How to Buy Digital Gold Online in India: Step-by-Step with UPI

How to buy digital gold online in India (why now + quick overview)

Thinking about how to buy digital gold online in India? Here’s the short version: your savings earn ~3–4% while everyday prices rise faster. Gold has historically kept up with inflation, and now UPI makes it effortless to buy 24K gold from your phone in seconds. This guide shows you exactly how to buy gold online in India the smart, modern way.

The problem: bank savings vs inflation

-

Savings accounts earn ~3–4% while real-life prices rise faster – your money quietly loses purchasing power.

-

Physical gold has making charges, locker fees, and purity worries – not ideal for small, frequent investments.

The solution: digital gold via UPI

-

Own 24K gold starting from ₹1 – perfect for micro-investing and first-time buyers.

-

Buy digital gold online in India 24×7 with UPI; instant allocation and transparent live pricing with no bank-hour limits.

“UPI crossed 10+ billion transactions in a single month for the first time in August 2023.” – Source

What you’ll learn in this guide

-

How to buy gold online in India with UPI (step-by-step).

-

KYC requirements and UPI limits.

-

Fees (spreads, 3% GST), storage, and safety.

-

Taxes on buy/sell/redemption and habit-building tips to grow consistently.

Quick OroPocket highlights

-

₹1 entry point + instant UPI checkout.

-

Free Bitcoin (Satoshis) on every gold/silver purchase.

-

Daily streaks, Spin-to-Win, referral bonuses (100 Satoshi + free spin).

-

24K pure gold, insured vaults, RBI-compliant partners.

Ready to start? Download the OroPocket app and make your first ₹1 digital gold buy in under a minute: https://oropocket.com/app

Digital gold explained: 24K purity, vaults, and why UPI makes it instant

Curious how to buy digital gold online in India and why it’s different from walking into a jewellery store? Here’s the clean, modern version: you own 24K gold (99.9x purity), backed 1:1 by physical bullion in insured vaults, and you can buy/sell anytime using UPI – starting from just ₹1.

What is digital gold (24K, 99.9x purity)

-

You buy by grams or rupee value; your holdings are backed 1:1 by physical gold stored in secure, insured vaults.

-

It’s a simple app experience – no lockers, no making charges for storage, no store visits, and instant liquidity when you sell.

Purity, vaulting, and audits

-

International standards (like LBMA Good Delivery) ensure purity, weight, and traceability across the supply chain.

-

Independent audits reconcile vaulted bars with platform allocations on a regular cadence, ensuring every gram is matched and accounted for.

“The LBMA Good Delivery List sets stringent standards to ensure the purity, weight, and appearance of gold bars traded globally.” – Source

Why UPI is the ideal payment rail

-

Real-time, interoperable, and available 24×7/365 – perfect for micro-investing from ₹1.

-

Works across all major UPI apps, so you can buy digital gold in India instantly with transparent live pricing and immediate allocation.

When digital gold makes more sense than physical

-

Investing and accumulation without making charges or locker fees.

-

Quick liquidity: sell back instantly at live rates.

-

Gifting remotely: send gold to friends/family in seconds.

-

Physical coins/bars only when you need them (making + delivery charges apply on redemption).

Where OroPocket fits

-

Mobile-first and UPI-native for 30-second checkouts.

-

Bitcoin rewards on every gold/silver purchase to boost effective value.

-

24K pure gold with insured vaults, audits, and transparent live pricing.

-

Micro-buys from ₹1, plus habit tools like daily streaks and Spin-to-Win.

