Do I have to pay capital gains tax when selling gold?

Introduction: Do you pay capital gains tax when you sell gold? (Short answer + what changed)

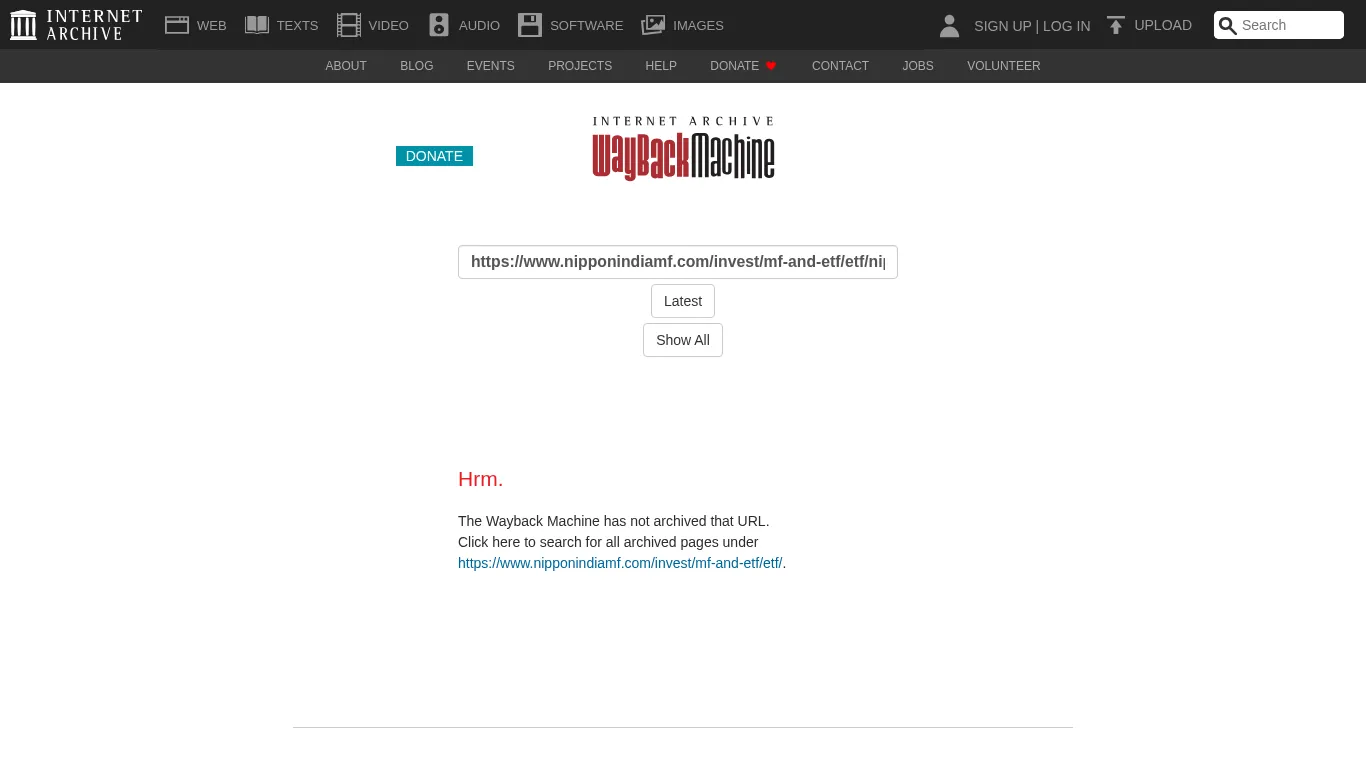

Short answer: Yes. If you sell gold at a profit, you pay capital gains tax. The rate and rules depend on how long you held it and the format you hold – physical gold, digital gold, Gold ETFs/Gold Mutual Funds, or Sovereign Gold Bonds (SGBs).

