Digital Gold Providers in India Compared: SafeGold vs MMTC-PAMP vs Augmont

Introduction: India’s digital gold heavyweights at a glance

“India’s bar and coin demand rose 7% year-on-year to 47 tonnes in Q1 2025, underscoring resilient retail appetite for gold.” – Source

What you’ll learn in 5 minutes

-

Who really holds your gold (and how) when you buy from SafeGold, MMTC-PAMP, or Augmont

-

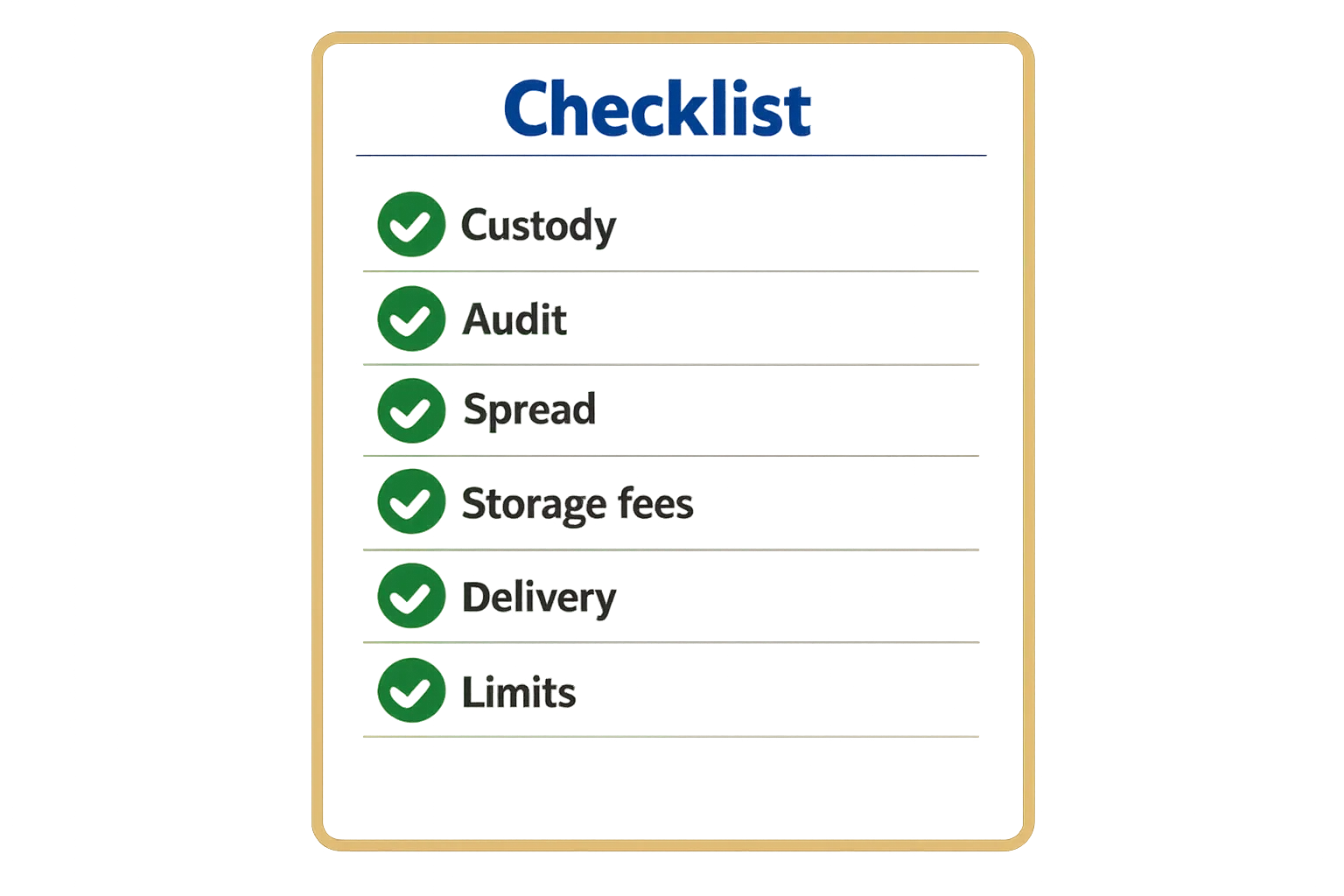

Clear differences in custody, audits, pricing/spreads, delivery, limits, and app experience

-

A quick due-diligence checklist you can use before you buy

-

A modern alternative for ₹1-investors who also want Bitcoin rewards

If you’re asking “is SafeGold safe?”, or comparing digital gold in India to find the best platform for digital gold, this guide gives you a fast, unbiased starting point.