Ready to try it? Download OroPocket and make your first ₹1 UPI purchase now: https://oropocket.com/app

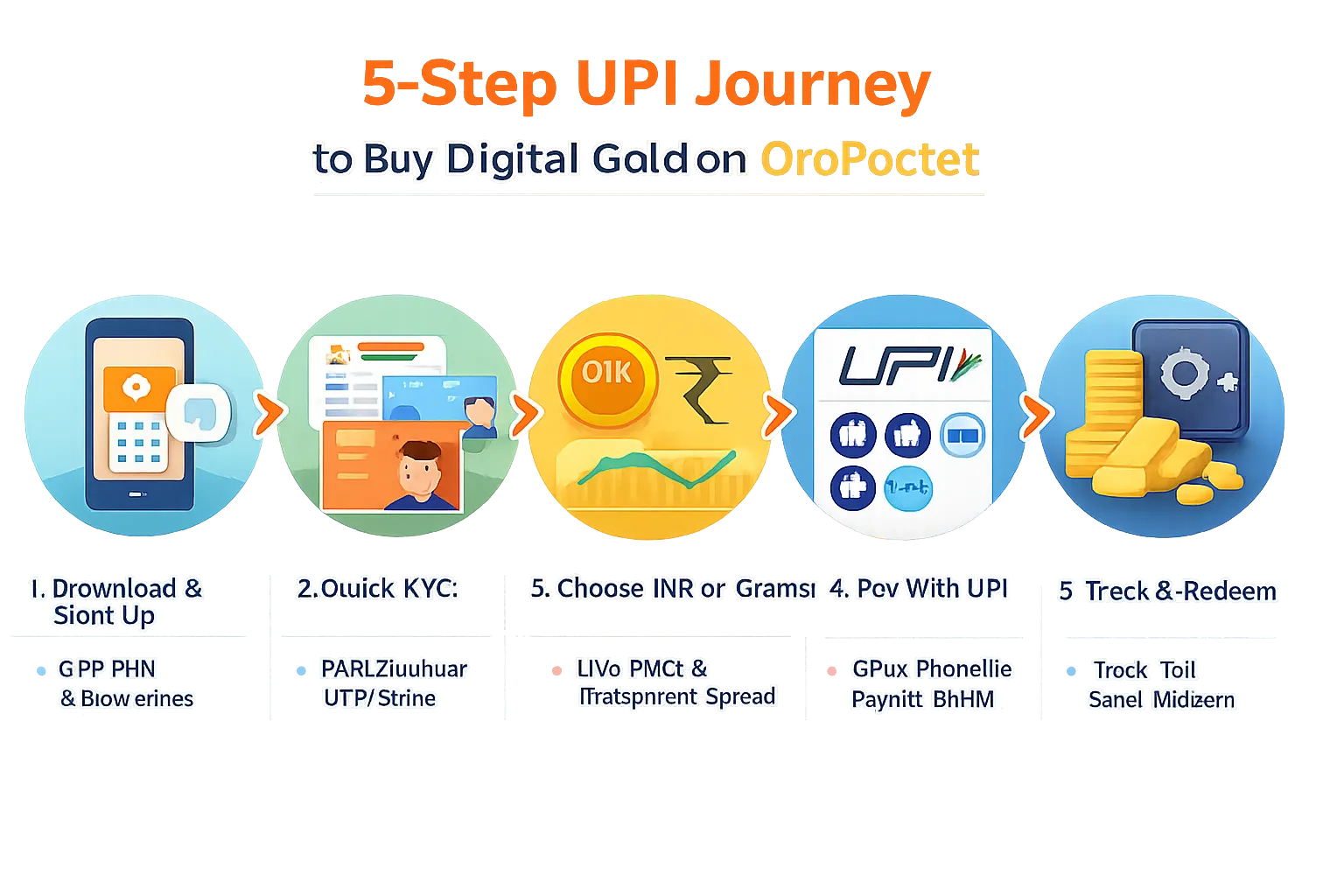

Step-by-step: How to buy digital gold online in India via UPI (OroPocket)

Buy 24K digital gold with UPI in under a minute.

Step 1: Download and sign up (iOS/Android)

-

Install OroPocket from the App Store or Google Play, create your account, and verify your mobile number via OTP.

-

Set a strong PIN and enable biometrics for secure, one-tap logins.