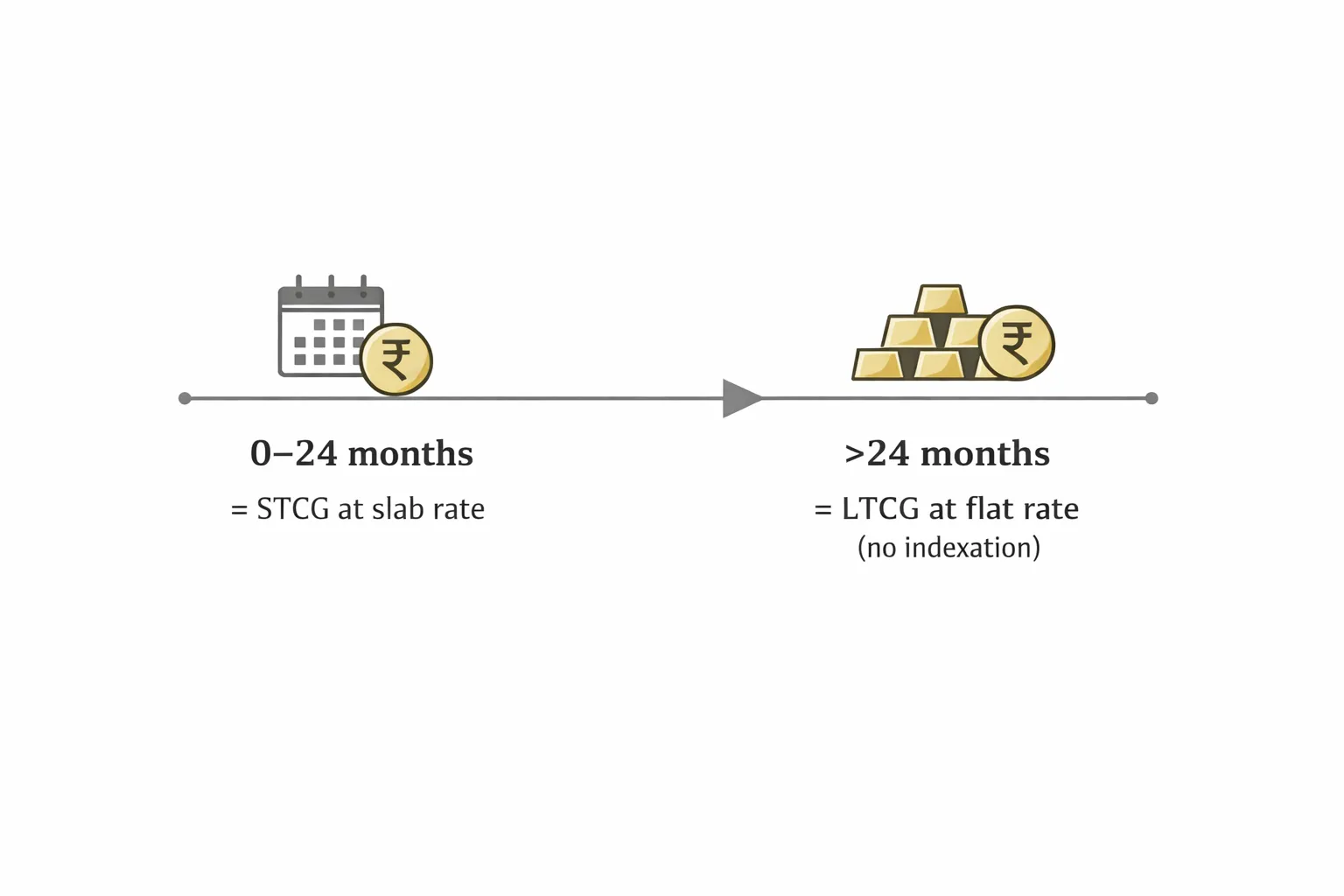

Budget 2024 update (quick): India moved to a simplified capital gains regime. For most non-equity assets like gold, long-term capital gains generally apply after 24 months of holding and are taxed at a flat rate (without indexation). Short-term gains are taxed at your income slab. Always confirm the current rules in the year you sell.

What counts as “gold” for tax: Jewellery, coins/bars, digital gold (apps), Gold ETFs/Gold Mutual Funds, and SGBs (which have special treatment at maturity).

GST vs Income Tax: When you buy gold, 3% GST applies. When you sell gold at a profit, capital gains tax applies. Different taxes, different times.

At-a-glance: tax rules by format

|

Gold format |

STCG (holding period) |

STCG tax |

LTCG (holding period) |

LTCG tax |

Notes |

|---|---|---|---|---|---|

|

Physical/Digital Gold |

≤ 24 months |

Taxed at your income slab |

> 24 months |

Flat rate (no indexation) |

Applies to jewellery, coins, bars, and digital gold bought via apps |

|

Gold ETF/Gold MF (non-equity) |

≤ 24 months |

Taxed at your income slab |

> 24 months |

Flat rate (no indexation) |

Same treatment as physical/digital gold |

|

Sovereign Gold Bonds (SGBs) |

Depends on holding and how you exit |

As per slab if STCG |

Depends on holding and how you exit |

Capital gains on redemption at maturity are tax-exempt |

Semi-annual interest (~2.5% p.a.) is taxable; premature sale on exchange may attract capital gains |

Why this guide:

-

Cut through conflicting info on “Do I have to pay capital gains tax when selling gold?” with a clear, format-by-format comparison.

-

For sellers of old jewellery, digital gold users selling gold online, ETF/MF investors, and SGB holders.

