Gold Rate: 7 Factors That Decide Today’s Price (and When to Buy)

Gold Rate: 7 Factors That Decide Today’s Price (and When to Buy)

Gold rates change every day – and if you’re a retail investor in India, it can feel like the price is “random.” It’s not. The gold rate you see is a stack of inputs: global spot price + USD/INR + taxes + local premiums + purity.

If you’re a student, salaried professional, small business owner, or first-time investor, you don’t need to “predict gold.” You need a simple decision framework – and a way to buy without big minimums, heavy making charges, or complicated paperwork.

That’s where OroPocket fits: start from ₹1, buy 24K digital gold, pay instantly via UPI, and earn free Bitcoin (Satoshi) cashback on every purchase. Stop watching. Start growing.

Gold price vs gold rate in India: what you’re actually paying

Before you decode today’s price, understand the two most confused terms:

1) Global spot price (the “world price”)

This is the live benchmark price of gold in global markets (quoted in USD per ounce). It moves with worldwide demand/supply, interest rates, risk sentiment, etc.

2) Local retail gold rate (what you see in India)

This is what you pay in ₹ – and it includes the spot price plus India-specific add-ons, like:

-

USD/INR conversion

-

Import duty

-

GST

-

Local premiums / dealer margins

-

Purity conversion (24K vs 22K)

If you want a deeper breakdown of how “app gold pricing” works (spot price, spread, and what you should track daily), use this guide: digital gold price decoded: what drives rates and how to track value daily.

Purity check: why 24K and 22K rates differ

Gold isn’t “one price.” It’s priced by purity.

|

Type |

Purity |

Typical use |

Why the price differs |

|---|---|---|---|

|

24K |

99.9% |

Bars/coins, digital gold |

Highest purity → highest per-gram price |

|

22K |

91.6% |

Jewellery |

Cheaper per gram because it’s mixed with other metals for strength |

Quick math:

22K gold value ≈ 24K gold value × 0.916 (before making charges/taxes/premiums).

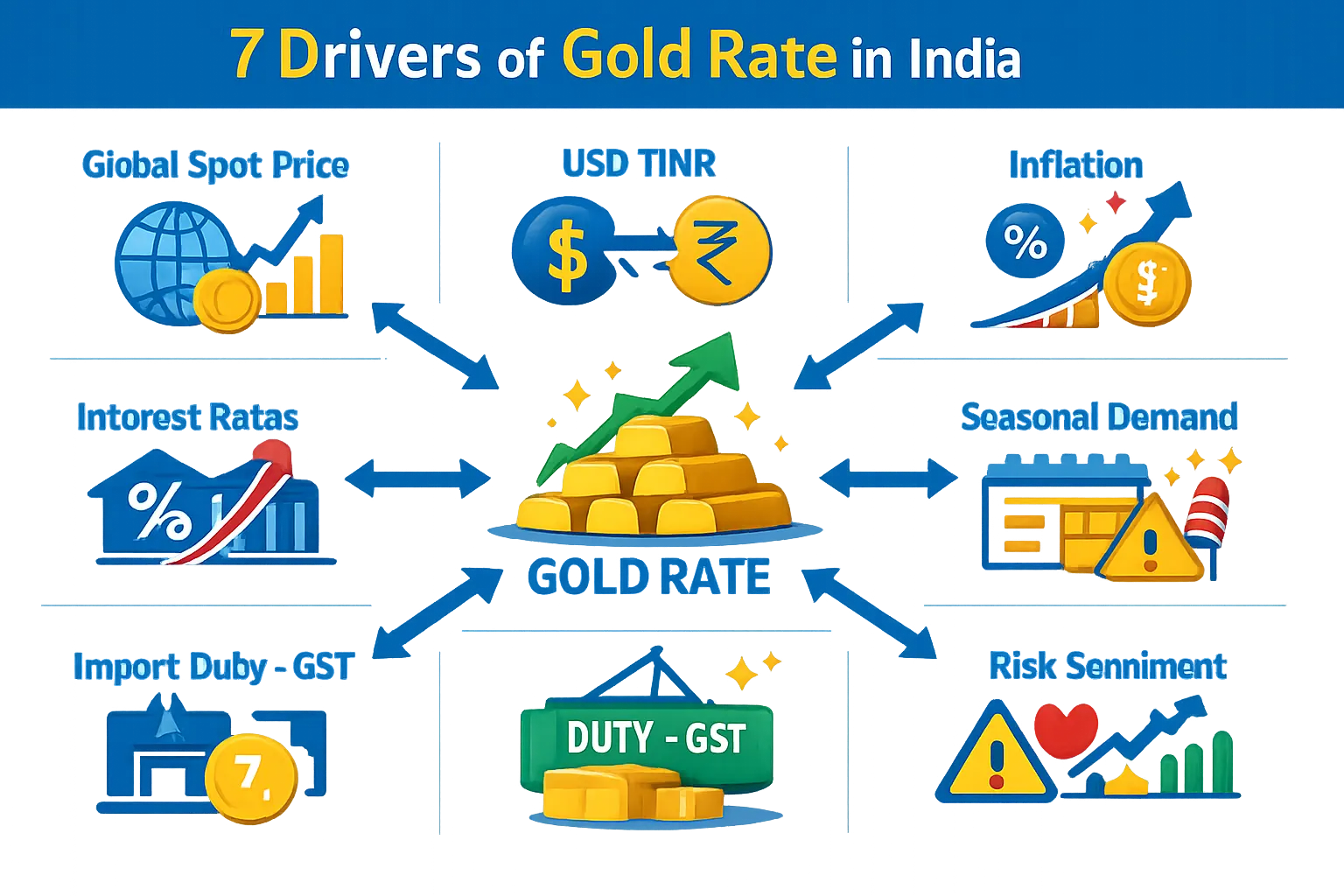

The 7 biggest factors that decide today’s gold rate in India

1) Global spot price (LBMA/COMEX-led markets)

Gold trades 24/7 globally. If global spot rises, Indian rates typically rise too (after currency and taxes).

