Gold stocks vs digital gold: which suits your goals, risk, and timeline?

Intro: Gold stocks vs digital gold – quick answer and at‑a‑glance

Indians want the stability of gold but still crave growth. Today you have two clear routes: buy asset‑backed digital gold (own the metal, stored in insured vaults) or invest in gold mining stocks (equities of companies that dig and sell gold). If you’re deciding between electronic gold investment and investment in gold stocks, here’s the quick answer.

-

Digital gold = lower volatility, direct exposure to gold price, 24/7, UPI‑friendly, goal‑based saving.

-

Gold mining stocks = higher return potential but higher risk; behaves like equities with gold‑linked earnings.

When each wins (30‑second guide):

-

New investors, short‑to‑medium goals (1–5 years), want simplicity and real gold: pick digital gold.

-

Market‑savvy, can handle drawdowns, seeking upside: add gold mining funds/stocks for 10–20% of your “gold bucket.”

OroPocket makes gold digital investment effortless: a modern, RBI‑compliant way to buy 24K digital gold from ₹1 via UPI – plus you earn free Bitcoin rewards on every purchase. We’ll compare both paths in detail below.

“Indian investors purchased an estimated 12 tonnes of digital gold from January–November 2025, about 50% more than the 8 tonnes in 2024.” – Source

Feature-by-feature: Digital Gold vs Gold Mining Stocks (at a glance)

|

Feature |

Digital Gold |

Gold Mining Stocks |

|---|---|---|

|

Ownership |

Direct ownership of 24K gold, fully vaulted and insured |

No metal ownership; you own shares in mining companies |

|

Access |

Mobile apps; UPI-friendly; buy from ₹1; 24/7 |

Demat/broker app; market hours; typically via international FoFs/ETFs or select stocks |

|

Costs |

Buy/sell spread; 3% GST on purchase; no locker costs |

Brokerage + fund expense ratios; possible STT; no GST on equity units |

|

Volatility |

Low-to-moderate (tracks gold price) |

High (equity-like; leveraged to gold cycles, company risks) |

|

Liquidity |

High – instant buy/sell any time |

High during market hours; T+ settlement norms apply |

|

Tax |

Capital gains: slab rate <3 years; 20% with indexation ≥3 years |

If via Indian equities: equity tax rules; if via international FoFs/ETFs: taxed like debt/slab (check latest norms) |

|

Ideal use-case |

1–5 year goals, safety-first allocation, emergency fund diversifier |

Return-seeking satellite allocation for market-savvy investors |

Note on scope: This guide focuses on the Indian investor journey – apps for digital gold (UPI-native) and typical miner exposure via mutual funds/ETFs/FoFs or select listed equities.