-

About OroPocket: A modern way to buy/sell 24K digital gold from ₹1 with UPI – and you earn free Bitcoin on every purchase. Same tax rules as gold when you sell.

How gold is taxed now: holding period, rates, and key definitions

Capital asset definition and what triggers tax: Gold – whether jewellery, coins/bars, digital holdings, Gold ETFs/Gold Mutual Funds, or SGBs – is a capital asset. Tax is triggered when you sell or redeem for more than your cost (including eligible costs like making charges for jewellery and transaction fees).

Holding period matters:

-

Short-term: Up to 24 months. Typically taxed at your income-tax slab rate.

-

Long-term: More than 24 months. Taxed at a flat LTCG rate; indexation benefit has been removed for most non-equity assets like gold in the new regime.

What changed vs older rules (36 months + indexation): Earlier, gold generally became long-term after 36 months and enjoyed indexation, which inflated your purchase price to reduce tax. Post-Budget 2024 simplification, long-term kicks in after 24 months with a flat rate and no indexation, so don’t apply the old 36-month + indexation logic.

GST vs capital gains (don’t confuse): 3% GST is charged when you buy gold. Capital gains tax is applied only when you sell at a profit. Different taxes, different times.

Documentation you’ll need:

-

Physical jewellery/coins/bars: Purchase invoice. If missing or inherited, a registered valuer’s report can help establish cost/fair value.

-

Digital gold (apps): App transaction statements and order history.

-

Gold ETFs/Gold Mutual Funds: Broker or AMC/CAMS statements and contract notes.

-

Sovereign Gold Bonds: SGB holding statement from bank/demat and redemption/premature sale records.

Practical tip: Always verify the Finance Act changes applicable to the financial year you sell in – rates and holding periods can change.

Tax by format: Physical gold vs Digital gold vs Gold ETF/MF vs SGBs

Physical gold (jewellery/coins/bars)

-

Purchase: 3% GST on gold value; if jewellery, 5% GST on making charges (if charged separately).

-

Sale: STCG (≤24 months) taxed at your slab; LTCG (>24 months) taxed at a flat rate (no indexation).

-

No TDS on sale by individuals; PAN may be required for high-value transactions. Keep invoices/maker details for accurate cost tracking when calculating capital gain tax on gold.

Digital gold (apps like OroPocket and others)

-

Taxed like physical gold when you sell – same STCG/LTCG rules. Ideal for selling gold online with clear digital records.

-

Buy via UPI; retain app statements and order history for cost and date of acquisition.

-

Rewards/cashback: Treated as income as per prevailing rules; declare under the appropriate head. This is separate from capital gains tax on sale.

Gold ETFs/Gold Mutual Funds (non-equity)

-

Sale/redemption: STCG at slab if held ≤24 months; LTCG at flat rate if held >24 months.

-

No GST on buying/selling units; standard STT doesn’t apply; brokerage/expense ratios impact net returns.

-

Maintain broker/AMC statements and contract notes for proof.

