.

-

How the “safe gold price” on trusted platforms compares to the raw spot.

-

Smart, actionable tactics to save money in gold – timing buys, using micro-investing, reducing effective spread, and stacking rewards so you keep more of your returns.

-

How to track digital gold price in India versus physical prices and avoid hidden markups.

Who this guide is for

-

First-time buyers who want simple clarity before their first rupee.

-

Micro-savers building a habit with ₹1–₹100 buys.

-

Cost-conscious investors focused on squeezing every basis point.

-

Anyone exploring the fast-growing digital gold market and looking to make smarter, cheaper purchases.

We’re OroPocket. We make saving gold simple: start from ₹1, pay via UPI, and earn free Bitcoin on every gold purchase – so your money on gold works twice as hard.

Ready to buy smarter, not costlier? Download the OroPocket app at https://oropocket.com/app.

How Digital Gold Pricing Actually Works (Spot → INR → Premiums → Spread → GST)

The price stack in plain English

-

Global reference: LBMA spot (USD/oz) vs futures

-

LBMA spot is the global benchmark for immediate delivery of gold, quoted in USD per troy ounce. It does not include local taxes or retail costs.

-

Futures quotes include expectations, carry costs, and exchange margins – useful for traders, not for retail “you-own-it” pricing.

-

-

FX conversion to INR and wholesale premiums in India

-

Apps convert USD/oz to INR/gram using the live USD/INR rate, then layer India’s wholesale/import premium to reflect local market realities.

-

-

Provider costs: hedging, vaulting, insurance, logistics, technology

-

Secure storage, insurance, hedging against price swings, and logistics/tech infrastructure are real costs that sit between raw spot and your final quote.