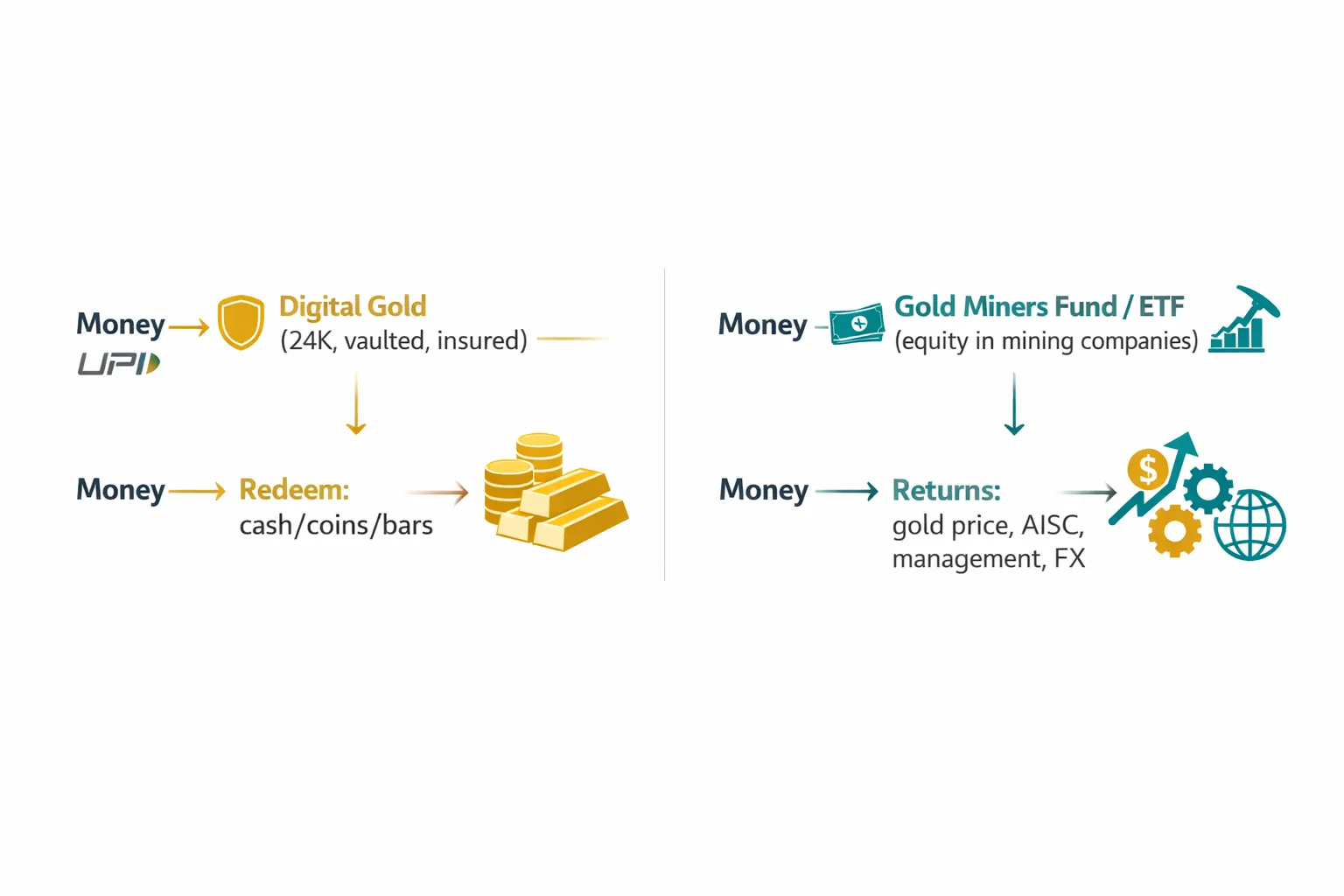

How they work (under the hood)

Digital gold (asset-backed)

-

What you actually own: 24K gold allocated in your name, vaulted and insured by authorized partners.

-

Buying flow: Register → pay via UPI/netbanking → units credited at live price → vault receipt.

-

Redemption: sell back 24/7 for cash or request delivery of coins/bars (making/delivery charges may apply).

-

Key platform checks: purity (99.9%), vault/custodian, insurance, daily reconciliation, holding period limits (some providers cap at ~5 years).

-

Typical costs: buy-sell spread, 3% GST on buy, nominal storage/insurance (often embedded).

Gold mining stocks (equity exposure)

-

What you actually own: shares of companies that mine/refine gold; revenues linked to gold price + operational efficiency.

-

Typical access for Indians: domestic mutual funds/FOFs investing in global gold miners or international brokers/ETFs like major gold miner indices.

-

Return drivers: gold price, ore grades, costs (AISC), management quality, jurisdiction/geopolitics, FX (INR vs USD).

-

Typical costs: fund expense ratio, brokerage (ETFs), currency conversion/spread (if overseas), no GST on buy of units.