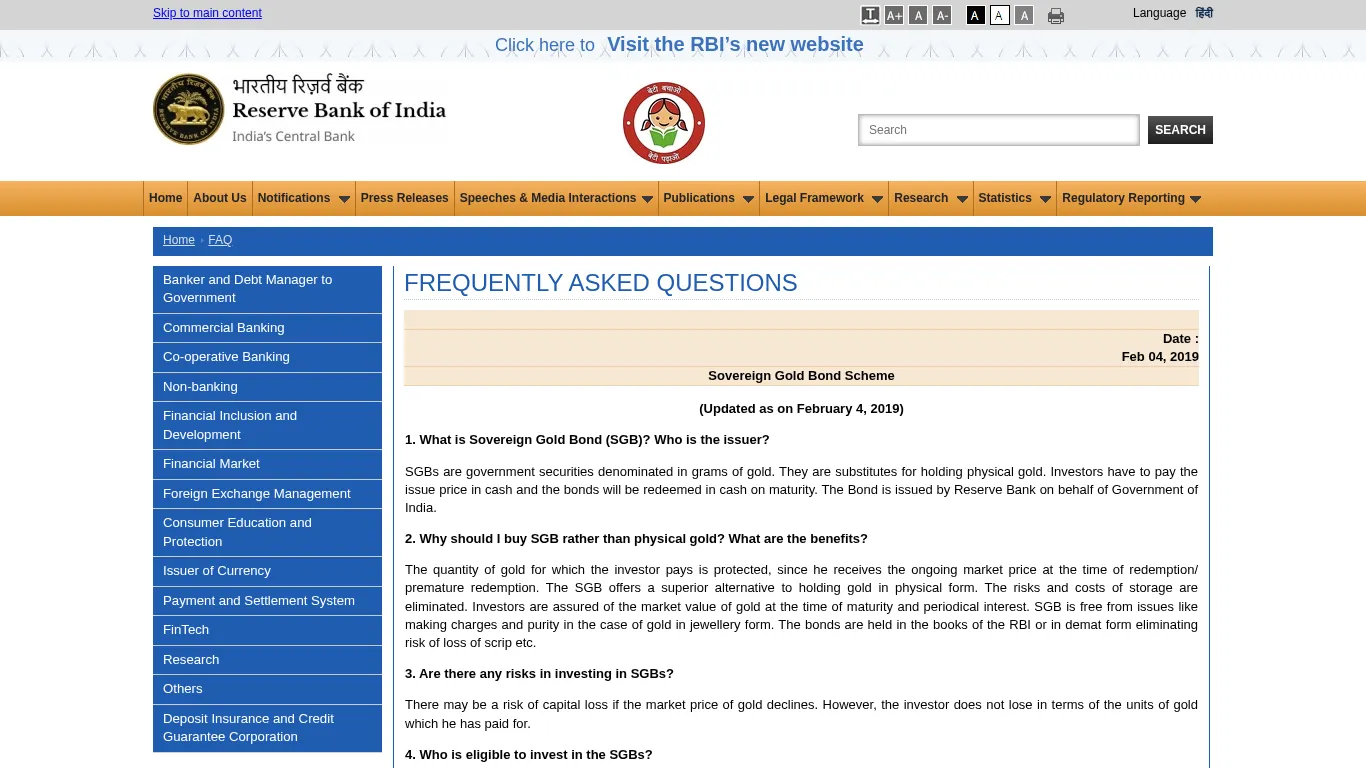

Sovereign Gold Bonds (SGBs)

-

Interest: ~2.5% p.a., taxable at your income slab each year.

-

Redemption at maturity (8 years): Capital gains fully tax-exempt for individuals.

-

Premature exit (sell on exchange before maturity): Capital gains tax applies based on holding period and how you exit.

“Capital gains tax arising on redemption of SGB to an individual has been exempted.” – Source

Common compliance

-

PAN requirements for large cash/transaction amounts; KYC norms via jewellers/brokers/banks.

-

Retain all proofs for cost of acquisition and sale/redemption – crucial if you’re ever asked to justify calculations on “Do I have to pay capital gains tax when selling gold?”

Where each format shines (tax view)

-

SGBs: Best for long-term holders – maturity redemption is tax-free.

-

Digital/physical: Flexible, easy to gift, fast liquidity; keep bills/app statements to substantiate costs.

-

ETFs/MFs: Efficient for portfolio allocation, SIPs, and demat/mf platforms; clean audit trail and no GST on units.

-

OroPocket: Adds unique Bitcoin rewards on top of your gold accumulation while following the same tax rules as gold on sale.

Special cases: inherited/gifted gold, exchanging old jewellery, no bills, NRIs

Inherited gold: There’s no tax when you inherit. Tax applies only when you sell. Your holding period includes the original buyer’s period; for older acquisitions, a valuation as of 1 April 2001 may be relevant to establish cost – use a registered valuer if bills are missing.

Gifts: Gold received from specified relatives or on marriage is generally exempt on receipt. When you sell later, capital gains apply based on your sale price minus cost (use gift deed/bills or valuer’s report to establish cost).

Exchanging old jewellery for new: This is effectively a sale plus a new purchase. Capital gains are triggered on the old piece based on its holding period. Keep the jeweller’s exchange invoice detailing quantity, purity, and value.

No bills? Obtain a registered valuer’s report to substantiate cost/fair value. Retain identity proofs and payment records to avoid disputes at the time of selling gold online or offline.

NRIs: Tax treatment on sale is generally similar to residents. SGB eligibility and repatriation rules differ; interest is taxable. TDS may be applied by intermediaries for certain transactions – check with your broker/bank for specifics.

Cash, PAN and reporting thresholds: Provide PAN for high-value transactions, avoid large cash dealings, and prefer banking channels for transparency.

