Digital silver in India: how to buy, fees, and use-cases

Digital silver in India: what it is and why it matters in 2025–26

What is digital silver (in simple words)

-

It’s silver you own in grams digitally – each gram is fully backed by 999/999.9 purity metal stored in audited, 100% insured vaults.

-

You can buy/sell 24×7 on your phone via UPI. No making charges, no lockers, no handling – just tap, own, and track.

Digital silver vs physical silver (quick comparison)

-

Purity and storage assurance vs jeweller-by-jeweller variability

-

No making charges; transparent live pricing; instant liquidity

-

Delivery-on-demand when you want coins/bars (redeem anytime)

“India’s online jewellery market is projected to reach ₹330 billion in 2025, signaling rapid digital adoption of precious metals.” – Source

Why now (India context)

-

Inflation and volatile markets: silver has historically held value while offering upside from industrial demand (EVs, solar, electronics).

-

UPI-native investing from ₹1: micro-investing removes entry barriers – perfect for first-time investors building a habit.

-

“Can we buy digital silver with UPI?” Yes – within 30 seconds on OroPocket. Plus, you earn free Bitcoin (Satoshi) as cashback on every purchase.

What you’ll learn in this guide

-

How to buy digital silver step-by-step (via UPI, from just ₹1)

-

All fees decoded: GST, spreads, storage, delivery/redemption

-

Liquidity, taxes, and how redemption works

-

SIPs, practical use-cases, and how to pair gold + silver smartly

Ready to start? Download OroPocket to buy digital silver in seconds and earn free Bitcoin on every purchase: https://oropocket.com/app

How digital silver works: purity, pricing, vaults, and spreads

Purity & backing

-

Typically 999/999.9 fineness; every gram you buy is allocated to you and backed by real silver stored securely.

-

Regular third‑party audits; vaults are fully insured; assets are held with regulated, RBI-compliant partners and authorized bullion providers.

“SEBI’s framework for Silver ETFs requires 99.9% purity LBMA Good Delivery bars, with physical silver held by a SEBI‑registered custodian.” – Source

Pricing mechanics (spot → your buy price)

-

Live spot price of silver (global/India reference prices)

-

Platform premium (covers vaulting, insurance, hedging, operations)

-

GST (3%) on the purchase value

-

= Your final buy price

-

Sell price reflects the live market less the platform’s buy–sell spread Notes:

-

Spreads can widen during high volatility or low-liquidity hours and tighten during normal markets.

-

Transparent platforms show buy and sell quotes in real time so you always know your net price.

Liquidity and settlement

-

Instant buy/sell during market hours; proceeds are settled to your linked bank/UPI.

-

Delivery option: convert holdings to coins/bars on demand; making, delivery, and packaging fees apply (quoted upfront before you confirm).

When digital silver beats physical

-

No making charges or locker rent; lower friction to start and manage.

-

Easy partial sells (liquidate exactly the grams/₹ you need).

-

Track performance in-app; automate purchases via SIP to average costs over time – ideal for first‑time investors.

-

With OroPocket, you can buy digital silver via UPI in under 30 seconds – and earn free Bitcoin (Satoshi) cashback on every purchase.

Watch: how to buy digital silver with UPI (walkthrough)

-

Download OroPocket, complete KYC, choose grams or ₹, pay via UPI, view holdings instantly.

Start with as little as ₹1. Download OroPocket and buy digital silver in seconds: https://oropocket.com/app

How to buy digital silver in India (UPI-friendly): step-by-step on OroPocket

Step 1: Download OroPocket (iOS/Android) and sign up

-

Mobile-first; start with ₹1; RBI-compliant partners

Step 2: Quick KYC (PAN/Aadhaar) for higher limits

-

Fast verification; secure data handling

Step 3: Add money or pay directly via UPI

-

UPI apps supported for near-instant checkout

Step 4: Choose silver in ₹ or grams and tap Buy

-

See live price, fees, and holdings instantly

Step 5: Automate with Silver SIPs

-

Set daily/weekly/monthly SIP from ₹1 to build habit

Step 6: Earn free Bitcoin on every purchase

-

Satoshi cashback on silver buys; track rewards

-

Gamified streaks (bonus every 5 days) and Spin‑to‑Win

Step 7: Gift silver instantly or redeem for coins/bars

-

P2P gifting; doorstep delivery (fees apply)