Step 2: Complete quick KYC (2–5 minutes)

-

Submit PAN, complete Aadhaar eKYC via OTP, and capture a live selfie.

-

Why it matters: keeps your account compliant, unlocks higher limits, and ensures smooth payouts to your bank.

Step 3: Choose ₹ or grams & check live price

-

Start fractional from ₹1 or select grams (e.g., 0.10 g, 1 g).

-

See exactly what you pay in rupees and the net grams after spread – fully transparent before you confirm.

Step 4: Pay with UPI (instant allocation)

-

Approve the collect request in any UPI app (GPay, PhonePe, Paytm, BHIM, or your bank’s app).

-

Get instant confirmation – your balance updates in real time with 24K gold allocated to your account.

Step 5: Track, sell, send, redeem

-

Track your holdings, average cost, and set price alerts.

-

Sell anytime for instant liquidity; send/gift gold to contacts; optionally redeem as coins/bars (making + delivery charges apply).

Pro tips

-

Do a ₹101 test buy to learn the flow end-to-end.

-

Use reminders or calendar nudges to build a steady micro-buy habit.

Get started now with ₹1 and UPI on OroPocket: https://oropocket.com/app

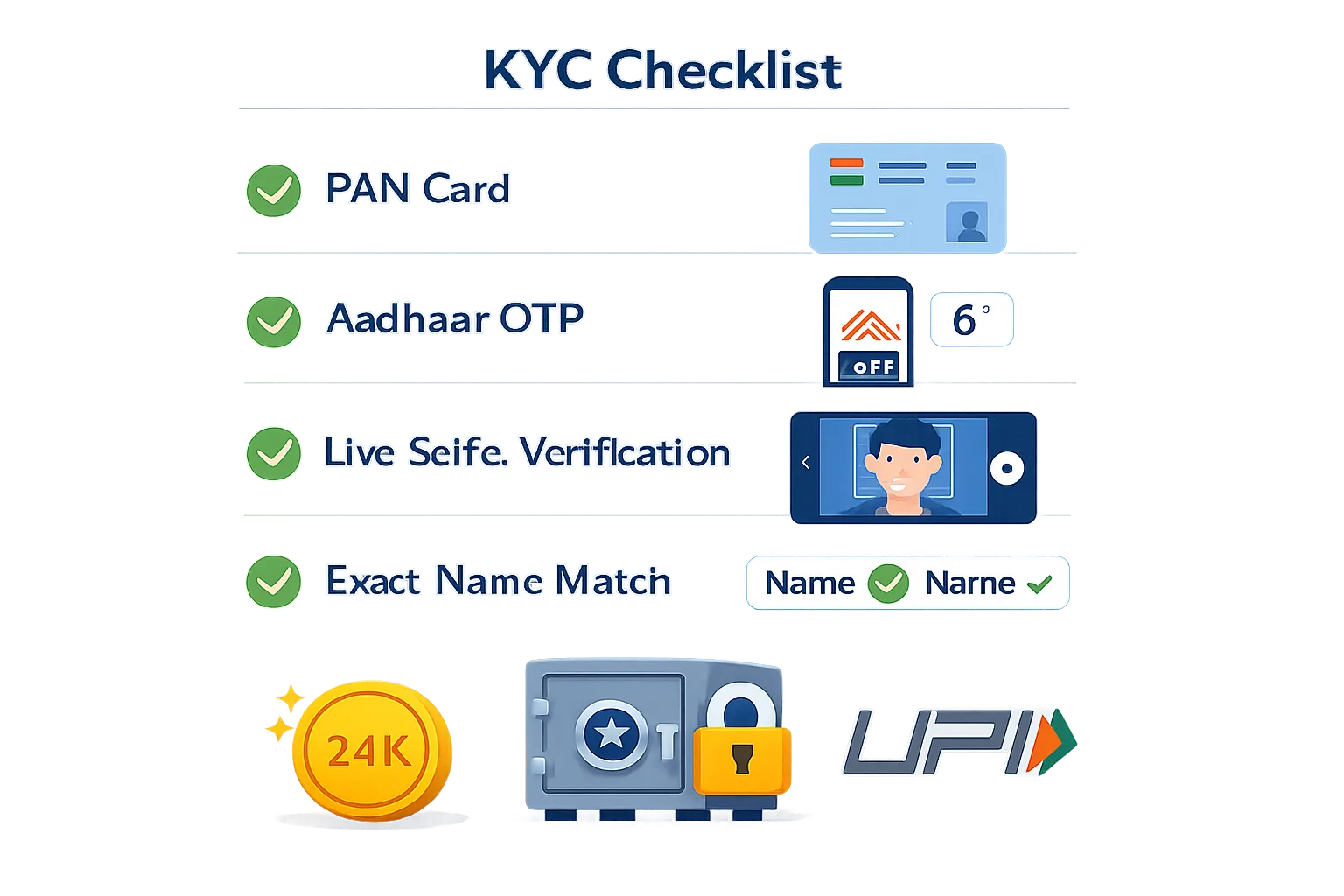

KYC and UPI limits: documents, timelines, troubleshooting

What documents you need

-

PAN for identity and tax compliance.

-

Aadhaar eKYC (OTP) via your Aadhaar-linked mobile number.

-

A live selfie for liveness check; ensure your exact name matches PAN/Aadhaar.

How long it takes (and how to avoid delays)

-

Typical eKYC time: ~2–5 minutes.

-

Tips to sail through:

-

Use steady, bright lighting for the selfie; keep your face centered.

-

Make sure your name in the app exactly matches PAN/Aadhaar (including initials/spaces).

-

Keep the Aadhaar-linked phone handy for OTP; ensure a stable data connection.

-

UPI limits: practical buying ranges

-

Per-transaction and daily caps vary by bank/app (often up to ₹1,00,000 per transaction; check your UPI app for exact limits).

-

Practical ranges:

-

Micro-buys: ₹1–₹500 to build a daily/weekly habit.

-

Regular top-ups: ₹500–₹5,000 for monthly accumulation.