-

-

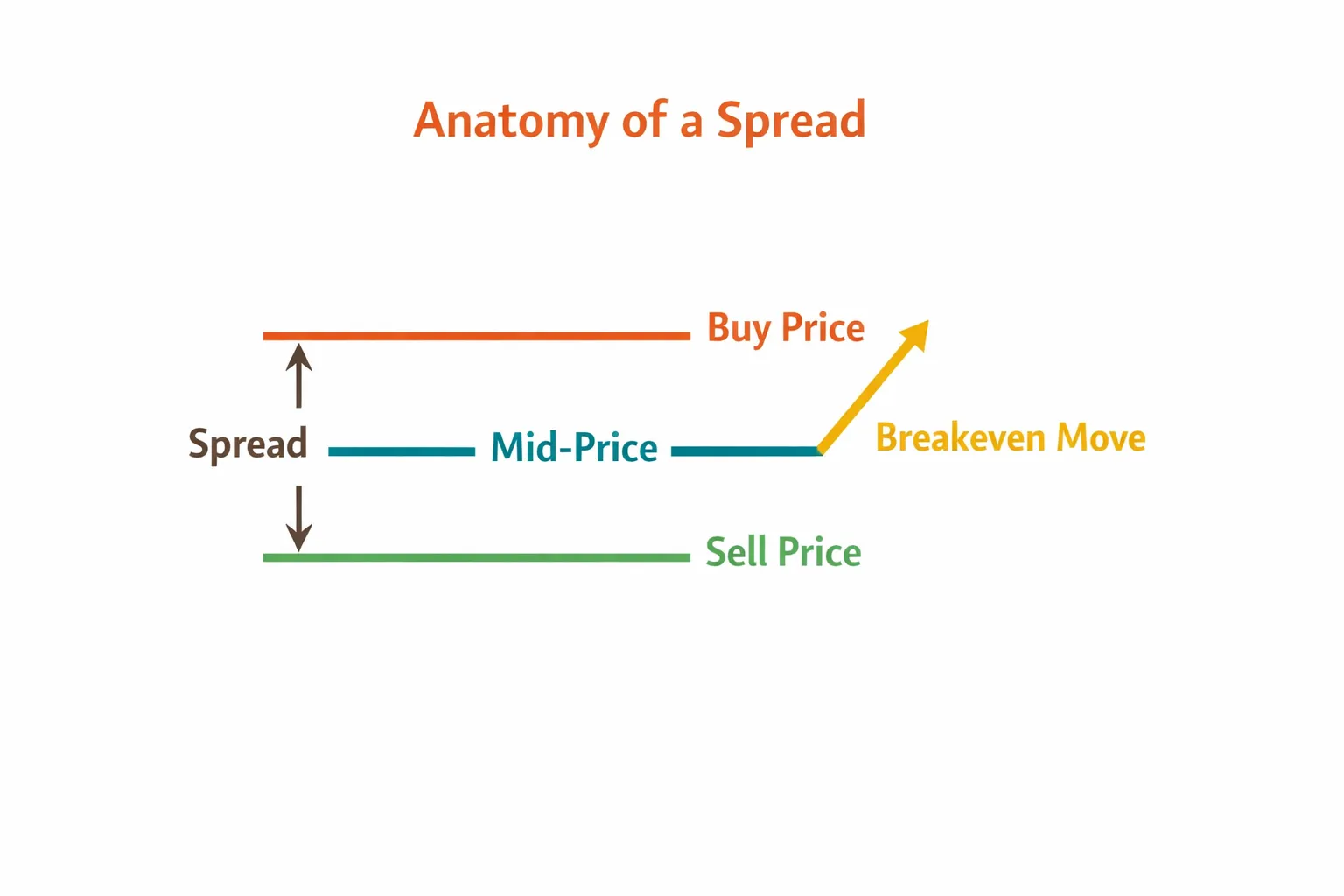

Platform margin and the buy–sell spread (your real friction)

-

The spread is the difference between the Buy and Sell price you see on the app. It covers carrying and operating costs and market risk.

-

-

GST (3%) on purchase and how it’s applied

-

A flat 3% GST applies on the purchase value of gold in India. There’s no GST when you sell back.

-

A simple working formula you can use

-

App Quote (Buy) ≈ [LBMA Spot in USD × USD/INR] + [wholesale premium] + [platform margin/spread share] + [applicable taxes/charges]

-

App Quote (Sell) ≈ Buy Quote − [spread] (varies by volatility/time of day)

What changes intraday

-

Spot and USDINR move constantly; platforms hedge and refresh quotes in near real time.

-

Spreads often widen during high volatility or off-market hours to cover risk.

-

Different apps can show slightly different prices at the same time due to:

-

Different hedging models and refresh frequencies

-

Varying wholesale sourcing and premiums

-

Platform-specific margins and fee policies

-

Components of the Price of Digital Gold

|

Component |

What it is |

Who collects it |

How it moves intraday |

|---|---|---|---|

|

Global spot (LBMA, USD/oz) |

International benchmark price for immediate delivery |

No one “collects”; it’s a market reference |

Moves with global trading (24/5), typically most during London/US hours |

|

USD/INR conversion |

Exchange rate used to convert USD to INR |

FX market makers/banks set rates |

Moves with FX market; can be volatile around macro news/RBI actions |

|

Wholesale/import premium |

Local India premium over spot due to demand, supply, duties |

Bullion wholesalers/importers |

Widens with demand spikes, tight supply, or duty changes; narrows in calm markets |

|

Provider carrying costs |

Hedging, vaulting, insurance, logistics, technology |

Digital gold provider and partners |

Mostly stable; hedging component can adjust with volatility |

|

Platform margin |

App/platform’s service margin |

Platform |

Generally stable; may adjust by time of day or campaign |

|

Buy–sell spread |

Gap between buy and sell quotes to cover risk/costs |

Provider/platform |

Widens in high volatility/off-hours; tightens in liquid hours |

|

GST (3% on buy) |

Statutory tax on purchase value |

Government of India |

Fixed on purchase; no GST on sell-back |

|

Payment processing |

UPI/payment gateway fees (if charged) |

Payment processor and/or platform |

Typically fixed per transaction or %; not market-driven |

“Buyback rates are lower than selling rates; the buy–sell spread covers costs like GST, payment gateway, trustee, insurance, and custodian fees.” – Source