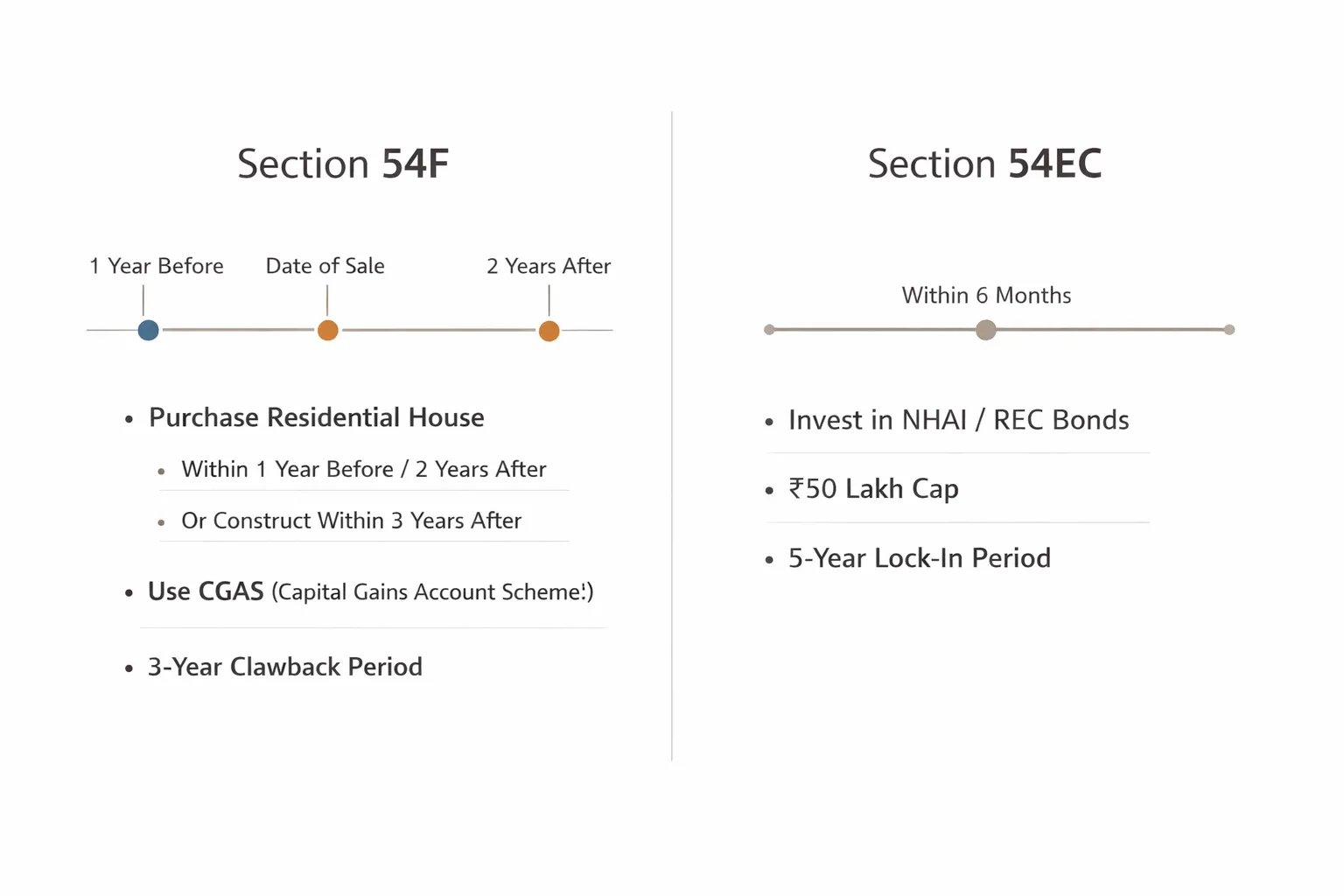

Proof checklist to avoid scrutiny:

-

Purchase invoice or gift deed/inheritance proof

-

Registered valuer’s report (if bills missing)

-

Identity and PAN

-

Payment mode/statement copies

-

Sale/exchange invoice, purity/weight details

“During income-tax searches, jewellery up to 500g for each married woman, 250g for each unmarried woman, and 100g for each male member is generally not seized.” – Source

How to compute your tax: step-by-step examples you can copy

Define your asset and format: Identify whether it’s physical jewellery/coins/bars, digital gold, a Gold ETF/Gold Mutual Fund, or an SGB sold before maturity. Confirm the exact purchase and sale dates to determine the holding period.

Short-term example (sold within 24 months):

-

STCG formula: Sale price – (Purchase price + eligible costs such as making charges, brokerage, platform fees).

-

Tax: Add STCG to your total income and pay tax as per your slab.

Long-term example (sold after 24 months):

-

LTCG formula: Sale price – (Purchase price + eligible costs).

-

Tax: Apply the flat LTCG rate (no indexation under the new regime for gold and other non-equity assets). Surcharge and cess may apply.

Example with inherited gold:

-

Holding period: Use the original owner’s purchase date.

-

Cost: If very old and invoices are missing, obtain a registered valuer’s report; in some scenarios, fair market value as of a reference date may be relevant per prevailing rules.

-

Compute ST/LT as above and apply the appropriate rate.

SGB scenarios:

-

At maturity (8 years): No capital gains tax on redemption for individuals.

-

Sold on exchange before maturity: Compute capital gains using your cost and sale price; apply STCG/LTCG based on your holding period.