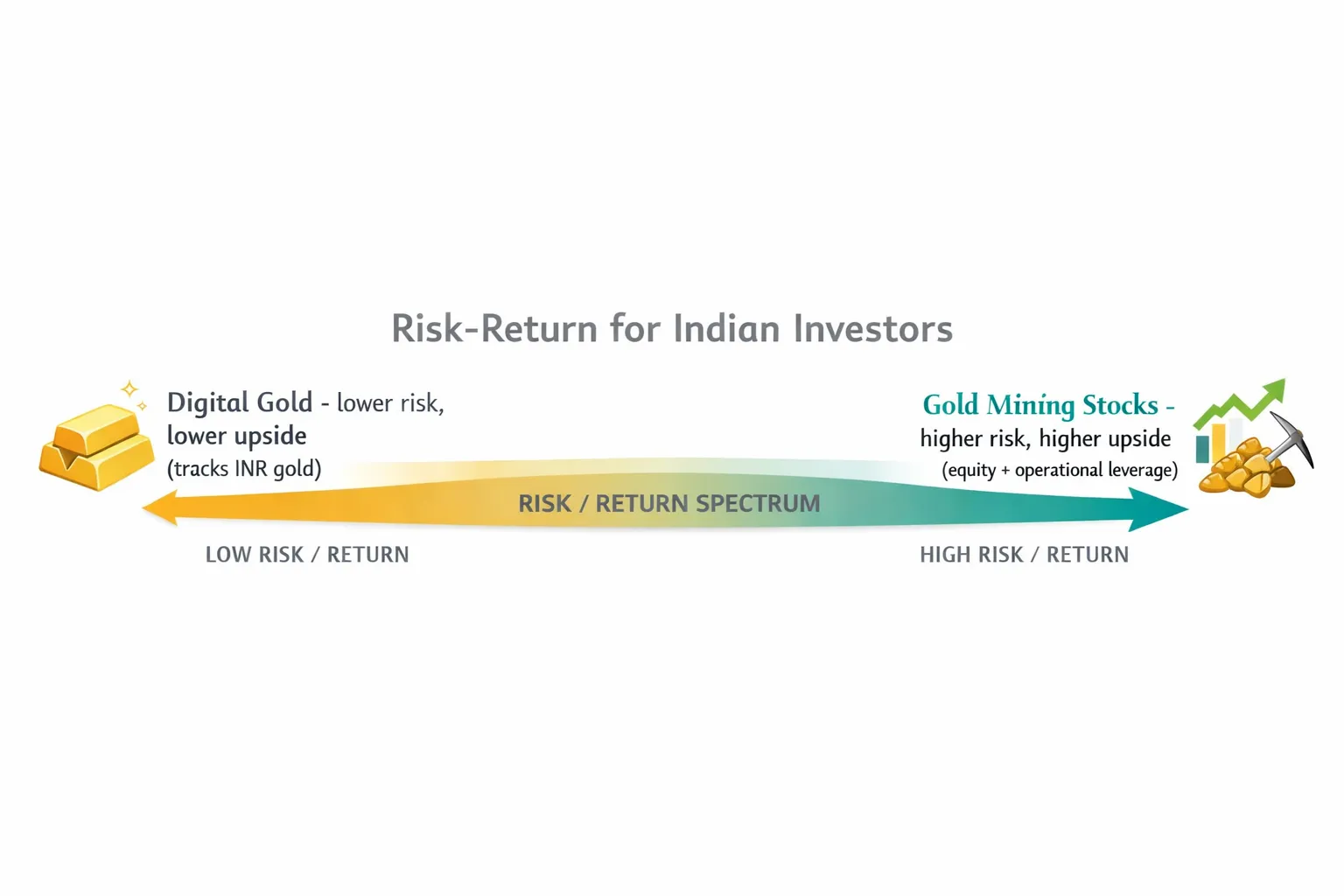

Returns, volatility and correlation: what really moves each

Digital gold tracks domestic INR gold prices closely. Because it’s the asset itself, day-to-day swings are usually lower than equities, though INR/USD moves can cause small lead/lag effects versus global spot. Gold mining stocks, by contrast, are equities. They typically amplify gold’s moves thanks to operational leverage – great in bull markets, painful in flat/down cycles.

Correlation profile:

-

Digital gold: low correlation to equities; tied to macro drivers like inflation, interest rates, USD strength, and risk-off episodes.

-

Miners: part commodity, part equity; earnings-sensitive and sentiment-driven, so they carry partial correlation to broader markets.

Scenario examples:

-

If gold rises +10%, diversified miner baskets often move ~1.5–2x depending on margins and cost curves.

-

If gold is flat, miners can still swing on production surprises, M&A, cost inflation (AISC), and FX.

Practical takeaway: choose the engine that matches your nerves and goals – digital gold for stability; miners for upside with higher volatility.

“Gold mining stocks often display 1.5x–2x sensitivity to gold price moves due to operational leverage.” – Source

“World Gold Council research discusses how rising gold prices expand miners’ margins via operational leverage (AISC vs realized prices).” – Source

Costs and fees you actually pay

Before you choose between electronic gold investment and investment in gold stocks, know the drag you’ll actually pay over time. Here’s the clean breakdown and how to think about the break-even.