Want transparent pricing with micro-buys and Bitcoin rewards on every purchase? Download OroPocket: https://oropocket.com/app

Premiums and Spreads: What You Really Pay (and When They Widen)

Definitions that matter

-

Premium: The extra you pay over global spot due to India-specific wholesale factors (import/wholesale premiums, duties, local demand–supply).

-

Spread: The gap between the Buy and Sell quotes on your app. This is your real friction – what you must “earn back” before you’re in profit.

Typical ranges and what drive them

-

Normal conditions vs. high-volatility days

-

Premiums: Often modest in calm markets, can jump during festival demand, import constraints, or sudden INR moves.

-

Spreads: Typical digital gold buy–sell spreads range roughly 2–6% provider-agnostic. Expect wider spreads when gold or USDINR whipsaw.

-

-

Off-hours quoting; effect of liquidity/hedging costs

-

Outside major market hours, hedging is costlier and quotes refresh less frequently, so spreads can widen.

-

-

Smaller ticket sizes vs. payment method fees

-

Micro-buys don’t always mean worse pricing – top platforms standardize spreads for everyone.

-

But payment method fees (e.g., card surcharges, certain gateway fees) can inflate your effective cost on tiny tickets. Prefer UPI when possible.

-

Your action checklist

-

Always check both Buy and Sell quotes before confirming – this is your effective spread.

-

Refresh quotes and avoid peak-volatility minutes (major data releases, sudden INR spikes).

-

Track your effective spread over time. Keep a quick note: date, buy, sell, spread %, and payment method.

Typical Costs by Channel (India)

|

Channel |

Typical Buy–Sell Spread |

GST on buy |

Other fees (making/delivery/brokerage) |

Liquidity |

|---|---|---|---|---|

|

Digital Gold (24×7) |

~2–6% |

3% |

Possible payment gateway fees; delivery/minting charges if you take coins/bars |

High (24×7 on most apps) |

|

Jeweller Coin/Bar |

~2–5% buyback discount vs sell; varies by jeweller |

3% |

Making/premium on coins/bars ~1–10%; delivery/valuation costs |

Medium (business hours, in-person) |

|

Gold ETF |

~0.05–0.50% market bid–ask |

0% (securities) |

Brokerage per trade; expense ratio ~0.5–1.0% p.a. |

High (market hours) |

|

SGB (Primary/Secondary) |

Primary issue: N/A; Secondary market can trade at discount/premium (~1–5% typical) |

0% |

None on primary; brokerage on secondary; early exit constraints |

Low–Medium (8-year maturity; 5-year early exit windows; thin secondary) |

Want transparent pricing, micro-buys from ₹1, and rewards that put more money on gold to work for you? Download the OroPocket app: https://oropocket.com/app.

Taxes, GST, and Hidden Fees You Shouldn’t Ignore

“GST on gold purchase (unwrought or semi‑manufactured forms) is 3% in India.” – Source

GST on purchase

-

3% GST applies when you buy gold – whether physical or digital. This is baked into the price you see on most apps showing the live price of digital gold.

-

No GST when you sell back to the platform. Your proceeds are based on the sell quote minus any platform-specific fees (if applicable).

Capital gains in brief

-

STCG (holding ≤ 3 years): Taxed as per your income slab.

-

LTCG (holding > 3 years): 20% with indexation for physical/digital gold (prevailing rules).

-

Note: Finance-law updates can affect how funds are taxed; verify the latest treatment for Gold ETFs/Gold Mutual Funds, which may differ from physical/digital gold.

