Gold SIP vs Gold ETF vs SGB: Which Is Best for 2026?

Intro: Gold SIP vs Gold ETF vs SGB – the 2026 quick answer

Gold is at/near all-time highs, retail interest is surging, and macro uncertainty is pushing safe-haven demand. Yet the “best way to invest in gold in India” isn’t one-size-fits-all. Physical gold comes with hidden costs (3% GST, making charges, storage) and lower liquidity. Digital routes – Gold SIPs (digital gold), Gold ETFs, and SGBs – offer cleaner pricing, better liquidity, and smarter taxation. Here’s the quick answer for 2026.

“Global investment demand for gold hit a four-year high at 1,180 tonnes in 2024; total gold demand value reached $382 billion.” – Source

Why this comparison matters in 2026

-

Gold investment is back in focus: prices near record highs, central-bank buying strong, and Indian retail demand resilient.

-

Physical gold’s hidden costs (3% GST, making charges, storage) make digital routes more efficient for returns and liquidity.

TL;DR – What to pick by goal

-

Need micro-investing (₹1–₹500/day), 24×7 liquidity, UPI ease, gifting/rewards? Choose a Gold SIP via a digital gold app (e.g., OroPocket).

-

Want maximum tax-efficiency and can wait 8 years? Choose Sovereign Gold Bonds (SGBs).

-

Want stock-market liquidity and demat-based exposure? Choose Gold ETFs.

Comparison at a glance (fast facts)

