Digital silver in India: How to buy, store, and sell safely

Introduction: Digital silver in India – what it is and why it matters now

Digital silver is the modern, hassle-free way to invest in silver without stepping into a bullion shop or worrying about storage. As prices, convenience, and trust converge, Indians are increasingly choosing the “silver digital buy” route – small, frequent investments via UPI with instant liquidity and transparent pricing. If you’re exploring how to invest in digital silver or how to invest in silver online in India, this section gives you the quick, practical answer.

“India imported a record 304 million ounces of silver in 2022, surpassing the previous 2015 record of 260 million ounces.” – Source

What is digital silver?

-

Simple definition: Digital silver represents real 999-fineness silver stored in fully insured, professional vaults. You buy and sell fractional ownership online, starting from as little as ₹1–₹100.

-

1:1 backing: Every unit you purchase is backed one-to-one by physical silver. Reputable platforms facilitate secure custody, third-party audits, and options to redeem for physical coins/bars.

-

How it works: You pay via UPI or other instant rails, receive vault-backed units in your account, track holdings in-app, and sell at live market-linked prices whenever you want.

With OroPocket, you can invest in digital gold and silver in under 30 seconds, starting from ₹1, and earn free Bitcoin (Satoshi) on every purchase – combining the stability of silver with the upside of crypto rewards.

Why Indian investors are shifting online

-

Convenience first: UPI payments, 24/7 availability, and instant liquidity beat the hassles of buying, storing, and reselling physical bullion.

-

Micro-investing made easy: A low entry barrier (₹1–₹100) encourages first-time investors to start small and build a habit – perfect for SIP-style stacking.

-

Flexible top-ups: Add to your holdings during festivals (Akshaya Tritiya, Dhanteras, Diwali) or salary days with small, frequent purchases instead of saving up for a big lump sum.

-

No storage stress: Your metal is held in insured vaults with audits, so you avoid locker charges, theft risk, and purity disputes.

-

Rewards layer with OroPocket: Daily streaks, spin-to-win, and referral bonuses make saving feel like a game – while you stack silver grams and earn Bitcoin rewards.

If you’re evaluating how to invest in digital silver vs. physical, the online route offers superior convenience, transparency, and liquidity – especially for smaller, more regular investments.

Quick answer: Is digital silver safe?

Yes – if you use the right platform. Digital silver is safe when you choose RBI-compliant providers that work with authorized bullion partners, store metal in fully insured vaults, undergo regular third-party audits, display transparent spreads/fees, and offer clear redemption policies.

What to verify before you invest in silver online in India:

-

Purity: 999-fineness (99.9% pure) with clear backing and audit trails.

-

Vault & insurance: Name of vaulting partner, insurance coverage, and claims process.

-

Audits: Independent, third-party audits; frequency (monthly/quarterly) and public summaries.

-

Pricing transparency: Live price linkage, visible spreads, GST (3%), and any platform/storage fees.

-

Redemption: Options and charges for physical delivery; purity and hallmarking on redemption.

-

KYC & data security: Seamless but compliant onboarding, encryption, and robust fraud controls.

With OroPocket, your silver is 100% insured, priced transparently, and redeemable – plus you earn Satoshi on every purchase. It’s the simplest way to start your silver digital buy journey.

Ready to stack your first grams of silver? Download the OroPocket app now: https://oropocket.com/app