Comparison at a glance (skim-friendly)

|

Provider |

Purity |

Minimum buy |

Typical spread/fees (indicative) |

Custody model (trustee + vault partners) |

Audit cadence |

Storage fee policy |

Delivery/redeem options |

Limits |

Where you can buy (partner apps) |

|---|---|---|---|---|---|---|---|---|---|

|

SafeGold |

24K 999/999.9 |

₹10–₹50 (varies by app) |

~2.5–5.0% buy-sell spread; GST 3% on buys |

Independent trustee structure; vault partners such as Brink’s/Sequel; 100% insured |

Regular third‑party audits (frequency varies by partner) |

Often free for initial years on partner apps; nominal fee thereafter |

Coins/bars delivery; many partners support jewellery redemption via leading brands |

PAN typically required beyond ₹2 lakh; app-level daily gram/value caps may apply |

Commonly on large payment apps and jewellers’ apps (e.g., major wallets, marketplaces, jeweller networks) |

|

MMTC-PAMP |

24K 999.9 (LBMA-accredited) |

₹1–₹100 (varies by app) |

~2.5–4.5% buy-sell spread; GST 3% on buys |

Refinery-custodied, insured vaults; global standards; independent assurance |

Regular external audits/assays in line with international standards |

Frequently free up to 5 years on many partner apps; then nominal |

Coins/bars delivery nationwide; gifting features common |

PAN/KYC thresholds; daily transaction caps vary by app |

Prominently available on major payment apps and MMTC-PAMP’s own channels |

|

Augmont |

24K 999/999.9 (BIS/NABL hallmarked) |

₹1–₹10 (varies by app) |

~2.5–5.0% buy-sell spread; GST 3% on buys |

Custody via Augmont with independent trusteeship; leading vault partners; insured |

Periodic third‑party audits |

Often free (policy varies by partner); some offer lifetime free storage |

Coins/bars delivery; some partners support jewellery exchange |

PAN/KYC thresholds; app-level daily limits (grams/value) |

Available via investing apps, micro-savings apps, and Augmont’s retail network |

Note: Spreads, fees, limits, and storage policies are indicative and can differ by partner app and city. Always check the latest terms inside the app before you buy.

Quick note for readers comparing alternatives

Prefer an app-first experience with ₹1 entry, UPI buys in seconds, and free Bitcoin rewards on every purchase? OroPocket is built for modern micro-investors who want gold’s stability plus Bitcoin rewards. Get the app at https://oropocket.com/app.

How digital gold providers actually work (and what to check)

The ecosystem in plain English

-

Seller/refiner: Mints/refines the 24K gold and issues your units.

-

Trustee: Holds legal title on behalf of investors, separate from the seller.

-

Vault partner: Provides secure, insured storage of the physical bars/coins.

-

Insurer: Covers risks like theft or loss at vault facilities.

-

The app you buy from: The distribution layer (pricing UI, payments like UPI, support).

What proves you own the gold

-

Purchase invoice with gram quantity, purity, price, tax, and your KYC details.

-

Trustee confirmation or certificate stating gold is held in trust for you.

-

Serialised bar linkage and bar lists (where available) tying custody to your holdings.

The due-diligence lenses you’ll use in this guide

-

Custody: Identify the independent trustee, vault partners, and insurance cover.

-

Verification: Look for third-party audit frequency and the auditor’s name.

-

Pricing transparency: Check live price source, total buy–sell spread, all fees, and GST.

-

Redemption: Note minimum redemption, delivery timelines, and jewellery exchange options.

-

Limits & KYC: PAN-linked caps, daily quantity/value limits, and storage fee policy after any free period.

-

App UX: Payment rails (UPI), partner network breadth, and human support responsiveness.