|

Basis |

Gold SIP (Digital Gold) |

Gold ETF |

Sovereign Gold Bonds (SGBs) |

|---|---|---|---|

|

Min investment |

From ₹1 (app-dependent) |

≈ 1 unit (~1 gram) |

1 gram |

|

Liquidity |

24×7 buy/sell within app; near-instant settlement |

High – buy/sell on exchange during market hours |

Moderate – exchange trading but lower volumes; RBI redemption windows |

|

Lock-in |

None |

None |

8 years (early exit from year 5 on interest dates or via secondary market) |

|

Costs |

3% GST on buy + platform spread/storage (varies by app) |

Expense ratio ~0.35%–1% + brokerage/SEBI fees; no GST |

No expense ratio, no GST; possible secondary market premium/discount |

|

Taxes |

STCG: slab; LTCG (≥3 yrs): 20% with indexation |

STCG: slab; LTCG (≥3 yrs): 20% with indexation |

2.5% interest taxed; capital gains on redemption at maturity exempt |

|

Return components |

Gold price move (minus spreads/fees) |

Gold price move (minus expense ratio) |

Gold price move + 2.5% annual interest (biannual payout) |

|

SIP-friendly |

Yes (₹1–₹500/day gold investment SIP is common) |

Yes (via SIP in gold ETF/FOF with demat or MF route) |

Not a classic SIP; issued in tranches or bought on exchange |

|

Collateral/loans |

Limited; platform-dependent |

Possible with select brokers |

Eligible as collateral with banks/NBFCs |

|

Ideal horizon |

Short-to-mid term (1–5 years) or ongoing accumulation |

Short-to-mid term; tactical allocations |

Long term (5–8 years) to maximize tax edge |

|

Best for |

Micro-investors, 24×7 liquidity, UPI, gifting, rewards |

Market liquidity, demat users, tactical rebalancing |

Tax-efficient, patient investors seeking govt-backed exposure |

What we’ll cover next

-

How each option works, returns/tracking, costs/taxes, liquidity and safety

-

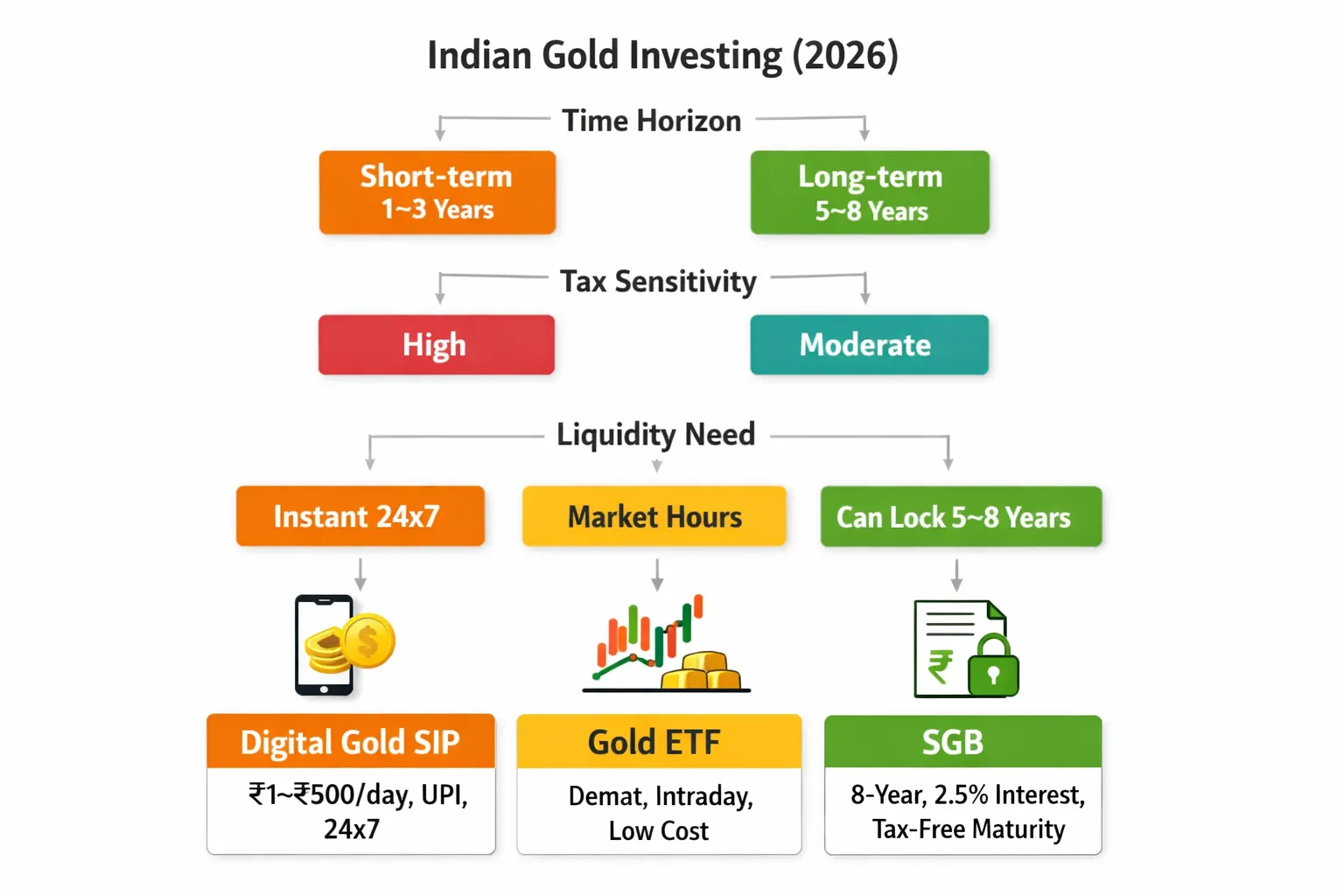

A decision tree to pick your best route and a 5-minute setup guide for a low-ticket gold SIP via mobile

About OroPocket (in one line)

Mobile-first digital gold with ₹1 entry, instant UPI, and free Bitcoin rewards on every purchase.

How each option works in India (mechanics, buying, oversight)

Gold SIP (Digital Gold)

-

What it is: Fractional ownership of 24K, investment-grade gold held in professional vaults. You buy grams/rupee value digitally; your balance reflects vaulted gold allocated to you.

-

How returns accrue: Tracks domestic gold prices. Your net return equals gold price movement minus platform spread/storage or maker–taker fees, if any.

-

How to buy: UPI-first apps make it seamless – start from ₹1 and set up daily/weekly/monthly Gold SIPs (gold investment SIP). You can top up anytime, pause, or increase amounts as your income grows.

-

Oversight & custody: Gold is stored with partnered, 100% insured vaults and audited providers. As these are platform-native products, investor due diligence on provider credibility, pricing transparency, and redemption policies is essential.