Pro tips

-

Enable price alerts, use SIP for volatility, avoid impulsive buys

OroPocket vs typical digital-silver apps

|

Feature |

OroPocket |

Other apps (generic) |

|---|---|---|

|

Min investment |

₹1 |

Often ₹10–₹100+ |

|

UPI checkout |

Yes |

Yes/Partial |

|

SIP automation |

Yes |

Limited/Manual |

|

Bitcoin rewards |

Yes; unique |

No |

|

Daily streaks/Spin-to-Win |

Yes; unique |

No |

|

Instant gifting |

Yes |

Sometimes |

|

Redemption to coins/bars |

Yes |

Yes |

|

Transparency on fees |

Live |

Varies |

|

Compliance & insured vaults |

Yes |

Varies |

Start investing now. Download OroPocket and buy digital silver in seconds via UPI: https://oropocket.com/app

Fees explained: GST, spreads, storage, redemption – and how to pay less

All the costs you should know

-

GST (3%) on purchase value

-

Buy/sell spread (market-driven; check the live quote before you buy)

-

Storage/insurance (often included in the spread; platform-specific)

-

Redemption/Delivery fees (making + shipping/insurance for coins/bars)

-

Bank/UPI fees (usually nil for UPI, but confirm in-app)

Sample cost breakdown (₹10,000 purchase)

Illustration only; actual rates vary by market conditions.

-

Live spot price (per gram): ₹88

-

Platform premium: +1.5% → effective pre‑GST price: ₹89.32/g

-

GST (3%) on ₹89.32/g: ₹2.68/g

-

Your buy price: ~₹92.00/g

If you pay ₹10,000 at a buy price of ₹92/g, you receive ~108.70 g.

-

If the sell spread is ~0.8%, your sell price when the spot is unchanged ≈ ₹87.30/g.

-

Immediate sell value: 108.70 g × ₹87.30 ≈ ₹9,484 (reflects GST and spread impact).

-

Breakeven: You’d need the market to rise to ~₹92.74/g (about 5–6% above the original ₹88 spot) to break even in this example.

What this means:

-

GST and spreads matter. Buy during normal market hours when spreads are tighter, and think in multi‑week/month horizons.

-

SIPs can average the cost across volatile days.

Digital silver vs Silver ETF vs Physical coins/bars

-

Fees: Digital silver typically embeds storage/insurance in a transparent buy–sell spread; ETFs charge an annual expense ratio; physical coins/bars include GST plus minting/making premiums.

-

Liquidity: Digital silver is instant in‑app; ETFs trade only during market hours; physical requires a buyer/jeweller and may involve price negotiation.

-

Taxation: Rules can change. Digital silver and physical are often treated as capital assets; ETFs follow mutual fund taxation. Always check the latest tax guidance or consult a professional.

-

Delivery: Digital silver can be redeemed into coins/bars on demand (fees apply); ETFs don’t offer delivery; physical is already in-hand but needs secure storage.

Cost comparison across products

|

Parameter |

Digital Silver |

Silver ETF |

Physical Coins/Bars |

|---|---|---|---|

|

Upfront tax/fees |

3% GST on purchase value; premium included in price |

No GST on units; brokerage/exchange charges apply |

3% GST + jeweller margin; coins/bars may carry minting premiums |

|

Ongoing cost (spread/expense ratio) |

Buy–sell spread (e.g., ~0.5%–3%); some platforms add storage after a free period |

Annual expense ratio (e.g., ~0.3%–1.0%) + tracking error |

None formal, but buyback spreads can be wide (e.g., 2%–8%); insurance optional |

|

Liquidity speed |

Instant in‑app; proceeds to bank/UPI |

Market hours; T+1/T+2 settlement via broker/DP |

Dependent on jeweller/buyer; same‑day if negotiated |

|

Delivery option |

Yes – redeem to coins/bars (making + shipping fees) |

No physical delivery |

Already physical (no delivery needed) |

|

Min investment |

Very low (often ₹1–₹10) |

1 unit (varies by NAV); SIP via MF route typically ₹100–₹500 |

Usually in grams; practical minimums ~₹200–₹1,000+ |

|

Platform/brokerage costs |

Usually none beyond spread; UPI typically ₹0 |

Brokerage + exchange fees + GST on brokerage; DP charges may apply |

None to a broker; jeweller margin built into price |

|

Making charges |

Only on redemption to coins/bars |

None |

Yes (coins/bars/jewellery have minting/making charges) |

|

Storage/locker needs |

Vaulting/insurance included; no locker |

None for investor |

Bank locker/home safe; optional insurance cost |

How to minimize costs

-

Use SIPs to average price across volatility instead of lump-sum buys on a single day.

