Smart Money Habits

Digital Gold vs Gold ETFs vs Sovereign Gold Bonds: which is best for you?

Introduction: Digital Gold vs Gold ETFs vs SGBs (and a quick answer)

Why gold still matters in India

- Inflation hedge and portfolio diversifier in INR terms: When prices rise and the rupee wobbles, gold often holds its ground. It’s a practical ballast for any Indian portfolio and a smart way to pursue gold investment in India without the hassles of jewellery.

- Cultural plus investment: festival spikes and long-term store of value. Diwali, Akshaya Tritiya, weddings – demand pops during festivals, but the bigger story is decades of preservation. For many, digital gold investment in India is the modern way to invest in gold online while keeping tradition alive.

“India’s Q3 2024 gold bar and coin purchases hit a record ₹88,680 crore (US$10B), up 20% year-on-year.” – Source

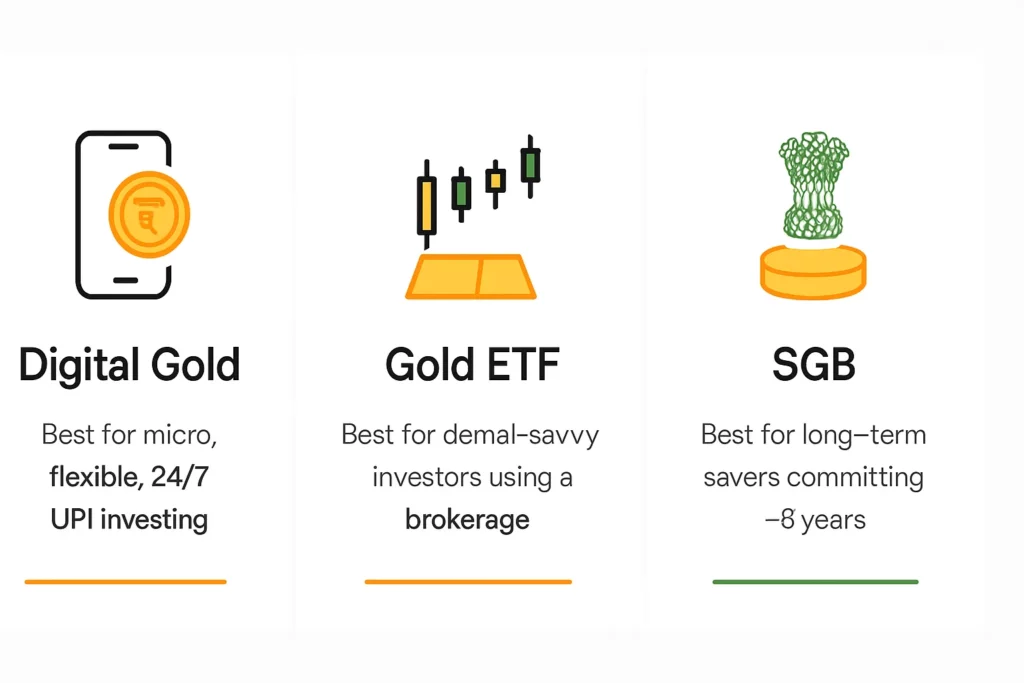

The 10-second takeaway

- Digital Gold: Best for micro, flexible, 24/7, UPI-first investing. Start with ₹1, build a habit, stay liquid.

- Gold ETF: Best for demat-savvy investors who want market-hour liquidity inside a brokerage.

- SGB: Best for long-term savers who can commit ~8 years for tax-free maturity plus interest.

