How Can I Invest in Gold? 6 Smart Options for Indians (2026)

How Can I Invest in Gold in 2026 (India)? The 6 Smart Options – With Costs, Liquidity, and “Best For” Picks

If you’re searching “how can I invest in gold”, you’re probably here because:

-

Your bank savings are quietly losing to inflation

-

You want a safer diversifier than pure stocks

-

You want a simple, mobile-first way to start (UPI, small amounts, no locker stress)

-

You want clarity – not jargon

This guide breaks down the 6 most practical gold investment options Indians use in 2026 (and exactly who each one is best for). We’ll also cover the “hidden drags” competitors often skip: spreads, making charges, liquidity traps, demat friction, and tax gotchas.

“In India, the buy-sell spread for digital gold investments typically ranges between 2% and 5%… Additionally, a 3% GST is applied at the time of purchase… investors may experience an immediate loss of approximately 5% to 8% when purchasing digital gold.” – Moneycontrol

The 6 ways to invest in gold (2026 quick map)

At-a-glance comparison table

|

Option |

Best for |

Typical minimum |

Liquidity |

Main “drag” on returns |

Complexity |

|---|---|---|---|---|---|

|

Physical Gold (coins/jewellery) |

Gifting + usage value |

High |

Medium |

Making charges + storage + resale deductions |

Low |

|

Digital Gold (apps) |

Beginners + micro-investing |

₹1+ |

High |

GST + spread |

Very low |

|

Gold ETFs |

Low-cost market-linked exposure |

1 unit |

High (market hours) |

Expense ratio + brokerage + demat |

Medium |

|

Sovereign Gold Bonds (SGBs) |

Long-term hold + interest |

~1 gram |

Medium |

Lock-in + secondary liquidity |

Medium |

|

Gold Mutual Funds |

SIP without demat |

₹100+ |

High |

Fund expenses (plus underlying ETF costs) |

Low–Medium |

|

Gold Savings Schemes (jewellers) |

Planned jewellery buying |

Varies |

Low–Medium |

Scheme terms + making charges at redemption |

Low |

If you want a deeper decision tree, use this: gold SIP vs gold ETF vs SGB – what works best in 2026.