-

Extras: Many apps add rewards and loyalty (e.g., Bitcoin cashback), instant sell 24×7, peer-to-peer gifting, and goal-based SIPs – great for habit-building and micro-investing.

Gold ETFs

-

What it is: SEBI-regulated exchange-traded funds backed by 99.5% purity physical gold. Each unit represents a small quantity of gold held by the fund’s custodian.

-

How returns accrue: ETF NAV closely tracks domestic gold prices. Minor tracking error arises from expenses, cash positions, and market frictions.

-

How to buy: Requires a demat + broker account. You can buy/sell intraday on NSE/BSE at market prices. SIPs can be set up via your broker or by investing regularly in a gold ETF/feeder fund.

-

Oversight & custody: Governed by SEBI’s mutual fund/ETF regulations. Fund houses operate under trustee oversight, with audited holdings, independent custodians, and daily NAV disclosures.

Sovereign Gold Bonds (SGBs)

-

What it is: RBI-issued Government of India securities linked to gold price, denominated in grams. They mirror gold’s price and also pay a fixed coupon.

-

How returns accrue: Dual sources – gold price movement plus a fixed 2.5% per annum interest, paid semi-annually on the initial subscription amount.

-

How to buy: Subscribe during primary tranches announced a few times a year, or buy existing series on the secondary market via exchanges. Holdings can be kept in demat or as a certificate.

-

Oversight & custody: Issued by RBI on behalf of the Government of India. Sovereign backing provides high credibility; redemption value is linked to published domestic gold prices on maturity.

Returns and tracking: what actually drives performance

Price linkage

-

All three routes ultimately track domestic INR gold prices.

-

Key drivers: global gold (USD/oz), INR/USD movement, Indian import duty/cess changes, and local premiums/discounts.

-

Net impact: a weaker rupee or higher import duties can lift INR gold even if global prices are flat.

