How Do You Invest in Gold? 7 Options Indians Use in 2026

How Do You Invest in Gold in India? The 7 Options Indians Use in 2026

If you’re Googling “how do you invest in gold”, you’re probably in one of these situations:

-

Your savings account feels like it’s losing to inflation

-

You want something safer than stocks, but still meaningful

-

You want a simple, mobile-first way to start (ideally with UPI)

-

You don’t want purity worries, locker stress, or big minimums

Good news: in 2026, gold investing isn’t just for people buying jewellery or stacking coins. Indians now use 7 mainstream routes – each with different trade-offs on cost, liquidity, taxes, and convenience.

Below is the cleanest breakdown – and a simple “pick the right one” framework.

“As of Jan 14, 2026, gold prices have increased by ~183.65% over the previous five years (CAGR ~23.19%).” – The Economic Times

The 7 ways to invest in gold (quick map)

At-a-glance comparison (2026)

|

Option |

Best for |

Minimum |

Liquidity |

Key costs |

Complexity |

|---|---|---|---|---|---|

|

Physical gold (coins/jewellery) |

Gifting/usage + tradition |

High |

Medium |

Making charges + storage |

Low |

|

Digital gold (apps) |

Beginners + SIP-like habit |

₹1–₹100 |

High |

Spread + GST |

Very low |

|

Gold ETFs |

Low-cost market-linked exposure |

1 unit |

High (market hours) |

Expense ratio + brokerage |

Medium |

|

Sovereign Gold Bonds (SGBs) |

Long-term hold + interest |

~1 gram |

Medium |

Low visible cost |

Medium |

|

Gold mutual funds (FoF) |

SIP in gold without Demat |

₹100+ |

High |

Expense ratio |

Low–Medium |

|

Gold savings schemes (jewellers) |

People planning jewellery purchase |

Varies |

Low–Medium |

Terms vary |

Low |

|

Gold futures/commodities |

Traders/hedgers |

High |

High |

Margin + risk |

High |

If you want a deeper side-by-side decision, this guide may help: gold SIP vs gold ETF vs SGB – what works best in 2026.

1) Physical Gold (coins, bars, jewellery)

What it is

Buying gold in hand – typically jewellery, coins, or bars.

Best for

-

Weddings, gifting, emotional value

-

People who want usage value, not just investment returns

Watch-outs (the real costs people ignore)

-

Jewellery = making charges (often the biggest hidden drag on returns)

-

Purity verification and resale deductions can hurt liquidity

-

Storage risk (locker cost + safety)

Bottom line

Physical gold is emotionally powerful, but as an “investment,” it’s often costly and inefficient unless you’re buying investment-grade coins/bars and managing storage smartly.

2) Digital Gold (apps) – the simplest “start now” option

What it is

You buy real 24K gold digitally, stored in insured vaults via authorised bullion partners. You can sell instantly or redeem (depending on provider).

Why it’s exploding in 2026

Because it solves the 3 biggest beginner problems:

-

No big minimum

-

No locker

-

No purity tension

Why OroPocket is built for this moment

OroPocket is a mobile-first platform for digital gold & silver that makes investing feel effortless – and rewarding.

Core OroPocket advantages (built for Indian retail investors):

-

₹1 entry point: start immediately, no waiting

-

Instant UPI payments: buy in under 30 seconds

-

100% secure & compliant: RBI-compliant + insured vault storage + authorised partners

-

Gamified investing: streaks, spin-to-win, tiered rewards = habits that stick

-

Free Bitcoin on every buy: earn Satoshi cashback on each gold/silver purchase

Gold stability + Bitcoin upside – without needing to “trade crypto.”

If you want the full step-by-step process, use this: how to buy digital gold in India via UPI (fees + tips).

Watch-outs

Digital gold pricing includes:

-

GST (3%)

-

Spread (difference between buy and sell price)

To avoid surprises, read: digital gold charges explained – spread, GST, storage, selling fees.

Bottom line

For most beginners asking “how do you invest in gold?”, digital gold is the fastest, simplest start – especially if you want micro-investing and UPI convenience.

3) Gold ETFs (Exchange Traded Funds)

What it is

An ETF that tracks gold prices and trades on stock exchanges like a share. You generally need a Demat + broker.

Best for

-

Investors who already use Demat

-

People who want transparent market pricing and generally lower “spread” than many retail formats

Costs to consider

-

ETF expense ratio

-

Brokerage charges per trade

-

Demat maintenance (depending on broker)

Bottom line

Gold ETFs are strong for cost-conscious investors – if you’re comfortable with Demat and stock-market trading hours.

