How Do I Invest in Gold? 5 Simple Ways to Start in 2026

How Do I Invest in Gold in 2026? Start Simple, Start Smart

If you’re searching “how do I invest in gold”, you’re likely feeling at least one of these:

-

Your savings account returns feel invisible after inflation

-

You want an asset that’s safer than stocks, but still meaningful

-

You want to start on your phone, ideally using UPI, without paperwork

-

You don’t want purity worries, lockers, or big minimum amounts

In 2026, you don’t need to “wait till you have money” to invest in gold. You can start with ₹1, build a habit, and grow steadily – without overthinking.

“Over the past five years (2021–2026), gold delivered ~183% absolute returns (CAGR ~23.10%).” – Source

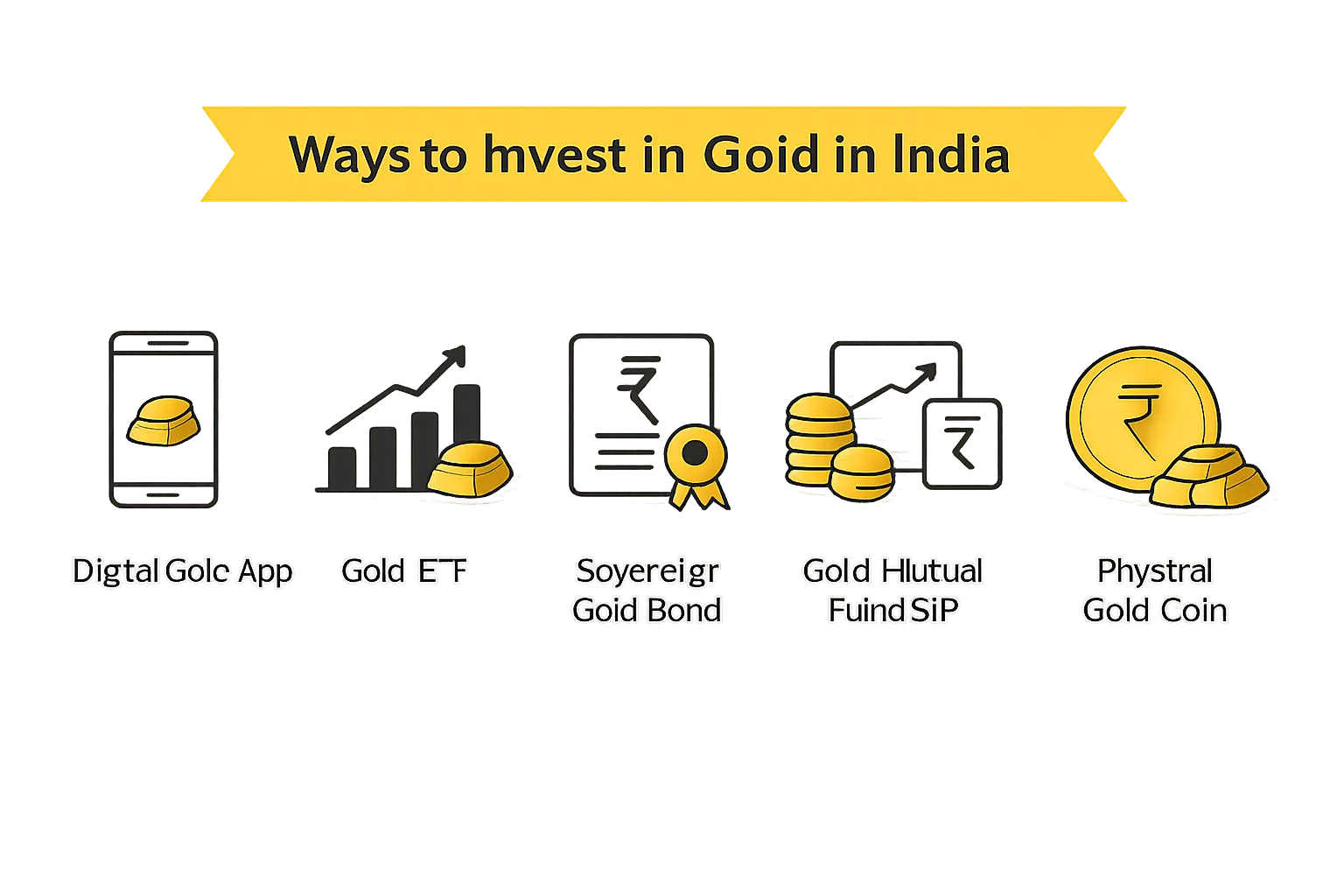

The 5 simplest ways to invest in gold in India (2026 shortlist)

Most competitor articles overwhelm you with 7–10 options, then quietly ignore the real decision factors (minimums, friction, spreads, lock-ins, and how real people actually invest).