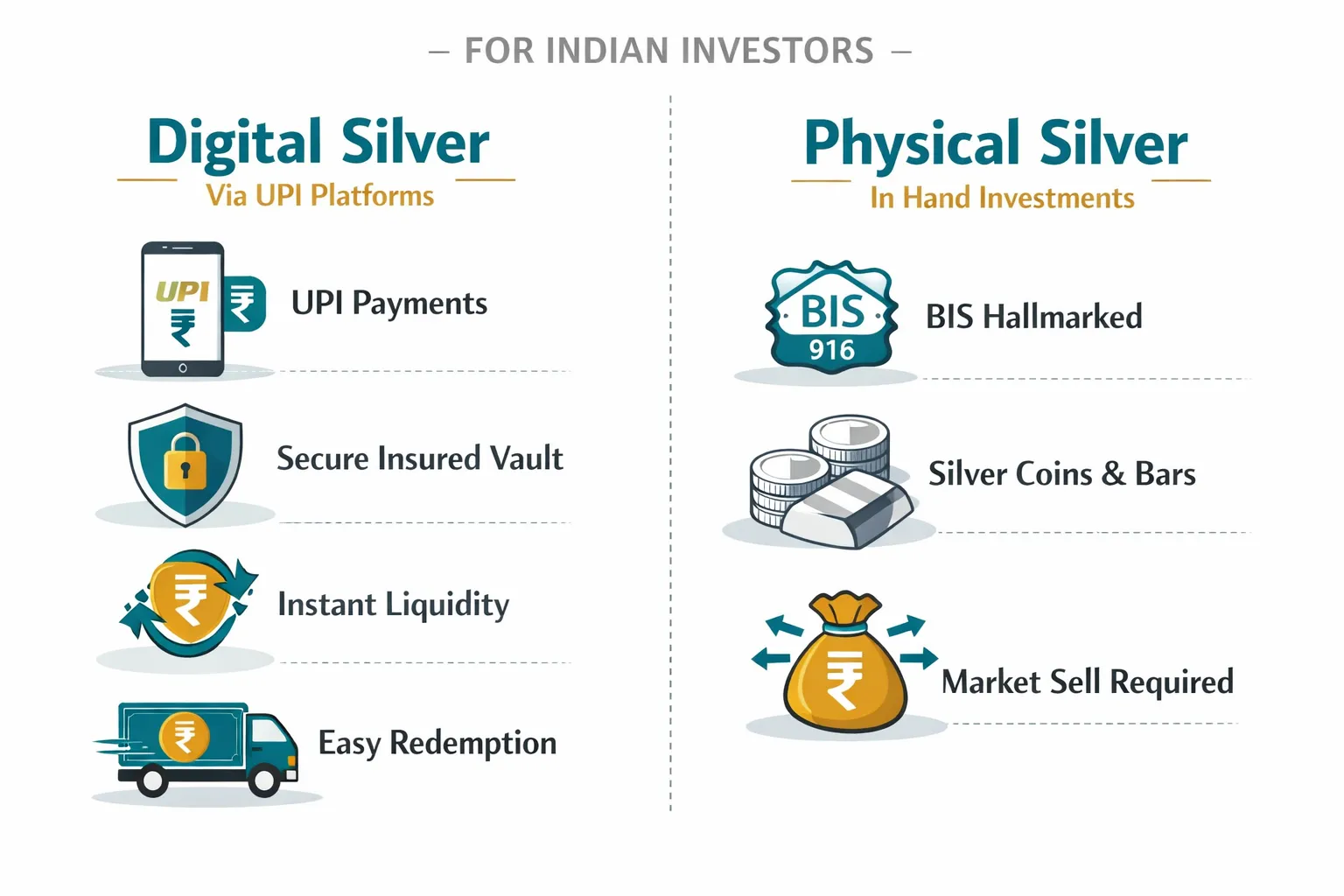

Digital silver vs physical silver: which one should you choose?

Choosing between digital silver and physical silver depends on how you plan to use it. If you want to buy silver online in India for quick, small-ticket investing and easy liquidity, digital wins. If you want something tangible for gifting or rituals, a silver coin or bar is better.

Side-by-side comparison

|

Feature |

Digital Silver |

Physical Silver |

|---|---|---|

|

Storage |

Held in secure, fully insured professional vaults by the platform |

At home or bank locker; user-managed |

|

Purity assurance |

Backed by 999 fineness with third-party audits and custody records |

BIS hallmarking on coins/bars; verify fineness and hallmark |

|

Minimum investment |

Very low (often ₹1–₹100); ideal for micro-investing and SIP-style stacking |

Higher ticket size (coins/bars); typically buy in grams or 10g+ |

|

Liquidity |

Instant sell at live, market-linked prices in-app |

Must find a buyer/jeweller; price negotiation and purity checks |

|

Buying hours |

24/7 via app; UPI/NetBanking |

Limited to store hours or delivery timelines |

|

Price transparency |

Live digital quotes; visible spread/fees; GST (3%) |

Varies by dealer; making charges/spreads can apply; GST (3%) |

|

Theft risk |

Minimal (insured vaults) |

Possible without lockers/insurance |

|

Fees/charges |

Platform spread; GST; potential storage/redemption fees |

Spreads, making charges (if any), locker cost, GST |

|

Redemption/Delivery |

Optional redemption into coins/bars (fees apply, delivery timelines) |

Immediate possession at purchase |

When each wins:

-

Digital silver: Traders and accumulators who want liquidity, small tickets, transparent pricing, and UPI-friendly convenience.