-

Prefer digital accumulation; redeem to coins/bars only when you need gifting or physical delivery.

-

Compare spreads before buying; purchase during normal market hours for tighter quotes.

-

Use UPI for low/no payment gateway fees; avoid credit card surcharges.

-

Redeem in fewer, larger batches to amortize delivery and making charges.

-

Track live buy/sell prices and set alerts; don’t chase spikes – let your SIP do the work.

Pay less, stack smarter. Download OroPocket and start micro‑investing in digital silver from ₹1 via UPI: https://oropocket.com/app

Use-cases: when digital silver truly shines

Everyday wealth building

-

Start small from ₹1 and build a consistent habit with SIPs.

-

Set goal-based SIPs for festivals (Dhanteras/Diwali), gadgets, or life events.

Inflation hedge and volatility buffer

-

Silver has historically held purchasing power better than idle cash.

-

Acts as a diversifier alongside equities to soften drawdowns.

Industrial tailwinds (solar, electronics, EVs)

-

Long-term demand from PV, electronics, and auto electrification supports the thesis.

“Industrial silver demand hit a new record of 680.5 Moz in 2024, driven by a surge in photovoltaic applications after a 64% jump in PV silver demand in 2023.” – Source

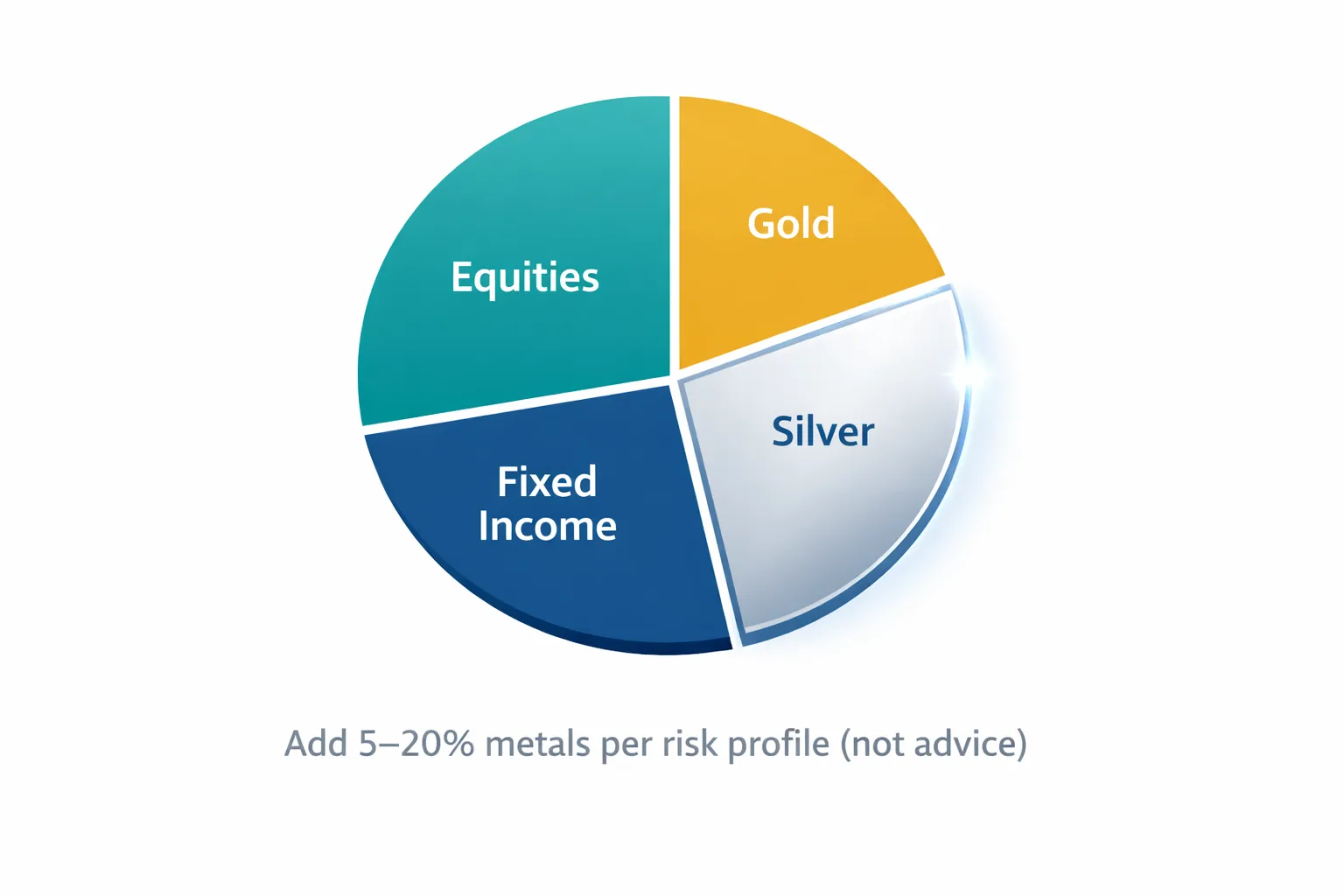

Smart metals mix: gold + silver

-

Use a balanced mix – e.g., 60/40 or 70/30 (adjust to your risk and goals).

-

Rebalance annually or when price bands are hit to capture swings.

Gifting and P2P value transfer

-

Send silver instantly to friends and family for birthdays, festivals, and milestones.

-

Add rewards: with OroPocket, gifting can also help recipients start their own investing habit.

Build smarter, not harder. Download OroPocket to invest, SIP, and gift digital silver in seconds via UPI: https://oropocket.com/app

Liquidity, safety, and redemption: from app to doorstep

Liquidity: how fast can you sell?

-

T+0/T+1 settlement to your linked bank; balances and holdings update instantly in‑app.

-

No lock-in: sell any time, including partial redemptions in grams or ₹.

Safety: vaults, insurance, audits

-

Segregated holdings stored in fully insured, high‑security vaults.

-

Regular third‑party audits and reconciliations to verify gram‑for‑gram backing.