Here’s the clean shortlist of the 5 most accessible options for Indians in 2026:

Quick comparison table (decision-ready)

|

Option |

Best for |

Minimum |

Liquidity |

Main costs/downsides |

Complexity |

|---|---|---|---|---|---|

|

Digital Gold (apps like OroPocket) |

Beginners, micro-investing, UPI-first users |

₹1 |

High |

GST + buy/sell spread |

Very low |

|

Gold ETFs |

Demat users who want transparent pricing |

1 unit |

High (market hours) |

Expense ratio + brokerage + Demat |

Medium |

|

Sovereign Gold Bonds (SGBs) |

Long-term holders who can wait |

~1 gram |

Medium |

Lock-in/limited liquidity windows |

Medium |

|

Gold Mutual Funds (FoF) |

SIP investors without Demat |

₹100+ |

High |

Expense ratio (plus underlying ETF costs) |

Low–Medium |

|

Physical Gold (coins/jewellery) |

Gifting, tradition, usage value |

Higher |

Medium |

Making charges, storage, resale cuts |

Low |

If you want a deeper framework: gold SIP vs gold ETF vs SGB (which is best for 2026?)

1) Digital Gold (the easiest way to start in 2026)

Digital gold is the simplest answer for most people asking: “How do I invest in gold?” – because it removes the friction that stops you from starting.

What it is

You buy real 24K gold digitally, stored in insured vaults through authorised partners. You can typically sell anytime (platform rules apply), and your holding is tracked in grams.

Best for

-

Students and first-time investors who want to start tiny and stay consistent

-

Salaried people who want a “gold SIP” habit without Demat

-

Anyone who wants UPI convenience, no locker, no purity stress

The OroPocket advantage (why beginners stick with it)

Most platforms help you “buy gold.” OroPocket helps you build a habit.

Core OroPocket USPs (built for 2026 India):

-

₹1 entry point: start instantly, no waiting, no “minimum investment” anxiety

-

Instant UPI payments: buy in under 30 seconds

-

100% secure & compliant: RBI-compliant, insured vault storage, authorised bullion partners

-

Gamified investing: daily streaks, spin-to-win, tiered rewards (habit > hype)

-

Free Bitcoin on every purchase: earn Satoshi cashback whenever you buy gold/silver

-

Referral rewards: both sides earn 100 Satoshi + free spin

This is the modern gold story: Gold stability (5,000-year track record) + Bitcoin upside (rewarded exposure) – without you needing to trade crypto or learn charts.

To go step-by-step: how to buy digital gold in India via UPI (fees + tips)

Costs to know (don’t get surprised)

Digital gold typically includes:

-

GST (3%)

-

Buy/sell spread (the difference between buying price and selling price)

Full clarity here: digital gold charges explained (spread, GST, selling fees)

Bottom line

If you’re starting from zero, digital gold is the fastest path to consistency – and consistency is what builds wealth.

Stop watching. Start growing.

2) Gold ETFs (best if you already use Demat)

Gold ETFs are exchange-traded funds that track gold prices and trade like a stock.

Best for

-

Investors who already have a broker + Demat

-

People who want market-linked gold exposure with transparent pricing

What competitor articles usually gloss over

ETFs are “low cost” on paper, but your actual cost depends on:

-

ETF expense ratio

-

Brokerage per trade

-

Demat maintenance charges (if any)

-

Trading friction (market hours only)

Bottom line

Gold ETFs are great if you’re already in the stock market ecosystem. If you’re not, they add setup friction – one of the biggest reasons beginners quit.