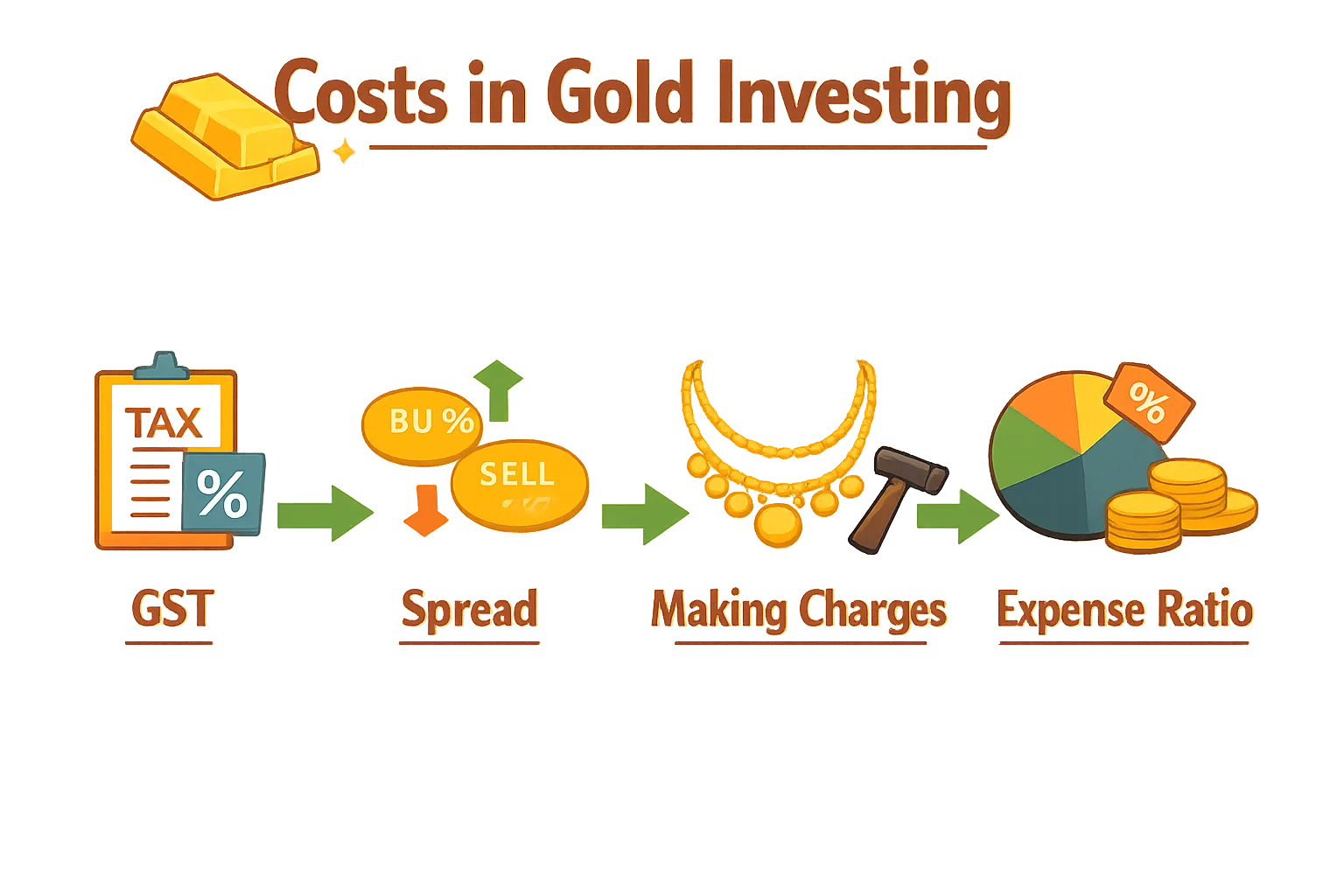

The biggest mistake people make with gold: ignoring “friction costs”

Most gold options track the same underlying price – but your real returns vary based on what you pay to enter, hold, and exit.

Friction costs include:

-

Making charges (physical jewellery)

-

Bid-ask spread (digital gold)

-

Expense ratios + brokerage (ETFs/funds)

-

Lock-ins / weak secondary market liquidity (SGBs)

-

Redemption conditions (jeweller schemes)

Keep these in mind as we go through each option.

1) Physical Gold (jewellery, coins, bars)

What it is

Buying gold in hand – usually jewellery, coins, or bars.

Best for

-

Weddings, gifting, tradition

-

People who value usage + emotional utility (not just investment returns)

The real pros

-

Tangible ownership

-

No platform risk, no demat, no apps

The real cons (investment-wise)

-

Jewellery making charges can permanently reduce resale value

-

Storage: locker cost, theft risk, insurance hassles

-

Resale deductions: impurities / verification / jeweller margins

Smart move

If you want physical gold as an investment, prefer 24K coins/bars from reputed sources, keep invoices, and avoid heavy-design jewellery as “investment.”

2) Digital Gold (apps) – best “start today” option for beginners

What it is

You buy real 24K gold digitally, stored in insured vaults via bullion partners. You can typically sell instantly or redeem (depending on provider).

Best for

-

First-time investors

-

People who want micro-investing (₹1–₹100)

-

Anyone who wants UPI convenience and doesn’t want lockers/purity stress

Costs to know (don’t skip this)

Digital gold usually includes:

-

3% GST

-

Buy-sell spread (platform-dependent)

To go deeper (with examples), read: digital gold charges explained – spread, GST, storage, selling fees.

Why OroPocket is built for 2026 gold investors

OroPocket is for people who want simple, consistent investing – not complexity.