-

Digital gold costs:

-

Buy–sell spread (varies by provider).

-

3% GST on purchase of gold value.

-

Storage/insurance fees (often embedded; check T&Cs).

-

Delivery/minting/making charges if you take coins/bars.

-

-

Gold mining exposure costs:

-

Mutual funds/FOFs expense ratio (commonly ~1–2% TER in India; check scheme SID).

-

ETF expense ratio (global miners ETF ~0.5–0.6%); plus brokerage + small taxes.

-

Currency conversion costs if investing overseas.

-

No GST on buying fund units/ETF shares.

-

-

Hidden drags to watch:

-

Bid–ask spreads (funds/ETFs).

-

Exit loads (if any).

-

International remittance charges under LRS for direct overseas investing.

-

-

Illustrative break-even thinking:

-

One-time 3% GST on digital gold vs ongoing TER on miners funds.

-

Example: a 1.5% TER compounds to ~4.5% over 3 years (ignoring market returns), roughly comparable to the 3% one-time GST on digital gold – so your horizon matters as much as expected returns.

-

Pricing & fees matrix (typical ranges; check your provider’s T&Cs)

|

Cost component |

Digital Gold |

Gold Miners via Mutual Fund/FOF (India) |

Gold Miners via ETF (India/Overseas) |

|---|---|---|---|

|

GST on buy |

3% on gold value |

Not applicable on fund units |

Not applicable on ETF units |

|

Buy–sell spread |

~0.5%–3.0% total (provider-dependent) |

Reflected in NAV; none directly |

ETF bid–ask ~0.05%–0.50% |

|

Storage/insurance |

Often embedded; effectively ~0%–0.5% p.a. |

Included in TER |

Included in TER |

|

Expense ratio (TER) |

None (platform margin embedded) |

~1.0%–2.0% p.a. |

~0.5%–0.6% p.a. (miners ETF) |

|

Brokerage/transaction |

None for buy/sell on app; payment gateway fee may apply |

None at buy/sell (MF); small exit load may apply |

Brokerage as per broker; exchange/SEBI charges minimal |

|

Exit load |

None for sell-back |

0%–1% (scheme-specific) |

None (but brokerage/spreads apply) |

|

Delivery/making/minting |

Coins/bars: ~1%–5% + delivery/shipping if chosen |

Not applicable |

Not applicable |

|

Currency conversion |

Not applicable |

Not applicable (domestic FOFs) |

0.3%–1.5% FX spread if investing overseas; bank/LRS charges extra |

|

Other taxes/charges |

Standard payment/settlement charges on app |

TER is before returns; STT and taxes per MF norms |

STT/exchange fees minimal; LRS/TCS as applicable for direct overseas routes |

Tip: If your holding period is short (1–2 years) and you want direct gold exposure, the one-time 3% GST may still be more efficient than multiple years of 1%–2% TER on miners funds – provided your goal is stability rather than equity-like upside.

Liquidity, access and minimums

-

Digital gold:

-

24/7 buy/sell on apps; instant UPI; micro-investing from as low as ₹1.

-

Instant encashment to wallet/bank (provider-dependent) or convert to physical coins/bars.

-

No demat required; simple KYC; works on any smartphone with internet.

-

-

Gold mining stocks/funds:

-

ETFs trade only during market hours; T+2 settlement typical. Mutual funds transact at end-of-day NAV based on cut-off times.

-

Requires demat/brokerage for ETFs; standard KYC for mutual funds.

-

Minimums: 1 ETF unit (price varies); SIPs for funds can start at ₹100–₹500+.

-

-

Real-world friction:

-

Digital gold: requires internet connectivity; UPI makes payments near-instant.

-

Funds/ETFs: cut-off times for NAV, exchange holidays, and T+ settlement norms; overseas investing may need LRS remittances, FX conversion, and extra documentation.

-

-

Who benefits:

-

Students/first-jobbers and goal-based savers who want micro amounts, 24/7 access, and quick cash-outs: digital gold.

-

Active market participants comfortable with equity volatility and market hours, seeking upside via miners: ETFs/mutual funds.

-

Taxes in India (2026): digital gold vs gold miners

-

Digital gold (treated like physical gold):

-

Holding < 36 months: gains taxed per your income slab (STCG).

