Gold as savings: build your emergency fund with micro-investing

Introduction: Gold as savings – the modern way to build your emergency fund

Your emergency fund is your first line of defense. But parking all of it in a low-yield savings account is a silent leak. A smarter, modern approach is to treat gold as savings – using micro-investing to steadily build a resilient buffer that protects your purchasing power while keeping liquidity within reach.

Why emergency funds fail in traditional savings

-

Savings accounts often don’t beat inflation; the real value erodes month after month.

-

Cash is liquid but loses purchasing power, especially in high-inflation periods.

The case for “gold as savings”

-

Gold historically holds value and helps diversify risk versus a cash-only buffer. It’s a proven inflation hedge and a shock absorber when markets wobble.

-

Micro-investing lets you invest money in gold from as little as ₹1. No waiting to “save up enough” – you build your gold buffer daily, just like rounding up spare change.

-

With OroPocket, your gold is 24K, fully insured, and securely vaulted. You also earn free Bitcoin (Satoshi) on every gold/silver purchase – combining long-term stability with modern upside.

What this guide covers

-

How to invest money in gold via tiny, automated buys (SIP-like) using UPI so you can build “portfolio gold” without friction.

-

How to set targets, automate streaks, and leverage rewards (Bitcoin cashback, daily streak bonuses, spin-to-win) on OroPocket to supercharge outcomes.

-

Practical allocations, costs, risks, and a step-by-step action plan to turn gold as savings into a living, growing emergency fund.

Who this is for

-

First-time investors who want a safer alternative to idle savings.

-

Salaried professionals who want to beat inflation without complexity.

-

Bitcoin-curious users who want exposure without buying crypto directly.

Ready to build an emergency fund that actually keeps up with life? Download the OroPocket app and start micro-investing in 24K gold from ₹1 today: https://oropocket.com/app

Gold in an emergency fund: liquidity, volatility, and why small, steady buys win

Gold-as-savings is a practical way to protect your emergency fund from inflation without losing access to cash when you need it most. The key is choosing the right format (digital gold), sizing it sensibly, and building it through small, steady buys.

Liquidity, the right way

-

Physical gold: inconvenient to sell quickly, pricing/purity risk at the counter, and friction when time is critical.

-

Digital gold: tap-to-sell and convert to cash fast – ideal for emergencies. With OroPocket, you can invest money in gold via UPI in seconds and liquidate instantly when life throws a curveball.

“Gold’s unique attributes as a scarce, highly liquid and uncorrelated asset enable it to act as a diversifier over the long term.” – Source

Volatility and sizing

-

Gold can move month-to-month; don’t hold 100% of your emergency corpus in gold.

-

Use a sensible allocation (e.g., 10–30%) to add stability and diversification alongside cash and liquid funds.

-

Rebalance occasionally so your portfolio gold remains within the chosen range.

Why micro-investing matters

-

Smooths your entry price over time with rupee-cost averaging – no need to “time” the market.

-

Builds a habit, not just a balance – the discipline matches how emergencies arrive: unannounced.

-

Start from ₹1 via UPI on OroPocket, automate streaks, and turn everyday micro-buys into resilient, inflation-aware savings.

Bottom line

-

Gold strengthens an emergency fund when added thoughtfully – not as an all-or-nothing bet. Use digital gold for liquidity, keep allocation sensible, and build it through micro-investing.

Ready to add gold as savings to your emergency buffer? Download OroPocket and start with ₹1 today: https://oropocket.com/app

How micro‑investing with OroPocket works (₹1 entry, UPI, and Bitcoin rewards)

Build “gold as savings” the smart way: start with ₹1, automate with UPI, and earn Bitcoin rewards while you grow your emergency buffer.

Video: Build your emergency fund with micro‑investing on OroPocket – set a goal, enable UPI auto‑buys, understand Bitcoin rewards, and sell gold instantly in an emergency. Official OroPocket channel: https://www.youtube.com/@OroPocket

Start with ₹1, set a target

-

Define your emergency fund goal (e.g., 3–6 months’ expenses).

