Gold-to-Silver Ratio Strategy: Rebalance and Grow Your Precious Metals Stack

The Gold-to-Silver Ratio at a Glance (Why It Matters in India, 2025)

What the ratio is – in one line

-

The gold-to-silver ratio shows how many ounces of silver it takes to buy one ounce of gold.

Why Indian investors should care now

-

Inflation-beating goal: Savings accounts lag inflation; adding precious metals can diversify and defend your purchasing power.

-

India-first advantage: With OroPocket, you can buy, switch, and rebalance gold to silver (or silver to gold) in micro-amounts via UPI – no paperwork, no minimums.

-

Habit > hype: Consistent, small, rules-based switches can grow your stack over time – no FOMO, just discipline.

“In March 2020, the gold–silver ratio reached a record high of 125:1.” – Source

How the ratio guides action

-

High ratio: Silver is cheap versus gold – consider swapping gold for silver (gold for silver).

-

Low ratio: Gold is cheap versus silver – consider swapping silver for gold (silver for gold).

-

Use it as a compass for silver versus gold investment decisions, not a crystal ball.

Quick guardrails

-

Don’t overtrade on tiny moves; focus on clear bands (e.g., 80+ high, 50- low, hold in the mid-range).

-

Always account for spreads, premiums, and taxes before switching. In India, check GST and making/processing charges that affect effective entry/exit prices.

Ready to put this into action? Download OroPocket to start micro-rebalancing gold and silver with UPI in under 30 seconds – and earn free Bitcoin on every purchase: https://oropocket.com/app

How to Read the Ratio: Formula, History Bands, and What “High” or “Low” Means

The simple formula

-

Gold-to-silver ratio = Price of gold per ounce ÷ Price of silver per ounce.

“Gold is a highly liquid yet scarce asset and a portfolio diversifier that can improve a portfolio’s risk-return profile.” – Source

Context bands most traders watch

-

120+ (extreme high): rare crisis spikes.

-

80–100 (upper range): stress/fear-heavy environments.

-

50–80 (modern normal): neutral.

-

30–50 (lower range): bull market phases for silver.

-

<30 (extreme low): rare blow-off phases.

How to interpret (without overfitting)

-

Rising ratio: gold outperforming silver – consider patience or a measured tilt toward silver (gold for silver) as the gold to silver ratio stretches higher.

-

Falling ratio: silver outperforming gold – consider leaning back toward gold at lower bands (silver for gold), especially below ~50.

Use the gold to silver ratio as a compass for silver versus gold investment decisions; it helps frame silver vs gold as an investment, not predict exact prices.

A quick Indian example

-

If gold = ₹6,800/gram and silver = ₹90/gram, ratio ≈ 6,800 ÷ 90 = 75.6 – a mid-to-upper band reading. Some investors tilt to silver but avoid aggressive switching until ~80+, respecting spreads and taxes.

Start small and switch smart. Download OroPocket to micro-rebalance gold and silver via UPI – and earn free Bitcoin on every purchase: https://oropocket.com/app

A Practical Gold-to-Silver Ratio Strategy: Thresholds, Rebalancing Rules, and Triggers

Set your personal bands

-

Core bands many use: 50 / 65 / 80.

-

Only switch when the ratio crosses a band by a buffer (e.g., 2–3 points) to avoid whipsaws.