-

Physical silver: Gifters/collectors wanting tangible bars/coins for festivals, weddings, and rituals.

Safety lens for Indian buyers

-

Physical silver: Prefer BIS-hallmarked coins/bars. Check fineness (e.g., 999), jeweller/bullion dealer reputation, and retain invoices.

-

Digital silver: Verify who custodies the bars (authorized bullion partners), insurance coverage, frequency of independent audits, pricing transparency (spread, GST, fees), and clear redemption partners/policies.

“BIS hallmarking for silver requires a fineness mark, BIS logo, the assay centre’s mark, and the year of marking (as per IS 2112).” – Source

Decision guide

-

If you prioritise liquidity + convenience + small tickets → choose digital silver (perfect for “silver coin vs digital silver” comparisons where budget and speed matter).

-

If you want tangible possession for gifting/rituals → choose physical bars/coins (BIS-hallmarked).

Pro tip: You don’t have to pick only one. Many investors start with digital silver for habit-building and quick exits, then redeem part of their holdings into coins/bars for special occasions.

Start stacking with OroPocket: buy digital silver in seconds via UPI, starting at ₹1 – earn free Bitcoin on every purchase, track everything in-app, and redeem when you need. Download the app: https://oropocket.com/app

How to invest in digital silver online (step-by-step via UPI)

1) Pick a trusted platform (OroPocket)

-

RBI-compliant, working with authorized bullion partners, and storing metal in 100% insured vaults.

-

Unique edge: Earn free Bitcoin (Satoshi) on every silver purchase. Stack silver, get crypto rewards – two assets for the price of one.

2) Complete quick KYC

-

Submit PAN and basic details. It takes a few minutes.

-

Why it matters: KYC protects against fraud, enables secure payments, and keeps your account compliant for seamless buying/selling.

3) Fund seamlessly via UPI and start from ₹1

-

Open the OroPocket app → Choose Silver → Enter any amount (start from ₹1) → Pay via UPI.

-

Live price lock-in: Your quote is locked for a short window while you confirm. The final trade executes at that locked price.

-

Understand the spread: Platforms display a small difference between buy and sell prices to cover operational costs. You’ll see this transparently before you place the order.

-

Result: You get fractional grams of 999-fineness silver, backed 1:1 by metal in insured vaults.

4) Set a silver SIP (optional)

-

Automate weekly/monthly buys to rupee-cost average your silver. Perfect for building a long-term position without timing the market.

-

OroPocket perks: Daily streaks and spin-to-win boosts add gamified rewards to your SIP – earn more Satoshi as you stay consistent.

5) Track, top-up, and secure your account

-

Monitor holdings in real time, see live P&L, and track your Bitcoin rewards.

-

Enable PIN/biometric login and set price alerts to buy dips or take profits.

-

Top up in seconds via UPI whenever you want – salary day, festival time, or market dips.

6) Redemption or instant sell

-

Need cash? Sell your digital silver instantly at live prices and withdraw to INR.

-

Prefer physical? Redeem for coins/bars (when enabled by partner terms). Expect nominal delivery/redemption and making/processing fees.

-

Fee awareness: GST (3%) applies on purchase, plus transparent platform spread and any storage/redemption charges shown upfront.

Video walkthrough: Buy ₹1 of digital silver via UPI and set a SIP

Learn how to place your first “silver digital buy,” automate SIP in silver, and view Bitcoin rewards inside the app.

SEO tips covered: how to invest in silver online in India, buy silver with UPI, silver digital buy, SIP in silver.

Start with ₹1 today and earn Satoshi on every purchase. Download the OroPocket app: https://oropocket.com/app

