Gold Prices Over the Last 10 Years: Returns, Key Drivers & What It Means for 2026

Gold prices over the last 10 years: what actually happened (and why it matters for 2026)

If you’ve been tracking gold prices over the last 10 years, you’ve probably noticed one thing: gold doesn’t move in a straight line – but it does tend to reward patient investors, especially during inflation spikes, rate cycles, wars, and currency weakness.

For Indian retail investors (students, salaried pros, first-time savers), the big question isn’t “Can I time the perfect bottom?” It’s:

-

How volatile is gold normally?

-

What made gold rally (or fall) in each phase?

-

What return expectations make sense for 2026 and beyond?

-

What’s the simplest way to invest without stress – preferably with UPI, tiny amounts, and rewards?

Here’s the decade in review – clean, data-led, and actionable.

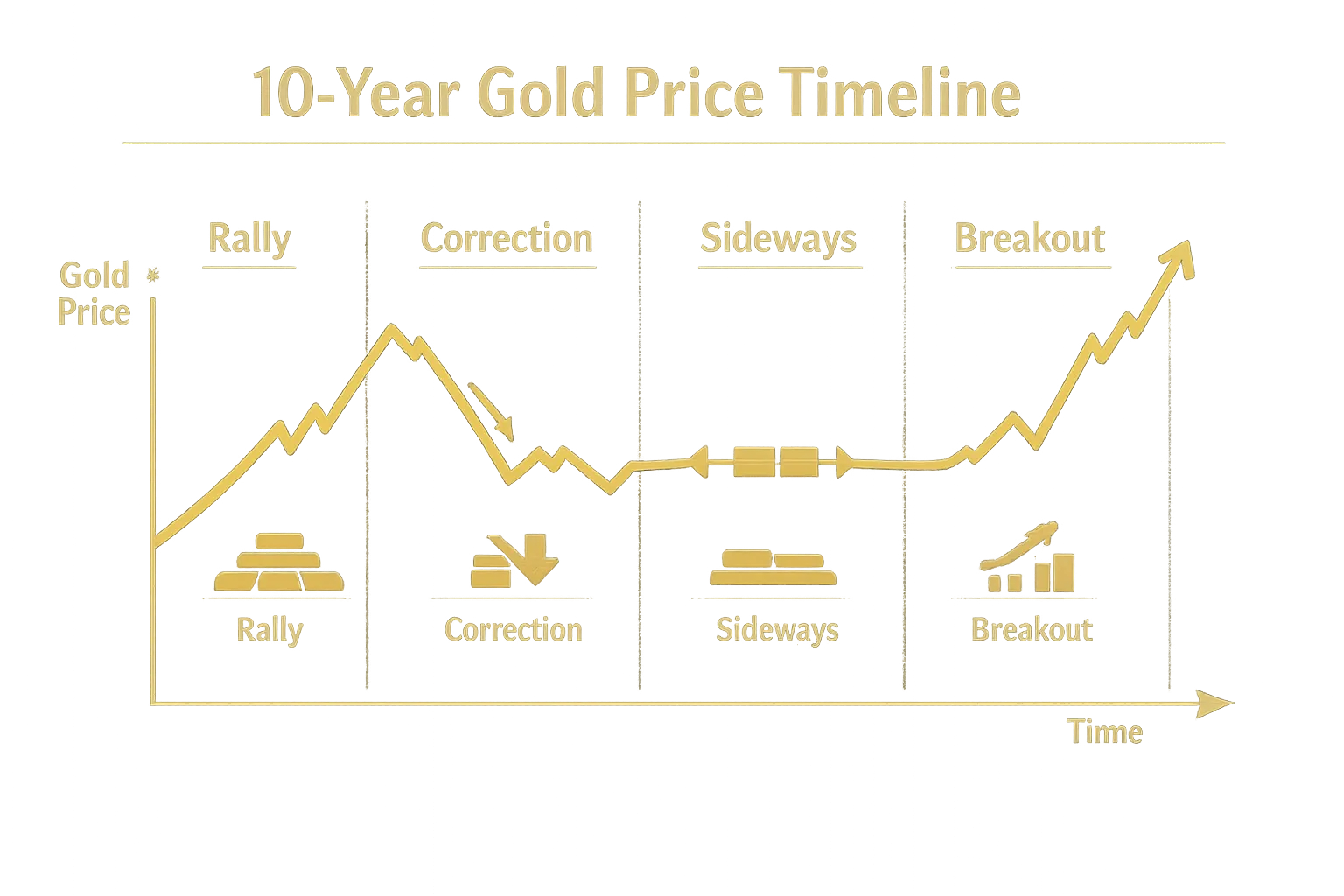

The 10-year gold story in one line: cycles, not magic

Gold’s last decade can be understood as four repeating forces:

-

US interest rates & real yields (gold hates high real yields)

-

US dollar strength/weakness (gold often moves opposite the dollar)

-

Geopolitical risk + recession fear (safe-haven demand)

-

Central bank + investor flows (ETFs + official reserve buying)

In India, there’s a fifth: USD-INR + import duties + seasonal demand.

If you’re investing digitally, it helps to learn the cycle once – and then stop reacting emotionally.

To go deeper on what drives prices and how to invest smarter, see our OroPocket breakdown on the gold market and 2026 drivers: gold market investment in 2026 and what drives gold prices.

The returns reality check (global): gold had weak years too – and still won

You’ll hear “gold always goes up.” Not true short-term. True long-term more often than people admit.

“Over the past decade (2016–2025), gold annual returns ranged from negative years (e.g., -3.65% in 2021) to huge up years (e.g., +64.29% in 2025).” – Source

Takeaway: Gold can dip even in a bull decade. That’s why SIP/staggered buying beats “all-in today”.

Gold in India: price growth is real (and the INR effect is a big deal)

India doesn’t just track global gold – it tracks global gold plus currency.