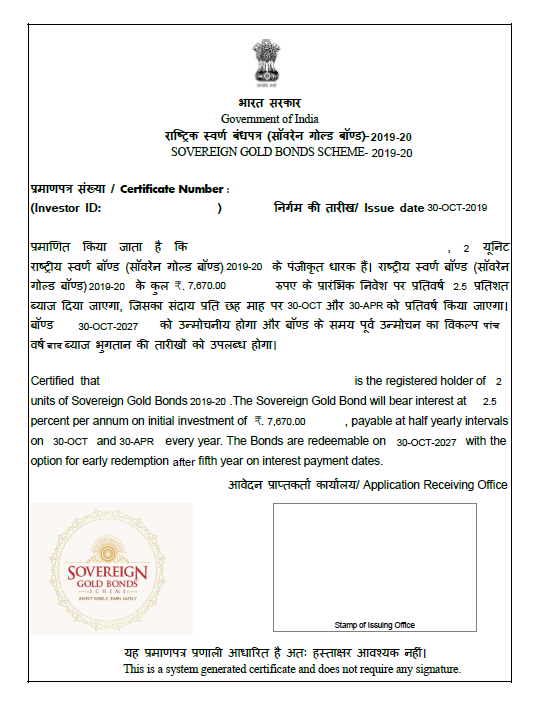

4) Sovereign Gold Bonds (SGBs)

What it is

Government-issued bonds where returns track gold price + you also get fixed interest (when applicable per scheme terms). Historically, they’re designed to reduce physical gold demand.

Best for

-

Long-term investors who can tolerate lock-ins / limited liquidity

-

People who like the idea of interest + gold-linked value

Watch-outs

-

Availability can be periodic (issue windows)

-

Liquidity can be weaker if you need to exit early (secondary market depth varies)

Bottom line

SGBs can be excellent for long holds – but they’re not ideal if you want anytime buy/sell simplicity.

5) Gold Mutual Funds (Gold FoFs)

What it is

Mutual funds that typically invest in Gold ETFs. You can invest via lump sum or SIP – often without needing Demat.

Best for

-

SIP investors who want gold exposure inside a mutual fund workflow

-

People who prefer fund convenience over trading ETFs

Costs

-

Fund expense ratio (and underlying ETF costs)

Bottom line

A smooth “set and forget” route for gold exposure, especially for SIP-style investors.

6) Gold Savings Schemes (jewellers)

What it is

A monthly instalment plan run by jewellers – often aimed at helping you buy jewellery later.

Best for

-

People who are sure they want jewellery purchase at maturity

Watch-outs

-

Terms vary widely (fees, flexibility, redemption rules)

-

Not always the best for pure investment returns (depends on scheme structure)

Bottom line

Good for planned jewellery buying. Not the cleanest investment vehicle for most people.

7) Gold Futures (commodities / derivatives)

What it is

Trading gold contracts (e.g., on commodities exchanges), usually with margin. High risk, high complexity.

Best for

-

Experienced traders hedging price exposure

-

Professionals with risk systems, discipline, and margin capacity

Watch-outs

-

Leverage can amplify losses fast

-

Not beginner-friendly

Bottom line

If your question is “how do you invest in gold” as a beginner – skip futures. Build your base first.

What most competitor articles miss (and what you should do instead)

Many guides compare options but miss the biggest practical truth for Indian retail investors:

The best gold investment is the one you’ll actually do consistently.

Not the “perfect” product – the product you can buy every week or month without friction.

That’s why mobile-first micro investing is winning:

-

You start with ₹1–₹100

-

You invest regularly

-

You don’t deal with lockers, purity checks, or market timing stress

And in OroPocket’s case, you’re rewarded for consistency:

-

Daily streaks

-

Spin-to-win

-

Referral rewards (100 Satoshi + free spin for both)

Stop watching. Start growing.

Final verdict: Which gold option should you choose in 2026?

-

Want tradition + gifting? Physical gold

-

Want low-cost market exposure with Demat? Gold ETFs

-

Want long-hold structure and can handle lock-ins? SGBs

-

Want a SIP-like approach without Demat? Gold mutual funds

-

Want the easiest beginner path with UPI + micro amounts? Digital gold

-

Want to “trade” gold? Futures (only if experienced)

The OroPocket move (for most beginners)

If you’re starting from zero and want the simplest path to build a gold habit:

Start with ₹1 on OroPocket. Buy digital gold via UPI. Earn free Bitcoin on every purchase.

Gold gives you stability. Bitcoin rewards give you upside. The game mechanics give you consistency.

Your money deserves momentum – not inactivity.

![How to Invest in Gold & Silver Together in India [2026 Portfolio Guide] 8 How20to20Invest20in20Gold2020Silver20Together20in20India205B202620Portfolio20Guide5D cover](https://blog.oropocket.com/wp-content/uploads/2025/12/How20to20Invest20in20Gold2020Silver20Together20in20India205B202620Portfolio20Guide5D-cover-300x200.webp)