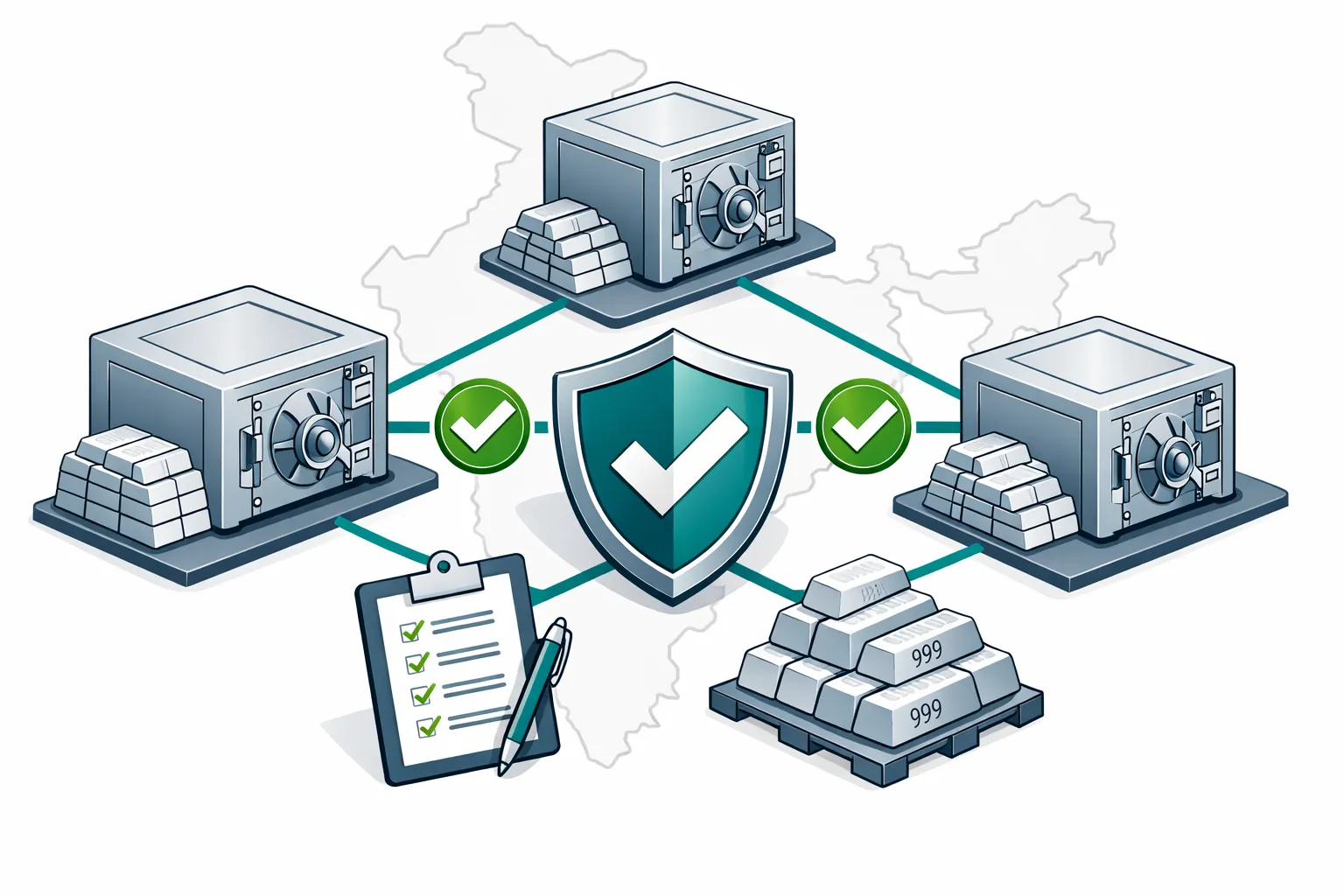

Behind the scenes: storage, vaulting, and insurance (how your silver stays safe)

Who actually holds your silver?

-

Authorized vaulting partners: Your silver is stored in professional, fully insured vaults operated by recognized custodians. Bars are 999-fineness and held on a segregated or specifically allocated basis.

-

Clear ownership mapping: Every purchase maps to fractional grams recorded against specific bar lists. Your in-app balance equals real metal units, backed 1:1 by physical inventory.

Insurance and audits

-

Insurance first: Your holdings are covered against risks like theft and fire while inside the vault network, with policies held by the custodian.

-

Independent verification: Third-party auditors reconcile platform records with vault bar lists at regular cadences (monthly/quarterly), ensuring balances match the physical stock.

-

Transparent documentation: Audit summaries and bar lists typically include serial numbers, refiner/brand, fineness, and weight. Users can access published summaries and key certificates for added confidence.

Compliance and partner standards

-

RBI-compliant flows: Payments and customer onboarding follow Indian regulations, including KYC/AML checks and secure fund flows.

-

Authorized bullion partners: Custody partners source from recognized refiners with stringent quality controls.