Comparison at a glance

| Factor | Digital Gold | Gold ETF | SGB |

|---|---|---|---|

| Purity | 24K (typically 99.9%), vaulted | Backed by 99.5%+ bullion via fund | Price linked to 999 purity benchmark |

| Regulation | Guidelines-led; not SEBI/RBI regulated | SEBI-regulated mutual fund | RBI-issued, Government of India backed |

| Minimum investment | From ₹1 (e.g., OroPocket) | 1 unit (~0.5 g equivalent), needs demat | 1 gram |

| Costs & fees | 3% GST on buy; buy–sell spread | Expense ratio (≈0.5–1%); brokerage; demat | No annual fees; no GST; issue/redemption norms apply |

| Taxation (FY 2024–25) | < 3 yrs: taxed at slab; ≥ 3 yrs: 20% with indexation | Gains taxed at slab; no indexation | Interest (2.5% p.a.) taxable; maturity capital gains tax-free; early sale taxed like physical gold (indexation >3 yrs) |

| Liquidity | Instant 24/7 with provider | Market-hours on exchange | Exchange listing (often thin volumes); early redemption windows from year 5; maturity at year 8 |

| Lock-in | None | None | 8 years (exit windows from year 5; or sell on exchange) |

| Income (interest) | None | None | 2.5% p.a., paid semi-annually |

| SIP availability | Yes (daily/weekly/monthly on many apps) | Broker-led SIP options available | Not typical |

| Storage | Insured, professional vaults | Fund/custodian | Demat or certificate (no storage hassles) |

| Convert-to-physical | Often available for coins/bars (fees apply), provider-dependent | No | No |

| Rewards | On OroPocket: free Bitcoin (Satoshi) on every gold buy | None | None |

Key context your decision depends on

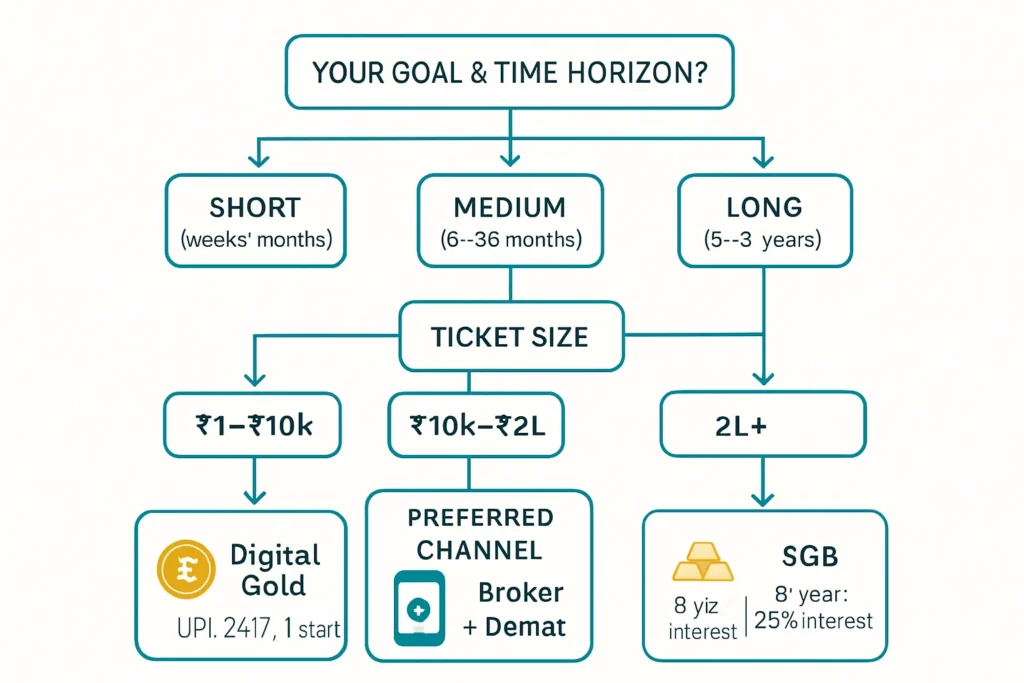

- Time horizon: weeks vs years. Want quick liquidity for short-term goals or an 8-year commitment for tax efficiency?

- Ticket size: from ₹1 to ₹2 lakh+; micro-savers vs lump-sum investors.

- Need for liquidity vs tax efficiency: quick exits vs tax-free maturity.