-

Create a micro-SIP style plan: choose daily/weekly auto-buys so you invest money in gold consistently without timing the market.

Automate with UPI

-

Make instant purchases via any UPI app in under 30 seconds – no paperwork, no minimum threshold.

-

OroPocket is built mobile-first: buy, track, and sell your portfolio gold in just a few taps.

Get rewarded while you save

-

Earn free Bitcoin (Satoshi) on every gold/silver purchase – turn every micro-buy into more value.

-

Daily streaks: bonus rewards every 5 consecutive days you invest.

-

Spin to Win: daily spins for extra gold/Bitcoin rewards.

-

Referral program: invite friends and both of you earn 100 Satoshi + a free spin.

Build habits, not friction

-

Smart notifications and streaks keep you consistent, turning small steps into a serious buffer.

-

Send Gold: gift gold to friends/family without breaking your streak or your momentum.

What you own

-

24K pure gold, 100% insured and securely vaulted with RBI-compliant partners – real metal, not a promise. Liquidity remains one tap away when emergencies hit.

Ready to start with ₹1 and turn micro-buys into a resilient emergency fund? Download OroPocket now: https://oropocket.com/app

How much gold belongs in your emergency fund? A practical allocation framework

Gold can strengthen your emergency fund when sized right. Think of it as “gold as savings” that protects purchasing power while keeping liquidity at hand through digital, tap‑to‑sell access.

The 70/30 starting point

-

For many, a 70% cash/liquid fund + 30% digital gold split balances liquidity and inflation defense.

-

This keeps most of your buffer instantly accessible, with a meaningful allocation to portfolio gold for diversification.

Calibrate by your reality

-

Very stable income (tenured, dual-income): 20–30% gold.

-

Moderate stability (early-career, single-income): 15–25% gold.

-

Variable income (freelancers, commission-based): 10–20% gold.

Rebalancing rule

-

Rebalance quarterly/biannually to maintain your target split.

-

In volatile periods, use small, frequent top-ups (micro-buys) instead of large lump sums to invest money in gold gradually.

Examples

-

Salaried pro in Tier 2 city: 75% cash/liquid + 25% gold.

-

Freelancer in Tier 1: 80–90% cash/liquid + 10–20% gold.

Emergency fund allocation by profile

|

Profile |

Cash/Liquid Allocation |

Digital Gold Allocation |

Rationale |

Rebalancing Tip |

|---|---|---|---|---|

|

Tenured government employee (Tier 2) |

70–75% |

25–30% |

Highly stable income; gold adds inflation defense without sacrificing access via digital sell. |

Quarterly rebalance; auto top-up gold if it falls below 25%. |

|

Dual-income salaried couple (Tier 1) |

70–80% |

20–30% |

Low interruption risk but higher city expenses and EMIs; gold diversifies savings. |

Biannual rebalance; use micro-buys during salary credit week. |

|

Early‑career single‑income (Tier 2) |

75–85% |

15–25% |

Job shifts and relocation risk; keep more cash while building gold steadily. |

Monthly micro-buys until target; rebalance when gold drifts ±3%. |

|

Freelancer/consultant (Tier 1) |

80–90% |

10–20% |

Variable cashflows; protect runway with cash and a modest gold sleeve. |

Biannual review; weekly micro-buys to average entry price. |

|

Commission‑based sales (Tier 2/3) |

85–90% |

10–15% |

Income volatility and frequent short‑term needs demand higher cash. |

Rebalance only if gold > target by 3–5%; avoid lump‑sum shifts. |

|

Startup employee, ESOP‑heavy (Tier 1) |

75–85% |

15–25% |

Company risk and cliff periods; gold helps counter inflation and concentration risk. |

Rebalance post‑appraisal/bonus cycles with small top‑ups. |

Don’t over-allocate

-

Emergency funds prioritize access and stability. Avoid a full gold allocation to reduce short‑term price risk and keep emergencies friction‑free.