-

Why standards matter: LBMA Good Delivery specifications and robust SOPs help ensure consistent purity, global liquidity, and reliable chain-of-custody across the vaulting lifecycle.

“LBMA Good Delivery sets a minimum 999.0 fineness for silver bars and prescribes strict vaulting and handling protocols to maintain integrity and traceability.” – Source

OroPocket’s safety stack

-

Account security: Data encryption, device checks, and fraud monitoring; enable 2FA/PIN/biometric for every login and trade.

-

Operational controls: Real-time risk flags, session monitoring, and anomaly detection protect your funds and rewards.

-

Support you can count on: Clear SLAs and a structured dispute resolution process ensure quick help if something looks off.

Looking to store digital silver safely with insured vaults in India? OroPocket is built for security from vault to app – compliant, audited, and transparent – so you can focus on stacking grams, not worrying about where they’re kept.

Start secure with OroPocket: https://oropocket.com/app

Pricing, fees, taxes, and spreads: pay less, keep more

Smart investors watch every rupee – especially with digital silver fees in India varying by platform. Here’s how to minimise the silver price spread, understand silver GST, and keep more when you sell silver online in India.

What you pay when you buy digital silver

-

Live price: Based on global spot + local market premiums and FX; updates in real time.

-

Platform spread: The difference between buy and sell quotes that covers operational and custody costs.

-

GST (purchase): 3% GST applies on silver bullion purchases in India.

-

Vaulting/maintenance: Some platforms may charge a small storage/maintenance fee (monthly or annual); others embed it in the spread.

What you pay when you sell or redeem

-

Sell spread: The platform’s sell quote will be slightly below spot (transparent in-app).

-

Instant payout fee (if any): Some platforms offer instant bank payouts for a small fee; standard NEFT/IMPS may be free.

-

Redemption and delivery: If you redeem into coins/bars, expect minting/making charges, packaging, and courier/door-delivery fees.

“GST on silver bullion and coins in India is 3%.” – Source

How OroPocket helps you optimize

-

Start from ₹1: Micro-buys let you average into dips and reduce timing risk.

-

SIPs: Automate weekly/monthly buys to smooth volatility via rupee-cost averaging.

-

Rewards: Stack Bitcoin cashback (Satoshi) on every purchase; boost with daily streaks and spin-to-win.

-

Practical tips:

-

Buy during lower-spread windows (typically higher-liquidity hours).

-

Avoid frequent micro-sells (spreads add up); batch exits when possible.

-

Plan redemptions to consolidate making/delivery charges.

-

Tax basics (high-level only)

-

Capital gains rules may apply on sale; your holding period can change the tax treatment.

-

Short-term vs long-term classification and indexation may be relevant.

-

Always consult a qualified tax advisor for your specific situation.

India-focused fee & tax cheat-sheet

|

Item |

Digital Silver |

Physical Silver (Bars/Coins) |

|---|---|---|

|

Buy-side GST |

3% on purchase value |

3% on purchase value |

|

Platform/vault fee range |

0–0.04% per month (0–0.48% p.a.) or embedded in spread |

Locker/insurance costs if stored in bank; none if self-stored (higher theft risk) |

|

Typical spread range |

~1.0%–3.0% (platform-dependent, market conditions) |

~2%–8% dealer spread; additional making charges for minted coins |

|

Sell/exit costs |

Sell spread; optional instant payout fee (0–1%); standard bank transfer often free |

Potential assay/purity verification; buyback discounts (often 1%–5% below spot) |

|

Redemption making/delivery charges |

Applicable for minting coins/bars and courier/door delivery |

Making charges at time of purchase for minted coins; delivery/transport if applicable |

|

Indicative holding tax treatment |

Capital gains on sale; holding period matters; indexation may apply for long-term |

Capital gains on sale; holding period matters; indexation may apply for long-term |

|

Disclaimer |

Indicative; varies by platform; consult advisor. |

Indicative; varies by jeweller/dealer; consult advisor. |

Cut your cost of ownership with OroPocket: buy silver with UPI in under 30 seconds, automate SIPs, and earn Bitcoin rewards that offset fees over time. Download the app: https://oropocket.com/app

Automate with SIPs and build habits (plus rewards you won’t get anywhere else)

Why SIPs in digital silver work

-

Beat timing stress with rupee-cost averaging. Volatility becomes your friend as fixed-amount buys collect more grams when prices dip.