Set-off basics:

-

Short-term capital losses from gold can be set off against both STCG and LTCG in the same year; long-term capital losses can be set off only against LTCG.

-

Unabsorbed capital losses can generally be carried forward for up to 8 assessment years if you file your return on time.

What to declare in ITR:

-

Report capital gains in Schedule CG (capital gains schedule).

-

For SGBs, show the semi-annual interest under “Income from Other Sources.”

-

Maintain scrip-wise/transaction-wise details if asked.

Paperwork to keep:

-

Purchase proof or registered valuer’s report

-

Sale invoice/contract note/exchange contract

-

App/broker statements and bank statements

-

SGB holding/redemption statements

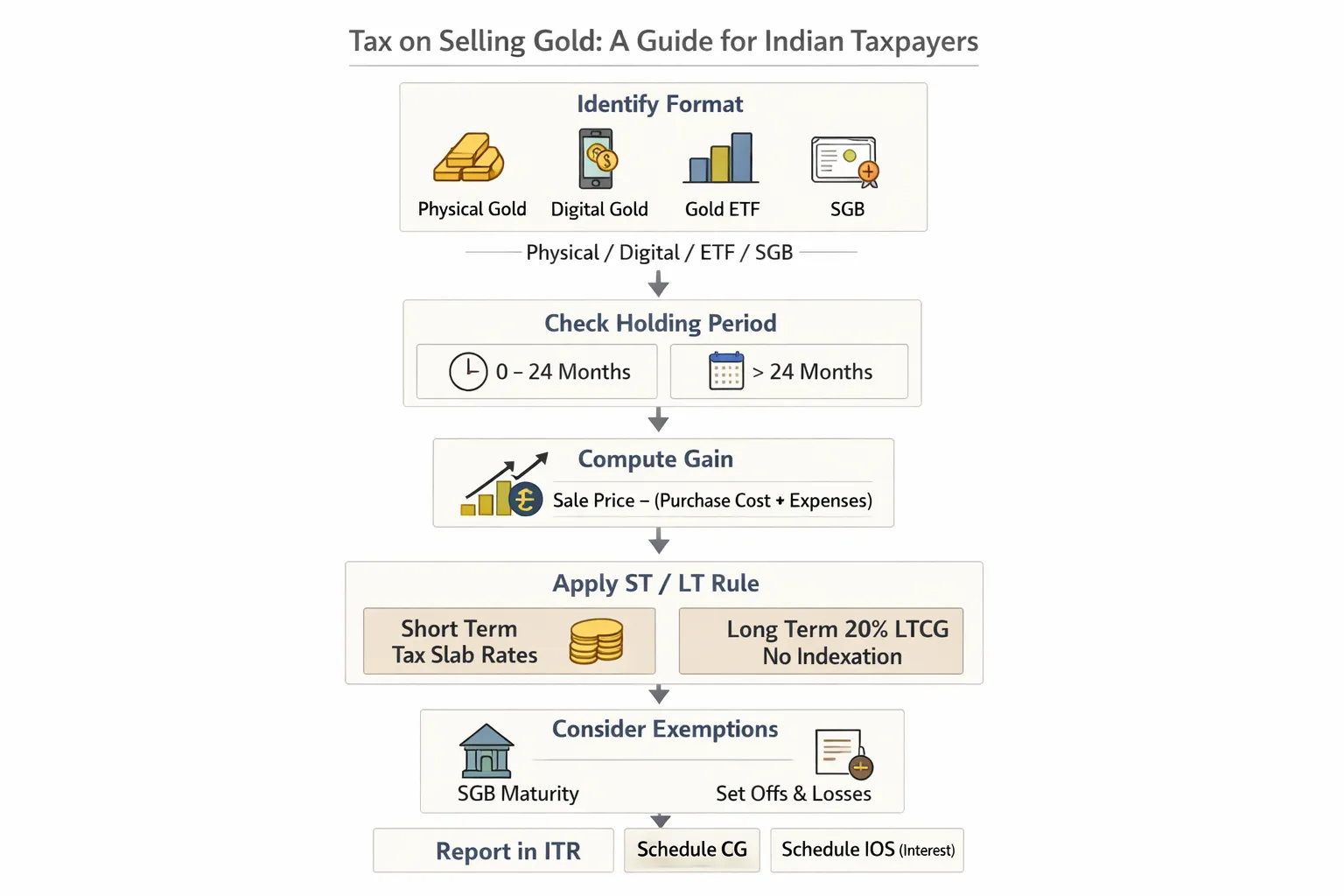

Legal ways to reduce or defer tax: Sections 54F and 54EC (and timing)

Section 54F (buying/constructing a residential house):

-

Key conditions:

-

Eligible for individuals/HUFs on sale of a long-term capital asset (other than a residential house).