“In Aug 2021, SEBI directed brokers to stop offering unregulated products like digital gold via their platforms, citing Rule 8(3)(f); brokers were told to cease by Sep 10, 2021.” – Source

SafeGold: custody, pricing, delivery, and where to buy

Snapshot

SafeGold is a digital gold provider that powers gold buying and selling across a large partner network, including major payment apps and jeweller ecosystems. You can typically access SafeGold through popular wallets and commerce apps (e.g., Amazon Pay, PhonePe), micro-savings apps (e.g., Jar), and jewellery partners (e.g., Tanishq/CaratLane), all offering 24K 999/999.9 purity with insured vault storage and instant liquidity.

Custody & audits

-

Trustee: SafeGold works with an independent trustee (commonly IDBI Trusteeship Services) that holds legal title of customers’ gold separately from the operating entity.

-

Vault partners & insurance: Leading vault providers such as Brink’s/Sequel store the metal with full insurance coverage; insurance typically covers theft and physical loss within vault premises.

-

Audit cadence & disclosures: Look for third‑party audit reports and bar lists published periodically. On their site, check sections covering “Trustee,” “Custody,” and “Audit/Compliance” to verify the audit firm’s name and frequency.

Pricing & limits

-

Minimum investment: Often as low as ₹10–₹50 (varies by partner app).

-

Indicative spread & storage: Typical buy–sell spread band ~2.5–5.0% plus 3% GST on buys. Many partners offer free storage for initial years; thereafter, a nominal annual fee (e.g., ~0.3–0.4% p.a.) may apply.

-

KYC & caps: PAN required beyond common thresholds (e.g., ₹2 lakh cumulative). App-level daily quantity/value caps may apply; verify inside the partner app.

Redemption & delivery

-

Coins/bars: Redeem to coins/bars with minimum gram thresholds set by each partner; delivery usually within a few business days, with minting/delivery charges shown upfront.

-

Jewellery exchange: Through jeweller partners like Tanishq/CaratLane, you can convert digital gold value towards jewellery purchases. Expect store/online redemption flows where your digital balance is netted off at live rates, with making charges applicable on jewellery.

App experience

-

Payments & UX: UPI-enabled buys/sells, 24/7 pricing, and instant liquidity are standard. Experience and feature depth (e.g., SIPs, gifting, delivery options) differ by partner app.

-

Support: Customer support is routed via the app you use; for custody or delivery escalations, partners coordinate with SafeGold and the vault/logistics provider.

Pros and cons (who it suits)

-

Pros:

-

Widest distribution via top apps; easy UPI access and 24/7 liquidity

-

24K purity with insured professional vaulting and trustee oversight

-

Flexible redemption, including jewellery exchange at leading brands

-

-

Cons:

-

Fees vary by partner; spreads and delivery charges can add up

-

Storage may become chargeable after free period

-

App-by-app policy differences require careful review before buying

-

MMTC-PAMP: custody, pricing, delivery, and where to buy

Snapshot

MMTC-PAMP is a joint venture between MMTC (a Government of India enterprise) and PAMP SA (Switzerland), an LBMA-accredited global bullion brand. It offers 24K 999.9 gold and is available through leading payment apps as well as its own website. You can typically buy via Google Pay, Paytm, or directly through MMTC-PAMP’s online store, with insured storage and nationwide delivery.

Custody & audits

-

Vaulting & security: Institutional-grade vaulting with insurance coverage against physical loss/theft; assay-certified packaging for delivered products.

-

Audits & certifications: LBMA accreditation and regular third‑party audits/assays underpin purity and bar integrity. Verify external assurance reports, assay certificates, and any audit frequency statements on their site.

Pricing & limits

-

Minimum investment: Often as low as ₹1–₹100 depending on the partner app.

-

Spreads & storage: Indicative buy–sell spread ~2.5–4.5% plus 3% GST on buys. Many channels offer free storage for up to 5 years; check current policy in‑app.

-

KYC & caps: PAN/KYC thresholds apply (e.g., beyond ₹2 lakh cumulative); daily gram/value limits can vary by app and channel.

Redemption & delivery

-

Coins/bars: Redeem to 24K coins/bars with minimum gram thresholds; typical delivery in a few business days. Minting/delivery charges are displayed before checkout.

-

Gifting & jewellery: Gifting features are commonly available; jewellery conversion depends on partner tie-ups and may not be standard – confirm in the app or website flow.