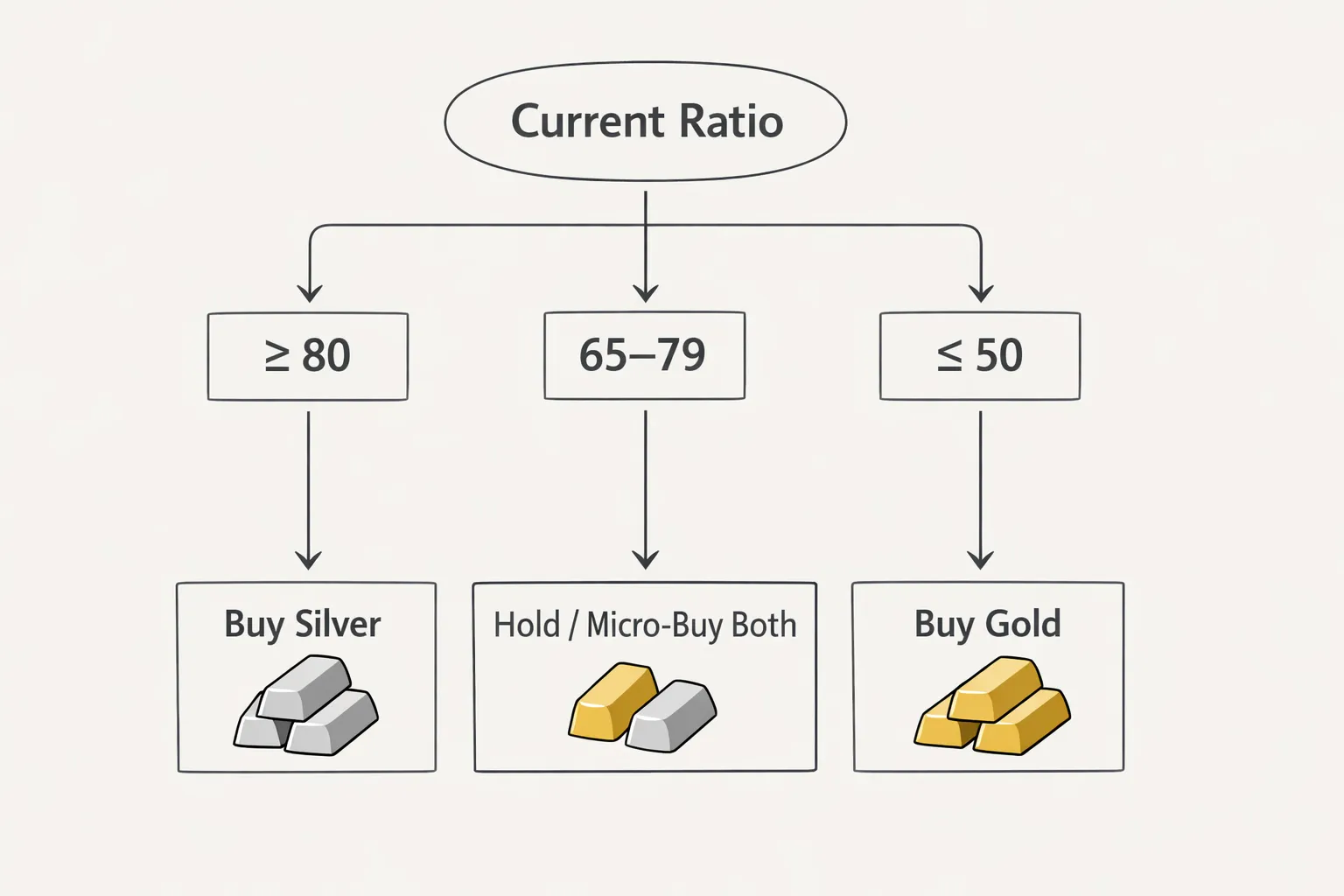

Simple actions by band

-

≥80: accumulate silver (gold for silver swap in small bites).

-

65–79: hold; accumulate both with micro-buys.

-

≤50: accumulate gold (silver for gold swap, measured size).

Position sizing for Indian micro-investors

-

Use tiny, repeatable amounts (₹100–₹1,000) to smooth timing risk.

-

Keep transaction costs <1–2% of the trade size where possible.

Trigger types to use

-

Price/ratio alerts, calendar reminders, or paycheck-linked micro-buys.

-

Only one switch per band-crossing; avoid ping-pong trading.

Recheck the math

-

Confirm the live ratio using the same units (per gram or per troy ounce) before executing.

Band-based actions for micro rebalancing

|

Ratio band |

Action (buy/hold/switch) |

Typical move size (₹) |

Why this helps |

Caution (spreads/premiums) |

|---|---|---|---|---|

|

≥80 (tilt to silver) |

Switch small gold to silver; buy silver |

200–1,000 |

Exploits extreme relative value; builds silver on dips |

Check spread/premiums on silver; avoid overtrading |

|

65–79 (hold/micro-buy both) |

Hold; micro-buy both metals |

100–500 |

Keeps habit; smooths volatility via DCA |

Fees can dilute tiny buys – stay under 1–2% costs |

|

≤50 (tilt to gold) |

Switch small silver to gold; buy gold |

200–1,000 |

Consolidates into gold when silver is rich |

Watch swap costs; confirm ratio in same units |

Download OroPocket to automate micro-buys, set alerts, and switch gold for silver (or silver for gold) via UPI – plus earn free Bitcoin on every purchase: https://oropocket.com/app

Make It Work in India with Micro-Investing: Costs, Taxes, Spreads, and UPI Speed

Friction to watch

-

Premiums and spreads: Spreads can widen during volatile moves in the gold to silver ratio. Size trades so that costs stay proportionate – small, steady bites beat one big, poorly priced switch.