-

Operated within an RBI‑compliant framework with authorized bullion partners.

Redemption to coins/bars (optional)

-

Choose from popular denominations (e.g., 10g, 20g, 50g, 100g, 1kg), subject to availability.

-

Applicable charges: making, packaging, delivery/insurance – quoted upfront before you confirm.

-

KYC/PAN norms apply. Doorstep delivery with tracking and standard timelines communicated at checkout.

Security best practices

-

Enable 2FA and device biometrics; never share OTPs.

-

Keep your device OS and the OroPocket app updated.

-

Maintain up‑to‑date KYC; whitelist your bank account for payouts.

-

Use strong passwords and avoid public Wi‑Fi when transacting.

Move from digital to doorstep on your terms. Download OroPocket and buy, sell, or redeem silver in minutes: https://oropocket.com/app

Taxes on digital silver in India: GST, STCG/LTCG, indexation, reporting

GST at purchase

-

3% GST applies on the value of silver when you buy (digital or physical). This is levied on the transaction value at checkout and becomes part of your cost of acquisition.

“GST on precious metals (including gold/silver bullion and coins) is 3%.” – Source

Notes:

-

GST is charged on purchases, not on sale proceeds.

-

If you redeem to coins/bars, making and delivery may attract additional GST per applicable rules.

Capital gains on sale

-

Short‑term (held ≤3 years): Gains are taxed as per your income‑tax slab. Example: If you bought digital silver worth ₹50,000 and sold in 18 months for ₹62,000, the ₹12,000 profit is added to your income and taxed at your slab rate.

-

Long‑term (held >3 years): Typically taxed at 20% with indexation. Indexation adjusts your purchase cost using the Cost Inflation Index (CII), which can significantly reduce taxable gains.

Illustrative LTCG example (indexation):

-

Purchase (FY A): ₹1,00,000 (includes GST/premiums in your cost of acquisition)

-

Sale (FY B): ₹1,35,000

-

Suppose CII (FY A) = 280 and CII (FY B) = 340

-

Indexed cost = 1,00,000 × (340/280) = ₹1,21,429

-

Long‑term capital gain = ₹1,35,000 − ₹1,21,429 = ₹13,571

-

Tax (20%): ≈ ₹2,714 (+ applicable cess/surcharge)

Always check the latest Finance Act provisions and CBDT rules before filing, as thresholds and rates can change.