-

Larger buys: Split into multiple UPI payments if you hit per-tx/day caps.

-

Troubleshooting

-

KYC rejected or pending:

-

Re-capture selfie in good light; remove glasses/hats; keep still.

-

Fix name mismatches to match PAN/Aadhaar exactly.

-

Ensure PAN is active and Aadhaar is linked to your current mobile number for OTP.

-

Retry after a few minutes if the network was unstable.

-

-

Privacy & data protection:

-

Your documents are encrypted and used strictly for verification and compliance.

-

Access is restricted; OroPocket follows RBI-aligned processes with authorized bullion partners.

-

Ready to complete KYC and start with ₹1 via UPI? Download OroPocket: https://oropocket.com/app

Fees, GST, spreads, and redemption charges (how to keep costs low)

The buy–sell spread (what it is, why it exists)

-

The spread is the difference between the live buy price and sell price at any moment.

-

It covers wholesale sourcing, hedging, secure vaulting/insurance, logistics, and platform operations so you can buy/sell 24×7 in tiny amounts.

-

Typical ranges vary with market conditions and liquidity; check the live quote before you confirm.

Taxes and charges you’ll see

-

3% GST applies on the purchase value of digital gold; there’s no GST when you sell back.

-

Physical redemption (optional) may include making charges for coins/bars and delivery/shipping fees for insured logistics.

How to minimize total cost

-

Buy during calmer market windows when spreads are tighter; avoid frequent micro-sells that compound costs.

-

Always compare the effective price (gold price + spread + 3% GST) before tapping confirm.

-

Stay digital if you’re investing for value; redeem physically only when you specifically need coins/bars.

OroPocket cost clarity

-

Live buy/sell rates with the spread shown upfront – no hidden fees.

-

UPI-friendly checkout for instant allocation; secure storage and insurance included during the standard custody period.

-

Clear invoice with base value and GST, plus transparent estimates for any optional physical redemption.