-

Holding ≥ 36 months: 20% tax with indexation (LTCG) + cess/surcharge as applicable.

-

3% GST applies on purchase value.

-

-

Gold mining exposure via mutual funds/FOFs/ETFs (non-equity classification in India):

-

For units acquired on/after 1 Apr 2023, most such funds are taxed at your slab rate irrespective of holding period (no LTCG indexation under amended rules for non-equity funds that don’t meet equity thresholds). Check scheme documents and consult a tax advisor.

-

-

Direct overseas miners via LRS/broker:

-

Taxation can differ (typically treated as foreign securities); reporting, DTAA, and FX aspects apply. Consult a CA before using this route.

-

-

Planning tip:

-

For long horizons (≥3 years), digital gold’s indexation can be more tax‑efficient than post‑2023 gold funds. For shorter horizons, compare net-of-tax outcomes considering GST vs ongoing fund taxation.

-

“Finance Act 2023 introduced Section 50AA: gains on units of specified mutual funds (≤35% domestic equity) acquired on/after 1 April 2023 are treated as short‑term and taxed at slab rates, with no indexation benefit.” – Source

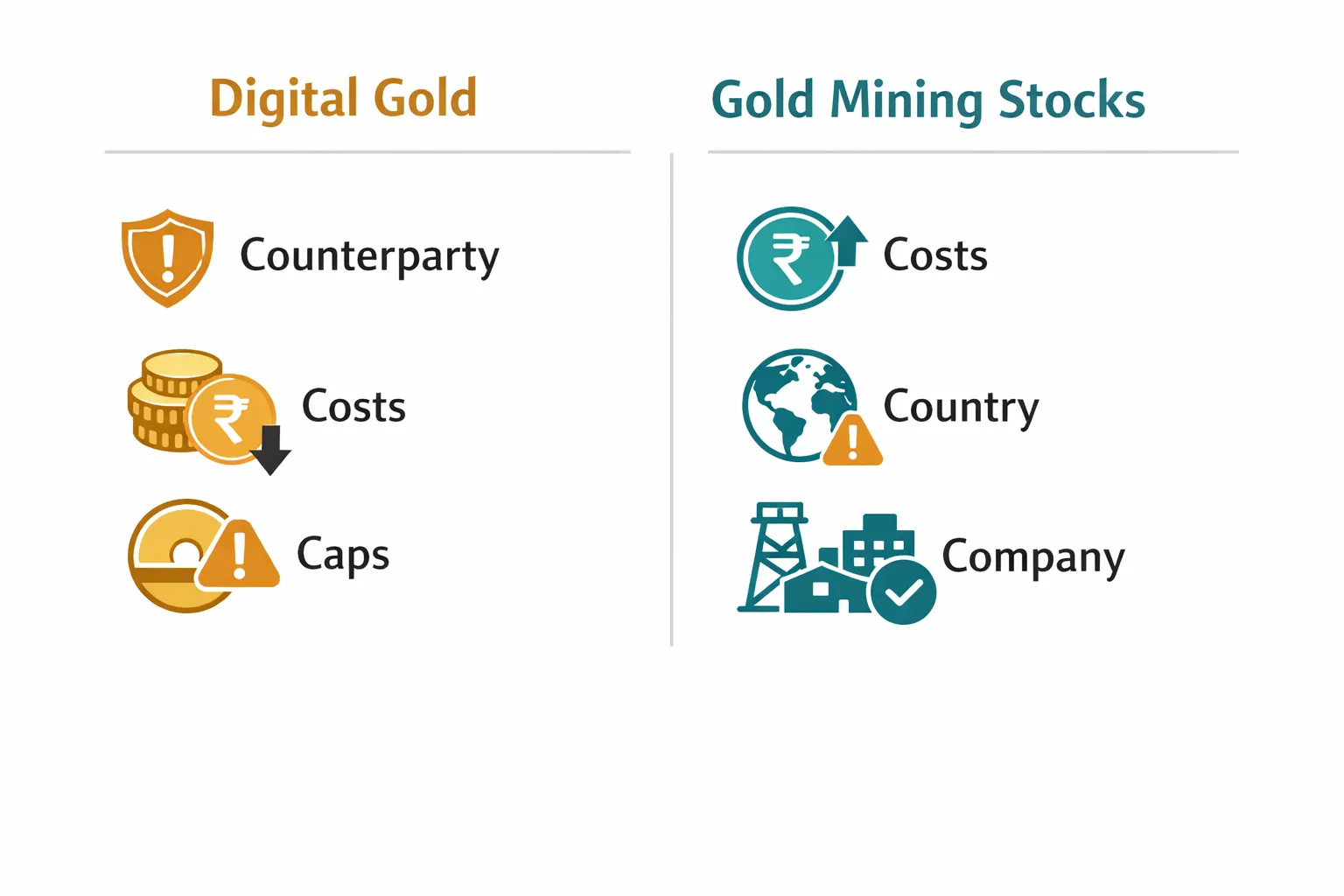

Risk checklist: what could go wrong (and how to reduce it)

Digital gold risks

-

Provider/counterparty risk; ensure authorized bullion partners, insured vaults, clear T&Cs.

-

Holding period caps and redemption fees; plan exits ahead of time.

-

Pricing transparency and spreads; buy during normal market hours when spreads are tighter.

-

Regulatory landscape: not SEBI-regulated like MFs; choose RBI-compliant, reputable platforms.

Gold mining stocks risks

-

Company risks: reserves, grades, AISC inflation (diesel, wages), capex overruns, strikes.

-

Jurisdiction/geopolitics/environmental permitting.

-

Equity market drawdowns even when gold is stable.

-

FX risk (USD revenue vs INR investor), especially via global funds/ETFs.

Mitigations

-

Digital gold: pick vetted platforms (audits, 24K 99.9%, insured vaults). OroPocket: RBI-compliant, 100% insured vaults, authorized partners.

-

Miners: diversify via funds/ETFs; prefer low-cost diversified baskets; stagger entries (SIPs) to manage volatility.