-

Invest the net consideration in one residential house in India.

-

Timelines: Purchase within 1 year before or 2 years after sale; construct within 3 years after sale.

-

Ownership limits: On the date of transfer, you should not own more than one residential house (other than the new one).

-

Clawback: If you sell the new house within 3 years, the exemption is revoked and taxed.

-

-

Use CGAS: If you need time, deposit unutilized amounts into the Capital Gains Account Scheme before the ITR due date to keep the exemption alive until you buy/construct.

Section 54EC (REC/NHAI capital gains bonds):

-

Invest the capital gains in specified bonds within 6 months of transfer.

-

Lock-in of 5 years; early transfer/loan against bonds revokes exemption.

-

Maximum eligible investment: ₹50 lakh in a financial year.

-

Interest on these bonds is taxable.

What not to do:

-

Missing timelines (2/3 years for 54F; 6 months for 54EC).

-

Buying a second home where not allowed by 54F conditions.

-

Mixing personal and capital gains funds without tracking – keep clear audit trails.

Who should consider what:

-

54F: Home upgraders or those planning a primary residence in the near term.

-

54EC: Conservative investors seeking certainty and willing to accept the 5-year lock-in.

“Section 54F allows exemption when net consideration from a long-term asset (other than a house) is invested in one residential house within prescribed timelines; Section 54EC exempts gains invested in specified bonds within 6 months, subject to a ₹50 lakh cap and 5-year lock-in.” – Source

Gold derivatives (futures/options) and active traders

Not the same as investing in gold units or jewellery:

-

Profits from gold futures and options (traded on recognized exchanges) are typically treated as non-speculative business income under Section 43(5) exceptions – not capital gains tax on gold. You’re taxed at slab rates after deducting eligible expenses.

Expense deductions:

-

You can deduct ordinary and necessary expenses against trading income if you maintain books of account: brokerage, exchange/clearing fees, internet/data, research tools, GST on brokerage and platform fees, depreciation on eligible equipment, and professional fees (CA/subscription).

-

Keep invoices and broker statements; claim only business-related expenses, proportionately if you also invest.

Compliance considerations:

-

Turnover for F&O: Common practice is to compute “tax audit turnover” as the absolute sum of profits and losses for futures, plus for options the absolute P/L plus the premium received on sale of options. This is used to assess audit thresholds – work with your CA to compute correctly.

-

Audit thresholds: Tax audit may be triggered based on turnover and profit profile (for example, if you declare lower profit than presumptive norms, or cross turnover limits). Rules vary by cash usage and other conditions – confirm with a CA.

-

Advance tax: Required if your total tax liability for the year exceeds the threshold. Pay quarterly to avoid 234B/234C interest.

-

GST: No GST on your trading profits or losses in securities/derivatives; GST applies on brokerage and associated services (which you can claim as a business expense).

Presumptive schemes and audits:

-

Many active F&O traders explore Section 44AD presumptive taxation for small businesses if turnover and conditions fit. Its applicability to derivatives depends on your facts and comfort with compliance – get written advice from a CA.

-

If you opt out of presumptive or don’t meet conditions, maintain detailed books and evaluate tax audit needs under Section 44AB.

Record-keeping (non-negotiable):

-

Daily contract notes and trade confirmations

-

Year-end broker P&L, turnover statement, and ledger

-

Bank statements (fund transfers to/from broker)

-

Invoices for all business expenses (internet, tools, research, CA)

-

Working papers for turnover computation and advance tax workings

Set-off and carry-forward basics for traders:

-

Non-speculative business loss (like F&O trading loss) can generally be set off against any income except salary in the same year; unabsorbed loss can be carried forward (subject to timely ITR filing) as per prevailing rules.

-

Keep capital gains from physical/digital gold separate from business income from derivatives – different heads, different rules.

When to consult a CA (practically: almost always):

-

If your turnover is rising, you run options-writing strategies, or you have mixed income (salary + F&O + capital gains). Getting your turnover, advance tax, and audit stance right saves you penalties and interest.

Which one should you choose? Tax-efficiency by goal and holding period

If you want maximum tax relief: Choose Sovereign Gold Bonds (SGBs) and hold to maturity – your gains at redemption are tax-free, while the 2.5% interest is taxable annually.

If you want flexibility + tiny ticket sizes: Go for digital gold. With OroPocket, start at ₹1 via UPI, build a daily habit, and earn free Bitcoin on every purchase. Remember: tax on selling gold later still applies as per holding period rules.

If you want demat-based allocation and SIPs: Pick Gold ETFs/Gold Mutual Funds – clean statements, easy to rebalance, and no GST on unit transactions.

If you want gifting and physical comfort: Physical gold works for cultural needs and gifting, but mind 3% GST, making charges, and liquidity spreads.