All potential charges at a glance

|

Charge |

What it is |

When it applies |

Typical range/notes |

How OroPocket handles it |

|---|---|---|---|---|

|

Buy spread |

Difference between market benchmark and your buy price |

Every purchase |

Varies with volatility/liquidity; commonly part of a net 2–6% spread |

Shown live before you confirm; fully transparent |

|

Sell spread |

Difference between market benchmark and your sell price |

Every sale |

Varies with market conditions |

Instant live quote in-app before you sell |

|

3% GST on purchase |

Statutory tax on buying gold |

On every buy |

3% on taxable value |

Auto-calculated and itemized on your invoice |

|

Making charges (only on redemption) |

Minting cost for coins/bars |

Only if you convert to physical |

Higher for smaller denominations/designs |

Displayed clearly before you redeem; optional |

|

Delivery/shipping |

Insured logistics for physical coins/bars |

Only if you convert to physical |

Varies by location/weight/insurer |

Estimated upfront; pay only if you redeem |

|

Storage/insurance |

Secure vaulting and insurance for your gold |

While holding digitally |

Typically included for a standard custody period |

Included; details shown in-app prior to purchase |

|

UPI fees |

Payment processing fees to customer |

At payment |

Typically NIL for consumers |

OroPocket does not add a UPI surcharge |

Keep your costs low and your gold stack growing. Buy digital gold in India the simple way – start with ₹1 via UPI on OroPocket: https://oropocket.com/app