Core OroPocket advantages:

-

₹1 entry point: start immediately

-

Instant UPI payments: buy in under 30 seconds

-

100% secure & compliant: RBI-compliant, insured vaults, authorised bullion partners

-

Gamified investing: daily streaks, spin-to-win, tiered rewards (habits that stick)

-

Free Bitcoin on every purchase: get Satoshi cashback on every gold/silver buy

Gold stability + Bitcoin upside – without “trading crypto” -

Referral rewards: both earn 100 Satoshi + free spin

Stop watching. Start growing. The best gold plan is the one you’ll actually follow weekly.

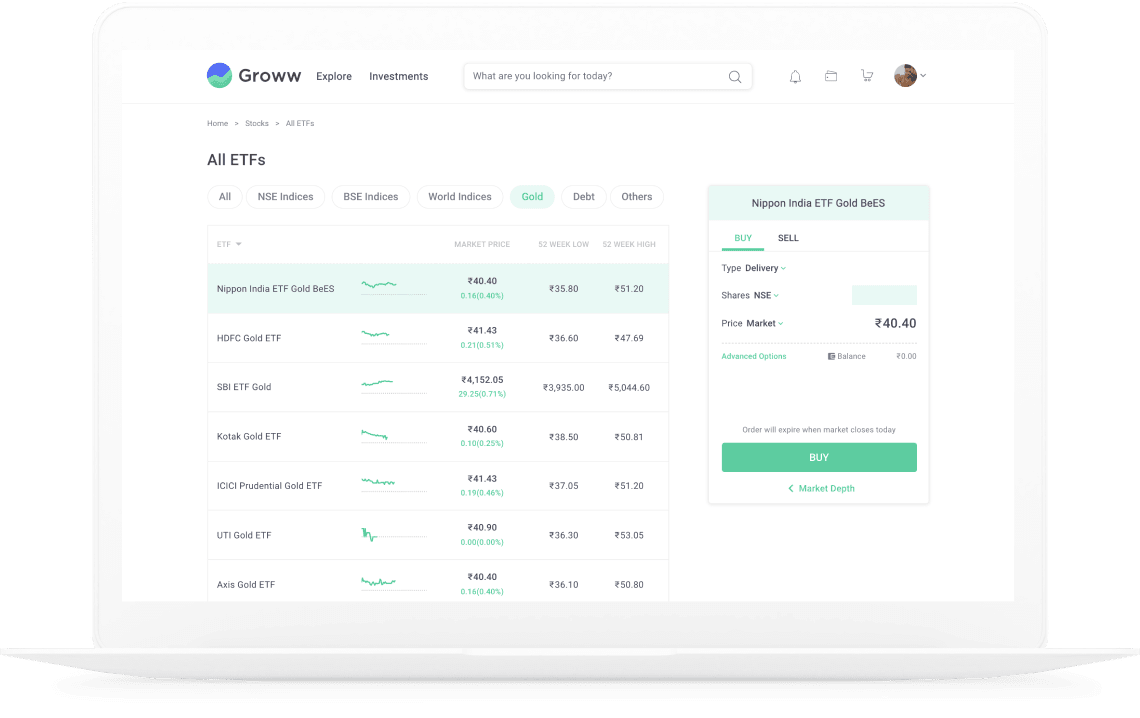

3) Gold ETFs – gold exposure via the stock market

What it is

An Exchange Traded Fund that tracks gold prices and trades like a share on NSE/BSE.

Best for

-

Investors who already have Demat + broker

-

People who want transparent pricing and easy entry/exit during market hours

Costs

-

ETF expense ratio

-

Brokerage per trade

-

Possible demat charges (depends on broker)

Watch-outs

-

You need to invest during market hours

-

Tracking error can exist (usually small)

Bottom line: Great for cost-conscious investors who are already comfortable with stock-market workflows.

