Gold Rate Today: Live 22K & 24K Prices + Why Gold Changes Daily (2026)

Gold Rate Today in India (2026): Live 22K & 24K Prices + Why Gold Changes Daily

If you searched “gold rate today”, you want two things – the latest price and a simple, credible reason for why it moved since yesterday. This guide gives you both, plus a smarter way to track and buy gold without dealer drama, making-charge shock, or high minimums.

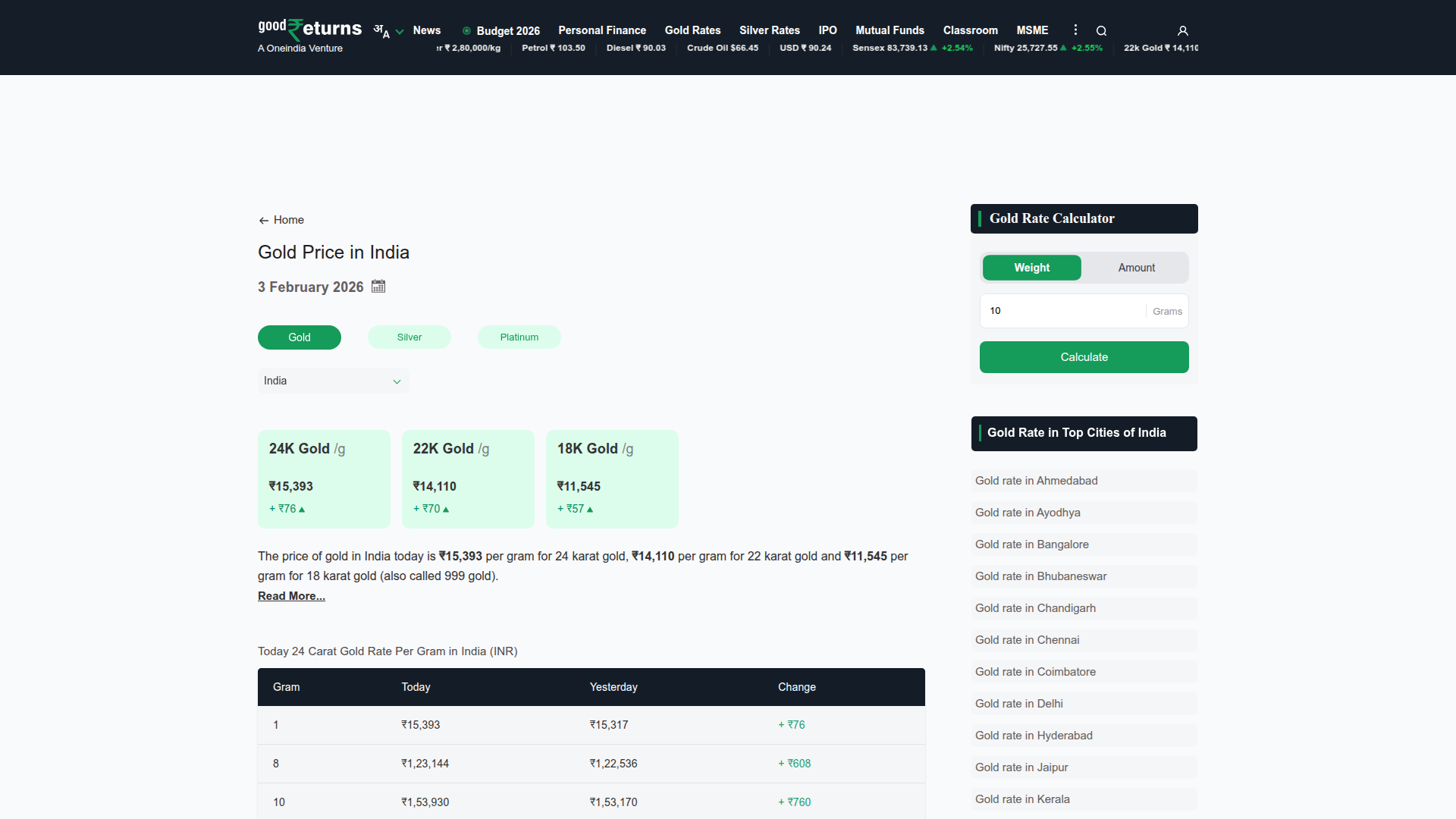

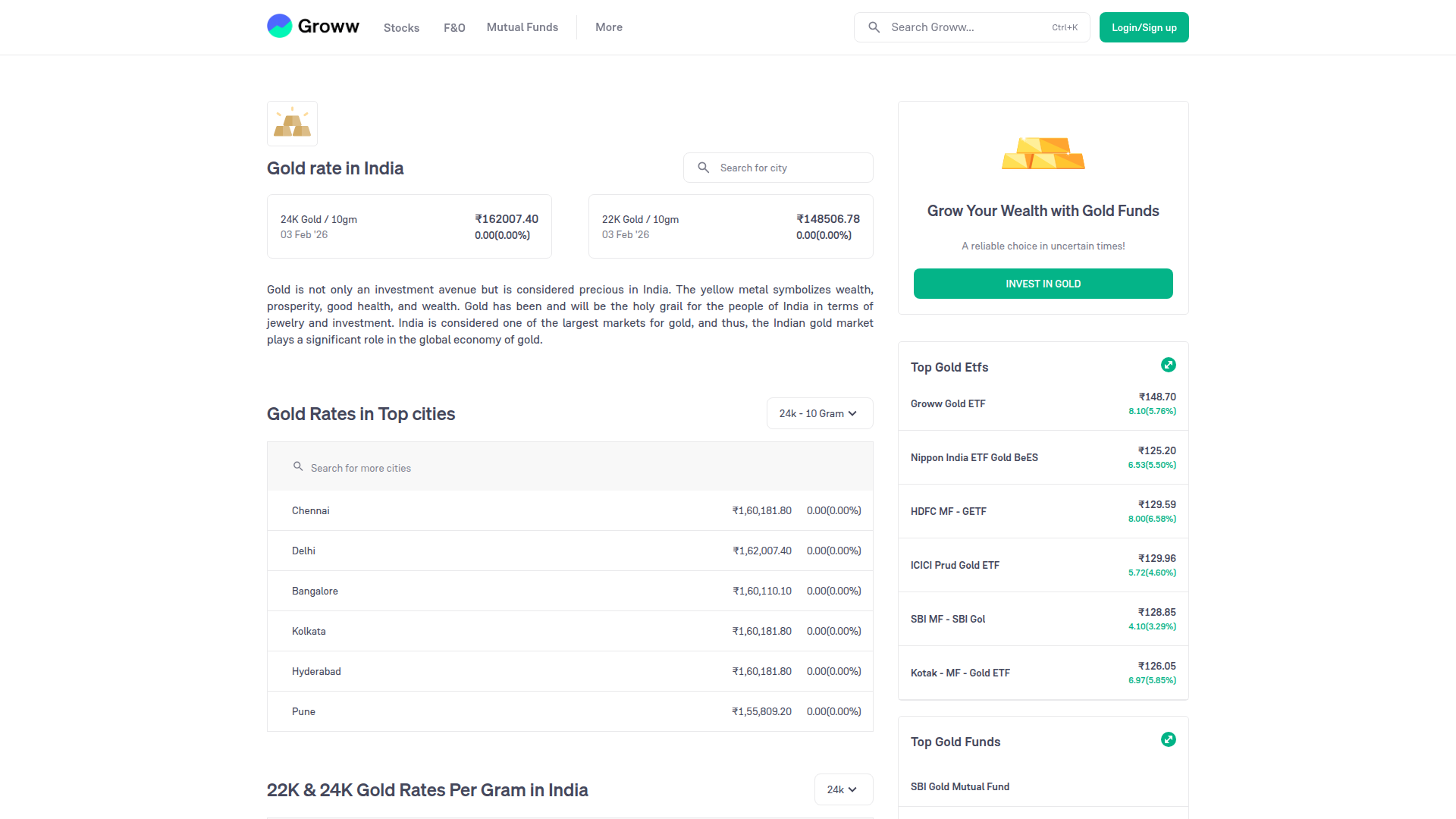

Today’s Gold Rate (Quick Snapshot)

Gold rates vary slightly by city and seller. Use this section to understand the benchmark rate and then expect a local premium (GST, making charges, spreads, delivery).