App experience

-

Where to buy: Seamless purchase flows on Paytm/Google Pay versus the MMTC-PAMP site; UPI payments supported by partner apps with instant liquidity.

-

Support: App-channel support plus MMTC-PAMP’s own customer service for delivery/custody queries.

Pros and cons (who it suits)

-

Pros:

-

999.9 purity from a JV with a Swiss LBMA leader; high brand trust

-

Widely available on top payment apps; free storage windows are common

-

Strong delivery experience with assay-certified packaging

-

-

Cons:

-

Spreads and delivery charges still apply; vary across channels

-

Daily limits and KYC thresholds differ by app

-

Jewellery conversion options are limited or partner-dependent

-

Augmont: custody, pricing, delivery, and where to buy

Snapshot

Augmont operates across the “phygital” spectrum – digital gold and physical products – backed by integrated refining-to-retail capabilities. You can buy Augmont digital gold via its own app/site and through partner platforms like Groww, Gullak, and other micro-saving/investing apps. Expect 24K 999/999.9 purity, insured vaulting, and nationwide delivery.

Custody & audits

-

Trustee & vault partners: Augmont structures custody with an independent trustee holding investor title, while secure third‑party vault partners provide storage; insurance covers physical loss/theft within vaults.

-

Audits & disclosures: Periodic third‑party audits are standard; look for published audit statements, bar lists, and trustee confirmations on their site or partner app disclosures.

Pricing & limits

-

Minimum investment: Often ₹1–₹10 depending on the partner app or channel.

-

Spreads & storage: Indicative buy–sell spread ~2.5–5.0% plus 3% GST on buys. Storage may be free for an initial period; thereafter nominal annual storage fees can apply – confirm policy per app.

-

KYC & caps: PAN/KYC thresholds (e.g., beyond ₹2 lakh cumulative) and daily purchase limits vary by app.

Redemption & delivery

-

Coins/bars: Redeem to coins/bars once minimum gram thresholds are met; typical delivery within a few business days with minting/delivery charges shown before checkout.

-

Jewellery exchange: Select partners and Augmont’s retail network may support jewellery conversion – check live terms in-app.

App experience

-

Payments & integrations: UPI-first buying with instant settlement on most partner apps; features like SIPs, gifting, and price alerts vary by integration.

-

Support: In-app support via the partner you use, with escalations routed to Augmont/vault/logistics teams for fulfilment.

Pros and cons (who it suits)

-

Pros:

-

Integrated refinery-to-retail presence; wide partner availability

-

24K purity with insured custody and trustee separation

-

Strong delivery footprint; potential jewellery conversion via partners

-

-

Cons:

-

Spread and delivery fees vary by partner/channel

-

Storage may become chargeable after free period

-

Policy differences across apps require careful review before buying

-

Pricing deep-dive: spreads, GST, and the real cost to you

The three components of cost

-

3% GST on purchase (non-recoverable): Applied to the gold value at checkout; this tax is not clawed back when you sell.

-

Buy–sell spread: The gap between the platform’s buy and sell quotes. It exists to cover hedging, custody, insurance, logistics, and platform operations.

-

Delivery/minting and post‑grace storage fees: Minting and delivery apply when redeeming to coins/bars; storage fees may kick in after an initial free period.

“GST on gold bullion/jewellery purchases in India is 3% under Chapter 71 of the GST Tariff; making charges on jewellery typically attract 5%.” – Source

Head-to-head pricing snapshot

|

Provider |

GST on buy |

Typical buy–sell spread (indicative) |

Storage grace period |

Storage fee after grace |

Delivery/making charges |

Minimum redemption thresholds |

|---|---|---|---|---|---|---|

|

SafeGold |

3% |

~2.5–5.0% |

Often free for initial years (varies by app) |

~0.3–0.4% p.a. (app-specific) |

Minting + courier shown at checkout |

App-specific coin/bar minimum grams |

|

MMTC-PAMP |

3% |

~2.5–4.5% |

Frequently free up to ~5 years (channel-specific) |

Nominal thereafter |

Assay-pack minting + delivery fees disclosed |

Channel-specific gram thresholds |

|

Augmont |

3% |

~2.5–5.0% |

Often free initially (varies by partner) |

Nominal annual fee post-grace |

Minting + delivery shown in-app |

Partner/app-defined thresholds |

Notes: Bands are indicative and vary by app/channel and market conditions. Always check the latest in-app quote and fee policy.