Payment and redemption extras

-

Payment method fees:

-

Cards may attract surcharges or gateway fees; UPI is often zero-cost and helps you save money in gold, especially on micro-buys.

-

-

Physical redemption (if you convert digital to coins/bars):

-

Making/minting, packaging, and delivery fees apply. Only opt in if you explicitly want coins/bars; otherwise, it’s cheaper to stay digital for a safe gold price.

-

-

Platform/operational nuances:

-

Check for overnight/wallet transfer charges (if any), minimum redemption thresholds, or inactivity fees in the app T&Cs.

-

Some platforms bundle costs into the spread; others list them as separate line items – always review before confirming.

-

Bottom line: taxes and fees are part of the price stack that shapes the digital gold price in India. Know the 3% GST, track your holding period for capital gains, prefer UPI to minimize payment friction, and avoid unnecessary physical redemption costs. That’s how you keep more money on gold in a fast-moving digital gold market.

Ready to buy smarter and keep more of your returns? Download the OroPocket app: https://oropocket.com/app.

7 Proven Ways to Save Money on Digital Gold (Without Timing the Market)

-

Use micro-buys/SIPs to average price and reduce timing risk

-

Set a daily/weekly SIP (₹1–₹100). You’ll smooth out spikes in the digital gold price in India and avoid decision fatigue.

-

Prefer UPI to avoid card surcharges and failed-payment retries

-

UPI is instant and often zero-fee. Card payments can add gateway charges that quietly raise your effective cost.

-

Check spreads – buy when spread is within your target band; avoid extreme-volatility minutes

-

Keep a simple band (e.g., ≤3–4% for many apps). If spreads widen, refresh or wait a few minutes. Don’t chase quotes during macro-news spikes.

-

Skip physical redemption unless gifting (making + delivery fees)

-

Converting to coins/bars adds making, minting, and delivery costs. Stay digital to preserve returns unless you’re gifting.

-

Stack platform rewards/loyalty to offset spread (cashback, vouchers)

-

Apply promo credits and seasonal offers. Even 1–2% back meaningfully narrows your all-in cost of ownership.

-

Leverage OroPocket streaks and Spin-to-Win for bonus rewards and lower effective cost of ownership

-

Build 5-day streaks for bonus rewards. Use daily spins to win extra gold or Bitcoin – compounding benefits on top of your savings habit.

-

Refer friends – use referral bonuses to subsidize future purchases

-

On OroPocket, both of you earn 100 Satoshi plus a free spin. Referral rewards can fund your next micro-buy and systematically reduce net cost.

Put these into practice today – start with a ₹1 SIP, pay via UPI, and stack rewards so your money on gold goes further. Download OroPocket: https://oropocket.com/app.

Track Price vs Spot Like a Pro (LBMA, MCX, and App Quotes)

Where to look

-

LBMA spot (global reference): A trusted global benchmark for bullion. It’s not the final price you’ll transact at in India because it excludes INR conversion, local premiums, and taxes.

-

MCX (domestic futures): India’s rupee-denominated reference for near-month and far-month gold contracts – useful to see local expectations versus spot.

-

App quotes (your execution price): This is what you actually pay/receive. It includes INR conversion, wholesale premiums, spread, and GST on buys.

A simple 3-step comparison

-

Step 1: Note LBMA spot (USD/oz) and USDINR

-

Example: Spot × USD/INR → base ₹/oz; divide by 31.1035 to get ₹/g.

-

-

Step 2: Add a reasonable premium band

-

Include wholesale/import premiums and expected platform spread share (e.g., a few percent depending on conditions).

-

-

Step 3: Compare to app buy/sell

-

If your app’s buy price is far above your band, refresh or wait a few minutes (especially during volatile or off-hours). If sell is unusually low, spreads may be widened – consider delaying.

-

Pro tips

-

Set app price alerts for both buy and sell to avoid anchoring to headlines.