- Comfort with demat/brokerage vs app + UPI: market-hour trading vs tap-and-go investing.

How each option works (India-specific, no jargon)

Digital Gold (via mobile apps like OroPocket)

- You buy 24K gold digitally; provider stores insured bullion with a custodian.

- Buy/sell anytime; start from ₹1; pay via UPI; option to gift/transfer.

- Provider spread applies; GST on purchase; optional delivery (making + delivery charges).

Gold ETFs (via your brokerage + demat)

- Exchange-traded mutual funds that hold 99.5% pure gold.

- Buy/sell during market hours; NAV tracks domestic gold price (with tracking error).

- Costs: expense ratio, brokerage, demat; no GST on ETF units.

Sovereign Gold Bonds (RBI)

- Government-backed bonds linked to gold price; tenure 8 years.

- 2.5% p.a. interest paid semi-annually; redemption price linked to gold.

- Early exit: tradable on exchanges; premature redemption window from year 5.

Costs and fees you actually pay

| Cost item | Digital Gold | Gold ETF | SGB |

|---|---|---|---|

| Purchase tax | 3% GST on purchase value | No GST on ETF units; exchange stamp duty as applicable | No GST at subscription; online discount of ₹50/g when announced by RBI |

| Platform/spread | Provider buy/sell spread; quotes track spot; delivery/making charges if you take coin/bar | Bid–ask spread on exchange (varies by liquidity) | None at primary issue; on exchange, bid–ask spread can widen due to low volumes |

| Recurring costs | Typically no storage fee; some platforms may charge after a free storage period | Expense ratio (ongoing), demat AMC, brokerage account charges | None (no AMC/expense ratio) |

| Exit costs | Sell-side spread; optional delivery + making charges if you convert to physical | Brokerage on sell, exchange/SEBI fees; tracking error affects realized returns | No charge at RBI maturity; brokerage and price impact if selling on exchange before maturity |

| Misc. | 24/7 UPI; SIPs; provider spread is the main friction | Market-hours only; tracking error vs domestic gold; SIP via some brokers | Premature redemption window from year 5; redemption price uses IBJA average; secondary-market liquidity can impact execution price |

Taxation (FY 2024–25): what you’ll owe and when

Digital Gold (treated like physical gold)

- STCG: slab rate if held ≤ 3 years; LTCG: 20% with indexation if held > 3 years.

Gold ETFs (post Finance Act, 2023)

- For units acquired on/after 1 Apr 2023: gains taxed at slab rate; no indexation.

- Grandfathering: legacy units (before 1 Apr 2023) may retain 20% with indexation after 3 years.

Sovereign Gold Bonds (RBI)

- Interest (2.5% p.a.) taxable at slab; no TDS.

- Capital gains on redemption at maturity (8 years): tax-exempt.

- If sold on exchange before maturity: capital gains tax applies; indexation available for LTCG.

Practical tips

- Match product to your tax horizon (short vs long).

- Consider SIPs and averaging for price volatility (Digital Gold/ETF).

“Finance Act 2023 removed indexation for debt-style mutual funds (including Gold ETFs) bought on or after April 1, 2023 – gains are taxed at your slab rate regardless of holding period.” – Source

Liquidity, lock-in and access

Digital Gold

- 24/7 buy/sell with instant UPI settlement; provider limits may apply (e.g., ₹2 lakh caps, storage duration rules by platform)

Gold ETFs

- Intraday liquidity during market hours; depends on market depth and ETF AUM; can set limit orders

SGBs

- Tenure 8 years; early redemption window from year 5 (via RBI); tradable on exchanges any time but volumes and pricing may be thin

Execution realities

- Slippage sources: spreads (Digital Gold), bid-ask (ETF), discount/premium to IV (SGB on exchange)

Safety, purity and regulation

Digital Gold

- Vaulting with independent custodians; insured; periodic audits; platform is not directly regulated by RBI/SEBI – choose RBI-compliant partners, audit transparency, and insured vaults.