-

Taxes: Understand applicable taxes for your situation (e.g., taxes on purchase and capital gains on sale). Keep records of buy prices, dates, and fees. Plan rebalances to minimize churn and tax drag.

Why micro buys help

-

Averaging-in reduces timing risk and emotional decision-making. You don’t need to guess tops/bottoms in silver vs gold as an investment.

-

Small, scheduled rebalances curb overtrading. Use predefined rules tied to the ratio (not headlines) to decide when to tilt gold for silver or silver for gold.

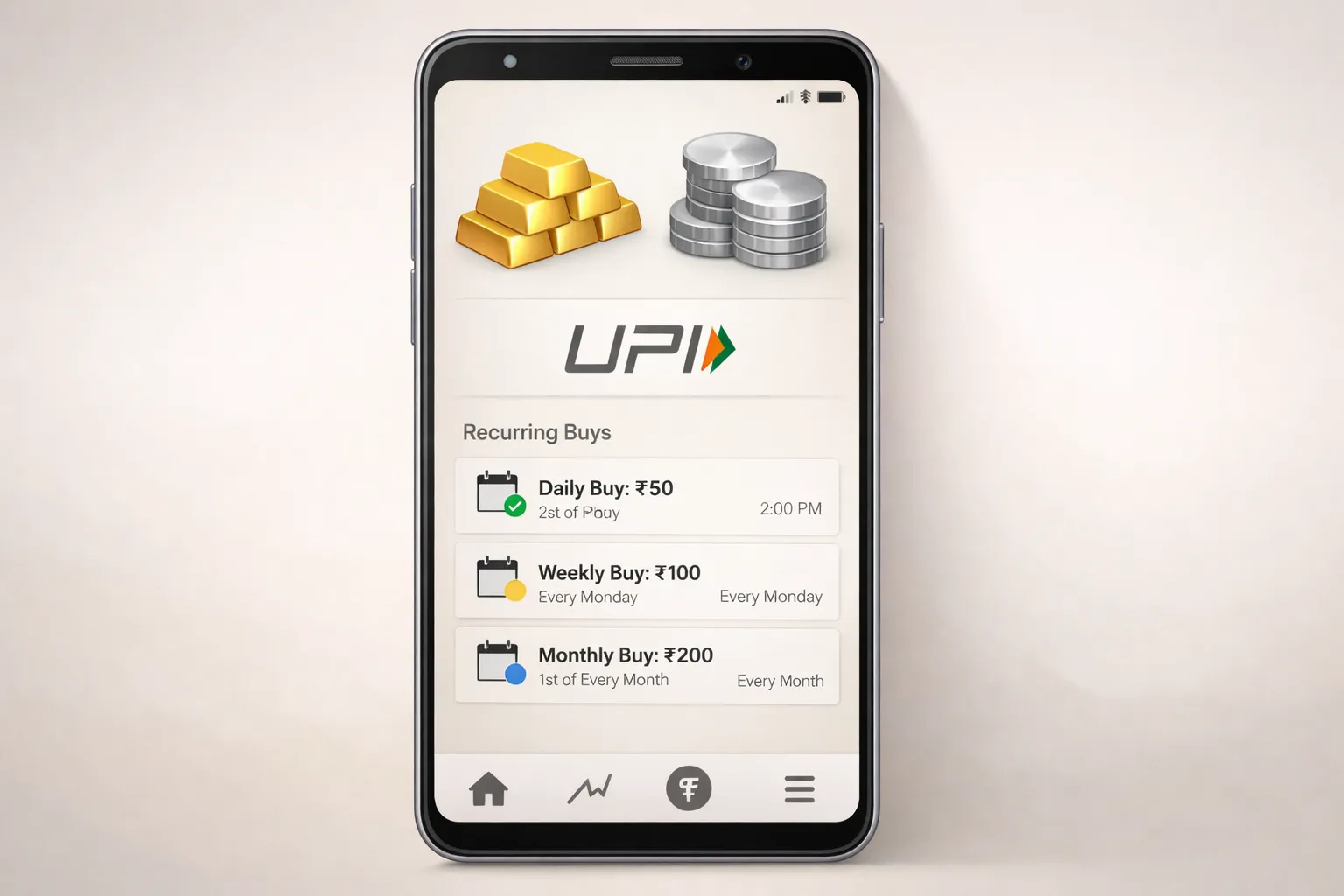

Where OroPocket fits

-

Start at ₹1 via UPI: Buy in seconds – no paperwork, no minimums – perfect for building a silver versus gold investment over time.