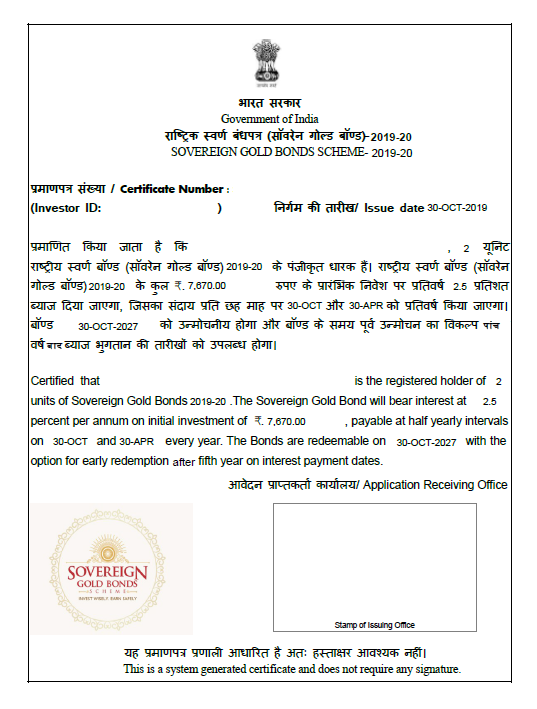

4) Sovereign Gold Bonds (SGBs) – strong for long-term, but liquidity is the trade-off

What it is

Government-issued bonds where returns track gold price + you receive fixed interest (scheme terms historically include 2.5% p.a.).

Best for

-

Long-term holders (think 5+ years) who want gold exposure plus interest

-

Investors okay with availability windows and not-perfect liquidity

Watch-outs

-

New issues are periodic (not always open)

-

Secondary market liquidity can be thin; you may sell at a discount if you need urgent exit

Bottom line: SGBs can be excellent if you genuinely won’t need the money soon.

5) Gold Mutual Funds – SIP in gold without Demat

What it is

Mutual funds (often “Gold FoF”) that invest in Gold ETFs.

Best for

-

People who want SIP-style gold investing inside mutual fund apps

-

Investors who don’t want Demat but want market-linked gold exposure

Costs

-

Fund expense ratio (plus indirect underlying ETF costs)

Watch-outs

-

Returns are gold-linked, but expenses slightly reduce performance

-

Some funds have exit loads for short holding periods

Bottom line: A “set and forget” way to allocate to gold.

6) Gold Savings Schemes (jewellers) – only if you’re sure you’ll buy jewellery

What it is

Monthly instalment schemes from jewellers to accumulate toward a future jewellery purchase.

Best for

-

People with a fixed goal: buy jewellery at maturity

Watch-outs

-

Terms vary widely (fees, flexibility, redemption rules)

-

Effective return may be worse than market-linked options once making charges apply

Bottom line: Not ideal for pure investing. Useful mainly for planned jewellery buying.

What competitors miss: the best gold investment is the one you’ll do consistently

Most articles obsess over “best product.” Real life works differently:

The best gold plan is the one you can repeat without friction.

That’s exactly why micro-investing is winning in 2026:

-

You start with ₹1–₹100

-

You build a habit

-

You don’t depend on market hours, lockers, or perfect timing

If you want the beginner roadmap, read: how to invest in gold with little money in India (start from ₹1 online).

Final verdict: Which option should you choose?

-

Want gifting + tradition → Physical gold (prefer coins/bars over heavy jewellery)

-

Want long-term + interest and can handle lock-ins → SGBs

-

Want low-cost market exposure with Demat → Gold ETFs

-

Want SIP convenience without Demat → Gold mutual funds

-

Want the easiest start + UPI + micro amounts → Digital gold

The OroPocket move (for most beginners)

If you want to start clean, small, and consistent:

Start with ₹1 on OroPocket. Buy digital gold via UPI. Earn free Bitcoin on every purchase.

Gold gives stability. Bitcoin rewards add upside. Gamification builds the habit.

Stop watching. Start growing.