How to compare apples-to-apples

-

Example: Buy ₹10,000 today; sell after 3 months.

-

Upfront GST: ₹10,000 × 3% = ₹300 (sunk cost).

-

Spread impact: If the combined buy–sell spread is ~3.5%, your exit price would need to be ~3.5% higher just to break even (ignoring delivery/storage).

-

Storage: If still within grace, zero impact; post-grace, pro‑rate annual fee (e.g., 0.3% p.a. ≈ 0.075% for 3 months).

-

Delivery: Only if you redeem coins/bars – add minting + courier charges; these do not apply if you sell back digitally.

-

Tips to reduce cost impact:

-

Minimise frequent in‑out trades; hold through short-term volatility to avoid paying the spread repeatedly.

-

Redeem physically only when necessary; compare total minting + delivery versus selling digitally.

-

Use UPI for instant, low-friction payments; avoid small, frequent transactions that amplify fixed fees.

Security and audits: who holds your gold and how it’s verified

Custody checklist

-

Trustee independence: Ensure a named, independent trustee holds legal title on investors’ behalf, separate from the seller/operator.

-

Vault partner reputation: Look for recognised vaulting firms with bank-grade security and a track record in precious metals custody.

-

Insurance scope: Confirm vault-level insurance covers theft, fire, and physical loss; check exclusions and whether transit is covered during delivery.

Audits and attestations

-

Frequency: Prefer quarterly or more frequent independent audits; monthly reconciliations are ideal for high-volume platforms.

-

Auditor name: Verify a named third-party auditor or assurance firm; check if they specialise in bullion/commodities.

-

What reports disclose: Total investor gold vs physical holdings, bar lists with serials, variance/exceptions, and remediation steps.

How to read the audit:

-

Bar lists: Match serial numbers, refiners, weights, and fineness; look for LBMA/BIS compliance where applicable.

-

Reconciliation: Confirm total investor ledger balances equal or are lower than total vaulted holdings.

-

Exceptions: Review any noted variances, pending deliveries, or damaged/rehabbed bars and how they were resolved.

Ownership proof

-

Save the tax invoice for each buy (amount, grams, purity, GST).

-

Download trustee/custody confirmation where available.

-

Keep redemption/delivery acknowledgements and bar/coin serials for physical conversions.

Red flags to avoid

-

Vague or missing audit pages; no named auditor or trustee.

-

No clarity on vault partner or insurance scope.

-

Opaque pricing pages; spreads/fees hidden until checkout.

Delivery, limits, liquidity and tax: the stuff most people miss

Delivery and redemption

-

Minimums: Physical redemption typically requires meeting a coin/bar threshold (e.g., 0.5g, 1g, 5g, 10g). Check the exact gram threshold in-app before placing a delivery request.

-

Timelines: Standard processing and courier timelines range from 2–7 business days depending on city and serviceability.

-

Coverage: Most providers offer pan-India delivery with PIN-code checks at checkout; remote-area surcharges or longer timelines may apply.

-

Packaging: Expect tamper-proof, assay-sealed packaging for coins/bars, with serialisation and certificate details printed or enclosed.

-

Charges: Minting (for coins/bars) and courier fees are added at checkout; these vary by weight and destination.

Limits & KYC

-

PAN requirements: Without PAN, cumulative purchases are commonly capped (e.g., around ₹2 lakh). PAN/KYC removes or increases caps and enables higher-value transactions.

-

Daily limits: App-level daily caps can apply by value or grams to manage risk and logistics; check limits on the buy screen.

-

Storage grace period: Many platforms offer free storage for an initial period (often 1–5 years). After grace, a nominal annual fee (e.g., ~0.3–0.4% p.a.) may apply – verify the policy in your app profile or FAQs.

Liquidity and settlement

-

Sellback speed: Digital sellbacks are usually instant on pricing, with settlement timing ranging from T+0 to T+1 on banking rails.

-

Payout rails: UPI/IMPS often enable near-real-time credit; NEFT/RTGS may follow banking hours. Check the “sell” confirmation screen for the stated credit timeline.