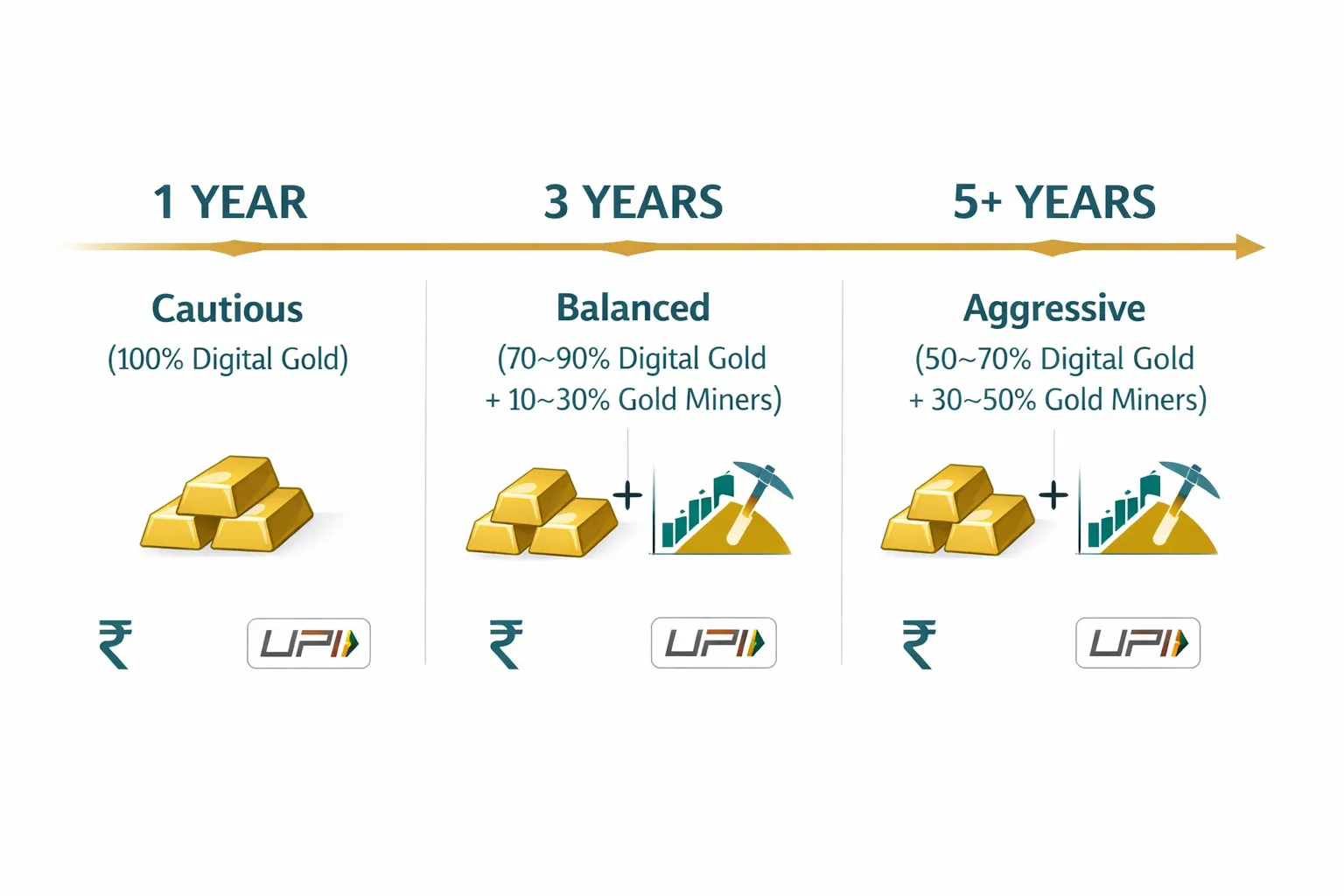

Which suits your 1–3–5 year goals?

-

1 year (short-term parking/emergency buffer):

-

Digital gold favored for lower volatility and anytime liquidity; avoid high miner exposure.

-

-

3 years (medium-term goals like gadgets, travel, small wedding expenses):

-

Core in digital gold; aggressive investors may add up to a small slice (e.g., 10–20% of gold allocation) in miners for upside.

-

-

5+ years (wealth building, child’s future, long goals):

-

Blend works: majority in digital/physical-backed exposure for stability; satellite in miners for growth, rebalanced yearly.

-

-

Risk personas:

-

Cautious beginner: 100% digital gold.

-

Balanced: 70–90% digital gold + 10–30% miners fund.

-

Aggressive/market-savvy: 50–70% digital gold + 30–50% miners fund (accept high drawdowns).

-

-

Reminder: keep overall gold allocation to a sensible portion of your total portfolio; revisit annually.

How to start today (step-by-step)

Digital gold on OroPocket (fastest way)

-

Download the OroPocket app (iOS/Android) and complete quick KYC.

-

Add funds via UPI; start from ₹1.

-

Buy 24K gold at live rates; track holdings in-app.

-

Build the habit: use daily streaks, spin-to-win, and SIP-like micro-buys.

-

Perk: earn free Bitcoin (Satoshis) as cashback on every gold/silver purchase; referral rewards too.

-

Redeem anytime: sell for cash or request delivery of coins/bars.

Gold mining exposure via funds/ETFs (India route)

-