Gold ETFs

- SEBI-regulated mutual funds; trustees, custodians; underlying gold of 99.5% purity; daily NAV disclosure; statutory audits.

SGBs

- RBI-issued, Government of India backed; price based on IBJA 999 purity benchmark; no storage risk; e-certificate or demat.

What to verify before you invest

- Purity (24K/999), custodian, insurer, audit reports (Digital Gold).

- Expense ratio and tracking error history (ETF).

- Issue price/discount, tranche calendar, redemption mechanics (SGB).

Returns and risks: what actually drives outcomes

Return components

- Gold price move (all three).

- Income: SGB’s 2.5% p.a. interest; potential platform rewards (e.g., OroPocket Bitcoin cashback) boost effective yield.

- Costs drag: GST/spread (Digital Gold), expense ratio/brokerage (ETF), exchange discount/premium (SGB).

Key risks

- Price volatility in INR (all).

- Provider/counterparty risk (Digital Gold).

- Tracking error and liquidity (ETF).

- Liquidity/exit price risk before maturity (SGB).

Historical perspective

- Gold’s long-term role as a diversifier and crisis hedge in Indian portfolios.

“In 2024, India’s investment demand for gold reached 239 tonnes – up 29% year-on-year and the highest since 2013.” – Source

“Portfolios with 7.5%–15% gold allocations showed higher risk-adjusted returns and lower drawdowns in WGC analysis.” – Source

Which one should you choose? (Goal + time-horizon playbook)

If you need flexibility and tiny ticket sizes

- Choose Digital Gold: ₹1 start, 24/7 liquidity, UPI; set daily/weekly SIPs; ideal for first-time investors and giftings.

If you already use a broker and want market-hour liquidity

- Choose Gold ETF: clean brokerage execution, portfolio integration, no GST on unit purchase; suitable for medium-term goals and rebalancing.

If you can commit 5–8 years and want tax-free maturity

- Choose SGB: 2.5% interest + gold price; zero capital gains tax at 8-year redemption; good for long-term wealth parking.

Extra credit: make your gold work harder

- Use rewards/loyalty programs (e.g., Bitcoin cashback on OroPocket) to boost effective returns without extra risk.

Getting started with OroPocket (Digital Gold)

30-second setup

- Download app (iOS/Android), complete KYC-lite in minutes, and pay via UPI.

- Clean, mobile-first flow tailored for digital gold investment in India.

Make your first buy from ₹1

- Instant purchase at the live 24K price – no minimums. Start a daily/weekly/monthly SIP to invest in gold online effortlessly.

- Build your stack gradually without timing the gold market investment.

Earn as you stack

- Get Bitcoin rewards (Satoshi) on every gold/silver buy.

- Keep streaks for bonus rewards, unlock spin-to-win, and earn referral rewards – progress feels rewarding.

Useful actions

- Send or gift gold to friends and family in a tap.

- Track portfolio growth in-app; optional delivery available (charges apply).

- Your holdings are 100% insured in professional vaults with RBI-compliant partners – transparent, secure gold investment in India.

Final verdict

TL;DR

- Pick Digital Gold if you want flexibility, micro-investing via UPI, and habit-building – with OroPocket’s Bitcoin rewards sweetening every purchase.

- Pick a Gold ETF if you’re demat-ready and prefer market-hour trading inside your broker.

- Pick SGBs if you can stay for ~8 years and value the tax-free maturity + 2.5% interest.

Pro move

- Blend them: build a daily/weekly position in Digital Gold; hold a core allocation in SGBs for tax efficiency; use ETFs for tactical rebalancing.

Next steps

- Start with ₹1 on OroPocket, set an SIP, and let rewards compound your edge.

![10 best places to buy digital silver online in India [2026] 10 1020best20places20to20buy20digital20silver20online20in20India205B20265D cover](https://blog.oropocket.com/wp-content/uploads/2025/12/1020best20places20to20buy20digital20silver20online20in20India205B20265D-cover-300x200.webp)