Dial in your allocation, then automate it. Start micro‑buys from ₹1 on OroPocket and let your “gold as savings” work alongside cash: https://oropocket.com/app

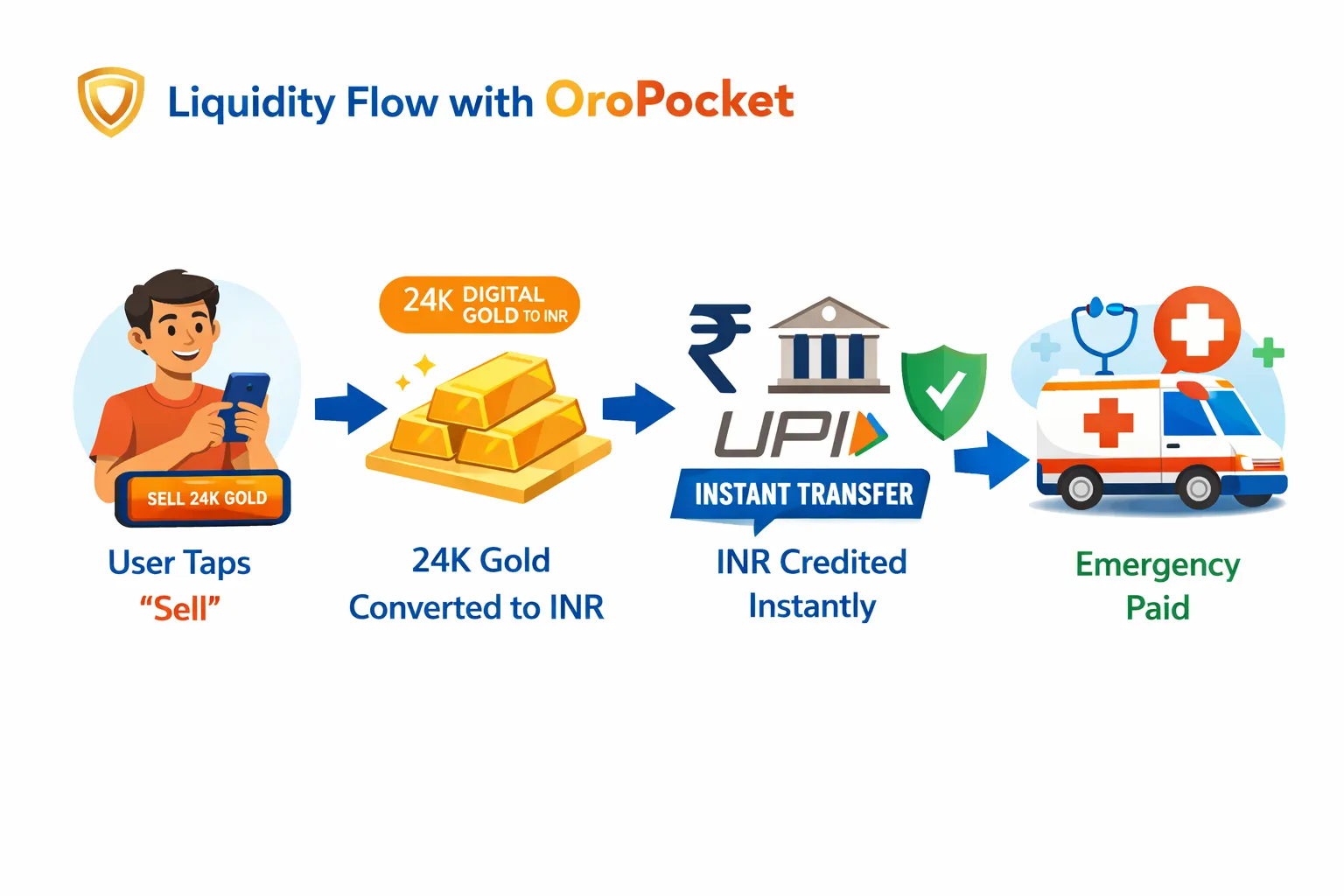

From gold to cash in minutes: liquidity, safety, and compliance on OroPocket

When emergencies hit, speed and certainty matter. OroPocket turns your digital gold into cash in minutes – without paperwork or hassle.

Instant sell flow

-

Open OroPocket → Sell gold → UPI/bank settlement.