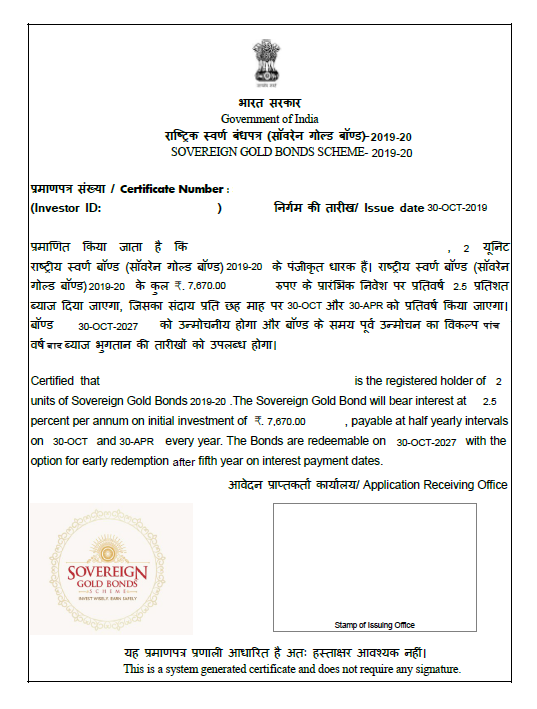

3) Sovereign Gold Bonds (SGBs) (best for long-hold investors)

SGBs are government securities whose value tracks gold prices, and they also pay fixed interest (as per scheme terms).

“Sovereign Gold Bonds offer a fixed 2.5% annual interest (paid semi-annually) on the initial investment.” – Source

Best for

-

Investors who can commit long-term and don’t need instant liquidity

-

People who like the structure of interest + gold-linked appreciation

The key drawback

SGBs can be harder to buy consistently (issue windows vary; secondary market liquidity can be uneven). So while they may be “best on paper,” they’re not always best in real life for beginners trying to build a monthly habit.

Bottom line

SGBs can be excellent for disciplined long-term investors – but not ideal for “start today with UPI” beginners.

4) Gold Mutual Funds (FoF) (SIP-friendly without Demat)

Gold mutual funds usually invest in gold ETFs (Fund of Funds). You can invest via SIP and typically don’t need a Demat account.

Best for

-

People already investing in mutual funds who want gold exposure

-

SIP investors who don’t want to trade ETFs manually

What to watch

-

Expense ratio at the fund level

-

Plus the underlying ETF costs (indirectly reflected)

Bottom line

Great “set-and-forget” gold exposure – especially if your investing life is already mutual-fund-first.

5) Physical Gold (coins, bars, jewellery) (best for tradition, not efficiency)

Physical gold is the most familiar route – but it’s rarely the most efficient investment route.

Best for

-

Gifting, weddings, emotional and cultural value

-

People who want “gold you can wear/use”

Hidden return killers (especially in jewellery)

-

Making charges (biggest drag)

-

Purity verification issues at resale

-

Storage risk/cost (lockers, theft risk)

Bottom line

Buy physical gold for sentiment and usage. For pure investing, most people do better with digital gold, ETFs, or SGBs.

The biggest truth most gold guides miss

Most “best way to invest in gold” articles try to find the perfect product.

But real wealth comes from one thing:

The best gold investment is the one you’ll actually do consistently.

That’s why mobile-first micro-investing is winning in 2026:

-

You start with ₹1–₹100

-

You invest weekly/monthly without friction

-

You stay consistent because it feels easy – and even rewarding

Final verdict: So, how do I invest in gold in 2026?

If you want the clean decision:

-

Want the easiest start + UPI + micro amounts? Digital gold

-

Want demat-based market exposure? Gold ETFs

-

Want long-hold benefits + interest? SGBs

-

Want SIP in a mutual fund setup? Gold mutual funds

-

Want gifting/tradition? Physical gold

The OroPocket move (best beginner default)

If you’re starting from zero and want momentum (not confusion):

Start with ₹1 on OroPocket. Buy digital gold via UPI in under 30 seconds.

Get free Bitcoin (Satoshi cashback) on every purchase. Build streaks. Earn rewards. Stay consistent.

Gold gives you stability. Bitcoin rewards give you upside.

The game mechanics give you discipline.

Stop watching. Start growing.