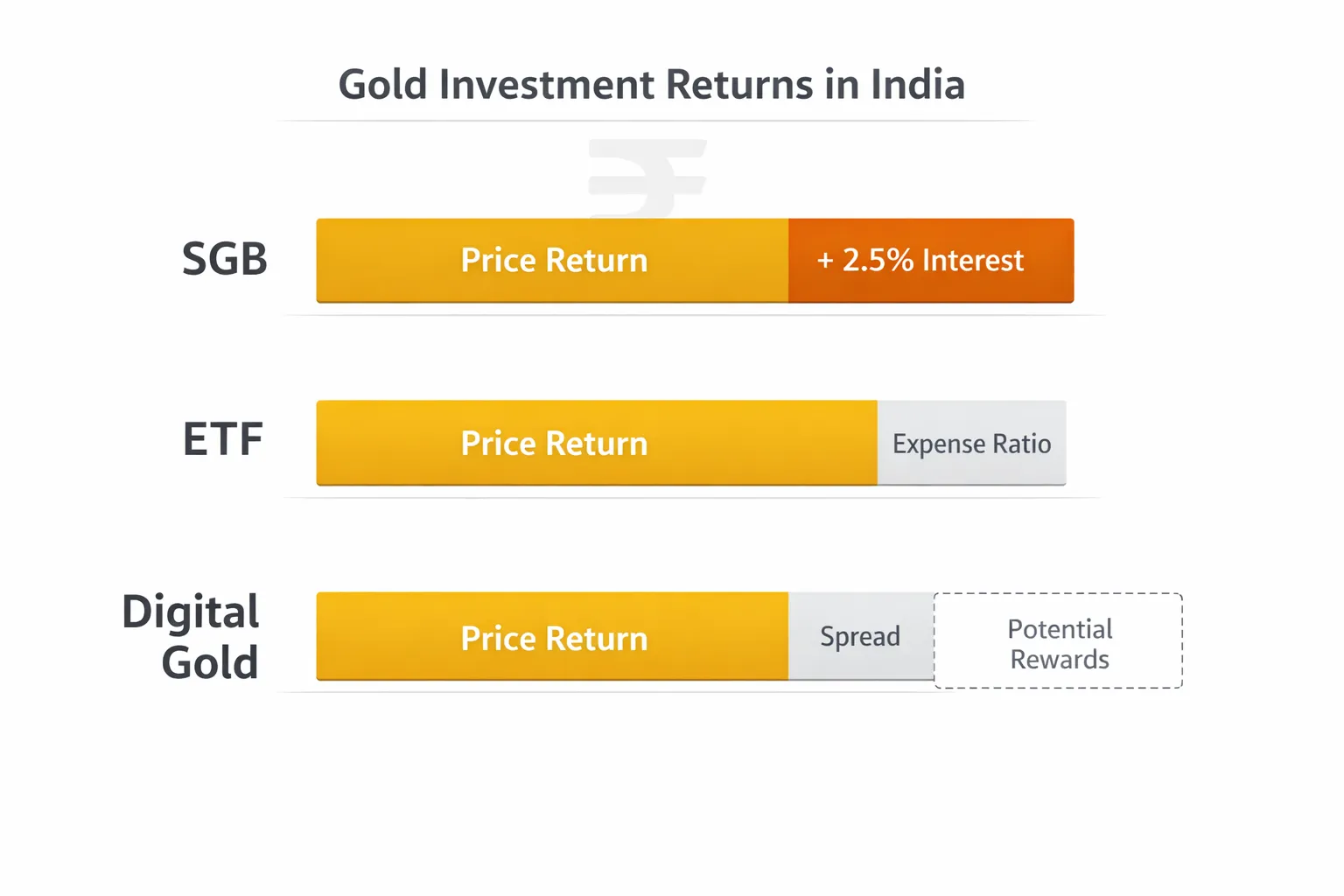

Return components by product

-

Digital Gold (SIP): Price return minus platform spread/storage; some apps add non-guaranteed rewards (e.g., Bitcoin cashback) that can enhance net outcomes for disciplined SIPs.

-

Gold ETFs: Price return less the expense ratio; minor tracking error persists due to fund frictions.

-

SGBs: Price return plus fixed 2.5% per annum interest (taxable), and tax-free capital gains if held to 8-year maturity.

Tracking error and slippage

-

ETFs: NAV tracks domestic gold closely but not perfectly. Expense ratios, cash drag, and creation/redemption spreads introduce small tracking deviations.

-

Digital Gold: Quotes often reference IBJA-linked prices. Buy/sell spreads and platform fees define “slippage” from the headline gold rate.

-

SGBs: No tracking error at maturity. Redemption follows the published average 999 purity price for the preceding three business days, eliminating NAV-style drift.

“SGBs pay 2.50% interest per annum (semi-annual) on nominal value; redemption is based on the simple average of 999 purity gold prices over the previous three business days as published by IBJA.” – Source

Historical perspective (illustrative, not a forecast)

-

Over multiple years in INR, gold has trended up through cycles. Timing helps, but disciplined accumulation via a gold investment SIP and staying invested typically matters more than trying to catch the exact bottom or top.

“As of Dec 31, 2024, gold in India delivered a 5-year annualized return of about 14.2%.” – Source

Total cost of ownership and taxes (what you actually keep)

Purchase and holding costs

-

Digital Gold: Platform spread; the displayed buy price typically factors in 3% GST on gold. Optional delivery/making charges if you take physical delivery. Storage/custody costs may be embedded.

-

ETFs: Expense ratio (≈0.35%–1%), plus brokerage, demat AMC, and exchange/GST charges. Small tracking error persists.

-

SGBs: No expense ratio. When tranches open, online applications often get a per-gram discount. Secondary market prices can be at a premium/discount to gold.

Exit costs

-

Digital: Sell spread; instant or near-instant payout per app policy. Some platforms may levy withdrawal/transfer fees.

-

ETFs: Bid–ask spread + brokerage + exchange/GST charges; STT generally doesn’t apply to non-equity ETFs; capital gains tax applies.

-

SGBs: Early exit via exchange may face liquidity and premium/discount risk; no charges at sovereign redemption on maturity.

Taxation (high-level, resident individual)

-

Digital Gold: Capital gains tax – STCG per slab (<36 months), LTCG at 20% with indexation (≥36 months).

-

ETFs: Capital gains tax – STCG per slab (<36 months), LTCG at 20% with indexation (≥36 months).

-

SGBs: 2.5% p.a. interest taxed per slab; capital gains exempt if held to 8-year maturity. If sold on exchange before maturity, gains taxed per holding period (indexation for LTCG).