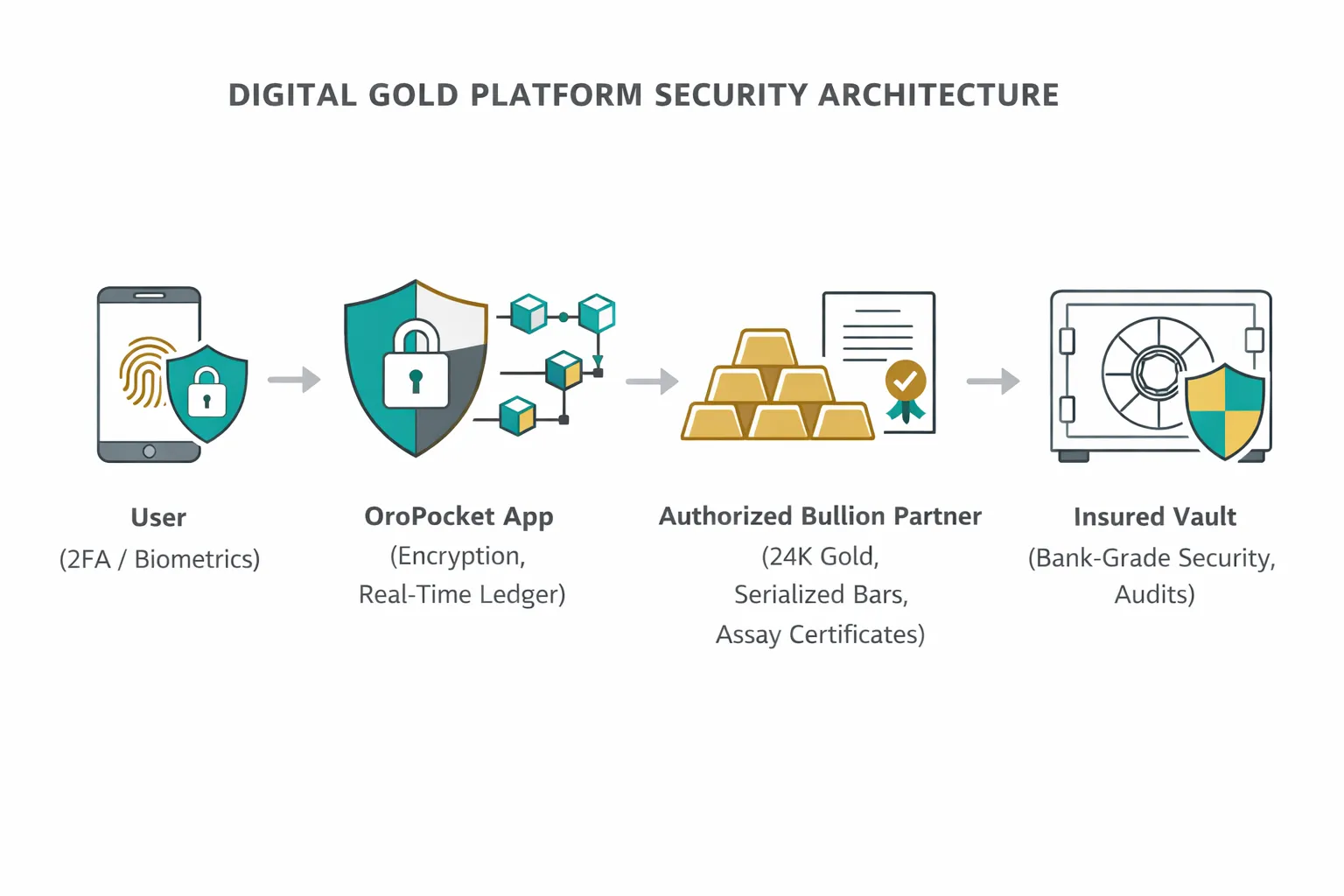

Is digital gold safe? Purity, vaults, audits, and proof of ownership

Purity assurance (24K, 99.9x)

-

Sourced via authorized bullion partners with strong due diligence.

-

Serialized bars with documented assays and traceability.

Vaulting & insurance

-

Fully insured professional vaults with bank-grade security.

-

Coverage includes theft, fire, and natural disasters as per policy terms.

-

Periodic reconciliation between partner vault records and platform allocations to ensure 1:1 backing.

Proof of ownership

-

Your gold is allocated on a ledger to your name; you see holdings instantly after each buy.

-

Download invoices and account statements anytime for records and tax filing.

-

1:1 backing with instant sell-back at live rates, or optional physical redemption (coins/bars).

What to verify on any platform

-

Purity documentation (24K standards), insured custody, and independent third-party audits.

-

Transparent live pricing and clear spreads/GST.

-

Clear redemption T&Cs covering making and delivery charges.

OroPocket security features

-

RBI-compliant processes with authorized bullion partners.

-

Two-factor authentication, device binding, and encryption at rest/in transit.

-

Real-time alerts and detailed activity logs for account security.

Invest with confidence. Download OroPocket and start stacking 24K digital gold via UPI: https://oropocket.com/app

Build a habit that sticks: micro-buys, streaks, and free Bitcoin rewards

Start tiny, stay consistent

-

Micro-buys (₹1–₹100) reduce decision fatigue and help you average in smoothly.

-

Set weekly/monthly reminders or SIP-like routines to keep the habit going.

Gamification that helps you save

-

Keep your daily streak alive – unlock bonuses every 5 consecutive days.

-

Spin-to-Win and clear progress bars make saving feel rewarding and visible.

Free Bitcoin on every purchase

-

Earn tiered Satoshi rewards on every gold/silver buy.

-

Over time, the Bitcoin cashback helps offset a slice of the spread and adds upside potential.

Send/gift gold instantly

-

Perfect for festivals, birthdays, weddings, and shagun – no jeweller visits or making charges.

A simple 30-day routine

-

Buy ₹101/day to build momentum.

-

Maintain your streak and spin daily for bonuses.

-

Refer friends (100 Satoshi + free spin) to boost rewards together.

-

Review your grams and rewards weekly; tweak next week’s target.