-

Typical time: minutes, subject to bank rails and normal market liquidity.

“Immediate money transfer through mobile device round the clock 24*7 and 365 days.” – Source

Safety first

-

24K pure gold, fully insured, vaulted with authorized bullion partners.

-

RBI-compliant workflows with robust KYC and transparent audit trails.

-

Your holdings are secure, auditable, and always visible in-app.

What to expect on pricing

-

Live market-linked pricing with a visible buy–sell spread.

-

For best execution, sell during normal market hours when spreads are typically tight.

-

Use micro-sells if you need to stage liquidity over a few hours on volatile days.

Peace-of-mind checklist

-

Maintain 70–90% of your emergency corpus in cash/liquid instruments for immediate needs.

-

Use digital gold as the second layer you can tap quickly when expenses exceed first-layer cash.

-

Set alerts and keep UPI linked so you can move from gold to cash in minutes.

Build a buffer that’s both resilient and ready. Start micro-investing in 24K gold from ₹1 on OroPocket: https://oropocket.com/app

Beating inflation (without equity-level risk): why gold can strengthen savings

Inflation doesn’t wait. A cash-only emergency buffer quietly loses purchasing power every year. Adding a measured slice of digital gold – your “gold as savings” – helps your safety net keep up without taking equity-level risk.

Inflation eats idle cash

-

Cash-only buffers lose purchasing power year after year.

-

Even when bank rates rise, inflation often closes the gap – eroding real value.

“India’s digital gold trading volumes rose from under 0.5 tonnes in 2016 to roughly 4–5 tonnes in 2022, alongside an estimated 5–6 million active accounts.” – Source

Gold’s role

-

Long-term store of value with low correlation to many risk assets – helpful when markets wobble.

-

Works as a hedge layer within a broader cash-first emergency corpus so you retain liquidity while protecting purchasing power.

Expectation setting

-

Gold is volatile in the short run; size appropriately (10–30%) instead of going all-in.

-

Focus on consistency via micro-buys (rupee-cost averaging) to smooth your entry price and reduce timing risk.

Practical tip

-

Automate small weekly buys; review monthly; rebalance quarterly to your target split.

-

Use OroPocket to invest money in gold from ₹1 via UPI, keep your portfolio gold liquid, and stay disciplined with streaks and alerts.

Want savings that fight inflation without adding stock-market stress? Start building “gold as savings” on OroPocket: https://oropocket.com/app