Tax basics (India)

-

GST: A non-recoverable 3% GST applies on digital gold purchases at checkout.

-

Capital gains:

-

Short-Term Capital Gains (STCG): If you sell within 3 years, gains are added to your income and taxed as per your slab.

-

Long-Term Capital Gains (LTCG): If you sell after 3 years, gains are taxed at 20% with indexation.

-

-

Not apples-to-apples: Sovereign Gold Bonds (SGBs) and Gold ETFs/Mutual Funds are different products with different tax and regulatory frameworks; they’re outside this head-to-head.

App experience: where to buy each and how it feels to use

SafeGold: where and how

-

Where to buy: Widely available on major consumer apps and jeweller ecosystems – think Amazon Pay, PhonePe, Jar, and retail partners like Tanishq/CaratLane. This breadth is a big plus if you already use these apps daily.

-

UX highlights: Instant UPI payments, live pricing, quick buy/sell, and simple redemption. Many partner apps add SIP/top-ups and gifting.

-

UX quirks to expect:

-

Policies vary by app: minimum buy, storage grace period, and delivery thresholds can differ.

-

Delivery/minting fees surface at checkout; read the pricing page before redeeming.

-

Jewellery exchange flows are partner-specific; you’ll typically net off your digital gold balance at live rates and pay making charges separately.

-

MMTC-PAMP: where and how

-

Where to buy: Available on Google Pay, Paytm, and MMTC-PAMP’s own website/app.

-

UX highlights: 24K 999.9 purity with strong brand trust; clean purchase flow; free storage windows (often up to five years depending on channel); seamless gifting options.

-

UX quirks to expect:

-

Daily gram/value limits and KYC thresholds depend on the app you use.

-

Delivery charges and assay-pack premiums are clear but add to the total; check before confirming.

-

Some flows prioritise buy/sell simplicity over advanced analytics (you may need a separate tracker for long-term trends).

-

Augmont: where and how

-

Where to buy: Augmont’s own app/site plus integrations with investing and micro-savings apps like Groww, Gullak, and others.

-

UX highlights: UPI-first checkout, SIP/top-up features, price alerts on some partner apps, and robust phygital options (digital accumulation with physical delivery).

-

UX quirks to expect:

-

Spreads/storage policies can differ across partner apps versus Augmont’s own channel.

-

Jewellery exchange options may depend on the specific partner network – confirm before planning a redemption.

-

Some partners batch-deliver to certain PIN codes, so timelines can vary slightly by location.

-

What great UX looks like (checklist)

-

Fast UPI flows: Payment authorisation to gold credit in seconds, with instant sellback support.

-

Clear pricing page: Live price source, buy–sell spread, GST, delivery/minting, and storage policy spelled out upfront.

-

Quick KYC: PAN verification in-app, with visible limits and thresholds post-KYC.

-

Responsive support: In-app chat or helpline with clear SLAs for custody/delivery escalations.

-

Transparent redeem flow: Gram thresholds, minting and courier fees, and delivery timelines shown before you tap “Confirm.”

Final verdict + due-diligence checklist (and a modern alternative)

Which one should you choose?

-

If you want widest partner access and jewellery exchange: SafeGold

-

If you value JV pedigree and big-wallet integrations: MMTC-PAMP

-

If you prefer phygital breadth and partner app variety: Augmont

Our lean take

All three can work for long-term holders who prioritise credible custody and clear audits; your choice should come down to spread, delivery needs, and the convenience of the apps you already use.

Quick buyer’s checklist (save this)

-

Do I see the trustee’s name and latest audit on the website?

-

Is the spread disclosed up front? What happens after free storage years?

-

What are delivery minimums/charges and timelines in my PIN code?

-

What are my account limits and KYC requirements?

-

Are redemption options (coins/bars/jewellery) clearly stated with fees?

-

Is customer support responsive with clear escalation paths?

Considering an app-first alternative

For ₹1 micro-investing, instant UPI, and free Bitcoin rewards on every gold/silver purchase, check OroPocket. It adds gamified streaks, referrals, and Satoshi cashback – ideal for young investors who want gold’s stability with a Bitcoin upside layer.

Call to action

Ready to try an investment app built for India? Download the OroPocket app: https://oropocket.com/app