“Average 24K gold price in India rose from ₹28,623/10g (2016) to ₹94,630/10g (Jan 2026).” – Source

This is why Indians often experience stronger “felt returns” in INR terms – especially during periods of rupee weakness.

Gold prices over the last 10 years: phase-by-phase (2016–2026)

Below is the simplest way to understand the decade: phases, not noise.

Phase 1 (2016–2018): “Risk on / rate hikes” kept gold contained

What happened

-

The Fed was normalizing policy and gradually hiking rates.

-

Equity markets had strong runs (risk-on mood).

-

Gold held up, but didn’t explode.

What moved the price

-

Real yields rising = pressure on gold

-

USD strength episodes = pressure on gold

-

Periodic geopolitical jitters = short rallies

Investor lesson Gold can be boring – and that’s fine. Boring phases are where disciplined accumulation starts.

Phase 2 (2019–2020): the breakout (trade war → COVID shock)

What happened

-

Trade tensions + growth fear started pushing flows into defensive assets.

-

COVID triggered global panic, stimulus, and a rush to safety.

What moved the price

-

Massive monetary easing and uncertainty

-

ETF and safe-haven demand surged

-

Real yields dropped sharply

Investor lesson You don’t need to predict crises. You need a position before the crisis.

Phase 3 (2021–2022): inflation shock + rate shock = choppy gold

What happened

-

Inflation spiked globally.

-

Central banks responded with aggressive rate hikes.

-

Gold had periods of strength, then pullbacks.

What moved the price

-

Inflation supports gold… but

-

High real yields and a strong USD can offset it

-

War/geopolitical risk (e.g., Russia–Ukraine) supported safe-haven demand

Investor lesson Gold’s relationship with inflation isn’t “up only.” It’s inflation vs real yields.

Phase 4 (2023–2026): “de-dollarization flows + central banks + volatility” tailwind

What happened

-

Persistent geopolitical uncertainty

-

Strong official-sector (central bank) buying narrative

-

Investor positioning stayed constructive

India overlay

-

INR weakness at times amplified local prices

-

Domestic demand rises during festival/wedding cycles

Investor lesson Gold’s 2023–2026 tone is about structural demand, not just panic buying.