-

Earn free Bitcoin: Get Satoshi rewards on every gold/silver purchase to offset part of spreads/premiums.

-

Habit builders: Daily streaks and Spin to Win keep you consistent; you can also gift or send gold to family with a tap.

-

Secure and compliant: 24K gold, insured vaults, RBI-compliant partners – so you focus on stacking, not logistics.

Practical tip

-

Decide a monthly micro-budget (e.g., ₹1,000). Allocate per the bands and automate:

-

≥80 ratio: 60% silver, 40% gold (gold for silver tilt)

-

65–79 ratio: 50% silver, 50% gold (balanced micro-buys)

-

≤50 ratio: 60% gold, 40% silver (silver for gold tilt)

-

-

Review quarterly. Keep transaction costs under ~1–2% of trade size, and avoid switching more than once per clear band-crossing.

Download OroPocket to stack gold and silver from ₹1 via UPI, automate micro-rebalances, and earn free Bitcoin on every purchase: https://oropocket.com/app

Silver vs Gold as an Investment: Volatility, Use-Cases, and Who Should Hold More

Silver’s edge

-

Higher volatility and strong industrial demand; can outrun gold late in bull cycles.

-

Smaller market size; reacts faster to investment flows and sentiment.

Gold’s edge

-

Lower volatility; widely viewed as a monetary safe haven.

-

Diversifies during equity drawdowns; deep global liquidity even in stress.

“In 2023, industrial applications accounted for approximately 55% of global silver demand.” – Source

Who might tilt where

-

Early-career investors comfortable with swings: consider a higher silver tilt when the gold to silver ratio is ≥80 (tilt gold for silver).

-

Capital preservation mindset: lean more toward gold; switch to silver only at clear extremes (e.g., ≥80), and tilt back to gold at ≤50 (silver for gold).

How this feeds the ratio strategy

-

Let the ratio nudge your tilt – without abandoning core diversification. Use bands to rebalance, not to “all-in.”

Silver versus gold investment factors

|

Factor |

Gold |

Silver |

What it means for you |

|---|---|---|---|

|

Volatility |

Lower; smoother price path |

Higher; larger swings |

Match to risk tolerance: silver can amplify gains and losses |

|

Industrial demand |

Limited; mostly monetary/investment/jewelry |

High; electronics, solar, EVs |

Silver can outperform in growth cycles; more cyclical |

|

Liquidity |

Very high, global |

High but thinner than gold |

Easier to move larger value in gold; silver can have wider swings on flows |

|

Typical premiums |

Often lower % vs. silver |

Often higher % vs. gold |

Account for spreads/premiums; micro-buys help average costs |

|

Crisis behavior |

Safe-haven bid; tends to hold up |

Can lag early in crises, then catch up |

Gold first line for stability; silver for recovery phases |

|

Best use (hedge/growth) |

Hedge, ballast, liquidity |

Growth, cyclical upside |

Blend: gold as core hedge, silver for upside tilt |

Ready to build a balanced stack? Download OroPocket to micro-invest from ₹1 via UPI, tilt between gold and silver using ratio bands, and earn free Bitcoin on every purchase: https://oropocket.com/app

Worked Examples: Turn Alerts into Action (₹500–₹5,000)

Turn your gold to silver alerts into simple, rules-based actions. Scale the rupee amounts up or down; the logic stays the same for ₹500 or ₹5,000.

Example A – Small tilt at upper band (ratio 82 → buy silver)

-

Budget: ₹1,000.

-

Execution: ₹700 silver, ₹300 gold to keep core diversification.

-

Rationale: Respect the signal (high ratio favors silver) without going all-in; keep your base gold.

-

Scale rule: For ₹500 use ₹350 silver/₹150 gold; for ₹5,000 use ₹3,500 silver/₹1,500 gold.

Example B – Switch when ratio falls from 82 to 62 (partial reversal)

-

You previously added more silver at 82.

-

At 62, rebalance 10–20% of silver back into gold (silver for gold) to lock relative gains.

-

Execution idea: If you hold ₹10,000 in silver, swap ₹1,000–₹2,000 into gold.

-

Rationale: Falling ratio = silver outperforming; bank some outperformance while maintaining a diversified silver versus gold investment.

Example C – Extreme swing play (100 → 50)

-

Start: 1 g gold when ratio hits 100 (convert a fraction into silver; keep some gold core).