-

SIPs build discipline. Small, automated purchases help you invest in silver monthly without second-guessing every move.

-

Perfect for long-term allocators who want exposure to digital gold and silver with less emotional decision-making.

Micro-investing from ₹1 on OroPocket

-

Start tiny, stay consistent. Begin with ₹1 and scale up as your comfort grows.

-

Stack grams seamlessly via UPI – no minimum thresholds, no friction.

-

Track your progress in-app and celebrate milestones as your holdings grow.

Gamified consistency = more upside

-

Daily streak bonuses: Earn extra rewards every 5 consecutive days of activity.

-

Spin-to-win: Free daily spins offer bonus silver/Bitcoin rewards.

-

Referral perks: Invite friends – both of you get 100 Satoshi + a free spin.

-

Bitcoin rewards amplify value: Every purchase stacks Satoshi on top of your silver, boosting total potential over time.

Practical plan

-

90-day SIP blueprint:

-

Set weekly or bi-weekly SIPs (e.g., every Monday or 1st & 15th).

-

Enable price alerts; add extra on deep dips.

-

Review monthly: Check grams stacked, rewards earned, and tweak SIP amount.

-

Avoid overtrading: Let your SIP do the heavy lifting and reduce needless sells.

-

SEO angles covered: silver SIP India, invest in silver monthly, micro-investing UPI, free Bitcoin India.

Build habits that compound. Automate your silver SIP and earn Satoshi on every buy with OroPocket: https://oropocket.com/app