-

Keep a simple personal log of:

-

Date/time

-

LBMA spot, USDINR

-

App buy/sell

-

Effective spread (%)

-

Your average buy price

-

-

Over time, you’ll learn each platform’s typical ranges and know when pricing is favorable.

Want transparent pricing, micro-buys from ₹1, and Bitcoin rewards that offset costs? Download OroPocket: https://oropocket.com/app.

Real-World Scenarios: Your Net Cost After Spreads, GST, and Rewards

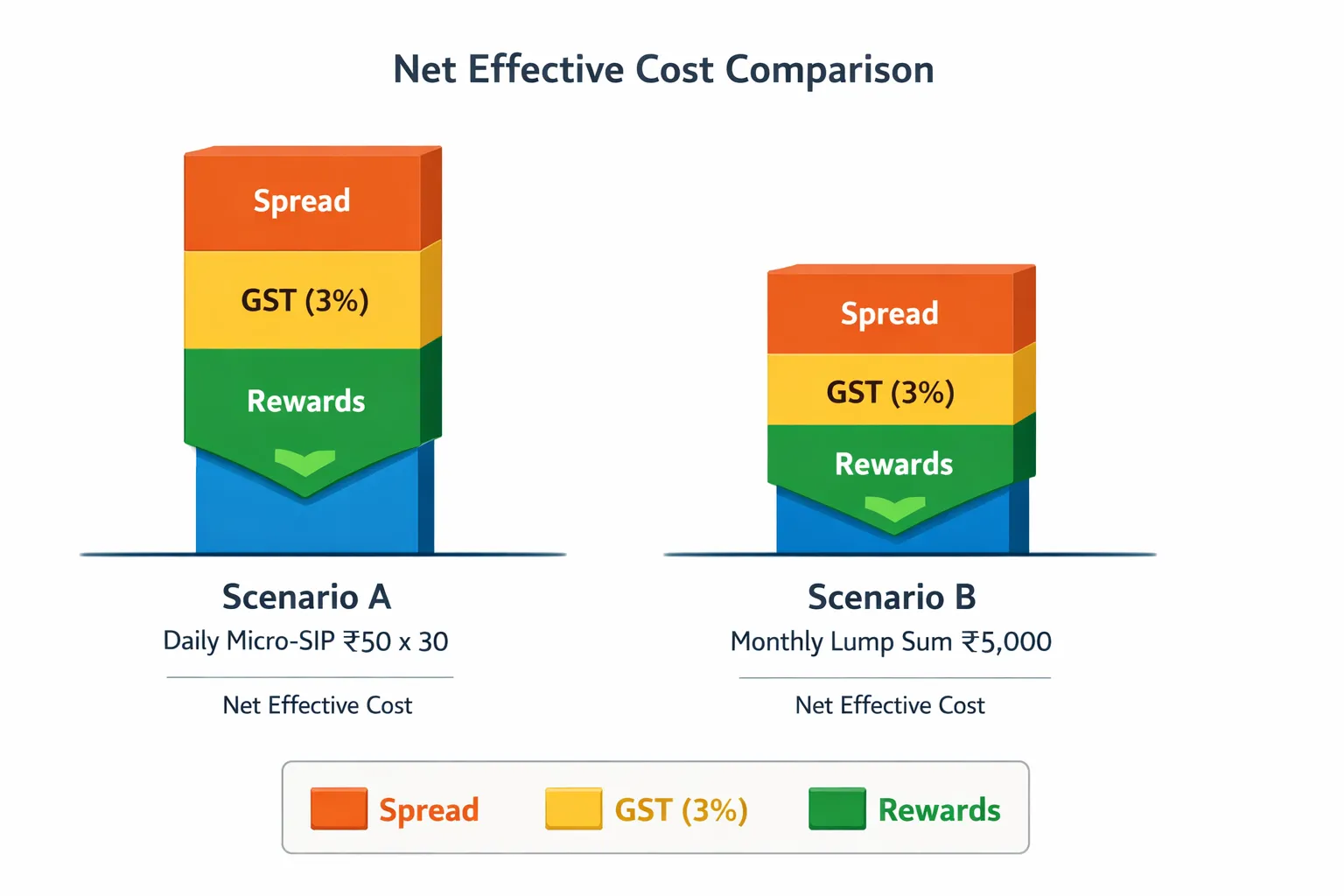

Scenario A: Daily micro-SIP (₹50 x 30 days)

-

Setup: ₹50 per day for 30 days = ₹1,500 total.