Pick a diversified miners fund/FOF or a global ETF via a compliant route.

-

Review TER, historical drawdowns, mandate (pure miners vs mixed materials), and post-2023 taxation.

-

Start a SIP to average volatility; set an annual rebalance back to your target weight.

-

Keep all statements/contract notes for tax and tracking.

Final verdict: pick the engine that matches your journey

-

If you want simplicity, low hassle, and direct gold ownership with micro-investing: digital gold wins. It’s built for 1–3–5 year goals and peace of mind, with gold digital investment tracking INR prices and 24/7 access.

-

If you’re comfortable with equity swings and want potential outperformance during gold bull cycles: add a miners fund as a satellite, not the core. Treat investment in gold stocks as a higher‑volatility booster, not your safety net.

-

Smart middle path for most young Indians: make digital gold your base allocation, then layer a modest miners allocation as your confidence grows and the market setup supports it.

Why consider OroPocket for electronic gold investment:

-

Start from ₹1 with instant UPI – no barriers to getting started.

-

24K, fully insured gold with RBI‑compliant, authorized partners.

-

Habit-forming features: daily streaks, spin‑to‑win, SIP-like micro‑buys.

-

Unique perk: earn free Bitcoin (Satoshi) cashback on every gold/silver purchase.

-

Gift/send gold easily to friends and family.

Next step: download OroPocket and set your first auto‑buy today.

CTA: Get the OroPocket app now: https://oropocket.com/app