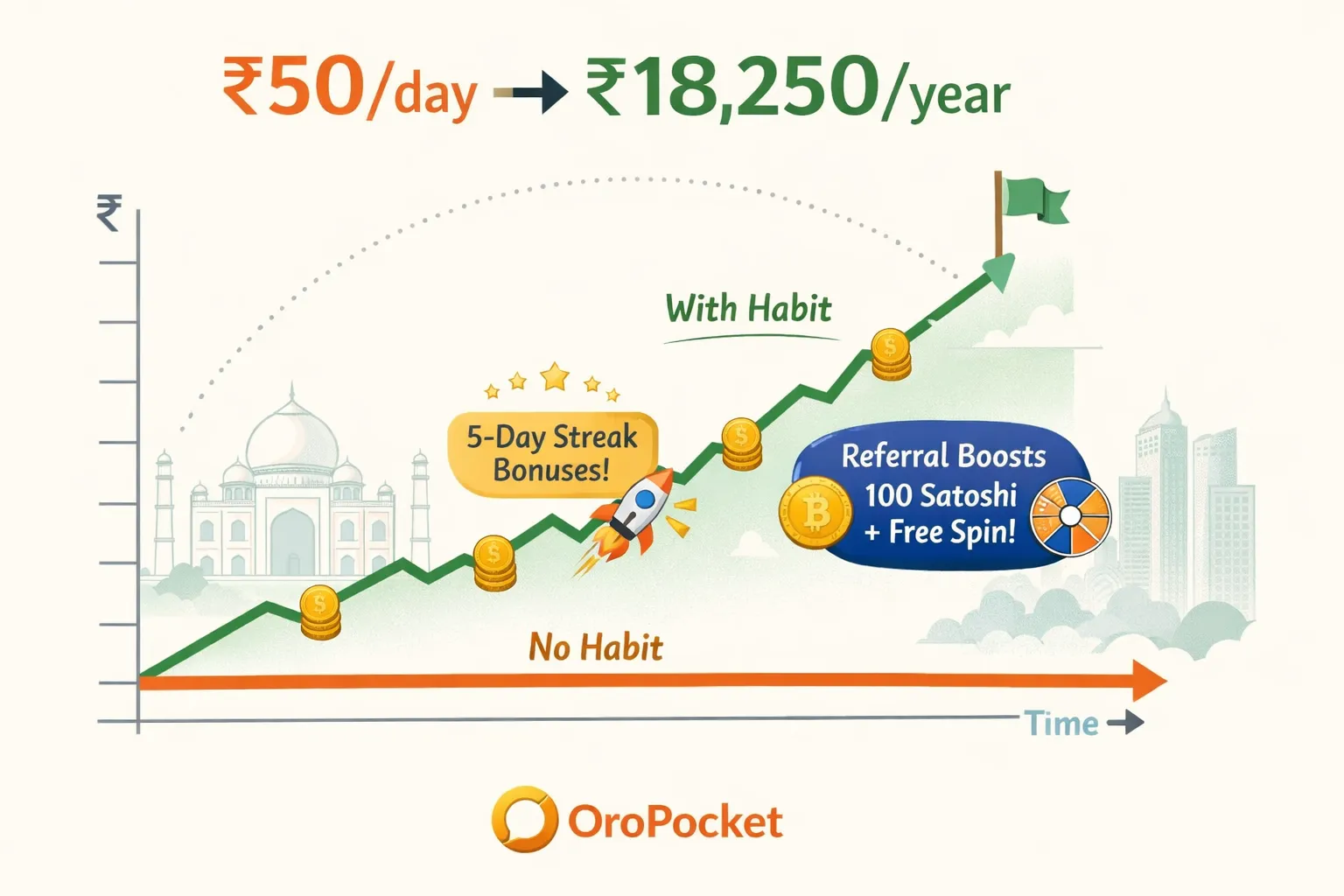

Your 30‑day micro‑investing plan: build ₹10,000 in gold the smart way

Build your “gold as savings” buffer in 30 days with tiny, automated buys. Target: ₹10,000 in digital 24K gold. Suggested baseline: ~₹333/day for 30 days (or ₹500/day for 20 days).

Week 1: Set the rails

-

Calculate 3–6 months’ expenses; decide what slice belongs in portfolio gold (typically 10–30% of your emergency corpus).

-

Set a clear 30‑day target (₹10,000) and a daily micro‑SIP amount (₹200–₹500).

-

Enable UPI auto‑buys in OroPocket; pick a fixed time each day so habits stick.

-

Turn on notifications and streak reminders to keep consistency high.

-

Pro tip: Keep most of your buffer in cash/liquid instruments; use gold as the inflation‑aware second layer.

Suggested schedule:

-

Option A: ₹333/day × 30 days = ~₹9,990

-

Option B: ₹500/day × 20 days + two ₹250 top‑ups = ~₹10,000

-

Option C: ₹2,500/week × 4 weeks = ₹10,000

Week 2: Lock habits, unlock rewards

-

Maintain daily streaks – earn bonus rewards every 5 consecutive days.

-

Take your daily Spin to Win for extra gold/Bitcoin rewards.

-

Refer 2 friends this week: earn 100 Satoshi + a free spin per referral.

-

Track progress in‑app: goal % complete, total units, Satoshi earned.

-

If you fall behind, add a small weekend top‑up (₹300–₹700) instead of a big lump sum.

Week 3: Optimize

-

Review your cashflow and adjust the daily amount (e.g., from ₹300 to ₹350) if you missed days.

-

Use “Send Gold” for small gifts (birthdays/festivals) without breaking your investing streak.

-

Keep buys small and steady to invest money in gold at an average price (rupee‑cost averaging), not by timing the market.