-

Friction you face:

-

GST: 3% on each daily buy.

-

Spread: the gap between buy/sell (assume a typical 3–4% range; example: 3.5% average in calm markets).

-

-

Illustration (assumptions for learning):

-

Gross friction ≈ GST (3.0%) + Spread (3.5%) = 6.5%.

-

Rewards offset: Bitcoin cashback + streaks + spins can reduce your effective cost. If combined rewards over the month total ~1.0–2.0% of purchase value, net friction ≈ 4.5–5.5%.

-

-

Why micro-SIP helps:

-

You average out volatile days in the digital gold market and avoid buying everything at a peak.

-

Daily streaks and Spin-to-Win can meaningfully chip away at costs over time.

-

Scenario B: Monthly lump sum (₹5,000 on the 5th)

-

Setup: One-shot ₹5,000 buy.

-

Friction you face:

-

GST: 3% (same).

-

Spread: can be tight on liquid hours or widen on volatile/off-hours.

-

-

Illustration (assumptions for learning):

-

If spread is 3.0% at purchase, gross friction ≈ 6.0%.

-

Rewards: With fewer transactions, you might get only base cashback (say ~0.5–1.0% illustrative), net friction ≈ 5.0–5.5%.

-

If you buy during a volatility spike and the spread widens to ~4–5%, gross friction can jump to ~7–8% before rewards – this is the “slippage” risk for lump sums.

-

-

Takeaway:

-

Lump sums are simpler but more exposed to one moment’s price/spread.

-

Micro-SIPs smooth timing and can unlock more streak-based rewards on OroPocket.

-

Your breakeven move

-

Quick mental math:

-

Breakeven % ≈ Spread % + 3% GST − Rewards %.

-

Example: If spread is 3.5% and you earn 1.5% rewards, breakeven ≈ 3.5 + 3.0 − 1.5 = 5.0%. Gold needs to rise ~5% from your buy price to break even on an immediate sell.

-

-

Why rewards matter:

-

Consistent streaks, daily spins, and referral bonuses accumulate – shrinking your breakeven over time and helping you save money in gold without timing the market.

-

Beat friction the smart way: use micro-buys, pay via UPI, and stack rewards so more of your money on gold compounds, not fees. Start now with OroPocket: https://oropocket.com/app.

Digital Gold vs Other Ways (When Cost and Liquidity Matter)

-

Short-term hedge: 24×7 liquidity you can actually use

-

Digital gold lets you buy/sell any day, any hour – useful when you want a quick hedge against a falling rupee or spiking volatility. Your execution price already reflects the live price of digital gold in India, including spread and GST.

-

Gold ETFs are efficient but restricted to market hours and exchange liquidity. You also need a demat, brokerage account, and you face bid–ask plus brokerage and potential slippage. For overnight moves or weekends, ETFs can’t match digital’s round-the-clock access.

-

-

Gifting/emergencies: instant transfer beats wait times

-

With digital gold, you can send gold instantly to family – no bank timings, no delivery delays. This is ideal for small emergency buffers or quick gifts.

-

ETFs/mutual funds settle post-trade (T+1/T+2), and selling requires a broker/app, market hours, and then a bank credit cycle. SGBs require a sale on the exchange or an early redemption window – neither is “instant.”