What moves spot price?

-

Central bank buying/selling

-

Global risk sentiment (wars, crises)

-

Inflation expectations

-

Real interest rates

2) USD/INR exchange rate (the “hidden lever”)

India imports most of its gold. Gold is priced in USD, so:

-

Rupee weakens → gold becomes costlier in India

-

Rupee strengthens → gold becomes cheaper in India

Even if the global spot price is flat, USD/INR can move your local rate.

3) Inflation expectations (gold’s “panic button”)

When people expect inflation to stay high, they look for stores of value. Gold benefits because it’s seen as an inflation hedge.

“The price of gold per 10 grams was ₹48,099 in 2021 and rose to ₹1,17,570 by September 24, 2025 (about 144.5% absolute return).” – Forbes India

That’s why parking cash in low-yield savings often loses in real terms.

4) Interest rates (and especially “real rates”)

Gold doesn’t pay interest. So when interest rates rise (and bonds/FDs start paying more), some money shifts away from gold.

Rule of thumb:

-

Higher real rates → pressure on gold

-

Lower real rates → support for gold

5) Import duty + GST (India’s built-in markup)

India’s retail rate includes government levies:

-

Import-related costs (duty, related charges)

-

GST (and other local costs)

These don’t change every day like spot, but they set the baseline for why Indian retail prices stay above global spot conversions.

6) Seasonal jewellery demand (weddings, festivals, Akshaya Tritiya)

India’s cultural demand matters. When jewellers see a surge in buying, local premiums can rise.

But here’s the twist: when prices spike too much, buyers pull back.

“In the third quarter of 2025, India’s total gold demand fell ~16% YoY to 209.4 tonnes, largely due to a 31% drop in jewellery demand attributed to soaring gold prices.” – Times of India (citing WGC data)

7) Risk sentiment (“fear trade”)

In uncertain times – geopolitical tensions, recessions, stock market stress – gold gets bought as a “safe haven.”

If headlines are getting worse and markets are shaky, gold often catches bids fast.

How to judge if today’s gold rate is high or low: a simple checklist

Use this quick filter before you buy:

Step 1: Is the move driven by USD/INR or spot?

-

Spot up, INR stable → global-driven rally

-

Spot flat, INR weaker → currency-driven rise (often reverses faster)

Step 2: Are rates spiking in a straight line?

Parabolic moves are usually emotional. If you’re investing (not buying for a wedding tomorrow), consider spreading buys.

Step 3: Are you paying “jewellery markups”?

If your goal is wealth-building, avoid paying:

-

Making charges

-

Wastage charges

-

Higher buy/sell spreads

Step 4: Will you hold for 3+ years?

Gold works best when you give it time. If your horizon is short, prefer flexible formats and staggered entry.

When to buy gold (without trying to time it perfectly)

The smarter strategy: buy in small parts

Trying to hit the “lowest price” is a trap. A better strategy:

-

Buy a fixed amount weekly/monthly (like a SIP)

-

Add extra when there’s a meaningful dip

If you want a clear comparison of SIP-style gold investing options, read gold SIP vs gold ETF vs SGB: which is best for 2026?.

Best ways to buy gold in India (and what most people get wrong)

Jewellery

Best for: wear + tradition

Watch-outs: making charges, wastage, resale deductions

Coins/Bars

Best for: physical holding, gifting

Watch-outs: premiums, storage risk, buyback rules

Digital gold (app-based)

Best for: convenience, micro-investing, liquidity

Watch-outs: platform spreads, partner credibility, storage/insurance clarity

Gold ETFs

Best for: demat investors, liquidity

Watch-outs: market hours, brokerage, tracking error

Sovereign Gold Bonds (SGBs)

Best for: long-term holders (if available), interest component

Watch-outs: liquidity constraints, issuance windows, price vs NAV dynamics

Why OroPocket is built for real Indian investors (not “finance influencers”)

Most people don’t fail at investing because they’re lazy. They fail because investing feels like:

-

too expensive,

-

too complex,

-

too easy to postpone.

OroPocket flips that.

OroPocket advantages (built to make you consistent)

-

Start from ₹1: no “I’ll invest when I have more money” excuses

-

Free Bitcoin on every gold/silver buy: you stack two assets with one habit

-

Gold + Bitcoin combination: stability + upside without needing to trade crypto directly

-

Gamified investing: streaks, spin-to-win, tiered rewards that build daily momentum

-

100% secure & compliant: RBI-compliant, insured vaults, authorised bullion partners

-

Instant UPI payments: buy in under 30 seconds

-

Referral rewards: both users earn 100 Satoshi + free spin

If you’re choosing between traditional safe options and modern gold investing, this breakdown helps: FD vs digital gold: which is better?

Conclusion: The gold rate isn’t random – so don’t invest randomly

Today’s gold rate is the result of 7 forces: global spot price, USD/INR, inflation expectations, interest rates, taxes, seasonal demand, and risk sentiment.

Your winning move isn’t guessing tomorrow’s price. It’s building a system:

-

small buys,

-

consistent habit,

-

low friction,

-

real security,

-

and rewards that keep you engaged.

Stop watching. Start growing.

Download OroPocket, start with ₹1, and earn free Bitcoin every time you buy gold or silver.