Typical holding period breakpoints: Plan for more than 24 months to qualify for long-term capital gains (LTCG) at a flat rate; selling within 24 months leads to slab-rate taxation.

Liquidity vs taxation trade-off: Weigh instant sale (ETFs/digital) against SGBs’ tax-free maturity. Premature SGB sale may attract capital gain tax; ETFs have bid-ask spreads; digital gold offers quick exits for selling gold online.

|

Format |

Liquidity |

Tax at sale |

Indexation |

Extra benefits |

Costs (GST, making charges/TER) |

Best for |

|---|---|---|---|---|---|---|

|

Sovereign Gold Bonds (SGBs) |

Low to moderate; lock-in till 8-year maturity; premature exit via exchange from year 5 (liquidity depends on market) |

Redemption at maturity: tax-free for individuals; premature sale: STCG at slab (≤24 months) or LTCG at flat rate (>24 months) |

Not applicable under new regime for most non-equity; special exemption at maturity instead |

2.5% p.a. interest (taxable), no storage hassles |

No GST on bond units; brokerage/price impact if selling on exchange |

Long-term holders seeking maximum tax efficiency |

|

Digital gold (e.g., OroPocket) |

High; instant buy/sell via app and UPI |

STCG at slab (≤24 months); LTCG at flat rate (>24 months) |

No |

Bitcoin rewards on every purchase with OroPocket; micro-investing from ₹1; easy gifting |

3% GST on buy; platform spread; no making charges |

Habit builders, small-ticket investors, quick liquidity |

|

Gold ETF/Gold Mutual Fund |

High; intraday for ETFs, T+ timelines for MFs |

STCG at slab (≤24 months); LTCG at flat rate (>24 months) |

No |

Demat/MF platform access, SIPs, clean audit trail |

No GST on units; ETF brokerage + spread; MF TER |

Portfolio allocators, SIP users, demat investors |

|

Physical gold (jewellery/coins/bars) |

Moderate; depends on jeweller/buyer |

STCG at slab (≤24 months); LTCG at flat rate (>24 months) |

No |

Tangible asset, cultural gifting |

3% GST on gold; jewellery making charges (+5% GST on making if charged separately); buy-sell spreads; storage/security |

Gifting, occasions, those preferring physical comfort |

OroPocket perspective: If you value flexibility, tiny ticket sizes, and rewards, digital gold via OroPocket gives a practical balance – start with ₹1, pay via UPI in seconds, and earn free Bitcoin on every purchase. When you eventually sell, capital gain tax on gold applies as per the same rules outlined above.

Checklist before you sell: paperwork, PAN/GST, and avoiding headaches

Documents to gather:

-

Purchase invoice or registered valuer’s report (if bills are missing)

-

App/broker/AMC statements (digital gold, ETFs/MFs) and SGB holding/redemption statement

-

Government ID and PAN

PAN and reporting thresholds:

-

Provide PAN for high-value transactions

-

Avoid large cash deals; prefer bank/UPI transfers for clear audit trails

Jewellery exchange:

-

Treat as a sale; get a proper exchange invoice noting purity, weight, and value of old gold applied

Inherited/gifted gold:

-

Keep proof such as gift deed, will, or succession documents; valuation report if invoices are unavailable

SGBs:

-

Know your exit: Maturity redemption is tax-free on gains; exchange sale before maturity can trigger capital gains tax

ETFs/MFs:

-

Download capital gains statements from your broker or registrar (CAMS/KFintech) and match with contract notes

ITR planning:

-

Use the right schedule (Schedule CG; SGB interest under “Income from Other Sources”)

-

Consider advance tax if gains are significant

-

Store all proofs for at least 6–8 years

Final verdict (+ OroPocket tip)

If you can hold for the long haul and want the best tax outcome: Sovereign Gold Bonds (SGBs) held to maturity are hard to beat – redemption gains are tax-free for individuals, while the 2.5% interest is taxable each year.

If you want flexibility, tiny amounts, and daily habit-building: Digital gold makes it effortless. With OroPocket, start at ₹1 via UPI, stack 24K gold in seconds, and earn free Bitcoin on every purchase – unique in India. Remember, when you sell, tax on selling gold applies as per holding period rules.

For demat-native investors: Gold ETFs/Gold MFs offer simple, diversified, and liquid exposure with transparent pricing and clean statements for tax filing.

Bottom line: Plan your holding period around the 24-month LTCG threshold, keep your purchase/sale documents tight, and use Sections 54F/54EC where eligible to reduce or defer tax.

Next step: Try OroPocket to accumulate 24K gold the modern way – tiny ticket sizes, instant UPI payments, and Bitcoin rewards that make every buy smarter.

Call to action: Download the OroPocket app at https://oropocket.com/app