Start now with ₹1 and make the habit stick with OroPocket: https://oropocket.com/app

Compare options: best way to buy digital gold online in India

What to look for (quick checklist)

-

Transparent live pricing (buy/sell spread shown)

-

₹1 entry for micro-investing

-

UPI reliability and instant allocation

-

Insured vaults and clear audit disclosures

-

Easy gifting and optional physical redemption

-

Rewards that boost effective value

-

Habit tools (streaks, reminders, gamification)

Why OroPocket stands out

-

The only platform that combines gold with Bitcoin rewards on every buy – plus streaks and Spin-to-Win to keep your habit strong.

-

Instant UPI checkout; send/gift gold in seconds; live, transparent pricing with no hidden fees.

Feature comparison snapshot

|

Platform Type |

₹1 Entry |

UPI Speed |

Bitcoin Rewards |

Daily Streaks |

Spin-to-Win |

Referral Bonuses |

Send/Gift Gold |

Physical Redemption |

Pricing Transparency |

|---|---|---|---|---|---|---|---|---|---|

|

OroPocket |

Yes |

Instant |

Yes (Satoshis on every buy) |

Yes |

Yes |

Yes (100 Satoshi + free spin) |

Yes (instant) |

Yes (coins/bars; charges apply) |

Live buy/sell + spread shown |

|

Wallet apps (generic) |

Yes |

Instant |

No |

Limited/No |

No |

Limited/Varies |

Limited/Varies |

Yes (via partners) |

Live price; spread visibility varies |

|

Broker apps (generic) |

Often |

Fast |

No |

No |

No |

Limited/Varies |

Limited/No |

Sometimes (via partners) |

Live price; disclosures vary |

|

Bullion platforms (generic) |

Yes |

Fast |

No |

No |

No |

Limited/Varies |

Yes |

Yes (strong catalog) |

Live price; clear redemption terms |

Note: Features vary by provider; check each app’s latest terms.

Decision shortcut

-

If you value habit-building + extra rewards + simplicity → pick OroPocket for the best way to buy digital gold online in India.

Start with ₹1 today and make your first UPI purchase on OroPocket: https://oropocket.com/app

Taxes and records: GST, capital gains, and invoices (India)

Capital gains basics

-

STCG: If you sell within <3 years, gains are taxed at your income tax slab.

-

LTCG: If you sell after ≥3 years, gains are taxed at 20% with indexation (CII adjusts your cost upward, reducing taxable gains).

-

Cost basis: Includes purchase price + 3% GST and any applicable fees at buy (e.g., platform charges, if any).

GST

-

3% GST applies on the purchase value of digital gold.

-

No GST is levied at the time of sale back to the platform.

High-value compliance and smooth payouts

-

Keep KYC current (PAN, Aadhaar eKYC) to unlock higher limits and faster settlements.

-

Use UPI/bank-linked payments tied to your verified profile.

-

Maintain accurate profile details (name match with PAN/Aadhaar) to avoid payout delays.

Record-keeping made easy

-

Download invoices (showing base price + 3% GST) and statements for every transaction.

-

Maintain a simple log: date, amount (₹), grams, effective price, GST, and any fees.

-

Track holding periods per lot so you can compute STCG vs LTCG correctly at tax time.

Plan ahead, keep clean records, and buy smart. Start your ₹1 UPI purchase on OroPocket: https://oropocket.com/app

Conclusion: Start with ₹1 today on OroPocket (UPI in under a minute)

Why now

-

Inflation won’t wait. Your savings lose value each month, while 24K gold has historically held up better.

-

UPI makes buying digital gold instant – no bank hours, no paperwork. Small daily actions compound faster than waiting for the “perfect” entry.

OroPocket advantage (recap)

-

₹1 entry point to start immediately

-

Instant UPI checkout (24×7) with live, transparent pricing

-

Free Bitcoin (Satoshis) on every gold/silver purchase

-

Daily streak bonuses and Spin-to-Win to keep your habit strong

-

24K pure gold, insured vaults, RBI‑compliant partners

-

Send/gift gold in seconds; optional physical redemption

-

No hidden fees – clear spreads, GST, and invoices

Next step (CTA)

-

Download OroPocket and make your first ₹101 gold buy today: https://oropocket.com/app