-

Check your allocation against target (e.g., aiming for 20–25% gold within your emergency fund).

Week 4: Review and rebalance

-

Verify you’ve reached ~₹10,000; if slightly short, finish with two ₹250–₹500 top‑ups.

-

Rebalance: if gold has drifted above your chosen band, pause buys until cash catches up; if below, keep daily buys on.

-

Schedule the next milestone (₹15,000 in 30–45 days) and keep UPI auto‑buys active.

-

Optional confidence check: do a tiny test sell to see the gold‑to‑cash flow in action, so you’re ready if an emergency arises.

Your results compound as a habit. Keep buys tiny, frequent, and automated – and let rewards add a little extra money from gold while you build a resilient buffer.

Ready to execute this 30‑day plan today? Download OroPocket and start with ₹1 via UPI: https://oropocket.com/app

Costs, taxes, and fine print: know exactly what you’re paying

Understand the moving parts so your “gold as savings” strategy stays efficient and predictable.

Common cost components

-

Buy-sell spread: live market pricing + platform spread.

-

Taxes: applicable levies at purchase/sale as per law.

-

Storage/servicing: vaulting/insurance/handling (if applicable).

How to minimize costs

-

Use automated micro-buys to avoid poor timing and smooth volatility.

-

Avoid panic selling; plan top-ups and exits during normal market hours.

Tax basics (high level)

-

Capital gains depend on holding period and prevailing rules.

-

Always consult a licensed tax professional; laws can change.

Transparency and trust

-

RBI-compliant processes and insured vaults for peace of mind.

-

Clear in-app pricing and transaction records for every buy/sell.

Risk reminder

-

Gold prices can fluctuate; size allocation prudently for emergencies.

What fees apply and how to reduce them

|

Cost Component |

What It Is |

When It Applies |

How OroPocket Handles It |

How You Can Reduce It |

|---|---|---|---|---|

|

Buy–sell spread |

Difference between buy and sell price around live market rates |

On every buy/sell |

Displays live prices and spread before you confirm |

Use micro-buys to rupee-cost average; transact during normal market hours for tighter spreads |

|

Taxes at purchase |

Statutory taxes/levies as per Indian law |

On purchase of digital gold |

Charges applicable taxes transparently on the order slip |

Plan steady, smaller purchases; avoid event-driven lump sums unless needed |

|

Capital gains tax |

Tax on gains based on holding period and current rules |

On sale/redemption |

Provides transaction records to help you compute gains |

Track holding periods; consult a tax professional for optimization |

|

Storage & insurance |

Secure vaulting, insurance, and custody servicing |

Ongoing while you hold gold |

Uses authorized bullion partners; fully insured vaults; costs reflected upfront (if applicable) |

Hold long enough to justify fixed costs; use rewards to offset effective cost |

|

Payment rails/bank charges |

Any charges your bank/UPI may levy (if any, per bank policy) |

On funding/withdrawal via UPI/bank |

Supports instant UPI; shows net amounts; no surprise in-app fees |

Prefer UPI; check bank fee policies; consolidate small withdrawals when practical |

|

Instant sell/settlement |

Operational processing to convert gold to INR |

On selling and crediting bank/UPI |

One-tap sell; settlement in minutes subject to bank rails; any fees shown before confirm |

Sell during regular hours; avoid repeated micro-withdrawals the same day |

|

Price slippage/volatility |

Market movement between quote and execution |

During fast-moving markets |

Uses live quotes; confirms price before execution |

Place orders in calmer hours; use automation to average entry price |

Keep your costs low, your process simple, and your plan consistent. Invest money in gold from ₹1 with OroPocket and use Bitcoin rewards to offset effective costs while you build a resilient emergency buffer.

Ready to start? Download OroPocket now: https://oropocket.com/app

Real‑life playbooks: how Indians actually use gold as savings

Gold as savings works best when it’s small, steady, and automated. Here’s how different Indians put it to work with OroPocket.

Case 1: The salaried professional (Tier 2 city)

-

Target: ₹1.5L emergency fund; allocates 25% to digital gold (₹37,500).