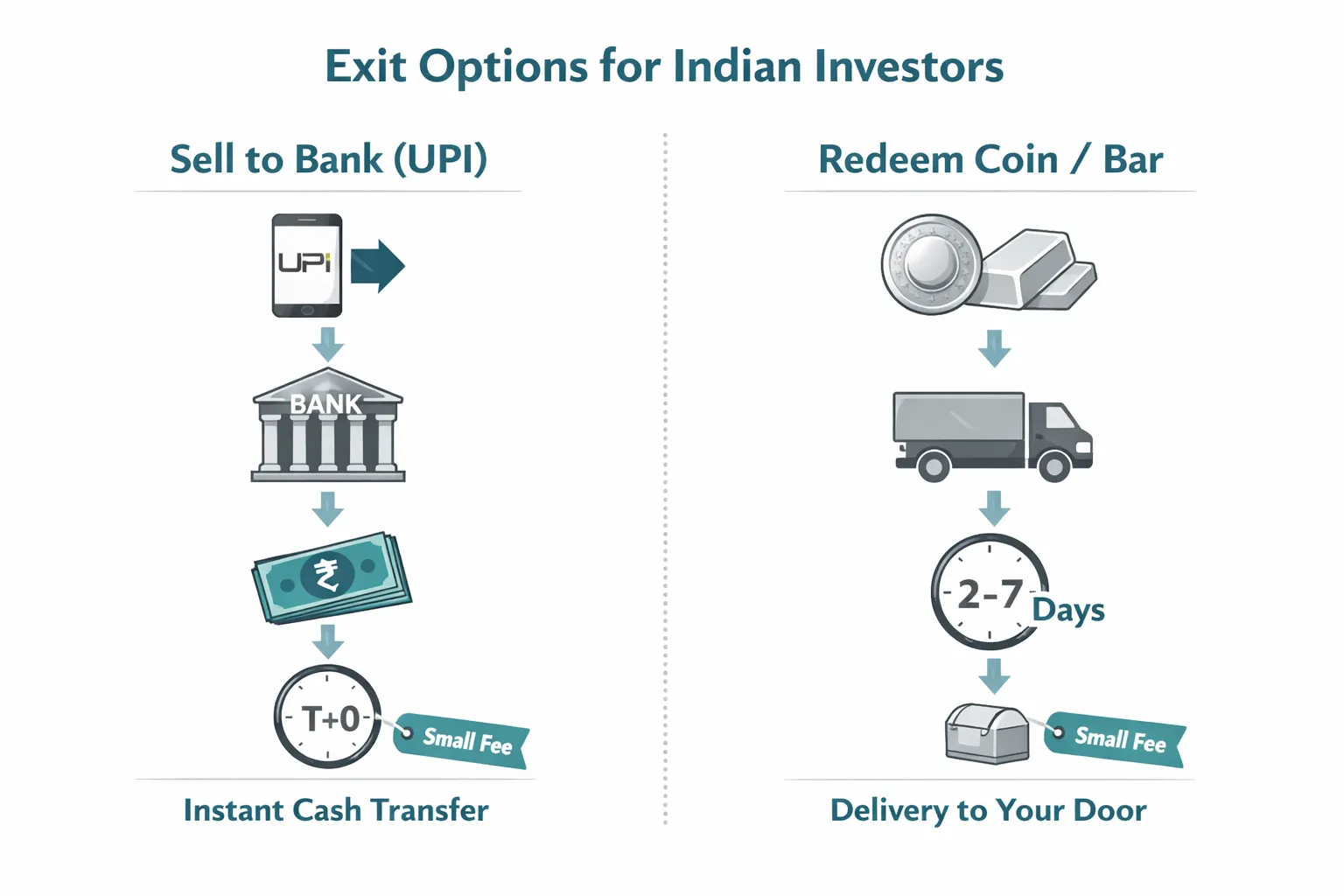

How to sell and redeem digital silver safely (and get cash fast)

Instant sell to INR via UPI

-

Fast exits: Sell your digital silver at live prices and withdraw to your bank – T+0 settlement where supported; otherwise T+1.

-

Price lock: Your sell quote locks for a short window while you confirm; execution happens at the locked price.

-

Minimums: Some platforms set a minimum sell amount or unit size (e.g., 0.1g or ₹50). Check the app’s FAQs for specifics.

Redeem to physical bars/coins

-

When to redeem: Ideal for gifting, ceremonies, or if you want tangible bars/coins.

-

Costs to expect: Minting/making charges, packaging, and delivery fees. GST applies as per regulations.

-

KYC and address checks: Confirm PAN and delivery address; some redemptions may require OTP or document verification for security.

Exit strategy tips

-

Define targets: Set a target allocation for silver (e.g., 5–15% of portfolio) and trim back when it exceeds your range.

-

Use alerts: Enable price alerts to ladder your sells into strength instead of panic exits.

-

Laddering: Sell in tranches at pre-set price levels to average your exit and reduce regret.

OroPocket shortcuts

-

One-tap sell: Exit instantly with a simple confirmation flow.

-

Track realized P&L: See your cumulative returns and trade history.

-

Notifications: Get payout and delivery updates in real time.

-

Help on standby: Chat and ticket support to resolve queries fast.

SEO angles covered: sell digital silver India, redeem silver coin, instant UPI payout silver.

Cash out or convert to coins – your call. Sell or redeem in minutes with OroPocket: https://oropocket.com/app

Risk management and safety checklist (before you buy, store, or sell)

Due diligence on the platform

-

RBI-compliance claims: Confirm compliant flows (KYC/AML), payment rails, and who regulates the partners.

-

Bullion partner credentials: Look for authorized partners and LBMA Good Delivery–accredited refiners for 999-fineness assurance.

-

Vault and insurance: Identify the vaulting provider, insured risks (theft/fire), and whether coverage is for full replacement value.

-

Audit frequency: Check if independent audits are monthly/quarterly, with public summaries and reconciled bar lists.

-

Redemption policy: Read thresholds, making/delivery charges, timelines, and supported denominations for coins/bars.

-

Pricing transparency: Review live price linkage, visible buy/sell spread, GST, and any storage/maintenance fees.

-

Data security: Ensure encryption, device binding, and secure login (PIN/biometric/2FA). Verify how your data is stored and used.

Account security hygiene

-

Strong PIN/biometric + unique email/password; avoid reusing passwords across apps.

-

Lock your device; enable app-based 2FA where available.

-

Beware of phishing links/SMS; never share OTPs or UPI PINs – even with “support” agents.

-

Verify UPI collect requests carefully; cross-check merchant name and amount.

-

Keep the app updated; enable transaction and withdrawal alerts.

Product risks you should accept

-

Price volatility: Silver can swing more than gold; expect sharp moves in both directions.

-

Spreads and fees: Buy/sell spread, GST on purchase, and redemption/delivery or instant payout fees.

-

Liquidity during stress: Temporary delays or wider spreads can occur in extreme markets or during maintenance windows.

-

Counterparty exposure: Choose platforms that segregate customer assets and publish audit evidence.

-

Tax treatment: Capital gains may apply; rules depend on holding period – consult a tax advisor.

Smart portfolio use

-

Diversifier role: Keep silver as a slice of your total investments (e.g., 5–15%), aligned with risk tolerance.