-

-

When SGBs win (and when they don’t)

-

Win: Long horizon + 2.5% interest. If you’re holding 5–8 years, SGBs add fixed interest on top of price appreciation, and maturity redemption is tax-efficient. For disciplined savers who don’t need short-term liquidity, SGBs are tough to beat.

-

Don’t: Early liquidity matters. There’s a 5-year lock-in before early exit windows, and secondary-market liquidity can be thin or at a discount. For emergency funds or tactical hedging, digital gold is usually a better fit.

-

-

Physical coins/jewellery: ceremonial, not cost-optimized

-

Great for gifting and tradition, but making/premium charges and resale discounts typically erode financial returns. Storage, purity checks, and buyback terms add friction. If your goal is saving gold efficiently, digital or SGB/ETF routes are usually cheaper over time.

-

Bottom line: If cost and liquidity matter today, digital gold shines – especially for micro-savers and quick hedges – while SGBs are the long-game champion. For ceremonial needs, go physical; for intraday liquidity and convenience, go digital. Want transparent pricing, instant UPI buys, and rewards that help you save money on gold? Download OroPocket: https://oropocket.com/app.

Why OroPocket Helps You Save More Over Time

Pay less, earn more (net-net)

-

Micro-investing from ₹1 keeps you consistent without overpaying on big one-shot buys

-

Average your cost over time and avoid buying at a single, unlucky peak in the digital gold market.

-

-

Bitcoin Rewards: earn free Satoshi on every gold/silver purchase (tiered)

-

Two assets for the price of one – your gold stack grows while Bitcoin rewards help offset spreads and fees.

-

-

Daily Streaks and Spin-to-Wwin: gamified bonuses that cumulatively offset spreads

-

Stay active, build streaks, use daily spins – small, regular rewards reduce your effective net cost on every gram.

-

Pro tip: Refer friends to stack extra Satoshi and spins, further lowering your average entry price.

-

Fast, compliant, secure

-

Instant UPI payments; buy in under 30 seconds

-

No card surcharges, no failed-payment drama – seamless UPI flows mean more of your money goes into gold.

-

-

24K pure gold, 100% insured vaults; RBI-compliant with authorized bullion partners

-

A safe gold price experience with real, securely vaulted assets you can buy/sell anytime.

-

-

Send Gold instantly – perfect for gifting or quick help to family

-

Move value in seconds, no bank timings, no logistics delays.

-

Why this combo matters

-

Stability of gold + upside potential of Bitcoin rewards

-

Gold protects your purchasing power; Bitcoin rewards add asymmetric upside – together they help you save money in gold without timing the market.

-

-

Builds the habit: progress you can see, every day

-

Micro-buys, streaks, and rewards make saving gold simple and sticky – ideal for first-time investors and cost-conscious savers watching the price of digital gold in India.

-

Ready to turn every rupee into more gold (and Bitcoin rewards)? Download OroPocket now: https://oropocket.com/app.

Conclusion: Start Saving Real Money on Every Gram – With OroPocket

-

You now know the price stack behind the price of digital gold in India – spot, USD/INR, wholesale premium, platform spread, and 3% GST – and exactly where costs sneak in.

-

Don’t overthink timing. Use micro-buys, pay via UPI, and stack rewards (Bitcoin cashback, streaks, spins, referrals) to lower your effective cost month after month.

-

Next step: get hands-on. Track your own effective spread and breakeven, keep a simple log, and let OroPocket’s rewards do the heavy lifting while you build real wealth in the digital gold market.

Call to action:

-

Download the OroPocket app (iOS/Android) and start with ₹1: https://oropocket.com/app

![How to invest in digital gold online in India: step-by-step for beginners [2026] 8 How20to20invest20in20digital20gold20online20in20India 20step by step20for20beginners205B20265D cover 1](https://blog.oropocket.com/wp-content/uploads/2025/12/How20to20invest20in20digital20gold20online20in20India-20step-by-step20for20beginners205B20265D-cover-1-300x200.webp)