-

Move: Swap 0.5 g gold for silver at 100 (gold for silver), leaving 0.5 g gold untouched.

-

At 50: Swap part of the silver back to gold (silver for gold). Because the ratio halved, the silver you got with 0.5 g gold now converts into ~1.0 g gold if fully switched – so even a partial swap lifts total grams.

-

Rationale: Extreme ratios reward measured switching; never abandon core gold.

Example D – SIP-style routine using OroPocket

-

Weekly ₹250 micro-buys via UPI; allocate per bands:

-

≥80: tilt 60% silver / 40% gold

-

65–79: balance 50% silver / 50% gold

-

≤50: tilt 60% gold / 40% silver

-

-

Use Bitcoin rewards and streak bonuses to defray costs over time.

-

Rationale: Automates discipline and reduces timing risk; lets the gold to silver ratio guide tilts calmly.

Tips to keep outcomes consistent:

-

One switch per clear band-crossing; avoid ping-pong trading.

-

Confirm the live ratio in the same unit (per gram or per troy ounce) before executing.

-

Keep costs in check: aim for total spreads/fees under ~1–2% of each trade; prefer small, repeatable moves.

Put this playbook to work in minutes. Download OroPocket to automate micro-buys and smart switches via UPI – and earn free Bitcoin on every purchase: https://oropocket.com/app

Automate Small Rebalances (Without Overtrading) Using OroPocket Habits

Keep it simple

-

One check per week (or per band-crossing), not per hour.

-

Predefine amounts per band; avoid impulse buys.

Habit stack with OroPocket

-

Daily streaks: use 5-day bonuses to top up the underweight metal.

-

Spin to Win: allocate bonuses to the lagging metal.

-

Referrals: convert 100 Satoshi rewards into additional micro-buys.

Alerts and schedules

-

Set third-party price/ratio alerts; execute only if your band rules trigger.

-

Calendar block: 10 minutes every Friday to review and act.

Tracking progress

-

Focus on grams/ounces accumulated, not rupee P&L day-to-day.

-

Rebalance no more than once per band move.

Build the habit, not the hype. Download OroPocket to automate micro-rebalances via UPI and earn free Bitcoin on every purchase: https://oropocket.com/app

Risk Controls: Costs, Taxes, Premiums, and When Not to Trade

Friction checklist before every swap

-

Premiums/spreads: Compare buy vs sell rates first. In volatile windows, spreads widen – size each gold for silver or silver for gold move so total fees stay proportionate.

-

Taxes/compliance: Understand applicable taxes and reporting rules for your situation; keep clear records (date, price, fees) for every gold to silver ratio-driven switch. When in doubt, consult a tax professional.

-

Liquidity: Avoid thin-hour switching on big news days. Use simple rules and price alerts instead of impulsive market orders.

Overtrading trap

-

If the ratio is range-bound (e.g., 67–70), repeated switching can bleed returns into spreads and premiums.

-

Use buffers (±2–3 points) and minimum ticket sizes to stay efficient; if your total costs exceed ~1–2% of the trade, consider waiting.

Time horizon and temperament

-

Ratio normalization can take months or years; size trades accordingly and stick to your plan.

-

Keep a core never-sell stack. Use only a portion (e.g., 10–30% of your metals) for band-based switches tied to the gold to silver ratio.

Honest expectations

-

No guarantees – this is a relative value tactic, not a promise of profits.

-

Past extremes (e.g., 2020’s crisis spike) are rare; don’t design a plan that needs outliers to work. Treat silver vs gold as an investment tilt, not a binary bet.

Build disciplined, low-cost habits with micro-amounts and clear buffers. When you’re ready, download OroPocket to switch gold for silver (or silver for gold) in seconds via UPI – and earn free Bitcoin on every purchase: https://oropocket.com/app

Conclusion and Next Step: Start Small, Stay Disciplined, Grow with OroPocket

The playbook, in one minute

-

Use the gold-to-silver ratio as your compass for silver vs gold as an investment.

-

Define clear bands (e.g., ≤50 / 65–79 / ≥80) and pre-set move sizes to guide silver for gold or gold for silver switches.

-

Automate habits with tiny, regular actions via UPI – and let Bitcoin rewards sweeten the math.

Why begin with OroPocket today

-

₹1 entry, instant UPI payments, 24K insured vaulting, and free Satoshi on every purchase.

-

Build a modern precious metals habit that actually sticks – micro-buy, rebalance, and grow with a disciplined gold to silver framework.

Ready to rebalance and grow your stack the smart way? Download the OroPocket app now: https://oropocket.com/app