Putting it together

-

Same ₹10,000/month for 3 years: your net depends on spreads/expense ratios/demat costs and, crucially, taxation at exit. SGBs reward patience (maturity exemption), ETFs optimize liquidity for active rebalancing, and Digital Gold minimizes friction for micro-SIPs with 24×7 flexibility.

|

Instrument |

Buy costs |

Ongoing costs |

Exit costs |

Tax on gains |

Tax on cashflows |

Notes |

|---|---|---|---|---|---|---|

|

Digital Gold (SIP) |

Platform spread; displayed price typically includes GST; optional making/delivery charges if taking physical delivery |

Embedded storage/custody, if any; no demat |

Sell spread; possible withdrawal/transfer fee; instant payout per app policy |

STCG per slab (<36 mo); LTCG 20% with indexation (≥36 mo) |

None (no periodic income) |

24×7 buy/sell via UPI; SIP from ₹1; check provider credibility, pricing transparency, vaulting |

|

Gold ETF |

Brokerage + exchange/GST; typically no GST on units; minor prem/discount to iNAV |

Expense ratio ≈0.35%–1%; demat AMC; small tracking error |

Brokerage + bid–ask spread; exchange/GST charges; generally no STT for non-equity ETFs |

STCG per slab (<36 mo); LTCG 20% with indexation (≥36 mo) |

None (usually no dividends) |

Requires demat; intraday liquidity; SIP via broker/FOF; suitable for rebalancing |

|

SGB |

Issue price; online discount during tranches; no GST; secondary at premium/discount |

None (no expense ratio) |

No cost at sovereign redemption; early exchange sale subject to liquidity/premium/discount |

Exempt if redeemed at 8-year maturity; otherwise STCG/LTCG as per holding period (indexation for LTCG) |

2.5% p.a. interest taxed per slab (semi-annual payout) |

RBI/Govt backed; 8-year maturity with early exit from year 5; eligible as collateral with lenders |