What moved gold the most? (The 6 drivers that matter in 2026)

Here’s a practical scoreboard – what to watch, and why it matters.

|

Driver |

Why it matters for gold |

2026 watch-out |

|---|---|---|

|

US real yields |

Higher real yields raise the opportunity cost of holding gold |

If rates stay high longer, rallies may be choppy |

|

US dollar (DXY) |

Gold often moves opposite the USD |

USD weakness = support for gold |

|

Inflation expectations |

Gold is a long-term purchasing power hedge |

Sticky inflation keeps demand alive |

|

Geopolitical risk |

Safe-haven flows spike during uncertainty |

Uncertainty premium may persist |

|

Central bank buying |

Official reserves shifting into gold can lift the “floor” |

Any slowdown can cool momentum (not collapse it) |

|

INR & import dynamics (India) |

Imported commodity + currency effect |

INR volatility can override global moves locally |

If you want a simple ruleset to avoid timing mistakes, read: when is the best time to buy gold in India.

What “normal volatility” looks like (so you don’t panic-sell)

Gold’s normal behavior:

-

Short dips happen even in strong cycles

-

Sideways months are common

-

Big rallies usually come in bursts – often when fear spikes or yields drop

So what should you do instead of guessing tops?

-

Build a base allocation gradually (SIP/staggered buying)

-

Rebalance once or twice a year

-

Treat gold like portfolio insurance + long-term store of value, not a day trade

Realistic return expectations for 2026 (by time horizon)

Let’s be honest and useful.

If your horizon is 3–12 months

-

Expect volatility

-

Returns can be great or flat – even negative – depending on rate/FX moves

Best strategy: stagger buys; don’t bet your emergency fund on a short window.

If your horizon is 2–5 years

-

Gold tends to behave like a strong hedge + cycle-driven return asset

Best strategy: keep a steady allocation and add more during corrections.

If your horizon is 7–10+ years

-

Gold historically shines as purchasing power protection

Best strategy: consistent accumulation + disciplined rebalancing.

The easiest way to invest without timing stress: micro-SIP + UPI (and rewards)

This is where most investors lose the plot: they overcomplicate.

A simple plan that works for real people:

-

Pick a fixed day (salary day or Sunday)

-

Invest a small amount (even ₹10–₹100)

-

Do it every week/month via UPI

-

Ignore daily noise

Want to start tiny? Here’s our step-by-step: how to invest in gold with little money (start from ₹1).

Why OroPocket is built for 2026-style investors (not old-school gold buyers)

Most gold apps help you buy gold.

OroPocket helps you build a habit – and gives you extra upside while you do it.

What you get with OroPocket (built for mass-market India)

-

Start from ₹1: no “minimum investment” excuses

-

Instant UPI buys: invest in under 30 seconds

-

Free Bitcoin on every purchase: stack gold + Sats together

-

Gamified investing: streaks, spin-to-win, tiered rewards (habit > motivation)

-

Gold as an inflation hedge: because savings accounts don’t protect purchasing power

-

100% secure & compliant: RBI-compliant processes, insured vault storage, authorized partners

-

Referrals that pay: both people earn 100 Satoshi + free spin

The emotional edge (why people stick)

-

Control: you’re not waiting for “someday”

-

Progress: you can track growth daily

-

Smart: you’re building a hedge + upside combo

-

Rewarded: Bitcoin cashback turns investing into a win loop

Quick verdict: what the last 10 years teach you for 2026

If you remember only this:

-

Gold moves in cycles, not straight lines

-

The biggest drivers are rates, USD, geopolitics, and central banks

-

In India, INR amplifies everything

-

Trying to time peaks is a tax on your returns

-

Staggered buying + long horizon wins more often than prediction

Stop watching. Start growing.

Download OroPocket, start with ₹1, buy gold via UPI, and collect free Bitcoin on every purchase – so your portfolio gets stability + upside without complexity.