High‑value transactions and TDS/TCS notes

-

For large purchases/sales, TCS/TDS may apply under specific provisions (e.g., section 206C/194Q) depending on value, counterparty, and payment method.

-

Rules are nuanced and updated periodically – confirm with your tax advisor and check platform invoices for any collected TCS.

ITR reporting & records

-

Keep all records: invoices, purchase dates, gram quantity, buy/sell prices, GST, spreads, and any redemption charges.

-

For sales:

-

Short‑term gains: report under Capital Gains (STCG).

-

Long‑term gains: report under Capital Gains (LTCG) with indexation details.

-

-

Individuals typically file under ITR‑2 when reporting capital gains; confirm your applicable ITR form.

-

Retain statements from the app showing unit (gram) holdings and transaction history for audit trail.

Want a clean tax trail and instant records? Buy and track digital silver on OroPocket – download the app: https://oropocket.com/app

Strategies to maximize outcomes on OroPocket (and reduce risk)

Automate discipline with SIPs from ₹1

-

Set daily/weekly/monthly SIPs to average your cost through market cycles.

-

Micro-SIPs from ₹1 build the habit without stressing cash flow.

Stack extra value with rewards

-

Earn free Bitcoin (Satoshi) on every silver purchase – tiered rewards that grow with activity.

-

Keep a daily streak to unlock periodic bonuses (every 5 days).

-

Spin‑to‑Win for extra gold/Bitcoin rewards.

-

Refer friends: both get 100 Satoshi + a free spin when they join.

Buy the dip, set alerts, and pace entries

-

Use price alerts to avoid FOMO buys.

-

Stagger entries (e.g., split your monthly amount into 4 weekly tranches) to reduce timing risk.

Balance metals: gold + silver playbook

-

Combine stability (gold) with growth (silver).

-

Use rebalancing bands like ±5% to systematically top up laggards and trim winners.

Risk basics

-

No guaranteed returns – precious metals can be volatile.

-

Diversify across assets and time horizons; don’t over-allocate to a single bet.

-

Match your SIP and allocation to your goals and liquidity needs; avoid leverage.

Turn rewards into results. Download OroPocket and start a ₹1 silver SIP with Bitcoin cashback today: https://oropocket.com/app

FAQs: can we buy digital silver today? common questions answered

Quick answers

-

Can we buy digital silver with UPI? Yes – on OroPocket in ~30 seconds.

-

Minimum amount? ₹1.

-

Is it 999 purity? Yes; holdings are backed by 999/999.9 silver stored in insured vaults.

-

Do I need KYC? Basic KYC is required for higher limits and regulatory compliance.

-

Is it 24×7? Buying is typically available; selling follows market/partner hours.

-

How are prices set? Live spot + platform premium + 3% GST; sell price reflects market less spread.

-

Digital silver vs Silver ETF? Digital silver = direct gram ownership; ETF = fund units. Fees/liquidity/tax treatment differ.

-

Can I gift silver? Yes, instant P2P gifting in-app.

-

How fast is redemption? Delivery timelines depend on your location and the denomination (quoted at checkout).

-

Is OroPocket compliant? Operates within an RBI‑compliant framework with authorized bullion partners and insured vaults.

-

How do Bitcoin rewards work? Satoshi cashback is credited per reward tier on every eligible purchase; track in-app.

-

What if a provider shuts? Metal is custodied with authorized vault partners; audits and reconciliations help protect customer interests.

Have more questions? Try OroPocket now – buy, SIP, gift, or redeem digital silver from ₹1 via UPI, and earn free Bitcoin on every purchase: https://oropocket.com/app

Conclusion: start small today – own silver in minutes and earn free Bitcoin

Your next 5 minutes

-

Download OroPocket, complete quick KYC, buy your first ₹1 of digital silver via UPI.

-

Turn on a Silver SIP and let compounding + rewards work for you automatically.

Why OroPocket

-

₹1 entry, UPI speed, insured vaults, and free Bitcoin (Satoshi) on every buy.

-

Gamified streaks to build the habit; instant gifting; transparent pricing; seamless redemption to coins/bars.

Call to action

-

Ready to try digital silver the modern way? Get the OroPocket app now: https://oropocket.com/app

-

Start today; keep it simple; stay consistent.