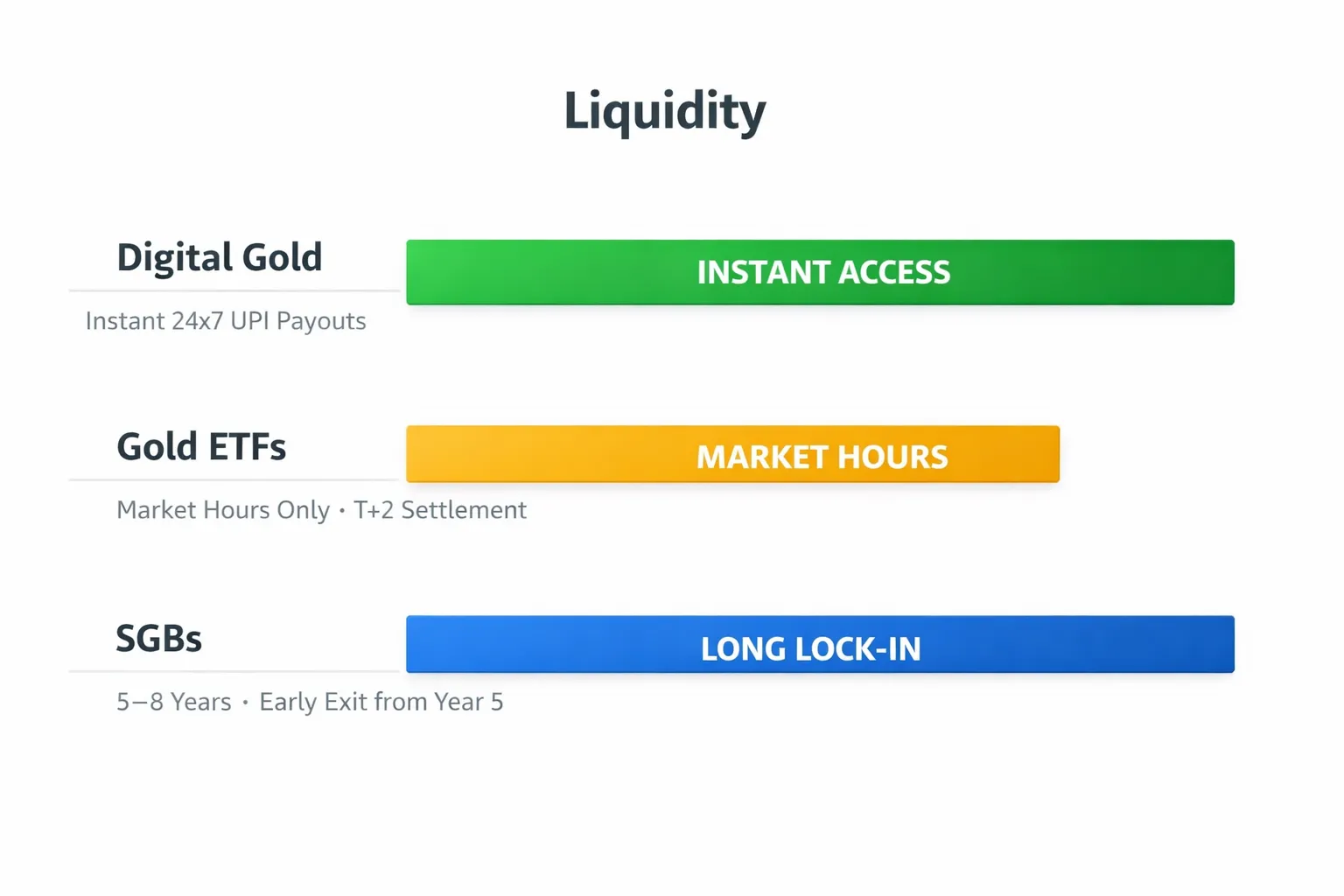

Liquidity, lock-ins, and access (how fast can you get your money?)

Digital Gold (SIP)

-

24×7 buy/sell with no lock-in. Many apps offer instant UPI payouts to your bank, making it ideal for emergency buffers and day-to-day flexibility.

Gold ETFs

-

Intraday liquidity during market hours via your broker/demat. Settlement is typically T+2. Watch bid–ask spreads and volumes for best execution.

SGBs

-

8-year maturity. Early redemption windows start from year 5 on coupon dates via RBI. Secondary market liquidity exists but can be thin and trade at premiums/discounts to the intrinsic gold value.

Practical implications

-

If emergency cash access matters, keep a portion in Digital Gold or ETFs. For maximum tax efficiency, use SGBs for long-term allocation. A laddering approach – mix Digital Gold for instant needs, ETFs for market access, and SGBs for long-horizon, tax-free maturity – balances speed with returns.

Safety, custody, and regulatory comfort

Digital Gold (SIP)

-

Vaulted, insured 24K gold backed by authorized bullion partners. Look for transparent buy/sell pricing, regular audit reports, and clear redemption rules.

-

Platform risk exists: prefer platforms working with RBI/SEBI-compliant partners where applicable. Read T&Cs to confirm ownership structure (allocated gold), lien rights, and dispute resolution.

Gold ETFs

-

Sit inside a SEBI-regulated mutual fund structure with trustee oversight, audited vaults/custodians, and daily portfolio disclosures. Strong governance, standardized reporting, and independent audits enhance comfort.

SGBs

-

Carry a sovereign guarantee on principal and interest, issued by RBI on behalf of the Government of India. No purity, making, or storage risks borne by the investor; redemption is in INR based on published 999 purity prices.

Collateral and other utilities

-

SGBs are widely accepted as collateral by banks/NBFCs. Gold ETFs may be eligible with select brokers/lenders. Digital gold acceptance varies by lender; check loan-to-value, margins, and haircuts in advance.

Who should pick what? A 2026 decision tree

If you have ₹1–₹500/day, want habits, and instant liquidity

-

Pick a Gold SIP via digital gold; automate via UPI; set bite-sized goals and build streaks.

If you are in a higher tax slab and can hold for 8 years

-

Prioritise SGBs for tax-free maturity plus 2.5% interest (semi-annual).

If you value intraday control and already have a demat

-

Use Gold ETFs for precise sizing, low costs, and easy rebalancing during market hours.

Blended allocation (example frameworks)

-

Short-term buffer: 60% Digital, 30% ETF, 10% SGB

-

Long-term core: 20% Digital (tactical), 30% ETF, 50% SGB

Risks to acknowledge

-

Price volatility across all routes; ETF tracking error; platform risk in digital gold; SGB liquidity can be thin before year 5.