Live reference sources (check and cross-verify)

22K vs 24K gold rate: what you’re actually paying for

|

Type |

Purity |

Best for |

Why the price differs |

|---|---|---|---|

|

24K |

~99.9% |

Investment (coins/bars/digital gold) |

Highest purity → highest per-gram rate |

|

22K (916) |

~91.6% |

Jewellery |

Mixed with alloy for strength → lower gold content so lower rate |

If you’re planning to invest (not wear), learn the practical buying checklist in rules for buying gold in India.

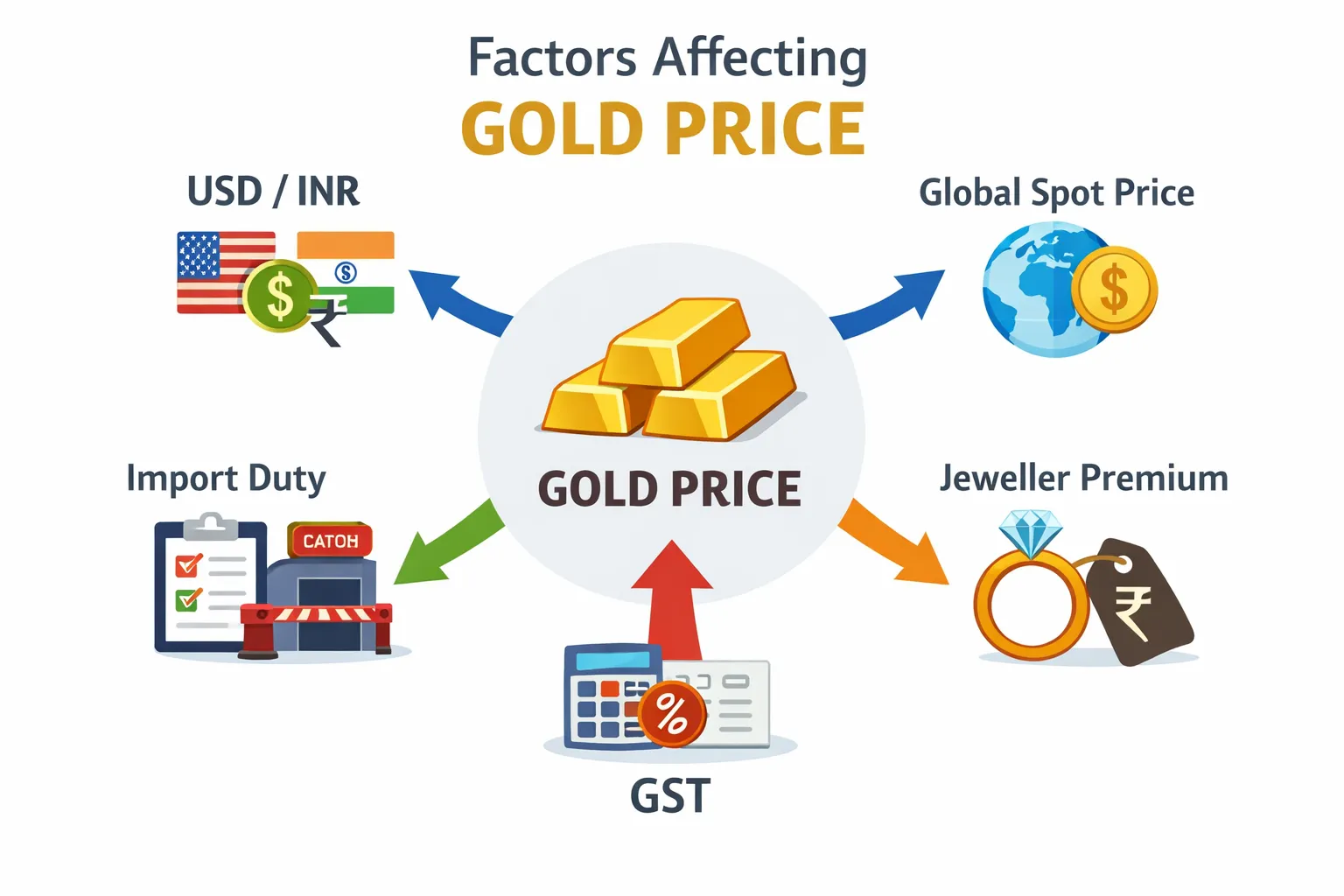

Why Gold Rate Changes Every Day (And Sometimes Every Hour)

Gold is priced globally, but paid for locally. That means your daily price is a moving mix of international markets + rupee movement + Indian taxes + seller premium.