-

Rebalance: Use calendar or band-based rebalancing (e.g., +/-2–3%) to trim euphoria and add during dips.

-

Build steadily: Use SIPs/DCA to avoid timing risk; keep an emergency fund separate.

-

Exit discipline: Set alerts and ladder sells at pre-defined levels; avoid panic exits.

Pre-trade checklist (1 minute):

-

Is the platform RBI-compliant with named bullion and vault partners?

-

Are vault insurance and independent audit summaries available?

-

Are spreads, GST, and redemption fees clearly shown?

-

Is your account secured with biometric/PIN and alerts on?

-

Do you have a target allocation and exit plan?

Looking for a safer way to get started? OroPocket helps you reduce digital silver risks in India with insured vaults, transparent pricing, audits, and secure login – plus you earn free Bitcoin on every purchase. Download the app: https://oropocket.com/app

Digital silver vs Silver ETFs vs futures: which is right for you?

Choosing how to invest in silver in India comes down to access, risk, and your style. Here’s a clear comparison of digital silver vs silver ETF vs MCX futures so you can pick what fits your goals.

Digital silver (custodied grams)

-

Pros:

-

Fractional investing from ₹1; UPI-friendly and mobile-first.

-

Instant liquidity with live market-linked quotes.

-

Optional redemption into coins/bars (subject to fees and partner terms).

-

On OroPocket, you also earn Bitcoin (Satoshi) rewards on every purchase.

-

-

Cons:

-

Platform spread/fees apply.

-

Relies on custodian trust (verify insurance, audits, and redemption policy).

-

Best for: Beginners and micro-investors who want simplicity, small tickets, and quick exits. Great if you prefer app-based investing and want to stack grams over time.

Silver ETFs (through stock brokers)

-

Pros:

-

Exchange-listed, demat-based exposure; NAV-driven liquidity during market hours.

-

No need to manage custody or physical storage yourself.

-

Works smoothly if you already invest via a broker.

-

-

Cons:

-

Brokerage, demat AMC, and expense ratio costs.

-

Tracking error vs. spot silver.

-

Market hours only; no physical redemption in most cases.

-

Best for: Hands-off equity investors who are comfortable with a demat account and want silver exposure alongside mutual funds/ETFs.

Silver futures (MCX derivatives)

-

Pros:

-

Leverage for traders; efficient price discovery.

-

Useful for hedging if you have exposure to silver in your business or portfolio.

-

-

Cons:

-

High risk; margins and daily mark-to-market can amplify losses.

-

Requires experience, discipline, and active monitoring.

-

Not suitable for beginners.

-

Best for: Experienced traders/hedgers who understand derivatives, risk management, and margin calls.

How to choose

-

Beginners and micro-investors → choose digital silver (easy UPI payments, instant liquidity, small tickets, optional redemption).

-

Hands-off equity investors → choose silver ETF (demat-based, familiar with stock market workflows).

-

Traders/hedgers with experience → choose futures (high risk/high control for tactical exposure).

SEO angles covered: digital silver vs silver ETF, invest in silver India options, MCX silver vs digital silver.

Want the simplest way to start? Buy digital silver on OroPocket from ₹1, earn free Bitcoin on every purchase, and sell in seconds via UPI. Download the app: https://oropocket.com/app

Conclusion: Start with ₹1 on OroPocket – stack silver and earn free Bitcoin

Why start today

-

Beat inflation with a time-tested asset while avoiding locker hassles and purity worries.

-

Build a consistent habit with SIPs and micro-buys – you don’t need a big lump sum to begin.

-

Go from “I’ll start someday” to “I invested today” in under 30 seconds via UPI.

Why choose OroPocket

-

₹1 entry point: Invest any amount, anytime – perfect for first-timers.

-

Instant UPI buys/sells: Liquidity when you want it, at live market-linked prices.

-

100% insured vaults: Your 999-fineness silver is safely custodied and audit-backed.

-

Gamified progress: Daily streaks and spin-to-win keep you motivated.

-

Unique upside: Get free Bitcoin (Satoshi) on every silver purchase – two assets for the price of one.

Your next step (CTA)

-

Download the OroPocket app on iOS or Android and make your first ₹1 digital silver buy in under 30 seconds: https://oropocket.com/app

Friendly reminder

-

Investing involves risk. Do your due diligence, understand fees/taxes, and consult a tax advisor for personalized guidance.