5-minute setup guides (step-by-step)

A. Start a Gold SIP on mobile (Digital Gold)

-

Download the OroPocket app and complete quick KYC.

-

Link your UPI ID.

-

Set the ₹ amount (start from ₹1) and choose frequency: daily/weekly/monthly.

-

Enable auto-pay so your SIP runs hands-free.

-

Track rewards and streaks to boost your effective returns over time.

-

Enable gifting to send gold to friends/family on milestones.

-

Tip: Use daily SIPs to smooth price volatility; over time, rewards can offset part of spreads/GST.

B. Buy a Gold ETF (demat route)

-

Open a demat + trading account if you don’t already have one.

-

Screen for a low-cost gold ETF with strong liquidity (check expense ratio and volumes).

-

Place a buy order during market hours; consider limit orders to manage spreads.

-

Optionally automate buys via your broker’s SIP/auto-invest feature.

-

Monitor tracking error and expense ratio annually; switch if costs drift up.

C. Subscribe to SGBs

-

Watch for RBI SGB tranche announcements (a few windows annually).

-

Apply online via your bank/broker to avail the typical ₹50/gm online discount.

-

Plan to hold till maturity (8 years) for tax-free capital gains; coupon (2.5% p.a.) is semi-annual and taxable.

-

Consider a ladder: stagger purchases across different tranches/years to diversify entry prices and redemption dates.

-

For secondary market purchases, always compare the traded price to the live gold value to avoid overpaying premiums.

Smart tactics: premiums, discounts, and SIP hygiene

SGB premiums/discounts

-

Always compare the traded SGB price per gram to the live domestic 999 price (often IBJA-linked). Implied premium/discount = (SGB price − spot price) ÷ spot price.

-

When can a premium be okay? If you plan to hold to maturity (8 years), the tax-free capital gains at redemption plus the fixed 2.5% coupon can justify paying a modest premium – especially when there are 3+ years left. Be cautious with rich premiums when gold is already at highs.

-

Buying at a discount in the secondary market can boost effective yield, but check liquidity and series maturity date.

ETF hygiene

-

Prefer higher AUM and consistently tight bid–ask spreads; both reduce slippage. In thin markets, use limit orders rather than market orders.

-

Keep an eye on expense ratios and tracking error; a low sticker ER isn’t helpful if tracking deviates persistently.

-

If the ETF is illiquid, consider using the associated FoF (fund of fund) route for SIPs, but still monitor total cost.

Digital gold best practices

-

Choose platforms with transparent pricing: clearly shown buy/sell quotes, spreads, and any storage/withdrawal charges.

-

Keep spreads low: the smaller the buy–sell gap, the less “drag” on your gold investment SIP. Rewards (like Bitcoin cashback) can help offset part of this drag over time.

-

Use daily or weekly SIPs to average entry prices; avoid frequent churning – spreads compound against you.

Rebalancing rhythm

-

Set a target allocation for gold (for many investors, 10–15% of the portfolio is common, adjust to your risk) and rebalance:

-

Annually (e.g., at financial year-end), or

-

Threshold-based (e.g., when gold weight deviates by ±5% of target).

-

-

Use Digital Gold for quick trims/additions, ETFs for tactical rebalancing, and keep SGBs as the long-hold core unless you need liquidity.

Final verdict: Which is best for 2026?

Our take

-

For long-term, tax-efficient core exposure: SGBs win if you can hold 8 years.

-

For liquid, low-cost, portfolio-friendly exposure: Gold ETFs win for demat investors.

-

For building habits with tiny tickets, instant access, and everyday utility: a Gold SIP via a trusted digital gold app (like OroPocket) is unbeatable.

Suggested blend by investor type

-

First-time/micro investor: Start with a Digital Gold SIP; add SGBs when tranches open.

-

Salaried professional with demat: Core in SGBs + ETFs; keep a small digital SIP for flexibility.

Next step

-

Download the OroPocket app to start a ₹1 Gold SIP with UPI in under 30 seconds – and earn Bitcoin rewards on every purchase: https://oropocket.com/app