The simple formula: how “gold rate today” is built

Today’s retail gold price ≈

Global spot gold price (USD)

→ USD/INR exchange rate

→ Import duty + other charges

→ Domestic bullion premium

→ GST + jeweller margin/making/spread

1) USD/INR: the silent daily driver

Even if global gold is flat, a weaker rupee usually means higher gold rates in India because India imports most of its gold.

2) Global spot price (risk-on vs risk-off)

Gold typically rises when investors want safety (wars, recessions, banking stress) and cools when markets chase risk assets.

3) Interest rates (Fed + RBI expectations)

Gold doesn’t pay interest. When yields rise, gold can face pressure; when rate cuts are expected, gold often gets support.

4) India’s wedding & festival demand (the seasonal rocket fuel)

Demand spikes during wedding seasons and festivals, pushing local premiums up – especially for jewellery.

“Approximately 50% of India’s annual gold demand is attributed to weddings.” – Source

5) Jeweller premiums, making charges, and spreads (the part most people ignore)

Two people can pay wildly different “gold rates” on the same day because:

-

Making charges (jewellery) are often a bigger drag than price movement

-

Buy-sell spread (coins/digital) changes across platforms

-

Some sellers quote “base gold rate” but add hidden costs at billing

If you want to go deeper on pricing mechanics, read gold price decoded: what drives rates & how to track value daily.

How to Track Gold Prices Like a Pro (Without Overthinking)

Create a 60-second daily gold habit

-

Check 24K per gram as your “pure gold” benchmark

-

Compare 22K only if you’re buying jewellery (22K = 916)

-

Track USD/INR trend – it often explains “why today changed”

-

Watch event risk (Fed policy, inflation prints, geopolitical headlines)

-

Use a consistent source daily to avoid confusion (don’t hop between 10 apps)

A smarter tracking move: invest small, frequently

Trying to “time the lowest gold price” is a trap. A better approach for most Indians is micro-buying (small amounts across weeks/months). This smooths volatility and builds discipline.

Jewellery vs Coins vs ETFs vs Digital Gold (What Fits Which Goal?)

|

Option |

Best for |

Key advantage |

Key drawback |

|---|---|---|---|

|

Jewellery |

Wearing + tradition |

Emotional + social utility |

Making charges + resale loss |

|

Coins/Bars |

Gifting + physical holding |

Tangible |

Storage + spread |

|

Gold ETF |

Demat investors |

Market-linked, liquid |

Requires demat; market hours |

|

Digital gold |

Mobile-first savers |

Buy from ₹1, easy to accumulate |

Platform spreads; choose trusted provider |

Want a clean comparison before you choose? Use digital gold vs gold ETFs vs sovereign gold bonds.

OroPocket Angle: Stop Watching Gold Rates. Start Growing Daily.

Most people track “gold rate today” like it’s a scoreboard. Smart investors use it like a habit trigger.

Why OroPocket is built for modern India

Here’s what changes when you buy gold the OroPocket way:

-

Start from ₹1: no “wait till salary day” excuses

-

Instant UPI buys (under 30 seconds): no bank transfer friction

-

100% secure & compliant: insured vault storage + authorized bullion partners

-

Gamified investing: streaks + spin-to-win rewards that build consistency

-

Free Bitcoin on every purchase: you stack gold + Satoshi together

-

Referral rewards: both sides earn 100 Satoshi + free spin

This is wealth-building that feels like progress – not paperwork.

Gold + Bitcoin: the combo retail India actually wanted

Gold brings stability. Bitcoin brings upside potential. OroPocket brings both – without forcing you into complex crypto trading.

And gold has historically protected purchasing power better than “doing nothing”:

“Over the past five years, gold delivered a ~23.2% CAGR in India.” – Source

Final Take: Use “Gold Rate Today” as Your Signal to Invest Smarter

If you’re checking gold prices every day, you already have the interest. Now convert that attention into action.

Stop watching. Start growing.

Open OroPocket, start with ₹1, pay via UPI, and earn free Bitcoin while you accumulate real 24K gold – securely vaulted and fully insured.

Your future self won’t remember the exact rate you bought at.

They’ll remember that you started – and stayed consistent.