-

Action: ₹200/day UPI auto-buy + streak bonuses; hits goal in ~10 months without feeling the pinch.

-

Why it works: Consistency + micro-buys smooth the entry price and keep momentum high.

Case 2: The freelancer (variable income)

-

Target: ₹3L emergency fund; allocates 15% to digital gold (₹45,000).

-

Action: Weekly ₹1,500 buys + Spin to Win + referral boosts; rebalances quarterly to stay within the 10–20% band.

-

Why it works: Flexible schedule handles income swings while keeping gold as a steady inflation hedge.

Case 3: The gifter-parent

-

Uses Send Gold for small milestones (birthdays/exam results) without disrupting the emergency target.

-

Builds a family habit around Dhanteras/Diwali micro-buys; kids see progress and learn the value of saving.

-

Why it works: Keeps habits fun and visible while growing a practical safety net.

Pulling it together

-

Micro-buys + rewards = visible progress, less stress, more control.

-

You don’t need big lumps to make a difference – ₹1 to ₹200 daily adds up fast when you stay consistent.

-

Ready to start? Download OroPocket and build your “gold as savings” habit now: https://oropocket.com/app

FAQs: quick answers before you start

Is digital gold safe for emergencies?

-

Yes – as a portion of your emergency corpus. With OroPocket’s 24K, insured, vaulted gold and instant tap-to-sell, it works as a liquid second layer to cash.

How fast can I get cash?

-

Typically minutes via UPI/bank rails, subject to network/bank timings. Open the app → sell gold → receive INR.

What if gold prices dip when I need money?

-

Keep most of your emergency fund in cash/liquid instruments; use gold as the second line of defense (10–30%). Micro-buys smooth your average entry price.

Do I need a large amount to begin?

-

No. Start with ₹1 on OroPocket and automate small daily/weekly micro-buys – an SIP-like approach to invest money in gold and build “gold as savings.”

Do I get anything extra for buying gold?

-

Yes. You earn free Bitcoin (Satoshi) on every purchase, plus daily streak bonuses and Spin to Win rewards – turning micro-buys into more value.

Can I gift or send gold without breaking my habit?

-

Yes. Use Send Gold for small gifts. Your streaks and micro-SIPs can continue alongside, so your portfolio gold keeps growing.

Are there any hidden fees?

-

No hidden fees. You’ll see live pricing, the buy–sell spread, and taxes clearly in the app before you confirm.

How do I decide how much gold to hold?

-

A practical range is 10–30% of your emergency fund depending on income stability. Rebalance quarterly/biannually.

Ready to build your emergency fund the modern way? Download OroPocket and start with ₹1 via UPI: https://oropocket.com/app

Conclusion: Start building your emergency fund with OroPocket today

Gold as savings is the modern way to protect your emergency buffer from inflation – without giving up instant access to cash. With OroPocket, you can invest money in gold from ₹1 via UPI, earn Bitcoin rewards on every purchase, and keep your portfolio gold liquid for when life happens.

The simple formula

-

Keep most of your emergency fund in cash/liquid instruments.

-

Add 10–30% digital gold via micro-buys to fight inflation and diversify.

Why OroPocket

-

₹1 entry, UPI-native, 24K insured gold, RBI-compliant partners.

-

Bitcoin rewards on every purchase + gamified streaks to keep you going.

-

Send Gold, Spin to Win, and referrals make the habit sticky – turning micro-buys into more money from gold over time.

Your next step (takes 30 seconds)

-

Download the app and set your first auto-buy now.

Disclaimer: This article is for education only and not investment/tax advice. Markets and regulations can change; do your own research and consult licensed professionals.

![Best App for Investing in Gold in India [2026]: Fees, Rewards, and Safety Compared 6 Best20App20for20Investing20in20Gold20in20India205B20265D 20Fees20Rewards20and20Safety20Compared cover](https://blog.oropocket.com/wp-content/uploads/2026/01/Best20App20for20Investing20in20Gold20in20India205B20265D-20Fees20Rewards20and20Safety20Compared-cover-300x200.webp)